UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

FOR THE QUARTERLY PERIOD ENDED

Commission File Number

| (Exact Name of Registrant as Specified in Its Charter) |

| (State or Other Jurisdiction | (I.R.S. Employer | |

| of Incorporation or Organization) | Identification No.) |

(Address of Principal Executive Offices and Issuer’s

Telephone Number, including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each Class | Trading Symbol | Name of each exchange on which registered |

| None. | N/A | N/A |

Indicate by check mark whether

the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☐ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

As of November 18, 2021, the issuer had outstanding shares of common stock.

TABLE OF CONTENTS

| 2 |

PART I FINANCIAL INFORMATION

ITEM 1 Financial Statements

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF SEPTEMBER 30, 2021 AND MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| September 30, 2021 | March 31, 2021 | |||||||

| (Unaudited) | (Audited) | |||||||

| ASSETS | ||||||||

| Current asset: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Prepayment and other receivables | ||||||||

| Total current assets | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accrued liabilities and other payables | $ | $ | ||||||

| Amount due to a director | ||||||||

| Amount due to a shareholder | ||||||||

| Promissory notes, related parties | ||||||||

| Total current liabilities | ||||||||

| TOTAL LIABILITIES | ||||||||

| Commitments and contingencies | ||||||||

| STOCKHOLDERS’ (DEFICIT) EQUITY | ||||||||

| Convertible preferred shares; shares authorized, and shares undesignated as of September 30, 2021 and March 31, 2021 | ||||||||

| Series A preferred stock, $ par value; shares designated; and shares issued and outstanding as of September 30, 2021 and March 31, 2021, respectively | ||||||||

| Series B preferred stock, $ par value; shares designated; shares issued and outstanding as of September 30, 2021 and March 31, 2021 | ||||||||

| Common stock, $ par value; shares authorized; and shares issued and outstanding as of September 30, 2021 and 2020, respectively | ||||||||

| Accumulated other comprehensive loss | ( | ) | ||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Stockholders’ (deficit) equity | ( | ) | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY | $ | $ | ||||||

*On August 16, 2021, the Company effected a 5 for 1 reverse split of its issued and outstanding shares of common stock. Except for shares authorized, all references to number of shares and per share information have been retroactively adjusted to reflect such split.

See accompanying notes to condensed consolidated financial statements.

| 3 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

| Three months ended September 30, | Six months ended September 30, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| Revenue, net | $ | $ | $ | $ | ||||||||||||

| Cost of revenue | ( | ) | ( | ) | ||||||||||||

| Gross profit | ||||||||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative expenses | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Professional fee | ( | ) | ( | ) | ||||||||||||

| Total operating expenses | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| LOSS FROM OPERATIONS | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other (expenses) income | ||||||||||||||||

| Foreign exchange gain | ||||||||||||||||

| Interest expenses, related parties | ( | ) | ( | ) | ||||||||||||

| LOSS BEFORE INCOME TAXES | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Income tax expense | ||||||||||||||||

| NET LOSS | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other comprehensive income: | ||||||||||||||||

| – Foreign currency adjustment loss | ||||||||||||||||

| COMPREHENSIVE LOSS | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Net loss per share – Basic and Diluted | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Weighted average common shares outstanding | ||||||||||||||||

| - Basic | ||||||||||||||||

| – Diluted | ||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

| 4 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

| Six months ended September 30, | ||||||||

| 2021 | 2020 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Change in operating assets and liabilities: | ||||||||

| Prepayment and other receivables | ||||||||

| Accrued liabilities and other payables | ||||||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Cash flows from financing activities: | ||||||||

| Advance from a director | ||||||||

| Advance from a shareholder | ||||||||

| Proceed from issuance of promissory notes | ||||||||

| Net cash provided by financing activities | ||||||||

| Foreign currency translation adjustment | ||||||||

| Net change in cash and cash equivalents | ||||||||

| BEGINNING OF PERIOD | ||||||||

| END OF PERIOD | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | ||||||||

| Cash paid for income taxes | $ | $ | ||||||

| Cash paid for interest | $ | $ | ||||||

See accompanying notes to condensed consolidated financial statements.

| 5 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| Series A preferred stock | Series B Preferred stock to be issued | Common stock | Accumulated other | Total stockholders’ | ||||||||||||||||||||||||||||||||

| No. of shares | Amount | No. of shares | Amount | No. of shares | Amount | comprehensive income | (Accumulated losses) | (deficit) equity | ||||||||||||||||||||||||||||

| Balance as of April 1, 2020 | $ | $ | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||||||||||

| Foreign currency translation adjustment | – | – | – | |||||||||||||||||||||||||||||||||

| Net loss for the period | – | – | – | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance as of June 30, 2020 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | – | – | – | |||||||||||||||||||||||||||||||||

| Net loss for the period | – | – | – | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance as of September 30, 2020 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||

| Balance as of April 1, 2021 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||||||||

| Foreign currency translation adjustment | – | – | – | |||||||||||||||||||||||||||||||||

| Net loss for the period | – | – | – | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance as of June 30, 2021 | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||||||

| Conversion of preferred stock | ( | ) | ( | ) | – | ( | ) | |||||||||||||||||||||||||||||

| Fractional shares from reverse split | – | – | ( | ) | ||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | – | – | – | |||||||||||||||||||||||||||||||||

| Net loss for the period | – | – | – | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance as of September 30, 2021 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

| 6 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

NOTE-1 BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared by management in accordance with both accounting principles generally accepted in the United States (“GAAP”), and the instructions to Rule 10-01 of Regulation S-X. Certain information and note disclosures normally included in audited financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to those rules and regulations, although the Company believes that the disclosures made are adequate to make the information not misleading.

