2021Q20001552000--12-31falseP5YP5YP5YP5Y612300015520002021-01-012021-06-30xbrli:shares00015520002021-07-30iso4217:USD0001552000us-gaap:ServiceMember2021-04-012021-06-300001552000us-gaap:ServiceMember2020-04-012020-06-300001552000us-gaap:ServiceMember2021-01-012021-06-300001552000us-gaap:ServiceMember2020-01-012020-06-300001552000us-gaap:ServiceOtherMember2021-04-012021-06-300001552000us-gaap:ServiceOtherMember2020-04-012020-06-300001552000us-gaap:ServiceOtherMember2021-01-012021-06-300001552000us-gaap:ServiceOtherMember2020-01-012020-06-3000015520002021-04-012021-06-3000015520002020-04-012020-06-3000015520002020-01-012020-06-300001552000mplx:MarathonPetroleumCorporationMember2021-04-012021-06-300001552000mplx:MarathonPetroleumCorporationMember2020-04-012020-06-300001552000mplx:MarathonPetroleumCorporationMember2021-01-012021-06-300001552000mplx:MarathonPetroleumCorporationMember2020-01-012020-06-300001552000us-gaap:ProductMember2021-04-012021-06-300001552000us-gaap:ProductMember2020-04-012020-06-300001552000us-gaap:ProductMember2021-01-012021-06-300001552000us-gaap:ProductMember2020-01-012020-06-300001552000us-gaap:ProductMembermplx:MarathonPetroleumCorporationMember2021-04-012021-06-300001552000us-gaap:ProductMembermplx:MarathonPetroleumCorporationMember2020-04-012020-06-300001552000us-gaap:ProductMembermplx:MarathonPetroleumCorporationMember2021-01-012021-06-300001552000us-gaap:ProductMembermplx:MarathonPetroleumCorporationMember2020-01-012020-06-300001552000us-gaap:OilAndGasRefiningAndMarketingMember2021-04-012021-06-300001552000us-gaap:OilAndGasRefiningAndMarketingMember2020-04-012020-06-300001552000us-gaap:OilAndGasRefiningAndMarketingMember2021-01-012021-06-300001552000us-gaap:OilAndGasRefiningAndMarketingMember2020-01-012020-06-300001552000us-gaap:NaturalGasMidstreamMember2021-04-012021-06-300001552000us-gaap:NaturalGasMidstreamMember2020-04-012020-06-300001552000us-gaap:NaturalGasMidstreamMember2021-01-012021-06-300001552000us-gaap:NaturalGasMidstreamMember2020-01-012020-06-300001552000mplx:RentalCostOfSalesMember2021-04-012021-06-300001552000mplx:RentalCostOfSalesMember2020-04-012020-06-300001552000mplx:RentalCostOfSalesMember2021-01-012021-06-300001552000mplx:RentalCostOfSalesMember2020-01-012020-06-300001552000mplx:RentalcostofsalesrelatedpartiesMembermplx:MarathonPetroleumCorporationMember2021-04-012021-06-300001552000mplx:RentalcostofsalesrelatedpartiesMembermplx:MarathonPetroleumCorporationMember2020-04-012020-06-300001552000mplx:RentalcostofsalesrelatedpartiesMembermplx:MarathonPetroleumCorporationMember2021-01-012021-06-300001552000mplx:RentalcostofsalesrelatedpartiesMembermplx:MarathonPetroleumCorporationMember2020-01-012020-06-300001552000us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredPartnerMember2021-04-012021-06-300001552000us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredPartnerMember2020-04-012020-06-300001552000us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredPartnerMember2021-01-012021-06-300001552000us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredPartnerMember2020-01-012020-06-300001552000us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredPartnerMember2021-04-012021-06-300001552000us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredPartnerMember2020-04-012020-06-300001552000us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredPartnerMember2021-01-012021-06-300001552000us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredPartnerMember2020-01-012020-06-30iso4217:USDxbrli:shares0001552000mplx:LimitedPartnersCommonUnitsMember2021-04-012021-06-300001552000mplx:LimitedPartnersCommonUnitsMember2020-04-012020-06-300001552000mplx:LimitedPartnersCommonUnitsMember2021-01-012021-06-300001552000mplx:LimitedPartnersCommonUnitsMember2020-01-012020-06-3000015520002021-06-3000015520002020-12-310001552000mplx:SeriesAConvertiblePreferredUnitsMember2021-06-300001552000mplx:SeriesAConvertiblePreferredUnitsMember2020-12-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2021-06-300001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2020-12-310001552000mplx:LimitedPartnersCommonUnitsMembermplx:MarathonPetroleumCorporationMember2021-06-300001552000mplx:LimitedPartnersCommonUnitsMembermplx:MarathonPetroleumCorporationMember2020-12-310001552000us-gaap:SeriesBPreferredStockMember2021-06-300001552000us-gaap:SeriesBPreferredStockMember2020-12-310001552000mplx:LoopLlcandExplorerPipelineMember2021-06-300001552000mplx:LoopLlcandExplorerPipelineMember2020-12-310001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2021-01-012021-06-300001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2020-01-012020-06-3000015520002019-12-3100015520002020-06-300001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2019-12-310001552000mplx:LimitedPartnersCommonUnitsMembermplx:MarathonPetroleumCorporationMember2019-12-310001552000us-gaap:SeriesBPreferredStockMember2019-12-310001552000mplx:LoopLlcandExplorerPipelineMember2019-12-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2020-01-012020-03-310001552000mplx:LimitedPartnersCommonUnitsMembermplx:MarathonPetroleumCorporationMember2020-01-012020-03-310001552000us-gaap:SeriesBPreferredStockMember2020-01-012020-03-310001552000us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001552000us-gaap:NoncontrollingInterestMember2020-01-012020-03-3100015520002020-01-012020-03-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2020-03-310001552000mplx:LimitedPartnersCommonUnitsMembermplx:MarathonPetroleumCorporationMember2020-03-310001552000us-gaap:SeriesBPreferredStockMember2020-03-310001552000mplx:LoopLlcandExplorerPipelineMember2020-03-3100015520002020-03-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2020-04-012020-06-300001552000mplx:LimitedPartnersCommonUnitsMembermplx:MarathonPetroleumCorporationMember2020-04-012020-06-300001552000us-gaap:SeriesBPreferredStockMember2020-04-012020-06-300001552000us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300001552000us-gaap:NoncontrollingInterestMember2020-04-012020-06-300001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2020-06-300001552000mplx:LimitedPartnersCommonUnitsMembermplx:MarathonPetroleumCorporationMember2020-06-300001552000us-gaap:SeriesBPreferredStockMember2020-06-300001552000mplx:LoopLlcandExplorerPipelineMember2020-06-300001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2021-01-012021-03-310001552000mplx:LimitedPartnersCommonUnitsMembermplx:MarathonPetroleumCorporationMember2021-01-012021-03-310001552000us-gaap:SeriesBPreferredStockMember2021-01-012021-03-310001552000us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001552000us-gaap:NoncontrollingInterestMember2021-01-012021-03-3100015520002021-01-012021-03-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2021-03-310001552000mplx:LimitedPartnersCommonUnitsMembermplx:MarathonPetroleumCorporationMember2021-03-310001552000us-gaap:SeriesBPreferredStockMember2021-03-310001552000mplx:LoopLlcandExplorerPipelineMember2021-03-3100015520002021-03-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2021-04-012021-06-300001552000mplx:LimitedPartnersCommonUnitsMembermplx:MarathonPetroleumCorporationMember2021-04-012021-06-300001552000us-gaap:SeriesBPreferredStockMember2021-04-012021-06-300001552000us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-012021-06-300001552000us-gaap:NoncontrollingInterestMember2021-04-012021-06-30xbrli:pure0001552000mplx:WesternRefiningWholesaleWesternRefiningProductTransportMember2020-07-312020-07-310001552000mplx:GatheringandProcessingMember2020-01-012020-03-310001552000mplx:SaleOfJavelinaAssetsAndLiabilitiesMember2021-01-012021-06-300001552000mplx:WesternRefiningWholesaleWesternRefiningProductTransportMember2020-07-310001552000mplx:MarEnBakkenCompanyLLCMember2021-06-300001552000mplx:MarEnBakkenCompanyLLCMembermplx:LogisticsandStorageMember2021-06-300001552000mplx:MarEnBakkenCompanyLLCMembermplx:LogisticsandStorageMember2020-12-310001552000mplx:IllinoisExtensionPipelineCompanyLLCMember2021-06-300001552000mplx:IllinoisExtensionPipelineCompanyLLCMembermplx:LogisticsandStorageMember2021-06-300001552000mplx:IllinoisExtensionPipelineCompanyLLCMembermplx:LogisticsandStorageMember2020-12-310001552000mplx:LoopLlcMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:LoopLlcMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:LoopLlcMember2020-12-310001552000mplx:AndeavorLogisticsRioPipelineMember2021-06-300001552000mplx:AndeavorLogisticsRioPipelineMembermplx:LogisticsandStorageMember2021-06-300001552000mplx:AndeavorLogisticsRioPipelineMembermplx:LogisticsandStorageMember2020-12-310001552000mplx:MinnesotaPipeLineCompanyLLCMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:MinnesotaPipeLineCompanyLLCMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:MinnesotaPipeLineCompanyLLCMember2020-12-310001552000mplx:WhistlerPipelineLLCMember2021-06-300001552000mplx:WhistlerPipelineLLCMembermplx:LogisticsandStorageMember2021-06-300001552000mplx:WhistlerPipelineLLCMembermplx:LogisticsandStorageMember2020-12-310001552000mplx:ExplorerPipelineMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:ExplorerPipelineMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:ExplorerPipelineMember2020-12-310001552000mplx:W2WHoldingsLLCMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:W2WHoldingsLLCMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:W2WHoldingsLLCMember2020-12-310001552000mplx:LogisticsandStorageMembermplx:OtherVIEsandNonVIEsMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:OtherVIEsandNonVIEsMember2020-12-310001552000mplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2021-06-300001552000mplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2020-12-310001552000mplx:MarkWestUticaEMGMember2021-06-300001552000mplx:MarkWestUticaEMGMembermplx:GatheringandProcessingMember2021-06-300001552000mplx:MarkWestUticaEMGMembermplx:GatheringandProcessingMember2020-12-310001552000mplx:SherwoodMidstreamLLCMember2021-06-300001552000mplx:GatheringandProcessingMembermplx:SherwoodMidstreamLLCMember2021-06-300001552000mplx:GatheringandProcessingMembermplx:SherwoodMidstreamLLCMember2020-12-310001552000mplx:MarkWestEMGJeffersonDryGasGatheringCompanyL.L.C.Member2021-06-300001552000mplx:MarkWestEMGJeffersonDryGasGatheringCompanyL.L.C.Membermplx:GatheringandProcessingMember2021-06-300001552000mplx:MarkWestEMGJeffersonDryGasGatheringCompanyL.L.C.Membermplx:GatheringandProcessingMember2020-12-310001552000mplx:MarkWestTornadoGPLLCMember2021-06-300001552000mplx:GatheringandProcessingMembermplx:MarkWestTornadoGPLLCMember2021-06-300001552000mplx:GatheringandProcessingMembermplx:MarkWestTornadoGPLLCMember2020-12-310001552000mplx:RendezvousGasServicesL.L.C.Member2021-06-300001552000mplx:GatheringandProcessingMembermplx:RendezvousGasServicesL.L.C.Member2021-06-300001552000mplx:GatheringandProcessingMembermplx:RendezvousGasServicesL.L.C.Member2020-12-310001552000mplx:DirectOwnershipInterestMembermplx:SherwoodMidstreamHoldingsMember2021-06-300001552000mplx:GatheringandProcessingMembermplx:SherwoodMidstreamHoldingsMember2021-06-300001552000mplx:GatheringandProcessingMembermplx:SherwoodMidstreamHoldingsMember2020-12-310001552000mplx:CentrahomaProcessingLLCMember2021-06-300001552000mplx:CentrahomaProcessingLLCMembermplx:GatheringandProcessingMember2021-06-300001552000mplx:CentrahomaProcessingLLCMembermplx:GatheringandProcessingMember2020-12-310001552000mplx:GatheringandProcessingMembermplx:OtherVIEsandNonVIEsMember2021-06-300001552000mplx:GatheringandProcessingMembermplx:OtherVIEsandNonVIEsMember2020-12-310001552000mplