As filed with the United States Securities and Exchange Commission on May 24, 2022

Registration No. 333-262852

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Epsium Enterprise Limited

(Exact Name of Registrant as Specified in Its Charter)

| N/A | 5810 | British Virgin Islands | ||

| (I.R.S. Employer Identification Number) |

(Primary Standard Industrial Classification Code Number) |

(State or Other Jurisdiction of Incorporation or Organization) |

c/o Companhia de Comércio Luz Limitada

Alameda Dr. Carlos D’assumpcao

Edf China Civil Plaza 235-243, 14 Andar P

Macau, SAR China

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Office)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

+1(800) 221-0102

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

With a copy to:

William S. Rosenstadt, Esq.

Mengyi “Jason” Ye, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue, 3rd Floor

New York, NY 10017

(212) 588 0022

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging Growth Company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION ON MAY 24, 2022 |

EPSIUM ENTERPRISE LIMITED

6,002,670 ordinary shares

This prospectus relates to the resale of 6,002,670 ordinary shares, par value $0.00002 per share, of EPSIUM ENTERPRISE LIMITED, a British Virgin Islands company (the “Company”), by those shareholders named in the section of this prospectus entitled “Selling Shareholders” (each, a “Selling Shareholder” and collectively, the “Selling Shareholders”). The 6,002,670 ordinary shares registered herein were issued in connection with a Regulation S private placement conducted from September 7, 2021 to September 15, 2021.

We are not selling any ordinary shares in this offering, and we will not receive any proceeds from the sale of shares by the Selling Shareholders.

This is an offering of the ordinary shares of the shareholders of the offshore holding company. You are not investing in Companhia de Comércio Luz Limitada (“Luz”), our indirect partially-owned subsidiary, which was formed in Macau.

Because of our corporate structure, we are subject to unique risks due to uncertainty of the interpretation and the application of the PRC laws and regulations. We are also subject to the risks of uncertainty about any future actions of the PRC government in this regard. Our investors may never directly hold equity interests in our operating subsidiary. The Chinese regulatory authorities could disallow our organizational structure, which would likely result in a material change in our operations and the value of our ordinary shares. As a result, the value of such securities may significantly decline or become worthless. For a detailed description of the risks relating to our corporate structure, doing business in the PRC, and the offering as a result of the structure, see “Risk Factors - Risks Relating to Doing Business in the PRC” and “Risk Factors – Risks Relating to this Offering,” beginning on page [ ].

Additionally, since our operating subsidiary is based in Macau, China, we are subject to certain legal and operational risks associated with our operations in China. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in our operations, significant depreciation of the value of our ordinary shares, or a complete hinderance of our ability to offer or continue to offer our securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange. For a description of relevant PRC-related risks to this offering, see “Risk Factors - Risks Relating to Doing Business in the PRC”.

The Selling Shareholders may offer all or part of the shares for resale from time to time through public or private transactions, at a price of $0.02 per share until the shares are listed on a national securities exchange or quoted on the OTC Bulletin Board, OTCQX or OTCQB, at which time they may be sold at prevailing market prices or in privately negotiated transactions. See “Plan of Distribution” beginning on page 30 for more information.

| i |

No underwriter or other person has been engaged to facilitate the sale of ordinary shares in this offering. The Selling Shareholders may be deemed underwriters of the ordinary shares that they are offering. We have agreed to pay certain expenses in connection with this registration statement. The Selling Shareholders will pay all underwriting discounts and selling commissions, if any, in connection with the sale of the ordinary shares.

No public market currently exists for our ordinary shares, and a public market may never develop, or, if any market does develop, it may not be sustained. Our ordinary shares are not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market-maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our ordinary shares to be eligible for quotation on the over-the-counter markets administered by the OTC Markets Group, Inc. (“OTC”). To be eligible for quotation on OTC’s Venture Market (the “OTCQB”), we must remain current in their periodic filings with the SEC. If we are not able to pay the expenses associated with our reporting obligations, we will not be able to apply for quotation on the OTCQB. We currently do not have a market-maker who has agreed to file such application for quotation on the OTC. There can be no assurance that our ordinary shares will ever be quoted on a quotation service or listed on a stock exchange, or that any public market for our stock will develop.

This prospectus provides a general description of the securities being offered. You should read this prospectus and the registration statement of which it forms a part before you invest in any securities.

Son I Tam, our Chief Executive Officer and Chief Financial officer, is currently the beneficial owner of 54,000,000 ordinary shares representing 90% of the total voting power, and has the controlling interest of our Company. Upon the closing of this offering, Son I Tam will own approximately 90% of our total voting power and we will continue to be a “controlled company” and for so long as we remain a controlled company under this definition, we are eligible to utilize certain exemptions from the corporate governance requirements, and we intend to rely on such exemptions.

Investing in our ordinary shares involves a high degree of risk. Before buying any ordinary shares, you should carefully read the discussion of material risks of investing in our ordinary shares in “Risk Factors” beginning on page [ ] of this prospectus. Because our operations are primarily located in Macau, SAR China, we may be subject to certain legal and operational risks associated with our operations in the People’s Republic of China, or PRC or China, including changes in the legal, political and economic policies of the Chinese government, the relations between China and the United States, or Chinese or United States regulations may materially and adversely affect our business, financial condition and results of operations. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in our operations and the value of our ordinary shares, or could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors and cause the value of such securities to significantly decline or be worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity (“VIE”) structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. We do not believe that our subsidiaries are directly subject to these regulatory actions or statements, as we do not adopt a VIEs in our corporate structure, and neither have we have implemented any monopolistic behavior nor our business involves the collection of user data or implicate cybersecurity. As of the date of this prospectus, no relevant laws or regulations in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission, or the CSRC, or any other PRC governmental authorities for our offering, nor has our Cayman Islands holding company or any of our subsidiaries received any inquiry, notice, warning or sanctions regarding our offering from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions by the PRC government are newly published and official guidance and related implementation rules have not been issued, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange. The Standing Committee of the National People’s Congress, or the SCNPC, or other PRC regulatory authorities may in the future promulgate laws, regulations or implementing rules that requires our company or any of our subsidiaries to obtain regulatory approval from Chinese authorities before offering in the U.S.

| ii |

Furthermore, as more stringent criteria have been imposed by the SEC and the Public Company Accounting Oversight Board, or the PCAOB, recently, our securities may be prohibited from trading if our auditor cannot be fully inspected. A termination in the trading of our securities or any restriction on the trading in our securities would be expected to have a negative impact on the Company as well as on the value of our securities. As of the date of the prospectus, TAAD, LLP (“TAAD”), our auditor, is not subject to the determinations as to inability to inspect or investigate registered firms completely announced by the PCAOB on December 16, 2021. While the Company’s auditor is based in the U.S. and is registered with PCAOB and subject to PCAOB inspection, in the event it is later determined that the PCAOB is unable to inspect or investigate completely the Company’s auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could cause trading in the Company’s securities to be prohibited under the Holding Foreign Company Accountable Act, and ultimately result in a determination by a securities exchange to delist the Company’s securities. See “The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering.” on pages 22 and 23.

