EXHIBIT 13.0

Quaint Oak Bancorp, Inc.

PRESIDENT’S LETTER TO SHAREHOLDERS

To Our Valued Shareholders:

On behalf of the Board of Directors, Senior Management and Team Members of the Quaint Oak Family of Companies, I am pleased to present our 2021 Annual Report to Shareholders.

As we emerge from 2021, we mark two years of successfully working remotely. We have, of course, staffed our Banking offices and certain cash management service positions on site. All Team Members, however, have mastered remote communication and service skills at a level not previously imagined. This capability in both IT and human interaction has promoted the continued growth and expansion in our Family of Companies. These skills have provided the financial results presented in this Annual Report as well as providing us the opportunity to grow beyond our immediate market and to expand our talented personnel. Currently, we employ Team Members in fifteen different states and several of our Companies promote business on a nationwide level. As we move into 2022 and as reported previously, the current strategic focus of the Company looks to increase the potential collaboration of the Bank with outside Fintech companies. This avenue offers expansion opportunities that otherwise would not fit within our current size and structure. The year 2021 resulted in a growth in assets at yearend when compared to December 31, 2020 of 14.5%. This growth in assets has continued despite the forgiveness of outstanding PPP loans. At year-end 2021, the outstanding advances under the PPP program had been reduced to $42.9 million with $140.6 million having successfully gone through the forgiveness process.

The increased income results of the Company primarily came from loan production of the Bank providing a net loan balance increase of $99.5 million, including loans held for sale. This increase in outstanding loan balance was accompanied by a reduction in our deposit funding costs of 86 basis points, driving down our overall deposit cost of funds to an average rate of 0.86% for the year ended December 31, 2021.

We are very pleased to report that the Company’s net income for the year ended December 31, 2021 was 97.3% higher when compared to year-end 2020.

The Company has repurchased an additional 1,398 shares during the twelve months ended December 31, 2021. To date we have repurchased over 40% of the original shares issued in our initial public offering. As recently announced, the Company declared a quarterly cash dividend of $0.11 per share on the common stock of the Company payable on February 7, 2022, to the shareholders of record at the close of business on January 24, 2022. Additionally, stockholders’ equity increased year over year ending December 31, 2021, by over $8.2 million or approximately 28.5%. As always, in conjunction with having maintained a strong repurchase plan, our current and continued business strategy includes long-term profitability and payment of dividends reflecting our strong commitment to shareholder value.

Robert T. Strong

President and Chief Executive Officer

Quaint Oak Family of Companies

Quaint Oak Bancorp, Inc.

Quaint Oak Bank

Quaint Oak Abstract, LLC | Quaint Oak Mortgage, LLC | Quaint Oak Real Estate, LLC

Quaint Oak Insurance Agency, LLC

Oakmont Capital Holdings, LLC | Oakmont Commercial, LLC

Fueling the Growth of Business

Quaint Oak Bancorp, Inc.

| TABLE OF CONTENTS |

| Page |

|

| Selected Consolidated Financial and Other Data |

1 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

3 |

| Reports of Independent Registered Public Accounting Firm |

19 |

| Consolidated Balance Sheets |

21 |

| Consolidated Statements of Income |

22 |

| Consolidated Statements of Comprehensive Income |

24 |

| Consolidated Statements of Stockholders’ Equity |

25 |

| Consolidated Statements of Cash Flows |

26 |

| Notes to Consolidated Financial Statements |

28 |

| General Information |

70 |

| Locations |

71 |

Quaint Oak Bancorp, Inc.

SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA

Set forth below is selected financial and other data of Quaint Oak Bancorp, Inc. You should read the financial statements and related notes contained in this Annual Report which provide more detailed information.

| At or For the Years Ended December 31, |

||||||||

| 2021 |

2020 |

|||||||

| (Dollars in Thousands) |

||||||||

| Selected Financial and Other Data: |

||||||||

| Total assets |

$ | 554,115 | $ | 484,075 | ||||

| Cash and cash equivalents |

10,705 | 33,913 | ||||||

| Investment in interest-earning time deposits |

7,924 | 9,463 | ||||||

| Investment securities available for sale at fair value |

4,033 | 10,725 | ||||||

| Loans held for sale |

107,823 | 53,191 | ||||||

| Loans receivable, net |

403,966 | 359,122 | ||||||

| Federal Home Loan Bank stock, at cost |

2,178 | 1,665 | ||||||

| Premises and equipment, net |

2,653 | 2,341 | ||||||

| Deposits |

447,166 | 354,845 | ||||||

| Federal Home Loan Bank borrowings |

49,193 | 38,193 | ||||||

| Subordinated debt |

7,933 | 7,899 | ||||||

| Total Quaint Oak Bank Stockholders’ Equity |

34,789 | 28,728 | ||||||

| Noncontrolling Interest |

2,120 | - | ||||||

| Total Stockholders’ Equity |

36,909 | 28,728 | ||||||

| Selected Operating Data: |

||||||||

| Total interest income |

$ | 24,995 | $ | 16,323 | ||||

| Total interest expense |

4,375 | 5,488 | ||||||

| Net interest income |

20,620 | 10,835 | ||||||

| Provision for loan losses |

2,201 | 830 | ||||||

| Net interest income after provision for loan losses |

18,419 | 10,005 | ||||||

| Total non-interest income |

11,982 | 6,655 | ||||||

| Total non-interest expense |

21,087 | 12,123 | ||||||

| Income before income taxes |

9,314 | 4,537 | ||||||

| Income taxes |

2,492 | 1,292 | ||||||

| Net income |

$ | 6,822 | $ | 3,245 | ||||

| Net income attributable to noncontrolling interest |

$ | 418 | $ | - | ||||

| Net income attributable to Quaint Oak Bancorp, Inc. |

$ | 6,404 | $ | 3,245 | ||||

| Selected Operating Ratios(1): |

||||||||

| Average yield on interest-earning assets |

4.78 | % | 4.41 | % | ||||

| Average rate on interest-bearing liabilities |

1.03 | 1.74 | ||||||

| Average interest rate spread(2) |

3.75 | 2.67 | ||||||

| Net interest margin(2) |

3.93 | 2.93 | ||||||

| Average interest-earning assets to average interest-bearing liabilities |

123.99 | 117.39 | ||||||

| Net interest income after provision for loan losses to non-interest expense |

87.35 | 82.52 | ||||||

| Total non-interest expense to average assets |

3.89 | 3.15 | ||||||

| Efficiency ratio(3) |

69.36 | 69.32 | ||||||

| Return on average assets |

1.18 | 0.84 | ||||||

| Return on average equity |

20.68 | 12.16 | ||||||

Quaint Oak Bancorp, Inc.

| At or For the Years Ended December 31, |

||||||||

| 2021 |

2020 |

|||||||

| Asset Quality Ratios(4): |

||||||||

| Non-performing loans as a percent of loans receivable, net(5) |

0.00 | % | 0.18 | % | ||||

| Non-performing assets as a percent of total assets(5) |

0.00 | 0.19 | ||||||

| Non-performing assets and troubled debt restructurings as a percent of total assets |

0.03 | 0.22 | ||||||

| Allowance for loan losses as a percent of non-performing loans |

n/m* |

475.83 | ||||||

| Allowance for loan losses as a percent of total loans receivable |

1.29 | 0.85 | ||||||

| Net charge-offs to average loans receivable |

0.00 | 0.00 | ||||||

| Capital Ratios(4): |

||||||||

| Tier 1 leverage ratio |

7.41 | % | 8.56 | % | ||||

| Common Tier 1 capital ratio |

9.45 | 13.31 | ||||||

| Tier 1 risk-based capital ratio |

9.45 | 13.31 | ||||||

| Total risk-based capital ratio |

10.69 | 14.52 |

___________________

(1) With the exception of end of period ratios, all ratios are based on average daily balances during the indicated periods.

(2) Average interest rate spread represents the difference between the average yield on interest-earning assets and the average rate paid on interest-bearing liabilities, and net interest

margin represents net interest income as a percentage of average interest-earning assets.

(3) The efficiency ratio represents the ratio of non-interest expense divided by the sum of net interest income and non-interest income.

(4) Asset quality ratios and capital ratios are end of period ratios, except for net charge-offs to average loans receivable.

