UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22167

Virtus Strategy Trust

(Exact name of registrant as specified in charter)

101 Munson

Street

Greenfield, MA 01301-9668

(Address of principal executive offices) (Zip code)

Jennifer

Fromm, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-2608

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 243-1574

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days

after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR

270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this

information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”)

control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC

20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

(b) Not applicable.

ANNUAL REPORT

VIRTUS STRATEGY TRUST

| Virtus

AllianzGI Convertible Fund* |

| Virtus

AllianzGI Core Plus Bond Fund |

| Virtus

AllianzGI Emerging Markets Consumer Fund* |

| Virtus

AllianzGI Global Allocation Fund* |

| Virtus

AllianzGI Global Dynamic Allocation Fund* |

| Virtus

AllianzGI Global Sustainability Fund |

| Virtus

AllianzGI High Yield Bond Fund* |

| Virtus

AllianzGI International Small-Cap Fund* |

| Virtus

AllianzGI Preferred Securities and Income Fund |

| Virtus

AllianzGI Short Duration High Income Fund* |

| Virtus

AllianzGI Water Fund* |

| Virtus

NFJ Emerging Markets Value Fund* |

*Prospectus supplement applicable to this fund appears at the

back of this annual report.

As permitted by regulations adopted by the Securities and

Exchange Commission, paper copies of each Fund’s shareholder reports like this one will no longer be sent by mail, unless specifically requested from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the

reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be

affected by this change and you need not take any action.

You may elect at any time to receive not only shareholder

reports but also certain other communications from the Fund electronically, or you may elect to receive paper copies of all future shareholder reports free of charge to you. If you own your shares directly with the Fund, you may make such elections

by calling the Fund at 1-800-243-1574 or, with respect to requesting electronic delivery, by visiting www.virtus.com. An election made directly with the Fund will apply to all Virtus Mutual Funds in which you own shares directly. If you own your

shares through a financial intermediary, please contact your financial intermediary to make your request and to determine whether your election will apply to all funds in which you own shares through that intermediary.

Not FDIC Insured • No Bank Guarantee • May Lose

Value

Table of Contents

|

1

|

|

2

|

|

6

|

| Fund

|

Fund

Summary |

Schedule

of

Investments |

|

10

|

44

|

|

12

|

48

|

|

15

|

53

|

|

18

|

55

|

|

22

|

66

|

|

26

|

80

|

|

29

|

82

|

|

31

|

87

|

|

34

|

89

|

|

37

|

92

|

|

39

|

96

|

|

42

|

98

|

|

101

|

|

107

|

|

112

|

|

116

|

|

126

|

|

154

|

|

155

|

|

156

|

|

157

|

Proxy Voting Procedures and Voting Record

(Form N-PX)

The subadvisers

vote proxies, if any, relating to portfolio securities in accordance with procedures that have been approved by the Board of Trustees of the Trust (“Trustees”, or the “Board”). You may obtain a description of these

procedures, along with information regarding how the Funds voted proxies during the most recent 12-month period ended June 30, free of charge, by calling toll-free 1-800-243-1574. This information is also available through the Securities and

Exchange Commission’s (the “SEC”) website at https://www.sec.gov.

PORTFOLIO

HOLDINGS INFORMATION

The Trust files a

complete schedule of portfolio holdings for each Fund with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT-P. Form N-PORT-P is available on the SEC’s website at https://www.sec.gov.

This report is not authorized for distribution to prospective

investors in the Funds presented in this book unless preceded or accompanied by an effective prospectus which includes information concerning the sales charge, each Fund’s record and other pertinent information.

To Virtus Strategy Trust Shareholders:

I am pleased to present this annual

report, which reviews the performance of your Fund for the 12 months ended September 30, 2021.

During this fiscal year, markets expressed

optimism about the economic reopening that was driven by the release of COVID-19 vaccines, monetary support, and fiscal stimulus. Doubts crept in during the period, however, as the Delta variant impacted productivity and cascading supply chain

issues led to higher prices. Strong corporate profitability drove equity markets higher for much of the period, although concerns about inflation and interest rates hindered fixed income markets.

Domestic and international equity indexes delivered strong

returns for the 12 months ended September 30, 2021. U.S. large-capitalization stocks returned 30.00%, as measured by the S&P 500® Index, but were outpaced by small-cap

stocks, which gained 47.68%, as measured by the Russell 2000® Index. Within international equities, developed markets, as measured by the MSCI EAFE® Index (net), returned 25.73%, while emerging markets, as measured by the MSCI Emerging Markets Index (net), gained 18.20%.

In fixed income markets, the yield on the 10-year Treasury

rose sharply to 1.52% on September 30, 2021, from 0.69% on September 30, 2020, based on fears of rising inflation. The broader U.S. fixed income market, as represented by the Bloomberg U.S. Aggregate Bond Index, was down 0.90% for the 12-month

period, but non-investment grade bonds, as measured by the Bloomberg U.S. Corporate High Yield Bond Index, were up 11.28%.

On behalf of our investment managers, I thank you for

entrusting the Virtus Funds with your assets. Please call our customer service team at 800-243-1574 if you have questions about your account or require assistance. We appreciate your business and remain committed to your long-term financial

success.

Sincerely,

George R.

Aylward

President, Virtus Funds

November 2021

Refer to the Manager’s Discussion section for your

Fund’s performance. Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investing involves risk, including the

risk of loss of principal invested.

VIRTUS STRATEGY

TRUST

DISCLOSURE OF FUND EXPENSES (Unaudited)

FOR THE SIX-MONTH PERIOD OF April 1,

2021 TO September 30, 2021

We believe it is important for you to

understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of a Virtus Strategy Trust Fund (each, a “Fund”), you may incur two types of costs: (1) transaction costs, including sales

charges on purchases of Class A shares and contingent deferred sales charges on Class C shares; and (2) ongoing costs, including investment advisory fees, distribution and service fees, and other expenses. Class P shares, Institutional Class shares,

Class R6 shares and Administrative Class shares are sold without sales charges and do not incur distribution and service fees. Class R6 shares also do not incur shareholder servicing fees. For further information regarding applicable sales charges,

see Note 1 in the Notes to Financial Statements. These examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. These

examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period. The Annualized Expense Ratios may be different from the expense ratios in the Financial Highlights which are for the

fiscal year ended September 30, 2021.

Please note that the expenses shown in the

accompanying tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges or contingent deferred sales charges. Therefore, the accompanying tables are useful in comparing ongoing costs only,

and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The calculations assume no shares were bought or sold during the period.

Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses

The table below provides information about

actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account

value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| |

|

Beginning

Account Value

April 1, 2021 |

|

Ending

Account Value

September 30, 2021 |

|

Annualized

Expense

Ratio |

|

Expenses

Paid

During

Period* |

|

AllianzGI Convertible

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

$

1,000.00 |

|

$

1,027.80 |

|

0.96

% |

|

$

4.88 |

| |

Class

C |

1,000.00

|

|

1,024.10

|

|

1.73

|

|

8.78

|

| |

Class

P |

1,000.00

|

|

1,029.20

|

|

0.71

|

|

3.61

|

| |

Institutional

Class |

1,000.00

|

|

1,029.30

|

|

0.71

|

|

3.61

|

| |

Administrative

Class |

1,000.00

|

|

1,028.10

|

|

0.93

|

|

4.73

|

|

AllianzGI Core Plus Bond

Fund

|

|

|

|

|

|

|

|

|

| |

Class

P |

1,000.00

|

|

1,024.70

|

|

0.36

|

|

1.83

|

| |

Institutional

Class |

1,000.00

|

|

1,025.10

|

|

0.32

|

|

1.62

|

| |

Class

R6 |

1,000.00

|

|

1,024.90

|

|

0.26

|

|

1.32

|

|

AllianzGI Emerging Markets Consumer

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

914.80

|

|

1.39

|

|

6.67

|

| |

Institutional

Class |

1,000.00

|

|

916.70

|

|

1.04

|

|

5.00

|

|

AllianzGI Global Allocation

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,048.90

|

|

0.52

|

|

2.67

|

| |

Class

C |

1,000.00

|

|

1,044.80

|

|

1.27

|

|

6.51

|

| |

Class

P |

1,000.00

|

|

1,049.80

|

|

0.32

|

|

1.64

|

| |

Institutional

Class |

1,000.00

|

|

1,050.30

|

|

0.29

|

|

1.49

|

| |

Class

R6 |

1,000.00

|

|

1,050.40

|

|

0.22

|

|

1.13

|

| |

Administrative

Class |

1,000.00

|

|

1,062.90

|

|

0.41

|

|

2.12

|

|

AllianzGI Global Dynamic Allocation

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,071.20

|

|

0.82

|

|

4.26

|

| |

Class

C |

1,000.00

|

|

1,067.20

|

|

1.58

|

|

8.19

|

| |

Class

P |

1,000.00

|

|

1,071.80

|

|

0.66

|

|

3.43

|

| |

Institutional

Class |

1,000.00

|

|

1,072.70

|

|

0.54

|

|

2.81

|

| |

Class

R6 |

1,000.00

|

|

1,073.00

|

|

0.54

|

|

2.81

|

| |

Administrative

Class |

1,000.00

|

|

1,071.50

|

|

0.79

|

|

4.10

|

|

AllianzGI Global Sustainability

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,104.90

|

|

0.94

|

|

4.96

|

| |

Class

P |

1,000.00

|

|

1,105.80

|

|

0.79

|

|

4.17

|

| |

Institutional

Class |

1,000.00

|

|

1,106.50

|

|

0.69

|

|

3.64

|

VIRTUS STRATEGY

TRUST

DISCLOSURE OF FUND EXPENSES (Unaudited) (Continued)

FOR THE SIX-MONTH PERIOD OF April 1,

2021 TO September 30, 2021

| |

|

Beginning

Account Value

April 1, 2021 |

|

Ending

Account Value

September 30, 2021 |

|

Annualized

Expense

Ratio |

|

Expenses

Paid

During

Period* |

|

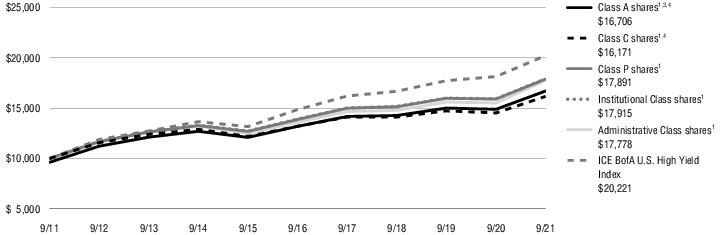

AllianzGI High Yield Bond

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

$1,000.00

|

|

$1,040.60

|

|

1.07%

|

|

$

5.47 |

| |

Class

C |

1,000.00

|

|

1,036.90

|

|

1.81

|

|

9.24

|

| |

Class

P |

1,000.00

|

|

1,042.50

|

|

0.80

|

|

4.10

|

| |

Institutional

|

1,000.00

|

|

1,042.70

|

|

0.83

|

|

4.25

|

| |

Administrative

Class |

1,000.00

|

|

1,063.30

|

|

0.97

|

|

5.02

|

|

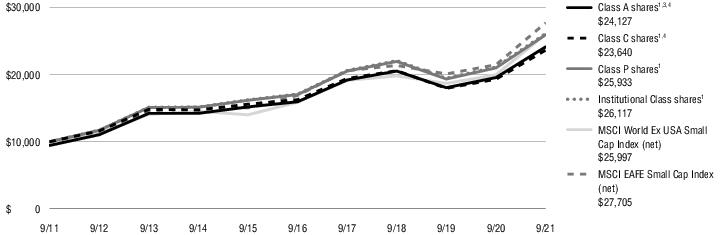

AllianzGI International Small-Cap

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,014.50

|

|

1.25

|

|

6.31

|

| |

Class

C |

1,000.00

|

|

1,010.60

|

|

2.00

|

|

10.08

|

| |

Class

P |

1,000.00

|

|

1,015.30

|

|

1.10

|

|

5.56

|

| |

Institutional

Class |

1,000.00

|

|

1,015.30

|

|

1.04

|

|

5.25

|

| |

Class

R6 |

1,000.00

|

|

1,015.60

|

|

1.00

|

|

5.05

|

|

AllianzGI Preferred Securities and Income

Fund

|

|

|

|

|

|

|

|

|

| |

Class

P |

1,000.00

|

|

1,071.20

|

|

0.59

|

|

3.06

|

| |

Institutional

Class |

1,000.00

|

|

1,071.90

|

|

0.55

|

|

2.86

|

| |

Class

R6 |

1,000.00

|

|

1,072.00

|

|

0.50

|

|

2.60

|

|

AllianzGI Short Duration High Income

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,012.30

|

|

0.86

|

|

4.34

|

| |

Class

C |

1,000.00

|

|

1,011.00

|

|

1.11

|

|

5.60

|

| |

Class

P |

1,000.00

|

|

1,013.70

|

|

0.68

|

|

3.43

|

| |

Institutional

Class |

1,000.00

|

|

1,014.30

|

|

0.60

|

|

3.03

|

| |

Class

R6 |

1,000.00

|

|

1,014.50

|

|

0.55

|

|

2.78

|

|

AllianzGI Water

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,089.80

|

|

1.22

|

|

6.39

|

| |

Class

C |

1,000.00

|

|

1,085.60

|

|

1.97

|

|

10.30

|

| |

Class

P |

1,000.00

|

|

1,091.00

|

|

0.94

|

|

4.93

|

| |

Institutional

Class |

1,000.00

|

|

1,091.00

|

|

0.93

|

|

4.87

|

|

NFJ Emerging Markets Value

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

973.90

|

|

1.14

|

|

5.64

|

| |

Class

C |

1,000.00

|

|

970.30

|

|

1.89

|

|

9.34

|

| |

Class

P |

1,000.00

|

|

974.80

|

|

0.99

|

|

4.90

|

| |

Institutional

Class |

1,000.00

|

|

975.10

|

|

0.89

|

|

4.41

|

|

* |

Expenses

are equal to the relevant Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (183) expenses were

accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

For Funds which may invest in other funds, the annualized

expense ratios noted above do not reflect fees and expenses associated with any underlying funds. If such fees and expenses had been included, the expenses would have been higher.

You can find more information about a Fund’s expenses in

the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs, refer to that Fund’s prospectus.

Hypothetical Example for Comparison Purposes

The table below provides information about

hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not your Fund’s actual return. The hypothetical account values and

expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare these 5% hypothetical

examples with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

VIRTUS STRATEGY

TRUST

DISCLOSURE OF FUND EXPENSES (Unaudited) (Continued)