In the opinion of management, the consolidated balance sheet as of March 31, 2021 which has been derived from audited financial statements and these unaudited condensed consolidated financial statements reflect all normal and recurring adjustments considered necessary to state fairly the results for the periods presented. The results for the period ended September 30, 2021 are not necessarily indicative of the results to be expected for the entire fiscal year ending March 31, 2022 or for any future period.

These unaudited condensed consolidated financial statements and notes thereto should be read in conjunction with the Management’s Discussion and the audited financial statements and notes thereto included in the Annual Report on Form 10/A for the year ended March 31, 2021.

NOTE-2 ORGANIZATION AND BUSINESS BACKGROUND

DH Enchantment, Inc. (formerly Energy Management International, Inc.) (the “Company”) was incorporated in the State of Nevada on July 9, 2004 under the name Amerivestors, Inc. On March 3, 2009, the Company changed its name to Gust Engineering & Speed Productions, Inc. and on October 27, 2009, the Company changed its name to Energy Management International, Inc. Further, on August 16, 2021, the Company changed its current name to DH Enchantment, Inc.

Currently, the Company through its subsidiaries, is mainly engaged in the sale and distribution of COVID-19 rapid antigen tester set. This business commenced its operations in Hong Kong in October 2020.

On July 26, 2021, the Company consummated the

Share Exchange Transaction (the “Share Exchange”) among DH Investment Group Limited (“DHIG”) and its shareholders.

The Company acquired all of the issued and outstanding shares of DHIG from DHIG’s shareholders, in exchange for shares of

Series B preferred stock, at par value of $. Upon completion of the Share Exchange, DHIG became a

Prior to the Share Exchange, the Company was considered as a shell company due to its nominal assets and limited operation. The transaction will be treated as a recapitalization of the Company.

The Share Exchange between the Company and DHIC that was effectuated on July 26, 2021, was deemed as a merger of entities under common control of which Miss Sally Kin Yi LO is the common director and shareholder of both the Company and DHIG. Under the guidance in ASC 805 for transactions between entities under common control, the assets, liabilities and results of operations, are recognized at their carrying amounts on the date of the Share Exchange, which required retrospective combination of the Company and DHIG for all periods presented.

| 7 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

On June 29, 2021, the Company authorized and approved

the amendment and restatement of our Articles of Incorporation to: (i) change our name to DH Enchantment Inc.; and (ii) amend the powers,

rights and designation of the Series A Convertible Preferred Stock as more fully set forth below; and (iii) effectuate a

After the amendment, holders of the Series A Convertible Preferred Stock are no longer: (i) entitled to receive dividends or other distributions; (ii) entitled to vote on matters submitted to a vote of the stockholders; and (iii) able to convert the Series A Convertible Preferred Stock into common stock or any other securities of the corporation.

On August 16, 2021, the Company

effected a

Description of subsidiaries

| Name |

Place of incorporation and kind of legal entity |

Principal activities and place of operation |

Particulars of registered/ paid up share capital |

Effective interest held | ||||

| 0,000 |

The Company and its subsidiaries are hereinafter referred to as (the “Company”).

NOTE-3 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying condensed consolidated financial statements reflect the application of certain significant accounting policies as described in this note and elsewhere in the accompanying condensed consolidated financial statements and notes.

| l | Basis of presentation |

| 8 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

These accompanying condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

| l | Use of estimates and assumptions |

In preparing these condensed consolidated financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheet and revenues and expenses during the years reported. Actual results may differ from these estimates.

| l | Basis of consolidation |

The condensed consolidated financial statements include the accounts of ENMI and its subsidiaries. All significant inter-company balances and transactions within the Company have been eliminated upon consolidation.

| l | Cash and cash equivalents |

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

| l | Revenue recognition |

The Company adopted Accounting Standards Update ("ASU") No. 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASU 2014-09”) using the full retrospective transition method. The Company's adoption of ASU 2014-09 did not have a material impact on the amount and timing of revenue recognized in its condensed consolidated financial statements.

Under ASU 2014-09, the Company recognizes revenue when control of the promised goods or services is transferred to customers, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services.

The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

| • | identify the contract with a customer; |

| • | identify the performance obligations in the contract; |

| • | determine the transaction price; |

| • | allocate the transaction price to performance obligations in the contract; and |

| • | recognize revenue as the performance obligation is satisfied. |

| 9 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| l | Income taxes |

The Company adopted the ASC 740 Income tax provisions of paragraph 740-10-25-13, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the condensed consolidated financial statements. Under paragraph 740-10-25-13, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the condensed consolidated financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Paragraph 740-10-25-13 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the provisions of paragraph 740-10-25-13.

The estimated future tax effects of temporary differences between the tax basis of assets and liabilities are reported in the accompanying balance sheets, as well as tax credit carry-backs and carry-forwards. The Company periodically reviews the recoverability of deferred tax assets recorded on its balance sheets and provides valuation allowances as management deems necessary.

| l | Uncertain tax positions |

The Company did not take any uncertain tax positions

and had

| l | Foreign currencies translation |

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the condensed consolidated statement of operations.

The reporting currency of the Company is United States Dollar ("US$") and the accompanying condensed consolidated financial statements have been expressed in US$. In addition, the Company is operating in Hong Kong and maintains its books and record in its local currency, Hong Kong Dollars (“HKD”), which is a functional currency as being the primary currency of the economic environment in which their operations are conducted. In general, for consolidation purposes, assets and liabilities of its subsidiary whose functional currency is not US$ are translated into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive income within the statements of changes in stockholder’s equity.