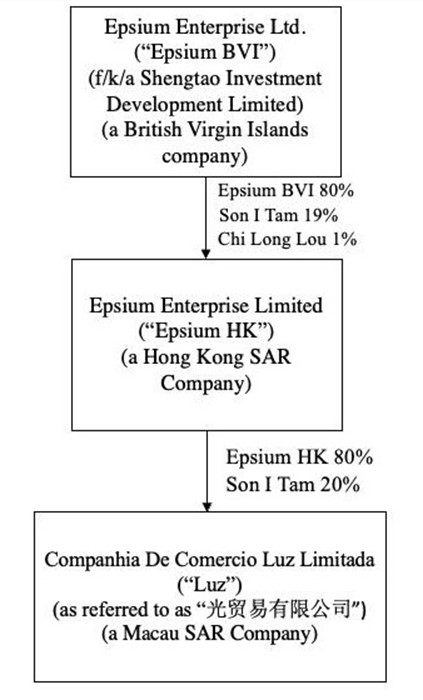

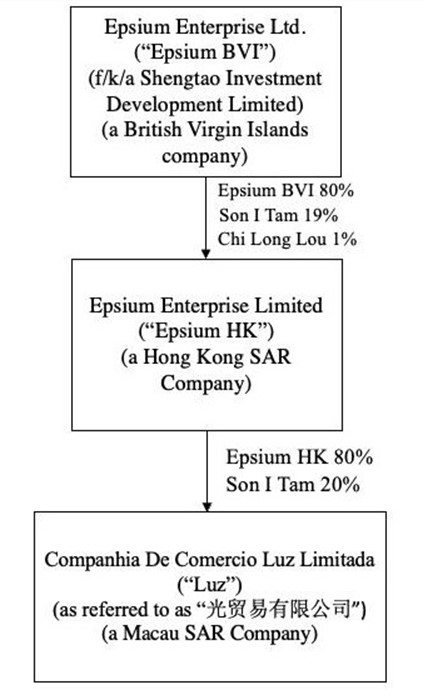

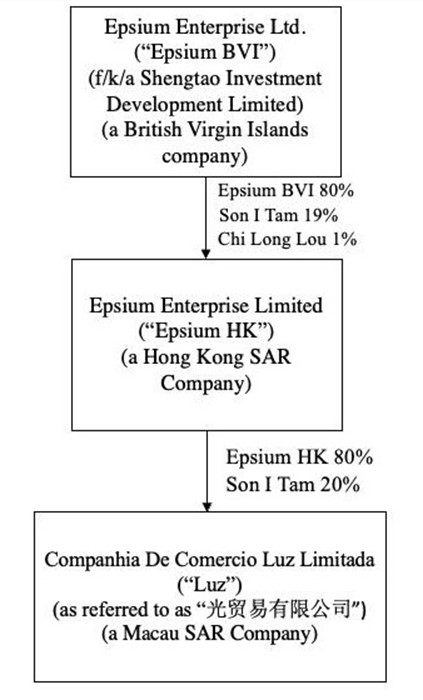

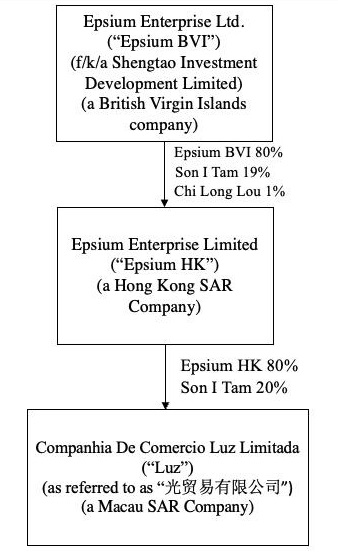

Investors are cautioned that you are not buying shares of a Macau-based operating company but instead are buying shares of a British Virgin Islands holding company issuer that operates through its subsidiaries. Epsium Enterprise Limited, or Epsium BVI, is a holding company incorporated in British Virgin Islands. As a holding company with no material operations, Epsium BVI conducts a substantial majority of its operations through its subsidiaries established in Macau, SAR China. Investors in our ordinary shares should be aware that they will not directly hold equity interests in the Macau operating entities, but rather purchasing equity solely in Epsium BVI, our British Virgin Islands holding company.

Epsium BVI is a holding company with no operations of its own. We conduct our operations in Macau primarily through our Macau subsidiary, Luz. We may rely on dividends to be paid by Luz to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses. If Luz incurs debt on their own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us.

Epsium BVI is permitted under the BVI laws to provide funding to Epsium HK through loans or capital contributions without restrictions on the amount of the funds, subject to satisfaction of applicable government registration, approval and filing requirements. Epsium HK is also permitted under the laws of Hong Kong to provide funding to Epsium BVI through dividend distribution without restrictions on the amount of the funds. As of the date of this prospectus, there has been no distribution of dividends or assets among the holding company or the subsidiaries and no transfers, dividends, or distributions to our shareholders.

We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments. See “Transfers of Cash to and from Our Subsidiaries” on page 5 and “Risk Factors- Risks Related to Our Ordinary Shares- Because we do not expect to pay dividends in the foreseeable future after this offering, you must rely on price appreciation of our ordinary shares for return on your investment” on page [--] .

Investing in our ordinary shares involves risks. You should review carefully the risks and uncertainties described under the heading “Risk Factors”.

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION (the “SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE ORDINARY SHARES OR DETERMINED THAT THIS PROSPECTUS IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2022.

| iii |

You should not assume that the information contained in the registration statement to which this prospectus is a part is accurate as of any date other than the date hereof, regardless of the time of delivery of this prospectus or of any sale of the ordinary shares being registered in that registration statement of which this prospectus forms a part.