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2021-06-300001552000mplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2020-12-310001552000mplx:BakkenPipelineSystemMembermplx:IndirectOwnershipInterestMember2021-06-300001552000mplx:WinktoWebsterPipelineLLCMembermplx:IndirectOwnershipInterestMember2021-06-300001552000mplx:IndirectOwnershipInterestMembermplx:SherwoodMidstreamHoldingsMember2021-06-300001552000mplx:MarkWestUticaEMGMember2020-01-012020-03-310001552000mplx:OtherVIEsMember2021-01-012021-06-300001552000mplx:NonVIEsMember2021-01-012021-06-300001552000mplx:OtherVIEsandNonVIEsMember2021-01-012021-06-300001552000mplx:OtherVIEsMember2020-01-012020-06-300001552000mplx:NonVIEsMember2020-01-012020-06-300001552000mplx:OtherVIEsandNonVIEsMember2020-01-012020-06-300001552000mplx:OtherVIEsMember2021-06-300001552000mplx:NonVIEsMember2021-06-300001552000mplx:OtherVIEsandNonVIEsMember2021-06-300001552000mplx:OtherVIEsMember2020-12-310001552000mplx:NonVIEsMember2020-12-310001552000mplx:OtherVIEsandNonVIEsMember2020-12-310001552000mplx:GatheringandProcessingMember2021-06-300001552000mplx:GatheringandProcessingMember2020-12-310001552000mplx:LogisticsandStorageMember2021-06-300001552000mplx:LogisticsandStorageMember2020-12-310001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2019-07-310001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2019-07-312019-07-310001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2020-01-012020-12-310001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2021-06-300001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2020-12-310001552000mplx:MarathonPetroleumCorporationMemberus-gaap:ServiceMember2021-04-012021-06-300001552000mplx:MarathonPetroleumCorporationMemberus-gaap:ServiceMember2020-04-012020-06-300001552000mplx:MarathonPetroleumCorporationMemberus-gaap:ServiceMember2021-01-012021-06-300001552000mplx:MarathonPetroleumCorporationMemberus-gaap:ServiceMember2020-01-012020-06-300001552000us-gaap:OtherAffiliatesMemberus-gaap:ServiceMember2021-04-012021-06-300001552000us-gaap:OtherAffiliatesMemberus-gaap:ServiceMember2020-04-012020-06-300001552000us-gaap:OtherAffiliatesMemberus-gaap:ServiceMember2021-01-012021-06-300001552000us-gaap:OtherAffiliatesMemberus-gaap:ServiceMember2020-01-012020-06-300001552000us-gaap:OtherAffiliatesMember2021-04-012021-06-300001552000us-gaap:OtherAffiliatesMember2020-04-012020-06-300001552000us-gaap:OtherAffiliatesMember2021-01-012021-06-300001552000us-gaap:OtherAffiliatesMember2020-01-012020-06-300001552000us-gaap:AssetUnderConstructionMembermplx:MarathonPetroleumCorporationMember2021-04-012021-06-300001552000us-gaap:AssetUnderConstructionMembermplx:MarathonPetroleumCorporationMember2021-01-012021-06-300001552000us-gaap:AssetUnderConstructionMembermplx:MarathonPetroleumCorporationMember2020-04-012020-06-300001552000us-gaap:AssetUnderConstructionMembermplx:MarathonPetroleumCorporationMember2020-01-012020-06-300001552000mplx:MarathonPetroleumCorporationMember2020-01-012020-12-310001552000mplx:MarathonPetroleumCorporationMember2021-06-300001552000mplx:MarathonPetroleumCorporationMember2020-12-310001552000us-gaap:OtherAffiliatesMember2021-06-300001552000us-gaap:OtherAffiliatesMember2020-12-310001552000mplx:MinimumCommittedVolumeContractsMembermplx:MarathonPetroleumCorporationMember2021-06-300001552000mplx:MinimumCommittedVolumeContractsMembermplx:MarathonPetroleumCorporationMember2020-12-310001552000mplx:ReimbursableProjectsMembermplx:MarathonPetroleumCorporationMember2021-06-300001552000mplx:ReimbursableProjectsMembermplx:MarathonPetroleumCorporationMember2020-12-310001552000us-gaap:OtherAffiliatesMembermplx:ReimbursableProjectsMember2021-06-300001552000us-gaap:OtherAffiliatesMembermplx:ReimbursableProjectsMember2020-12-310001552000mplx:LimitedPartnersCommonUnitsMember2020-12-310001552000mplx:LimitedPartnersCommonUnitsMember2021-06-300001552000us-gaap:SubsequentEventMember2021-07-012021-07-020001552000us-gaap:SeriesBPreferredStockMembermplx:ANDXLPMember2019-07-290001552000us-gaap:SeriesBPreferredStockMembermplx:ANDXLPMember2019-07-292019-07-290001552000us-gaap:SeriesBPreferredStockMembermplx:ANDXLPMemberus-gaap:PreferredPartnerMember2021-01-012021-06-300001552000us-gaap:SeriesBPreferredStockMembermplx:ANDXLPMember2021-01-012021-06-300001552000us-gaap:SeriesBPreferredStockMember2021-01-012021-06-300001552000us-gaap:SubsequentEventMember2021-07-272021-07-270001552000mplx:LimitedPartnersCommonUnitsMemberus-gaap:SubsequentEventMember2021-07-272021-07-270001552000mplx:LimitedPartnersCommonUnitsMemberus-gaap:SubsequentEventMember2021-08-132021-08-130001552000us-gaap:SubsequentEventMember2021-08-062021-08-060001552000us-gaap:SeriesBPreferredStockMemberus-gaap:SubsequentEventMember2021-08-162021-08-1600015520002021-04-272021-04-2700015520002020-04-282020-04-2800015520002020-07-282020-07-280001552000mplx:SeriesAConvertiblePreferredUnitsMember2016-05-132016-05-130001552000mplx:SeriesAConvertiblePreferredUnitsMember2016-05-130001552000mplx:SeriesAConvertiblePreferredUnitsMember2021-01-012021-06-300001552000mplx:LogisticsandStorageMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2021-04-012021-06-300001552000mplx:LogisticsandStorageMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001552000mplx:LogisticsandStorageMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2021-01-012021-06-300001552000mplx:LogisticsandStorageMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001552000mplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2021-04-012021-06-300001552000mplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001552000mplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2021-01-012021-06-300001552000mplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001552000us-gaap:ProductMembermplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