UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For

the fiscal year ended: | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from _______________________ to ____________________________________ | |

Commission

File Number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

(Address of principal executive offices) | ||

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| OTCQB |

Securities registered pursuant to Section 12(b) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐

Yes ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐

Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such (files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐

Yes ☒

The

aggregate market value of common stock held by non-affiliates of the registrant as of June 30, 2021 was $

The number of shares of common stock outstanding on April 14, 2022, was shares.

DOCUMENTS INCORPORATED BY REFERENCE

CLEAN ENERGY TECHNOLOGIES, INC.

Form 10-K

TABLE OF CONTENTS

| 2 |

NOTE ABOUT FORWARD-LOOKING STATEMENTS

In this Annual Report on Form 10-K, references to “Clean Energy Technologies,” the “Company,” “we,” “us,” “our” and words of similar import refer to Clean Energy Technologies, Inc., unless the context requires otherwise.

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this report.

Forward-looking statements include, but are not limited to, statements concerning the following:

| ● | our possible or assumed future results of operations; | |

| ● | our business strategies; | |

| ● | our ability to attract and retain customers; | |

| ● | our ability to sell additional products and services to customers; | |

| ● | our cash needs and financing plans; | |

| ● | our competitive position; | |

| ● | our industry environment; | |

| ● | our potential growth opportunities; | |

| ● | expected technological advances by us or by third parties and our ability to leverage them; | |

| ● | Our inability to predict or anticipate the duration or long-term economic and business consequences of the ongoing COVID-19 pandemic; | |

| ● | the effects of future regulation; and | |

| ● | our ability to protect or monetize our intellectual property. |

You should read any other cautionary statements made in this Annual Report as being applicable to all related forward-looking statements wherever they appear in this Annual Report. We cannot assure you that the forward-looking statements in this Annual Report will prove to be accurate and therefore prospective investors are encouraged not to place undue reliance on forward-looking statements. You should read this Annual Report completely. Other than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future. We undertake no obligation to revise or update publicly any forward-looking statements for any reason, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on these forward-looking statements.

| 3 |

BUSINESS

Who We Are

We develop renewable energy products and solutions and establish partnerships in renewable energy that make environmental and economic sense. Our mission is to be a segment leader in the Zero Emission Revolution by offering recyclable energy solutions, clean energy fuels and alternative electric power for small and mid-sized projects in North America, Europe, and Asia. We target sustainable energy solutions that are profitable for us, profitable for our customers and represent the future of global energy production.

Our principal businesses

Waste Heat Recovery Solutions – we recycle wasted heat produced in manufacturing, waste to energy and power generation facilities using our patented Clean CycleTM generator to create electricity which can be recycled or sold to the grid.

Waste to Energy Solutions - we convert waste products created in manufacturing, agriculture, wastewater treatment plants and other industries to electricity, renewable natural gas (“RNG”), hydrogen and bio char which are sold or used by our customers.

Engineering, Consulting and Project Management Solutions – we bring a wealth of experience in developing clean energy projects for municipal and industrial customers and Engineering, Procurement and Construction (EPC) companies so they can identify, design and incorporate clean energy solutions in their projects.

| 4 |

Our Business Strategy

Our strategy is focused on further developing our existing Waste Heat Recovery business while expanding into the rapidly growing markets for Waste to Energy Solutions and clean energy engineering, consulting and project management services.

Our strategy focuses on three main elements:

| ● | Expanding our Waste Heat Recovery product line to include waste heat recovery ORC systems producing over 1 MW of power so we can qualify for midsized and large heat recovery projects in the United States, China, Southeast Asian and Pacific Rim countries. | |

| ● | Establishing a Waste to Energy business by selling our ablative thermal processing products based on proprietary HTAP technology and developing small and mid-sized waste to energy power plants producing electricity and RNG for the grid and methane, hydrogen and biochar for resale. | |

| ● | Leveraging our engineering, procurement and manufacturing experience in Waste Heat Recovery and Waste to Energy to assist companies and EPCs incorporate clean energy solutions into energy and industrial construction projects. |

We intend to implement this strategy through:

Adding a new ORC system manufactured by Enertime for Waste Heat Recovery that will enable us to implement projects in the U.S. markets producing between 1 MW and 10 MW of electricity.

Taking advantage of federal investment tax credits and state incentives that now include waste heat recover as a recognized clean energy source making our Clean Cycle Generator and ORC systems more profitable to install. On December 21, 2020, Congress passed the Consolidated Appropriations Act, 2021 enacted waste energy recovery Sec. 48 Investment Tax Credit, which extended Investment Tax Credit of 26% including Waste Heat to Power providing a dollar-for-dollar offset against current liability.

Benefiting from higher energy costs which provide higher returns on our Waste Heat Recovery and Waste to Energy products and projects.

Improving our balance sheet and capital position to permit us to invest in more products and projects.

Establishing HTAP manufacturing facilities in Turkey for our Waste to Energy products and expanding patent protection on the proprietary technology.

Leveraging our existing marketing channels to sell HTAP Waste to Energy products to industrial companies and government agencies.

Working with clean energy project development and finance companies to establish Waste to Energy power plants producing electricity, RNG, hydrogen, methane and biochar from biomass, municipal waste, timber waste and other biomass and while retaining an equity interest in these facilities to provide re-occurring revenue.

Sourcing LNG and selling it to privately owned pipeline companies in China through our newly formed LNG Trading company to participate in the rapidly growing clean energy market.

Acquiring natural gas pipeline operators into our joint venture with Shenzen Gas who will hold 51% of the joint venture and agreed to provide either a 100 million dollar credit line or otherwise finance these acquisitions in a framework agreement.

| 5 |

Participate in other minority investments in medium to large clean energy projects being developed in China that may be sourced by our majority stockholder in Hong Kong.

Leveraging the LNG trading and investment relationships to create opportunities for us to sell our Waste Recovery and Waste to Energy products in China and to provide engineering, consulting and project management services.

In 2021, we raised $4.78 million in a Regulation A equity offering. The proceeds from this offering were used to expand and enhance our existing business, improve our balance sheet and to expand into new energy-based businesses in China.

Business and Segment Information

We design, produce and market clean energy products and integrated solutions focused on energy efficiency and renewable energy. Our aim is to become a leading provider of renewable and energy efficiency products and solutions by helping commercial companies and municipalities reduce energy waste and emissions, lower energy costs and generate incremental revenue by providing electricity, renewable natural gas and biochar to the grid.

Segment Information

Our three segments for accounting purposes are:

Clean Energy Solutions - our Waste Heat Recovery Solutions, Waste to Energy Solutions, China LNG initiatives and Engineering and Consulting Services which are the core offerings of our business.

CETY Europe – our subsidiary established in Italy for the purposes of servicing our customers in the EU that we are required to report as a separate accounting entity.

Electronic Manufacturing Business - our legacy electronics manufacturing business that do not contribute significantly to our revenues or business plan that we are required to report as a separate accounting entity.

Our Clean Energy Solutions Business

Waste Heat Recovery Solutions

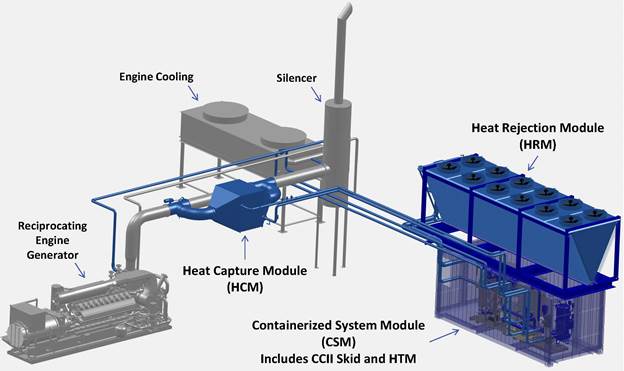

We provide our customers with power plants that capture wasted heat energy and produce electricity using a unique Organic Rankine Cycle (ORC) system containing our Clean CycleTM generator. Our magnetic bearing Integrated Power Modules is at the heart of our Clean CycleTM generator which can fit into a standard cargo container we call our Containerized System Module, producing 140KW per Clean Cycle generator and can be linked together for projects generating up to 1MW of power.