(5) Non-performing assets consist of non-performing loans at December 31, 2021 and non-performing loans other real estate owned at December 31, 2021 and 2020. Non-performing

loans consist of non-accruing loans plus accruing loans 90 days or more past due.

n/m* Not meaningful

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

General

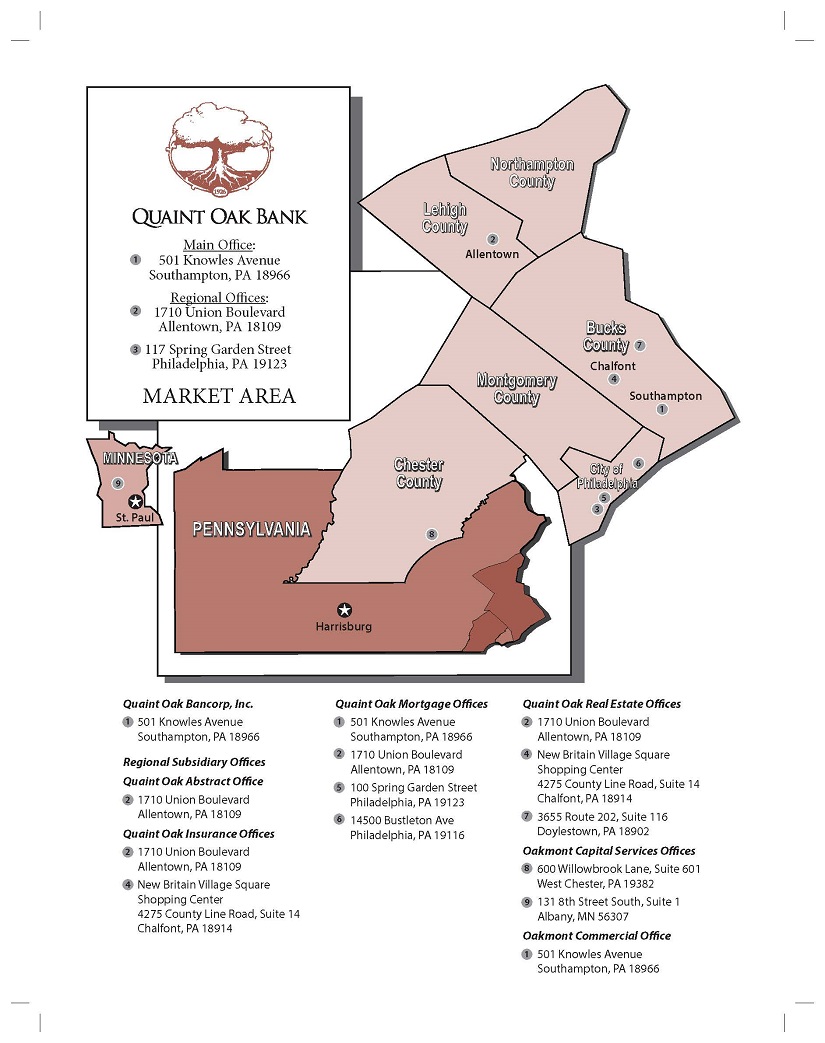

Quaint Oak Bancorp, Inc. (the “Company”) was formed in connection with Quaint Oak Bank’s (the “Bank”) conversion to a stock savings bank completed on July 3, 2007. The Company’s results of operations are dependent primarily on the results of Quaint Oak Bank, a wholly owned subsidiary of the Company, along with the Bank’s wholly owned subsidiaries. The Bank, a Pennsylvania-chartered stock savings bank, is headquartered in Southampton, Pennsylvania and conducts business through three regional offices located in the Delaware Valley, Lehigh Valley and Philadelphia markets. At December 31, 2021, the Bank has six wholly-owned subsidiaries, Quaint Oak Mortgage, LLC, Quaint Oak Real Estate, LLC, Quaint Oak Abstract, LLC, QOB Properties, LLC, Quaint Oak Insurance Agency, LLC, and Oakmont Commercial, LLC, each a Pennsylvania limited liability company. The mortgage company offers mortgage banking services in the Lehigh Valley, Delaware Valley and Philadelphia County region of Pennsylvania. The real estate and abstract companies offer real estate sales and title abstract services, respectively, primarily in the Lehigh Valley region of Pennsylvania. These companies began operation in July 2009. In February 2019, Quaint Oak Mortgage opened a mortgage banking office in Philadelphia, Pennsylvania. QOB Properties, LLC began operations in July 2012 and holds Bank properties acquired through a foreclosure proceeding or acceptance of a deed in lieu of foreclosure. Quaint Oak Insurance Agency, LLC, located in Chalfont, Pennsylvania, began operations in August 2016 and provides a broad range of personal and commercial insurance coverage solutions. Oakmont Commercial, LLC began operations in October 2021 and operates as a multi-state specialty commercial real estate financing company. Since January, 2021, the Bank holds a majority equity position in Oakmont Capital Holdings, LLC, a multi-state equipment finance company based in West Chester, Pennsylvania with a second significant facility located in Albany, Minnesota.

Quaint Oak Bank’s profitability depends, to a large extent, on net interest income, which is the difference between the income earned on its loan and investment portfolios and the cost of funds, consisting of the interest paid on deposits and borrowings. Results of operations are also affected by provisions for loan losses, fee income and other non-interest income and non-interest expense. Non-interest expense principally consists of compensation, directors’ fees and expenses, office occupancy and equipment expense, data processing expense, professional fees, advertising expense, FDIC deposit insurance assessment, and other expenses.

Quaint Oak Bank’s business consists primarily of originating residential, multi-family and commercial real estate loans secured by property, commercial business loans, and to a lesser extent other consumer loans in its market area. At December 31, 2021, commercial real estate loans and commercial business loans comprise the largest percentage of Quaint Oak Bank’s loan portfolio, before net items, at 44.4% and 31.5%, respectively. At December 31, 2021, commercial business loans include $42.6 million of SBA PPP loans. Quaint Oak Bank’s loans are primarily funded by certificates of deposit and money market accounts. At December 31, 2021, certificates of deposit amounted to 40.2% of total deposits compared to 56.2% of total deposits at December 31, 2020. At December 31, 2021, money market accounts amounted to 44.9% of total deposits compared to 28.1% of total deposits at December 31, 2020. In conjunction with the expansion of our commercial lending activities, we began offering a business checking account, along with a consumer checking account product in December 2014. At December 31, 2021, non-interest bearing checking accounts amounted to 14.5% of total deposits compared to 15.3% of total deposits at December 31, 2020. Management anticipates that certificates of deposit, money market accounts and business checking will be the primary sources of funding for Quaint Oak Bank’s assets.

Our results of operations are significantly affected by general economic and competitive conditions, particularly with respect to changes in interest rates, government policies and actions of regulatory authorities as well as other factors beyond our control. Future changes in applicable law, regulations or government policies may materially affect our financial condition and results of operations.

Forward-Looking Statements Are Subject to Change

This Annual Report contains certain forward-looking statements (as defined in the Securities Exchange Act of 1934 and the regulations thereunder). Forward-looking statements are not historical facts but instead represent only the beliefs, expectations or opinions of the Company and its management regarding future events, many of which, by their nature, are inherently uncertain. Forward-looking statements may be identified by the use of such words as: “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, or words of similar meaning, or future or conditional terms such as “will”, “would”, “should”, “could”, “may”, “likely”, “probably”, or “possibly.” Forward-looking statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. Such statements are subject to certain risks, uncertainties and assumptions, many of which are difficult to predict and generally are beyond the control of and its management, that could cause actual results to differ materially from those expressed in, or implied or projected by, forward-looking statements. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) economic and competitive conditions which could affect the volume of loan originations, deposit flows and real estate values; (2) the levels of non-interest income and expense and the amount of loan losses; (3) competitive pressure among depository institutions increasing significantly; (4) changes in the interest rate environment causing reduced interest margins; (5) general economic conditions, either nationally or in the markets in which the Company is or will be doing business, being less favorable than expected;(6) political and social unrest, including acts of war or terrorism; (7) the impact of the current outbreak of the novel coronavirus (COVID-19) or (8) legislation or changes in regulatory requirements adversely affecting the business in which the Company is or will be engaged. The Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

COVID-19

On March 11, 2020, the World Health Organization declared COVID-19 a pandemic. Due to orders issued by the governor of Pennsylvania and for the health of our customers and employees, the Bank closed lobbies to all three branch offices but remained fully operational. Other immediate responses to the pandemic included some of the following actions by the Company:

• Moved more than 92% of its employees to remote work-from-home status.

• Waived fees on deposit accounts and cash management services.

In response to the COVID-19 crisis, the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act was passed by Congress and signed into law on March 27, 2020. The CARES Act provides an estimated $2.2 trillion of economy-wide financial stimulus to combat the pandemic and stimulate the economy in the form of financial aid to individuals, businesses, nonprofits, states, and municipalities through loans, grants, tax changes, and other types of relief.

