Filed Pursuant to Rule 424(b)(4)

Registration

No. 333-260682

PROSPECTUS

2,500,000 Units

Each Unit Consisting of One Share of Common Stock and

One Warrant to Purchase One Share of Common Stock

We are offering 2,500,000 units (each a “Unit” and collectively, the “Units”), at a public offering price of $6.00 per Unit, of Modular Medical, Inc. (the “Company,” “Modular Medical,” “we,” “our” or “us”) with each Unit consisting of one share of our common stock, par value $0.001 per share, which we refer to as the “Common Stock,” and one warrant (a “Warrant”) to purchase one share of Common Stock. The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities, and so we do not intend to apply for listing of the Warrants on any national securities exchange. The shares of our Common Stock and the Warrants comprising the Units are immediately separable upon issuance and will be issued separately. The Warrants included in the Units will be exercisable immediately upon issuance, will expire five years from the date of issuance and have an exercise price of $6.60 per share (110% of the price per unit sold in this offering.) This offering also includes the shares of Common Stock issuable from time to time upon exercise of the Warrants. The Warrants will be issued in book-entry form pursuant to a warrant agency agreement between us and Colonial Stock Transfer Company, Inc. as warrant agent.

Prior to this offering, our Common Stock was traded on the over-the-counter market and quoted on the OTCQB market under the symbol “MODD.” On February 9, 2022, the last reported sale price of our Common Stock on the OTCQB was $7.90. We were approved to list our Common Stock on the Nasdaq Capital Market under the symbol “MODD,”and we began trading on the Nasdaq Capital Market on February 10, 2022. There is no established trading market for the warrants, and we do not expect a market to develop.

All share and per-share information, as well as all financial information, contained in this prospectus has been adjusted to give effect to the one-for- three (l-for-3) reverse stock split (the “Reverse Stock Split”), which was effective at the commencement of trading of our Common Stock on November 29, 2021.

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

| Per Unit | Total | |||||||

| Public offering price | $ | 6.00 | $ | 15,000,000 | ||||

| Underwriting discounts and commissions(1) | $ | 0.42 | $ | 1,050,000 | ||||

| Proceeds to us (before expenses) | $ | 5.58 | $ | 13,950,000 | ||||

| (1) | The underwriters will receive compensation in addition to the underwriting discount. See “Underwriting” beginning on page 78. |

Certain affiliates of our directors and other existing stockholders have agreed to purchase an aggregate of approximately $1,800,000 of Units in this offering at the initial public offering price per Unit and on the same terms as other purchasers in this offering. The underwriters will receive the same underwriting discount on any Units purchased by these stockholders as they will on any other securities sold to the public in this offering.

Investing in our securities involves a high degree of risk. See “Risk Factors,” beginning on page 14.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the Units to investors on or about February 14, 2022.

Sole Book-Running Manager

Oppenheimer & Co.

Co-Lead Managers

| The Benchmark Company | Lake Street |

The date of this prospectus is February 9, 2022

TABLE OF CONTENTS

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the Units offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

For investors outside the United States: We have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Units and the distribution of this prospectus outside of the United States.

Market and Other Industry Data

Unless otherwise indicated, market data and certain industry forecasts used throughout this prospectus were obtained from various sources, including internal surveys, market research, consultant surveys, publicly available information and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based upon our management’s knowledge of the industry, have not been independently verified. The future performance of the industry and markets in which we operate and intend to operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the sections titled “Risk Factors” and “Special Note Regarding Forward-looking Statements” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in these publications and reports.

| i |

This summary highlights selected information contained elsewhere in this prospectus and does not contain all the information that you should consider before making your investment decision. Before investing in our Units, you should carefully read this entire prospectus, including the information set forth under the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus and our consolidated financial statements and the accompanying notes included in this prospectus. Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Modular Medical,” the “Company,” “we,” “us,” and “our” refer to Modular Medical, Inc. and its wholly-owned subsidiary, Quasuras, Inc.

Except as otherwise indicated in this prospectus, all Common Stock, Warrant and per share information and all exercise prices with respect to our stock options and warrants reflect, on a retroactive basis, a 1-for-3 reverse stock split of our Common Stock, which became effective on the OTCQB on November 29, 2021.

Overview

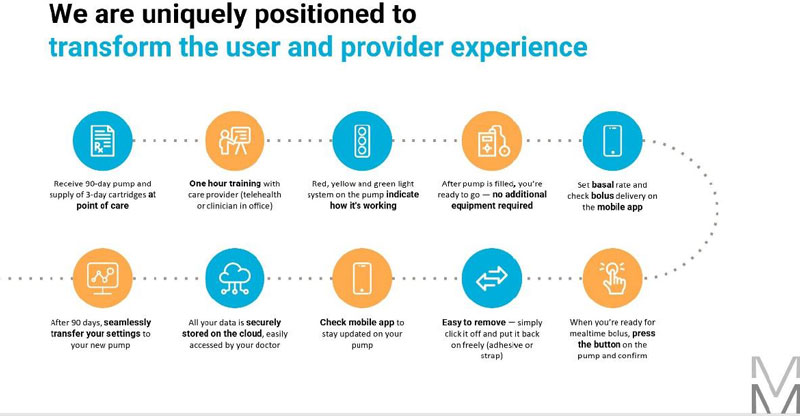

Modular Medical is a development stage medical device company focused on the design, development, and commercialization of an innovative insulin pump using modernized technology to increase pump adoption in the diabetes marketplace. Through the creation of a novel two-part patch pump, our MODD1 product candidate, or MODD1, the Company seeks to fundamentally alter the trade-offs between cost and complexity and access to the higher standards of care that presently available insulin pumps provide. By simplifying and streamlining the user experience from introduction, prescription, reimbursement, training and day-to-day use, we seek to expand the wearable insulin delivery device market beyond the highly motivated “super users” and expand the category into the mass market. The product candidate seeks to serve both the type 1 and the rapidly growing, especially in terms of device adoption, type 2 diabetes markets.

Differentiation

We believe that there are a number of shortcomings and issues with currently available insulin pumps that prevent a substantial number of people who require insulin on a daily basis from choosing an insulin pump to treat their diabetes. We believe that by tailoring our insulin pump to address such factors, we can expand the scope and adoption rate of insulin pump usage. We believe that to achieve broader market acceptance, an insulin pump must be easier to learn to use, less time consuming to operate, more intuitive to both patients and physicians, and meet the standards for coverage by insurance providers so that co-payments required from patients are affordable and the hurdles to insurance coverage are significantly reduced.

Among the more prominent issues are:

| · | Complexity: Many existing pumps are highly complex and require significant technical expertise to use effectively. We believe such pumps were designed for “super users,” who have high levels of motivation and technical competence. The complexity of pumps proves daunting to less technically inclined users. |

| · | Cumbersome: We believe that a majority of existing pumps are bulky and difficult to manage, in many cases requiring additional equipment to introduce a catheter to the patient’s body and up to 48 inches of tubing, which must be replaced frequently, to connect the catheter to a pump. This requires users to carry spare parts and other equipment adding to the difficulty of using the pump. | |