Translation of amounts from HKD into US$ has been made at the following exchange rates for the six months ended September 30, 2021:

| September 30, 2021 | September 30, 2020 | |||||||

| Period-end HKD:US$ exchange rate | ||||||||

| Average HKD:US$ exchange rate | ||||||||

| 10 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| l | Comprehensive income |

ASC Topic 220, “Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated other comprehensive income, as presented in the accompanying condensed consolidated statements of changes in stockholders’ equity, consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included in the computation of income tax expense or benefit.

| l | Related parties |

The Company follows the ASC 850-10, Related Party for the identification of related parties and disclosure of related party transactions.

Pursuant to section 850-10-20 the related parties include a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of section 825–10–15, to be accounted for by the equity method by the investing entity; c) trusts for the benefit of employees, such as pension and Income-sharing trusts that are managed by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The condensed consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial statements is not required in those statements. The disclosures shall include: a) the nature of the relationship(s) involved; b) a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; c) the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d) amount due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

| l | Commitments and contingencies |

The Company follows the ASC 450-20, Commitments to report accounting for contingencies. Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

| 11 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s condensed consolidated financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not believe, based upon information available at this time that these matters will have a material adverse effect on the Company’s financial position, results of operations or cash flows. However, there is no assurance that such matters will not materially and adversely affect the Company’s business, financial position, and results of operations or cash flows.

| l | Fair value of financial instruments |

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and has adopted paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 of the FASB Accounting Standards Codification establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, paragraph 820-10-35-37 of the FASB Accounting Standards Codification establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by paragraph 820-10-35-37 of the FASB Accounting Standards Codification are described below:

| Level 1 | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. | |

| Level 2 | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. | |

| Level 3 | Pricing inputs that are generally observable inputs and not corroborated by market data. |

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

The carrying amounts of the Company’s financial assets and liabilities, such as cash and cash equivalents, approximate their fair values because of the short maturity of these instruments.

| 12 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| l | Recent accounting pronouncements |

In December 2019, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”) 2019-12, “Simplifying the Accounting for Income Taxes.” The standard is expected to reduce cost and complexity related to accounting for income taxes. The new guidance eliminates certain exceptions and clarifies and amends existing guidance to promote consistent application among reporting entities. Depending on the amended guidance within this standard, adoption is to be applied on a retrospective, modified retrospective or prospective basis. The Company adopted this standard effective January 1, 2021, and the adoption did not have a material effect on the Company’s consolidated financial statements.

In January 2020, the FASB issued ASU 2020-01, “Clarifying the Interactions between Topic 321, Topic 323, and Topic 815.” The new guidance clarifies the interactions between accounting standards that apply to equity investments without readily determinable fair values. Specifically, it addresses the accounting for the transition into and out of the equity method. The Company adopted this standard effective January 1, 2021 on a prospective basis, and the adoption did not have a material effect on the Company’s consolidated financial statements.

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and does not believe the future adoption of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations.

NOTE-4 GOING CONCERN UNCERTAINTIES

The Company’s condensed consolidated financial statements as of September 30, 2021 have been prepared using generally accepted accounting principles in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenues sufficient to cover its operating costs and allow it to continue as a going concern. These raise substantial doubt about the ability of the Company to continue as a going concern for a reasonable period of time. In addition, with respect to the ongoing and evolving coronavirus (COVID-19) outbreak, which was designated as a pandemic by the World Health Organization on March 11, 2020, the outbreak has caused substantial disruption in international and U.S. economies and markets and if repercussions of the outbreak are prolonged, could have a significant adverse impact on the Company’s business.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management’s plan is to obtain such resources for the Company by obtaining capital and the continued financial support from management and significant shareholders sufficient to meet its minimal operating expenses and seeking third party equity and/or debt financing. Management believes the Company is currently pursuing additional financing for its operations. However, there is no assurance that the Company will be successful in securing sufficient funds to sustain the operations.

These and other factors raise substantial doubt about the Company’s ability to continue as a going concern. These condensed consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets and liabilities that may result in the Company not being able to continue as a going concern.

NOTE-5 PROMISSORY NOTES

As at September 30, 2021, the Company had loan

proceeds of $

| 13 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

NOTE-6 STOCKHOLDERS’ EQUITY (DEFICIT)

Authorized shares

As of September 30, 2021 and March 31, 2021, the Company’s authorized shares were 5,000,000 and 10,000,000 shares of Series A preferred stock and Series B preferred stock respectively, with par values of $0.002 and $0.001 respectively.

As of September 30, 2021 and March 31, 2021, the Company’s authorized shares were shares of common stock, with a par value of $.

Issued and outstanding shares

On June 29, 2021, the Company authorized to execute

and file with the Secretary of State of the Nevada the Articles of Amendment, (i) to amend the designation for Series A Preferred Stock;

(ii) to designate shares as Series B preferred stock. The Company also approved a

On July 26, 2021, the Company consummated the

Share Exchange Transaction among DH Investment Group Limited (“DHIG”) and its shareholders and issued shares of Series

B preferred stock in exchange for

On August

16, 2021, the Company effected a

As of September 30, 2021 and March 31, 2021, the Company had 3,120,001 and 3,920,001 shares of Series A preferred stock issued and outstanding respectively.

As of September 30, 2021 and March 31, 2021, the Company had 100,000 shares of Series B preferred stock issued and outstanding.

As of September 30, 2021 and March 31, 2021, the Company had 831,310,013 and 511,309,161 shares of common stock issued and outstanding, respectively.

NOTE-7 INCOME TAX

The provision for income taxes consisted of the following:

| Six months ended September 30, | ||||||||

| 2021 | 2020 | |||||||

| Current tax | $ | $ | ||||||

| Deferred tax | ||||||||

| Income tax expense | $ | $ | ||||||

| 14 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

The effective tax rate in the periods presented is the result of the mix of income earned in various tax jurisdictions that apply a broad range of income tax rate. The Company mainly operates in Hong Kong that is subject to taxes in the jurisdictions in which they operate, as follows:

United States of America

ENMI is registered in the State of Nevada and is subject to the tax laws of United States of America.

