UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

SCHEDULE 14A

________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to Section 240.14a-12 |

SPARTACUS ACQUISITION CORPORATION

(Name of Registrant as Specified In Its Charter)

_______________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|||

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

|

(1) |

Title of each class of securities to which transaction applies: |

|||

|

|

||||

|

(2) |

Aggregate number of securities to which transaction applies: |

|||

|

|

||||

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

|

|

||||

|

(4) |

Proposed maximum aggregate value of transaction: |

|||

|

|

||||

|

(5) |

Total fee paid: |

|||

|

|

||||

|

☐ |

Fee paid previously with preliminary materials. |

|||

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

(1) |

Amount Previously Paid: |

|||

|

|

||||

|

(2) |

Form, Schedule or Registration Statement No. |

|||

|

|

||||

|

(3) |

Filing Party: |

|||

|

|

||||

|

(4) |

Date Filed: |

|||

|

|

||||

PROXY STATEMENT FOR SPECIAL MEETING IN LIEU OF 2021 ANNUAL MEETING OF

STOCKHOLDERS OF

Spartacus Acquisition Corporation

PROSPECTUS FOR 102,572,147 SHARES OF COMMON STOCK AND 10,000,000 WARRANTS OF

Spartacus Acquisition Shelf Corp.

Dear Spartacus Acquisition Corporation Stockholders:

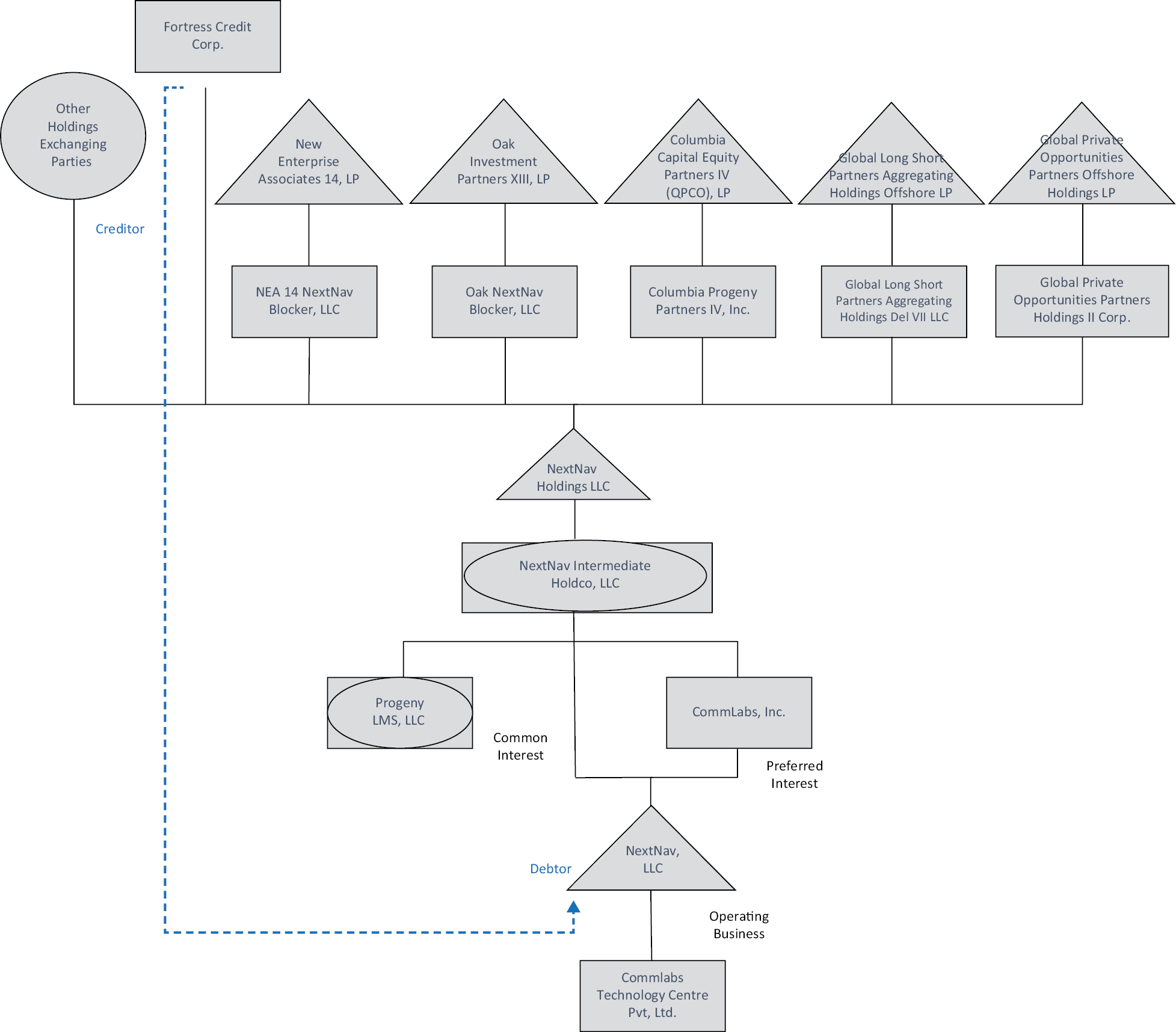

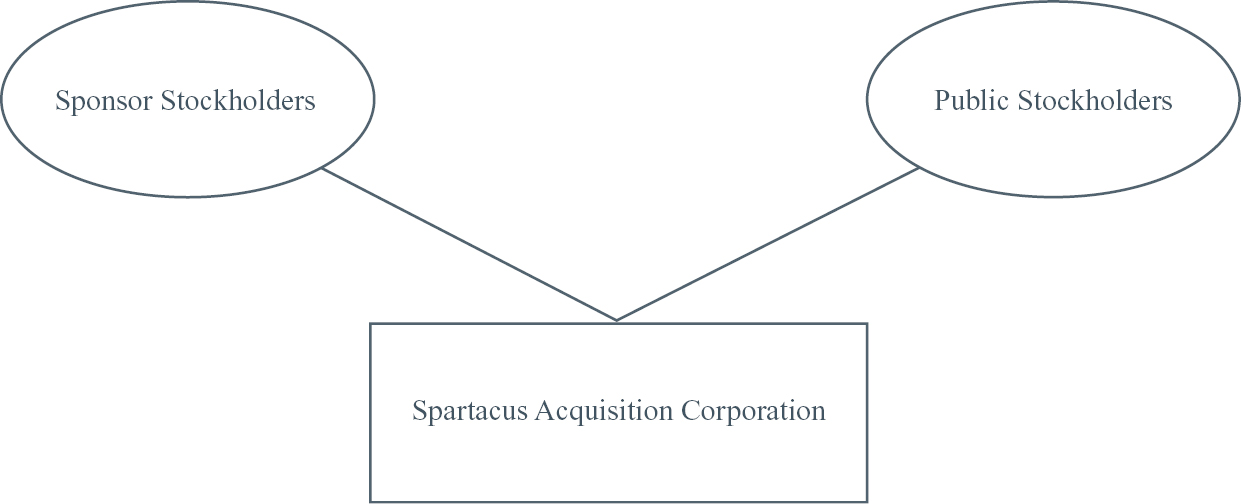

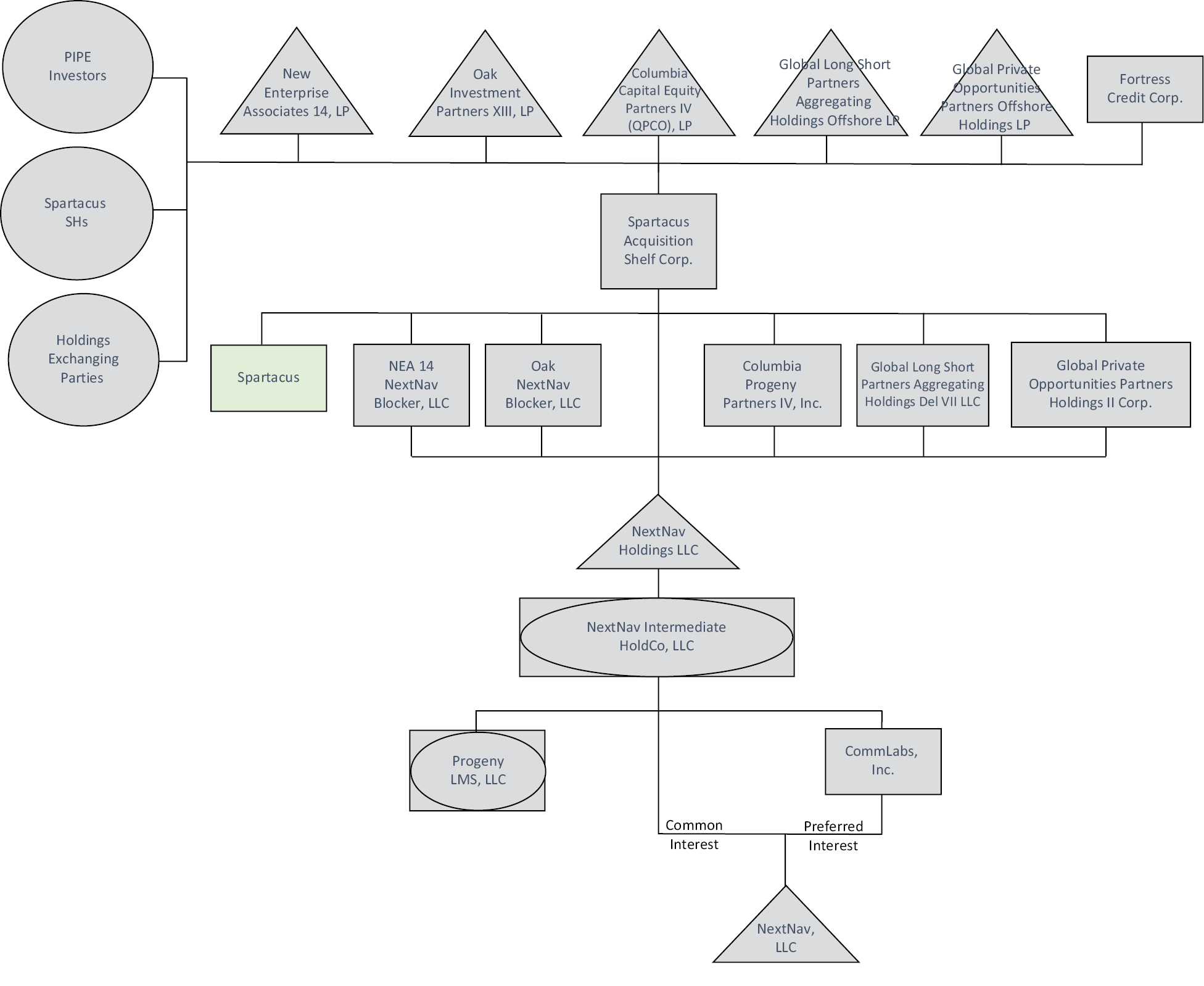

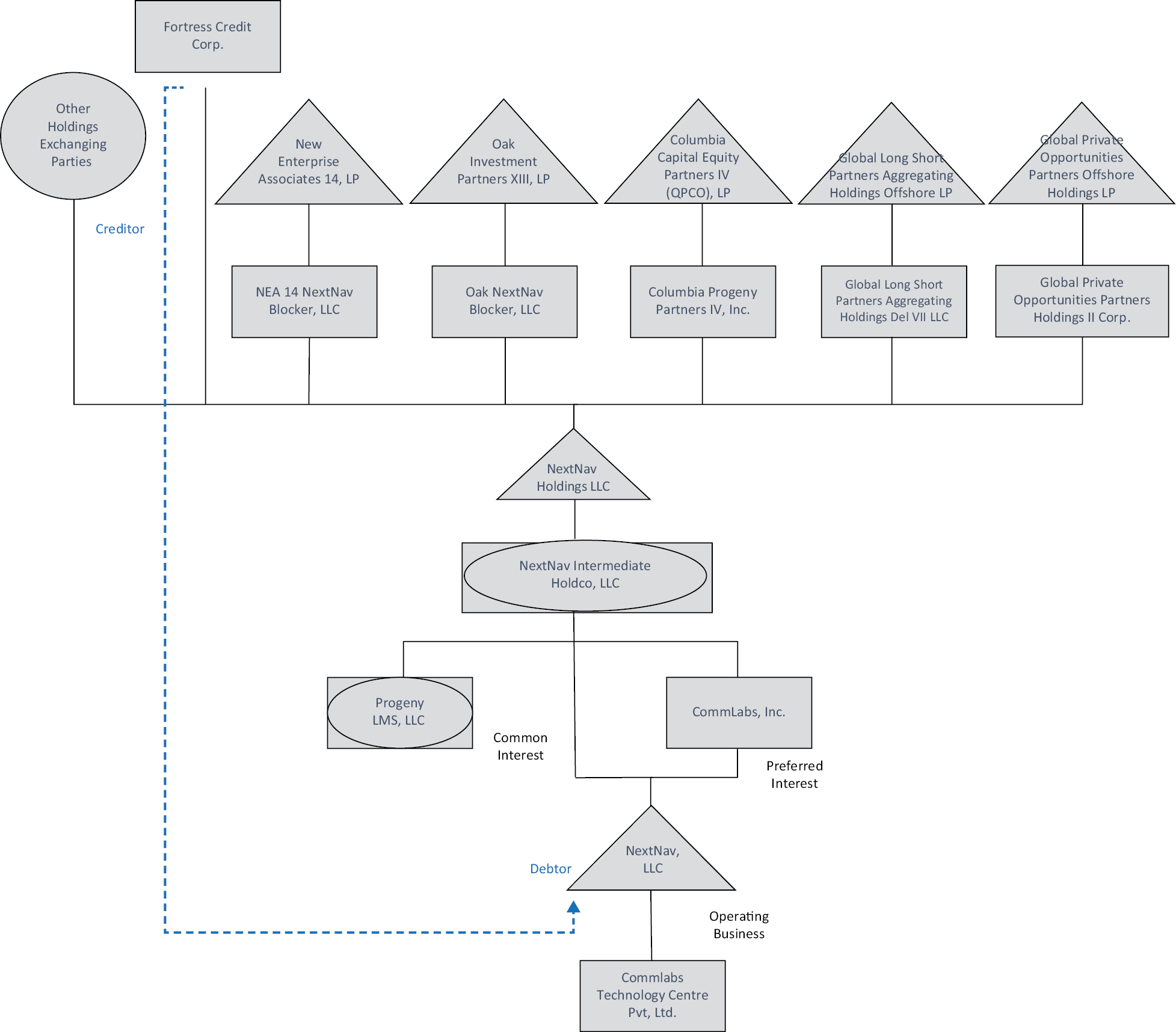

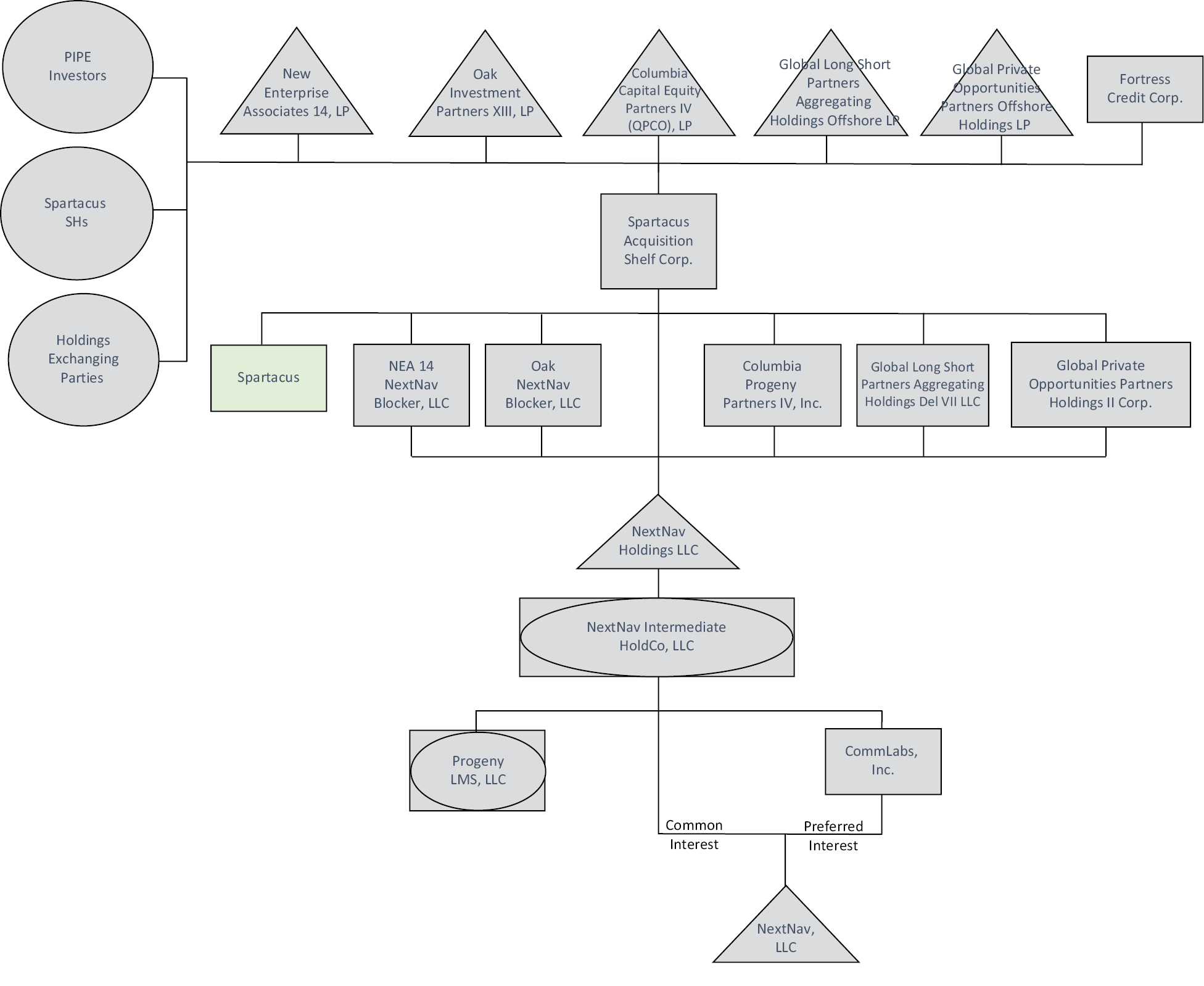

On June 9, 2021, Spartacus Acquisition Corporation, a Delaware corporation (“we,” “us,” “our,” “Spartacus” or the “Company”), Spartacus Acquisition Shelf Corp., a Delaware corporation (“Shelf”), NextNav, LLC, a Delaware limited liability company, NextNav Holdings, LLC, a Delaware limited liability company (“Holdings”), NEA 14 NextNav Blocker, LLC, a Delaware limited liability company (“NEA Blocker”), Oak NextNav Blocker, LLC, a Delaware limited liability company (“Oak Blocker”), Columbia Progeny Partners IV, Inc., a Delaware corporation (“Columbia Blocker”), Global Long Short Partners Aggregating Holdings Del VII LLC, a Delaware limited liability company (“GS Blocker 1”), Global Private Opportunities Partners Holdings II Corp., a Delaware corporation, (“GS Blocker 2,” and collectively with NEA Blocker, Oak Blocker, Columbia Blocker, and GS Blocker 1, “Blockers”), SASC (SPAC) Merger Sub 1 Corporation, a Delaware corporation (“MS 1”), SASC (Target) Merger Sub 2 LLC, a Delaware limited liability company (“MS 2”), SASC (NB) Merger Sub 3 LLC, a Delaware limited liability company (“MS 3”), SASC (OB) Merger Sub 4 LLC, a Delaware limited liability company (“MS 4”), SASC (CB) Merger Sub 5 Corporation, a Delaware corporation (“MS 5”), SASC (GB1) Merger Sub 6 LLC, a Delaware limited liability company (“MS 6”) , and SASC (GB2) Merger Sub 7 Corporation, a Delaware corporation (“MS 7,” and collectively with MS 1, MS 2, MS 3, MS 4, MS 5, and MS 6, the “Merger Entities”), entered into an Agreement and Plan of Merger (the “Merger Agreement”). The Merger Entities are each wholly owned subsidiaries of Shelf. The Merger Agreement provides for, among other things, (a) MS 1 to be merged with and into Spartacus, with Spartacus surviving the merger; (b) MS 2 to be merged with and into Holdings, with Holdings surviving the merger; (c) MS 3 to be merged with and into NEA Blocker, with NEA Blocker surviving the merger; (d) MS 4 to be merged with and into Oak Blocker, with Oak Blocker surviving the merger; (e) MS 5 to be merged with and into Columbia Blocker, with Columbia Blocker surviving the merger; (f) MS 6 to be merged with and into GS Blocker 1, with GS Blocker 1 surviving the merger; and (g) MS 7 to be merged with and into GS Blocker 2, with GS Blocker 2 surviving the merger. As a result of the Transactions, the Company, NEA Blocker, Oak Blocker, Columbia Blocker, GS Blocker 1, GS Blocker 2 and Holdings and the various operating subsidiaries of Holdings (we refer to Holdings and its operating subsidiaries collectively as “NextNav”), will become wholly owned subsidiaries of Shelf, with the equity holders of each of NEA Blocker, Oak Blocker, Columbia Blocker, GS Blocker 1, GS Blocker 2 (collectively referred to as the “Sellers”), and the equity holders of Holdings (collectively with Sellers, the “Holdings Exchanging Parties”) and the Company’s stockholders becoming stockholders of Shelf.