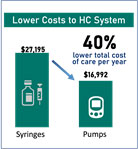

| · | Cost: Costs associated with insulin pump therapy are high and can be prohibitive, especially for those on fixed or limited incomes. These costs vary by pump, but multi-thousand-dollar upfront payments, often with substantial co-payments in addition to possible daily co-payments on consumables, can easily place current pumps out of reach for patients. This makes insurance providers hesitant to pay for them, leading to limited or absent reimbursement/coverage and high hurdles for patients to gain access. |

| 1 |

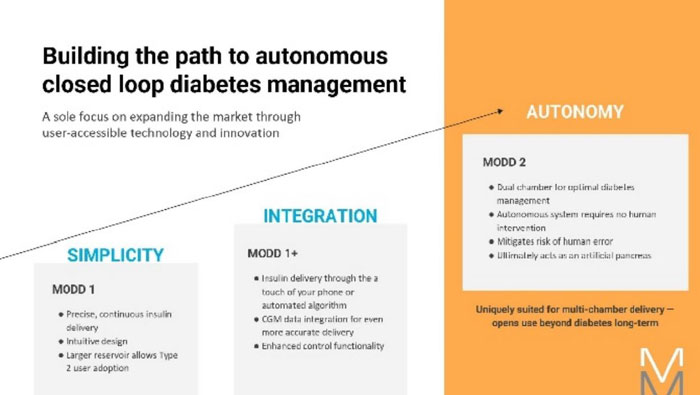

Our team has substantial knowledge of the diabetes industry and experience in developing, obtaining regulatory authorization for, and bringing insulin pumps to market. Based on this experience, we believe that our innovative insulin pump, using a new and proprietary method of pumping insulin, can address most or all of these shortcomings. It provides a state-of-the-art insulin pump capable of both basal (steady flow) and bolus (mealtime dosing) insulin disbursement. It also has been designed considering a natural migration path to multi-chamber/multi-liquid pumps, potentially offering an exciting array of new therapies to patients with diabetes and other conditions.

Our goal is to become the leader in expanding access to insulin pump technology to a wider portion of diabetes sufferers and provide not just care for the super users, but “diabetes care for the rest of us.”

The MODD1 is a high-precision, first-line pump that we believe represents the best choice for new pump patients because it is easy to afford, easy to learn, easy to use, and has a revolutionary design and technology that enable precision with low-cost manufacture and high reproducibility.

Key features include:

| · | Two parts - one reusable, one disposable - snap together to form the working system | |

| · | One button interface, easy to learn and use | |

| · | 90-day reusable, 3-day disposable cartridges | |

| · | Removable at any time from an adhesive bracket | |

| · | No external controller required, no charging, no battery replacement | |

| · | Slim profile, lighter weight |

A proprietary survey of American healthcare payors representing 50 million covered lives (approximately 1/3 of U.S. covered lives) performed for us by industry leading survey firm ISA has demonstrated that a majority of payors are willing to grant equivalent or preferential coverage for a product with this feature set at launch in exchange for about a 20% rebate. These costs are built into all of our models.

Diabetes Classifications and Therapies

Diabetes is typically classified as either type 1, or T1D, or type 2, or T2D:

| · | T1D is an auto-immune condition characterized by the body’s nearly complete inability to produce insulin. It is frequently diagnosed during childhood or adolescence. Individuals with T1D require daily insulin therapy to survive. |

| · | T2D represents over 90% of all individuals diagnosed with diabetes and is characterized by the body’s inability to either properly utilize insulin or produce sufficient insulin. Initially, many people with T2D attempt to manage their condition with improvements in diet and exercise and/or the use of oral medications and/or injection of glucagon-like peptide-1 (GLP-1) drugs. However, as their diabetes advances, patients often progress to requiring insulin therapies such as once-daily long-acting insulin and ultimately to intensified mealtime rapid-acting insulin therapy. This represents an important portion of the diabetes market with an estimated 1.6 million T2D intensively treated with insulin currently in the United States. |

Glucose, the primary source of energy for cells, must be maintained at certain levels in the blood in order to permit optimal cell function and health. In people with diabetes, blood glucose levels are not well controlled and frequently become very high, a condition known as hyperglycemia, and very low, a condition called hypoglycemia. Hyperglycemia can lead to serious long-term complications, including blindness, kidney disease, nervous system disorders, occlusive vascular diseases, lower-limb amputation, stroke, cardiovascular disease, and death. Hypoglycemia can lead to confusion or loss of consciousness, often requiring a visit to the emergency room or, in certain cases, result in seizures, coma, and/or death.

| 2 |

All people with T1D, which is our primary market, require daily insulin. According to the Seagrove 2021 Diabetes Blue Book, approximately 18% of people with T2D in the United States, or 4.7 million people, require insulin (basal (steady supply) alone represents 3.1 million and basal plus mealtime represent 1.6 million) to manage their diabetes. In this prospectus, we refer to people with T1D and people with T2D who require mealtime insulin as “insulin-requiring people with diabetes.”

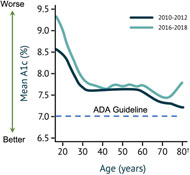

Currently, there are two primary therapies available for insulin-requiring people with diabetes: multiple daily insulin injections directly into the body through syringes or insulin pens, referred to as Multiple Daily Injection, or MDI therapy, or the use of an insulin pump to deliver mealtime insulin boluses (single doses) to help with glucose absorption after carbohydrate consumption and a continuous subcutaneous insulin infusion, or CSII therapy, into the body. Generally, CSII therapy is considered to provide a number of advantages over MDI therapy, primarily an improvement in glycemic control, as measured by certain diabetes management tests such as hemoglobin A1c (HbA1c) measure and more recently Time in Range (TIR) where a continuous glucose measuring device is used to calculate this test. Among other medical benefits, it has been demonstrated that insulin pump use can decrease glucose variability, reduce the number of hypoglycemia, decrease the daily doses of insulin and reduce the fear of hypoglycemia.

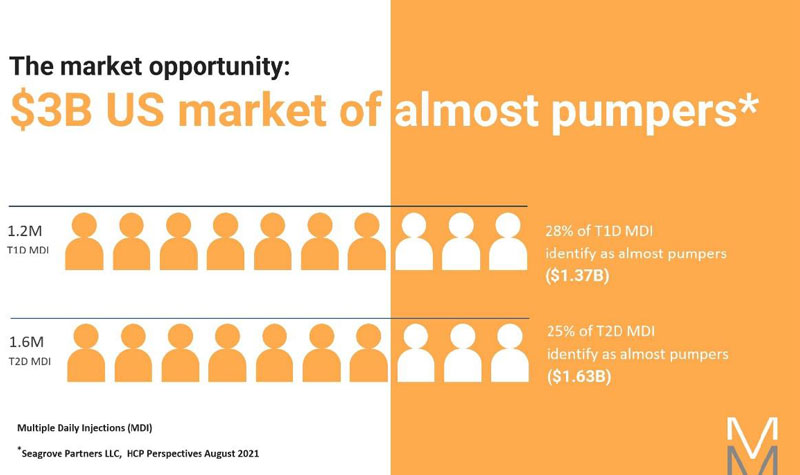

Notwithstanding these advantages, the difficulty in use resulting from the complexity and cumbersome design of available insulin pumps as well as high and often prohibitive costs for both the patient and insurance provider has resulted not only in dissatisfaction among many existing pump users (fewer than half purchase a new pump after the warranty expires per Seagrove Partners estimate), but also has severely limited the adoption rate of insulin pumps by a large segment of the MDI diabetes population, who we refer to in this prospectus as “Almost Pumpers.”

We define Almost Pumpers as individuals who treat their diabetes with MDI. These individuals are aware of pumps and the potential benefits, however, for a variety of reasons, they choose to continue giving themselves shots. We undertook one-on-one interviews with over 200 of these individuals to understand their past experiences on or considering pumps, existing pump shortcomings, the cost and insurance hurtles challenges, complexity to learn and time and complexity to operate that drives them to remain on MDI. With this detailed understanding, we brought a series of prototype models to them to react to, so we could refine the design and include features that would motivate them to be able to use this technology to better care for their diabetes. To date, the MODD1 pump has been well received by these individuals.