For the six months ended September 30, 2021

and 2020, there were

BVI

Under the current BVI law, the Company is not subject to tax on income.

Hong Kong

The Company’s subsidiary operating in Hong

Kong is subject to the Hong Kong Profits Tax at the two-tiered profits tax rates from

| Six months ended September 30, | ||||||||

| 2021 | 2020 | |||||||

| Loss before income taxes | $ | ( | ) | $ | ( | ) | ||

| Statutory income tax rate | ||||||||

| Income tax expense at statutory rate | ( | ) | ( | ) | ||||

| Tax effect of non-deductible items | ||||||||

| Tax loss not recognized as deferred tax assets | ||||||||

| Income tax expense | $ | $ | ||||||

The following table sets forth the significant components of the deferred tax assets and liabilities of the Company as of September 30, 2021 and March 31, 2021:

| September 30, 2021 | March 31, 2021 | |||||||

| Deferred tax assets: | – | – | ||||||

| Net operating loss carryforwards | $ | $ | ||||||

| Less: valuation allowance | ( | ) | ||||||

| Deferred tax assets, net | $ | $ | ||||||

| 15 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

NOTE-8 AMOUNT DUE TO RELATED PARTIES

As of September 30, 2021, the amount due to a

related parties represented temporary advances made by the Company’s director, Ms. LO Kin Yi Sally, and by the major shareholder.

The amount due to the director was unsecured, interest-free with no fixed repayment term. Imputed interest on this amount is considered

insignificant. The amount due to shareholder was unsecured, repayable on demand with

NOTE-9 RELATED PARTY TRANSACTIONS

From time to time, the director of the Company

advanced funds to the Company for working capital purpose. Those advances which amounted to $

During the six months ended September 30, 2021, the Company has been provided free office space by its director. The management determined that such cost is nominal and did not recognize the rent expense in its financial statements.

During the six months ended September 30, 2021, a shareholder of the Company advanced an amount of $ which are unsecured, bear interest at 5% p.a. and repayable on demand.

During the six months ended September 30, 2021

also, the Company received loan proceeds of $

NOTE-10 CONCENTRATIONS OF RISK

The Company is exposed to the following concentrations of risk:

(a) Major customers

For the three and six months ended September 30, 2021, the individual customer who accounts for 10% or more of the Company’s revenues and its outstanding receivable balances as at period-end dates, are presented as follows:

| Three months ended September 30, 2021 | September 30, 2021 | |||||||||||

Customer | Revenues | Percentage of revenues | Accounts receivable | |||||||||

| Customer A | $ | $ | ||||||||||

| Customer B | ||||||||||||

| Total: | $ | Total: | $ | |||||||||

| 16 |

DH ENCHANTMENT, INC.

(Formerly Energy Management International, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| Six months ended September 30, 2021 | September 30, 2021 | |||||||||||

Customer | Revenues | Percentage of revenues | Accounts receivable | |||||||||

| Customer B | $ | $ | ||||||||||

| Customer C | ||||||||||||

| Customer A | ||||||||||||

| Total: | $ | Total: | $ | |||||||||

For the three and six months ended September 30, 2020, there was no individual customer that accounted for 10% or more of the Company’s revenues.

All of the Company’s customers are located in Hong Kong.

(b) Major vendor

For the three and six months ended September 30, 2021, the individual vendor who accounts for 10% or more of the Company’s purchases and its outstanding payable balances as at period-end dates, are presented as follows:

| Three months ended September 30, 2021 | September 30, 2021 | |||||||||||

| Supplier | Cost of revenues | Percentage of cost of revenues |

Trade accounts payable | |||||||||

| Vendor A | $ | $ | ||||||||||

| Six months ended September 30, 2021 | September 30, 2021 | |||||||||||

| Supplier | Cost of revenues | Percentage of cost of revenues |

Trade accounts payable | |||||||||

| Vendor A | $ | $ | ||||||||||

For the three and six months ended September 30, 2020, there was no individual vendor that accounted for 10% or more of the Company’s purchases.

The Company’s vendor is located in Hong Kong.

| (c) | Economic and political risk |

The Company’s major operations are conducted in Hong Kong. Accordingly, the political, economic, and legal environments in Hong Kong, as well as the general state of Hong Kong’s economy may influence the Company’s business, financial condition, and results of operations.

| (d) | Exchange rate risk |

The Company cannot guarantee that the current exchange rate will remain steady; therefore there is a possibility that the Company could post the same amount of profit for two comparable periods and because of the fluctuating exchange rate actually post higher or lower profit depending on exchange rate of HKD converted to US$ on that date. The exchange rate could fluctuate depending on changes in political and economic environments without notice.

NOTE-11 COMMITMENTS AND CONTINGENCIES

As of September 30, 2021, the Company has no material commitments or contingencies.

NOTE-12 SUBSEQUENT EVENTS

In accordance with ASC Topic 855, “Subsequent Events”, which establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before condensed consolidated financial statements are issued, the Company has evaluated all events or transactions that occurred after September 30, 2021, up through the date the Company issued the unaudited condensed consolidated financial statements.

| 17 |

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical facts, included in this Form 10-Q including, without limitation, statements in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s financial position, business strategy and the plans and objectives of management for future operations, events or developments which the Company expects or anticipates will or may occur in the future, including such things as future capital expenditures (including the amount and nature thereof); expansion and growth of the Company's business and operations; and other such matters are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances. However, whether actual results or developments will conform with the Company's expectations and predictions is subject to a number of risks and uncertainties, including general economic, market and business conditions; the business opportunities (or lack thereof) that may be presented to and pursued by the Company; changes in laws or regulation and other factors, most of which are beyond the control of the Company.