The following describes some of our responses to COVID-19 relative to the CARES Act, and other effects of the pandemic on our business.

Paycheck Protection Program. The CARES Act authorized the Small Business Administration (“SBA”) to temporarily guarantee loans under a new 7(a) loan program called the Paycheck Protection Program (“PPP”). As a qualified SBA lender, we were automatically authorized to originate PPP loans and chose to participate. Since March 2020, the Company has continued to work diligently to help support its existing and new customers through the SBA Paycheck Protection Program (“PPP”), loan modifications, loan deferrals and fee waivers. On December 27, 2020, the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the “Economic Aid Act”) became law. The Economic Aid Act opened a new PPP loan period for first loans and implemented a second loan draw for certain PPP borrowers, each through May 31, 2021. Under the first round the Company funded 854 PPP loans totaling $95.1 million. As of December 31, 2021, 849 of these first round PPP loans totaling $90.7 million were forgiven under the SBA forgiveness program. Under the second round of PPP the Company funded 985 PPP loans totaling $88.4 million as of December 31, 2021. As of December 31, 2021, 678 of the second round PPP loans totaling $49.9 million have been forgiven under the SBA forgiveness program. For the year ended December 31, 2021, the Company recognized approximately $4.4 million and $996,000 of deferred loan fees amortization related to PPP loans for the years ended December 31, 2021 and December 31, 2020, respectively.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Paycheck Protection Program Liquidity Facility. The CARES Act also allocated a limited amount of funds to the Federal Reserve Board (FRB) with a broad mandate to provide liquidity to eligible businesses, states or municipalities in light of COVID-19. On April 9, 2020, the U.S. Department of the Treasury announced several new or expanded lending programs to provide relief for businesses and governments. One of these programs was the Paycheck Protection Program Liquidity Facility (PPPLF). Under the PPPLF, all depository institutions that originate PPP loans are eligible to borrow on a non-recourse basis from their regional Federal Reserve Bank using SBA PPP loans as collateral. The principal amount of loans will be equal to the PPP loans pledged as collateral. There are no fees associated with these loans and the interest rate is 35 basis points. The maturity date of PPPLF loans will be the same as the maturity date of the PPP loans pledged as collateral. The PPPLF loan maturity date will be accelerated if the underlying PPP loan goes into default and the lender sells the PPP loan to the SBA under the SBA guarantee. The PPPLF loan maturity date also will be accelerated for any loan forgiveness reimbursement received by the lender from the SBA.

In April 2020, the Bank received approval to borrow from the FRB under the PPPLF program to assist in funding PPP loans. Through December 31, 2021, the Bank used the FRB program to fund $52.1 million of PPP loans. The Bank paid off approximately $48.2 million of PPP loans pledged as collateral under the PPPLF program and had $3.9 million of outstanding advances with the FRB at December 31, 2021. Through December 31, 2021 the Bank has not used the PPPLF program to fund any round two PPP loans.

Loan Modifications/Troubled Debt Restructurings. Under the CARES Act, loans less than 30 days past due as of December 31, 2019 will be considered current for COVID-19 modifications. A financial institution can then suspend the requirements under GAAP for loan modifications related to COVID-19 that would otherwise be categorized as a troubled debt restructuring (“TDR”), and suspend any determination of a loan modified as a result of COVID-19 as being a TDR, including the requirement to determine impairment for accounting purposes. Financial institutions wishing to utilize this authority must make a policy election, which applies to any COVID-19 modification made between March 1, 2020 and the earlier of either January 1, 2022 or the 60th day after the end of the COVID-19 national emergency. Quaint Oak Bank has made that election. Similarly, the Financial Accounting Standards Board has confirmed that short-term modifications made on a good-faith basis in response to COVID-19 to loan customers who were current prior to any relief will not be considered TDRs.

Prior to the enactment of the CARES Act, the banking regulatory agencies provided guidance as to how certain short-term modifications would not be considered TDRs, and have subsequently confirmed that such guidance could be applicable for loans that do not qualify for favorable accounting treatment under Section 4013 of the CARES Act.

The Bank addresses loan payment modification requests on a case-by-case basis considering the effects of the COVID-19 pandemic, related economic slow-down and stay-at-home orders on our customer and their current and projected cash flows through the term of the loan. Through December 31, 2021, the Bank modified 231 loans with principal balances totaling $90.6 million representing approximately 21.9% of our December 31, 2021 loan balances. A majority of deferrals are two-month payment deferrals of principal and interest, with payments after deferral increased to collect amounts deferred. In some cases, certain loans were granted additional deferrals.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Details with respect to total loan payment modifications made through December 31, 2021 are as follows:

| Number of COVID-19 Deferments |

Balance (in thousands) |

Percent of Total Loans at December 31, 2021 |

||||||||||

| One-to-four family residential owner occupied |

5 | $ | 2,070 | 21.2 | % | |||||||

| One-to-four family residential non-owner occupied |

50 | 8,566 | 22.1 | |||||||||

| Multi-family residential |

12 | 9,042 | 30.8 | |||||||||

| Commercial real estate |

97 | 55,274 | 30.1 | |||||||||

| Construction |

1 | 702 | 4.4 | |||||||||

| Home equity |

4 | 254 | 5.4 | |||||||||

| Commercial business |

62 | 14,685 | 11.2 | |||||||||

| Total |

231 | $ | 90,593 | 21.9 | % | |||||||

Of the 231 loans granted loan payment deferrals through December 31, 2021, two loans are still on deferral as of December 31, 2021.

Details with respect to loan payment deferrals still on deferral as of December 31, 2021 are as follows:

| As of December 31, 2021 |

||||||||||||

| Number of COVID-19 Deferments |

Balance (in thousands) |

Percent of Total Loans at December 31, 2021 |

||||||||||

| Commercial business |

2 | $ | 3,797 | 0.9 | % | |||||||

| Total |

2 | $ | 3,797 | 0.9 | % | |||||||

It is too early to determine if current active modified loans will perform in accordance with their modified terms.

Critical Accounting Policies

In reviewing and understanding financial information for the Company, you are encouraged to read and understand the significant accounting policies used in preparing our financial statements. These policies are described in Note 2 of the notes to our financial statements. The accounting and financial reporting policies of the Company conform to accounting principles generally accepted in the United States of America and to general practices within the banking industry. Accordingly, the consolidated financial statements require certain estimates, judgments, and assumptions, which are believed to be reasonable, based upon the information available. These estimates and assumptions affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the periods presented. The following accounting policies comprise those that management believes are the most critical to aid in fully understanding and evaluating our reported financial results. These policies require numerous estimates or economic assumptions that may prove inaccurate or may be subject to variations which may significantly affect our reported results and financial condition for the period or in future periods.

Allowance for Loan Losses. The allowance for loan losses represents management’s estimate of losses inherent in the loan portfolio as of the balance sheet date and is recorded as a reduction to loans receivable. The allowance for loan losses is increased by the provision for loan losses, and decreased by charge-offs, net of recoveries. Loans deemed to be uncollectible are charged against the allowance for loan losses, and subsequent recoveries, if any, are credited to the allowance. All, or part, of the principal balance of loans receivable are charged off to the allowance as soon as it is determined that the repayment of all, or part, of the principal balance is highly unlikely. Because all identified losses are immediately charged off, no portion of the allowance for loan losses is restricted to any individual loan or groups of loans, and the entire allowance is available to absorb any and all loan losses.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The allowance for loan losses is maintained at a level considered adequate to provide for losses that can be reasonably anticipated. Management performs a quarterly evaluation of the adequacy of the allowance. The allowance is based on the Company’s past loan loss experience, known and inherent risks in the portfolio, adverse situations that may affect the borrower’s ability to repay, the estimated value of any underlying collateral, composition of the loan portfolio, current economic conditions and other relevant factors. This evaluation is inherently subjective as it requires material estimates that may be susceptible to significant revision as more information becomes available.