It is estimated that 32% of Americans with T1D use insulin pump therapy. Clinicians were surveyed on potential pump users and identified that 28% of Americans with T1D, including 44% of those who currently utilize MDI, can be classified as i) having an interest in pump adoption and ii) meeting the American Diabetes Association guidelines for required glucose control. These individuals do not want to closely manage their glucose levels and incur the associated time and effort involved - they are the Almost Pumpers. We have developed what we believe to be the most technologically advanced delivery system to overcome their objections and provide motivation. We believe that there are four addressable hurdles to adoption:

| · | Usability: the device needs to be easy to learn and to operate; |

| · | Affordability: we will focus on overcoming copay and insurance hurdles rather than leaving the “insurance journey” to the clinician and patient; |

| · | Accessibility and Education: we will seek to engage patients to sample this new technology by supplying clinicians with free samples and simple training to allow people to see first-hand the typical barriers to adoption that have been overcome; and |

| · | Service and Support: we will have a support network available to address their questions and concerns. |

Our initial focus for our insulin pump is the almost pumper segment population located in the United States.

We believe this conversion process, engaging people to try and thereby receive the benefits of our technology will substantially increase adoption of insulin pumps among both those with T1D and T2D who remain reliant upon multiple daily injections. Diabetes is a disease that appears throughout the world. Therefore, we cannot segment the market by socioeconomics, education or level of care. We intend to create an insulin pump that appeals to all Almost Pumpers.

| 3 |

Our Insulin Pump

Instead of building complex, bespoke, and difficult to manufacture and maintain pumping and control systems, we began with the technology and the user in mind. Using proprietary and patented methods of insulin measurement, we were able to eschew the complex mechanisms used today and instead build a product candidate using only parts from high volume consumer electronics manufacturing lines, breaking the cost vs. functionality curve that has existed in the insulin pump space and representing the first truly modern insulin pump design.

The pre-production models of our low-cost insulin pump are now undergoing the testing required to submit to the Food and Drug Administration, or FDA, for clearance to market them in the United States. We expect to submit our product candidate to the FDA in March 2022 through a premarket notification (or 510(k)) process (see the section titled Government Regulation below for a discussion of the FDA submission process and requirements). After submission, we expect to receive two rounds of comments from the FDA, and we believe it will take approximately six months to obtain clearance from the FDA. After we obtain clearance from the FDA, we can commence our commercialization process, as discussed in the section titled Commercialization Strategy: Overcoming the Insurance Hurdles below. We continue to devote substantial time and resources to better understand the needs and preferences of Almost Pumpers and the specific patent/provider/payor requirements to motivate change from MDI patients.

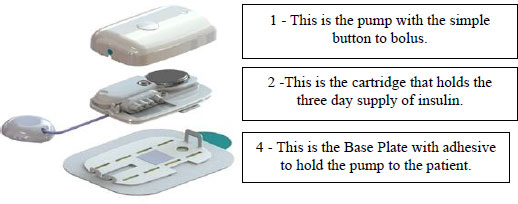

MODD1 has several distinguishing features:

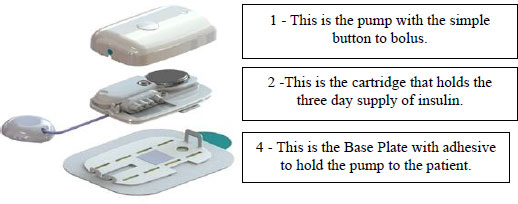

1- The pump has a simple button to press to deliver insulin as the patient requires it. The electronic pump uses a simple motor and rotating cam to motivate the insulin into the patient along with low power Bluetooth (LPBT) and near field communication (NFC) chips to allow the patient to communicate with their smart phone, tablet, or other mobile computing platform, as appropriate.

2 - The pump snaps together with a three-day disposable cartridge that is patient filled with insulin for delivery. It includes the power source and a simple coin cell that allows it to run through the 80-hour life of the cartridge.

3 - There is a set (not shown) that contains a soft 6 mm cannula and an introducer for insertion into the skin and removal of the needle used to transfer insulin to the body.

4 - MODD1 comes with a variety of methods for the patient to wear the pump. Options include: a base plate with adhesive (shown) for attaching to the body that has features for holding the pump to the patient; overwraps to hold the product candidate to the patient; and a velcro strap with a base plate suitable for wrapping around the arm or leg of the patient. The system will deliver a small continuous rate, called a basal, that will provide approximately 50% of the total daily dose required and the user will use the on-pump button to administer boluses, typically before and after meals.

The objective is to make the product candidate simple to acquire and take home, simple to learn and most importantly, simple to use to expand the pump market, drive adoption and ultimately better clinical outcomes.

| 4 |

Technological Advantages

The adoption of new ultra-high volume technologies will result in far easier manufacturing scale up as parts sourcing and assembly processes are far easier. The MODD1 was designed from the beginning for mass manufacturing processes and fully automated production assembly lines. This advantage is compounded by the high availability and already optimized cost reduction in its components. This has resulted in a cost of goods, estimated on our competitors’ announced margins and sales, 50% lower than our closest patch pump competitor.

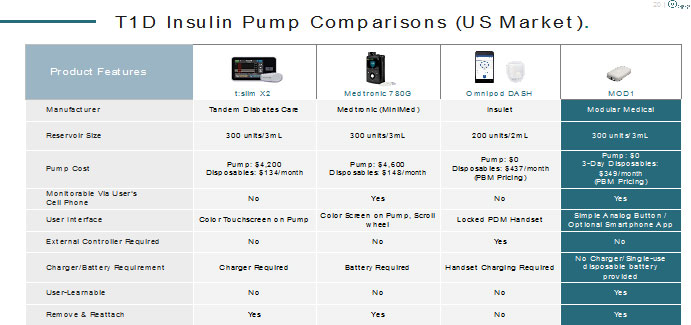

The adoption of modern, miniaturized technologies has led to numerous other advantages as well. The MODD1 pump is smaller in overall volume than Insulet’s popular Omnipod product and has a lower profile to the skin. Despite this, it holds a full 3mL (300 units) of insulin in line with full sized pumps such as Tandem and Medtronic, 50% more than the 2mL reservoir in the Omnipod. We believe that this volume advantage over other patch pumps will be significant as 24% of type 1 and over 50% of the rapidly growing type 2 market require more than 2 milliliters of insulin every 3 days (the expected wear time of patch pumps).

In addition, our new and patented pumping modality will provide what we believe is the most even (and thus closest to the function of a healthy pancreas) delivery of basal insulin in the industry. Basal rate can be delivered almost continuously while other pumps are delivering micro-boluses every five minutes for the Tandem, Omnipod and Medtronic pumps. We plan to demonstrate the impact of our system on glycemic control in a future clinical study.

The technology allows the patient to simply add insulin and operate. The battery is included in each cartridge and the device is operated without a controller. Nothing requires charging. MODD1 has been made push button simple to appeal to a wider audience of users.

This new technology has also made the MODD1 lighter than existing offerings. Compared to the Insulet Omnipod pump, MODD1 weighs 20 grams (vs. 26 grams) empty and 23 grams (vs. 28 grams) fully filled (despite carrying 50% more insulin), a reduction of 23% and 18% respectively. Also, unlike existing patch pumps, the MODD1 can be removed from the needle and taken off and replaced later if the user desires. This avoids loss of insulin in a pump due to accidental dislodging of the soft canula, an issue that users have expressed considerable dissatisfaction with on other patch pumps.

This technology is also uniquely suited to dual (or more) chamber pumps. We believe that such pumps will be integral to the realization of high time in range artificial pancreas solutions that require no human intervention, the next step forward from the cumbersome and awkward solutions today that require the user to announce meals, count and input carbs, and adjust delivery for exercise and sleep. The advantages of cost and miniaturization are multiplied in a multi-chamber setup and we expect to be able to reach price points, ease of use, and form factor unlike anything seen in the industry thus far. We believe that a prefilled, multi-hormone peel and stick-patch pump able to function in a fully autonomous closed loop system with CGM’s represents the next generation of diabetes care. We believe that we have demonstrated our technology and are securing the intellectual property on our approach.