These forward-looking statements can be identified by the use of predictive, future-tense or forward-looking terminology, such as "believes," "anticipates," "expects," "estimates," "plans," "may," "will," or similar terms. These statements appear in a number of places in this filing and include statements regarding the intent, belief or current expectations of the Company, and its directors or its officers with respect to, among other things: (i) trends affecting the Company's financial condition or results of operations for its limited history; (ii) the Company's business and growth strategies; and, (iii) the Company's financing plans. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Such factors that could adversely affect actual results and performance include, but are not limited to, the Company's limited operating history, potential fluctuations in quarterly operating results and expenses, government regulation, technological change and competition. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to our filings with the SEC under the Exchange Act and the Securities Act of 1933, as amended, including the Second Amendment to the Registration Statement on Form 10 filed with the Securities and Exchange Commission on November 3, 2021.

Consequently, all of the forward-looking statements made in this Form 10-Q are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. The Company assumes no obligations to update any such forward-looking statements.

| 18 |

ITEM 2 Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our Company’s financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and the related notes included elsewhere in the report. This discussion contains forward-looking statements that involve risks and uncertainties. Actual results and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of various factors. See “Cautionary Note Concerning Forward-Looking Statements” on page 2.

Unless otherwise noted, all currency figures quoted as “U.S. dollars”, “dollars” or “$” refer to the legal currency of the United States. Throughout this report, assets and liabilities of the Company’s subsidiaries are translated into U.S. dollars using the exchange rate on the balance sheet date. Revenue and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate component of accumulated other comprehensive income within the statement of stockholders’ equity.

Overview

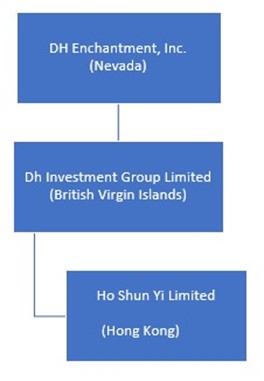

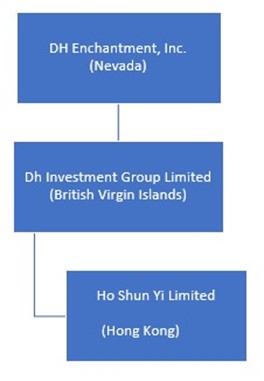

DH Enchantment, Inc. (f/k/a Energy Management International Inc.) is a holding company that, through its subsidiaries, is engaged primarily in the sale and distribution of COVID-19 rapid antigen tester sets produced by third parties. We operate our business through our wholly owned subsidiary Ho Shun Yi Limited (“HSY”). We commenced operations in Hong Kong in October 2020 and sell our products primarily in Hong Kong. We are not required to obtain permission from the Chinese authorities to operate or to issue securities to foreign investors. HSY was organized as a private limited liability company on July 9, 2018, in Hong Kong and is a wholly owned subsidiary of DH Investment Group Limited (“DHIG”). We acquired DHIG on July 26, 2021. Our corporate organization chart is below.

We are not a Chinese operating company but a Nevada holding company with operations conducted through our wholly owned subsidiaries based in Hong Kong. This structure presents unique risks as our investors may never directly hold equity interests in our Hong Kong subsidiary and will be dependent upon contributions from our subsidiaries to finance our cash flow needs. Further, in light of the recent statements and regulatory actions by the PRC government, such as those related to Hong Kong’s national security, the promulgation of regulations prohibiting foreign ownership of Chinese companies operating in certain industries, which are constantly evolving, and anti-monopoly concerns, we may be subject to the risks of uncertainty of any future actions of the PRC government in this regard including the risk that the PRC government could disallow our holding company structure, which may result in a material change in our operations, including our ability to continue our existing holding company structure, carry on our current business, accept foreign investments, and offer or continue to offer securities to our investors. These adverse actions could value the value of our common stock to significantly decline or become worthless. We may also be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the Chinese Securities Regulatory Commission, if we fail to comply with such rules and regulations, which could adversely affect the ability of the Company’s securities to continue to trade on the Over-the-Counter Bulletin Board, which may cause the value of our securities to significantly decline or become worthless.

| 19 |

There may be prominent risks associated with our operations being in Hong Kong. For example, as a U.S.-listed Hong Kong public company, we may face heightened scrutiny, criticism and negative publicity, which could result in a material change in our operations and the value of our common stock. It could also significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Additionally, changes in Chinese internal regulatory mandates, such as the M&A rules, Anti-Monopoly Law, and the soon to be effective Data Security Law, may target the Company's corporate structure and impact our ability to conduct business in Hong Kong, accept foreign investments, or list on an U.S. or other foreign exchange. For a detailed description of the risks facing the Company and the offering associated with our operations in Hong Kong, please refer to “Risk Factors – Risk Factors Relating to Doing Business in Hong Kong.”

We are at a development stage company and reported a net loss of $260,701 and $8,610 for the six months ended September 30, 2021 and 2020, respectively. We had current assets of $76,909 and current liabilities of $328,659 as of September 30, 2021. As of September 30, 2020, our current assets and current liabilities were $74,360 and $65,670, respectively.

History

We were incorporated in the state of Nevada on July 9, 2004, under the name Amerivestors, Inc. On March 3, 2009, we changed our name to Gust Engineering & Speed Production, Inc. and on October 27, 2009, we changed our name to Energy Management International, Inc. Effective August 16, 2021, we changed our name to DH Enchantment, Inc., our current name.