Our recent agreement with Enertime now permits us to install midsized and large ORC systems (between 1 MW and 10 MW) in the United States, allowing us to offer a full range of ORC systems to our customers. We believe this new capacity will enable us to expand our product offerings into larger scale waste recovery products in the United States. Enertime is a leader in producing ORC systems in Europe.

ORC waste heat recycling systems use pressurized working fluids that have a lower boiling point than water which make them ideal to repurpose waste heat into electricity. While most manufacturing processes do not produce enough heat to turn water into steam, there is enough heat to generate pressurized refrigerant in our ORC systems which is used to turn a turbine at high speeds to generate electricity.

We can link up to 10 Clean Cycle Generators together which can generate up to 10 GWh of electricity per year from waste heat which we estimate would reduce up to 5000 metric tons of CO2 production per year in an industrial heat recovery system or the annual equivalent of the CO2 emissions of approximately 2000 cars per year.

| 6 |

We believe the most important component in any ORC system is the turbine generator because it converts the steam heat into electricity and accounts for approximately 60% of the cost of the system. The more efficiently the turbine generator works, the better the ORC power plant operates. The remaining components consisting of the low boiling point fluid, condensers, which cool the fluids, the feed pumps, which pressurize the fluids to reduce boiling points and the heat exchangers, which extract the heat from the heat sources. These are more commoditized products and tend to perform at similar levels of efficiencies at similar price points.

We believe our Clean CycleTM generator is the most efficient turbine generator in it’s class and size available in the market for ORC systems generating up to 1 MW. We estimate that the Clean CycleTM generator has higher efficiency of approximately 15% than our competitors and its magnetic design eliminates the use of oils and lubricants, significantly reducing down time, repairs and operating costs. Our Integrated Power Module is compact and fit into a standard cargo container that can be delivered on a turnkey basis resulting in lower installation and implementation costs than on-site assembly.

We believe these features and benefits give us an important competitive advantage when building heat recovery power plants for our customers and provide us with the opportunity to compete with and obtain market share from the dominant industrial waste heat to power systems.

Over 121 Clean CycleTM generators have been deployed to date with 88 units used in biomass and waste to energy projects, 4 with diesel electric generators, 3 with turbine electric generators and 26 in industrial electric production applications. In 2021, we sold CCII units at 3 sites generating approximately $1.2 million in revenue. We expect to raise additional funds to expand our capacity to install 6-8 units per year which should approximately double our sales on a year-to-year basis.

We have a current backlog of two units representing approximately $800,000 in sales revenues.

The patented technology used in Clean CycleTM generator was purchased from General Electric International, together with over 100 installation sites, making us one of the leading provider of small-scale industrial waste heat to power systems. We have an exclusive license from Calnetix to use their magnetic turbine for heat waste recovery applications.

|

|

| Our Integrated Power Module | Our Clean Cycle TM Generator |

| 7 |

A complete ORC System with Integrated Power Module housed in a Containerized System Module (CSM)

Waste to Energy Solutions

We are adding a new business line in our clean energy solutions segment consisting of Waste to Energy processing equipment, engineering services and Waste to Energy processing power plant joint ventures where we expect to retain an ownership interest in the project.

Waste-to-Energy technologies that process non-renewable waste can reduce environmental and health damages while generating sustainable energy. Waste-to-Energy technologies consist of waste treatment process that creates energy in the form of electricity, heat or fuels from a waste source. These technologies can be applied to several types of waste: from the biomass (e.g. woodchips) to semi-solid (e.g. thickened sludge from effluent treatment plants) to liquid (e.g. domestic sewage) and gaseous (e.g. refinery gases) waste.

Waste to Energy Solutions can be used:

| ● | In any town, city or province with established waste management and collection. | |

| ● | Where there is a consistent supply of solid waste. | |

| ● | Places where treatment costs increase with shortages of space to store waste. | |

| ● | In areas with high energy prices to allow for cost of recovery from waste. |

Waste to Energy Solutions have many benefits:

| ● | Electricity from Waste to Energy plants can be generated from small amounts up to 30 MW providing for a wide range of opportunities to sell it back to the grid. | |

| ● | The synthetic renewable fuel gas produced from waste can be used for various production recyclable energy such as hot water, thermo-oil or steam, renewable natural gas or hydrogen. | |

| ● | Landfill waste is reduced and so is leachate and methane released from decomposing landfills. | |

| ● | Waste is a reliable source of energy and production is typically predictable and low cost whereas fossil fuel prices can fluctuate dramatically. |

| 8 |

But Traditional Incineration Methods Have Significant Downsides:

| ● | Air pollution can increase because scrubbing technologies are very expensive to install. | |

| ● | Many industrial, agricultural, and mixed municipal solid wastes have high moisture content at source and direct incineration of such waste requires burning fossil fuel. | |

| ● | to maintain thermal conversion process. | |

| ● | Carbon is released into the air which would otherwise be stored in landfill. | |

| ● | Ash and flue gas cleaning residues from incineration can also cause poisonous leachate problems if not properly disposed of which is costly and causes downstream environmental issues. | |

| ● | Generating electricity from incineration releases more CO2, SO2, NOx and mercury than natural gas. |

(Source: https://www.energyforgrowth.org/memo/waste-to-energy-one-solution-for-two-problems/)

The most common form of waste to energy systems are based on incinerators which simply burn waste using air. The Thermal Treatment on Grate is the most widespread technology being used by large waste landfills to generate electricity and heat. These systems produce substantial amounts of ash, heavy metals and carbon dioxide which need to be treated and disposed of to minimize its impact on the environment. They also require substantial amounts of pre-treatments prior to burning.

The Thermal on Grate incineration process, while wide-spread, is too expensive and complex for smaller and mid-sized waste to energy projects creating, what we believe, a significant market opportunity in small and mid-sized waste processing applications to create not only electricity but valuable renewable natural gas, bio diesel oil, hydrogen, methane, and biochar.

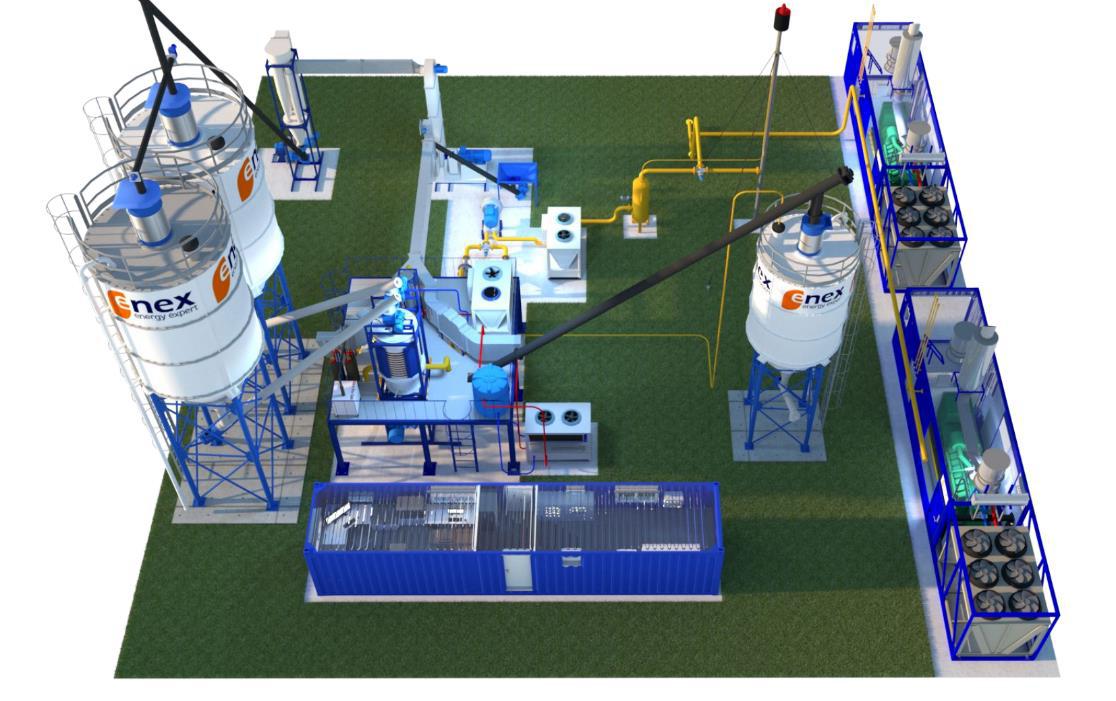

Our solution is a patented High Temperature Ablative Pyrolysis (HTAP) Biomass Reactor as viable commercial solution to the costs and environmental problems posed by traditional incarnation methods. We have the exclusive license and right to sell the HTAP10 and HTAP5 and related products manufactured by Enex which has a proven installed commercial base of customers using its waste to energy solutions. We believe this is an ideal solution to process waste for small to mid-sized waste to energy generation applications needed for processing industrial and municipality solid waste, agriculture waste, and forestry waste.