We believe this technology, especially in dual chamber, will open up numerous applications outside of diabetes where medication compliance of complex therapy regimes is difficult, addressing such spaces as weight loss and fertility, and simplifying complex delivery of multi-drug cocktails, especially those with diverse and challenging dosing schedules.

Commercialization Strategy: Overcoming the Insurance Hurdles

Our goal is to establish MODD1 as the best option for new pump patients as we expand the market into the Almost Pumpers (Type 1 and Type 2) and the newly motivated CGM users. We seek to grow the market by providing first-line insulin pump therapy that is well suited to meet the needs of both diabetes patients requiring insulin and their clinicians.

| · | According to Insulet’s published costs of goods, MODD1 is approximately 50% less expensive to manufacture than Omnipod. This low cost allows us to spend more on patients and sampling. This will save money for payers. We can offer the pump with no upfront cost to patients. Benefits of MODD1 include: |

| o | 20% discount vs. Insulet (PODD) will drive preferred status |

| o | Designed to use pharmacy benefits manager (PBM) codes as a disposable |

| 5 |

| o | No new code needed to be reimbursed at launch |

| o | Saves provider an estimated $1062/patient/year vs. Omnipod |

| · | MODD1 will be sampled and given to patients by the doctor or diabetes nurse educator at the time of the patient visit. When a patient is motivated to make change, our starter kit will make it easy for the clinician to initiate the new therapy that same day. We seek to eliminate the currently challenging “insurance journey” and product acquisition timeline and significantly reduce training time for the busy clinician, all major hurdles to pump adoption. We intend to add telehealth support to help the patient throughout adoption and use and to facilitate greater collaboration between patients and their physicians. |

Europe represents another large potential market for MODD1. Sixty million people in Europe live with diabetes, and approximately $161 billion is spent annually on diabetes healthcare costs in Europe. At present, cost containment is restricting pump uptake across Europe. Current pump usage across Europe hovers between 10% and 20% in many markets. Single payor healthcare systems across Europe traditionally attempt to contain costs in the short term and seek low price technologies with moderate medical benefits. MODD1 will offer a rebalance of this risk/reward strategy in that payors will incur only minor incremental short-term costs with the benefit of longer-term cost savings associated with reliable pump use. We intend to employ a partnership strategy across Europe following in-house managed regulatory and pricing activities in the major markets (e.g., the United Kingdom) and more cost receptive markets (e.g., Nordics). We are targeting European and United Kingdom approval towards early 2023.

Intellectual Property

Our success depends in part on our ability to obtain patents and trademarks, maintain trade secrets and know-how protection, enforce our proprietary rights against infringers, and operate without infringing on the proprietary rights of third parties. Because of the length of time and expense associated with developing new products and bringing them through the regulatory approval process, the health care industry places considerable emphasis on obtaining patent protection and maintaining trade secret protection for new technologies, products, processes, know-how, and methods.

As of December 31, 2021, we had one issued U.S. utility patent, five published U.S. utility patents, two pending foreign patent applications, and two pending international Patent Cooperation Treaty (PCT) patent applications covering various aspects of our technology, including our proprietary fluid movement technology. There can be no assurance that our pending patent applications will result in the issuance of patents, that patents issued to or licensed by us will not be challenged or circumvented by competitors, or that these patents will be found to be valid or sufficiently broad to protect our technology or provide us with a competitive advantage.

Risks Related to Our Business

Investing in our Units involves substantial risk. You should carefully consider all of the information in this prospectus before investing in our Units, including the risks related to this offering and our Units, our business and industry, our intellectual property, our financial results, and our need for financing, each as described under the section titled “Risk Factors” and elsewhere in this prospectus.

Risks in investing in our Units include, but are not limited to:

| · | Even if we are able to obtain all regulatory approvals and have completed all other steps needed to be taken to commercialize our insulin pump, if we or any contract manufacturers we select fails to comply with the FDA’s quality system regulations, the manufacturing and distribution of our product candidate could be interrupted, and our product sales and operating results could suffer. |

| · | We will need to outsource and rely on third parties for various aspects relating to the development, manufacture, sales and marketing of our insulin pump as well as in connection with assisting us in the preparation and filing of our FDA submission, and our future success will be dependent on the timeliness and effectiveness of the efforts of these third parties. |

| 6 |

| · | We are a developmental-stage medical device company and have a history of significant operating losses; we expect to continue to incur operating losses for the foreseeable future, and we may never achieve or maintain profitability. |

| · | We may not receive the necessary regulatory clearance or approvals for our insulin pump, and failure to timely obtain necessary clearances and/or approvals could harm our then operations, including our ability to commercialize our product candidate. |

| · | Obtaining marketing authorization in the United States will not obviate the need to obtain marketing authorization in other jurisdictions We must obtain approval from foreign regulatory authorities before we can market and sell any of our product candidates in countries outside the United States. We will incur additional costs in seeking such approvals, may experience delays in obtaining such approvals and cannot be certain that such approvals will be granted. |

| · | Although our product candidate does not presently require clinical trials to apply to the FDA for clearance, and even if a clinical trial is conducted, the results of our clinical testing may not demonstrate the safety and efficacy of the device or may be equivocal or otherwise not be sufficient for us to obtain approval of our product candidate. |

| · | We require additional capital to fund our growth, operations, and obligations, and our growth may be limited. We believe the proceeds of this offering will provide us with the capital required to obtain FDA approval of and to commercialize our insulin pump. |

| · | Any outbreak or worsening of an outbreak of contagious diseases, or other adverse public health developments, could have a material and adverse effect on our business operations, financial condition and results of operations. |

| · | Our competitors may develop products that are more effective, safer and less expensive than ours. |

| · | We may fail to sustain trading on Nasdaq, which could make it more difficult for investors to sell their shares. |

| · | We recently effected a reverse stock split of our Common Stock; however we may not be able to meet the minimum bid price requirement of Nasdaq. In addition, the reverse stock split may decrease the liquidity for shares of our Common Stock, and the trading liquidity of our Common Stock may not improve. |

| · | Sales of a significant number of shares of our Common Stock in the public markets, or the perception that such sales could occur, could depress the market price of our Common Stock. |

| · | We have limited internal research and development personnel, making us dependent on consulting relationships. |

| · | Technological breakthroughs in diabetes monitoring, treatment or prevention could render our insulin pump obsolete. |

| · | We may not be able to identify, negotiate and maintain the strategic alliances necessary to develop and commercialize our products and technologies, and we will be dependent on our corporate partners if we do. |

Listing on the Nasdaq Capital Market

Prior to this offering, our Common Stock was quoted on the OTCQB Market. In connection with this offering, we were approved to list our Common Stock on the Nasdaq Capital Market (“Nasdaq”) under the symbol “MODD,”and out Common Stock began trading on Nasdaq on February 10, 2022. We do not intend to apply for listing of the Warrants on any national securities exchange.

| 7 |

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. We will remain an emerging growth company until the earlier of (1) December 31, 2024 (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.07 billion, (3) the last day of the fiscal year in which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur on the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company, we may:

| · | present only two years of audited financial statements, plus unaudited condensed financial statements for any interim period, and related management’s discussion and analysis of financial condition and results of operations in this prospectus; |

| · | avail ourselves of the exemption from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley; |

| · | provide reduced disclosure about our executive compensation arrangements; and |

| · | not require stockholder non-binding advisory votes on executive compensation or golden parachute arrangements. |

In addition, under the JOBS Act, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this extended transition period, and, as a result we will adopt new or revised accounting standards on relevant dates on which adoption of such standards is required for other public companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act and have elected to take advantage of certain of the scaled disclosure available to smaller reporting companies.