Since inception to 2018, the Company posted periodic reports on the OTCMarkets website under the alternative reporting standard with the 12/31/2010 Quarterly Report being the last report. Thereafter, the Company ceased reporting and failed to file its Annual list due July 31, 2019 with the Nevada Secretary of State. This resulted in the revocation of the Company’s corporate charter.

In November, 2020, Barbara McIntyre Bauman in her capacity as a stockholder of the Company applied for custodianship of the Company with the District Court sitting in Clark County, Nevada (the “Court”) to revive the Company. Ms. Bauman was ultimately appointed by the Court to serve as custodian of the Company on January 11, 2021. Ms. Bauman served as the custodian until April 19, 2021, when Ms. Bauman’s motion to terminate custodianship of the Company was granted by the Court. A copy of the court records relating to the application and termination of custodianship of the Company are attached as Exhibit 99.1 hereto.

In connection with serving as the custodian, Ms. Bauman was appointed to serve as the sole executive officer and director of the Company effective January 11, 2021. Ms. Bauman subsequently returned the Company to Good Standing Status with the Nevada Secretary of State and caused the Company to re-commence posting periodic reports on the OTC Markets website under the alternative reporting standard. On March 2, 2021, the Company issued to Ms. Bauman 400,000,000 shares of common stock for repayment of related party debt totaling $6,610. On February 22, 2021, the Company issued to Ms. Bauman 3,500,000 shares of Series A Preferred Stock, for repayment of the related party debt totaling $4,403. These debts were incurred in connection with reviving and maintaining the Company.

On May 13, 2021, Ms. Bauman sold 400,000,000 shares of the Company’s common stock and 3,500,000 shares of the Company’s Series A Preferred Stock to Sally Kin Yi LO and Daily Success Development Ltd. for aggregate consideration of Three Hundred Forty Thousand Dollars ($340,000). In connection with the acquisition, Ms. Bauman resigned from her positions as Chief Executive Officer and Chief Operating Officer and Sally Kin Yi LO was appointed to serve as our Chief Executive Officer, Chief Financial Officer, Secretary and director. It is our understanding that the purchasers are not U.S. Persons within the meaning of Regulations S. Accordingly, the Shares are being sold pursuant to the exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended, Regulation D and Regulation S promulgated thereunder.

Effective July 1, 2021, Daily Success Development Limited converted 520,000 shares of its Series A Preferred Stock into 41,600,000 shares of Common Stock. As a result, Daily Success Development Limited holds 468,000,000 Common Shares (56.30%) and 1,755,000 Series A Preferred Shares (56.30%).

| 20 |

Effective July 1, 2021, Sally Lo converted 280,000 shares of its Series A Preferred Stock into 22,400,000 shares of Common Stock. As a result, Sally Lo holds 252,000,000 Common Shares (30.31%) and 945,000 Series A Preferred Shares (30.29%).

Acquisition of DH Investment Group Limited (“DHIG”), Our Testing Business

On July 26, 2021, we acquired all of the issued and outstanding shares of DH Investment Group Limited, a limited liability company organized under the laws of the British Virgin Islands (“DHIG”), from its shareholders Sally Lo and Daily Success Development Limited in exchange for 100,000 shares of our Series B Preferred Stock. DHIG operates its COVID-19 antigen testing business through its wholly owned subsidiary Ho Shun Yi Limited, a limited liability company organized under the laws of Hong Kong. In connection with the acquisition, each of Sally Lo and Daily Success Development Limited received 35,000 and 65,000 shares of our Series B Convertible Preferred Stock, respectively. Each one (1) shares of the Series B Convertible Preferred Stock is convertible ten (10) shares of our Common Stock. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to the shareholders of DHIG.

Prior to the Share Exchange, the Company was considered as a shell company due to its nominal assets and limited operation. The transaction was treated as a recapitalization of the Company.

The Share Exchange between the Company and DHIC that was effectuated on July 26, 2021, was deemed as a merger of entities under common control of which Miss Sally Kin Yi LO is the common director and shareholder of both the Company and DHIG. Under the guidance in ASC 805 for transactions between entities under common control, the assets, liabilities and results of operations, are recognized at their carrying amounts on the date of the Share Exchange, which required retrospective combination of the Company and DHIG for all periods presented.

As a result of our acquisition of DHIG, we entered into the COVID-19 antigen testing business. We intend to make additional acquisitions in the same industry and hope to expand into other territories such as China. We also hope to make opportunistic acquisitions in other industries in the future, regardless of whether such industries relate to the COVID-19 antigen testing business.

On June 29, 2021, our Board of Directors authorized and approved the amendment and restatement of our Articles of Incorporation to: (i) change our name to DH Enchantment Inc.; and (ii) amend the powers, rights and designation of the Series A Convertible Preferred Stock; and (iii) effectuate a 5:1 reverse split, all of which became effective on August 16, 2021. After the amendment, holders of the Series A Convertible Preferred Stock are no longer: (i) entitled to receive dividends or other distributions; (ii) entitled to vote on matters submitted to a vote of the stockholders; and (iii) able to convert the Series A Convertible Preferred Stock into common stock or any other securities of the corporation. All share and per share information in this financial statements and footnotes have been retroactively adjusted for the periods and years presented, unless otherwise indicated, to give effect to the reverse stock split.

On June 29, 2021, the Board of Directors of the Company also approved the designation of 10,000,000 shares of Series B Convertible Preferred Stock which took effect immediately.