Pyrolysis systems decompose waste without the use of oxygen under varying pressurized conditions and at temperatures ranging from 300 degrees Celsius and 1,300 degrees Celsius. The major advantage of pyrolysis is that it is a cost-effective technology and helps curb environmental pollution. Pyrolysis systems are gradually replacing traditional incineration and gaining momentum in the waste to energy processing market addresses many of the pre-treatment issues and, when using high temperature and high-pressure, substantially reduce or eliminates pollutant. (Source: “Life Cycle Assessment of Waste-to-Bioenergy Processes: a Review” Pooja Ghosh, ... Arunaditya Sahay, in Bioreactors, 2020)

Pyrolysis systems can produce hydrogen, renewable natural gas, bio-diesel oil, charcoal, and biochar which are used to power hydrogen, diesel, and natural gas engines or electrical turbines which can be sold and often are eligible for substantial tax and pricing benefits. When compared with the conventional incineration plant that runs in the capacity of kilotons per day, the scale of the pyrolysis plant is more flexible, and the output of pyrolysis can be integrated with other downstream technologies for product upgrading. (Source: Influential Aspects in Waste Management Practices Karthik Rajendran PhD,. Jerry D. Murphy PhD, in Sustainable Resource Recovery and Zero Waste Approaches, 2019) In addition, BioChar stores and reduces atmospheric CO2 and can be used as a soil conditioner, an organic component of animal feeds, construction materials, wastewater treatment and in textiles. (Source: https://www.bioenergyconsult.com/applications-of-biochar/)

The ablative pyrolysis system is a waste to energy process that largely eliminates pre-treatment and the harmful pollutants and storage waste produced when using standard incineration and other pyrolysis technologies. It uses high pressure to generate fast pyrolysis and is designed so that the heat transferred from a hot reactor wall softens the feedstock under pressure and permits larger feedstock particles to be processed without pre-treatment. These systems create high relative motion between the reactor wall and the feedstock. The process avoids the need of inert gas and hence the processing equipment is small and the reaction system is more intense. (Source: http://biofuelsacademy.org/index.html%3Fp=608.html )

| 9 |

ENEX, LTD, has developed a proprietary patented ablative pyrolysis system for commercial use that has been installed in 7 sites for use in waste to energy creating applications processing including peat, coal, flax waste, sawdust and wood scrap, straw, buckwheat husks, and cardboard, tapes, films and paper machine sludge. ENEX has implemented over 1,500 onsite power generation projects in Russia working with major energy production companies such as Gazprom, Rosneft, Lukoil and Rostelecom as well as completing serval projects for customers in the European Union, Middle East and United States. They are in the process of moving their manufacturing facilities to Turkey where units can be produced at competitive prices.

CETY has global rights (except Russia and CIS countries) to design, build, manufacture, sell and operate renewable energy and waste recovery facilities using Enex’s HTAP10 and HTAP5 systems and other Enex products and technologies.

The patented HTAP technology utilizes a higher temperature that uses a cleaner gas for the heating process and a more efficient biogas turbine. The units can be customized to produce hydrogen, natural gas, diesel oil and bio char in varying quantities which can be sold or used to produce electricity. We believe that the key benefits of the HTAP Biomass Reactor are:

| ● | Flexibility in waste sourcing and mixing. | |

| ● | Customized outputs of hydrogen, synthetic fuels, natural gas, methane, biochar, carbon black, or construction materials. | |

| ● | Better waste sourcing and mixing flexibility, | |

| ● | Near-zero emissions, | |

| ● | Modular design, | |

| ● | Zero liquid discharge, | |

| ● | Zero solid waste residue waste. | |

| ● | Modular, containerize design reducing implementation costs | |

| ● | Proven commercial implementation. |

We are targeting industrial and municipality solid waste, landfill waste, agriculture waste (straw, stems, plant biomass, manure, crop wastage), and forestry waste from tree cuttings and shredded products.

We are in the process of identifying projects domestically and internationally for the HTAP Biomass Reactor. We believe the first project where we expect to implement the HTAP10 technology will be with Ashfield Ag Resources to co-develop a biomass renewable energy processing facility. The project is planned for a location in Massachusetts to convert forest biomass waste products to renewably generated electricity and BioChar fertilizer. We expect to annually deliver up to 14,600 MWh of renewable electricity and 1,500 tons of BioChar. The Ashfield project is one of four renewable energy processing facilities we plan to commission.

| 10 |

ENEX HTAP 10 Waste to Energy Processing Plant.

We established a wholly owned subsidiary called CETY Capital that we expect will help us finance our customers renewable energy projects producing low carbon energy. CETY Capital, when implemented, should add flexibility to the capacity CETY offers its customers and fund projects utilizing its products and clean energy solutions. The in-house financing arm is expected to support our sales and build new renewable energy facilities. To date we have conducted no material operations in this subsidiary.

Our Clean Energy Initiatives in China

Natural gas is China’s fastest-growing primary fuel with demand quadrupling in the past decade. Developing the natural gas sector is a critical aspect China’s effort to reduce reliance on coal. According to the International Energy Agency, China is the world’s sixth-largest natural gas producer, the third-largest consumer, and the second-largest importer. In 2050, the U.S. Energy Information Administration (EIA) expects China to consume nearly three times as much natural gas as it did in 2018, which was 280.30 b/cm. China’s natural gas consumption accounted for 8.3% of its total energy mix in 2019. China anticipates boosting the share of natural gas as part of total energy consumption to 14% by 2030. Before COVID 19, China was expected to account for a third of global demand growth through 2022, thanks in part to the country’s “Blue Skies” policy and the strong drive to improve air quality. China’s relatively strong economic recovery from the COVID 19 crisis will probably increase that share. Natural gas is imported either through pipelines or as liquefied natural gas (LNG) on ships. According to Reuters, in 2019, the largest sources for Chinese LNG imports were Australia, Qatar, Malaysia, and Indonesia. ( Source: U.S. Department of Commerce, International TradeAdministration.https://www.trade.gov/country-commercial-guides/china energy#:~:text=China%20anticipates%20boosting%20the%20share,drive%20to%20improve%20air%20quality.)

Liquid Natural Gas in the Chinese energy market produces half as much carbon dioxide, less than a third as much nitrogen oxides, and 1 percent as much sulfur oxides at the power plant compared to the average air emissions from coal-fired generation. In addition to reduced air emissions, natural gas has other environmental benefits that make it a smart fuel choice. Natural gas-fired power plants use about 60 percent less water than coal plants and 75 percent less water than nuclear power plants for the same electricity output. (Source: Conoco Phillips)

In 2021, we acquired through our subsidiary, CETY Hong Kong, a liquefied natural gas trading operation called Jiangsu Huanya Jieneng (“JHJ”) which sources LNG from large LNG producers and distributors and sells it to non-state-owned industries and downstream customers in mainland China. In addition, CETY Hong Kong established a frame work agreement for a future joint venture with the overseas investment arm of a large state-owned gas enterprise in China called Shenzhen Gas (Hong Kong) International Co. Ltd. (“Shenzhen Gas”). CETY Hong Kong holds a 49% interest in the joint venture. The joint venture plans to acquire municipal natural gas operators in China with funds provided by Shenzhen Gas.