Corporate Information

Our principal executive offices are located at 16772 West Bernardo Drive, San Diego, CA 92127 and our telephone number is (858) 800-3500. We maintain a website at www.modular-medical.com to which we regularly post copies of our press releases, as well as additional information about us. Our filings with the Securities and Exchange Commission, or SEC, will be available free of charge through the website as soon as reasonably practicable after being electronically filed with or furnished to the SEC. Information contained on, or accessible through, our website does not constitute a part of this prospectus or our other filings with the SEC, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our Units.

All brand names or trademarks appearing in this prospectus are the property of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this prospectus is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owners.

Recent Developments

Warrant Amendment

On February 3, 2022, the Company entered into an amendment agreement (the “Amendment Agreement”) with each of the holders (each, a “Holder”, and collectively, the “Holders”) of the Common Stock Warrants issued by the Company in the 2021 Placement (as defined below), to amend such Common Stock Warrants in order to clarify that, in the event the Company or any subsidiary thereof, as applicable, at any time while the Common Stock Warrant is outstanding, shall sell or grant any option to purchase, or sell or grant any right to reprice, or otherwise dispose of or issue (or announce any offer, sale, grant or any option to purchase or other disposition) any Common Stock or securities entitling any person or entity to acquire shares of Common Stock (upon conversion, exercise or otherwise), at an effective price per share less than the then exercise price of the Common Stock Warrant (such lower price, the “Base Share Price” and such issuances collectively, a “Dilutive Issuance”), the then exercise price of the warrant, which is currently $24.00, shall be reduced at the option of the investor and only reduced to equal the Base Share Price. Each Common Stock Warrant was further amended to clarify that any adjustment to the exercise price pursuant to a Dilutive Issuance will remain through the occurrence of a sale of securities with gross proceeds in excess of $12 million (the “Qualified Capital Raise”), but no such adjustment would be made in the event of a Dilutive Issuance made subsequent to the completion of a Qualified Capital Raise.

| 8 |

Board Composition

On December 31, 2021, Liam Burns resigned as a member of our board of directors (the “Board”).

Effective November 29, 2021, the Board appointed Steven Felsher and Philip Sheibley as members of the Board. In addition, Messrs. Felsher and Sheibley were also appointed to serve on the audit committee and the nominating and governance committee of the Board.

Officer Stock Purchases

On October 28, 2021, we entered into purchase agreements with Ellen O’Connor (Lynn) Vos, our Chief Executive Officer, and Paul DiPerna, Chairman of our Board and our President, Chief Financial Officer and Treasurer, providing for the sale and issuance by us of 30,864 shares of our Common Stock, par value $0.001 per share at the closing market price on October 28, 2021 of $8.10 per share. We received proceeds of approximately $250,000 from the sale of the shares, comprising $150,000 from Ms. Vos and $100,000 from Mr. DiPerna.

Credit Facility and Security Agreement

On October 28, 2021, we issued a secured promissory note (the Bridge Note) to Manchester Explorer, L.P. (Manchester) that provides us with a $3,000,000 revolving credit facility with all amounts being drawn down by us thereunder being due and payable, subject to acceleration in the event of a default, on March 15, 2022 (the Maturity Date). Interest at the rate of 12% is payable on each drawn down without regard to the draw down date or the date when interest is paid. As of February 3, 2021, we have made draws totaling $2,000,000 under the Bridge Note.

The principal amount of the Bridge Note and interest due thereon is payable to Manchester no later than the earlier of (i) the Maturity Date and (ii) the date on which we have received proceeds in excess of $12,000,000 from a transaction or series of related transactions occurring prior to the Maturity Date, which such transactions constitute equity financings or other issuances of our equity securities.

Provided that no Event of Default (as such term is defined in the Bridge Note) has occurred, on any date prior to the Maturity Date, upon no less than three days written notice by us specifying the draw amount, Manchester will advance the draw amount to us. No draw amount can be in an amount less than $100,000 or exceed an amount equal to $3,000,000 minus the aggregate principal amount outstanding under the Bridge Note at the time of such draw request.

If an Event of Default occurs and is continuing, Manchester may declare all of the Bridge Note, including any interest and other amounts due, to be due and payable immediately. As security for our obligations under the Bridge Note, on October 28, 2021, we entered into a Security Agreement with Manchester under which granted Manchester a continuing and unconditional first priority security interest in and to any and all of our property, of any kind or description, tangible or intangible, wheresoever located and whether now existing or hereafter arising or acquired.

Reverse Stock Split

On November 24, 2021, we filed an Amendment to our Articles of Incorporation to effect a reverse split of our issued and outstanding Common Stock at an exchange ratio of 1-for-3. The reverse stock split was effective as of November 29, 2021.

| 9 |

Securities offered by us:

|

2,500,000 Units, each consisting of one share of Common Stock and one Warrant to purchase one share of Common Stock. The Units will not be certificated or issued in stand-alone form. The shares of our Common Stock and the Warrants comprising the Units are immediately separable upon issuance and will be issued separately; but will be purchased together in this offering. | |

| Description of Warrants included in Units: | The exercise price of the Warrants is $6.60 per share (110% of the public offering price per Unit). Each Warrant is exercisable for one share of Common Stock. Each Warrant will be exercisable immediately upon issuance and will expire five years after the initial issuance date. The terms of the Warrants will be governed by a warrant agency agreement, dated as of the effective date of this offering, between us and Colonial Stock Transfer Company, Inc. as the warrant agent (the “Warrant Agent”). This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the Warrants. For more information regarding the warrants, you should carefully read the section titled “Description of Our Securities—Warrants” in this prospectus. | |

|

Common Stock outstanding prior to this offering: |

6,390,372 shares of Common Stock outstanding as of February 9, 2022. | |

| Common

Stock to be outstanding after this offering: |

10,401,648 shares, including 1,511,276 shares to be issued upon automatic conversion of $6,610,560 principal amount of convertible promissory notes and accrued interest thereon or 12,901,648 shares, if the Warrants offered hereby are exercised in full . | |

| Use of proceeds: | We estimate that the net proceeds from this offering will be approximately $13,550,000, after deducting underwriting discounts and commissions and the estimated offering expenses payable by us.

We intend to use the net proceeds of this offering for general corporate purposes, including working capital, to develop our initial sales and marketing infrastructure, to fund additional research and development activities, to develop our initial manufacturing and production capabilities and make related capital expenditures and to repay a promissory note. See “Use of Proceeds” for additional information. | |

| Risk factors: | Investing in our securities involves substantial risk. You should read the “Risk Factors” section beginning on page 14 and other information included in this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities. |

| 10 |

Nasdaq Trading Symbol: |

Prior to this offering, our Common Stock was quoted on the OTCQB of the OTC Markets Group, Inc. (the “OTCQB”), under the symbol “MODD,” and, traded on a limited basis. As of February 9, 2022, the last reported sale price of our Common Stock on the OTCQB Market was $7.90. We were approved to list our Common Stock on the Nasdaq Stock Market (the “Nasdaq”) under the symbol “MODD,”and our Common Stock began trading on the Nasdaq on February 10, 2022. Nasdaq listing requirements include, among other things, a stock price threshold. As a result, on November 24, 2021, we filed a Certificate of Amendment to our Articles of Incorporation to effect a 1-for-3 reverse stock split. On November 29, 2021, the reverse stock split was effected on the OTCQB. We do not intend to apply for listing of the Warrants on any national securities exchange. | |

| Lock-ups | We and our directors and officers have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our Common Stock or securities convertible into Common Stock for a period of 180 days after the date of this prospectus. See “Underwriting” section. |