The allowance consists of specific, general and unallocated components. The specific component relates to loans that are identified as impaired. For loans that are identified as impaired, an allowance is established when the discounted cash flows (or collateral value or observable market price) of the impaired loan is lower than the carrying value of that loan. The general component covers pools of loans by loan class. These pools of loans are evaluated for loss exposure based upon historical loss rates for each of these categories of loans, adjusted for qualitative factors. These significant factors may include changes in lending policies and procedures, changes in existing general economic and business conditions affecting our primary lending areas, credit quality trends, collateral value, loan volumes and concentrations, seasoning of the loan portfolio, recent loss experience in particular segments of the portfolio, duration of the current business cycle and bank regulatory examination results. The applied loss factors are reevaluated quarterly to ensure their relevance in the current economic environment. Residential mortgage lending generally entails a lower risk of default than other types of lending. Consumer loans and commercial real estate loans generally involve more risk of collectability because of the type and nature of the collateral and, in certain cases, the absence of collateral. It is the Company’s policy to establish a specific reserve for loss on any delinquent loan when it determines that a loss is probable. An unallocated component is maintained to cover uncertainties that could affect management’s estimate of probable losses. The unallocated component of the allowance reflects the margin of imprecision inherent in the underlying assumptions used in the methodologies for estimating specific and general losses in the portfolio.

A loan is considered impaired when, based on current information and events, it is probable that the Company will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Factors considered by management in determining impairment include payment status, collateral value and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not considered impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length of the delay, the reasons for the delay, the borrower’s prior payment record and the amount of the shortfall in relation to the principal and interest owed. Impairment is measured on a loan by loan basis by either the present value of expected future cash flows discounted at the loan’s effective interest rate or the fair value of the collateral if the loan is collateral dependent. An allowance for loan losses is established for an impaired loan if its carrying value exceeds its estimated fair value. The estimated fair values of substantially all of the Company’s impaired loans are measured based on the estimated fair value of the loan’s collateral.

A loan is considered a troubled debt restructuring (“TDR”) if the Company, for economic or legal reasons related to a debtor’s financial difficulties, grants a concession to the debtor that it would not otherwise consider. Concessions granted under a TDR typically involve a temporary or permanent reduction in payments or interest rate or an extension of a loan’s stated maturity date at less than a current market rate of interest. Loans identified as TDRs are designated as impaired.

For loans secured by real estate, estimated fair values are determined primarily through third-party appraisals. When a real estate secured loan becomes impaired, a decision is made regarding whether an updated certified appraisal of the real estate is necessary. This decision is based on various considerations, including the age of the most recent appraisal, the loan-to-value ratio based on the original appraisal and the condition of the property. Appraised values are discounted to arrive at the estimated selling price of the collateral, which is considered to be the estimated fair value. The discounts also include estimated costs to sell the property.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The allowance calculation methodology includes further segregation of loan classes into risk rating categories. The borrower’s overall financial condition, repayment sources, guarantors and value of collateral, if appropriate, are evaluated annually for all loans (except one-to-four family residential owner-occupied loans) where the total amount outstanding to any borrower or group of borrowers exceeds $750,000, or when credit deficiencies arise, such as delinquent loan payments. Credit quality risk ratings include regulatory classifications of special mention, substandard, doubtful and loss. Loans criticized as special mention have potential weaknesses that deserve management’s close attention. If uncorrected, the potential weaknesses may result in deterioration of the repayment prospects. Loans classified substandard have a well-defined weakness or weaknesses that jeopardize the liquidation of the debt. They include loans that are inadequately protected by the current sound net worth and paying capacity of the obligor or of the collateral pledged, if any. Loans classified doubtful have all the weaknesses inherent in loans classified substandard with the added characteristic that collection or liquidation in full, on the basis of current conditions and facts, is highly improbable. Loans classified as a loss are considered uncollectible and are charged to the allowance for loan losses. Loans not classified are rated pass. In addition, Federal regulatory agencies, as an integral part of their examination process, periodically review the Company’s allowance for loan losses and may require the Company to recognize additions to the allowance based on their judgments about information available to them at the time of their examination, which may not be currently available to management. Based on management’s comprehensive analysis of the loan portfolio, management believes the current level of the allowance for loan losses is adequate.

Other-Than-Temporary Impairment of Securities. Securities are evaluated on at least a quarterly basis, and more frequently when market conditions warrant such an evaluation, to determine whether a decline in their value is other-than-temporary. To determine whether a loss in value is other-than-temporary, management utilizes criteria such as the reasons underlying the decline, the magnitude and duration of the decline and whether or not management intends to sell or expects that it is more likely than not that it will be required to sell the security prior to an anticipated recovery of the fair value. The term “other-than-temporary” is not intended to indicate that the decline is permanent, but indicates that the prospects for a near-term recovery of value are not necessarily favorable, or that there is a lack of evidence to support a realizable value equal to or greater than the carrying value of the investment. Once a decline in value for a debt security is determined to be other-than-temporary, the other-than-temporary impairment is separated into (a) the amount of the total other-than-temporary impairment related to a decrease in cash flows expected to be collected from the debt security (the credit loss) and (b) the amount of the total other-than-temporary impairment related to all other factors. The amount of the total other-than-temporary impairment related to the credit loss is recognized in earnings. The amount of the total other-than-temporary impairment related to all other factors is recognized in other comprehensive income, except for equity securities, where the full amount of the other-than-temporary impairment is recognized in earnings.

Income Taxes. Deferred income tax assets and liabilities are determined using the liability (or balance sheet) method. Under this method, the net deferred tax asset or liability is determined based on the tax effects of the temporary differences between the book and tax bases of the various assets and liabilities and net operating loss carryforwards and gives current recognition to changes in tax rates and laws. The realization of our deferred tax assets principally depends upon our achieving projected future taxable income. We may change our judgments regarding future profitability due to future market conditions and other factors. We may adjust our deferred tax asset balances if our judgments change.

Comparison of Financial Condition at December 31, 2021 and December 31, 2020

General. The Company’s total assets at December 31, 2021 were $554.1 million, an increase of $70.0 million, or 14.5%, from $484.1 million at December 31, 2020. This growth in total assets was primarily due to a $54.6 million, or 102.7%, increase in loans held for sale, and a $44.8 million, or 12.5%, increase in loans receivable, net. These increases were partially offset by a $23.2 million, or 68.4%, decrease in cash and cash equivalents and a $6.7 million, or 62.4%, decrease in investment securities available for sale at fair value. The largest increases within the loan portfolio occurred in commercial real estate which increased $52.0 million, or 39.4%, construction loans which increased $11.1 million, or 231.8%, multi-family residential loans which increased $5.3 million, or 22.0%, and one-to-four family owner occupied loans which increased $2.3 million, or 29.9%. The increases within the loan portfolio were partially offset by a decrease in commercial business loans which decreased $24.8 million, or 16.1%.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cash and Cash Equivalents. Cash and cash equivalents decreased $23.2 million, or 68.4%, from $33.9 million at December 31, 2020 to $10.7 million at December 31, 2021 as excess liquidity was used to fund loans.

Investment Securities Available for Sale. Investment securities available for sale decreased $6.7 million, or 62.4%, from $10.7 million at December 31, 2020 to $4.0 million at December 31, 2021 as the Company sold four corporate notes totaling $5.5 million and realized $362,000 of gains on the transactions.

Loans Held for Sale. Loans held for sale increased $54.6 million, or 102.7%, from $53.2 million at December 31, 2020 to $107.8 million at December 31, 2021 as the Bank’s mortgage banking subsidiary, Quaint Oak Mortgage, LLC, originated $225.7 million of one-to-four family residential loans during the year ended December 31, 2021 and sold $261.5 million of loans in the secondary market during this same period. Additionally, the Bank reclassified $17.4 million of equipment loans from loans receivable, net, to loans held for sale, received $9.8 million of loans held for sale from the formation of Oakmont Capital Holdings LLC, and originated $164.3 million in equipment loans held for sale during the year ended December 31, 2021. During the year ended December 31, 2021 the Company sold $101.1 million of equipment loans.

Loans Receivable, Net. Loans receivable, net, increased $44.8 million, or 12.5% funded primarily from deposits, excess liquidity and FHLB borrowings. Increases within the portfolio consisted of commercial real estate which increased $52.0 million, or 39.4%, construction loans which increased $11.1 million, or 231.8%, multi-family residential loans which increased $5.3 million, or 22.0%, and one-to-four family owner occupied loans which increased $2.3 million, or 29.9%. The increases within the loan portfolio were partially offset by a decrease in commercial business loans which decreased $24.8 million, or 16.1%. The Company continues its strategy of diversifying its loan portfolio with higher yielding and shorter-term loan products and selling substantially all of its newly originated one-to-four family owner-occupied loans into the secondary market.

Federal Home Loan Bank Stock. Federal Home Loan Bank stock increased $513,000, or 30.8%, from $1.7 million at December 31, 2020 to $2.2 million at December 31, 2021 as the Bank increased its level of FHLB borrowings.