CETY also plans to sell its waste heat recovery and waste to energy products in China as well as provide consulting services relating to the same to projects in China.

The JHJ team has more than 10 years of experience in the natural gas and clean energy industry and has maintained relationships and partners with many natural gas enterprises in China.

| 11 |

LNG Trading Operations

JHJ’s principal service is to source and supply LNG to industries and municipalities located in the southern part of Sichuan Province and portions of Yunnan Province. The LNG is principally used for heavy truck refueling stations and urban or industrial users in areas that do not have a connection to local LNG pipeline systems. We purchase large quantities of LNG from large wholesale LNG depots at fixed prices which are prepaid for in advance at a discount to market. We sell the LNG to our customers at prevailing daily spot prices for the duration of the contracts.

Either our sources or customers arrange for delivery of the LNG. Our profitability depends on our ability to purchase LNG at volume discounts at the beginning of a season and sell it at a delivered price that is higher than the price we pay.

JHJ traders are experienced LNG traders, familiar with the spot and future markets and have relationships with the major users of LNG in the areas that we serve. Our customers may be local or may be as far as 700km from each depot.

We compete with other LNG trading based on availability and price. We target our discount with our sources to partially hedge against falling spot prices and give us a gross profit targeted at substantially higher rate than our competitors which are approximately 20-30 percent margins compared against what we believe are 1-5 percent margins by our competitors. So long as there are no major fluctuations in the spot market, we can offer more competitive prices due to the discounts we receive from the large volumes purchased and the prepayments for the LNG. JHJ has currently established a supply of approximately 8,000 tons of LNG for distribution.

We are able to purchase LNG at a significant discount from our suppliers because our prepayments offer suppliers more certainty with respect to the sales of their inventory, address their cash flow issues, and allow them to better plan for production. We believe our downstream customers get better prices from us because of our bulk buying power, ease of inventory management and cash flow.

Both our suppliers and customers can reduce costs by using JHJ as a centralized procurement center and establishing professional logistics distribution based on stable supply and downstream demand.

In addition, at the time of our acquisition of JHJ, JHJ had substantially completed negotiations to enter into an agreement to obtain a 15% equity stake in Heze Hongyuan Natural Gas (HHNG), a local pipeline operator in the Shandong Province, by purchasing a stake through Chengdu Rongjun Enterprise Consulting Co., Ltd. (CRE) The investment is secured via a share-pledge by the majority shareholder of HHNG, and in case of a default, JHJ can take over the majority position. JHJ has full transparency to the use of proceeds as well as supervision of the operations of HHNG. In January 2022, JHJ entered into a convertible promissory note with CRE, at 12% annual interest, in the amount of Yuan 5,000,000 (approximately USD 787,686), which was funded by, purchases of our stock by PRC investors under our Regulation A offering at a price of USD .08 per share. The Note is convertible into 15% of HHNG equity interests subject to dilution by additional equity investment into HHNG by third parties. We do not expect the project to require additional investment from us, JHJ or HHNG. The project is currently planning and constructing additional pipelines in the Heze area and is expected to generate cash flow by the first quarter of 2023. We do not expect to make further direct minority investments in other pipeline operators as we expect these acquisitions to take place through our joint venture with Shenzhen Gas.

| 12 |

Joint Venture with Shenzhen Gas.

We are in the process of establishing a joint venture with Shenzhen Gas with plans to acquire natural gas utility companies in China. Shenzhen Gas is expected to provide a line of credit to the joint venture to fully cover the acquisition costs or otherwise facilitate capital infusions. We believe our participation in the joint venture will also provide our parent company, CETY and its subsidiaries, with the opportunity to sell its products and consulting services to the companies acquired by the joint venture.

We believe that Shenzhen Gas entered into the Joint Venture with us because of the expertise of JHJ in the LNG market in southwest China and their ability to source and complete profitable deals for the joint ventures.

Our subsidiary, Leading Wave Limited, signed a non-binding “Strategic Cooperation Framework Agreement” with Shenzhen Gas, on August 30, 2021. According to the agreement, we expect the joint venture will invest up to RMB 3 to 5 billion which will be financed through a credit line extended by Shenzhen Gas to the joint venture at an interest rate of approximately 5% per annum. JHJ’s team will be providing the know-how on the joint venture’s acquisition strategy as well as streamlining the operations of the portfolio companies to increase the overall profitability of the investments.

Engineering, Consulting and Project Management Services

Engineering. Our global engineering team supports the design, build, installation, and maintenance of our Clean CycleTM generators, supports our technology customers and innovative start-ups with a broad range of electrical, mechanical and software engineering services. CETY has assembled a team of experts from around the globe to assist customers at any point in the design cycle. These services include design processes from electrical, software, mechanical and Industrial design. Utilization of CETY’s design services will provide our customers with a complete end to end solution.

Supply Chain Management. CETY’s supply chain solution provides maximum flexibility and responsiveness through a collaborative and strategic approach with our customers. CETY can assume supply chain responsibility from component sourcing through delivery of finished product. CETY’s focus on the supply chain allows us to build internal and external systems and better our relationships with our customers, which allows us to capitalize on our expertise to align with our partners and customer’s objectives and integrate with their respective processes.

The Market for Our Products.

Waste to Energy.

There are more than 2500 waste-to-energy plants in the world, including almost 500 in Europe. ( Source: https://wteinternational.com/news/waste-to-energy-technologies-overview/). The waste-to-energy (WtE) market is expected to register a CAGR of 7.35% during the forecast period of 2021 – 2026, reaching a market size of USD 69.94 billion by 2026, up from USD 43.66 billion in 2019. The COVID-19 pandemic affected the market negatively in the form of supply chain disruptions and delays in project implementation. However, the market is expected to recover from 2021, owing to the increasing efforts to promote waste-to-energy plants by various countries across the world. In addition to this, an increasing amount of waste generation and growing concern for waste management to meet the need for sustainable urban living, and increasing focus on non-fossil fuel sources of energy are driving the demand for the waste-to-energy market. Thermal technology is expected to dominate the waste-to-energy market in the coming years, owing to the increasing development in incineration and gasification technologies, as well as the increasing amount of waste generated, especially from the emerging economies of Asia-Pacific. Asia-Pacific has witnessed significant development in the waste-to-energy industry in the past few years. It has dominated the market across the world with increasing efforts taken by the government in adopting better MSW management practices, providing incentives for waste-to-energy projects in the form of capital subsidies and feed-in tariffs, and providing financial support for R&D projects on a cost-sharing basis. Due to economic development and rapid urbanization in China, the generation of municipal solid waste (MSW) has been increasing rapidly. Therefore, the effective disposal of municipal solid waste has become a serious environmental challenge in China. (Source: https://www.reportlinker.com/p06192762/Waste-to-Energy-WtEMarket-Growth-Trends-COVID-19-Impact-and-Forecasts.html?utm_source=GNW

| 13 |

Increasing government regulations regarding the waste to energy in various countries is one of the major factors driving the growth of global waste to energy market. For instance, according to Federal Power Act 2019, this act gives federal authority over electric utilities in U.S. Also the acts like Public Utility Regulatory Policy Act (PURPA) and Energy Policy Act are applied by the government to increase the waste to energy and decrease the CO2 emission by fossil fuels. In addition, escalating investments in R&D by different countries is also fostering the growth of global waste to energy market. (Source https://www.mynewsdesk.com/brandessence/pressreleases/at-cagr-of-7-dot-6-percent-waste-to-energy-market-is-expected-to-reach-usd-52-dot-92-billion-by-2027-3125591)