FOR THE SIX-MONTH PERIOD OF April 1,

2021 TO September 30, 2021

| |

|

Beginning

Account Value

April 1, 2021 |

|

Ending

Account Value

September 30, 2021 |

|

Annualized

Expense

Ratio |

|

Expenses

Paid

During

Period* |

|

AllianzGI Convertible

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

$

1,000.00 |

|

$

1,020.26 |

|

0.96

% |

|

$

4.86 |

| |

Class

C |

1,000.00

|

|

1,016.39

|

|

1.73

|

|

8.74

|

| |

Class

P |

1,000.00

|

|

1,021.51

|

|

0.71

|

|

3.60

|

| |

Institutional

Class |

1,000.00

|

|

1,021.51

|

|

0.71

|

|

3.60

|

| |

Administrative

Class |

1,000.00

|

|

1,020.41

|

|

0.93

|

|

4.71

|

|

AllianzGI Core Plus Bond

Fund

|

|

|

|

|

|

|

|

|

| |

Class

P |

1,000.00

|

|

1,023.26

|

|

0.36

|

|

1.83

|

| |

Institutional

Class |

1,000.00

|

|

1,023.46

|

|

0.32

|

|

1.62

|

| |

Class

R6 |

1,000.00

|

|

1,023.76

|

|

0.26

|

|

1.32

|

|

AllianzGI Emerging Markets Consumer

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,018.10

|

|

1.39

|

|

7.03

|

| |

Institutional

Class |

1,000.00

|

|

1,019.85

|

|

1.04

|

|

5.27

|

|

AllianzGI Global Allocation

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,022.46

|

|

0.52

|

|

2.64

|

| |

Class

C |

1,000.00

|

|

1,018.70

|

|

1.27

|

|

6.43

|

| |

Class

P |

1,000.00

|

|

1,023.46

|

|

0.32

|

|

1.62

|

| |

Institutional

Class |

1,000.00

|

|

1,023.61

|

|

0.29

|

|

1.47

|

| |

Class

R6 |

1,000.00

|

|

1,023.97

|

|

0.22

|

|

1.12

|

| |

Administrative

Class |

1,000.00

|

|

1,023.01

|

|

0.41

|

|

2.08

|

|

AllianzGI Global Dynamic Allocation

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,020.96

|

|

0.82

|

|

4.15

|

| |

Class

C |

1,000.00

|

|

1,017.15

|

|

1.58

|

|

7.99

|

| |

Class

P |

1,000.00

|

|

1,021.76

|

|

0.66

|

|

3.35

|

| |

Institutional

Class |

1,000.00

|

|

1,022.36

|

|

0.54

|

|

2.74

|

| |

Class

R6 |

1,000.00

|

|

1,022.36

|

|

0.54

|

|

2.74

|

| |

Administrative

Class |

1,000.00

|

|

1,021.11

|

|

0.79

|

|

4.00

|

|

AllianzGI Global Sustainability

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,020.36

|

|

0.94

|

|

4.76

|

| |

Class

P |

1,000.00

|

|

1,021.11

|

|

0.79

|

|

4.00

|

| |

Institutional

Class |

1,000.00

|

|

1,021.61

|

|

0.69

|

|

3.50

|

|

AllianzGI High Yield Bond

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,019.70

|

|

1.07

|

|

5.42

|

| |

Class

C |

1,000.00

|

|

1,015.99

|

|

1.81

|

|

9.15

|

| |

Class

P |

1,000.00

|

|

1,021.06

|

|

0.80

|

|

4.05

|

| |

Institutional

|

1,000.00

|

|

1,020.91

|

|

0.83

|

|

4.20

|

| |

Administrative

Class |

1,000.00

|

|

1,020.21

|

|

0.97

|

|

4.91

|

|

AllianzGI International Small-Cap

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,018.80

|

|

1.25

|

|

6.33

|

| |

Class

C |

1,000.00

|

|

1,015.04

|

|

2.00

|

|

10.10

|

| |

Class

P |

1,000.00

|

|

1,019.55

|

|

1.10

|

|

5.57

|

| |

Institutional

Class |

1,000.00

|

|

1,019.85

|

|

1.04

|

|

5.27

|

| |

Class

R6 |

1,000.00

|

|

1,020.05

|

|

1.00

|

|

5.06

|

|

AllianzGI Preferred Securities and Income

Fund

|

|

|

|

|

|

|

|

|

| |

Class

P |

1,000.00

|

|

1,022.11

|

|

0.59

|

|

2.99

|

| |

Institutional

Class |

1,000.00

|

|

1,022.31

|

|

0.55

|

|

2.79

|

| |

Class

R6 |

1,000.00

|

|

1,022.56

|

|

0.50

|

|

2.54

|

|

AllianzGI Short Duration High Income

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,020.76

|

|

0.86

|

|

4.36

|

| |

Class

C |

1,000.00

|

|

1,019.50

|

|

1.11

|

|

5.62

|

| |

Class

P |

1,000.00

|

|

1,021.66

|

|

0.68

|

|

3.45

|

| |

Institutional

Class |

1,000.00

|

|

1,022.06

|

|

0.60

|

|

3.04

|

| |

Class

R6 |

1,000.00

|

|

1,022.31

|

|

0.55

|

|

2.79

|

VIRTUS STRATEGY

TRUST

DISCLOSURE OF FUND EXPENSES (Unaudited) (Continued)

FOR THE SIX-MONTH PERIOD OF April 1,

2021 TO September 30, 2021

| |

|

Beginning

Account Value

April 1, 2021 |

|

Ending

Account Value

September 30, 2021 |

|

Annualized

Expense

Ratio |

|

Expenses

Paid

During

Period* |

|

AllianzGI Water

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

$1,000.00

|

|

$1,018.95

|

|

1.22%

|

|

$

6.17 |

| |

Class

C |

1,000.00

|

|

1,015.19

|

|

1.97

|

|

9.95

|

| |

Class

P |

1,000.00

|

|

1,020.36

|

|

0.94

|

|

4.76

|

| |

Institutional

Class |

1,000.00

|

|

1,020.41

|

|

0.93

|

|

4.71

|

|

NFJ Emerging Markets Value

Fund

|

|

|

|

|

|

|

|

|

| |

Class

A |

1,000.00

|

|

1,019.35

|

|

1.14

|

|

5.77

|

| |

Class

C |

1,000.00

|

|

1,015.59

|

|

1.89

|

|

9.55

|

| |

Class

P |

1,000.00

|

|

1,020.10

|

|

0.99

|

|

5.01

|

| |

Institutional

Class |

1,000.00

|

|

1,020.61

|

|

0.89

|

|

4.51

|

|

* |

Expenses

are equal to the relevant Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (183) expenses were

accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

For Funds which may invest in other funds, the annualized

expense ratios noted above do not reflect fees and expenses associated with any underlying funds. If such fees and expenses had been included, the expenses would have been higher.

You can find more information about a Fund’s expenses in

the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs, refer to that Fund’s prospectus.

VIRTUS STRATEGY

TRUST

KEY INVESTMENT TERMS (Unaudited)

September 30, 2021

Alternative Credit Enhancement Securities® (“ACES”)

ACEs, a type of multiclass mortgage-related security in which

interest and principal payments from multifamily mortgages are structured into separately traded securities.

American Depositary Receipt (“ADR”)

Represents shares of foreign companies traded in U.S. dollars

on U.S. exchanges that are held by a U.S. bank or a trust. Foreign companies use ADRs in order to make it easier for Americans to buy their shares.

Asset-Backed Securities (“ABS”)

Asset-backed securities represent interests in pools of

underlying assets such as motor vehicle installment sales or installment loan contracts, leases of various types of real and personal property, and receivables from credit card arrangements.

Additional tier 1 securities (“ATIs”)

AT1 bonds were introduced by regulators after the global

financial crisis to shore up banks’ balance sheets. They have high coupons, and banks do not need to repay the principal. Because the bonds can be written off in certain circumstances, they are also known as “contingent

convertibles.”

Bank of England

The Central Bank of the United Kingdom, responsible for

controlling the money supply, interest rates, credit, and regulation of U.K. Banks with the goal of keeping the U.K. financial system stable.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index measures the U.S.

investment-grade fixed-rate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Bloomberg U.S. Corporate High Yield Bond Index

The Bloomberg U.S. Corporate High Yield Bond Index measures the

U.S. dollar-denominated, high yield, fixed-rate corporate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct

investment.

Collateralized Loan Obligation

(“CLO”)

A collateralized loan obligation is a

type of security backed by a pool of debt, typically low-rated corporate loans, structured so that there are several classes of bondholders with varying maturities, called tranches.

Dow Jones Sustainability World Index (net)

The Dow Jones Sustainability World Total Return Index tracks

the performance of the top 10% of the 2500 largest companies in the S&P Global Broad Market Index that are the world’s sustainability leaders based on economic, environmental and social criteria.

Earnings before interest, taxes and depreciation

(“EBITDA”)

A financial measure that reflects

operating and nonoperating profit before the deduction of interest and income taxes. Depreciation and amortization expenses are not included in the costs.

European Central Bank (“ECB”)

The ECB is the central bank of the 19 European Union countries

which use the euro. The bank main task is to maintain price stability, by making sure that inflation remains low, stable and predictable.

Exchange-Traded Fund (“ETF”)

An open-end fund that is traded on a stock exchange. Most ETFs

have a portfolio of stocks or bonds that track a specific market index.