The number of shares of our Common Stock to be outstanding after this offering is based on 6,390,372 shares of our Common Stock outstanding as of February 9, 2022, and excludes:

| · | 2,500,000 shares of our Common Stock issuable upon the exercise of the Warrants to be issued as part of the Units; |

| · | 1,511,276 shares of our Common Stock issuable upon automatic conversion of $6,610,560 principal amount of convertible promissory notes and accrued interest thereon at a price of $6.00 per share as a result of the closing of this offering; | |

| · | 1,511,276 shares of our Common Stock issuable upon exercise of restricted warrants with such warrants being issued upon automatic conversion of $6,610,560 principal amount of convertible promissory notes and accrued interest thereon as a result of the closing of this offering; | |

| · | 767,796 shares of our Common Stock issuable upon exercise of warrants issued to our convertible promissory note holders; | |

| · | 1,834,689 shares of our Common Stock issuable upon exercise of outstanding stock options with a weighted average exercise price of approximately $7.56 per share; and |

| · | 831,978 shares of our Common Stock reserved for issuance pursuant to future awards under our Amended 2017 Equity Incentive Plan, or the 2017 Plan. |

Certain affiliates of our directors and other existing stockholders have agreed to purchase an aggregate of approximately $1,800,000 of our Units in this offering at the initial public offering price per Unit and on the same terms as other purchasers in this offering. The underwriters will receive the same underwriting discount on any shares purchased by these stockholders as they will on any other Units sold to the public in this offering.

| 11 |

The following tables summarize our financial data for the periods presented and should be read together with the sections of this prospectus titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes thereto appearing elsewhere in this prospectus. The following summary statements of operations data for the six months ended September 30, 2021 and September 30, 2020 and the years ended March 31, 2021 and March 31, 2020 have been derived from our consolidated financial statements and footnotes included elsewhere in this prospectus. Our historical results are not necessarily indicative of our future results or of the results we expect in the future. Except as otherwise noted, all share and per share data for the periods shown have been adjusted, on a retroactive basis, to reflect a 1-for-3 reverse stock split, which became effective on November 29, 2021.

| Year ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Operating expenses | ||||||||

| Research and development | $ | 4,083,303 | $ | 3,034,152 | ||||

| General and administrative expenses | 3,253,412 | 2,313,870 | ||||||

| Total operating expenses | 7,336,715 | 5,348,022 | ||||||

| Loss from operations | (7,336,715 | ) | (5,348,022 | ) | ||||

| Other income | ||||||||

| Interest income | 130 | 28,749 | ||||||

| Interest expense | (39,791 | ) | — | |||||

| Loss before income taxes | (7,376,376 | ) | (5,319,273 | ) | ||||

| Provision for income taxes | 1,600 | 1,600 | ||||||

| Net loss | $ | (7,377,976 | ) | $ | (5,320,873 | ) | ||

| Net loss per share | ||||||||

| Basic and diluted | $ | (1.19 | ) | $ | (0.89 | ) | ||

| Shares used in computing net loss per share | ||||||||

| Basic and diluted | 6,211,562 | 5,954,923 | ||||||

| Six Months Ended September 30, | ||||||||

| 2021 | 2020 | |||||||

| Operating expenses | ||||||||

| Research and development | 3,893,511 | 2,063,480 | ||||||

| General and administrative | 3,174,489 | 1,669,910 | ||||||

| Total operating expenses | 7,068,000 | 3,733,390 | ||||||

| Loss from operations | (7,068,000 | ) | (3,733,390 | ) | ||||

| Other income | 368,872 | 104 | ||||||

| Interest expense | (1,194,670 | ) | — | |||||

| Loss on debt extinguishment | (1,321,450 | ) | — | |||||

| Loss before income taxes | (9,215,248 | ) | (3,733,286 | ) | ||||

| Provision for income taxes | 1,600 | 1,600 | ||||||

| Net loss | $ | (9,216,848 | ) | $ | (3,734,886 | ) | ||

| Net loss per share | ||||||||

| Basic and diluted | $ | (1.46 | ) | $ | (0.61 | ) | ||

| Shares used in computing net loss per share | ||||||||

| Basic and diluted | 6,320,916 | 6,156,602 | ||||||

| 12 |

The following summary balance sheet data as of September 30, 2021 is presented:

| · | on an actual basis; and | |

| · | on an as adjusted basis to give effect to our sale of $15,000,000 of shares of Common Stock in this offering at the offering price of $6.00 per Unit. |

The summary as adjusted balance sheet is for informational purposes only and does not purport to indicate balance sheet information as of any future date.

| September 30, 2021 | ||||||||

| Actual | As Adjusted | |||||||

| (Unaudited) | ||||||||

| Balance Sheet data: | ||||||||

| Cash and cash equivalents | $ | 798,161 | $ | 14,334,288 | ||||

| Total assets | $ | 1,374,838 | $ | 14,910,965 | ||||

| Total liabilities | $ | 6,475,652 | $ | 1,273,173 | ||||

| Accumulated deficit | $ | (25,163,858 | ) | $ | (25,163,858 | ) | ||

| Total stockholders’ equity (deficit) | $ | (5,100,814 | ) | $ | 13,637,792 | |||

| 13 |

Investing in our securities involves a high degree of risk. Before you invest in the Units, the Warrants and the Common Stock, you should carefully consider the following risks, as well as general economic and business risks, and all of the other information contained in this registration statement. Any of the following risks could harm our business, operating results and financial condition and cause the trading price of our Common Stock to decline, which would cause you to lose all or part of your investment. When determining whether to invest, you should also refer to the other information contained in this prospectus, including our financial statements and the related notes thereto.

Risks Related To Our Operations

We are a developmental stage medical device company and have a history of significant operating losses; we expect to continue to incur operating losses, and we may never achieve or maintain profitability.

As a development-stage enterprise, we do not currently have revenues to generate cash flows to cover operating expenses. Since our inception, we have incurred operating losses in each year due to costs incurred in connection with research and development activities and general and administrative expenses associated with our operations. For the years ended March 31, 2021 and 2020, we incurred net losses of approximately $7.4 million and $5.3 million, respectively. At March 31, 2021, we had an accumulated deficit of approximately $15.9 million. For the six months ended September 30, 2021, we incurred a net loss of approximately $9.2 million. At September 30, 2021, we had an accumulated deficit of approximately $25.2 million. As a result, we have limited capital resources and require the funds from this offering to continue our business.

We expect to incur losses for the foreseeable future, as we continue the development of, and seek regulatory clearance and approvals for, our insulin pump. As our prototype insulin pump is currently our only product candidate, if it fails to gain regulatory approval and market acceptance, we will not be able to generate any revenue or explore other opportunities to enhance shareholder value, such as through a sale. If we fail to generate revenue and eventually become profitable, or if we are unable to fund our continuing losses, our shareholders could lose all or a substantial part of their investment.

We might not be able to continue as a going concern which would likely cause our stockholders to lose most or all of their investment.

Our audited financial statements for the year ended March 31, 2021 were prepared under the assumption that we would continue as a going concern. However, our independent registered public accounting firm included a “going concern” explanatory paragraph in its report on our financial statements for the year ended March 31, 2021, indicating that, without additional sources of funding, our cash at March 31, 2021 is not sufficient for us to operate as a going concern for a period of at least one year from the date that the financial statements included in this prospectus are issued. Management’s plans concerning these matters, including our need to raise additional capital, are described in Management’s Discussion and Analysis of Financial Conditions and Results of Operations included in this prospectus and in Note 1 to our audited consolidated financial statements included in this prospectus. However, we cannot assure you that our plans will be successful. In light of the foregoing, there is substantial doubt about our ability to continue as a going concern. If we cannot continue as a viable entity, our stockholders would likely lose most or all of their investment in us.

| 14 |

We have no revenues and substantial indebtedness, which could adversely affect our business and financial position and, among other things, our ability to raise additional capital and our ability to satisfy our financial obligations.