Alternative thermal technologies like pyrolysis, gasification and plasma arc gasification are expected to lower carbon emissions and witness the growth in demand. Moreover, a shift in trend towards replacing conventional energy generating from fossil fuels with renewable energy to ensure energy security and reduce carbon emissions are potential factors to drive industry growth. The global waste to energy market size was valued at $35.1 billion in 2019, and is projected to reach $50.1 billion by 2027, growing at a CAGR of 4.6% from 2020 to 2027.

https://www.alliedmarketresearch.com/waste-to-energy-market

Waste Heat Recovery

A study by Market Research Future in October of 2021 forecasted the waste heat recover market would be worth USD 114 billion by 2028 registering a CAGR of 9.2 per year from a baseline of USD 59.44 billion in 2020. The primary economic driver in the waste heat recovery market are “rising energy use, economic development, and rising electricity prices. The use of energy in many sectors to manufacture products is steadily growing. The need for energy has increased in industrialized regions as industrialization has occurred. Companies are developing numerous strategies to transform waste heat into energy as the demand for energy grows. As a result, it is fueling the growth of the Waste Heat Recovery market. The government has taken various initiatives and enacted rules to save energy, which has promoted the usage of Waste Heat Recovery technologies. Due to environmental concerns, the government is taking steps to save energy; as a result, the Waste Heat Recovery sector is booming. Energy-efficient technology has become critical for industries looking to save money.” (Source: https://www.yahoo.com/now/waste-heat-recovery-market-worth-095200052.html)

In 2020 North America constituted the largest share of the market accounting for approximately 33% of the global total but countries in Asia and the Asia Pacific constitute the fasting growing geographic sectors due to rapid industrial expansion.

Waste heat recovery systems in the United States now qualify for beneficial investment tax credits of up to 26% on the investment driving additional companies to install ORC industrial waste heat to power units. Owners of waste energy recovery property can claim a 26% ITC if construction of such property begins during 2021 or 2022, and a 22% ITC if construction begins during 2023, provided in each case that the property is placed in service by the end of 2025. (Source: https://www.lw.com/thoughtLeadership/covid-19-tax-relief-package-extends-renewable-power-and-carbon-capture-tax credits#:~:text=Owners%20of%20waste%20energy%20recovery,by%20the%20end%20of%202025) We also believe the increasing prices for oil and natural gas as a factor that encourages the use of our waste heat recovery systems.

A Renewable Portfolio Standard (RPS) is a state incentive program that requires a certain percentage of electricity sold by utilities in the state to come from renewable resources. It diversifies the energy portfolio of the state while encouraging economic development. By establishing an RPS a state creates a market for Renewable Energy Credits (RECs). Each utility must obtain and retire a certain number of RECs annually. Several states including Colorado, Wisconsin, Illinois and California among others have now list waste heat to power as an eligible resource in their RPS program.

| 14 |

LNG Trading and Joint Venture

Since 2012, the National Development and Reform Commission has stressed that “natural gas vehicles, including urban buses, taxis, logistics distribution vehicles, trucks and other natural gas-fueled transportation vehicles” are the most important users of natural gas and require a consistent supply chain. As a result, regions and provinces in the PRC have accelerated the construction of a network of LNG refueling stations and encouraged the expansion of fleets of delivery vehicles. Due to China’s “carbon peak, carbon neutral” goal commitment, China’s environmental protection policies are gradually being tightened resulting in increased utilization rates of natural gas as a clean energy alternative is getting higher and higher. (Source China 13th Renewable Energy Development Five Year Plan https://www.iea.org/policies/6277-china-13th-renewable-energy-development-five-year-plan-2016-2020)

By 2027, analysts forecast spot trade in LNG will be $20 billion, more than double its 2020 value. Last year, China’s imports soared by 18% to a record 79 million tons, overtaking Japan as the world’s largest LNG buyer. China’s economic recovery from the COVID-19 pandemic was one factor, but the other was a pipeline reform that allowed more firms to become importers. (Source: Reuters U.S. supplies give China muscle to become major force in global LNG trade https://www.reuters.com/business/energy/us-supplies-give-china-muscle-become-major-force-global-lng-trade-2022-02-11/)

Aligning with many policy goals, natural gas will remain a growth engine for energy supply in the 14th FYP period. The policy direction on air pollution reduction, carbon emission control, and gas supply and midstream infrastructure development indicates continued support for higher penetration of gas in the growing energy mix. On the other hand, the focus on supply security and cost reduction from market reforms indicate an expectation of decelerating gas demand growth in the 14th FYP period compared with that in the previous five years. In the current IHS Markit outlook, China’s gas demand will grow 6% compound annual average during 2021-25—compared with the 11% growth in the previous five year—to reach 429 Bcm in 2025. (Source S& P Global. China’s Five Yar Plan’s Review and Expectation: Batural Gas Tick the Box for Many Policy Goals. https://ihsmarkit.com/research-analysis/chinas-fiveyear-plans-review-and-expectation-natural-gas-ticks.html).

We believe that Southwest China is rich in natural gas resources providing us with a stable source of supply and is an important major natural gas producing area in the country. We estimate that there are 16 LNG production plants with a capacity of more than 300,000 cubic meters per day in Southwest China, with a total design capacity of 11.7 million cubic meters per day. We believe the supply is mainly to satisfy LNG refueling stations and LNG vehicles which are among our primary downstream customers.

We estimate that by the end of 2022, a total of about 240 LNG refueling stations were operating in South Western China, including about 170 in Sichuan, about 30 in Yunnan, and about 40 in Guizhou; the daily consumption of LNG refueling stations that have been put into operation in Yunguichuan is about 7,200 tons per day, which is basically the same as the upstream output, reaching a “balance of production and sales”.

In order to help achieve the goal of “carbon peaking and carbon neutrality”, accelerate the clean and low-carbon transformation of transportation energy, the Sichuan Provincial Development and Reform Commission and Sichuan Provincial Energy Administration issued the “Sichuan Province Natural Gas Vehicle Refueling Station Layout Plan (2021-2025)”, which proposed that by 2025, Sichuan will build 500 new refueling stations (including 141 stations in the expressway service area ), including 15 CNG refueling stations, 401 LNG refueling stations, 8 L-CNG refueling stations, and 76 CNG/LNG joint refueling stations.

Based on the development plan for LNG refueling stations in the southwest region we believe that the downstream demand for LNG by our customers will maintain a steady growth rate over the next five years.

| 15 |

Sales and Marketing

We utilize both a direct sales force and global distribution group with expertise in heat recovery solutions and clean energy markets.

CETY maintains an online presence through our web portal and social media. We also have established cross-sale agreements with synergistic technology providers promoting our solutions to our respective customers. We utilize email campaigns to keep the marketplace abreast of the recent developments with our solutions. We work with the municipalities to identify incentive programs that could utilize our solutions.

Our application engineers assist in converting the opportunities into projects. We provide technical support to our Clean Cycle TM generator clients and recently introduced waste to energy plants through providing maintenance and product support.

Our market focus is segmented by the engine heat recovery, waste to energy plants, engineering & procurement, and renewable energy trade, Wastewater treatment plants and boiler applications with excess heat.

Our experienced team of LNG traders identify producers and customers for the LNG trading business as well as originate acquisition opportunities for our Shenzhen Gas joint venture.

Suppliers

Our heat recovery solutions systems are manufactured primarily from components available from multiple suppliers and to a lesser extend from custom fabricated components available from various sources. We purchase our components from suppliers based on price and availability. Our significant suppliers in the Waste Heat Recovery business include Powerhouse, Concise Instrument, and Grainger.

Our waste to energy components are sourced globally including the US with the exception of the core components originally sourced in Russia and being transitioned to Turkey and US. We are in the process of establishing an inhouse center of competence and technology development based out of Turkey to source these components in Europe and US with the ability to deploy the product globally. Although future impacts can not be predicted the company does not foresee any negative impact from the Russa and Ukraine conflict.

The liquid natural gas in China is obtained from various local production plants in Southeast China based on price and quality. Deliveries of the LNG are made through third party trucking companies. We purchase large quantities of LNG from large wholesale LNG depots at fixed prices which are discounted and prepaid for in advance at a discount to market.