No dealer, salesperson or any other person is authorized to give any information or make any representations in connection with this offering other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. The Selling Shareholders are offering to sell, and seeking offers to buy, ordinary shares only in jurisdictions where offers and sales are permitted. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

Until , 2022 (the 90th day after the date of this prospectus), all dealers that buy, sell or trade our ordinary shares, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to unsold allotments or subscriptions.

| i |

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the ordinary shares. Before making an investment decision, you should carefully read the entire prospectus. In particular, attention should be directed to the sections entitled “Risk Factors”, “Business”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes thereto contained herein.

Prospectus Conventions

“Luz” refers to Companhia de Comércio Luz Limitada (also referred to as 光貿易有限公司 in Macau), a company formed under the laws of Macau, SAR China, and an 80% owned subsidiary of Epsium HK.

“Epsium BVI” refers to EPSIUM ENTERPRISE LIMITED, a British Virgin Islands company.

“Epsium HK” refers to Epsium Enterprise Limited, a limited liability company incorporated in Hong Kong and an 80% owned subsidiary of Epsium BVI.

“SAR of China” refers to Special Administrative Region of the People’s Republic of China.

“PRC” or “China” refers to the People’s Republic of China.

This prospectus contains translations of certain MOP amounts into U.S. dollar amounts at specified rates solely for the convenience of the reader. All reference to “U.S. dollars”, “USD”, “US$” or “$” are United States dollars. The exchange rates in effect as of December 31, 2020 and 2019 were US $1.00 for MOP 7.98 and MOP 8.02 respectively. We use period-end exchange rates for assets and liabilities and average exchange rates for revenue and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred. Any discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

We obtained the industry and market data used in this prospectus or any document incorporated by reference from industry publications, research, surveys and studies conducted by third parties and our own internal estimates based on our management’s knowledge and experience in the markets in which we operate. We did not, directly or indirectly, sponsor or participate in the publication of such materials. We have sought to provide current information in this prospectus and believe that the statistics provided in this prospectus are reliable at the time of this prospectus.

Investors should note that this is an offering of the ordinary shares of the shareholders of the offshore holding company, Epsium Enterprise Limited. You are not investing in Luz, our operating subsidiary. Epsium BVI is a holding company with no operations of its own. We conduct our operations in China primarily through Luz in Macau.

| 1 |

Business Overview

EPSIUM ENTERPRISE LIMITED (“Epsium BVI”) was incorporated in the British Virgin Island in March 2020, and primarily conducts business through its 80% owned subsidiary, Companhia de Comércio Luz Limitada (“Luz”). Luz was incorporated under the laws of Macau in February 2010, with a registered capital of MOP $25,000. Our aim was to provide beverage products to customers. We are domestically oriented and have a global ambition.

In 2010, Luz was formally registered and established in Macau as our indirect partially-owned subsidiary. Luz is an import trading and distributor of wines & spirits in Macau. The company provides imported wines & spirits of world-class quality and excellent services to its clients. Luz is committed to meeting customer needs and putting customer care as its first priority. It has successively introduced world-renowned brands of wine, Scotch whisky, French cognac, and Chinese liquor. In 2020, it officially became the agent of the Chinese liquor “Xijiu” series products in Macau, and achieved the goal of increasing brand sales in 2020 for Xijiu.

Taking advantage of the fact that Macau’s economy and tax income mainly come from the gaming industry, most revenue of the gaming industry comes from the VIP room, and gamblers who visit the VIP room are consumers of luxury goods, such as alcohol, cigarettes, the Company provided products (e.g. Remy Martin and Macallan, etc.) that gaming companies and hotels need to enhance their image, and are the must-haves in VIP rooms.

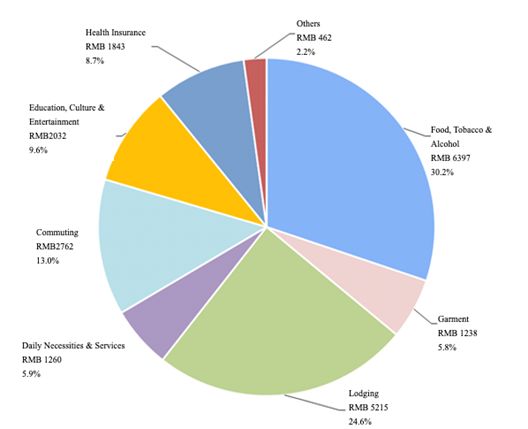

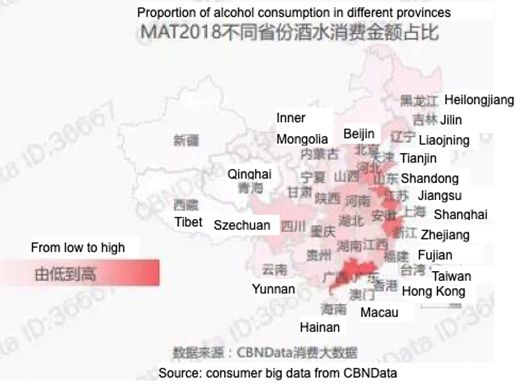

Regarding the Macau alcoholic beverage market where Luz is located, the consumption is concentrated on mainland Chinese tourists; according to the statistics released by the DSEC (Macau SAR Statistics and Census Service), in 2020, the total number of tourists coming from the mainland to Macau is 4,754,239, accounting for 80% of the total annual number of tourists coming to Macau. Due to the convenient geographical location of Macau (close to the coast of Guangdong), Chinese tourists traveling to and from Macau have become the natural customers and strong consumers for our products.

The Company firmly believes in putting customer care as its first priority, providing its customer quality products, and continuously meeting the market needs with new products and service. With a management team that has more than 15 years of wines & spirits distribution and marketing experience, a keen market sense, timely marketing strategy, Luz opened the Macau sales market for Rémy Martin, MACALLAN and a variety of wines. In the past 3 years, the company has held an important leadership position in local industry with its product offering, customer service and innovative thinking.

Not only does the Company believe in attracting tourists and customers from mainland, it also derives significant revenue locally. For example, major supermarket chains have 10 to 20 stores that sell a variety of wines and spirits on the market. They form a basic alcohol consumption channel with restaurants, restaurants, bars, clubs, and retail stores. According to Macau statistics, in the past few years, the annual growth rate of tourism to Macau's GDP has doubled, and the food and beverage industry accounts for approximately 20% of tourist spending budgets.