Federal Home Loan Mortgage Corporation (“Freddie

Mac”)

A government-owned corporation that buys

mortgages and packages them into mortgage-backed securities.

Federal National Mortgage Association (“Fannie

Mae”)

A government-sponsored, publicly traded

enterprise that makes mortgages available to low- and moderate-income borrowers. It does not provide loans, but backs or guarantees them in the secondary mortgage market.

Federal Reserve (the “Fed”)

The Central Bank of the United States, responsible for

controlling the money supply, interest rates and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 branches and all national and state

banks that are part of the system.

VIRTUS STRATEGY

TRUST

KEY INVESTMENT TERMS (Unaudited) (Continued) September 30, 2021

Financial Times Stock Exchange (“FTSE”)

FTSE Russell provides a comprehensive range of reliable and

accurate indexes, giving investors the tools they require to measure and analyze global markets across asset classes, styles or strategies.

FTSE/Johannesburg Stock Exchange

(“FTSE/JSE”)

The FTSE/JSE Africa Index Series

represents the South African equity market and its market segments. Market capitalization-weighted and alternatively-weighted indexes are available, including equally-weighted, shareholder-weighted, and capped indexes.

FTSE Milano Indice di Borsa (“FTSE MIB”)

The FTSE MIB Italia Series provides investors with a

comprehensive and complementary set of market-cap weighted indexes measuring the performance of Italian companies listed on the Italian stock exchange, Borsa Italia. The indexes are designed for use as performance benchmarks and are suitable for the

creation of structured products, index-tracking funds, exchange-traded funds and derivatives.

Global Depositary Receipt (“GDR”)

Represents shares of foreign companies traded in U.S. dollars

on U.S. exchanges that are held by an international bank or a trust. Foreign companies use GDRs in order to make it easier for foreign investors to buy their shares.

Government National Mortgage Association (“Ginnie

Mae”)

A U.S. government corporation that guarantees

the timely payment of principal and interest on mortgage-backed securities (MBSs) issued by approved Ginnie Mae lenders, with the goal of expanding the pool of homeowners by mostly aiding lending to homeowners who are traditionally underserved in

the mortgage marketplace such as first-time home buyers and low-income borrowers.

Group of Seven (“G7”)

An inter-governmental political forum whose members include

Canada, France, Germany, Italy, Japan, the U.K. and the U.S..

Intercontinental Exchange (“ICE”)

An American Fortune 500 company formed in 2000 that operates

global exchanges and clearing houses, and provides mortgage technology, data and listing services. The company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures

exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and over-the-counter energy, credit and equity markets.

ICE BofA 1-3 Year BB U.S. Cash Pay High Yield Index

The ICE BofA 1-3 Year BB U.S. Cash Pay High Yield Index is a

subset of The ICE BofA U.S. Cash Pay High Yield Index including all securities with a remaining term to final maturity less than 3 years and rated BB1 through BB3, inclusive. The ICE BofA 1-3 Year U.S. Cash Pay High Yield Index tracks the

performance of U.S. dollar denominated below investment grade corporate debt, currently in a coupon paying period, that is publicly issued in the U.S. domestic market.

ICE BofA Fixed Rate Preferred Securities Index

The ICE BofA Fixed Rate Preferred Securities Index tracks the

performance of fixed rate U.S. dollar denominated preferred securities issued in the U.S. domestic market.

ICE BofA U.S. Convertibles Index

The ICE BofA U.S. Convertibles Index is a widely used,

unmanaged index that measures the performance of U.S. dollar-denominated convertible securities not currently in bankruptcy with a total market value greater than $50 million at issuance. Its returns do not reflect any fees, expenses, or sales

charges, and it is not available for direct investment.

ICE BofA U.S. High Yield Index

The ICE BofA U.S. High Yield Index is market capitalization

weighted and is designed to measure the performance of U.S. dollar denominated below investment grade (commonly referred to as “junk”) corporate debt publicly issued in the U.S. domestic market. Its returns do not reflect any fees,

expenses, or sales charges, and it is not available for direct investment.

ICE BofA U.S. High Yield Institutional Capital Securities

Index (“HIPS”)

HIPS tracks the performance of

U.S. dollar denominated investment grade hybrid capital corporate and preferred securities publicly issues in the U.S. domestic market.

Leveraged Loans

Leveraged loans (also known as bank, senior or floating-rate

loans) consists of below investment-grade credit quality loans that are arranged by banks and other financial institutions to help companies finance acquisitions, recapitalizations, or other highly leveraged transactions. Such loans may be

especially vulnerable to adverse changes in economic or market conditions, although they are senior in the capital structure which typically provides investors/lenders a degree of potential credit risk protection.

London Interbank Offered Rate (“LIBOR”)

A benchmark rate that some of the world’s leading banks

charge each other for short-term loans and that serves as the first step to calculating interest rates on various loans throughout the world.

VIRTUS STRATEGY

TRUST

KEY INVESTMENT TERMS (Unaudited) (Continued) September 30, 2021

Markit CDX® Emerging Markets Index (“CDX.EM”)

CDX.EM is composed of Sovereign issuers from Latin America,

Eastern Europe, the Middle East, Africa and Asia as published by Markit from time to time

Markit CDX® North American High Yield Index (“CDX.NA.HY”)

CDX.NA.HY is composed of 100 liquid North American entities

with high yield credit ratings as published by Markit® from time to time.

Markit CDX® North American Investment Grade Index (“CDX.NA.IG”)

CDX.NA.IG is comprised of one hundred twenty five (125) of the

most liquid North American entities with investment grade credit ratings as published by Markit® from time to time.

Mortgage-Backed Securities (“MBS”)

Mortgage-backed securities represent interests in pools of

underlying home loans bought from banks which issue them.

MSCI AC World Index (net)

The MSCI All Country (“AC”) World Index (net)

captures large and mid cap representation across Developed Markets and Emerging Markets countries. The index covers approximately 85% of the global investable equity opportunity set.

MSCI EAFE® Index (net)

The MSCI EAFE® (Europe, Australasia, Far East) Index (net) is a free float-adjusted market capitalization-weighted index that measures developed foreign market equity performance, excluding

the U.S. and Canada. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

MSCI EAFE® Small Cap Index (net)

The MSCI EAFE® Small Cap Index is an equity index which captures small cap representation across Developed Markets countries around the world, excluding the US and Canada. With 2,376

constituents, the index covers approximately 14% of the free float adjusted market capitalization in each country.

MSCI Emerging Markets Index (net)

The MSCI Emerging Markets Index (net) is a free float-adjusted

market capitalization-weighted index designed to measure equity market performance in the global emerging markets. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any

fees, expenses, or sales charges, and it is not available for direct investment.

MSCI World ex USA Small Cap Index (net)

The MSCI World ex USA Small Cap Index captures small cap

representation across 22 of 23 Developed Markets (DM) countries (excluding the U.S.). With 2,574 constituents, the index covers approximately 14% of the free float-adjusted market capitalization in each country.

Payment-in-Kind Security (“PIK”)

A bond which pays interest in the form of additional bonds, or

preferred stock which pays dividends in the form of additional preferred stock.

Real Estate Investment Trust (“REIT”)

A publicly traded company that owns, develops and operates

income-producing real estate such as apartments, office buildings, hotels, shopping centers and other commercial properties.

Russell 2000® Index

The Russell 2000® Index is a market capitalization-weighted index of the 2,000 smallest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is

calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

S&P 500® Financials Index

The S&P 500® Financials Index comprises those companies included in the S&P 500 that are classified as members of the GICS financials sector.

S&P 500® Global Water Index

The S&P 500® Global Water Index is comprised of 50 of the largest publicly traded companies in water-related businesses that meet specific invest ability requirements. The Index is

designed to provide liquid exposure to the leading publicly-listed companies in the global water industry, from both developed markets and emerging markets.

S&P 500® Index

The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

VIRTUS STRATEGY

TRUST

KEY INVESTMENT TERMS (Unaudited) (Continued) September 30, 2021

Secured Overnight Financing Rate (“SOFR”)

SOFR is a broad measure of the cost of borrowing cash overnight

collateralized by U.S. Treasury securities.