2021-04-012021-06-300001552000us-gaap:ProductMembermplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001552000us-gaap:ProductMembermplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2021-01-012021-06-300001552000us-gaap:ProductMembermplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001552000mplx:LogisticsandStorageMembermplx:MarathonPetroleumCorporationMember2021-04-012021-06-300001552000mplx:LogisticsandStorageMembermplx:MarathonPetroleumCorporationMember2020-04-012020-06-300001552000mplx:LogisticsandStorageMembermplx:MarathonPetroleumCorporationMember2021-01-012021-06-300001552000mplx:LogisticsandStorageMembermplx:MarathonPetroleumCorporationMember2020-01-012020-06-300001552000mplx:LogisticsandStorageMember2021-04-012021-06-300001552000mplx:LogisticsandStorageMember2020-04-012020-06-300001552000mplx:LogisticsandStorageMember2021-01-012021-06-300001552000mplx:LogisticsandStorageMember2020-01-012020-06-300001552000mplx:GatheringandProcessingMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2021-04-012021-06-300001552000mplx:GatheringandProcessingMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001552000mplx:GatheringandProcessingMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2021-01-012021-06-300001552000mplx:GatheringandProcessingMemberus-gaap:ServiceMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001552000mplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2021-04-012021-06-300001552000mplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001552000mplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2021-01-012021-06-300001552000mplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001552000us-gaap:ProductMembermplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2021-04-012021-06-300001552000us-gaap:ProductMembermplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001552000us-gaap:ProductMembermplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2021-01-012021-06-300001552000us-gaap:ProductMembermplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001552000mplx:GatheringandProcessingMember2021-04-012021-06-300001552000mplx:GatheringandProcessingMember2020-04-012020-06-300001552000mplx:GatheringandProcessingMember2021-01-012021-06-300001552000mplx:GatheringandProcessingMember2020-01-012020-06-300001552000mplx:LogisticsandStorageMembermplx:ThirdPartyMember2021-04-012021-06-300001552000mplx:LogisticsandStorageMembermplx:ThirdPartyMember2021-01-012021-06-300001552000mplx:LogisticsandStorageMembermplx:ThirdPartyMember2020-04-012020-06-300001552000mplx:LogisticsandStorageMembermplx:ThirdPartyMember2020-01-012020-06-300001552000mplx:GatheringandProcessingMembermplx:ThirdPartyMember2021-04-012021-06-300001552000mplx:GatheringandProcessingMembermplx:ThirdPartyMember2021-01-012021-06-300001552000mplx:GatheringandProcessingMembermplx:ThirdPartyMember2020-04-012020-06-300001552000mplx:GatheringandProcessingMembermplx:ThirdPartyMember2020-01-012020-06-300001552000us-gaap:OperatingSegmentsMember2021-04-012021-06-300001552000us-gaap:OperatingSegmentsMember2020-04-012020-06-300001552000us-gaap:OperatingSegmentsMember2021-01-012021-06-300001552000us-gaap:OperatingSegmentsMember2020-01-012020-06-300001552000us-gaap:MaterialReconcilingItemsMember2021-04-012021-06-300001552000us-gaap:MaterialReconcilingItemsMember2020-04-012020-06-300001552000us-gaap:MaterialReconcilingItemsMember2021-01-012021-06-300001552000us-gaap:MaterialReconcilingItemsMember2020-01-012020-06-300001552000us-gaap:NondesignatedMembermplx:PurchasedproductcostsMember2021-04-012021-06-300001552000us-gaap:NondesignatedMembermplx:PurchasedproductcostsMember2020-04-012020-06-300001552000us-gaap:NondesignatedMembermplx:PurchasedproductcostsMember2021-01-012021-06-300001552000us-gaap:NondesignatedMembermplx:PurchasedproductcostsMember2020-01-012020-06-300001552000mplx:LogisticsandStorageMembermplx:PipelinesAndRelatedAssetsMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:PipelinesAndRelatedAssetsMember2020-12-310001552000mplx:LogisticsandStorageMembermplx:RefineriesandrelatedassetsMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:RefineriesandrelatedassetsMember2020-12-310001552000mplx:LogisticsandStorageMembermplx:TerminalsandrelatedassetsMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:TerminalsandrelatedassetsMember2020-12-310001552000mplx:BargesandtowingvesselsMembermplx:LogisticsandStorageMember2021-06-300001552000mplx:BargesandtowingvesselsMembermplx:LogisticsandStorageMember2020-12-310001552000mplx:LogisticsandStorageMembermplx:LandBuildingOfficeEquipmentAndOtherMember2021-06-300001552000mplx:LogisticsandStorageMembermplx:LandBuildingOfficeEquipmentAndOtherMember2020-12-310001552000us-gaap:AssetUnderConstructionMembermplx:LogisticsandStorageMember2021-06-300001552000us-gaap:AssetUnderConstructionMembermplx:LogisticsandStorageMember2020-12-310001552000mplx:GatheringandProcessingMembermplx:GasGatheringAndTransmissionEquipmentAndFacilitiesMember2021-06-300001552000mplx:GatheringandProcessingMembermplx:GasGatheringAndTransmissionEquipmentAndFacilitiesMember2020-12-310001552000mplx:GatheringandProcessingMembermplx:ProcessingFractionationAndStorageFacilitiesMember2021-06-300001552000mplx:GatheringandProcessingMembermplx:ProcessingFractionationAndStorageFacilitiesMember2020-12-310001552000mplx:GatheringandProcessingMembermplx:LandBuildingOfficeEquipmentAndOtherMember2021-06-300001552000mplx:GatheringandProcessingMembermplx:LandBuildingOfficeEquipmentAndOtherMember2020-12-310001552000us-gaap:AssetUnderConstructionMembermplx:GatheringandProcessingMember2021-06-300001552000us-gaap:AssetUnderConstructionMembermplx:GatheringandProcessingMember2020-12-310001552000mplx:LogisticsandStorageMember2019-12-310001552000mplx:GatheringandProcessingMember2019-12-310001552000mplx:LogisticsandStorageMember2020-01-012020-12-310001552000mplx:GatheringandProcessingMember2020-01-012020-12-3100015520002020-01-012020-12-310001552000mplx:LogisticsandStorageMembermplx:WesternRefiningWholesaleWesternRefiningProductTransportMember2020-01-012020-12-310001552000mplx:GatheringandProcessingMembermplx:WesternRefiningWholesaleWesternRefiningProductTransportMember2020-01-012020-12-310001552000srt:MinimumMembermplx:LogisticsandStorageMember2021-01-012021-06-300001552000srt:MaximumMembermplx:LogisticsandStorageMember2021-01-012021-06-300001552000srt:MinimumMembermplx:GatheringandProcessingMember2021-01-012021-06-300001552000srt:MaximumMembermplx:GatheringandProcessingMember2021-01-012021-06-300001552000us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMemberus-gaap:FairValueInputsLevel3Member2021-06-300001552000us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001552000us-gaap:NondesignatedMemberus-gaap:CommodityContractMember2021-06-300001552000us-gaap:NondesignatedMemberus-gaap:CommodityContractMember2020-12-310001552000srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMember2021-06-300001552000srt:MaximumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMember2021-06-30iso4217:USDutr:gal0001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-06-300001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMembermplx:NaturalGasMember2021-01-012021-06-300001552000us-gaap:CommodityContractMember2021-03-310001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-03-310001552000us-gaap:CommodityContractMember2020-03-310001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-03-310001552000us-gaap:CommodityContractMember2021-04-012021-06-300001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-04-012021-06-300001552000us-gaap:CommodityContractMember2020-04-012020-06-300001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-04-012020-06-300001552000us-gaap:CommodityContractMember2021-06-300001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-06-300001552000us-gaap:CommodityContractMember2020-06-300001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-06-300001552000us-gaap:CommodityContractMember2020-12-310001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-12-310001552000us-gaap:CommodityContractMember2019-12-310001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2019-12-310001552000us-gaap:CommodityContractMember2021-01-012021-06-300001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-01-012021-06-300001552000us-gaap:CommodityContractMember2020-01-012020-06-300001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-01-012020-06-300001552000us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-06-300001552000us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300001552000us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001552000us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMembermplx:NaturalGasMember2021-06-300001552000us-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMemberus-gaap:CommodityContractMember2021-06-300001552000us-gaap:NondesignatedMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:CommodityContractMember2021-06-300001552000us-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMemberus-gaap:CommodityContractMember2020-12-310001552000us-gaap:NondesignatedMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:CommodityContractMember2020-12-310001552000us-gaap:NondesignatedMemberus-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMember2021-06-300001552000us-gaap:NondesignatedMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CommodityContractMember2021-06-300001552000us-gaap:NondesignatedMemberus-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMember2020-12-310001552000us-gaap:NondesignatedMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CommodityContractMember2020-12-310001552000mplx:PurchasedproductcostsMember2021-04-012021-06-300001552000mplx:PurchasedproductcostsMember2020-04-012020-06-300001552000mplx:PurchasedproductcostsMember2021-01-012021-06-300001552000mplx:PurchasedproductcostsMember2020-01-012020-06-300001552000mplx:MPLXRevolvingCreditFacilitydueJuly2024Member2021-06-300001552000mplx:MPLXRevolvingCreditFacilitydueJuly2024Member2020-12-310001552000mplx:VariableRateSeniorNotesMembermplx:MPLXLPMember2021-06-300001552000mplx:VariableRateSeniorNotesMembermplx:MPLXLPMember2020-12-310001552000mplx:MPLXLPMembermplx:FixedRateSeniorNotesMember2021-06-300001552000mplx:MPLXLPMembermplx:FixedRateSeniorNotesMember2020-12-310001552000mplx:FixedRateSeniorNotesMembermplx:MarkWestMember2021-06-300001552000mplx:FixedRateSeniorNotesMembermplx:MarkWestMember2020-12-310001552000mplx:FixedRateSeniorNotesMembermplx:ANDXLPMember2021-06-300001552000mplx:FixedRateSeniorNotesMembermplx:ANDXLPMember2020-12-310001552000mplx:FinanceLeaseMembermplx:MarathonPipeLineLlcMember2021-06-300001552000mplx:FinanceLeaseMembermplx:MarathonPipeLineLlcMember2020-12-310001552000mplx:MPLXRevolvingCreditFacilitydueJuly2024Member2019-07-300001552000mplx:MPLXLPMembermplx:MPLXRevolvingCreditFacilitydueJuly2024Member2021-01-012021-06-300001552000mplx:MPLXLPMembermplx:MPLXRevolvingCreditFacilitydueJuly2024Member2021-06-300001552000mplx:VariableRateSeniorNotesMember2019-09-090001552000mplx:VariableRateSeniorNotesMembermplx:FloatingRateSeniorNotesDueSeptember2022Member2019-09-092019-09-090001552000srt:MinimumMembermplx:FixedRateSeniorNotesMember2021-06-300001552000srt:MaximumMembermplx:FixedRateSeniorNotesMember2021-06-300001552000mplx:SeniorNotesDueJanuary2025Membermplx:FixedRateSeniorNotesMember2021-01-150001552000mplx:SeniorNotesDueJanuary2025Membermplx:FixedRateSeniorNotesMember2021-06-300001552000mplx:SeniorNotesDueJanuary2025Membermplx:FixedRateSeniorNotesMembermplx:ANDXLPMember2021-01-150001552000mplx:SeniorNotesDueJanuary