Personalized service is the core value of Luz. The Company provides a rich product line and extensive sales channels. As a result, business volume and profit increased on average every year. The distribution channels of Luz cover most of Macau, including supermarkets chain, retail stores, clubs, restaurants, food courts, bars, hotels and Gaming companies. Luz’s products are in high demand since they are considered as customers’ necessities for the market in Macau.

| 2 |

Corporate Information

Our principal executive office is located at Alameda Dr. Carlos D’assumpcao, Edf China Civil Plaza 235-243, 14 Andar P, Macau, SAR China, and our phone number is +853-2857 5252. We maintain a corporate domain name at luzmacau.com through Luz. The information contained in, or accessible from, our domain name or any other website does not constitute a part of this prospectus.

There is currently no public trading market for our ordinary shares. We intend to apply for quotation our ordinary shares on the OTCQB after the effectiveness of this registration statement but we cannot assure you that we will be successful or that a liquid public market for our ordinary shares will develop.

The following diagram illustrates our corporate structure:

Recent Regulatory Development in the PRC

We are aware that, recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. For example, on July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued a document to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. Also, on July 10, 2021, the CAC issued a revised draft of the Measures for Cybersecurity Review for public comments, which required that, among others, in addition to “operator of critical information infrastructure”, any “data processor” controlling personal information of no less than one million users which seeks to list in a foreign stock exchange should also be subject to cybersecurity review, and further elaborated the factors to be considered when assessing the national security risks of the relevant activities.

| 3 |

Based on laws and regulations currently in effect in the PRC as of the date of this prospectus, we are not required to obtain regulatory approval from Chinese authorities, including the CSRC and CAC, before listing in the U.S, given that: (i) our products and services are offered not directly to individual users but through our institutional customers; (ii) we do not possess a large amount of personal information in our business operations; and (iii) data processed in our business does not have a bearing on national security and thus may not be classified as core or important data by the authorities.

Nevertheless, since these statements and regulatory actions are new, it is highly uncertain how soon the legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any. It is also highly uncertain what the potential impact such modified or new laws and regulations will have on our subsidiary’s daily business operation, its ability to accept foreign investments and the listing of our Ordinary Shares on a U.S. or other foreign exchanges. The PRC government has significant oversight and discretion over the conduct of our business and may intervene or influence our operations as the government deems appropriate to further regulatory, political and societal goals. The PRC government has recently published new policies that significantly affected certain industries such as the education and internet industries, and we cannot rule out the possibility that it will in the future release regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations.

Implications of Being an “Emerging Growth Company”

With less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| · | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002; |

| · | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis); |

| · | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); |

| · | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; |

| · | may present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations, or MD&A; |

| · | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and |

| · | are exempt from any proposed new requirements of the PCAOB rules relating to mandatory audit firm rotation and any requirement to include an auditor discussion and analysis narrative in our audit report. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

We will remain as an “emerging growth company” until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed US$1 billion, (ii) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (iii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934 (the “Exchange Act”), which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iv) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

| 4 |

Investors should be aware that we will be subject to the “Penny Stock” rules adopted by the SEC, which regulate broker-dealer practices in connection with transactions in Penny Stocks. These regulations may have the effect of reducing the level of trading activity, if any, in the secondary market for our stock, and investors in our ordinary shares may find it difficult to sell their shares. Please see the disclosure under “Risk Factors– Risk Related to Our Ordinary Shares.” Our ordinary shares may be considered a ‘penny stock’ which is subject to restrictions on marketability, so you may not be able to sell your shares” in this Prospectus for more information.

Implication of Being a Foreign Private Issuer

We are a foreign private issuer within the meaning of the rules under the Exchange Act of 1934. As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| · | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; | |

| · | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; | |

| · | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; | |

| · | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; | |

| · | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and | |

| · | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

Son I Tam, our Chief Executive Officer and Chief Financial officer, is currently the beneficial owner of 54,000,000 ordinary shares representing 90% of the total voting power, and has the controlling interest of our Company. Upon the closing of this offering, Son I Tam will own approximately 90% of our total voting power and we will continue to be a “controlled company” and for so long as we remain a controlled company under this definition, we are eligible to utilize certain exemptions, and we intend to rely on such exemptions.

Transfers of Cash to and from Our Subsidiaries

Epsium BVI is a holding company with no operations of its own. We conduct our operations in Macau primarily through our Macau subsidiary. We may rely on dividends to be paid by our Macau subsidiary to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses. If our Macau subsidiary incurs debt on their own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us.

Epsium BVI is permitted under the BVI laws to provide funding to our subsidiaries in Hong Kong and Macau through loans or capital contributions without restrictions on the amount of the funds, subject to satisfaction of applicable government registration, approval and filing requirements. Epsium HK is also permitted under the laws of Hong Kong to provide funding to Epsium BVI through dividend distribution without restrictions on the amount of the funds. As of the date of this prospectus, there has been no distribution of dividends or assets among the holding company or the subsidiaries and no transfers, dividends, or distributions to our shareholders.

We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

| 5 |

Subject to the BVI Business Companies Act and our bylaws, our board of directors may authorize and declare a dividend to shareholders at such time and of such an amount as they think fit if they are satisfied, on reasonable grounds, that immediately following the dividend the value of our assets will exceed our liabilities and we will be able to pay our debts as they become due. There is no further BVI statutory restriction on the amount of funds which may be distributed by us by dividend.

Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us. The laws and regulations of Macau do not currently have any material impact on transfer of cash from Epsium BVI to Epsium HK or from Epsium HK to Epsium BVI. There are no restrictions or limitation under the laws of Hong Kong imposed on the conversion of HK dollar into foreign currencies and the remittance of currencies out of Hong Kong or across borders and to U.S investors.

Cash dividends, if any, on our ordinary share will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10.0%.