At the special meeting in lieu of the 2021 annual meeting of stockholders (the “Special Meeting”), which will be held will be held virtually on October 27, 2021, at 10:30 a.m., Eastern Time, our stockholders will be asked to consider and vote upon a proposal (the “Business Combination Proposal”), to approve the business combination and adopt the Merger Agreement. The aggregate number of shares of Shelf common stock to be issued in the Transactions, based on Holdings’ expected capitalization at Closing, assuming no redemptions, is approximately 112.9 million shares of Shelf’s common stock. The number of shares of the equity consideration will be based on a $10.00 per share value for Shelf’s common stock. For additional information, see the section in the accompanying proxy statement/prospectus entitled “Proposal No. 1 — The Business Combination Proposal — The Merger Agreement — Consideration.” A copy of the Merger Agreement is attached to this proxy statement/prospectus as Annex A.

Our stockholders will also be asked to consider and vote upon the following proposals: (a) to approve a series of proposals regarding the material differences between Shelf’s amended and restated certificate of incorporation that will be in effect upon the closing of the Transactions (the “NextNav Charter”), a copy of which is attached to the accompanying proxy statement/prospectus as Annex B, and the Company’s current amended and restated certificate of incorporation (our “charter”) (collectively, the “charter Proposals”), (b) to approve and adopt the NextNav Inc. 2021 Omnibus Incentive Plan, a copy of which is attached to the accompanying proxy statement/prospectus as Annex D (the “Incentive Plan Proposal”), (c) to approve the NextNav Inc. 2021 Employee Stock Purchase Plan, a copy of which is attached to the accompanying proxy statement/prospectus as Annex E (the “Employee Stock

Purchase Plan Proposal”), (d) to elect three directors to serve on our board of directors until the 2024 annual meeting of stockholders, and until the election and qualification of their respective successors in office, subject to their earlier death, resignation or removal (the “Existing Director Election Proposal”), (e) to elect seven directors, effective as of and contingent upon the consummation of the Business Combination, to serve on Shelf’s board of directors until the expiration of their applicable term, and until their respective successors are duly elected and qualified or until their earlier resignation, removal or death (the “New Director Election Proposal” and together with the Existing Director Election Proposal, the “Director Election Proposals”), (f) to approve, in accordance with the provisions of Nasdaq Listing Rule 5635, the issuance of more than 20% of Spartacus’ issued and outstanding common stock in connection with the private placement of shares of Spartacus’ Class A common stock in connection with and immediately prior to consummation of the Business Combination (the “Nasdaq Proposal”), and (g) to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and voting of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes received to pass the resolution to approve the Business Combination Proposal, the charter Proposals, the Incentive Plan Proposal, the Employee Stock Purchase Plan Proposal, the Director Election Proposals, or the Nasdaq Proposal (the “Adjournment Proposal”). Each of these proposals is more fully described in the accompanying proxy statement/prospectus.

Pursuant to the Merger Agreement, each outstanding share of our common stock shall be converted into one share of Shelf’s common stock. Our outstanding warrants shall, by their terms, automatically entitle the holders to purchase shares of Shelf’s common stock upon consummation of the Business Combination. The accompanying proxy statement/prospectus covers 102,572,147 shares of Shelf common stock, including 10,000,000 shares of Shelf common stock issuable upon exercise of public warrants, and 10,000,000 public warrants to acquire shares of Shelf common stock. A registration statement covering the issuance of Shelf’s common stock upon exercise of our private placement warrants will be filed after the closing of the Transactions.

Additionally, in connection with the execution of the Merger Agreement, to raise additional proceeds in connection with the Transactions, Spartacus and Shelf have entered into subscription agreements pursuant to which, among other things, certain investors have agreed to purchase an aggregate of 20.5 million shares of Class A common stock (with such shares immediately being cancelled in connection with the mergers and in consideration for newly issued Shelf common stock), for a purchase price of $10.00 per share, for an aggregate purchase price of $205,000,000 (the “PIPE Financing”).

Our Class A common stock, units and warrants are currently listed on The Nasdaq Stock Market under the symbols “TMTS,” “TMTSU” and “TMTSW,” respectively. There are currently no holders of Shelf securities. Prior to the closing of the Business Combination, Shelf will apply to list, to be effective at the time of the business combination, its common stock and warrants on The Nasdaq Capital Market. We expect its common stock and warrants to be listed under the symbols “NN” and “NNAVW,” respectively. Our units will automatically separate into the component securities upon consummation of the Business Combination and, as a result, will no longer trade as a separate security; therefore, Shelf will not have units traded following consummation of the Business Combination.

Pursuant to our charter, we are providing holders of the shares of Class A common stock included in the units issued in our initial public offering (our “public stockholders”), with the opportunity, upon the closing of the mergers and the other transactions contemplated by the Merger Agreement (the “Transactions”) and subject to the limitations described in the accompanying proxy statement/prospectus, to redeem their shares of our Class A common stock for cash equal to their pro rata share of the aggregate amount on deposit in our Trust Account (as of two business days prior to the consummation of the Transactions). For illustrative purposes, based on funds in our Trust Account of approximately $203.0 million on June 30, 2021, stockholders would have received a redemption price of approximately $10.15 per share of our Class A common stock. Public stockholders may elect to redeem their shares even if they vote for the Business Combination Proposal.

We are providing the accompanying proxy statement/prospectus and proxy card to our stockholders in connection with the solicitation of proxies to be voted at the special meeting and at any adjournments or postponements of the special meeting. The special meeting of our stockholders will be held at 10:30 a.m. Eastern Time on October 27, 2021. Whether or not you plan to attend the special meeting, we urge you to read the accompanying proxy statement/prospectus and its annexes carefully, including the section entitled “Risk Factors” beginning on page 41.

Your vote is very important, regardless of the number of shares of our common stock you own. To ensure your representation at the special meeting, please take the time to vote by following the instructions contained

in the accompanying proxy statement/prospectus and on your proxy card. Please vote promptly whether or not you expect to virtually attend the special meeting. Submitting a proxy now will not prevent you from being able to vote online at the special meeting.

If you sign, date and return your proxy card without indicating how you wish to vote, your proxy will be voted “FOR” each of the proposals presented at the special meeting. If you fail to return your proxy card and do not virtually attend the special meeting to vote, if you abstain from voting, or if you hold your shares in “street name” through a broker or other nominee and fail to give such nominee voting instructions (a “broker non-vote”), it will have the same effect as a vote “AGAINST” the Business Combination Proposal, but will have no effect on the charter Proposals, the Incentive Plan Proposal, the Employee Stock Purchase Plan Proposal, the Existing Director Election Proposal, the New Director Election Proposal, the Nasdaq Proposal, or the Adjournment Proposal. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your shares or, if you wish to virtually attend the special meeting and vote online, obtain a legal proxy from your broker or bank.

The Business Combination Proposal is conditioned on the approval of the charter Proposals, the New Director Election Proposal and the Nasdaq Proposal. In addition, (i) the charter Proposals are conditioned on the approval of the Business Combination Proposal and the Nasdaq Proposal, (ii) the Incentive Plan Proposal and the Employee Stock Purchase Plan Proposal are conditioned on the approval of the Business Combination Proposal, the charter Proposals and the Nasdaq Proposal, (iii) the New Director Election Proposal is conditioned on the approval of the Business Combination Proposal, the charter Proposals and the Nasdaq Proposal and (iv) the Nasdaq Proposal is conditioned on the Business Combination Proposal and the charter Proposals. Neither the Existing Director Election Proposal nor the Adjournment Proposal is conditioned on the approval of any other proposal set forth in the proxy statement/prospectus. It is important for you to note that if the Business Combination Proposal is not approved by our stockholders, or if any other proposal is not approved by our stockholders and we and NextNav do not waive the applicable closing condition under the Merger Agreement, then we will not consummate the Transactions. In addition, NextNav’s obligations to consummate the Transactions are conditioned upon the Company’s available closing date total cash (including cash in the Trust Account after giving effect to any redemptions and payment of transaction expenses, and the proceeds of the PIPE Financing) being equal to or greater than $250.0 million.

Our board of directors unanimously recommends that our stockholders vote “FOR” the Business Combination Proposal and “FOR” the other proposals presented in this proxy statement/prospectus. In considering the recommendation of our board of directors, you should keep in mind that our directors and executive officers may have interests in the Transactions that are different from, or in addition to, the interests of our stockholders generally. For additional information, see the section entitled “Proposal No. 1 — The Business Combination Proposal — Interests of Certain Persons in the Business Combination.”

|

Sincerely, |

||

|

/s/ Peter D. Aquino |

||

|

Peter D. Aquino |

||

|

Chief Executive Officer and Chairman of the Board |

This proxy statement/prospectus is dated September 16, 2021, and is first being mailed to our stockholders on or about September 20, 2021.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS OR ANY OF THE SECURITIES TO BE ISSUED IN THE TRANSACTIONS, PASSED UPON THE MERITS OR FAIRNESS OF THE TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

Spartacus ACQUISITION CORPoration

6470 E Johns Crossing, Suite 490

Duluth, Georgia 30097

NOTICE OF SPECIAL MEETING IN LIEU OF 2021 ANNUAL MEETING OF STOCKHOLDERS OF Spartacus Acquisition Corporation

To Be Held on October 27, 2021

To the Stockholders of Spartacus Acquisition Corporation:

NOTICE IS HEREBY GIVEN that a special meeting in lieu of the 2021 annual meeting of stockholders (the “special meeting”), of Spartacus Acquisition Corporation, a Delaware corporation, will be held on October 27, 2021, at 10:30 a.m., Eastern Time. Only stockholders who hold shares of common stock of Spartacus Acquisition Corporation at the close of business on September 13, 2021, the record date for the special meeting, are entitled to vote at the special meeting and any adjournments or postponements thereof.