Bank-Owned Life Insurance. The Company purchased $3.5 million in bank-owned life insurance (BOLI) as a mechanism for funding various employee benefit costs. The Company is the beneficiary of these policies that insure the lives of certain officers of its subsidiaries. The cash surrender value of the insurance policies amounted to $4.1 million at both December 31, 2021 and 2020.

Premises and Equipment, Net. Premises and equipment, net, increased $312,000, or 13.3%, to $2.7 million at December 31, 2021 from $2.3 million at December 31, 2020. The increase was due primarily to technology upgrades.

Goodwill and Other Intangible, Net. Goodwill increased $2.1 million, or 399.6%, from $515,000 at December 31, 2020 to $2.6 million at December 31, 2021, due to the recognition of $2.1 million of goodwill as part of the acquisition of Oakmont Capital Holdings, LLC in January 2021. Goodwill and other intangible assets, net of accumulated amortization, is also related to the acquisition by Quaint Oak Insurance Agency of the renewal rights to a book of business on August 1, 2016 at a total cost of $1.0 million. Based on a valuation, $515,000 of the purchase price was determined to be goodwill and $485,000 was determined to be related to the renewal rights to the book of business and deemed to be an other intangible asset. This other intangible asset is being amortized over a ten year period based upon the annual retention rate of the book of business. The balance of other intangible asset at December 31, 2021 was $222,000, net of accumulated amortization of $263,000.

Other Real Estate Owned, Net. There was no other real estate owned (OREO) at December 31, 2021. During the year ended December 31, 2021, the Company held one property that was collateral for a non-performing construction loan. During the year ended December 31, 2021, the Company made $350,000 of capital improvements to the property, sold the property totaling $636,000, and realized a net loss of $73,000. Non-performing assets amounted to $9,000 at December 31, 2021 compared to $929,000, or 0.19%, of total assets at December 31, 2020.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Prepaid Expenses and Other Assets. Prepaid expenses and other assets decreased $713,000, or 13.0%, to $4.8 million at December 31, 2021 from $5.5 million at December 31, 2020, due primarily to a $1.9 million decrease in receivables due from wholesalers on the sale of mortgage loans. This decrease was also partially offset by a $506,000 net increase in the right-of-use asset driven by the capitalization of the Company’s 117-12 Spring Garden Street, Philadelphia, Pennsylvania lease in accordance with the Financial Accounting Standards Board accounting standard ASU 2016-02, Leases (Topic 842). This decrease was partially offset by a $362,000 increase in the net deferred tax asset.

Deposits. Total deposits increased $92.3 million, or 26.0%, to $447.2 million at December 31, 2021 from $354.8 million at December 31, 2020. This increase in deposits was primarily attributable to increases of $101.0 million, or 101.4%, in money market accounts, $10.5 million, or 19.4% in non-interest bearing checking accounts, and $2,000, or 25.0% in passbook accounts, partially offset by a decrease of $19.5 million, or 9.8%, in certificates of deposit, and a decrease of $258,000, or 16.4%, in savings accounts. The increase in money market accounts was primarily due to the attractive rate that the Company offered as customers looked for a non-maturing deposit product in a rising interest rate environment.

Borrowings. During the year ended December 31, 2021, the Company used excess liquidity to pay down $10.0 million of FHLB short-term and $5.0 million of FHLB long-term borrowings. During 2021, the Company borrowed $26.0 million of short-term FHLB advances to provide additional liquidity in anticipation of loan funding needs. Federal Reserve Bank (FRB) long-term borrowings decreased $44.2 million, or 91.9%, to $3.9 million at December 31, 2021 from $48.1 million at December 31, 2020 as the Company paid off PPP loans pledged as collateral under the FRB’s Paycheck Protection Program Liquidity Facility (PPPLF). The Company did not utilize the FRB’s PPPLF to fund second round PPP loans.

Subordinated Debt. On December 27, 2018, the Company issued $8.0 million in subordinated notes. These notes have a maturity date of December 31, 2028, and bear interest at a fixed rate of 6.50%. The Company may, at its option, at any time on an interest payment date on or after December 31, 2023, redeem the notes, in whole or in part, at par plus accrued interest to the date of redemption. The balance of subordinated debt, net of unamortized debt issuance costs, was $7.9 million at both December 31, 2021 and 2020.

Accrued Expenses and Other Liabilities. Accrued expenses and other liabilities increased $2.6 million, or 74.7%, to $6.0 million at December 31, 2021 from $3.4 million at December 31, 2020, due primarily to a $547,000, or 29.8%, increase in lease liability driven by the capitalization of the Company’s 117-12 Spring Garden Street, Philadelphia, Pennsylvania lease in accordance with the Financial Accounting Standards Board accounting standard ASU 2016-02, Leases (Topic 842). Also contributing to the increase in accrued expenses and other liabilities is $260,000 in accrued bonus expense and a $102,000 increase in the net tax liability. In addition, accrued expenses and other liabilities increased as a result of Oakmont’s results for the year ended December 31, 2021. The remainder of the increase is attributable to an increase in other expense accruals.

Stockholders’ Equity. Total stockholders’ equity increased $8.2 million, or 28.5%, to $36.9 million at December 31, 2021 from $28.7 million at December 31, 2020. Contributing to the increase was net income for the year ended December 31, 2021 of $6.4 million, noncontrolling interest of $1.7 million, net income attributable to noncontrolling interest of $418,000, common stock earned by participants in the employee stock ownership plan of $265,000, amortization of stock awards and options under our stock compensation plans of $168,000, the reissuance of treasury stock under the Bank’s 401(k) Plan of $96,000 and the reissuance of treasury stock for exercised stock options of $87,000. These increases were partially offset by dividends paid of $839,000, other comprehensive loss, net of $95,000, and the purchase of treasury stock of $25,000.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Comparison of Operating Results for the Years Ended December 31, 2021 and 2020

General. Net income amounted to $6.4 million for the year ended December 31, 2021 compared to $3.2 million for the year ended December 31, 2020, an increase of $3.2 million, or 97.3%. The increase was primarily the result of an increase in net interest income of $9.8 million and an increase in non-interest income of $5.3 million, partially offset by an increase in non-interest expense of $9.0 million, an increase in the provision for loan losses of $1.4 million and an increase in the provision for income taxes of $1.2 million.

Net Interest Income. Net interest income increased $9.8 million, or 90.3%, to $20.6 million for the year ended December 31, 2021 from $10.8 million for the year ended December 31, 2020. The increase in net interest income was driven by an $8.7 million, or 53.1% increase in interest income and a $1.1 million, or 20.3%, decrease in interest expense.

Interest Income. Interest income increased $8.7 million, or 53.1%, to $25.0 million for the year ended December 31, 2021 from $16.3 million for the year ended December 31, 2020. The increase in interest income was primarily due to a $151.6 million increase in average loans receivable, net, including loans held for sale, which increased from an average balance of $332.1 million for the year ended December 31, 2020 to an average balance of $483.7 million for the year ended December 31, 2021, and had the effect of increasing interest income $7.1 million. The increase in interest income was also due to a 37 basis point increase in the yield on average loans receivable, net, including loans held for sale, which increased from 4.71% for the year ended December 31, 2020 to 5.10% for the year ended December 31, 2021, and had the effect of increasing interest income $1.8 million. The increase in interest income was partially offset by a $263,000, or 39.5%, decrease in interest and dividends on investment securities, interest-bearing deposits with others, and Federal Home Loan Bank stock.