Risk Factors Summary

Investing in our ordinary shares involves a high degree of risk. Below is a summary of material factors that make an investment in our ordinary shares speculative or risky. Importantly, this summary does not address all of the risks that we face. Please refer to the information under the heading “Risk Factors” on page 12 of this prospectus for additional discussion of the risks summarized in this risk factor summary as well as other risks that we face. These risks include, but are not limited to, the following:

Risks Related to our Business and Industry (see page 12 – “Risk Factors – Risks Related to Our Business and Industry” of this prospectus)

| · | We are susceptible to general economic conditions, natural catastrophic events and public health crises, and travel restrictions, quarantines, and changes in consumer behavior as a result thereof could adversely affect our operating results. See page [--] of this prospectus. |

| · | Our business is particularly sensitive to reductions in discretionary consumer and corporate spending as a result of downturns in the economy. See page 12 of this prospectus. |

| · | The wines & spirits import and export industry in China is highly competitive and growing rapidly in the past few years; if we are unable to compete successfully, our financial condition and results of operations may be harmed. See page 13 of this prospectus. |

| · | The growth of third-party online and other wines & spirits supply intermediaries may adversely affect our margins and profitability. See page 13 of this prospectus. |

| · | We rely on a limited number of suppliers for our business. See page 13 of this prospectus. |

| · | If we become directly subject to the recent scrutiny involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and/or defend the matter, which could harm our business operations, stock price and reputation and could result in a significant loss of your investment in us. See page 14 of this prospectus. |

| · | Because we are an “emerging growth company,” we may not be subject to requirements that other public companies are subject to, which could affect investor confidence in us and our ordinary shares. See page 14 of this prospectus. |

Risks Relating to Doing Business in Macau (see page 15 – “Risk Factors – Risks Related to Doing Business in Macau” of this prospectus)

| · | Gaming is a highly regulated industry in Macau and the gaming and licensing authorities may exercise significant control over our operations. See page 15 of this prospectus. |

| · | Agreements for concessions and sub-concessions to operate casinos in Macau are for specific periods of time and may not be renewed upon their expiration. Also, the Macau government has the right to unilaterally terminate the concessions or sub-concessions in certain circumstances. Because we derive our rights from agreements with the casino operators, a termination of a casino operator’s license to operate a casino will cause a termination of our business at that casino. See page 15 of this prospectus. |

| 6 |

| · | Conducting business in Macau involves certain economic and political risks relating to changes in Macau’s and China’s political, economic and social conditions. See page 16 of this prospectus. |

| · | The Macau government may decide to impose more stringent laws with respect to the practice of gaming promoters issuing gaming credit to VIP gaming patrons and any change in our operations to comply with such laws may result in a decrease in our revenue. See page 16 of this prospectus. |

| · | China has imposed government restrictions on Chinese citizens travelling from mainland China to Macau and may continue to do so in the future. If China or other countries impose additional government restrictions on travel, the number of visitors to Macau could decline. See page 17 of this prospectus. |

Risks Relating to Doing Business in the PRC (see page 18 – “Risk Factors – Risks Related to Doing Business in the PRC” of this prospectus)

| · | All our operations are in Macau. However, due to the long arm provision under the current PRC laws and regulations, the Chinese government may exert substantial influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S exchanges, however, if our subsidiary or the holding company were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange and the value of our ordinary shares may significantly decline or become worthless, which would materially affect the interest of the investors. See page 18 of this prospectus. | |

| · | The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering. Trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act if the PCAOB determines that it cannot inspect or fully investigate our auditor, and as a result an exchange may determine to delist our securities. See page 22 of this prospectus. |

| · | PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Uncertainties with respect to the PRC legal system, including those regarding the enforcement of laws, and sudden or unexpected changes, with little advance notice, in laws and regulations in China could adversely affect us and limit the legal protections available to you and us. See page 19 of this prospectus. |

| · | If we become directly subject to the scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price and reputation. See page 20 of this prospectus. |

| · | We may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. We may be liable for improper use or appropriation of personal information provided by our customers. See page 20 of this prospectus. |

Risks Related to Our Ordinary Shares

| · | The highly concentrated ownership and voting power of the Company may impact shareholders’ interests in the Company. See page 24 of this prospectus. |

| · | There is no public market for our ordinary shares, an active trading market for our ordinary shares may not develop, and you may not be able to resell our ordinary shares at or above the price you pay for them, or at all. See page 24 of this prospectus. |

| · | We will incur increased costs as a result of being a public company, particularly after we cease to qualify as an “emerging growth company.” See page 24 of this prospectus. |

| · | Our ordinary shares may be considered a “penny stock” which is subject to restrictions on marketability, so you may not be able to sell your shares. See page 24 of this prospectus. |

| 7 |

| · | The market price for the ordinary shares may be volatile. See page 25 of this prospectus. |

| · | Future sales or issuances, or perceived future sales or issuances, of substantial amounts of our ordinary shares could adversely affect the price of the ordinary shares. See page 26 of this prospectus. |

| · | Risk of Selling Shareholders and broker-dealers or agents being deemed statutory underwriters; investors’ cause of action limited. See page 26 of this prospectus. |

| · | Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our shareholders have limited protections against interested director transactions, conflicts of interest and similar matters. See page 26 of this prospectus. |

| · | We are and will be a “controlled company” upon the closing of this offering and, as a result, will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. You will not have the same protections afforded to shareholders of companies that are subject to such requirements. See page 27 of this prospectus. |

| · | We are an “emerging growth company” and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our ordinary shares less attractive to investors. See page 28 of this prospectus. |

| 8 |

The Offering

The summary below describes the principal terms of this offering. Please see the “Plan of Distribution” section for a more detailed description of the terms of the Offering.

| Ordinary shares offered by Selling Shareholders: | 6,002,670 ordinary shares, par value $0.00002 | |

| Ordinary shares outstanding: | 60,002,670 ordinary shares | |

| Ordinary shares outstanding after the Offering: | 60,002,670 ordinary shares | |

|

Offering price per share:

|

$0.02 per share until the shares are listed on a national securities exchange or quoted on the OTC Bulletin Board, OTCQX or OTCQB, at which time they may be sold at prevailing market prices or in privately negotiated transactions | |

| Use of proceeds: | We will not receive any proceeds from the sale of ordinary shares by the Selling Shareholders. | |

| Voting Rights: | Holders of our ordinary shares are entitled to one vote per ordinary shares at all shareholder meetings. See “Description of Securities.” | |

|

Dividend policy:

|

We currently intend to retain future earnings, if any, to fund the development and growth of our business. Therefore, we do not currently anticipate paying cash dividends on our ordinary shares. | |

|

Risk factors:

|

An investment in our Company is highly speculative and involves a significant degree of risk. See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our ordinary shares. |

| 9 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including sections entitled “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and “Business,” contains forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| · | implementation of our business strategies; and |

| · | our anticipated capital requirements and future operating performance. |

Any statements that relate to future events or conditions, including, without limitation, the statements included in this prospectus that are not historical facts, that relate to industry prospects and that concern our prospective results of operations or financial position, may be deemed to be forward-looking statements. Often, however, our uses of the words “believe,” “anticipate,” “plan,” “expect,” “intend” and similar expressions will identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. Although we believe that the expectations reflected in the forward-looking statements contained in this prospectus are reasonable, these statements represent our current expectations and are inherently uncertain. The factors discussed below under “Risk Factors,” among others, could cause actual results, levels of activity, performance or achievements to differ materially from those indicated by these forward-looking statements. Forward-looking statements represent our views as of the date of this prospectus. While we may elect to update these forward-looking statements in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. For all of these reasons, you should not unduly rely on any forward-looking statements.