Results of Operations

Comparison of the three months ended September 30, 2021 and September 30, 2020

The following table sets forth certain operational data for the periods indicated:

| Three Months Ended September 30, | ||||||||

| 2021 | 2020 | |||||||

| Revenues | $ | 46,073 | $ | – | ||||

| Cost of revenue | (34,495 | ) | – | |||||

| Gross profit | 11,578 | – | ||||||

| General and administrative expenses | (179,601 | ) | (30 | ) | ||||

| Loss from operation | (168,023 | ) | (30 | ) | ||||

| Other expense, net | (1,970 | ) | – | |||||

| Income tax expense | – | – | ||||||

| Net loss | (169,993 | ) | (30 | ) | ||||

| 21 |

Revenue. We generated revenues of $46,073 and $0 for the three months ended September 30, 2021 and 2020. We commenced operations from November 2020.

For the three months ended September 30, 2021, the following customers accounted for 10% or more of our total net revenues:

| Customer name | Three months ended September 30, 2021 | September 30, 2021 | ||||||||||

| Revenues | Percentage of revenues | Trade accounts receivable | ||||||||||

| Hong Kong Rehabilitation A & E Association Limited | $ | 11,811 | 26% | $ | – | |||||||

| Uni-Alliance Limited | 11,672 | 25% | 1,395 | |||||||||

| $ | 23,483 | 51% | $ | 1,395 | ||||||||

For the three months ended September 30, 2020, there were no customers.

Cost of Revenue. Cost of revenue for the three months ended September 30, 2021 and 2020, was $34,495 and $0, respectively. We commenced operations in November 2020.

For the three months ended September 30, 2021, the following vendor accounted for 10% or more of our total net cost of revenue:

| Supplier name | Three months ended September 30, 2021 | September 30, 2021 | ||||||||||

| Cost of Revenues | Percentage of cost of revenues | Trade accounts payable | ||||||||||

| Phase Scientific International Limited | $ | 34,495 | 100% | $ | 3,783 | |||||||

For the three months ended September 30, 2020, there were no vendors.

Gross Profit. We achieved a gross profit of $11,578 and $0 for the three months ended September 30, 2021 and 2020, respectively.

We commenced operations from November 2020.

General and Administrative Expenses (“G&A”). We incurred G&A expenses of $179,601 and $30 for the three months ended September 30, 2021 and 2020, respectively. The increase in G&A is primarily attributable to the employment and other expenses.

Income Tax Expense. Our income tax expenses for the three months ended September 30, 2021 and 2020 were $0.

Comparison of the six months ended September 30, 2021 and September 30, 2020

The following table sets forth certain operational data for the periods indicated:

| Six Months Ended September 30, | ||||||||

| 2021 | 2020 | |||||||

| Revenues | $ | 145,885 | $ | – | ||||

| Cost of revenue | (122,724 | ) | – | |||||

| Gross profit | 23,161 | – | ||||||

| General and administrative expenses | (281,271 | ) | (8,610 | ) | ||||

| Loss from operation | (258,110 | ) | (8,610 | ) | ||||

| Other expense, net | (2,591 | ) | – | |||||

| Income tax expense | – | – | ||||||

| Net loss | (260,701 | ) | (8,610 | ) | ||||

| 22 |

Revenue. We generated revenues of $145,885 and $0 for the six months ended September 30, 2021 and 2020. We commenced operations from November 2020.

For the six months ended September 30, 2021, the following customers accounted for 10% or more of our total net revenues:

| Customer name | Six months ended September 30, 2021 | September 30, 2021 | ||||||||||

| Revenues | Percentage of revenues | Trade accounts receivable | ||||||||||

| Uni-Alliance Limited | $ | 52,611 | 36% | $ | 1,395 | |||||||

| Kin Pharm Dispensary Limited | 28,680 | 20% | – | |||||||||

| Hong Kong Rehabilitation A & E Association Limited | 25,730 | 18% | – | |||||||||

| $ | 107,021 | 74% | $ | 1,395 | ||||||||

For the six months ended September 30, 2020, there were no customers.

Cost of Revenue. Cost of revenue for the six months ended September 30, 2021 and 2020, was $122,724 and $0, respectively. We commenced operations in November 2020.

For the six months ended September 30, 2021, the following vendor accounted for 10% or more of our total net cost of revenue:

| Supplier name | Six months ended September 30, 2021 | September 30, 2021 | ||||||||||

| Cost of Revenues | Percentage of cost of revenues | Trade accounts payable | ||||||||||

| Phase Scientific International Limited | $ | 122,724 | 100% | $ | 3,783 | |||||||

For the six months ended September 30, 2020, there were no vendors.

Gross Profit. We achieved a gross profit of $23,161 and $0 for the six months ended September 30, 2021 and 2020, respectively.

We commenced operations from November 2020.

General and Administrative Expenses (“G&A”). We incurred G&A expenses of $281,271 and $8,610 for the six months ended September 30, 2021 and 2020, respectively. The increase in G&A is primarily attributable to the employment and other expenses.

Income Tax Expense. Our income tax expenses for the six months ended September 30, 2021 and 2020 were $0.

Liquidity and Capital Resources

We have never paid dividends on our Common Stock. Our present policy is to apply cash to investments in product development, acquisitions or expansion; consequently, we do not expect to pay dividends on Common Stock in the foreseeable future.

| September 30, 2021 | September 30, 2020 | |||||||

| Net cash used in operating activities | $ | (210,337 | ) | $ | (8,610 | ) | ||

| Net cash provided by investing activities | – | – | ||||||

| Net cash provided by financing activities | 212,822 | 22,082 | ||||||

| 23 |

Net Cash Used In Operating Activities.

For the six months ended September 30, 2021, net cash used in operating activities was $210,337, which consisted primarily of a net loss of $260,701, a decrease in prepayments and other receivables of $197 and offset by an increase in accrued liabilities and other payables of $50,167.

For the six months ended September 30, 2020, net cash was used in operating activities was $8,610, which consisted primarily of a net loss of $8,610.

We expect to continue to rely on cash generated through financing from our existing shareholders and private placements of our securities, however, to finance our operations and future acquisitions.