Interest Expense. Interest expense decreased $1.1 million, or 20.3%, to $4.4 million for the year ended December 31, 2021 from $5.5 million for the year ended December 31, 2020. The decrease in interest expense was primarily attributable to an 82 basis point decrease in rate on average certificate of deposit accounts, which decreased from 1.95% for the year ended December 31, 2020 to 1.13% for the year ended December 31, 2021, and had the effect of decreasing interest expense by $1.5 million. Also contributing to this decrease was a $16.7 million decrease in average certificate of deposit accounts which decreased from an average balance of $195.4 million for the year ended December 31, 2020 to an average balance of $178.7 million for the year ended December 31, 2021, and had the effect of decreasing interest expense $326,000. The decrease in interest expense was partially offset by a $126.8 million increase in average money market accounts which increased from $47.4 million at December 31, 2021 to $174.1 million at December 31, 2021 and had the effect of increasing interest expense $1.1 million. The average interest rate spread decreased from 2.67% for the year ended December 31, 2020 to 3.75% for the year ended December 31, 2021 while the net interest margin decreased from 2.93% for the year ended December 31, 2020 to 3.93% for the year ended December 31, 2021. The Company also experienced strong growth in average non-interest bearing deposits, which increased 107.7% at December 31, 2021, compared to December 31, 2020. Interest expense on deposits continues to be actively managed to lower costs.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Average Balances, Net Interest Income, Yields Earned and Rates Paid. The following table shows for the periods indicated the total dollar amount of interest from average interest-earning assets and the resulting yields, as well as the interest expense on average interest-bearing liabilities, expressed both in dollars and rates, and the net interest margin. All average balances are based on daily balances.

| Year Ended December 31, | |||||||||||||||||||||||||

| 2021 |

2020 |

||||||||||||||||||||||||

| Average Balance |

Interest |

Average Yield/ Rate |

Average Balance |

Interest |

Average Yield/ Rate |

||||||||||||||||||||

| (Dollars In Thousands) |

|||||||||||||||||||||||||

| Interest -earning assets: |

|||||||||||||||||||||||||

| Due from banks, interest-bearing |

$ | 25,076 | $ | 30 | $ | 0.12 | % | $ | 17,373 | $ | 72 | $ | 0.42 | % | |||||||||||

| Investment in interest-earning time deposits |

8,090 | 197 | 2.43 | 9,760 | 244 | 2.50 | |||||||||||||||||||

| Investment securities available for sale |

5,966 | 99 | 1.66 | 9,383 | 261 | 2.78 | |||||||||||||||||||

| Loans receivable, net (1) (2) |

483,733 | 24,592 | 5.10 | 332,146 | 15,657 | 4.71 | |||||||||||||||||||

| Investment in FHLB stock |

1,652 | 77 | 4.67 | 1,438 | 89 | 6.19 | |||||||||||||||||||

| Total interest-earning assets |

524,517 | 24,995 | 4.78 | % | 370,100 | 16,323 | 4.41 | % | |||||||||||||||||

| Non-interest-earning assets |

17,815 | 14,386 | |||||||||||||||||||||||

| Total assets | $ | 542,332 | $ | 384,486 | |||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||

| Passbook accounts |

11 | $ | * | * | % | $ | 6 | $ | * | * | % | ||||||||||||||

| Savings accounts |

1,655 | 3 | 0.18 | 1,826 | 4 | 0.22 | |||||||||||||||||||

| Money market accounts |

174,126 | 1,048 | 0.60 | 47,351 | 392 | 0.83 | |||||||||||||||||||

| Certificate of deposit accounts |

178,721 | 2,012 | 1.13 | 195,401 | 3,820 | 1.95 | |||||||||||||||||||

| Total deposits |

354,513 | 3,063 | 0.86 | 244,584 | 4,216 | 1.72 | |||||||||||||||||||

| FHLB short-term borrowings |

10,405 | 31 | 0.30 | 3,292 | 37 | 1.12 | |||||||||||||||||||

| FHLB long-term borrowings |

25,648 | 518 | 2.02 | 28,979 | 607 | 2.09 | |||||||||||||||||||

| FRB long-term borrowings |

23,266 | 81 | 0.35 | 30,534 | 108 | 0.35 | |||||||||||||||||||

| Other short-term borrowings | 1,300 | 162 | 12.46 | -- | -- | -- | |||||||||||||||||||

| Subordinated debt |

7,915 | 520 | 6.57 | 7,881 | 520 | 6.60 | |||||||||||||||||||

| Total interest-bearing liabilities |

423,047 | 4,375 | 1.03 | % | 315,270 | 5,488 | 1.74 | % | |||||||||||||||||

| Non-interest-bearing liabilities | 88,315 | 42,530 | |||||||||||||||||||||||

| Total liabilities |

511,362 | $ | 357,800 | ||||||||||||||||||||||

| Stockholders' Equity | 30,970 | 26,686 | |||||||||||||||||||||||

| Total liabilities and Stockholders' Equity | $ | 542,332 | $ | 384,486 | |||||||||||||||||||||

| Net interest-earning assets | $ | 101,470 | $ | 20,620 | 3.75 | % | $ | 54,830 | $ | 10,835 | 2.67 | % | |||||||||||||

| Net interest income; average interest reate spread | 3.93 | % | 2.93 | % | |||||||||||||||||||||

| Net interest margin (3) | |||||||||||||||||||||||||

| Average interest-earning assets to average | |||||||||||||||||||||||||

| interest-bearing liabilities | 123.99 | % | 117.39 | % | |||||||||||||||||||||

__________________

* Not meaningful

(1) Includes loans held for sale.

(2) Includes non-accrual loans during the respective periods. Calculated net of deferred fees and discounts, loans in process and allowance for loan losses.

(3) Equals net interest income divided by average interest-earning assets.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Rate/Volume Analysis. The following table shows the extent to which changes in interest rates and changes in volume of interest-earning assets and interest-bearing liabilities affected our interest income and expense during the periods indicated. For each category of interest-earning assets and interest-bearing liabilities, information is provided on changes attributable to (1) changes in rate, which is the change in rate multiplied by prior year volume, (2) changes in volume, which is the change in volume multiplied by prior year rate, and (3) changes in rate/volume, which is the change in rate multiplied by the change in volume.

| 2021 vs. 2020 |

2020 vs. 2019 |

|||||||||||||||||||||||||||||||

| Increase (Decrease) Due to |

Increase (Decrease) Due to |

|||||||||||||||||||||||||||||||

| Total |

Total |

|||||||||||||||||||||||||||||||

| Rate/ |

Increase |

Rate/ |

Increase |

|||||||||||||||||||||||||||||

| Rate |

Volume |

Volume |

(Decrease) |

Rate |

Volume |

Volume |

(Decrease) |

|||||||||||||||||||||||||

| (In Thousands) |

||||||||||||||||||||||||||||||||

| Interest income: |

||||||||||||||||||||||||||||||||

| Due from banks, interest-bearing |

$ | (52 | ) | $ | 32 | $ | (23 | ) | $ | (43 | ) | $ | (298 | ) | $ | 24 | $ | (20 | ) | $ | (294 | ) | ||||||||||

| Investment in interest-earning time deposits |

(6 | ) | (42 | ) | 1 | (47 | ) | (28 | ) | 3 | -- | (25 | ) | |||||||||||||||||||

| Investment securities available for sale |

(105 | ) | (95 | ) | 38 | (162 | ) | 4 | 29 | -- | 33 | |||||||||||||||||||||

| Loans receivable, net (1) (2) |

1,229 | 7,145 | 561 | 8,935 | (1,937 | ) | 5,190 | (763 | ) | 2,490 | ||||||||||||||||||||||

| Investment in FHLB stock |

(22 | ) | 14 | (3 | ) | (11 | ) | (7 | ) | 16 | (1 | ) | 8 | |||||||||||||||||||

| Total interest-earning assets |

1,044 | 7,054 | 574 | 8,672 | (2,266 | ) | 5,262 | (784 | ) | 2,212 | ||||||||||||||||||||||

| Interest expense: |

||||||||||||||||||||||||||||||||

| Passbook accounts |

-- | -- | -- | -- | -- | -- | -- | -- | ||||||||||||||||||||||||

| Savings accounts |

-- | -- | -- | -- | -- | -- | -- | -- | ||||||||||||||||||||||||

| Money market accounts |

(108 | ) | 1,051 | (289 | ) | 654 | 8 | 158 | 6 | 172 | ||||||||||||||||||||||

| Certificate of deposit accounts |

(1,619 | ) | (326 | ) | 138 | (1,807 | ) | (603 | ) | 423 | (63 | ) | (243 | ) | ||||||||||||||||||

| Total deposits |

(1,727 | ) | 725 | (151 | ) | (1,153 | ) | (595 | ) | 581 | (57 | ) | (71 | ) | ||||||||||||||||||

| FHLB short-term borrowings |

(27 | ) | 80 | (59 | ) | (6 | ) | (78 | ) | (58 | ) | 32 | (104 | ) | ||||||||||||||||||

| FHLB long-term borrowings |

(22 | ) | (70 | ) | 3 | (89 | ) | (32 | ) | 172 | (12 | ) | 128 | |||||||||||||||||||

| FRB long-term borrowings |

(2 | ) | (26 | ) | 1 | (27 | ) | -- | -- | 108 | 108 | |||||||||||||||||||||

| Subordinated debt |

(2 | ) | 2 | -- | -- | (1 | ) | 2 | -- | 1 | ||||||||||||||||||||||

| Other short-term borrowings |

-- | -- | 162 | 162 | (1 | ) | 2 | -- | 1 | |||||||||||||||||||||||

| Total interest-bearing liabilities |

(1,780 | ) | 711 | (44 | ) | (1,113 | ) | (706 | ) | 697 | 71 | 62 | ||||||||||||||||||||

| Increase (decrease) in net interest income |

$ | 2,824 | $ | 6,343 | $ | 618 | $ | 9,785 | $ | (1,560 | ) | $ | 4,565 | $ | (855 | ) | $ | 2,150 | ||||||||||||||

_______________________

(1) Includes loans held for sale.