ENFORCEABILITY OF CIVIL LIABILITIES

We are incorporated under the laws of the British Virgin Islands as an exempted company with limited liability. We are incorporated under the laws of the British Virgin Islands because of certain benefits associated with being a British Virgin Islands corporation, such as political and economic stability, an effective judicial system, a favorable tax system, the absence of foreign exchange control or currency restrictions and the availability of professional and support services. However, the British Virgin Islands has a less developed body of securities laws as compared to the United States and provides significantly less protection for investors than the United States.

Substantially all of our assets are located in Macau, Special Administrative Region (“SAR”) of the People’s Republic of China. In addition, our sole director and officer is national and resident of Macau, SAR China, and all or a substantial portion of his assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon us or our director and officer, or to enforce against us or him judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States.

We have appointed Cogency Global Inc. as our authorized representative to receive service of process with respect to any action brought against us in the United States District Court for the Southern District of New York under the federal securities laws of the United States or of any state in the United States or any action brought against us in the Supreme Court of the State of New York in the County of New York under the securities laws of the State of New York.

There is uncertainty as to whether the courts of the British Virgin Islands or the PRC would (i) recognize or enforce judgments of United States courts obtained against us or our director or officer predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States or (ii) entertain original actions brought in the British Virgin Islands or the PRC against us or our director or officer predicated upon the securities laws of the United States or any state in the United States.

| 10 |

It is uncertain that British Virgin Islands courts would enforce: (1) judgments of U.S. courts obtained in actions against us or other persons that are predicated upon the civil liability provisions of the U.S. federal securities laws; or (2) original actions brought against us or other persons predicated upon the Securities Act. Ogier has informed us that there is uncertainty with regard to British Virgin Islands law relating to whether a judgment obtained from the U.S. courts under civil liability provisions of the securities laws will be determined by the courts of the British Virgin Islands as penal or punitive in nature. Furthermore, there is currently no statutory enforcement or treaty between the United States and the British Virgin Islands providing for enforcement of judgments. However, a judgment obtained in the United States may be recognized and enforced in the courts of the British Virgin Islands at common law, without any re-examination on the merits of the underlying dispute, by an action commenced on the foreign judgment debt in the Grand Court of the British Virgin Islands, provided such judgment: (i) is given by a foreign court of competent jurisdiction; (ii) is final; (iii) is not in respect of taxes, a fine or a penalty; and (iv) was not obtained in a manner and is not of a kind the enforcement of which is contrary to natural justice or public policy of the British Virgin Islands.

The recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedure Law. PRC courts may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedure Law based either on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. There are no treaties between China and the United States for the mutual recognition and enforcement of court judgments, thus making the recognition and enforcement of a U.S. court judgment in China difficult.

| 11 |

An investment in our ordinary shares involves a high degree of risk. Before deciding whether to invest in our ordinary shares, you should consider carefully the risks described below, together with all of the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially and adversely affected, which could cause the trading price of our ordinary shares to decline, resulting in a loss of all or part of your investment. The risks described below and in the documents referenced above are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in our ordinary shares if you can bear the risk of loss of your entire investment.

Risks Relating to our Business and Industry

We are susceptible to general economic conditions, natural catastrophic events and public health crises, and travel restrictions, quarantines, and changes in consumer behavior as a result thereof could adversely affect our operating results.

Our operating results will be subject to fluctuations based on general economic conditions, in particular those conditions that impact event planning and hotel industry. Deterioration in economic conditions could cause decreases in business volume and reduce and/or negatively impact our short-term ability to grow revenues. Further, any decreased collectability of accounts receivable or early termination of agreements due to deterioration in economic conditions could negatively impact our results of operations.

Furthermore, our business is subject to the impact of natural catastrophic events such as earthquakes, floods or power outages, political crises such as terrorism or war, and public health crises such as disease outbreaks, epidemics, or pandemics in China, which is our primary markets and business locations. Currently, the rapid spread of coronavirus (COVID-19) globally has resulted in increased travel restrictions, disruption and shutdown of businesses. We may experience impacts from quarantines, market downturns and changes in customer behavior related to pandemic fears and impacts on our workforce if the virus becomes widespread in any of our markets. We thrive on tourism as we provide alcoholic merchandise and like services to our customers, including importing/exporting goods to known entertainment venues and hotels. This industry is particularly vulnerable to any pandemic event when tourism, transportation and local economy is impacted. One or more of our customers, distribution partners, service providers or suppliers may experience financial distress, file for bankruptcy protection, go out of business, or suffer disruptions in their business due to the coronavirus outbreak; as a result, our operation revenues may be impacted. The extent to which the coronavirus impacts our results will depend on future developments, which are highly uncertain and will include emerging information concerning the severity of the coronavirus and the actions taken by governments and private businesses to attempt to contain the coronavirus, but is likely to result in a material adverse impact on our business, results of operations and financial condition at least for the near term.

Our business is particularly sensitive to reductions in discretionary consumer and corporate spending as a result of downturns in the economy.

Consumer demand for hotel/casino resorts, trade shows and conventions and for the type of luxury amenities we offer is particularly sensitive to downturns in the economy and the corresponding impact on discretionary spending. Changes in discretionary consumer spending or corporate spending on conventions and business travel could be driven by many factors, such as: perceived or actual general economic conditions; fear of exposure to a widespread health epidemic, such as the COVID-19 Pandemic; any weaknesses in the job or housing market; credit market disruptions; high energy, fuel and food costs; the increased cost of travel; the potential for bank failures; perceived or actual disposable consumer income and wealth; fears of recession and changes in consumer confidence in the economy; or fear of war, political instability, civil unrest or future acts of terrorism. These factors could reduce consumer and corporate demand for the luxury amenities and leisure and business activities we offer, thus imposing additional limits on pricing and harming our operations.

Our possible lack of internal controls over financial reporting may affect the market for and price of our ordinary shares.