Competition

ORMAT, Exergy, TAS and Turboden are the leaders in ORC system power plants with more than 75% of installed capacity and plants, Exergy and TAS are following with around 13% and 6% of the market respectively while Turboden has recently penetrated the geothermal market with about 2% of the installed capacity.

The Waste to Energy Market is dominated by Hitachi Zosen Inova AG, Suez, Veolia, Ramboll Group A/S, Covanta Holding Corporation, China Everbright International Ltd., Abu Dhabi National Energy Company PJSC, Babcock & Wilcox Enterprises lnc., Whaleboater Technologies lnc., Xcel Energy lnc. (Source: https://www.mynewsdesk.com/brandessence/pressreleases/at-cagr-of-7-dot-6-percent-waste-to-energy-market-is-expected-to-reach-usd-52-dot-92-billion-by-2027-3125591)

We also compete with numerous companies that are smaller than the major companies who are focused on the smaller to medium sized installations in Waste Heat Recovery and Waste to Energy. We believe our waste to energy products are more efficient for use in small and medium sized operations than our competitors and provide us with a competitive advantage on that basis.

In China, our LNG trading operations compete with large state-owned LNG producers and importers such as Sinopec and many smaller local energy trading companies in the PRC. We compete based on price and consistency of services. Our joint venture with Shenzhen Gas competes with other large state-owned gas producers and smaller operators that may seek to grow by acquiring additional natural gas operators. We believe our local relationships maintained by our local trading team and affiliation with Shenzhen Gas, a major supplier in China, enable us to identify and acquire companies more efficiently than our competitors.

| 16 |

Company Information

We were incorporated in California in July 1995 under the name Probe Manufacturing Industries, Inc. We redomiciled to Nevada in April 2005 under the name Probe Manufacturing, Inc. We manufactured electronics and provided services to original equipment manufacturers (OEMs) of industrial, automotive, semiconductor, medical, communication, military, and high technology products. On September 11, 2015 Clean Energy HRS, or “CE HRS”, our wholly owned subsidiary acquired the assets of Heat Recovery Solutions from General Electric International. In November 2015, we changed our name to Clean Energy Technologies, Inc.

Our principal executive offices are located at 2990 Redhill Avenue, Costa Mesa, CA 92626. Our telephone number is (949) 273-4990. Our common stock is listed on the OTCQB Markets under the symbol “CETY.”

Our internet website address is www.cetyinc.com and our subsidiary’s web site is www.heatrecoverysolutions.com The information contained on our websites are not incorporated by reference into this document, and you should not consider any information contained on, or that can be accessed through, our website as part of this document.

The Company has three reportable segments: Clean Energy HRS (HRS), CETY Europe, and the legacy electronic manufacturing services (Electronic Assembly) division.

Patents

We currently hold 16 patents in 6 countries and 28 pending applications in 8 countries, which were acquired from General Electric International relating to our magnetic turbine technology.

Intellectual Property

As part of our asset acquisition from General Electric International we acquired an exclusive, irrevocable, sublicensable, limited transferable, royalty free, fully paid, worldwide perpetual license to develop, improve and commercialize Calnetix’s magnetic turbine in any Organic Rankine Cycle based application where heat is sourced from a reciprocating combustion engine of any type, except marine vessels, any gas or steam turbine systems for electrical power generation applications or any type of biomass boiler system.

We have a global manufacturing and sales agreement with ENEX for its pyrolysis system.

Facilities

We operate from a 20,000 sq-ft state of the art facility in Costa Mesa, California USA. We have in-house electro-mechanical assembly and testing capabilities. Our products are compliant with American Society of Mechanical Engineers and are UL and CE approved. We also have a 5000 sq-ft sales and service center located in Treviso, Italy. Our Asian headquarters is located in Hong Kong and our 3000 sq-ft Engineering consultancy and Natural Gas Trading company is located in Chengdu.

Employees

We presently have approximately 20 employees, including operational, engineering, accounting and marketing personnel. We utilize extensive number of consultants as well and have never experienced work stoppages and we are not a party to any collective bargaining agreement. We have 7 employees in JSJ in China.

| 17 |

Government Regulation

Our operations are subject to certain foreign, federal, state and local regulatory requirements relating to environmental, waste management, and health and safety matters. We believe we operate in substantial compliance with all applicable requirements. However, material costs and liabilities may arise from these requirements or from new, modified or more stringent requirements. Material cost may rise due to additional manufacturing cost of raw or made parts with the application of new regulations. Our liabilities may also increase due to additional regulations imposed by foreign, federal, state and local regulatory requirements relating to environmental, waste management, and health and safety matters. In addition, our past, current and future operations and those of businesses we acquire, may give rise to claims of exposure by employees or the public or to other claims or liabilities relating to environmental, waste management or health and safety concerns.

Our markets can be positively or negatively impacted by the effects of governmental and regulatory matters. We are affected not only by energy policy, laws, regulations and incentives of governments in the markets into which we sell, but also by rules, regulations and costs imposed by utilities. Utility companies or governmental entities could place barriers on the installation of our product or the interconnection of the product with the electric grid. Further, utility companies may charge additional fees to customers who install on-site power generation, thereby reducing the electricity they take from the utility, or for having the capacity to use power from the grid for back-up or standby purposes. These types of restrictions, fees or charges could hamper the ability to install or effectively use our products or increase the cost to our potential customers for using our systems in the future. This could make our systems less desirable, thereby adversely affecting our revenue and profitability potential. In addition, utility rate reductions can make our products less competitive which would have a material adverse effect on our future operations. These costs, incentives and rules are not always the same as those faced by technologies with which we compete. However, rules, regulations, laws and incentives could also provide an advantage to our Heat Recovery Solutions as compared with competing technologies if we are able to achieve required compliance at a lower cost when our Clean Cycle TM generators are commercialized. Additionally, reduced emissions and higher fuel efficiency could help our future customers combat the effects of global warming. Accordingly, we may benefit from increased government regulations that impose tighter emission and fuel efficiency standards.

Research and Development

We had no expenses in Research and Development costs during the years ended December 31, 2021 and 2020.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy our reports or other filings made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, N.E., Washington, DC 20549. You can obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these reports and other filings electronically on the SEC’s web site, www.sec.gov.

Item 1a. Risk Factors.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item. We reserve the right not to provide risk factors in our future filings. Our primary risk factors and other considerations include:

| 18 |

RISKS ABOUT OUR BUSINESS

OUR INDEPENDENT ACCOUNTANTS HAVE ISSUED A GOING CONCERN OPINION AND IF WE CANNOT OBTAIN ADDITIONAL FINANCING AND/OR REDUCE OUR OPERATING COSTS SUFFICIENTLY, WE MAY HAVE TO CURTAIL OPERATIONS AND MAY ULTIMATELY CEASE TO EXIST.

Going Concern

The financial statements have been prepared on a going concern basis, which contemplates continuity of operations, realization of assets and liquidation of liabilities in the normal course of business. The Company had a total stockholder’s deficit of $1,702,653 and a working capital deficit of $4,274,383 and an accumulated deficit of $17,423,930 as of December 31, 2021 and used $2,576,369 in net cash from operating activities for the year ended December 31, 2021. Therefore, there is doubt about the ability of the Company to continue as a going concern. There can be no assurance that the Company will achieve its goals and reach profitable operations and is still dependent upon its ability (1) to obtain sufficient debt and/or equity capital and/or (2) to generate positive cash flow from operations.

For the year ended December 31, 2021, we had a net profit of $278,429 compared to a net loss of $3,435,764 for the same period in 2020. The increase in the net profit in 2021 was mainly due to the change in derivative liability associated with the convertible debt and lower interest expense from 2021 to 2020.

WE HAVE AN ACCUMULATED DEFICIT AND MAY INCUR ADDITIONAL LOSSES; THEREFORE, WE MAY NOT BE ABLE TO OBTAIN THE ADDITIONAL FINANCING NEEDED FOR WORKING CAPITAL, CAPITAL EXPENDITURES AND TO MEET OUR DEBT SERVICE OBLIGATIONS.