Because we are a development stage company, we have not and do not anticipate generating any revenues for the foreseeable future. As a result, we are dependent upon our ability to raise capital through sales of our debt and equity securities.

In connection with our private placement completed in May 2021, we issued $6,610,550 aggregate principal amount of our 12% unsecured convertible promissory notes, hereinafter referred to as the 2021 Notes, with each 2021 Note due 12 months from the issuance date. As a result of the closing of this offering, 1,511,276 shares of our Common Stock (at a price of $6.00 per share) and 1,511,276 restricted warrants will be issued upon automatic conversion of the convertible promissory notes and accrued interest thereon.

The full effects of COVID-19 and other potential future public health crises, epidemics, pandemics or similar events are uncertain and could have a material and adverse effect on our business, financial condition, operating results and cash flows.

The global outbreak of the coronavirus disease 2019, or COVID-19, was declared a pandemic by the World Health Organization and a national emergency by the U.S. government in March 2020. This has negatively affected the world economy, disrupted global supply chains, significantly restricted travel and transportation, resulted in mandated closures and orders to “shelter-in-place” and created significant disruption of the financial markets. The extent of the impact on our operational and financial performance will depend on future developments, including the duration and spread of the pandemic and related actions taken by U.S. and foreign government agencies to prevent disease spread, all of which are uncertain, out of our control and cannot be predicted.

We have been complying with county and state orders and, until May 2021, had implemented a teleworking policy for our employees and contractors and significantly minimized the number of employees who visit our office. However, a facility closure, work slowdowns or temporary stoppage at one of our manufacturing suppliers could occur, which could have a longer-term impact and could delay our prototype production and ability to conduct business.

| 15 |

If our workforce is unable to work effectively, including because of illness, quarantines, absenteeism, government actions, facility closures, travel restrictions or other restrictions in connection with the COVID-19 pandemic, our operations will be negatively impacted. We may be unable to develop our product candidate, and our costs may increase as a result of the COVID-19 outbreak. The impacts could worsen if there is an extended duration of any COVID-19 outbreak or a resurgence of COVID-19 infection in affected regions after they have begun to experience improvement.

We rely on other companies to provide components and to perform services for us. An extended period of supply chain disruption caused by the response to COVID-19 could impact our ability to produce our initial product quantities and, if we are not able to implement alternatives or other mitigations, product deliveries would be adversely impacted and negatively impact our business, financial condition, operating results and cash flows. Limitations on government operations can also impact regulatory approvals that are necessary for us to operate our business.

The continued spread of COVID-19 has also led to disruption and volatility in the global capital markets. We were recently able to raise additional capital in a private placement that commenced in February 2021, however, we will need to raise additional capital to support our operations in the future. We may be unable to access the capital markets, and additional capital may only be available to us on terms that could be significantly detrimental to our existing stockholders and to our business.

We will need substantial additional funding to complete subsequent phases of our insulin pump product candidate and to operate our business and such funding may not be available or, if it is available, such financing is likely to substantially dilute our existing shareholders.

The discovery, development, and commercialization of new medical devices, such as our insulin pump, entails significant costs. While we believe that we have generally completed the engineering and mechanical aspects of our insulin pump prototype, we still must modify, refine and finalize our insulin pump to, among other things, meet the general needs and preferences of the almost pumper marketplace and the guidelines of third-party payors. To enable us to accomplish these and other related items and continue to operate our business, we will need to raise substantial additional capital and/or enter into strategic partnerships or joint ventures to enable us to:

| · | fund clinical studies and seek regulatory approvals; |

| · | build or access manufacturing and commercialization capabilities; |

| · | develop, test, and, if approved, market our product candidate; |

| · | acquire or license additional internal systems and other infrastructure; and |

| · | hire and support additional management, engineering and scientific personnel. |

Until we can generate a sufficient amount of product revenue to finance our cash requirements, which we may never achieve, we expect to finance our cash needs primarily through public or private equity offerings, debt financings or through the establishment of possible strategic alliances. This offering is being conducted to obtain such funding, although there can be no guarantee that we will successfully raise all the funding we require in this offering. Depending on the amount of funding we receive in this offering, as well as other factors, we may in the future seek additional capital from public or private offerings of our capital stock or borrow additional amounts under new credit lines or from other sources. If we issue equity or debt securities to raise additional funds, our existing stockholders may experience dilution, we may incur significant financing costs, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. In addition, if we raise additional funds through collaborations, licensing, joint ventures, strategic alliances, partnership arrangements or other similar arrangements, it may be necessary to relinquish valuable rights to our potential future products or proprietary technologies or grant licenses on terms that are not favorable to us.

We cannot be certain that additional funding will be available on acceptable terms, or at all. If we are not able to secure additional equity funding when needed, we may have to delay, reduce the scope of, or eliminate one or more of our clinical studies, development programs or future commercialization initiatives. In addition, any additional equity funding that we do obtain will dilute the ownership held by our existing equity holders. The amount of this dilution may be substantially increased if the trading price of our Common Stock is lower at the time of any financing. Regardless, the economic dilution to shareholders will be significant if our stock price does not increase significantly, or if the effective price of any sale is below the price paid by a particular shareholder. Any debt financing that we obtain in the future could involve substantial restrictions on activities and creditors could seek a pledge of some or all of our assets. We have not identified potential sources for such financing that we will require, and we do not have commitments from any third parties to provide any future debt financing. If we fail to obtain funding as needed, we may be forced to cease or scale back operations, and our results, financial condition and stock price would be adversely affected.

| 16 |

We have a limited operating history and historical financial information upon which you may evaluate our performance.

You should consider, among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like us, are in their early stages of development. We may not successfully address these risks and uncertainties or successfully complete our studies and/or implement our existing and new products. If we fail to do so, it could materially harm our business and impair the value of our Common Stock. Unanticipated problems, expenses and delays are frequently encountered in establishing a new business, conducting research, and developing new products. These include, but are not limited to, inadequate funding, failure to obtain regulatory approval, unforeseen research issues, lack of consumer acceptance, competition, sluggish product development, and inadequate sales and marketing. The failure by us to meet any of these conditions would have a materially adverse effect upon us and may force us to reduce or curtail operations. No assurance can be given that we can or will ever operate profitably.

We may not be able to meet our future capital needs.

To date, we have no revenue and we have limited cash liquidity and capital resources. We will need additional capital in the near future. Any equity financings will result in dilution and may contain other terms that are not favorable to our then-existing stockholders. We currently have debt financing, and any additional sources of debt financing that we may obtain in the future may result in a high interest expense. Any financing, if available, may be on unfavorable terms. If adequate funds are not obtained, we will be required to reduce or curtail operations.

The amount of financing we require will depend on a number of factors, many of which are beyond our control. Our results of operations, financial condition and stock price are likely to be adversely affected if our funding requirements increase or are otherwise greater than we expect.

Our future funding requirements will depend on many factors, including, but not limited to:

| · | the testing costs for our insulin pump product candidate and other development activities conducted by us directly, and our ability to successfully conclude the studies and activities and achieve favorable results; |

| · | our ability to attract future strategic partners to pay for or share costs related to our product development efforts; |

| · | the costs and timing of seeking and obtaining regulatory clearance and approvals for our product candidate; |

| · | the costs of filing, prosecuting, maintaining and enforcing any patents and other intellectual property rights that we may have and defending against potential claims of infringement; |

| · | decisions to hire additional scientific, engineering or administrative personnel or consultants; |

| · | our ability to manage administrative and other costs of our operations; and |

| · | the presence or absence of adverse developments in our research program. |

If any of these factors cause our funding needs to be greater than expected, our operations, financial condition, ability to continue operations and stock price may be adversely affected.

| 17 |

Our future cash requirements may differ significantly from our current estimates.