The special meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the special meeting online, vote and submit your questions during the special meeting by visiting https://www.cstproxy.com/spartacusacquisitioncorp/sm2021. We are pleased to utilize the virtual stockholder meeting technology to (i) provide ready access and cost savings for our stockholders and the Company, and (ii) to promote social distancing pursuant to guidance provided by the Center for Disease Control due to the novel coronavirus. The virtual meeting format allows attendance from any location in the world.

You are cordially invited to virtually attend the special meeting, which will be held to consider and vote upon the following matters:

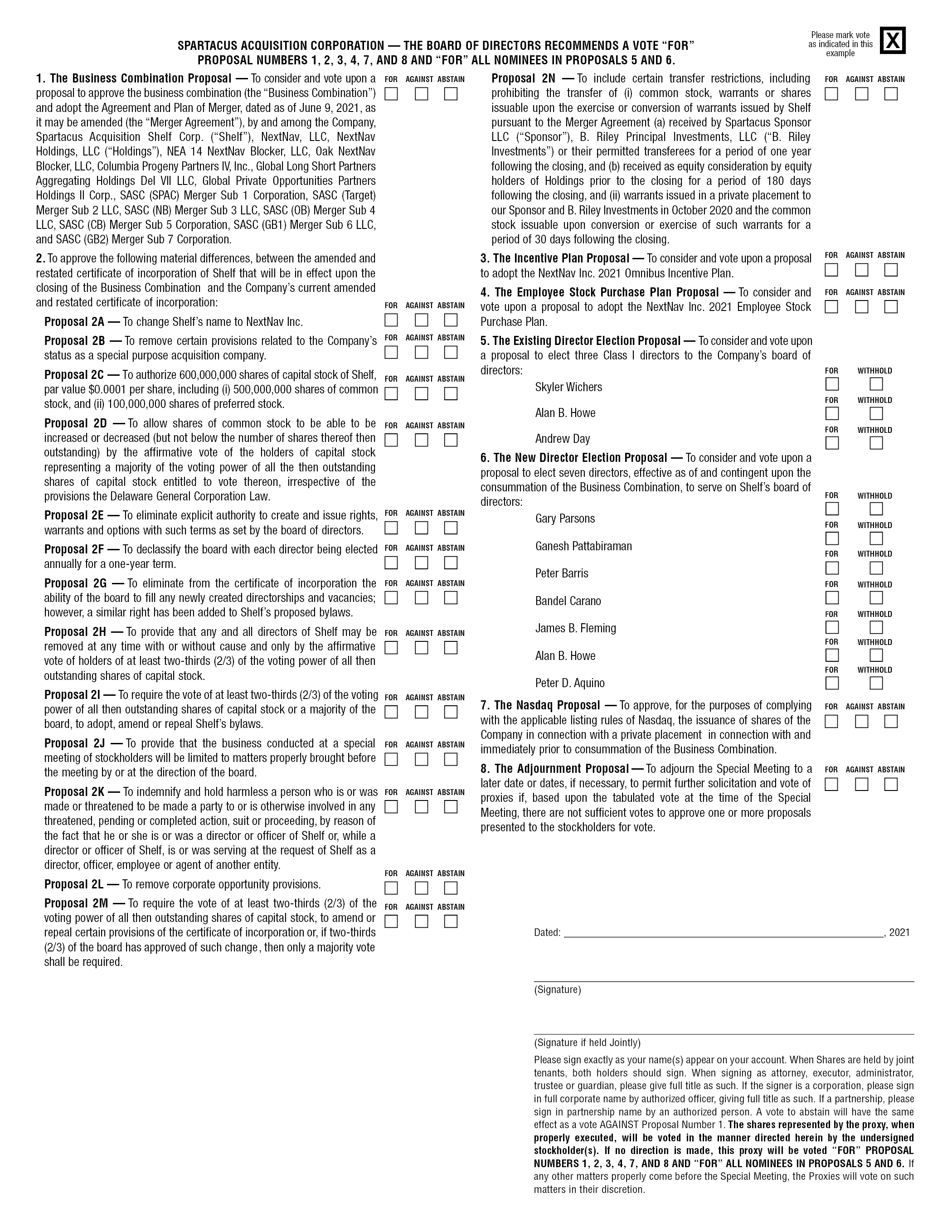

(1) The Business Combination Proposal — a proposal to approve the business combination and adopt the Merger Agreement;

(2) The charter Proposals — proposals to approve the following material differences, among other changes, between the amended and restated certificate of incorporation of Shelf that will be in effect upon the closing of the Transactions (the “NextNav Charter”), and the Company’s current amended and restated certificate of incorporation (our “charter”): (i) the name of the new public entity will be “NextNav Inc.” as opposed to “Spartacus Acquisition Corporation”; (ii) various provisions applicable only to blank check companies that are not applicable to Shelf will be removed; (iii) Shelf will have 500,000,000 authorized shares of common stock and 100,000,000 authorized shares of preferred stock, as opposed to the Company having 221,000,000 authorized shares of capital stock, consisting of 200,000,000 shares of Class A common stock and 20,000,000 shares of Class B common stock (together with the Class A common stock, our “common stock”) and 1,000,000 authorized shares of preferred stock, and will only have one class of common stock; (iv) Shelf’s stockholders will be able to increase or decrease (but not below the number of shares thereof then outstanding) the number of authorized shares of common stock by the affirmative vote of the holders of capital stock representing a majority of the voting power of all the then-outstanding shares, instead of by a vote of only the holders of that class being increased or decreased; (v) Shelf’s board of directors will be comprised of only one class of directors, with each director elected annually, as opposed to the current three classes of directors with each director elected to three year terms, and such directors may be removed with or without cause as opposed to only for cause; (vi) the NextNav Charter will include a requirement that the affirmative vote of at least two-thirds of the voting power of all the then outstanding shares Shelf be required to (A) adopt, amend or repeal any provision of the bylaws or (B) to amend certain articles of the NextNav Charter, unless two-thirds of the board of Shelf has already approved of change to the NextNav Charter, in which case only a majority of the voting power of all the then outstanding shares shall be required, in each case as opposed to, subject to certain exception, requiring a simple majority requirement; (vii) Shelf will not renounce any corporate opportunity; and (viii) the NextNav Charter will include provisions that restrict the transfer by certain Shelf stockholders other than our public stockholders for specific periods of time following closing;

(3) The Incentive Plan Proposal — a proposal to adopt the NextNav Inc. 2021 Omnibus Incentive Plan (the “Omnibus Plan”);

(4) The Employee Stock Purchase Plan Proposal — a proposal to adopt the NextNav Inc. 2021 Employee Stock Purchase Plan, (the “Employee Stock Purchase Plan”);

(5) The Existing Director Election Proposal — a proposal to elect three Class I directors to serve on our board of directors until the 2024 annual meeting of stockholders, and until their respective successors are duly elected and qualified or until their earlier resignation, removal or death;

(6) The New Director Election Proposal — a proposal to elect seven directors to Shelf’s board of directors (the “New Director Election Proposal” and together with the Existing Director Election Proposal, the “Director Election Proposals”);

(7) The Nasdaq Proposal — a proposal to approve, in accordance with the provisions of Nasdaq Listing Rule 5635, the issuance of more than 20% of Spartacus’ issued and outstanding common stock in connection with the private placement of shares of Spartacus’ Class A common stock in connection with and immediately prior to consummation of the Business Combination; and

(8) The Adjournment Proposal — a proposal to approve the adjournment of the special meeting by the chairman thereof to a later date, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve the Business Combination Proposal, the charter Proposals, the Incentive Plan Proposal, the Employee Stock Purchase Plan Proposal, the Director Election Proposals, or the Nasdaq Proposal.

These items of business are described in the attached proxy statement/prospectus, which we encourage you to read in its entirety before voting. Only holders of record of our common stock at the close of business on September 13, 2021 are entitled to notice of the special meeting and to vote and have their votes counted at the special meeting and any adjournments or postponements of the special meeting.

All Spartacus stockholders are cordially invited to virtually attend the special meeting. To ensure your representation at the special meeting, however, we urge you to complete, sign, date and return the enclosed proxy card as soon as possible. If you are a stockholder of record, you may also cast your vote online at the special meeting. If you sign, date and return your proxy card without indicating how you wish to vote, your proxy will be voted “FOR” each of the proposals presented at the special meeting. If you fail to return your proxy card and do not attend the special meeting online to vote, if you abstain from voting, or if you hold your shares in “street name” through a broker or other nominee and fail to give such nominee voting instructions (a “broker non-vote”), it will have the same effect as a vote “AGAINST” the Business Combination Proposal but will have no effect on the charter Proposals, the Incentive Plan Proposal, the Employee Stock Purchase Plan Proposal, the Existing Director Election Proposal, the New Director Election Proposal, the Nasdaq Proposal, or the Adjournment Proposal. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your shares or, if you wish to attend the special meeting and vote online, obtain a legal proxy from your broker or bank. Public stockholders may elect to redeem their public shares even if they vote “FOR” the Business Combination Proposal.

The Business Combination Proposal is conditioned on the approval of the charter Proposals, the New Director Election Proposal and the Nasdaq Proposal. In addition, (i) the charter Proposals are conditioned on the approval of the Business Combination Proposal and the Nasdaq Proposal, (ii) the Incentive Plan Proposal and the Employee Stock Purchase Plan Proposal are conditioned on the approval of the Business Combination Proposal, the charter Proposals and the Nasdaq Proposal, (iii) the New Director Election Proposal is conditioned on the approval of the Business Combination Proposal, the charter Proposals and the Nasdaq Proposal and (iv) the Nasdaq Proposal is conditioned on the Business Combination Proposal and the charter Proposals. Neither the Existing Director Election Proposal nor the Adjournment Proposal is conditioned on the approval of any other proposal set forth in the proxy statement/prospectus.