2025Membermplx:FixedRateSeniorNotesMember2021-01-012021-06-300001552000mplx:LogisticsandStorageMemberus-gaap:ServiceMember2021-04-012021-06-300001552000mplx:GatheringandProcessingMemberus-gaap:ServiceMember2021-04-012021-06-300001552000us-gaap:ServiceOtherMembermplx:LogisticsandStorageMember2021-04-012021-06-300001552000us-gaap:ServiceOtherMembermplx:GatheringandProcessingMember2021-04-012021-06-300001552000us-gaap:ProductMembermplx:LogisticsandStorageMember2021-04-012021-06-300001552000us-gaap:ProductMembermplx:GatheringandProcessingMember2021-04-012021-06-300001552000mplx:LogisticsandStorageMemberus-gaap:ServiceMember2020-04-012020-06-300001552000mplx:GatheringandProcessingMemberus-gaap:ServiceMember2020-04-012020-06-300001552000us-gaap:ServiceOtherMembermplx:LogisticsandStorageMember2020-04-012020-06-300001552000us-gaap:ServiceOtherMembermplx:GatheringandProcessingMember2020-04-012020-06-300001552000us-gaap:ProductMembermplx:LogisticsandStorageMember2020-04-012020-06-300001552000us-gaap:ProductMembermplx:GatheringandProcessingMember2020-04-012020-06-300001552000mplx:LogisticsandStorageMemberus-gaap:ServiceMember2021-01-012021-06-300001552000mplx:GatheringandProcessingMemberus-gaap:ServiceMember2021-01-012021-06-300001552000us-gaap:ServiceOtherMembermplx:LogisticsandStorageMember2021-01-012021-06-300001552000us-gaap:ServiceOtherMembermplx:GatheringandProcessingMember2021-01-012021-06-300001552000us-gaap:ProductMembermplx:LogisticsandStorageMember2021-01-012021-06-300001552000us-gaap:ProductMembermplx:GatheringandProcessingMember2021-01-012021-06-300001552000mplx:LogisticsandStorageMemberus-gaap:ServiceMember2020-01-012020-06-300001552000mplx:GatheringandProcessingMemberus-gaap:ServiceMember2020-01-012020-06-300001552000us-gaap:ServiceOtherMembermplx:LogisticsandStorageMember2020-01-012020-06-300001552000us-gaap:ServiceOtherMembermplx:GatheringandProcessingMember2020-01-012020-06-300001552000us-gaap:ProductMembermplx:LogisticsandStorageMember2020-01-012020-06-300001552000us-gaap:ProductMembermplx:GatheringandProcessingMember2020-01-012020-06-300001552000us-gaap:AccountingStandardsUpdate201409Member2020-12-310001552000us-gaap:AccountingStandardsUpdate201409Member2021-01-012021-06-300001552000us-gaap:AccountingStandardsUpdate201409Member2021-06-300001552000us-gaap:AccountingStandardsUpdate201409Member2019-12-310001552000us-gaap:AccountingStandardsUpdate201409Member2020-01-012020-06-300001552000us-gaap:AccountingStandardsUpdate201409Member2020-06-3000015520002043-10-012021-06-3000015520002021-07-012021-06-3000015520002022-01-012021-06-3000015520002023-01-012021-06-3000015520002024-01-012021-06-3000015520002025-01-012021-06-300001552000us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001552000us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMember2020-12-310001552000us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMemberus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-06-300001552000us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMember2021-01-012021-06-300001552000mplx:LoopLlcandExplorerPipelineMember2021-01-012021-06-300001552000us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMemberus-gaap:PensionPlansDefinedBenefitMember2021-06-300001552000us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMember2021-06-300001552000us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001552000us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMember2019-12-310001552000us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMemberus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-06-300001552000us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMember2020-01-012020-06-300001552000mplx:LoopLlcandExplorerPipelineMember2020-01-012020-06-300001552000us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMemberus-gaap:PensionPlansDefinedBenefitMember2020-06-300001552000us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMembermplx:LoopLlcandExplorerPipelineMember2020-06-300001552000us-gaap:PhantomShareUnitsPSUsMember2021-01-012021-06-300001552000us-gaap:PhantomShareUnitsPSUsMember2020-12-310001552000us-gaap:PhantomShareUnitsPSUsMember2021-06-300001552000us-gaap:PerformanceSharesMember2021-01-012021-06-300001552000us-gaap:PerformanceSharesMember2020-12-310001552000us-gaap:PerformanceSharesMember2021-06-300001552000srt:MaximumMembermplx:PerformanceUnitPerformanceConditionMember2021-01-012021-06-300001552000us-gaap:ReclassificationOtherMember2021-06-300001552000us-gaap:ReclassificationOtherMembermplx:MarathonPetroleumCorporationMember2021-06-300001552000us-gaap:ReclassificationOtherMembermplx:MarathonPetroleumCorporationMember2021-04-012021-06-300001552000us-gaap:ReclassificationOtherMembermplx:RefiningLogisticsMember2020-03-310001552000us-gaap:ReclassificationOtherMembermplx:MarathonPetroleumCorporationMembermplx:RefiningLogisticsMember2020-03-310001552000us-gaap:ReclassificationOtherMembermplx:MarathonPetroleumCorporationMembermplx:RefiningLogisticsMember2020-01-012020-03-310001552000mplx:ThirdPartyMember2021-04-012021-06-300001552000mplx:ThirdPartyMember2020-04-012020-06-300001552000mplx:ThirdPartyMember2021-01-012021-06-300001552000mplx:ThirdPartyMember2020-01-012020-06-300001552000mplx:ThirdPartyMember2021-06-300001552000mplx:MarathonPetroleumCorporationMembermplx:EnvironmentalLossContingencyMember2021-06-300001552000mplx:MarathonPetroleumCorporationMembermplx:EnvironmentalLossContingencyMember2020-12-310001552000us-gaap:GuaranteeTypeOtherMember2021-06-300001552000mplx:VariableRateSeniorNotesMembermplx:MPLXLPMemberus-gaap:SubsequentEventMember2021-08-040001552000mplx:VariableRateSeniorNotesMembermplx:FloatingRateSeniorNotesDueSeptember2022Memberus-gaap:SubsequentEventMember2021-08-042021-08-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM 10-Q