(2) Includes non-accrual loans during the respective periods. Calculated net of deferred fees and discounts, loans in process and allowance for loan losses.

Provision for Loan Losses. The Company increased its provision for loan losses by $1.4 million, or 165.2%, from $830,000 for the year ended December 31, 2020 to $2.2 million for the year ended December 31, 2021, based on an evaluation of the allowance relative to such factors as volume of the loan portfolio, concentrations of credit risk, prevailing economic conditions, prior loan loss experience and amount of non-performing loans at December 31, 2021.

Non-performing loans at December 31, 2021 consisted of one loan on non-accrual status in the amount of $9,000. Comparably, non-performing loans amounted to $643,000 or 0.18% of net loans receivable at December 31, 2020, consisting of five loans, two loans of which were on nonaccrual status and three loans of which were 90 days or more past due and accruing interest. The non-performing loans at December 31, 2021 consisted of one one-to-four family non-owner occupied residential loan, and is generally well-collateralized or adequately reserved for. The allowance for loan losses as a percent of total loans receivable was 1.29% at December 31, 2021 and 0.85% at December 31, 2020.

There was no other real estate owned (OREO) at December 31, 2021. During the year ended December 31, 2021, the Company held one property that was collateral for a non-performing construction loan. During the year ended December 31, 2021, the Company made $350,000 of capital improvements to the property, sold the property totaling $636,000, and realized a net loss of $73,000. Non-performing assets amounted to $9,000 at December 31, 2021 compared to $929,000, or 0.19% of total assets at December 31, 2020.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Non-Interest Income. Non-interest income increased $5.3 million, or 80.0%, from $6.7 million for the year ended December 31, 2020 to $12.0 million for the year ended December 31, 2021. The increase was primarily attributable to a $2.6 million, or 59.3%, increase in net gain on loans held for sale, a $1.0 million, or 897.4%, increase in gain on the sales of SBA loans, a $920,000, or 58.3%, increase in mortgage banking and title abstract fees, a $362,000 increase in gain on sale of investment securities available for sale, a $146,000, or 133.9%, increase in other fees and service charges, a $124,000, or 62.9%, decrease in loss on sales and write-downs of other real estate owned, a $19,000, or 3.9% increase in insurance commissions, and an $11,000, or 6.9%, increase in real estate sales commissions, net, earned by Quaint Oak Real Estate, a wholly owned subsidiary of Quaint Oak Bank.

Non-Interest Expense. Non-interest expense increased $9.0 million, or 73.9%, from $12.1 million for the year ended December 31, 2020 to $21.1 million for the year ended December 31, 2021. Salaries and employee benefits expense accounted for $7.1 million of the change as this expense increased 84.4%, from $8.4 million for the year ended December 31, 2020 to $15.5 million for the year ended December 31, 2021 due to expanding and improving the level of staff at the Bank and its subsidiary companies, primarily in the area of lending operations. Occupancy and equipment expense accounted for $708,000 of the change as this expense increased 77.5%, from $913,000 for the year ended December 31, 2020 to $1.6 million for the year ended December 31, 2021. Other expense accounted for $417,000 of the change as this expense increased 43.1%, from $968,000 for the year ended December 31, 2020 to $1.4 million for the year ended December 31, 2021 due primarily to the increase in subscription costs related to installing a new real estate closing platform at Quaint Oak Abstract, LLC. Advertising expense increased $238,000, or 210.6%, from $113,000 for the year ended December 31, 2020 to $351,000 for the year ended December 31, 2021. Data processing costs accounted for $184,000 of the change as this expense increased 25.7%, from $717,000 for the year ended December 31, 2020 to $901,000 for the year ended December 31, 2021, due primarily to recurring costs associated with the Bank’s checking and other transaction account products. Professional fees accounted for $118,000 of the change as this expense increased 21.8%, from $541,000 for the year ended December 31, 2020 to $659,000 for the year ended December 31, 2021, due primarily to increased audit and compliance costs. FDIC deposit insurance assessment increased $210,000, from $121,000 for the year ended December 31, 2020 to $331,000 for the year ended December 31, 2021. Directors’ fees and expenses accounted for $20,000 of the change as this expense increased 8.6%, from $232,000 for the year ended December 2020 to $252,000 for the year ended December 31, 2021. Partially offsetting these increases was other real estate owned expense which decreased $42,000, or 100.0%, from $42,000 for the year ended December 31, 2020 to none for the year ended December 31, 2021.

Provision for Income Tax. The provision for income tax increased $1.2 million, or 92.9%, from $1.3 million for the year ended December 31, 2020 to $2.5 million for the year ended December 31, 2021 due primarily to an increase in pre-tax income for the year ended December 31, 2021.

Operating Segments

The Company’s operations consist of two reportable operating segments: Banking and Mortgage Banking. Our Banking Segment generates revenues primarily from its lending, deposit gathering and fee business activities. Our Mortgage Banking Segment originates residential mortgage loans which are sold into the secondary market along with the loans’ servicing rights. Detailed segment information appears in Note 20 in the Notes to Consolidated Financial Statements.

Our Banking Segment reported a pre-tax segment profit (“PTSP”) for the year ended December 31, 2021 of $8.7 million, a $6.7 million, or 331.1%, increase from the year ended December 31, 2020. This increase in PTSP was due to a $9.6 million increase in net interest income and a $6.7 million increase in non-interest income, partially offset by an $8.2 million increase in non-interest expense, and a $1.4 million increase in the provision for loan losses. The increase in non-interest expense was due primarily to a $6.5 million, or 93.3%, increase in salaries and employee benefits expense, a $691,000, or 109.5%, increase in occupancy and equipment, a $380,000, or 41.8%, increase in other expense, a $210,000 increase in FDIC deposit insurance assessment, a $197,000, or 214.1%, increase in advertising expense, and a $135,000, or 28.7%, increase in data processing expense. The increase in non-interest income was primarily due to a $3.4 million increase in net gain on loans held for sale, a $1.0 million, or 109.9%, increase in mortgage banking and title abstract fees, a $1.0 million increase in gain on the sale of SBA loans, a $362,000 increase in gain on sale of investment securities available for sale, a $149,000 increase in loan servicing income, a $146,000, or 133.9%, increase in other fees and service charges, and a $124,000 decrease in the loss on sales and write-downs of other real estate owned. The $3.4 million in net gain on loans held for sale by our Banking Segment was due to the increase in equipment loans held for sale. The increase in net interest income was primarily attributable to an increase in interest income, driven by higher average loan balances and yields, partially offset by a higher cost of funds.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Our Mortgage Banking Segment reported a PTSP for the year ended December 31, 2021 of $641,000, an $1.9 million, or 74.6%, decrease from the year ended December 31, 2020. The decrease in PTSP was primarily due to a $1.3 million decrease in non-interest income which was driven by decreases of $1.2 million in net gain on the sale of loans and $501,000 in processing fees. Also contributing to this decrease was a $776,000 increase in non-interest expense, partially offset by a $229,000 increase in net interest income.

Exposure to Changes in Interest Rates

The Company’s ability to maintain net interest income depends upon its ability to earn a higher yield on assets than the rates it pays on deposits and borrowings. The Company’s interest-earning assets consist primarily of loans collateralized by real estate which have longer maturities than our liabilities, consisting primarily of certificates of deposit, money market accounts and to a lesser extent borrowings. Consequently, the Company’s ability to maintain a positive spread between the interest earned on assets and the interest paid on deposits and borrowings can be adversely affected when market rates of interest rise. At December 31, 2021 and 2020, certificates of deposit amounted to $179.9 million and $199.4 million, respectively, or 32.5% and 41.2%, respectively, of total assets at such dates.