Our cash requirements may differ significantly from our estimates from time to time, depending on a number of factors, including:

| · | the costs and results of our clinical studies regarding our insulin pump product candidate; |

| · | the time and costs involved in obtaining regulatory clearance and approvals; |

| · | whether we are able to obtain funding under future licensing agreements, strategic partnerships, or other collaborative relationships, if any; |

| · | the costs of compliance with laws, regulations, or judicial decisions applicable to us; and |

| · | the costs of general and administrative infrastructure required to manage our business and protect corporate assets and shareholder interests. |

If we fail to raise additional funds on a timely basis, we will need to scale back our business plans, which would adversely affect our business, financial condition, and stock price, and we may even be forced to discontinue our operations and liquidate our assets.

Technological breakthroughs in diabetes monitoring, treatment or prevention could render our insulin pump obsolete.

The diabetes treatment market is subject to rapid technological change and product innovation. Our insulin pump is based on our proprietary technology, but a number of companies, medical researchers and existing pharmaceutical companies are pursuing new delivery devices, delivery technologies, sensing technologies, procedures, drugs and other therapeutics for the monitoring, treatment and/or prevention of insulin-dependent diabetes. Any technological breakthroughs in diabetes monitoring, treatment or prevention could render our insulin pump obsolete, which, since our insulin pump is our only product candidate, would have a material adverse effect on our business, financial condition and results of operations and could result in shareholders losing their entire investment.

Any failure to attract and retain skilled directors, executives, employees and consultants could impair our product development and commercialization activities.

Our business depends on the skills, performance, and dedication of our directors, executive officers and key engineering, scientific and technical advisors. Many of our current engineering or scientific advisors are independent contractors and are either self-employed or employed by other organizations. As a result, they may have conflicts of interest or other commitments, such as consulting or advisory contracts with other organizations, which may affect their ability to provide services to us in a timely manner. We will need to recruit additional directors, executive management employees, and advisers, particularly engineering, scientific and technical personnel, which will require additional financial resources. In addition, there is currently intense competition for skilled directors, executives and employees with relevant engineering, scientific and technical expertise, and this competition is likely to continue. If we are unable to attract and retain persons with sufficient engineering, scientific, technical and managerial experience, we may be forced to limit or delay our product development activities or may experience difficulties in successfully conducting our business, which would adversely affect our operations and financial condition.

We have limited internal research and development personnel, making us dependent on consulting relationships.

We consider research and development to be an important part of the process of designing, developing, obtaining regulatory required approvals and the eventual commercialization of our insulin pump. We continue to incur increased research and development expenditures, which are attributable to effort and expenses incurred in designing and developing our innovative insulin pump. We expect to continue to incur substantial costs related to research and development.

| 18 |

We will need to outsource and rely on third parties for various aspects relating to the development, manufacture, sales and marketing of our insulin pump as well as in connection with assisting us in the preparation and filing of our FDA submission, and our future success will be dependent on the timeliness and effectiveness of the efforts of these third parties.

We are dependent on consultants for important aspects of our product development strategy. We do not have the required financial resources and personnel to carry out independently the development of our product candidate, and do not have the capability or resources to manufacture, market or sell our current product candidate. As a result, we contract with and rely on third parties for important functions, including in connection with the development and finalization of our insulin pump, the preparation and filing of our FDA submission and eventual manufacturing and commercialization of our product candidate. We have recently entered into several agreements with third parties for such services. If problems develop in our relationships with third parties, or if such parties fail to perform as expected, it could lead to delays or lack of progress in obtaining FDA clearance, significant cost increases, changes in our strategies, and even failure of our product initiatives.

We may not be able to identify, negotiate and maintain the strategic alliances necessary to develop and commercialize our products and technologies, and we will be dependent on our corporate partners if we do.

We may seek to enter into a strategic alliance with a diabetes related service providing company for the further development and approval of our insulin pump product candidate. At this time, we have not entered into any such strategic alliance. Strategic alliances, if entered into, could potentially provide us with additional funds, expertise, access, and other resources in exchange for exclusive or non-exclusive licenses or other rights to the product that we are currently developing or a product we may explore in the future. We cannot give any assurance that we will be able to enter into strategic relationships with a diabetes related service providing company or others in the near future or at all. In addition, we cannot assure you that any agreements that we do reach will achieve our goals or be on terms that prove to be economically beneficial to us. When we do enter into strategic or contractual relationships, we become dependent on the successful performance of our partners or counter-parties. If they fail to perform as expected, such failure could adversely affect our financial condition, lead to increases in our capital needs, or hinder or delay our development efforts. See “Our Business -Employees” below.

We may not receive the necessary regulatory clearance or approvals for our insulin pump, and failure to timely obtain necessary clearances and/or approvals could harm our then operations, including our ability to commercialize our product candidate.

Before we can market a new medical device, such as our insulin pump, we must first receive clearance under Section 510(k) of the Federal Food, Drug, and Cosmetic Act, or the FDCA. In the 510(k) clearance process, before a device may be marketed, the FDA must determine that such proposed device is “substantially equivalent” to a legally-marketed “predicate” device, which includes a device that has been previously cleared through the 510(k) process, a device that was legally marketed prior to May 28, 1976 (pre-amendments device), a device that was originally on the U.S. market pursuant to a premarket approval (PMA) and later down-classified, or a 510(k)-exempt device. To be “substantially equivalent,” the proposed device must have the same intended use as the predicate device, and either have the same technological characteristics as the predicate device or have different technological characteristics and not raise different questions of safety or effectiveness than the predicate device.

Certain future modifications made to our product candidate, which we currently expect to be cleared through 510(k), may require a new 510(k) clearance. The 510(k) clearance process can be expensive, lengthy and uncertain. The FDA’s 510(k) clearance process usually takes from three to 12 months, but can last longer. Despite the time, effort and cost, a device may not be approved or cleared by the FDA. Any delay or failure to obtain necessary regulatory authorizations could harm our business, including our ability to commercialize our product candidate and our shareholders could lose their entire investment. Furthermore, even if we are granted the required regulatory authorizations, such authorizations may be subject to significant limitations on the indicated uses for the device, which may limit the market for our product candidate.

| 19 |

If the FDA requires us to go through a lengthier, more rigorous examination for our product candidate than we had expected, product introductions or modifications could be delayed or canceled, which could adversely affect our ability to grow our business.

The FDA can delay, limit or deny clearance or approval for our insulin pump medical device for many reasons, including:

| · | our inability to demonstrate to the satisfaction of the FDA that our product candidate is substantially equivalent to the proposed predicate device; |

| · | the disagreement of the FDA with the design or implementation of our performance testing protocols or the interpretation of data from our performance testing; |

| · | the data from performance testing may be insufficient to support a determination of substantial equivalence or that our device meets required special controls or applicable performance standards; |

| · | our inability to demonstrate that the benefits of our pump outweigh the risks; |

| · | the manufacturing process or facilities we intend to use may not meet applicable requirements; and |

| · | the potential for approval policies or regulations of the FDA to change significantly in a manner rendering our data or regulatory filings insufficient for clearance or approval. |

In addition, the FDA may change its clearance and approval policies, adopt additional regulations or revise existing regulations, or take other actions, which may prevent or delay approval or clearance of our product candidate or impact our ability to modify our product candidate after clearance on a timely basis. Such policy or regulatory changes could impose additional requirements upon us that could delay our ability to obtain clearance for our pump, increase the costs of compliance or restrict our ability to maintain our current approval.