Our disclosure and internal controls over financial reporting may not be effective. We may not have the financial resources or personnel to develop or implement systems that would provide us with the necessary information on a timely basis so as to be able to implement financial controls. In addition, we may have difficulty in hiring and retaining a sufficient number of qualified employees. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records, and instituting business practices that meet Western standards. We may have made and may in the future make mistakes in the financial statements that are included or will be included in our public filings, such as a registration statement, due to lack of internal controls over financial reporting.

| 12 |

Our success depends substantially on the continued retention of certain key personnel and our ability to hire and retain qualified personnel in the future to support our growth and execute our business strategies.

If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. While we depend on the abilities and participation of our current management team generally, we rely particularly upon Son I Tam, our CEO and CFO, who is responsible for the development and implementation of our business plans. The loss of the service of Son I Tam for any reason could significantly and adversely impact our business and results of operations. Competition for senior management in the PRC is intense and the pool of qualified candidates is limited. We cannot assure you that the services of our senior executive and other key personnel will continue to be available to us, or that we will be able to find a suitable replacement for them if they were to leave.

The wines & spirits import and export industry in China is highly competitive and growing rapidly in the past few years; if we are unable to compete successfully, our financial condition and results of operations may be harmed.

The entertainment industry in China has been developing rapidly and become very competitive in recent years. As it is relatively easy to enter the market, there are many other liquor or wine trading companies providing service of various qualities across China. Competition is mainly based on rates, brand recognition, turnaround time, quality of venue and service levels. Our business and individual customers may change their budgets and preferences and choose venues outside Macau that offer lower rates or have access to venues and facilities that we do not have access to, which may have an adverse effect on our competitive position, results of operations and financial condition.

The growth of third-party online and other wines & spirits supply intermediaries may adversely affect our margins and profitability.

As our supplies can also be purchased and distributed through our cooperating agencies or third-party intermediaries whom we have profit sharing arrangements with or pay commissions to, if the volume of any supply intermediary becomes substantial, it may be on a better bargaining position to negotiate a higher profit percentage or commission, or other significant concession from us. As a result, the growth and importance of these supply intermediaries may adversely affect our ability to control the supply and cost of our products, which would in turn adversely affect our margins and profitability.

We rely on a limited number of suppliers for our business.

We rely on a limited number of suppliers for our trading business, and we may not be able to find replacements or immediately transition to alternative suppliers should we need to do so. When industry supply is constrained, our suppliers may allocate resources away from us and to our competitors. If we lose one or more of the suppliers, our operation may be disrupted, and our results of operations may be adversely and materially impacted.

The Company has a concentration of its revenues with specific customers. As of December 31, 2021, two customers’ account receivable accounted for 37.2% and 35.3% of the total outstanding accounts receivable balance. As of December 31, 2020, three customers’ account receivable accounted for 33.19%, 22.75%, and 16.46% of the total outstanding accounts receivable balance. For the year ended December 31, 2021, four customers accounted for 15.0%, 11.7%, 11.2% and 10.0% of total revenue. For the year ended December 31, 2020, one customer accounted for 28.24% of total revenue.

As of December 31, 2021, accounts payable to one major supplier accounted for 97.6% of the total accounts payable outstanding. As of December 31, 2020, accounts payable to four major suppliers accounted for 33.72%, 30.81%, 25.41% and 10.06% of the total accounts payable outstanding. For the year ended December 31, 2021, the Company purchased approximately 72.9% of its inventory from one supplier. For the year ended December 31, 2020, the Company purchased approximately 52.66% and 38.25% of its inventory from two suppliers.

A loss of either of these customers or suppliers could adversely affect the operating results or cash flows of the Company.

| 13 |

Local taxation may increase and current tax exemptions may not be extended.

We are subject to the following local taxation:

| · | We are not subject to Hong Kong profits tax because we are an investment holding company and all of our operations are performed outside Hong Kong. Our subsidiaries are incorporated under the BVI Business Companies Act, 2004 (No. 16 of 2004) and exempted from payment of BVI taxes. |

| · | Any dividends distributed by our Macau subsidiary to us or by the Promotion Entities to our subsidiaries may be subject to up to 12% of Complementary Tax, under the Macau Complementary Tax Law. |

A loss of any of these exemption benefits or increases in tax rates or imposition of additional taxes may have a material adverse effect on our financial condition and results of operations.

Because we are an “emerging growth company,” we may not be subject to requirements that other public companies are subject to, which could affect investor confidence in us and our ordinary shares.

We are an “emerging growth company,” as defined in the JOBS Act, and we intend to take advantage of certain exemptions from disclosure and other requirements applicable to other public companies that are not emerging growth companies including, most significantly, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act for so long as we are an emerging growth company. As a result, if we elect not to comply with such auditor attestation requirements, our investors may not have access to certain information they may deem important. See “Implications of Our Being an “Emerging Growth Company.”

| 14 |

Risks Relating to Doing Business in Macau

Gaming is a highly regulated industry in Macau and the gaming and licensing authorities may exercise significant control over our operations.

Gaming is a highly regulated industry in Macau. Our operations are contingent upon our maintaining all regulatory licenses, permits, approvals, registrations, findings of suitability, orders and authorizations pursuant to Macau law.

In addition, the casinos’ activities in Macau are subject to administrative review and approval by various agencies of the Macau government, including the Gaming Inspection and Coordination Bureau (“DICJ”), the Macau Judiciary Police, Health Bureau, Labor Affairs Bureau, Land Public Works and Transport Bureau, Fire Services Bureau, Financial Services Bureau (including the Tax Department), Monetary Authority of Macau, Financial Intelligence Office and Macau government Tourism Office. We cannot assure you that the casino operators will be able to obtain all necessary approvals and licenses, and their failure to do so may materially and adversely affect our business and operations. Macau law permits redress to the courts with respect to administrative actions; such redress is, however, largely untested in relation to gaming industry regulatory issues.

Current laws, such as licensing requirements, tax rates and other regulatory obligations, could change or become more stringent, resulting in additional regulations being imposed upon the gaming promotion operations or an increase in competition in the gaming industry. For example, in September 2009, the Macau government set a cap on commission payments to gaming promoters of 1.25% of rolling chip volume, which has been enforced since December 2009. Any failure to comply with these regulations may result in the imposition of liabilities, fines and other penalties and may materially and adversely affect our operations.