Sponsored

ADR

An ADR which is issued with the cooperation of the

company whose stock will underlie the ADR. Sponsored ADRs generally carry the same rights normally given to stockholders, such as voting rights. ADRs must be sponsored to be able to trade on a major U.S. exchange such as the New York Stock Exchange

(“NYSE”).

Tokyo Stock Price Index

(“TOPIX”)

Tokyo Stock Price Index is a

capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange.

Treasury Inflation Protected Securities

(“TIPS”)

TIPS are a type of Treasury security

issued by the U.S. government. TIPS are indexed to inflation in order to protect investors from a decline in the purchasing power of their money.

| |

Ticker Symbols: |

| |

Class A :

ANZAX |

| |

Class C:

ANZCX |

| |

Class P:

ANCMX |

| |

Institutional

Class: ANNPX |

| |

Administrative Class:

ANNAX |

AllianzGI Convertible Fund Fund Summary (Unaudited)

Portfolio Manager Commentary by

Allianz Global Investors U.S. LLC

| ■

|

The Fund is

diversified and has an investment objective of seeking maximum total return, consisting of capital appreciation and current income. There is no guarantee that the Fund will meet its objective. |

| ■

|

For

the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 25.71%, Class C shares at NAV returned 24.75%, Class P shares at NAV returned 26.03%, Institutional Class shares at NAV returned 26.02%, and Administrative

Class shares at NAV returned 25.76%†. For the same period, the ICE BofA U.S. Convertibles Index, the Fund’s style-specific benchmark appropriate for comparison,

returned 27.30%. |

† See footnote 5 on page 11.

All performance figures assume

reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown

above. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please visit Virtus.com for performance data current to the most recent month-end.

How did the markets perform during the Fund’s

fiscal year ended September 30, 2021?

The convertible bond market advanced for the

12-month period, with the ICE BofA U.S. Convertibles Index returning 27.30%. By way of comparison, the 10-year U.S. Treasury returned -6.22% and the S&P 500® Index

gained 30.00%.

Multiple factors influenced the

market during the 12-month period. Stronger-than-expected quarterly earnings results, a rapid economic recovery, ongoing accommodation by the U.S. Federal Reserve (the Fed), additional U.S. fiscal stimulus, and positive vaccine-related dynamics all

had a favorable impact on investor confidence. On the other hand, a confluence of macroeconomic risks late in the reporting period, including signs of inflation and higher interest rates, weighed on sentiment.

All sectors within the convertible bond market

finished higher. Materials, energy, and consumer discretionary were the top-performing sectors, while telecommunications, utilities, and health care were the bottom-performing sectors.

Below-investment-grade issuers outperformed

investment grade issuers.

Lastly, with $68

billion in convertible bond new issuance through September 2021, annual volume was on track to meet strategists’ upwardly revised targets.

What factors affected the Fund’s performance

during its fiscal year?

The Fund produced a

positive total return for the 12 months ended September 30, 2021.

The attribution for the period included several

positive performers from a variety of industries. The majority of the Fund’s issuers exceeded earnings expectations, which contributed to absolute performance during the period.

Sector allocations that helped relative performance

during the fiscal year included financials, utilities, and technology.

Sector allocations that hurt relative performance

during the 12-month period included consumer discretionary, energy, and transportation.

The preceding information is the opinion of

portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no

guarantee of future results, and there is no guarantee that market forecasts will be realized.

Market Volatility:

Local, regional, or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the Fund and its investments, including hampering the

ability of the portfolio manager(s) to invest the Fund’s assets as intended.

Issuer Risk: The

Fund will be affected by factors specific to the issuers of securities and other instruments in which the Fund invests, including

actual or perceived changes in the financial condition or business

prospects of such issuers.

Convertible

Securities: A convertible security may be called for redemption at a time and price unfavorable to the Fund.

Interest Rate: The

values of debt instruments may rise or fall in response to changes in interest rates, and this risk may be enhanced for securities with longer maturities.

Counterparties:

There is risk that a party upon whom the portfolio relies to complete a transaction will default.

Credit Risk: If the

issuer of a debt instrument fails to pay interest or principal in a timely manner, or negative perceptions exist in the market of the issuer’s ability to make such payments, the price of the security may decline.

Prepayments/Calls:

If issuers prepay or call fixed rate obligations when interest rates fall, it may force the Fund to reinvest at lower interest rates.

Equity Securities:

The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that

risk.

High Yield Fixed Income Securities: There is a greater risk of issuer default, less liquidity, and increased price volatility related to high yield securities than investment grade securities.

Prospectus: For

additional information on risks, please see the Fund’s prospectus.

Asset

Allocation

The

following table presents asset allocation within certain industries as a percentage of total investments as of September 30, 2021.

| Convertible

Bonds and Notes |

|

80%

|

| Internet

|

18%

|

|

| Software

|

15

|

|

| Healthcare-Products

|

5

|

|

| All

other Convertible Bonds and Notes |

42

|

|

| Convertible

Preferred Stocks |

|

15

|

| Short-Term

Investment |

|

5

|

| Total

|

|

100%

|

For information regarding the indexes and certain

investment terms, see the Key Investment Terms starting on page 6.

AllianzGI Convertible Fund

(Continued)

Average Annual Total Returns1 for periods ended 9/30/21

| |

|

1

Year |

5

Years |

10

Years |

| Class

A shares at NAV2 |

25.71 %

|

19.35%

|

14.89%

|

| Class

A shares at POP3,4 |

18.80

|

18.00

|

14.24

|

| Class

C shares at NAV2 and with CDSC4 |

24.75

|

18.47

|

14.05

|

| Class

P shares at NAV2 |

26.03

|

19.67

|

15.17

|

| Institutional

Class shares at NAV2 |

26.02

|

19.69

|

15.23

|

| Administrative

Class shares at NAV2 |

25.76

5 |

19.42

|

14.96

|

| ICE

BofA U.S. Convertibles Index |

27.30

|

17.37

|

14.37

|

| Fund

Expense Ratios6: Class A shares: Gross 1.06%, Net 0.96%; Class C shares: Gross 1.79%, Net 1.73%; Class P shares: Gross 0.82%, Net 0.71%;

Institutional Class shares: Gross 0.79%, Net 0.71%; Administrative Class Gross 1.00%, Net 0.93%. |