As of December 31, 2021, we had current liabilities of $6,879,888. The company has been able to raise additional capital of approximately $4.78 million and repaid approximately $2,000,000 of debt in 2021. Our debt could limit our ability to obtain additional financing for working capital, capital expenditures, debt service requirements, or other purposes in the future, as needed; to plan for, or react to, changes in technology and in our business and competition; and to react in the event of an economic downturn.

We may not be able to meet our debt service obligations. If we are unable to generate sufficient cash flow or obtain funds for required payments, or if we fail to comply with covenants in our revolving lines of credit, we will be in default.

WE ARE IN DEFAULT IN OUR OBLIGATIONS TO A MAJOR CREDITORS

We are in default of $297,655 payments of principal and interest on our notes payable to Cybernaut Zfounder Ventures.

OUR BUSINESS, RESULTS OF OPERATIONS AND FINANCIAL CONDITION MAY BE ADVERSELY AFFECTED BY PUBLIC HEALTH EPIDEMICS, INCLUDING THE CORONAVIRUS OR COVID-19.

Our business, results of operations and financial condition may be adversely affected if a public health epidemic, including the coronavirus or COVID-19 interferes with the ability of us, our employees, workers, contractors, suppliers, customers and other business partners to perform our and their respective responsibilities and obligations relative to the conduct of our business. We maintain offices in HaiXi with employees and workers upon whom we rely to, among other things, identify sources of supply in China, conduct factory inspections, place orders for merchandise, perform factory monitoring with respect to production, quality control and other requirements, and arrange shipping. A public health epidemic, including the coronavirus, poses the risk that we or our employees, workers, contractors, suppliers, customers and other business partners may be prevented from conducting business activities for an indefinite period of time, including due to shutdowns that may be requested or mandated by governmental authorities. We face similar risks if a public health epidemic, including the coronavirus, affects other geographic areas where our employees, workers, contractors, suppliers, customers and other business partners are located.

| 19 |

WE HAVE NOT MADE A PAYMENT UNDER A MATERIAL CONTRACT

We have not made a payment of $1,200,000 with the accrued interest of $325,843 which is the balance of the purchase price pursuant to our asset purchase agreement with General Electric International. In addition, we have not paid an amount of $972,233 in accrued transitional fees. We believe that the outstanding amounts should have been an offset to purchase price we paid due to a misrepresentation of the values of the disclosed assets as reflected in the principal amount of the outstanding note and in the transition agreements.

IF DEMAND FOR THE PRODUCTS AND SERVICES THAT THE COMPANY OFFERS SLOWS, OUR BUSINESS WOULD BE MATERIALLY AFFECTED.

Demand for products which it intends to sell depends on many factors, including:

| ● | the economy, and in periods of rapidly declining economic conditions, customers may defer purchases or may choose alternate products; | |

| ● | the cost of oil, gas and solar energy; | |

| ● | the competitive environment in the heat to power sectors may force us to reduce prices below our desired pricing level or increase promotional spending; | |

| ● | our ability to maintain efficient, timely and cost-effective production and delivery of the products and services; and, | |

| ● | All of these factors could result in immediate and longer term declines in the demand for the products and services that we offer, which could adversely affect our sales, cash flows and overall financial condition. |

WE OPERATE IN A HIGHLY COMPETITIVE MARKET. IF WE DO NOT COMPETE EFFECTIVELY, OUR PROSPECTS, OPERATING RESULTS, AND FINANCIAL CONDITION COULD BE ADVERSELY AFFECTED.

The markets for our products and services are highly competitive, with companies offering a variety of competitive products and services. We expect competition in our markets to intensify in the future as new and existing competitors introduce new or enhanced products and services that are potentially more competitive than our products and services. We believe many of our competitors and potential competitors have significant competitive advantages, including longer operating histories, ability to leverage their sales efforts and marketing expenditures across a broader portfolio of products and services, larger and broader customer bases, more established relationships with a larger number of suppliers, contract manufacturers, and channel partners, greater brand recognition, and greater financial, research and development, marketing, distribution, and other resources than we do and the ability to offer financing for projects. Our competitors and potential competitors may also be able to develop products or services that are equal or superior to ours, achieve greater market acceptance of their products and services, and increase sales by utilizing different distribution channels than we do. Some of our competitors may aggressively discount their products and services in order to gain market share, which could result in pricing pressures, reduced profit margins, lost market share, or a failure to grow market share for us. If we are not able to compete effectively against our current or potential competitors, our prospects, operating results, and financial condition could be adversely affected.

WE MAY LOSE OUT TO LARGER AND BETTER-ESTABLISHED COMPETITORS.

The alternative power industry is intensely competitive. Most of our competitors have significantly greater financial, technical, marketing and distribution resources as well as greater experience in the industry than we have. Our products may not be competitive with other technologies, both existing at the current time and in the future. If this happens, our sales and revenues will decline, or fail to develop at all. In addition, our current and potential competitors may establish cooperative relationships with larger companies to gain access to greater development or marketing resources. Competition may result in price reductions, reduced gross margins and loss of market share.

| 20 |

OUR INTERNATIONAL OPERATIONS SUBJECT US TO RISKS, WHICH COULD ADVERSELY AFFECT OUR OPERATING RESULTS.

Our international operations are exposed to the following risks, several of which are out of our control:

political and economic instability, international terrorism and anti-American sentiment, particularly in emerging markets;

| ● | preference for locally branded products, and laws and business practices favoring local competition; | |

| ● | unusual or burdensome foreign laws or regulations, and unexpected changes to those laws or regulations; | |

| ● | |import and export license requirements, tariffs, taxes and other barriers; | |

| ● | costs of customizing products for foreign countries; | |

| ● | increased difficulty in managing inventory; | |

| ● | less effective protection of intellectual property; and | |

| ● | difficulties and costs of staffing and managing foreign operations. |

Any or all of these factors could adversely affect our ability to execute any geographic expansion strategies or have a material adverse effect on our business and results of operations.

OUR PRODUCTS MAY BE DISPLACED BY NEWER TECHNOLOGY.

The alternative power industry is undergoing rapid and significant technological change. Third parties may succeed in developing or marketing technologies and products that are more effective than those developed or marketed by us, or that would make our technology obsolete or non-competitive. Accordingly, our success will depend, in part, on our ability to respond quickly to technological changes. We may not have the resources to do this.

WE MUST HIRE QUALIFIED ENGINEERING, DEVELOPMENT AND PROFESSIONAL SERVICES PERSONNEL.

We cannot be certain that we can attract or retain a sufficient number of highly qualified mechanical engineers, industrial technology and manufacturing process developers and professional services personnel. To deploy our products quickly and efficiently, and effectively maintain and enhance them, we will require an increasing number of technology developers. We expect customers that license our technology will typically engage our professional engineering staff to assist with support, training, consulting and implementation. We believe that growth in sales depends on our ability to provide our customers with these services and to attract and educate third-party consultants to provide similar services. As a result, we plan to hire professional services personnel to meet these needs. New technical and professional services personnel will require training and education and it will take time for them to reach full productivity. To meet our needs for engineers and professional services personnel, we also may use costlier third-party contractors and consultants to supplement our own staff. Competition for qualified personnel is intense, particularly because our technology is specialized and only a limited number of individuals have acquired the needed skills. Additionally, we will rely on third-party implementation providers for these services. Our business may be harmed if we are unable to establish and maintain relationships with third-party implementation providers.

WE MAY BE ADVERSELY AFFECTED BY SHORTAGES OF REQUIRED COMPONENTS. IN ADDITION, WE DEPEND ON A LIMITED NUMBER OF SUPPLIERS TO PROCURE OUR PARTS FOR PRODUCTION WHICH IF AVAILABILITY OF PRODUCTS BECOMES COMPROMISED IT COULD ADD TO OUR COST OF GOODS SOLD AND AFFECT OUR REVENUE GROWTH.