It is important for you to note that if the Business Combination Proposal is not approved by our stockholders, or if any other proposal is not approved by our stockholders and we and NextNav do not waive the applicable closing condition under the Merger Agreement, then we will not consummate the Transactions. After careful consideration, our board of directors has determined that the Business Combination Proposal, the charter Proposals, the Incentive Plan Proposal, the Employee Stock Purchase Plan Proposal, the Director Election Proposals, the Nasdaq Proposal, and the Adjournment Proposal are fair to and in the best interests of Spartacus and our stockholders and, therefore,

unanimously recommends that you vote or give instruction to vote “FOR” the Business Combination Proposal and “FOR” the other proposals presented in the accompanying proxy statement/prospectus. In considering the recommendation of our board of directors, you should keep in mind that our directors and executive officers may have interests in the Business Combination that are different from, or in addition to, the interests of our stockholders generally. For additional information, see the section entitled “Proposal No. 1 — The Business Combination Proposal — Interests of Certain Persons in the Business Combination.”

A complete list of Spartacus stockholders of record entitled to vote at the special meeting will be available for ten days before the special meeting at the principal executive offices of Spartacus for inspection by stockholders during ordinary business hours for any purpose germane to the special meeting.

Your vote is very important, regardless of the number of shares of our common stock you own. To ensure your representation at the special meeting, please take the time to vote by following the instructions contained in the accompanying proxy statement/prospectus and on your proxy card. Please vote promptly whether or not you expect to virtually attend the special meeting. Submitting a proxy now will not prevent you from being able to vote online at the special meeting.

Your attention is directed to the proxy statement/prospectus accompanying this notice (including the annexes thereto) for a more complete description of the business combination and related transactions and each of our proposals. Whether or not you plan to virtually attend the special meeting, we urge you to read the accompanying proxy statement/prospectus and its annexes carefully, including the section entitled “Risk Factors” beginning on page 41 thereof. If you have any questions regarding the accompanying proxy statement/prospectus or need assistance voting your shares, please call our proxy solicitor, Morrow Sodali LLC at (i) (800) 662-5200 if you are a stockholder or (ii) collect at (203) 658-9400 if you are a broker or bank.

|

Duluth, Georgia |

By Order of the Board of Directors, |

|

|

September 16, 2021 |

/s/ Igor Volshteyn |

|

|

Igor Volshteyn |

||

|

Chief Financial Officer and Corporate Secretary |

|

Page |

||

|

1 |

||

|

1 |

||

|

4 |

||

|

19 |

||

|

33 |

||

|

34 |

||

|

SELECTED UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

35 |

|

|

36 |

||

|

38 |

||

|

40 |

||

|

41 |

||

|

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

73 |

|

|

89 |

||

|

93 |

||

|

131 |

||

|

137 |

||

|

148 |

||

|

155 |

||

|

156 |

||

|

157 |

||

|

158 |

||

|

159 |

||

|

167 |

||

|

SPARTACUS’ MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

176 |

|

|

179 |

||

|

NEXTNAV’S MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

201 |

|

|

214 |

||

|

222 |

||

|

232 |

||

|

237 |

||

|

242 |

||

|

243 |

||

|

243 |

||

|

243 |

||

|

243 |

||

|

244 |

||

|

244 |

||

|

244 |

||

|

245 |

||

|

F-1 |

||

|

A-1 |

||

|

B-1 |

||

|

C-1 |

||

|

D-1 |

||

|

E-1 |

||

|

F-1 |

i

You may request copies of this proxy statement/prospectus and any other publicly available information concerning Shelf or the Company, without charge, by written request to Igor Volshteyn, Chief Financial Officer, at Spartacus Acquisition Corporation, 6470 E Johns Crossing, Suite 490, Duluth, Georgia 30097, or by telephone request at (770) 305-6434 or Morrow Sodali LLC, 470 West Avenue, Stamford, Connecticut 06902 or by telephone request at (800) 662-5200 if you are a stockholder or collect at (203) 658-9400 if you are a broker or bank or from the SEC through the SEC website at http://www.sec.gov.

In order for the Company’s stockholders to receive timely delivery of the documents in advance of the special meeting of the Company to be held on October 27, 2021, you must request the information no later than October 20, 2021, five business days prior to the date of the special meeting.

Unless otherwise stated or unless the context otherwise requires, the terms we, us, our, the Company and Spartacus refer to Spartacus Acquisition Corporation. Furthermore, in this proxy statement/prospectus:

“B. Riley Advisory” means GlassRatner Advisory & Capital Group, LLC (dba B. Riley Advisory Services).

“B. Riley Investments” means B. Riley Principal Investments, LLC.

“B. Riley Securities” means B. Riley Securities, Inc.

“Blockers” means NEA Blocker, Oak Blocker, Columbia Blocker, GS Blocker 1, and GS Blocker 2.

“Business Combination” or “business combination” means the Transactions contemplated by the Merger Agreement and related agreements.

“Class A common stock” means Class A common stock, par value $0.0001 per share, of Spartacus.

“Class B common stock” means Class B common stock, par value $0.0001 per share, of Spartacus.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“Company common stock” or “our common stock” means the Class A common stock and Class B common stock, collectively.

“Columbia Blocker” means Columbia Progeny Partners IV, Inc., a Delaware corporation.

“DGCL” means the Delaware General Corporation Law.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“founder shares” means the shares of our Class B common stock initially purchased by our Sponsor in a private placement prior to our IPO (or their permitted transferees).

“GS Blocker 1” means Global Long Short Partners Aggregating Holdings Del VII LLC, a Delaware limited liability company.

“GS Blocker 2” means Global Private Opportunities Partners Holdings II Corp., a Delaware corporation.

“Holdings” means NextNav Holdings, LLC, a Delaware limited liability company.

“Holdings Exchanging Parties” means Sellers and the other equity holders of Holdings.

“initial public offering” or “IPO” means our initial public offering, consummated on October 19, 2020, in which we sold 20,000,000 public units at $10.00 per unit.

“initial stockholders” or “initial holders” means our Sponsor and any other holders of our founder shares prior to our IPO (or their permitted transferees).

1

“Mergers” means, collectively, the following mergers pursuant to the Merger Agreement:

(a) the Spartacus Merger;

(b) the merger of MS 2 with and into Holdings, with Holdings surviving the merger;

(c) the merger of MS 3 with and into NEA Blocker, with NEA Blocker surviving the merger;

(d) the merger of MS 4 with and into Oak Blocker, with Oak Blocker surviving the merger;

(e) the merger of MS 5 with and into Columbia Blocker, with Columbia Blocker surviving the merger;

(f) the merger of MS 6 with and into GS Blocker 1, with GS Blocker 1 surviving the merger; and

(g) the merger of MS 7 with and into GS Blocker 2, with GS Blocker 2 surviving the merger.

“Merger Agreement” means the Agreement and Plan of Merger, dated as of June 9, 2021, as it may be amended, by and among Spartacus, Holdings, NextNav, LLC, Merger Entities, and Blockers.

“Merger Entities” means MS 1, MS 2, MS 3, MS 4, MS 5, MS 6, and MS 7.

“MS 1” means SASC (SPAC) Merger Sub 1 Corporation, a Delaware corporation.

“MS 2” means SASC (Target) Merger Sub 2 LLC, a Delaware limited liability company.

“MS 3” means SASC (NB) Merger Sub 3 LLC, a Delaware limited liability company.

“MS 4” means SASC (OB) Merger Sub 4 LLC, a Delaware limited liability company.

“MS 5” means SASC (CB) Merger Sub 5 Corporation, a Delaware corporation.

“MS 6” means SASC (GB1) Merger Sub 6 LLC, a Delaware limited liability company.

“MS 7” means SASC (GB2) Merger Sub 7 Corporation, a Delaware corporation.

“Nasdaq” means The Nasdaq Capital Market.

“NEA Blocker” means NEA 14 NextNav Blocker, LLC, a Delaware limited liability company.

“NextNav” means Holdings and its operating subsidiaries, including NextNav, LLC, a Delaware limited liability company.

“NextNav Bylaws” means the amended and restated bylaws of Shelf which will be adopted prior to the closing of the Business Combination and is attached hereto as Annex C.

“NextNav Charter” means the proposed amended and restated certificate of incorporation of Shelf. A copy of the proposed charter, which, if approved by our stockholders, will be filed with the Secretary of State of the State of Delaware immediately prior to the closing of the Business Combination is attached hereto as Annex B.

“Oak Blocker” means Oak NextNav Blocker, LLC, a Delaware limited liability company.

“PIPE Financing” means the expected issuance and sale of up to 20.5 million PIPE Shares at a purchase price of $10.00 per share for aggregate gross proceeds of $205.0 million in a private placement to the PIPE Investors pursuant to the Subscription Agreement.

“PIPE Investors” means the institutional accredited investors and qualified institutional buyers who entered into the Subscription Agreements for the PIPE Financing.

“PIPE Shares” means the shares of Class A common stock that are issued in the PIPE Financing.

“private placement warrants” means the warrants initially issued to our Sponsor and B. Riley Investments in a private placement simultaneously with the closing of our IPO.

“public shares” means the shares of our Class A common stock sold as part of the units in our IPO (whether they are purchased in our initial public offering or thereafter in the open market).

2

“public stockholders” means holders of our public shares, including our initial stockholders and management team to the extent our initial stockholders and/or members of our management team purchase public shares, provided that each initial stockholder’s and member of our management team’s status as a “public stockholder” shall only exist with respect to such public shares.

“public units” means Spartacus’ units sold in the IPO, each of which consists of one public share and one-half of one Public Warrants.

“public warrants” or “Public Warrants” means the 10,000,000 warrants underlying the public units issued in our IPO, each of which is exercisable for one share of our Class A common stock in accordance with its terms.

“Securities Act” means the Securities Act of 1933, as amended.

“Sellers” mean the equity holders of each of the Blockers.

“Shelf” means Spartacus Acquisition Shelf Corp., a Delaware corporation, which shall be the public company upon the closing of the business combination.

“special meeting” means the special meeting in lieu of the 2021 annual meeting of stockholders of Spartacus that is the subject of this proxy statement/prospectus.

“Spartacus Merger” means the merger of MS 1 with and into Spartacus, with Spartacus surviving the merger.

“Sponsor” means Spartacus Sponsor LLC, a Delaware limited liability company.

“Subscription Agreement” means the Subscription Agreement, dated June 9, 2021, entered into among the Company, Shelf and each of the PIPE Investors for the PIPE Financing.

“Transactions” means the Mergers and the other transactions contemplated by the Merger Agreement.

“Trust Account” means the trust account into which approximately $203.0 million of the net proceeds of our IPO and the private placement were deposited for the benefit of the public stockholders.

“warrant agreement” means, collectively, (i) the warrant agreement, dated October 15, 2020, by and between the Company and Continental Stock Transfer & Trust Company, as warrant agent, and (ii) the form of amended and restated warrant Agreement, by and among the Company, Shelf, and Continental Stock Transfer & Trust Company, as warrant agent.