____________________________________________

| | | | | |

| (Mark One) |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2021

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-35714

_____________________________________________

MPLX LP

(Exact name of registrant as specified in its charter)

_____________________________________________

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | | 27-0005456 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | | | | |

| 200 E. Hardin Street, | Findlay, | Ohio | | 45840 | |

| (Address of principal executive offices) | | (Zip code) | |

(419) 421-2414

(Registrant’s telephone number, including area code)

_____________________________________________

| | | | | | | | |

| Securities Registered pursuant to Section 12(b) of the Act |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Units Representing Limited Partnership Interests | MPLX | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.) Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No x

MPLX LP had 1,025,624,328 common units outstanding at July 30, 2021.

Table of Contents

Unless the context otherwise requires, references in this report to “MPLX LP,” “MPLX,” “the Partnership,” “we,” “our,” “us,” or like terms refer to MPLX LP and its subsidiaries. Additionally, throughout this Quarterly Report on Form 10-Q, we have used terms in our discussion of the business and operating results that have been defined in our Glossary of Terms.

Glossary of Terms

The abbreviations, acronyms and industry technology used in this report are defined as follows. | | | | | |

| |

| ASC | Accounting Standards Codification |

| ASU | Accounting Standards Update |

| |

| Barrel | One stock tank barrel, or 42 United States gallons of liquid volume, used in reference to crude oil or other liquid hydrocarbons |

| |

| Bcf/d | One billion cubic feet per day |

| Btu | One British thermal unit, an energy measurement |

| Condensate | A natural gas liquid with a low vapor pressure mainly composed of propane, butane, pentane and heavier hydrocarbon fractions |

| DCF (a non-GAAP financial measure) | Distributable Cash Flow |

| |

| EBITDA (a non-GAAP financial measure) | Earnings Before Interest, Taxes, Depreciation and Amortization |

| |

| |

| FASB | Financial Accounting Standards Board |

| GAAP | Accounting principles generally accepted in the United States of America |

| |

| |

| |

| |

| LIBOR | London Interbank Offered Rate |

| mbpd | Thousand barrels per day |

| Merger | MPLX acquisition by merger of Andeavor Logistics LP (“ANDX”) on July 30, 2019 |

| MMBtu | One million British thermal units, an energy measurement |

| MMcf/d | One million cubic feet of natural gas per day |

| NGL | Natural gas liquids, such as ethane, propane, butanes and natural gasoline |

| NYSE | New York Stock Exchange |

| |

| |

| |

| Realized derivative gain/loss | The gain or loss recognized when a derivative matures or is settled |

| SEC | United States Securities and Exchange Commission |

| Unrealized derivative gain/loss | The gain or loss recognized on a derivative due to changes in fair value prior to the instrument maturing or settling |

| VIE | Variable interest entity |

| Wholesale Exchange | The transfer to MPC of the Western wholesale distribution business, which MPLX acquired as a result of its acquisition of ANDX, on July 31, 2020. |

| |

Part I—Financial Information

Item 1. Financial Statements

MPLX LP

Consolidated Statements of Income (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions, except per unit data) | 2021 | | 2020 | | 2021 | | 2020 |

| Revenues and other income: | | | | | | | |

| Service revenue | $ | 578 | | | $ | 563 | | | $ | 1,167 | | | $ | 1,175 | |

| Service revenue - related parties | 907 | | | 857 | | | 1,779 | | | 1,785 | |

| Service revenue - product related | 76 | | | 22 | | | 153 | | | 61 | |

| Rental income | 99 | | | 98 | | | 198 | | | 194 | |

| Rental income - related parties | 168 | | | 237 | | | 410 | | | 471 | |

| Product sales | 304 | | | 120 | | | 586 | | | 289 | |

| Product sales - related parties | 31 | | | 30 | | | 73 | | | 63 | |

| | | | | | | |

| Sales-type lease revenue - related parties | 136 | | | 38 | | | 173 | | | 76 | |

Income/(loss) from equity method investments(1) | 66 | | | 89 | | | 136 | | | (1,095) | |