|

|

|

|

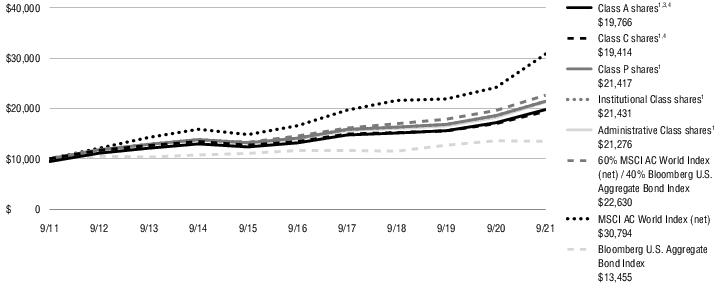

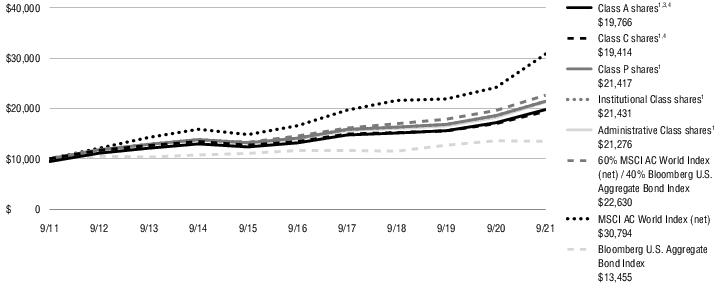

| All

returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s

shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com

for performance data current to the most recent month-end. |

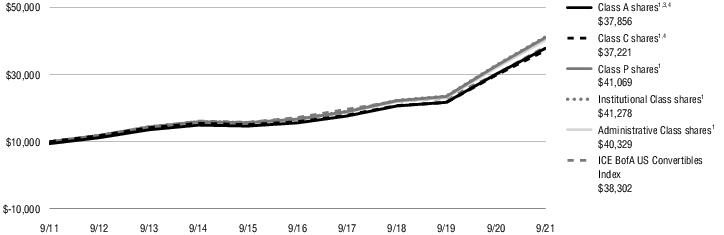

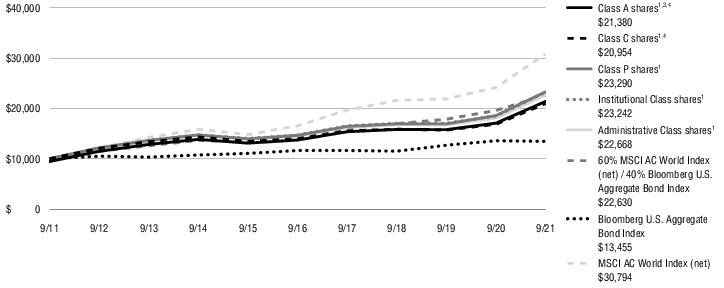

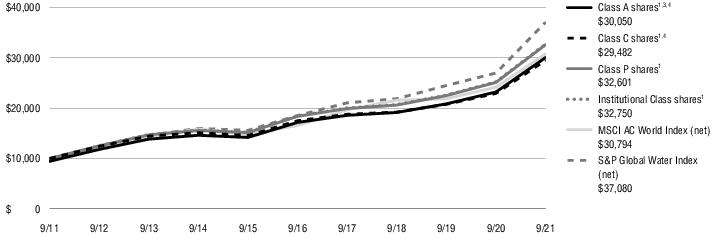

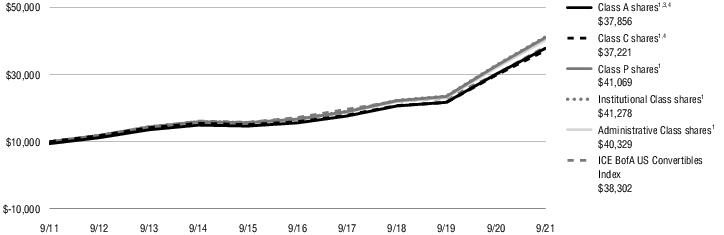

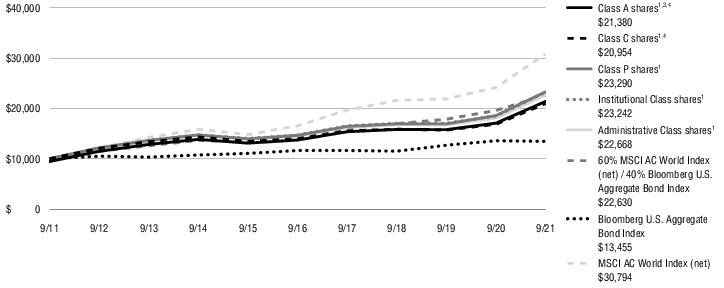

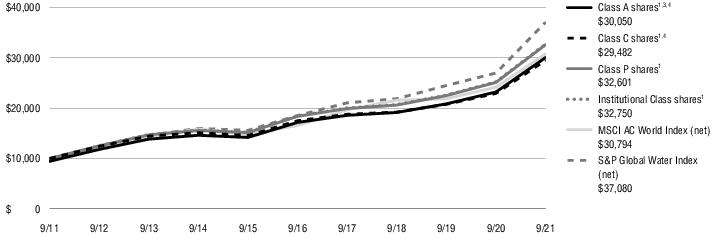

Growth of $10,000 for periods ended 9/30

This chart assumes an initial investment of $10,000

made on September 30, 2011, for Class A shares, Class C shares, Class P shares, Institutional Class shares, and Administrative Class shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital

gain distributions.

|

1 |

Total

returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

|

2 |

“NAV”

(Net Asset Value) total returns do not include the effect of any sales charge. |

|

3 |

“POP”

(Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

|

4 |

“CDSC”

(contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee

being paid and all Class C shares are 1% within the first year and 0% thereafter. |

|

5 |

Total

Return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the NAV at which shareholder transactions were processed. The total return

presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual report and

semiannual report. |

|

6 |

The

expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the

Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2023. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include

fees and expenses associated with any underlying funds. |

The index is unmanaged and not available for direct

investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms,

see the Key Investment Terms starting on page 6.

| |

Ticker Symbols: |

| |

Class P:

ACKPX |

| |

Institutional

Class: ACKIX |

| |

Class R6:

ACOSX |

AllianzGI Core Plus Bond Fund Fund Summary (Unaudited)

Portfolio Manager Commentary by

Allianz Global Investors U.S. LLC

| ■

|

The Fund is

diversified and has an investment objective of seeking total return, consisting of current income and capital appreciation. There is no guarantee that the Fund will meet its objective. |

| ■

|

For

the fiscal year ended September 30, 2021, the Fund’s Class P shares at NAV returned 2.89%, Institutional Class shares at NAV returned 2.92%, and Class R6 shares at NAV returned 2.90%. For the same period, the Bloomberg U.S. Aggregate Bond

Index, the Fund’s style-specific benchmark appropriate for comparison, returned -0.90%. |

All performance figures assume

reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown

above. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please visit Virtus.com for performance data current to the most recent month-end.

How did the markets perform during the Fund’s

fiscal year ended September 30, 2021?

The market environment over the 12-month period was

dominated by the tightening of credit spreads (the additional yield an investor receives above the yield from a U.S. Treasury bond of the same duration), which resulted from the reopening of the economy following the onset of the pandemic. In

particular, the companies that were most severely affected by closures were the best performers for the reporting period. These “reopening” sectors included travel, airlines, hotels, air lessors, aircraft supply chain, and commercial

real estate, both office and retail.

Investment grade fixed income sectors such as

energy, subordinated financials, and airlines all benefitted from the reopening of global economies. The reopening both spurred economic activity and, importantly, reduced the risk premium attached to many of these sectors during a period of

uncertainty, resulting in significant outperformance. On the commodity side, soaring oil and gas prices were a boon for companies in the energy sector, including

the midstream sector where the Fund had most of its exposure.

What factors affected the Fund’s performance

during its fiscal year?

For the 12 months

ended September 30, 2021, the Fund outperformed its benchmark, the Bloomberg U.S. Aggregate Bond Index.

The Fund’s outperformance for the fiscal year

was driven more by sector selection than security selection. Sector performance was led by both investment grade credit, including preferred securities, as well as active repositioning in high yield credit and an underweight in agency

mortgage-backed securities. From a security selection standpoint, performance was led mostly by investment grade credit, including preferreds.

Overweights to investment grade sectors drove

positive returns for the fiscal year. The Fund also benefitted from the addition of a basket of “rising stars,” companies that we believe will be upgraded from the high yield market into the investment grade market in the next 12-18

months. In tandem with the economic recovery, rating agencies upgraded debt at a record pace, which caused particularly strong outperformance for these companies.

The Fund’s overweights in both the

high-quality AAA-rated asset-backed security (ABS) sector and the high-quality government sector underperformed the benchmark for the 12-month period, as riskier segments of the market dominated during the COVID-19 recovery. We maintained overweight

positions in both sectors given that these sectors usually yield higher than U.S. Treasuries with less exposure to additional liquidity risk. Both sectors performed relatively well during the final three months of the fiscal year as markets

normalized. The security selection overweight to Small Business Administration (SBA) loans within the government sector also performed poorly during the 12-month period for primarily the same reason.

The preceding information is the opinion of

portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no

guarantee of future results, and there is no guarantee that market forecasts will be realized.

Market Volatility:

Local, regional, or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the Fund and its investments, including hampering the

ability of the portfolio manager(s) to invest the Fund’s assets as intended.

Debt Instruments:

Debt instruments are subject to greater levels of credit and liquidity risk, may be speculative and may decline in value due to changes in interest rates or an issuer’s or counterparty’s deterioration or default.