3

QUESTIONS AND ANSWERS ABOUT THE PROPOSALS FOR STOCKHOLDERS

The following questions and answers briefly address some commonly asked questions about the proposals to be presented at the special meeting, including with respect to the proposed Transactions. The following questions and answers do not include all the information that may be important to you. We urge stockholders to read carefully this entire proxy statement/prospectus, including the annexes and the other documents referred to herein.

Q: Why am I receiving this proxy statement/prospectus?

A: Our stockholders are being asked to consider and vote upon a proposal to approve the business combination and adopt the Merger Agreement, among other proposals. We have entered into the Merger Agreement by and among Shelf, NextNav, LLC, Holdings, the Merger Entities and the Blockers. Pursuant to the Merger Agreement, the aggregate consideration to be paid to the Holdings Exchanging Parties in the Transactions will consist of, based on Holdings’ current capitalization, an estimated 67.4 million shares of Shelf’s common stock, options to purchase approximately 2.0 million shares of Shelf’s common stock and a warrant to purchase approximately 4.4 million shares of Shelf’s common stock. In addition, each outstanding share of our common stock shall be converted into one share of Shelf common stock and our outstanding warrants shall, by their terms, automatically entitle the holders to purchase shares of Shelf common stock upon consummation of the business combination. The number of shares of Shelf’s common stock to be issued as consideration in the business combination will be based on a $10.00 per share value. For additional information, see the section entitled “Proposal No. 1 — The Business Combination Proposal — The Merger Agreement — Consideration.” A copy of the Merger Agreement is attached to this proxy statement/prospectus as Annex A.

Our Class A common stock, units and warrants are currently listed on Nasdaq under the symbols “TMTS,” “TMTSU” and “TMTSW,” respectively. Prior to the closing of the business combination, Shelf will apply to list, to be effective at the time of the business combination, its common stock and warrants on Nasdaq. We expect its common stock and warrants to be listed under the symbols “NN” and “NNAVW,” respectively. At the closing, any of our units that are not already trading separately will automatically separate into their component shares of Shelf common stock and warrants to purchase one share of Shelf common stock. Shelf will not have units traded following consummation of the business combination.

This proxy statement/prospectus and its annexes contain important information about the proposed business combination and the other matters to be acted upon at the special meeting. Your vote is important. You are encouraged to submit your proxy as soon as possible after carefully reviewing this proxy statement/prospectus and its annexes, which we urge you to do.

Q: What is being voted on at the special meeting?

A: Our stockholders are being asked to vote on the following proposals:

The Business Combination Proposal — a proposal to approve the business combination and adopt the Merger Agreement;

The charter Proposals — proposals to approve the following material differences, among other changes, between the amended and restated certificate of incorporation of Shelf that will be in effect upon the closing of the Transactions ( the “NextNav Charter”), and the Company’s current amended and restated certificate of incorporation (our “charter”): (i) the name of the new public entity will be “NextNav Inc.” as opposed to “Spartacus Acquisition Corporation”; (ii) various provisions applicable only to blank check companies that are not applicable to Shelf will be removed; (iii) Shelf will have 500,000,000 authorized shares of common stock and 100,000,000 authorized shares of preferred stock, as opposed to the Company having 221,000,000 authorized shares of capital stock, consisting of 200,000,000 shares of Class A common stock and 20,000,000 shares of Class B common stock (together with the Class A common stock, our “common stock”), and 1,000,000 authorized shares of preferred stock, and will only have one class of common stock; (iv) Shelf’s stockholders will be able to increase or decrease (but not below the number of shares thereof then outstanding) the number of authorized shares of common stock by the affirmative vote of the holders of capital stock representing a majority of the voting power of all the then-outstanding shares, instead of by a vote of only the holders of that class being increased or decreased; (v) Shelf’s board of directors will be comprised of only one class of directors, with each director elected annually, as opposed to the current three classes of directors with each director elected to three year terms, and such directors may be removed with or without

4

cause as opposed to only for cause; (vi) the NextNav charter will include a requirement that the affirmative vote of at least two-thirds of the voting power of all the then outstanding shares Shelf be required to (A) adopt, amend or repeal any provision of the NextNav Bylaws or (B) to amend certain articles of the NextNav Charter, unless two-thirds of the board of Shelf has already approved of change to the NextNav Charter, in which case only a majority of the voting power of all the then outstanding shares shall be required, in each case as opposed to, subject to certain exception, requiring a simple majority requirement; (vii) Shelf will not renounce any corporate opportunity; and (viii) the NextNav Charter will include provisions that restrict the transfer by certain Shelf stockholders other than our public stockholders for specific periods of time following closing;

The Incentive Plan Proposal — a proposal to adopt the NextNav Inc. 2021 Omnibus Incentive Plan (the “Omnibus Plan”);

The Employee Stock Purchase Plan Proposal — a proposal to adopt the NextNav Inc. 2021 Employee Stock Purchase Plan (the “Employee Stock Purchase Plan”);

The Existing Director Election Proposal — a proposal to elect three Class I directors to serve on our board of directors until the 2024 annual meeting of stockholders, or in each case until his or her respective successors are duly elected and qualified by our board of directors or until his or her earlier death, resignation or removal from office;

The New Director Election Proposal — a proposal to elect, seven directors to the Combined Company’s board of directors;

The Nasdaq Proposal — a proposal to approve, in accordance with the provisions of Nasdaq Listing Rule 5635, the issuance of more than 20% of Spartacus’ issued and outstanding common stock in connection with the PIPE Financing in connection with and immediately prior to consummation of the Business Combination; and

The Adjournment Proposal — a proposal to approve the adjournment of the special meeting by the chairman thereof to a later date, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve the Business Combination Proposal, the charter Proposals, the Incentive Plan Proposal, the Employee Stock Purchase Plan Proposal, the Nasdaq Proposal, or the Director Election Proposals.

Q: Who can attend, vote and ask questions at the Annual Meeting?

A: Only stockholders as of the record date, or their duly appointed proxies, may virtually attend the special meeting. To enter the special meeting and have the ability to submit questions during the special meeting, stockholders must have their control number available. Only one stockholder per control number can access the special meeting. We encourage stockholders to log in to the website and access the special meeting before the special meeting’s start time.

Stockholders may vote electronically during the special meeting at https://www.cstproxy.com/spartacusacquisitioncorp/sm2021 by entering your control number and following the instructions.

During the special meeting, we will endeavor to answer as many questions submitted by stockholders as time permits. We reserve the right to exclude questions regarding topics that are not pertinent to meeting matters or company business. If we receive substantially similar questions, we may group such questions together and provide a single response to avoid repetition.

Q: Are the proposals conditioned on one another?

A: The Business Combination Proposal is conditioned on the approval of the charter Proposals, the New Director Election Proposal and the Nasdaq Proposal. In addition, (i) the charter Proposals are conditioned on the approval of the Business Combination Proposal and the Nasdaq Proposal, (ii) the Incentive Plan Proposal and the Employee Stock Purchase Plan Proposal are conditioned on the approval of the Business Combination Proposal, the charter Proposals and the Nasdaq Proposal, (iii) the New Director Election Proposal is conditioned on the approval of the Business Combination Proposal, the charter Proposals and the Nasdaq Proposal and (iv) the Nasdaq Proposal is conditioned on the Business Combination Proposal and the charter Proposals. Neither the Existing Director Election Proposal nor the Adjournment Proposal is conditioned on

5

the approval of any other proposal set forth in the proxy statement/prospectus. It is important for you to note that if the Business Combination Proposal is not approved by our stockholders, or if any other proposal is not approved by our stockholders and we and NextNav do not waive the applicable closing condition under the Merger Agreement, then the Transactions will not be consummated.

Q: Why is Spartacus providing stockholders with the opportunity to vote on the Business Combination?

A: Our charter requires that we provide all holders of public shares with the opportunity to have their public shares redeemed upon the consummation of our initial business combination in conjunction with either a tender offer or a stockholder vote. For business and other reasons, we have elected to provide our stockholders with the opportunity to have their public shares redeemed in connection with a stockholder vote rather than pursuant to a tender offer. Therefore, we are seeking to obtain the approval of our stockholders of the Business Combination Proposal, as required by the DGCL, in order to provide our public stockholders with the opportunity to redeem their public shares in connection with the closing of the Transactions.

Q: What will happen in the Business Combination?

A: At the closing, (i) MS 1 will be merged with and into Spartacus, with Spartacus surviving the merger; (ii) MS 2 will be merged with and into Holdings, with Holdings surviving the merger; (iii) MS 3 will be merged with and into NEA Blocker, with NEA Blocker surviving the merger; (iv) MS 4 will be merged with and into Oak Blocker, with Oak Blocker surviving the merger; (v) MS 5 will be merged with and into Columbia Blocker, with Columbia Blocker surviving the merger; (vi) MS 6 will be merged with and into GS Blocker 1, with GS Blocker 1 surviving the merger; and (vii) MS 7 will be merged with and into GS Blocker 2, with GS Blocker 2 surviving the merger. As a result of the Transactions, the Company, NEA Blocker, Oak Blocker, Columbia Blocker, GS Blocker 1, GS Blocker 2 and Holdings and the various operating subsidiaries of Holdings will become wholly owned subsidiaries of Shelf, with our stockholders and each of the Holdings Exchanging Parties becoming stockholders of Shelf. Upon consummation of the Business Combination, Shelf will become the public company and change its name to NextNav Inc.

Q: What equity stake will current Spartacus stockholders and Seller hold in Shelf after the closing?

A: We anticipate that, upon completion of the Transactions, assuming that none of our stockholders exercise redemption rights and that, based on Holdings’ expected capitalization at Closing, an aggregate of approximately 112.9 million shares of Shelf’s common stock will be issued in connection with the Transactions, our existing stockholders, together with the PIPE Investors, will hold in the aggregate approximately 40.3% of Shelf’s outstanding common stock (approximately 17.7% held by our public stockholders, approximately 18.2% held by our PIPE Investors and approximately 4.4% held by our Sponsor) and the Holdings Exchanging Parties will hold approximately 59.7% of Shelf’s outstanding common stock. If approximately 14.0 million shares of our Class A common stock are redeemed for cash, which assumes the maximum redemption of our shares while still providing for a minimum of $250.0 million of available cash on the closing date after giving effect to payments to redeeming stockholders and the Company’s and certain Sponsor transaction expenses and the proceeds from the PIPE Financing, and that an aggregate of approximately 98.9 million shares of Shelf’s common stock will be issued as consideration in the Transactions, upon completion of the Transactions, our existing stockholders, together with the PIPE Investors, will hold in the aggregate approximately 31.8% of Shelf’s outstanding common stock (approximately 6.0% held by our public stockholders, approximately 20.7% held by our PIPE Investor and approximately 5.1% held by our Sponsor) and the Holdings Exchanging Parties will hold approximately 68.2% of Shelf’s outstanding common stock. These ownership percentages do not take into account (1) any warrants or options to purchase Shelf’s common stock that will be outstanding following the Business Combination or (2) any equity awards that may be issued under our proposed Omnibus Plan and Employee Stock Purchase Plan following the Business Combination. If the actual facts are different than these assumptions (which is likely), the ownership percentages held by each of our existing stockholders, including Sponsor and Holdings Exchanging Parties, will be different.