At various times, there have been shortages of some of the components that we use, as a result of strong demand for those components or problems experienced by suppliers. These unanticipated component shortages have resulted in curtailed production or delays in production, which prevented us from making scheduled shipments to customers in the past and may do so in the future. Our inability to make scheduled shipments could cause us to experience a reduction in our sales and an increase in our costs and could adversely affect our relationship with existing customers as well as prospective customers. Component shortages may also increase our cost of goods sold because we may be required to pay higher prices for components in short supply and redesign or reconfigure products to accommodate substitute components.

| 21 |

OUR PRINCIPAL SHAREHOLDERS, DIRECTORS AND EXECUTIVE OFFICERS, IN THE AGGREGATE, BENEFICIALLY OWN MORE THAN 50% OF OUR OUTSTANDING COMMON STOCK AND THESE SHAREHOLDERS, IF ACTING TOGETHER, WILL BE ABLE TO EXERT SUBSTANTIAL INFLUENCE OVER ALL MATTERS REQUIRING APPROVAL OF OUR SHAREHOLDERS.

Our principal shareholders, directors and executive officers in the aggregate, beneficially own more than 50% our outstanding common stock on a fully diluted basis. These shareholders, if acting together, will be able to exert substantial influence over all matters requiring approval of our shareholders, including amendments to our Articles of Incorporation, fundamental corporate transactions such as mergers, acquisitions, the sale of the company, and other matters involving the direction of our business and affairs and specifically the ability to determine the members of our board of directors. (See “Security Ownership of Certain Beneficial Owners and Managements”).

IF WE LOSE KEY SENIOR MANAGEMENT PERSONNEL OUR BUSINESS COULD BE NEGATIVELY AFFECTED. FURTHER, WE WILL NEED TO RECRUIT AND RETAIN ADDITIONAL SKILLED MANAGEMENT PERSONNEL AND IF WE ARE NOT ABLE TO DO SO, OUR BUSINESS AND OUR ABILITY TO CONTINUE TO GROW COULD BE HARMED.

Our success depends to a large extent upon the continued services of our executive officers. We could be seriously harmed by the loss of any of our executive officers. In order to manage our growth, we will need to recruit and retain additional skilled management personnel and if we are not able to do so, our business and our ability to continue to grow could be harmed. Although a number of companies in our industry have implemented workforce reductions, there remains substantial competition for highly skilled employees.

WE ARE SUBJECT TO ENVIRONMENTAL COMPLIANCE RISKS AND UNEXPECTED COSTS THAT WE MAY INCUR WITH RESPECT TO ENVIRONMENTAL MATTERS MAY RESULT IN ADDITIONAL LOSS CONTINGENCIES, THE QUANTIFICATION OF WHICH CANNOT BE DETERMINED AT THIS TIME.

We are subject to various federal, state, local and foreign environmental laws and regulations, including those governing the use, storage, discharge and disposal of hazardous substances in the ordinary course of our manufacturing process. If more stringent compliance or cleanup standards under environmental laws or regulations are imposed, or the results of future testing and analyses at our current or former operating facilities indicate that we are responsible for the release of hazardous substances, we may be subject to additional remediation liability. Further, additional environmental matters may arise in the future at sites where no problem is currently known or at sites that we may acquire in the future. Currently unexpected costs that we may incur with respect to environmental matters may result in additional loss contingencies, the quantification of which cannot be determined at this time.

OUR SALES AND CONTRACT FULFILLMENT CYCLES CAN BE LONG, UNPREDICTABLE AND VARY SEASONALLY, WHICH CAN CAUSE SIGNIFICANT VARIATION IN REVENUES AND PROFITABILITY IN A PARTICULAR QUARTER.

The timing of our sales and related customer contract fulfillment is difficult to predict. Many of our customers are large enterprises, whose purchasing decisions, budget cycles and constraints and evaluation processes are unpredictable and out of our control. Further, the timing of our sales is difficult to predict. The length of our sales cycle, from initial evaluation to payment for our products and services, can range from several months to well over a year and can vary substantially from customer to customer. Our sales efforts involve significant investment in resources in field sales, marketing and educating our customers about the use, technical capabilities and benefits of our products and services. Customers often undertake a prolonged evaluation process. As a result, it is difficult to predict exactly when, or even if, we will make a sale to a potential customer or if we can increase sales to our existing customers. Large individual sales have, in some cases, occurred in quarters subsequent to those we anticipated, or have not occurred at all. In addition, the fulfillment of our customer contracts is partially dependent on other factors related to our customers’ businesses that are not in our control. as with the sales cycle, this can also cause revenues and earnings to fluctuate from quarter to quarter. If our sales and/or contract fulfillment cycles lengthen or our substantial upfront investments do not result in sufficient revenue to justify our investments, our operating results could be adversely affected.

We have experienced seasonal and end-of-quarter concentration of our transactions and variations in the number and size of transactions that close in a particular quarter, which impacts our ability to grow revenue over the long term and plan and manage cash flows and other aspects of our business and cost structure. Our transactions vary by quarter, with the fourth quarter typically being our largest. If expectations for our business turn out to be inaccurate, our revenue growth may be adversely affected over time and we may not be able to adjust our cost structure on a timely basis and our cash flows may suffer.

| 22 |

OUR OPERATING MARGINS MAY DECLINE AS A RESULT OF INCREASING PRODUCT COSTS.

Our business is subject to significant pressure on pricing and costs caused by many factors, including competition, the cost of components used in our products, labor costs, constrained sourcing capacity, inflationary pressure, pressure from customers to reduce the prices we charge for our products and services, and changes in consumer demand. Costs for the raw materials used in the manufacture of our products are affected by, among other things, energy prices, consumer demand, fluctuations in commodity prices and currency, and other factors that are generally unpredictable and beyond our control. Increases in the cost of raw materials used to manufacture our products or in the cost of labor and other costs of doing business in the United States and internationally could have an adverse effect on, among other things, the cost of our products, gross margins, operating results, financial condition, and cash flows.

OUR SALES AND PROFITABLITY OF OPERATIONS IN THE UNITED STATES AND IN THE PRC ARE DEPENDANT ON THE PRICE OF OIL AND NATURAL GAS.

Our Waste Heat Recovery products and Waste Recovery products are dependent on the prices of traditional energy sources. Our products reuse wasted heat and create electricity or reusable fuel. As the price of energy increases, the economic justification for our products increases. At the same time, as the price for traditional fuel decreases, there is less incentive for customers to purchase our products and it may impair our ability to sell our products.

IF THE SPOT PRICE OF LNG IN CHINA DROPS BELIOW THE PURCHASE PRICE OUR TRADERS NETOTIATE WITH OUR SUPPLIERS, WE MAY NOT BE ABLE TO SELL OUR LNG OR MAY HAVE TO SELL IT AT A LOSS.

Our traders at JHJ purchase LNG at a fixed price in large volumes. If the spot prices for LNG drop below our purchase price, we may not be able to sell our LNG to our customers or may have to sell the LNG at a substantial loss. We do not purchase a sufficient volume of LNG to be able to hedge against price declines of this commodity. If we believe that LNG prices are too high and we are unable to purchase because we believe that prices will drop, we will not have sufficient supply of LNG to conduct trading operations until the market pricing returns to a level at which we can conduct operations.

WE MAY NOT HAVE SUFFICENT FUNDS TO CONDUCT OUR TRADING OPERATIONS IN THE PRC.

We are funding our trading operations through cash flow generated by JHJ and from funds provided by our parent. If we or JHJ does not have sufficient funds, we may not be able to conduct trading operations.

OUR WASTE TO ENERGY PRODUCTS FROM ENEX HAVE NOT BEEN TESTED IN THE UNITED STATES AND DEPEND ON DATA OBTAINED FROM OPERATIONS IN THE UKRAINE AND RUSSIA.

ENEX’s HTAP 5 and 10 have not been installed in the United States. In order to commence sales, our purchasers will need to accept data from Russia or the Ukraine that they may not deem reliable. As a result we may be required to post large bonds or find an EPC that will guarantee performance of the ENEX systems. We can not give any assurances that we will be able to finance the bonds or find an EPC willing to guaranty performance.