Interest Rate: The

values of debt instruments may rise or fall in response to changes in interest rates, and this risk may be enhanced for securities with longer maturities.

Variable Distribution Risk: Periodic distributions by investments of variable or floating interest rates vary with fluctuations in market interest rates.

ABS/MBS: Changes in

interest rates can cause both extension and prepayment risks for asset- and mortgage-backed securities. These securities are also subject to risks associated with the non-repayment of underlying collateral, including losses to the Fund.

High Yield Fixed Income Securities: There is a greater risk of issuer default, less liquidity, and increased price volatility related to high yield securities than investment grade securities.

Derivatives:

Investments in derivatives such as futures, options, forwards, and swaps may increase volatility or cause a loss greater than the principal investment.

Leverage: When a

fund is leveraged, the value of its securities may be more volatile and all other risks may be compounded.

Prospectus: For

additional information on risks, please see the Fund’s prospectus.

For information regarding the indexes and certain

investment terms, see the Key Investment Terms starting on page 6.

AllianzGI Core Plus Bond Fund

(Continued)

Asset

Allocation

The

following table presents asset allocation within certain sectors as a percentage of total investments as of September 30, 2021.

| Corporate

Bonds and Notes |

|

39%

|

| Financials

|

9%

|

|

| Utilities

|

5

|

|

| Communications

|

5

|

|

| All

other Corporate Bonds and Notes |

20

|

|

| Asset-Backed

Securities |

|

29

|

| Mortgage-Backed

Securities |

|

15

|

| U.S.

Government Securities |

|

14

|

| Short-Term

Investment |

|

2

|

| Preferred

Stocks |

|

1

|

| Total

|

|

100%

|

For information regarding the indexes and certain

investment terms, see the Key Investment Terms starting on page 6.

AllianzGI Core Plus Bond Fund

(Continued)

Average Annual Total Returns1 for periods ended 9/30/21

| |

|

1

Year |

Since

inception |

Inception

date |

| Class

P shares at NAV2 |

|

2.89 %

|

6.71 %

|

5/30/18

|

| Institutional

Class shares at NAV2 |

|

2.92

|

6.77

|

5/30/18

|

| Class

R6 shares at NAV2 |

|

2.90

|

6.80

|

5/30/18

|

| Bloomberg

U.S. Aggregate Bond Index |

|

-0.90

|

4.79

3 |

—

|

| Fund

Expense Ratios4: Class P shares: Gross 0.76%, Net 0.35%; Institutional

Class shares: Gross 0.76%, Net 0.30%; Class R6 shares: Gross 0.76%, Net 0.25%. |

|

|

|

|

| All

returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s

shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com

for performance data current to the most recent month-end. |

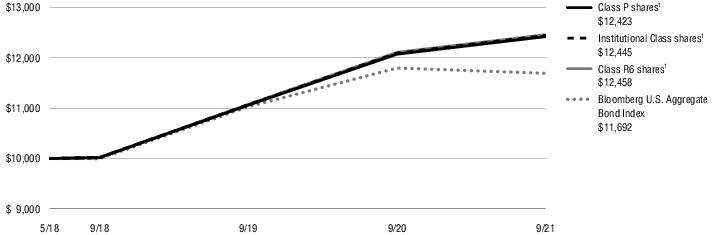

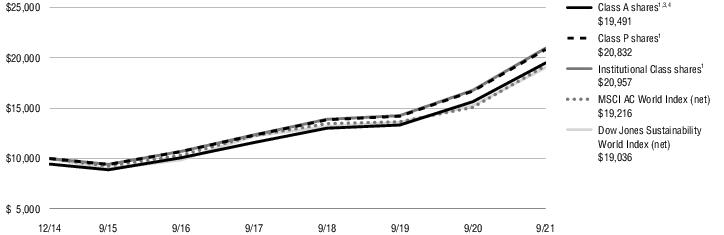

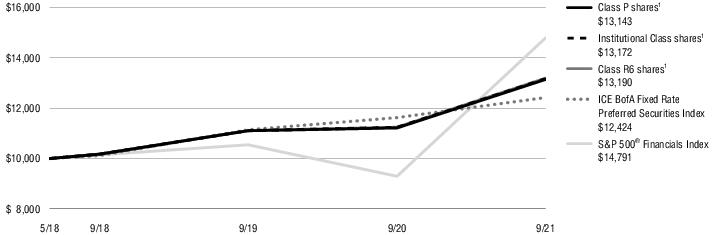

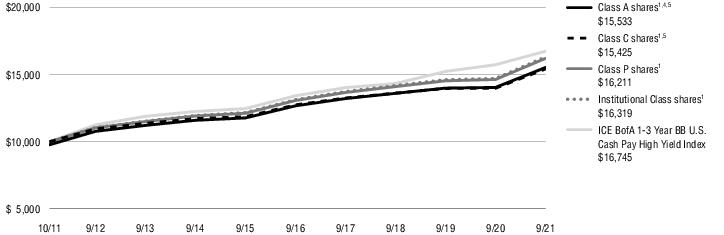

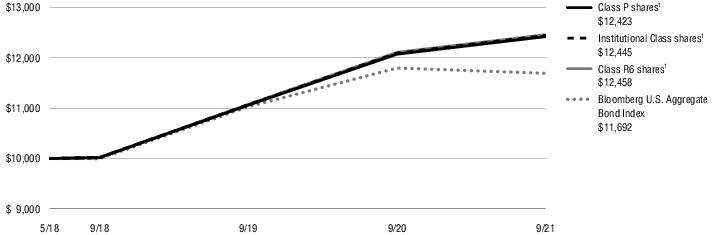

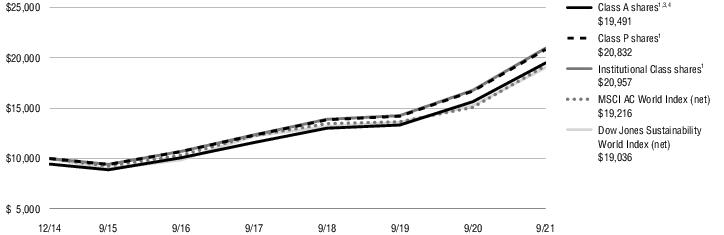

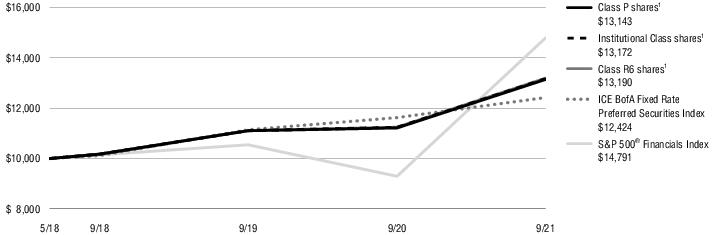

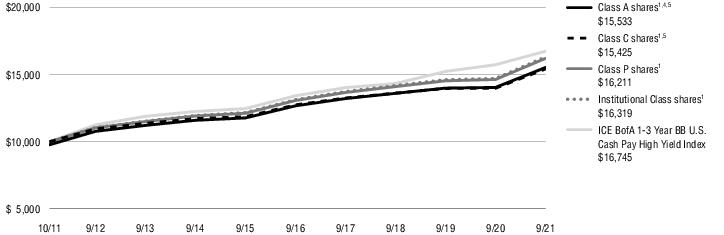

Growth of $10,000 for periods ended 9/30

This chart assumes an initial investment of $10,000

made on September 30, 2018 (inception date of the Fund), for Class P shares, Institutional Class shares, and Class R6 shares including any applicable sales charges or fees. Performance assumes reinvestment of dividends and capital gain

distributions.

|

1 |

Total

returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

|

2 |

“NAV”