Gap Analysis. The matching of assets and liabilities may be analyzed by examining the extent to which such assets and liabilities are “interest rate sensitive” and by monitoring a bank’s interest rate sensitivity “gap.” An asset and liability is said to be interest rate sensitive within a specific time period if it will mature or reprice within that time period. The interest rate sensitivity gap is defined as the difference between the amount of interest-earning assets maturing or repricing within a specific time period and the amount of interest-bearing liabilities maturing or repricing within that same time period. A gap is considered positive when the amount of interest rate sensitive assets exceeds the amount of interest rate sensitive liabilities. A gap is considered negative when the amount of interest rate sensitive liabilities exceeds the amount of interest rate sensitive assets. During a period of rising interest rates, a negative gap would tend to adversely affect net interest income while a positive gap would tend to result in an increase in net interest income. Conversely, during a period of falling interest rates, a negative gap would tend to result in an increase in net interest income while a positive gap would tend to affect adversely net interest income. Our current interest rate risk management policy provides that our one-year interest rate gap as a percentage of total assets should not exceed positive or negative 20%. This policy was adopted by our management and Board of Directors based upon their judgment that it established an appropriate benchmark for the level of interest-rate risk, expressed in terms of the one-year gap, for the Company. If our one-year gap position approaches or exceeds the 20% policy limit, management will obtain simulation results in order to determine what steps might appropriately be taken, in order to maintain our one-year gap in accordance with the policy. Alternatively, depending on the then-current economic scenario, we could determine to make an exception to our policy or we could determine to revise our policy. Our one-year cumulative gap was a positive 2.6% at December 31, 2021, compared to a positive 2.9% at December 31, 2020.

The following table sets forth the amounts of our interest-earning assets and interest-bearing liabilities outstanding at December 31, 2021, which we expect, based upon certain assumptions, to reprice or mature in each of the future time periods shown. Except as stated below, the amount of assets and liabilities shown which reprice or mature during a particular period were determined in accordance with the earlier of term to repricing or the contractual maturity of the asset or liability. The table sets forth an approximation of the projected repricing of assets and liabilities at December 31, 2021, on the basis of contractual maturities, anticipated prepayments, and scheduled rate adjustments within a three-month period and subsequent selected time intervals. The loan amounts in the table reflect principal balances expected to be redeployed and/or repriced as a result of contractual amortization and anticipated prepayments of adjustable-rate loans and fixed-rate loans, and as a result of contractual rate adjustments on adjustable-rate loans. The Company’s annual historical prepayment rates are applied to loans. Money market, savings and passbook accounts are assumed to have annual rates of withdrawal, or “decay rates,” of 40%, 40%, and 20%, respectively.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

| 3 Months or Less |

More than 3 Months to 1 Year |

More than 1 Year to 3 Years |

More than 3 Years to 5 Years |

More than 5 Years |

Total Amount |

|||||||||||||||||||

| (Dollars In Thousands) |

||||||||||||||||||||||||

| Interest-earning assets (1): |

||||||||||||||||||||||||

| Due from banks, interest-bearing |

$ | 9,851 | $ | -- | $ | -- | $ | -- | $ | -- | $ | 9,851 | ||||||||||||

| Investment in interest-earning time deposits |

1,553 | 2,934 | 3,437 | -- | -- | 7,924 | ||||||||||||||||||

| Investment securities available for sale |

4,033 | -- | -- | -- | -- | 4,033 | ||||||||||||||||||

| Loans held for sale |

107,823 | -- | -- | -- | -- | 107,823 | ||||||||||||||||||

| Loans receivable (2) |

45,096 | 28,566 | 72,436 | 169,915 | 96,179 | 412,192 | ||||||||||||||||||

| Investment in Federal Home Loan Bank stock |

-- | -- | -- | -- | 2,178 | 2,178 | ||||||||||||||||||

| Total interest-earning assets |

$ | 168,356 | $ | 31,500 | $ | 75,873 | $ | 169,915 | $ | 98,357 | $ | 544,001 | ||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||||||

| Passbook accounts |

$ | 1 | $ | 1 | $ | 6 | $ | 1 | $ | 1 | $ | 10 | ||||||||||||

| Savings accounts |

366 | 366 | 731 | 182 | 182 | 1,827 | ||||||||||||||||||

| Money market accounts |

40,138 | 40,138 | 80,275 | 20,069 | 20,068 | 200,688 | ||||||||||||||||||

| Certificate accounts |

20,946 | 46,627 | 95,806 | 16,531 | -- | 179,910 | ||||||||||||||||||

| FHLB borrowings |

26,000 | 7,171 | 7,000 | 9,022 | -- | 49,193 | ||||||||||||||||||

| FRB borrowings |

-- | 3,895 | -- | -- | -- | 3,895 | ||||||||||||||||||

| Subordinated debt |

-- | -- | -- | -- | 7,933 | 7,933 | ||||||||||||||||||

| Total interest-bearing liabilities |

$ | 87,451 | $ | 98,198 | $ | 183,818 | $ | 45,805 | $ | 28,184 | $ | 443,456 | ||||||||||||

| Interest-earning assets less interest-bearing liabilities |

$ | 80,905 | $ | (66,698 | ) | $ | (107,945 | ) | $ | 124,110 | $ | 70,173 | ||||||||||||

| Cumulative interest-rate sensitivity gap (3) |

$ | 80,905 | $ | 14,207 | $ | (93,738 | ) | $ | 30,372 | $ | 100,545 | |||||||||||||

| Cumulative interest-rate gap as a percentage of total assets at December 31, 2021 |

14.6 | % | 2.6 | % | (16.9 | )% | 5.5 | % | 18.1 | % | ||||||||||||||

| Cumulative interest-earning assets as a percentage of | ||||||||||||||||||||||||

| cumulative interest-bearing liabilities at December 31, 2021 |

192.5 | % | 107.7 | % | 74.6 | % | 107.3 | % | 122.7 | % | ||||||||||||||

________________________

(1) Interest-earning assets are included in the period in which the balances are expected to be redeployed and/or repriced as a result of anticipated prepayments, scheduled rate adjustments and

contractual maturities.

(2) For purposes of the gap analysis, loans receivable includes non-performing loans gross of the allowance for loan losses and deferred loan fees.

(3) Interest-rate sensitivity gap represents the difference between net interest-earning assets and interest-bearing liabilities.

Qualitative Analysis. Our ability to maintain a positive “spread” between the interest earned on assets and the interest paid on deposits and borrowings is affected by changes in interest rates. The Company’s fixed-rate loans generally are profitable if interest rates are stable or declining since these loans have yields that exceed its cost of funds. If interest rates increase, however, the Company would have to pay more on its deposits and new borrowings, which would adversely affect its interest rate spread. In order to counter the potential effects of dramatic increases in market rates of interest, the Company intends to continue to originate more variable rate loans and increase core deposits. The Company also intends to place a greater emphasis on shorter-term home equity loans and commercial business loans.

Liquidity and Capital Resources

The Company’s primary sources of funds are deposits, amortization and prepayment of loans and to a lesser extent, loan sales and other funds provided from operations. While scheduled principal and interest payments on loans are a relatively predictable source of funds, deposit flows and loan prepayments are greatly influenced by general interest rates, economic conditions and competition. The Company sets the interest rates on its deposits to maintain a desired level of total deposits. In addition, the Company invests excess funds in short-term interest-earning assets that provide additional liquidity. At December 31, 2021, the Company’s cash and cash equivalents amounted to $10.7 million. At such date, the Company also had $4.5 million invested in interest-earning time deposits maturing in one year or less.

Quaint Oak Bancorp, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The Company uses its liquidity to fund existing and future loan commitments, to fund deposit outflows, to invest in other interest-earning assets, and to meet operating expenses. At December 31, 2021, Quaint Oak Bank had outstanding commitments to originate loans of $27.9 million, commitments under unused lines of credit of $38.7 million, and $4.8 million under standby letters of credit.

At December 31, 2021, certificates of deposit scheduled to mature in one year or less totaled $67.6 million. Based on prior experience, management believes that a significant portion of such deposits will remain with us, although there can be no assurance that this will be the case.

In addition to cash flow from loan payments and prepayments and deposits, the Company has significant borrowing capacity available to fund liquidity needs. If the Company requires funds beyond its ability to generate them internally, borrowing agreements exist with the Federal Home Loan Bank of Pittsburgh (FHLB), which provide an additional source of funds. As of December 31, 2021, we had $49.2 million of borrowings from the FHLB and had $276.9 million in borrowing capacity. Under terms of the collateral agreement with the FHLB of Pittsburgh, we pledge residential mortgage loans as well as Quaint Oak Bank’s FHLB stock as collateral for such advances. In addition, as of December 31, 2021 Quaint Oak Bank had $899,000 in borrowing capacity with the Federal Reserve Bank of Philadelphia. There were no borrowings under this facility at December 31, 2021. The Bank also has borrowing capacity with the FRB under the PPPLF program in the amount of the outstanding pledged PPP loans that totaled $42.6 million at December 31, 2021. Quaint Oak Bank’s outstanding advances with the FRB under the PPPLF program were $3.9 million as of December 31, 2021.