Net Cash Provided By Investing Activities.

For the six months ended September 30, 2021 and 2020, no net cash was provided by investing activities.

Net Cash Provided By Financing Activities.

For the six months ended September 30, 2021, net cash provided by financing activities was $212,822, which consisting of advances from a director of $2,213, advances from a shareholder of $133,557 and proceed from issuance of promissory notes of $77,052.

For the six months ended September 30, 2020, net cash was provided by financing activities was $22,082, which consisting primarily of advances from a director of $22,082.

Off-Balance Sheet Arrangements

We are not party to any off-balance sheet transactions. We have no guarantees or obligations other than those which arise out of normal business operations.

Contractual Obligations and Commercial Commitments

We had the following contractual obligations and commercial commitments as of September 30, 2021:

| Contractual Obligations | Total | Less than 1 Year | 1-3 Years | 3-5 Years | More than 5 Years | |||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| Amounts due to related parties | $ | 199,657 | $ | 199,657 | $ | – | $ | – | $ | – | ||||||||||

| Promissory notes, related parties | 77,052 | 77,052 | – | – | – | |||||||||||||||

| Commercial commitments | – | – | – | – | – | |||||||||||||||

| Bank loan repayment | – | – | – | – | – | |||||||||||||||

| Total obligations | $ | 276,709 | $ | 276,709 | $ | – | $ | – | $ | – | ||||||||||

| 24 |

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires our management to make assumptions, estimates and judgments that affect the amounts reported, including the notes thereto, and related disclosures of commitments and contingencies, if any. We have identified certain accounting policies that are significant to the preparation of our financial statements. These accounting policies are important for an understanding of our financial condition and results of operations. Critical accounting policies are those that are most important to the presentation of our financial condition and results of operations and require management's subjective or complex judgment, often as a result of the need to make estimates about the effect of matters that are inherently uncertain and may change in subsequent periods. Certain accounting estimates are particularly sensitive because of their significance to financial statements and because of the possibility that future events affecting the estimate may differ significantly from management's current judgments. We believe the following accounting policies are critical in the preparation of our financial statements.

| l | Use of estimates and assumptions |

In preparing these combined and consolidated financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheet and revenues and expenses during the years reported. Actual results may differ from these estimates.

| l | Basis of consolidation |

The combined and consolidated financial statements include the accounts of ENMI and its subsidiaries. All significant inter-company balances and transactions within the Company have been eliminated upon consolidation.

| l | Cash and cash equivalents |

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

| l | Revenue recognition |

The Company adopted Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASU 2014-09”) using the full retrospective transition method. The Company's adoption of ASU 2014-09 did not have a material impact on the amount and timing of revenue recognized in its financial statements.

Under ASU 2014-09, the Company recognizes revenue when control of the promised goods or services is transferred to customers, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services.

The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

| · | identify the contract with a customer; | |

| · | identify the performance obligations in the contract; | |

| · | determine the transaction price; | |

| · | allocate the transaction price to performance obligations in the contract; and | |

| · | recognize revenue as the performance obligation is satisfied. |

| 25 |

| l | Cost of revenue |

Cost of revenue consists primarily of the cost of goods sold, which are directly attributable to the sales of COVID-19 rapid tester products.

| l | Income taxes |

The Company adopted the ASC 740 Income tax provisions of paragraph 740-10-25-13, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the combined and consolidated financial statements. Under paragraph 740-10-25-13, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the combined and consolidated financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Paragraph 740-10-25-13 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the provisions of paragraph 740-10-25-13.

The estimated future tax effects of temporary differences, if any, between the tax basis of assets and liabilities are reported in the accompanying balance sheets, as well as tax credit carry-backs and carry-forwards. The Company periodically reviews the recoverability of deferred tax assets recorded on its balance sheets and provides valuation allowances as management deems necessary.

| l | Foreign currencies translation |

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the combined and consolidated statement of operations.

The reporting currency of the Company is United States Dollar ("US$") and the accompanying combined and consolidated financial statements have been expressed in US$. In addition, the Company is operating in Hong Kong and maintains its books and record in its local currency, Hong Kong Dollars (“HKD”), which is its functional currency, being the primary currency of the economic environment in which their operations are conducted. In general, for consolidation purposes, assets and liabilities of its subsidiary whose functional currency is not US$ are translated into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive income within the statements of changes in stockholder’s equity.

| l | Comprehensive income |

ASC Topic 220, “Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated other comprehensive income, as presented in the accompanying combined and consolidated statements of changes in stockholders’ equity, consists of changes in unrealized gains and losses on translation of functional currencies to presentation currency. This comprehensive income is not included in the computation of income tax expense or benefit.

| 26 |

| l | Segment reporting |

ASC Topic 280, “Segment Reporting” establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organization structure as well as information about geographical areas, business segments and major customers in combined and consolidated financial statements. For the six months ended September 30, 2021 and 2020, the Company operates in one reportable operating segment in Hong Kong.

| l | Retirement plan costs |

Contributions to retirement plans (which are defined contribution plans) are charged to general and administrative expense in the accompanying statements of operation as the related employee service is provided.

| l | Related parties |

The Company follows the ASC 850-10, Related Party for the identification of related parties and disclosure of related party transactions.

Pursuant to section 850-10-20 the related parties include a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of section 825–10–15, to be accounted for by the equity method by the investing entity; c) trusts for the benefit of employees, such as pension and Income-sharing trusts that are managed by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The combined and consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial statements is not required in those statements. The disclosures shall include: a) the nature of the relationship(s) involved; b) a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; c) the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d) amount due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

| l | Commitments and contingencies |

The Company follows the ASC 450-20, Commitments to report accounting for contingencies. Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

| 27 |

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s consolidated financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.