(Net Asset Value) total returns do not include the effect of any sales charge. |

|

3 |

The

since inception index return is from the Fund’s inception date. |

|

4 |

The

expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the

Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 1, 2023. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include

fees and expenses associated with any underlying funds. |

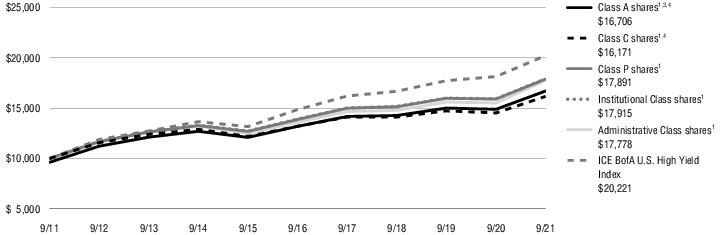

The index is unmanaged and not available for direct

investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms,

see the Key Investment Terms starting on page 6.

| |

Ticker Symbols: |

| |

Class A :

AMMAX |

| |

Institutional

Class: AERIX |

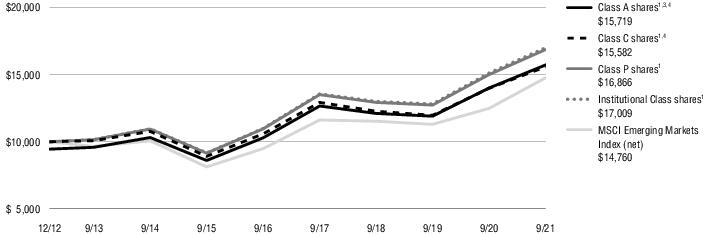

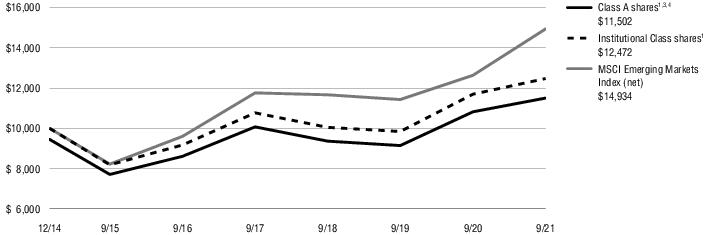

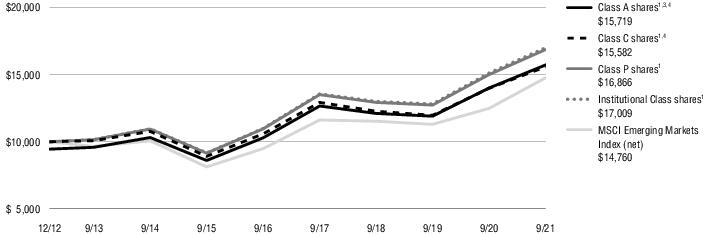

AllianzGI Emerging Markets Consumer Fund Fund Summary (Unaudited)

Portfolio Manager Commentary by

Allianz Global Investors U.S. LLC

| ■

|

The Fund is

diversified and has an investment objective of seeking long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

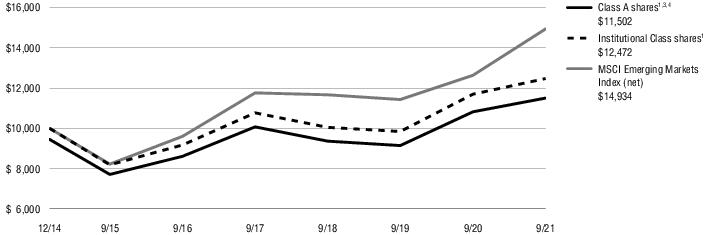

| ■

|

For

the fiscal year ended September 30, 2021, the Fund’s Class A shares at NAV returned 6.30%, and Institutional Class shares at NAV returned 6.63%. For the same period, the MSCI Emerging Markets Index (net), the Fund’s style-specific

benchmark appropriate for comparison, returned 18.20%. |

All performance figures assume

reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown

above. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please visit Virtus.com for performance data current to the most recent month-end.

How did the markets perform during the Fund’s

fiscal year ended September 30, 2021?

Emerging markets (EM) equities advanced during the

reporting period as the asset class rebounded thanks to improving sentiment and higher global growth expectations.

Favorable COVID-19 vaccine news and optimism over

the outlook for a global economic recovery initially propelled EM stocks higher, leading to an outperformance of deep value and economically sensitive stocks, which stood to benefit from rising inflation trends. This tailwind translated to positive

results in the asset class for the initial five months of the reporting period, with the MSCI Emerging Markets Index (net) reaching an all-time high in February of 2021. Performance was mixed in the latter half of the reporting period due primarily

to developments in China, where regulatory crackdowns and signs of slowing economic activity impacted results. Concerns that the U.S. Federal Reserve (the Fed) was getting closer to raising interest rates weighed on market prospects, and several EM

central banks raised rates to combat increasing inflationary pressures. The asset class underperformed in July of 2021 due to a crackdown

on the education sector in China and rising COVID-19 cases across

many Asian countries. EM equities also lagged in September 2021 due to concerns around the potential default of a major Chinese homebuilder, which investors feared could have ripple effects for other areas of the market.

At a regional level, Eastern European stocks soared,

with Russian equities among the strongest performers, helped by higher oil prices and an appreciation in the Russian ruble. Latin American markets outperformed the broader EM index as Mexican shares surged, helped in part by higher oil prices as

well as hopes that the new U.S. administration would be less aggressive on trade and immigration. Brazilian stocks also rallied sharply initially as hopes of a global economic recovery lifted the outlook for oil and industrial metals prices.

Meanwhile, Asian equities were impacted by regulatory announcements in China, while in contrast India advanced thanks to upbeat corporate earnings and the announcement of a pro-growth budget.

Sector performance for the benchmark index was

divergent, with nine out of 11 sectors advancing. More economically sensitive segments of the market rallied significantly, led by strong gains in materials, energy, information technology, and utilities. In contrast, consumer discretionary stocks

posted a double-digit decline due to weakness in key education and internet retailers within China, followed by more modest losses in the real estate sector.

What factors affected the Fund’s performance

during its fiscal year?

The Fund seeks to

capitalize on the long-term growth of the local emerging markets consumer, while limiting other risks including country and market capitalization. The Fund trailed its benchmark, the MSCI Emerging Markets Index (net), due to meaningful asset

allocation headwinds.

During the reporting

period, bottom-up stock selection was neutral relative to the benchmark, however, underperformance was attributable to the inability to own select non-consumer segments. Specifically, the Fund’s avoidance of semiconductors, energy, and

materials hurt performance during the reporting period given the increased demand for computer chips, oil & gas, and metals & mining companies. However, more conservative stock selection in communication

services and consumer staples offset results modestly.

Positive bottom-up stock-picking in consumer

discretionary and financials contributed to relative performance during the reporting period. From a country standpoint, stock selection in China detracted, as did a relative underweight in India and the inability to own key oil and gas companies in

Russia. Conversely, an overweight allocation and positive stock-picking within South Korea contributed to results, as did the Fund’s investments in select EM-consumer-related companies based in Germany.

The preceding information is the opinion of

portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no

guarantee of future results, and there is no guarantee that market forecasts will be realized.

Market Volatility:

Local, regional, or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the Fund and its investments, including hampering the

ability of the portfolio manager(s) to invest the Fund’s assets as intended.

Issuer Risk: The

Fund will be affected by factors specific to the issuers of securities and other instruments in which the Fund invests, including actual or perceived changes in the financial condition or business prospects of such issuers.

Equity Securities:

The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk.

Foreign & Emerging Markets: Investing in foreign securities, especially in emerging markets, subjects the portfolio to additional risks such as increased volatility, currency fluctuations, less liquidity, and political, regulatory, economic, and

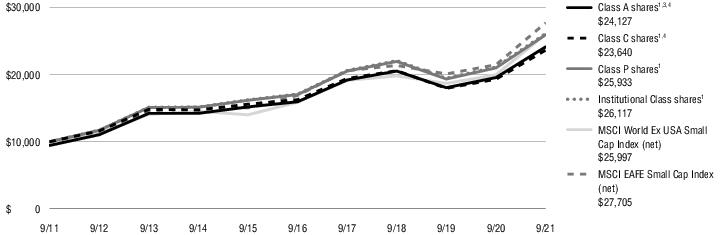

market risk.