For additional information regarding beneficial ownership, including how the exercise of warrants held by our Sponsor could alter ownership interests in Shelf, see the section in this proxy statement/prospectus entitled “Beneficial Ownership of Securities.”

If any of the public stockholders as of September 13, 2021 redeem their public shares at the closing of the business combination in accordance with our charter but continue to hold public warrants after the closing of the business combination, the aggregate value of the public warrants that may be retained by them, based on

6

the closing trading price per public warrant as of September 13, 2021, would be approximately $14.1 million, or $1.41 per public warrant, regardless of the amount of redemptions by the holders of public stockholders. Public stockholders that do not redeem their public shares in connection with the business combination will experience dilution upon the exercise of public warrants that are retained after the closing of the business combination by redeeming public stockholders. The percentage of the total number of outstanding shares of Shelf common stock that will be owned by public stockholders as a group will vary based on the number of public shares for which the holders thereof request redemption in connection with the business combination.

The following table illustrates varying beneficial ownership levels in Shelf, as well as possible sources and extents of dilution for non-redeeming public stockholders, assuming no redemptions by public stockholders, 50% of the maximum redemption by public stockholders, and the maximum redemptions by public stockholders:

|

No Redemptions(1) |

%(4) |

50% of Maximum Redemptions(2) |

%(4) |

Maximum Redemptions(3) |

%(4) |

||||||||||

|

Shares held by NextNav Stockholders |

67,391,678 |

59.7 |

% |

67,391,678 |

63.7 |

% |

67,391,678 |

68.2 |

% |

||||||

|

Spartacus Public Shares |

20,000,000 |

17.7 |

% |

12,981,356 |

12.3 |

% |

5,962,713 |

6.0 |

% |

||||||

|

Spartacus Founder Shares |

5,000,000 |

4.4 |

% |

5,000,000 |

4.7 |

% |

5,000,000 |

5.1 |

% |

||||||

|

PIPE Shares |

20,500,000 |

18.2 |

% |

20,500,000 |

19.4 |

% |

20,500,000 |

20.7 |

% |

||||||

|

Total Pro Forma Shares (projected to be issued and outstanding) |

112,891,678 |

100.0 |

% |

105,873,034 |

100.0 |

% |

98,854,391 |

100.0 |

% |

||||||

|

Potential sources of dilution: |

|

|

|

||||||||||||

|

Spartacus Warrants(5) |

18,750,000 |

12.4 |

% |

18,750,000 |

13.0 |

% |

18,750,000 |

13.7 |

% |

||||||

|

NextNav Employee Options(6) |

1,792,892 |

1.2 |

% |

1,792,892 |

1.2 |

% |

1,792,892 |

1.3 |

% |

||||||

|

Transaction Grant(7) |

2,726,908 |

1.8 |

% |

2,726,908 |

1.9 |

% |

2,726,908 |

2.0 |

% |

||||||

|

AT&T Warrants(8) |

4,351,662 |

2.9 |

% |

4,351,662 |

3.0 |

% |

4,351,662 |

3.2 |

% |

||||||

|

Other Options |

180,039 |

0.1 |

% |

180,039 |

0.1 |

% |

180,039 |

0.1 |

% |

||||||

|

Omnibus Plan(9) |

10,091,994 |

6.7 |

% |

10,091,994 |

7.0 |

% |

10,091,994 |

7.4 |

% |

||||||

|

Total Pro Forma Shares (projected to be issued and outstanding including potential sources of dilution) |

150,785,173 |

|

143,766,529 |

|

136,747,886 |

|

|||||||||

____________

(1) The expected beneficial ownership of shares of Shelf common stock immediately following the closing of the business combination and the PIPE Financing, assuming none of our public shares are redeemed, has been determined based upon the following assumptions: (i) no public stockholder has exercised its redemption rights to receive cash from the Trust Account in exchange for its shares of Class A common stock; and (ii) there will be an aggregate of 112,891,678 shares of Shelf common stock issued and outstanding at the closing of the business combination (including (w) 20,000,000 shares of Shelf common stock issued to our holders of public shares upon the conversion of the public shares upon the closing of the business combination, (x) 5,000,000 shares of Shelf common stock issued to our initial stockholders upon the conversion of the Class B common stock shares upon the closing of the business combination, (y) 20,500,000 shares of Shelf common stock issued to our PIPE Investors upon the conversion of 20,500,000 Class A common stock shares of upon the closing of the business combination, and (z) 67,391,678 shares of Shelf common stock issued to the equity holders of Holdings, NEA Blocker, Oak Blocker, Columbia Blocker, GS Blocker 1 and GS Blocker 2 in connection with the business combination).

(2) This scenario assumes that approximately half of the 14,037,287 shares of Class A common stock (or 7,018,644 shares of Class A common stock) are redeemed (the maximum redemption under which Spartacus believes it would be able to satisfy the minimum cash condition of $250.0 million). The expected beneficial ownership of shares of Shelf common stock immediately following the closing of the business combination and the PIPE Financing, assuming half of the maximum number of public shares are redeemed which Spartacus believes it would be able to satisfy the minimum cash condition of $250.0 million, has been determined based upon the following assumptions: (i) 7,018,644 shares of Class A common stock held by public stockholders are redeemed to receive cash from the Trust Account in exchange for shares of Class A common stock; and (ii) there will be an aggregate of 105,873,034 shares of Shelf common stock issued and outstanding at the closing of the business combination (including (w) 12,981,356 shares of Shelf common stock issued to our holders of public shares upon the conversion of the public shares upon the closing of the business combination), (x) 5,000,000 shares of Shelf common stock issued to our initial stockholders upon the conversion of the Class B common

7

stock shares upon the closing of the business combination, (y) 20,500,000 shares of Shelf common stock issued to our PIPE Investors upon the conversion of 20,500,000 Class A common stock shares of upon the closing of the business combination, and (z) 67,391,678 shares of Shelf common stock issued to the equity holders of Holdings, NEA Blocker, Oak Blocker, Columbia Blocker, GS Blocker 1 and GS Blocker 2 in connection with the business combination).

(3) This scenario assumes that approximately 14,037,287 shares of Class A common stock are redeemed (the maximum redemption under which Spartacus believes it would be able to satisfy the minimum cash condition of $250.0 million). The expected beneficial ownership of shares of Shelf common stock immediately following the closing of the business combination and the PIPE Financing, assuming the maximum number of public shares are redeemed which Spartacus believes it would be able to satisfy the minimum cash condition of $250.0 million, has been determined based upon the following assumptions: (i) 14,037,287 shares of Class A common stock held by public stockholders are redeemed to receive cash from the Trust Account in exchange for shares of Class A common stock; and (ii) there will be an aggregate of 98,854,391 shares of Shelf common stock issued and outstanding at the closing of the business combination (including (w) 5,962,713 shares of Shelf common stock issued to our holders of public shares upon the conversion of the public shares upon the closing of the business combination), (x) 5,000,000 shares of Shelf common stock issued to our initial stockholders upon the conversion of the Class B common stock shares upon the closing of the business combination, (y) 20,500,000 shares of Shelf common stock issued to our PIPE Investors upon the conversion of 20,500,000 Class A common stock shares of upon the closing of the business combination, and (z) 67,391,678 shares of Shelf common stock issued to the equity holders of Holdings, NEA Blocker, Oak Blocker, Columbia Blocker, GS Blocker 1 and GS Blocker 2 in connection with the business combination).

(4) Numbers may not equal 100% due to rounding.

(5) Includes 10,000,000 public warrants and 8,750,000 private placement warrants.

(6) Represents NextNav stock options held by NextNav employees exercisable for shares of Shelf common stock.

(7) Represents 2,726,908 restricted shares of Shelf common stock or restricted stock units of Shelf that may be granted under the Omnibus Plan pursuant to the Merger Agreement to certain individuals that were executives, employees or individual service providers of NextNav as of immediately prior to the closing exercisable for shares of Shelf common stock.

(8) Represents NextNav warrants held by AT&T exercisable for shares of Shelf common stock.

(9) Represents the maximum number of shares of Shelf common stock reserved for issuance under the Omnibus Plan, excluding the above 2,726,908 restricted shares of Shelf common stock or restricted stock units of Shelf that may be granted under the Omnibus Plan pursuant to the Merger Agreement to certain individuals that were executives, employees or individual service providers of NextNav as of immediately prior to the closing exercisable for shares of Shelf common stock.

Q: What conditions must be satisfied to complete the Transactions?

A: There are a number of closing conditions in the Merger Agreement, including that our stockholders have approved the Transactions and adopted the Merger Agreement. For a summary of the conditions that must be satisfied or waived prior to completion of the Transactions, see the section entitled “Proposal No. 1 — The Business Combination Proposal — The Merger Agreement — Conditions to the Closing of the Transactions.”

Q: Why is Spartacus proposing the charter Proposals?