On November 1, 2012, the Macau government raised the minimum age required for the entrance in casinos in Macau from 18 to 21, while allowing current casino employees to maintain their positions while in the process of reaching the minimum required age. This could adversely affect our ability and the ability of our business associates to engage sufficient staff for our operations in the future.

Under the existing legal framework, VIP gaming promoters must report suspicious transactions within 48 hours of becoming aware of such suspicious behavior. Failure to report suspicious transactions constitutes an administrative offence. Depending on the number of suspicious transactions reported, the DICJ may at any time instruct concessionaires or sub-concessionaires to enforce stricter control of suspicious transactions reporting. We did not have suspicious transaction reported. We cannot assure you that this requirement will not be more strictly enforced in the future.

There are limited precedents interpreting and applying the laws of Macau and regulations concerning gaming. These laws and regulations are complex and a court or administrative or regulatory body may in the future interpret these laws and regulations in a manner that differs from our interpretation or issue new or modified regulations, which could have a material adverse effect on our business, financial condition and results of operations.

Agreements for concessions and sub-concessions to operate casinos in Macau are for specific periods of time and may not be renewed upon their expiration. Also, the Macau government has the right to unilaterally terminate the concessions or sub-concessions in certain circumstances. Because we derive our rights from agreements with the casino operators, a termination of a casino operator’s license to operate a casino will cause a termination of our business at that casino.

The concession of SJM and the sub-concession of MGM Grand Paradise Limited, was due to expire on March 31, 2020, nonetheless it was extended to 26 June 2022. The concession of Galaxy Casino, S.A. (“Galaxy”), the sub-concession of Venetian Macau, S.A. (“Venetian Macau”), the concession of Wynn Resorts (Macau), S.A. (“Wynn Macau”) and the sub- concession of Melco Crown Gaming (Macau) Limited (“Melco Crown Gaming”) will expire on June 26, 2022, unless extended pursuant to certain provisions of Macau law. Upon expiration of these concessions and sub-concessions, all casinos, gaming assets and equipment and ownership rights to the casino properties in Macau will revert to the Macau government without compensation to the casinos. We cannot assure you that the concessionaires or sub-concessionaires will be able to renew or extend their concessions or sub-concessions on terms favorable to them or at all. If any of the concessions or sub-concessions are not renewed or extended upon their stated expiration date, or if the Macau government exercises its early redemption right, we will cease to generate any revenue from the affected casinos and our gaming promotion operations at the affected casino will cease accordingly.

| 15 |

The existing gaming concessions are due to expire in June 2022, there is no political decision or regulatory framework published regarding the continuance of the existing concessions or what new regime shall be applicable to the gaming industry.

The Macau gaming law may become object of revision in the near future. A public consultation process regarding the revision of gaming law was launched on 15th September, and the process will run until 29th October. The Macau government has aimed to complete the revision of the gaming law by the fourth quarter this year, prior to submitting a finalized draft project to the Legislative Assembly.

The project published for consultation indicates a higher control by the regulatory entities regarding gaming operations and monetary deposits. If the Legislative Assembly approve this project as presented, that may materially affect the amount of cash flow in gaming operations.

The Macau government has the right to unilaterally terminate the concession or sub-concession agreements upon the occurrence of certain events of default. The concession and sub-concession agreements contain various general covenants and other provisions with which the concessionaires or sub-concessionaires are required to comply. These include the obligations to submit periodic information to the Macau government, operate casinos in a fair and honest manner and maintain certain levels of insurance. Failure to comply with the terms and conditions of the concession or sub-concession agreements in a manner satisfactory to the Macau government could ultimately result in the termination of the concession or sub-concession agreements. The occurrence of any event of default may, and any termination of the concession or sub-concession agreements will, cause all of the casinos, gaming assets and equipment and ownership rights to the casino properties in Macau to be automatically transferred to the Macau government. If this occurs, we will cease to generate any revenue from the affected casinos.

Conducting business in Macau involves certain economic and political risks relating to changes in Macau’s and China’s political, economic and social conditions.

Conducting business in Macau involves certain risks such as risks relating to changes in Macau’s and China’s political, economic and social conditions, changes in Macau governmental policies, changes in Macau laws or regulations or their interpretation, changes in exchange control regulations, potential restrictions on foreign investment and repatriation of capital, measures that may be introduced to control inflation, such as interest rate increases, and changes in the rates or method of taxation. In addition, our operations in Macau are exposed to the risk of changes in laws and policies that govern operations of Macau-based companies. The PRC government may continue to adopt policy and regulatory measures aimed at curtailing the possibility of corruption in Macau’s gaming industry. In addition to corruption charges against many top mainland officials, the campaign has deterred high rollers from visiting Macau. Therefore, we cannot be certain that any new PRC government policies and regulatory measures will not materially and adversely affect our business, financial condition, results of operations and prospects.

The Macau government may decide to impose more stringent laws with respect to the practice of gaming promoters issuing gaming credit to VIP gaming patrons and any change in our operations to comply with such laws may result in a decrease in our revenue.

The Gaming Credit Law governs the granting of gaming credit in Macau, and forbids the assignment or transfer, in any form, of the power to grant gaming credit. For the past 20 years, it has been customary practice in Macau that casinos issue gaming credit to VIP gaming promoters in the form of non-negotiable chips that can only be used in that gaming promoter’s VIP gaming rooms. The non-negotiable chips may not be redeemed for cash, cash chips or other goods or services. The gaming promoters extend such gaming credit to VIP gaming patrons. However, if the Macau government in the future imposes a more stringent law governing the extension of gaming credit to VIP gaming patrons, we may be required to adjust our operations to comply with such law, and limit our ability to extend gaming credit which may reduce rolling chip turnover, which in turn may materially and adversely affect our business and results of operations.

| 16 |

A weakening in economic and credit market conditions may adversely affect tourism and the profitability of our business.

There can be no assurance that the recent difficult financial conditions in the global markets will improve or that government responses to these conditions will successfully address fundamental weakness in the global markets, restore consumer confidence or increase market liquidity. Weakness in the global economy or in the economy of China, where a significant number of gaming patrons reside and/or generate their income, may result in a reduction in the number of gaming patrons or the frequency of visits by these gaming patrons to our VIP rooms. Any reduction in demand for the gaming activities that we promote would reduce our revenue.

China has imposed government restrictions on Chinese citizens travelling from mainland China to Macau and may continue to do so in the future. If China or other countries impose additional government restrictions on travel, the number of visitors to Macau could decline.