A: We are asking our stockholders to approve material differences between the organizational documents of Shelf that will be in effect upon the closing of the Transactions and our charter. The proposed material differences that we are asking our stockholders to approve include the following:

(i) the name of the new public entity will be “NextNav Inc.” as opposed to “Spartacus Acquisition Corporation,”

(ii) various provisions applicable only to blank check companies that are not applicable to Shelf will be removed,

(iii) Shelf will have 500,000,000 authorized shares of common stock and 100,000,000 authorized shares of preferred stock, as opposed to the Company having 221,000,000 authorized shares of capital stock, consisting of 200,000,000 shares of Class A common stock and 20,000,000 shares of Class B common stock, and 1,000,000 authorized shares of preferred stock, and only have one class of common stock,

(iv) Shelf’s stockholders will be able to increase or decrease (but not below the number of shares thereof then outstanding) the number of authorized shares of common stock by the affirmative vote of the holders of capital stock representing a majority of the voting power of all the then-outstanding shares, instead of by a vote of only the holders of that class being increased or decreased,

8

(v) Shelf’s board of directors will be comprised of only one class of directors, with each director elected annually, as opposed to the current three classes of directors with each director elected to three year terms, and such directors may be removed with or without cause as opposed to only for cause,

(vi) the NextNav Charter will include a requirement that the affirmative vote of at least two-thirds of the voting power of all the then outstanding shares Shelf be required to (A) adopt, amend or repeal any provision of the NextNav Bylaws or (B) to amend certain articles of the NextNav Charter, unless two-thirds of the board of Shelf has already approved of change to the NextNav Charter, in which case only a majority of the voting power of all the then outstanding shares shall be required, in each case as opposed to, subject to certain exception, requiring a simple majority requirement,

(vii) Shelf will not renounce any corporate opportunity, and

(viii) the NextNav Charter will include provisions that restrict the transfer by certain Shelf stockholders other than our public stockholders for specific periods of time following closing.

Q: Why is Spartacus proposing the Incentive Plan Proposal and the Employee Stock Purchase Plan Proposal?

A: The purpose of the Omnibus Plan is to provide eligible employees, directors and consultants of Shelf with the opportunity to receive stock-based incentive awards in order to encourage such persons to contribute materially to the growth of Shelf and align their economic interests with those of its stockholders. The Employee Stock Purchase Plan provides eligible employees with an opportunity to purchase shares of Shelf common stock at a discount through accumulated payroll deductions and to benefit from stock price appreciation, thus enhancing the alignment of employee and stockholder interests. Nasdaq Listing Rule 5635(c) requires stockholder approval of certain equity compensation plans. Accordingly, we are proposing the Incentive Plan Proposal and the Employee Stock Purchase Plan Proposal to request such stockholder approval of the Omnibus Plan and the Employee Stock Purchase Plan. In addition, pursuant to the Merger Agreement, approval of the Incentive Plan Proposal and the Employee Stock Purchase Plan Proposal is a condition to consummation of the Transactions.

Q: What happens if I sell my shares of Company common stock before the special meeting?

A: The record date for the special meeting is September 13, 2021, and is earlier than the date on which we expect the Business Combination to be completed. If you transfer your shares of common stock after the record date, but before the special meeting, unless the transferee obtains a proxy from you to vote those shares, you will retain your right to vote at the special meeting. However, you will not be able to seek redemption of your shares because you will no longer be able to deliver them for cancellation upon consummation of the Business Combination. If you transfer your shares of our common stock before the record date, you will have no right to vote those shares at the special meeting or redeem those shares for a pro rata portion of the proceeds held in our Trust Account. Regardless of whether you transfer your shares of common stock before or after the record date, your transferee will be entitled to exercise redemption rights with respect to the shares purchased by following the procedures set forth in this proxy statement/prospectus.

Q: What constitutes a quorum at the special meeting?

A: A quorum will be present at the special meeting if holders of shares of our outstanding capital stock representing a majority of the voting power of all outstanding shares of our capital stock entitled to vote at such meeting are represented in person or by proxy. If a stockholder fails to vote his, her or its shares online or by proxy, or if a broker fails to vote online or by proxy shares held by it in nominee name, such shares will not be counted for the purposes of establishing a quorum. If a stockholder who holds his, her or its shares in “street name” through a broker or other nominee fails to give voting instructions to such broker or other nominee (a “broker non-vote”) on all of the proposals set forth in this proxy statement/prospectus, such shares will not be counted for the purposes of establishing a quorum. An abstention from voting, shares represented at the special meeting online or by proxy but not voted on one or more proposals, or a broker non-vote, so long as the stockholder has given the broker or other nominee voting instructions on at least one of the proposals in this proxy statement/prospectus, will each count as present for the purposes of establishing a quorum. In the absence of a quorum, the chairman of the special meeting may adjourn the special meeting until a quorum shall attend. As of the record date for the special meeting, the presence online or by proxy of 12,500,001 shares of our common stock is required to achieve a quorum.

9

Q: What vote is required to approve the proposals presented at the special meeting?

A: The approval of the Business Combination Proposal requires the affirmative vote of the holders of a majority of the outstanding shares of our common stock entitled to vote on such proposal. Accordingly, a stockholder’s failure to vote online or by proxy, a broker non-vote or an abstention on the Business Combination Proposal will have the same effect as a vote “AGAINST” such proposal.

The approval of each of the charter Proposals, the Incentive Plan Proposal, the Employee Stock Purchase Plan Proposal, the Nasdaq Proposal and the Adjournment Proposal require the affirmative vote of holders of a majority of the total votes cast on such proposal. In order to be elected as a director as described in (i) the Existing Director Election Proposal, a nominee must receive a plurality of all the votes cast only by holders of Class B common stock at the special meeting, which means that the nominees with the most votes are elected and (ii) the New Director Election Proposal, a nominee must receive a plurality of all the votes cast at the special meeting, which means that the nominees with the most votes are elected. Accordingly, neither a stockholder’s failure to vote online or by proxy, a broker non-vote nor an abstention will be considered a “vote cast,” and, thus, will have no effect on the outcome of the charter Proposals, the Incentive Plan Proposal, the Employee Stock Purchase Plan Proposal, the Existing Director Election Proposal, the New Director Election Proposal, the Nasdaq Proposal, or the Adjournment Proposal.

Q: How will the initial stockholders and Spartacus’ directors and officers vote?

A: In connection with our IPO, we entered into an agreement with each of our initial stockholders, our executive officers and our directors, pursuant to which they agreed to vote any shares of our common stock owned by them in favor of a proposed business combination. As of the date of this proxy statement/prospectus, our Sponsor (and their affiliates (as defined by Rule 405 under the Securities Act)), executive officers and directors, in the aggregate, own approximately 22% of our issued and outstanding shares of common stock, including all of the founder shares. None of our initial stockholders, executive officers or directors have entered into agreements, and are not currently in negotiations, to purchase or sell shares prior to the record date.

Q: May the initial stockholders, Spartacus’ directors, officers, advisors or their respective affiliates purchase shares in connection with the Business Combination?

A: At any time prior to the special meeting, our initial stockholders, directors, officers, advisors or their respective affiliates may purchase shares of our common stock on the open market, and may purchase shares in privately negotiated transactions from stockholders who vote, or indicate an intention to vote, against the Business Combination Proposal, or who have elected or redeem, or indicate an intention to redeem, their shares in connection with the Business Combination. Any such privately negotiated purchases may be effected at purchase prices that are in excess of fair market value or in excess of the per-share pro rata portion of the Trust Account. Our initial stockholders, directors, officers, advisors and their respective affiliates may also enter into transactions with stockholders and others to provide them with incentives to acquire shares of our common stock, to vote their shares in favor of the Business Combination Proposal or to not redeem their shares in connection with the Business Combination. While the exact nature of such incentives has not been determined as of the date of this proxy statement/prospectus, they might include, without limitation, arrangements to protect such persons against potential loss in value of their shares, including the granting of put options and the transfer to such persons of shares or warrants for nominal value. Our initial stockholders, directors, officers or their respective affiliates will not effect any such purchases when they are in possession of any material non-public information relating to Spartacus or NextNav, during a restricted period under Regulation M under the Exchange Act or in a transaction which would violate Section 9(a)(2) or Rule 10(b)-5 under the Exchange Act.

Q: How many votes do I have at the special meeting?

A: Our stockholders are entitled to one vote at the special meeting for each share of our common stock held of record as of September 13, 2021, the record date for the special meeting. As of the close of business on the record date, there were 25,000,000 outstanding shares of our common stock.

Q: What interests do our Sponsor and Spartacus’ current executive officers and directors have in the Business Combination?

A: Our Sponsor and our directors and executive officers have interests in the Business Combination that are different from or in addition to (and which may conflict with) the interests of our stockholders. As more

10

fully set forth below, the Sponsor and its affiliates have approximately $8.7 million in the aggregate at risk that depends upon the completion of a business combination. Specifically, (i) $25,000 of such amount was paid for the 5,000,000 founders shares (which if unrestricted and freely tradable would be valued at approximately $50.4 million, based on the closing price of our Class A common stock on September 13, 2021), (ii) $8,104,244 for its 8,104,244 private placement warrants (which based on our quarterly third-party valuation was valued at $1.42 per private placement warrant, or approximately $11.5 million in the aggregate, as of June 30, 2021), and (iii) as of September 13, 2021, there was $600,000 drawn under a working capital loan from our Sponsor. The foregoing interests, and those set forth in more detail below, present a risk that the Sponsor and its affiliates will benefit from the completion of a business combination, including in a manner that may not be aligned with public stockholders — as such, the Sponsor may be incentivized to complete an acquisition of a less favorable target company or on terms less favorable to public stockholders rather than liquidate. These interests include, among other things, the interests listed below:

• that our Sponsor and certain of our officers and directors will hold Shelf common stock following the Business Combination, subject to lock-up agreements;

• that our Sponsor and our officers and directors will hold private placement warrants to purchase shares of Shelf common stock following the Business Combination;

• that MILFAM Investments LLC, an affiliate of MILFAM CI LLC SPARTACUS, one of the managing members of our Sponsor, paid $5.0 million for its 500,000 public units (which if unrestricted and freely tradable would be valued at approximately $5.4 million, based on the closing price of our public units on September 13, 2021) (MILFAM Investments LLC has not waived its redemption rights in connection with the underlying 500,000 public shares.);

• that our Sponsor paid (i) $25,000 for its 5,000,000 founder shares that it currently owns (which if unrestricted and freely tradable would be valued at approximately $50.4 million, based on the closing price of our Class A common stock on September 13, 2021) and (ii) $8,104,244 for its 8,104,244 private placement warrants (which based on our quarterly third-party valuation was valued at $1.42 per private placement warrant, or approximately $11.5 million in the aggregate, as of June 30, 2021) and that such securities are expected to have a significantly higher value at the time of the consummation Business Combination and will have little or no value if we do not complete the Business Combination;

• the fact that given the differential in purchase price that our Sponsor paid for the founder shares as compared to the price of the public units sold in the IPO and the substantial number of shares of Shelf common stock that our Sponsor will receive upon conversion of the founder shares in connection with the Business Combination, our Sponsor and its affiliates may realize a positive rate of return on such investments even if other public stockholders experience a negative rate of return following the Business Combination;