| Other income | 3 | | | 2 | | | 4 | | | 3 | |

| Other income - related parties | 27 | | | 25 | | | 55 | | | 51 | |

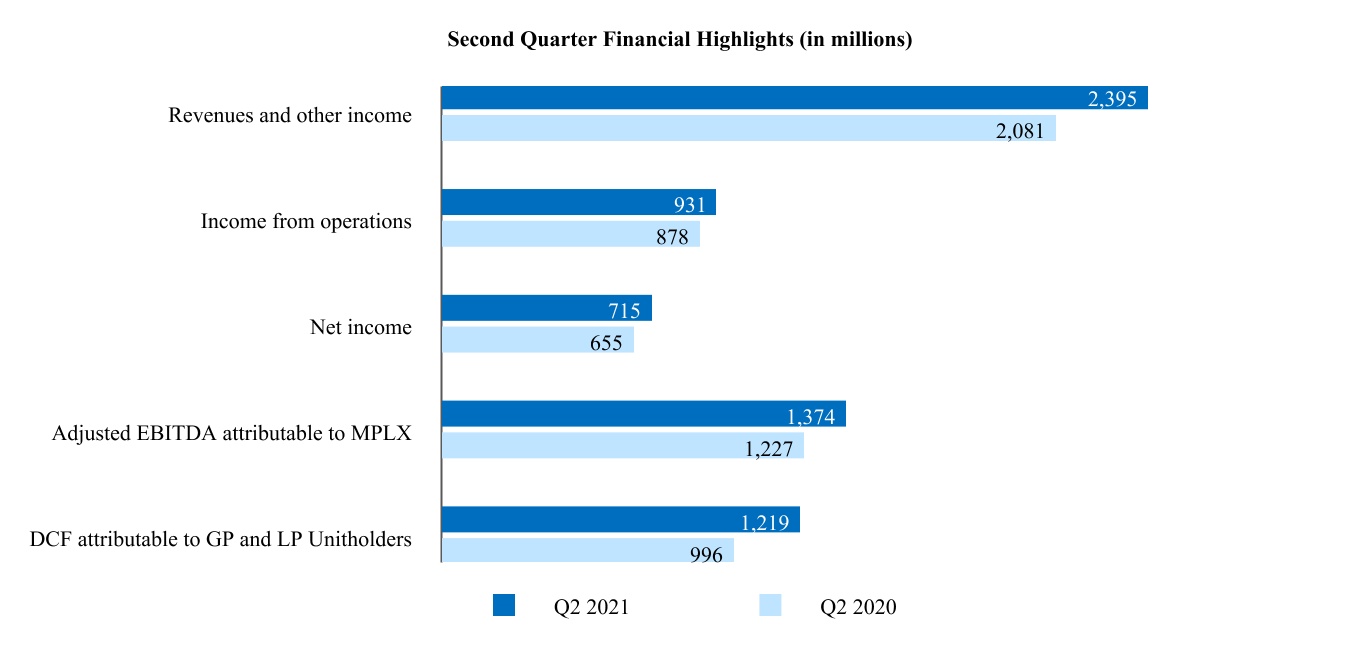

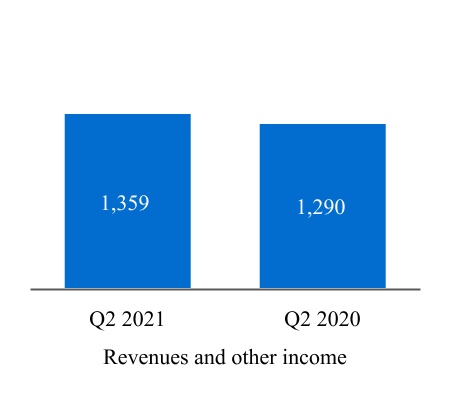

| Total revenues and other income | 2,395 | | | 2,081 | | | 4,734 | | | 3,073 | |

| Costs and expenses: | | | | | | | |

| Cost of revenues (excludes items below) | 293 | | | 315 | | | 566 | | | 683 | |

| Purchased product costs | 338 | | | 87 | | | 614 | | | 222 | |

| Rental cost of sales | 32 | | | 33 | | | 64 | | | 68 | |

| Rental cost of sales - related parties | 23 | | | 41 | | | 62 | | | 87 | |

| Purchases - related parties | 297 | | | 280 | | | 595 | | | 556 | |

| Depreciation and amortization | 318 | | | 321 | | | 647 | | | 646 | |

| Impairment expense | 42 | | | — | | | 42 | | | 2,165 | |

| General and administrative expenses | 87 | | | 96 | | | 173 | | | 193 | |

| | | | | | | |

| Other taxes | 34 | | | 30 | | | 66 | | | 61 | |

| Total costs and expenses | 1,464 | | | 1,203 | | | 2,829 | | | 4,681 | |

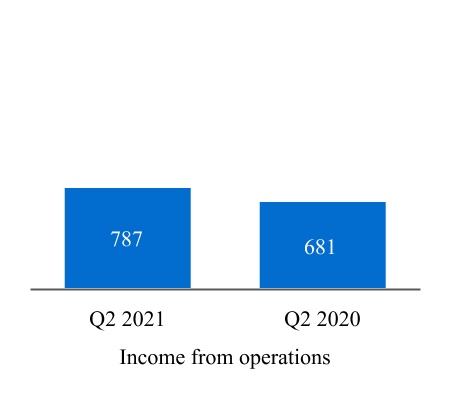

| Income/(loss) from operations | 931 | | | 878 | | | 1,905 | | | (1,608) | |

| Related party interest and other financial costs | 2 | | | 1 | | | 2 | | | 4 | |

Interest expense (net of amounts capitalized of $5 million, $10 million, $10 million and $23 million respectively) | 195 | | | 206 | | | 393 | | | 417 | |

| Other financial costs | 19 | | | 16 | | | 46 | | | 32 | |

| Income/(loss) before income taxes | 715 | | | 655 | | | 1,464 | | | (2,061) | |

| Provision for income taxes | — | | | — | | | 1 | | | — | |

| Net income/(loss) | 715 | | | 655 | | | 1,463 | | | (2,061) | |

| Less: Net income attributable to noncontrolling interests | 9 | | | 7 | | | 18 | | | 15 | |

| | | | | | | |

| Net income/(loss) attributable to MPLX LP | 706 | | | 648 | | | 1,445 | | | (2,076) | |

| Less: Series A preferred unit distributions | 21 | | | 21 | | | 41 | | | 41 | |

| Less: Series B preferred unit distributions | 10 | | | 10 | | | 21 | | | 21 | |

| | | | | | | |

| Limited partners’ interest in net income/(loss) attributable to MPLX LP | $ | 675 | | | $ | 617 | | | $ | 1,383 | | | $ | (2,138) | |

| Per Unit Data (See Note 6) | | | | | | | |

| Net income/(loss) attributable to MPLX LP per limited partner unit: | | | | | | | |

| Common - basic | $ | 0.66 | | | $ | 0.58 | | | $ | 1.34 | | | $ | (2.02) | |

| Common - diluted | $ | 0.66 | | | $ | 0.58 | | | $ | 1.34 | | | $ | (2.02) | |

| Weighted average limited partner units outstanding: | | | | | | | |

| Common - basic | 1,029 | | | 1,059 | | | 1,033 | | | 1,059 | |

| Common - diluted | 1,029 | | | 1,059 | | | 1,033 | | | 1,059 | |

| | | | | | | |

(1) The three and six months ended June 30, 2021 includes $6 million of impairment expense. The six months ended June 30, 2020 includes $1,264 million of impairment expense.

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Statements of Comprehensive Income (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, | | |

| (In millions) | 2021 | | 2020 | | 2021 | | 2020 | | |

| Net income/(loss) | $ | 715 | | | $ | 655 | | | $ | 1,463 | | | $ | (2,061) | | | |

| Other comprehensive income/(loss), net of tax: | | | | | | | | | |

| Remeasurements of pension and other postretirement benefits related to equity method investments, net of tax | — | | | — | | | (2) | | | (1) | | | |

| Comprehensive income/(loss) | 715 | | | 655 | | | 1,461 | | | (2,062) | | | |

| Less comprehensive income attributable to: | | | | | | | | | |

| Noncontrolling interests | 9 | | | 7 | | | 18 | | | 15 | | | |

| | | | | | | | | |

| Comprehensive income/(loss) attributable to MPLX LP | $ | 706 | | | $ | 648 | | | $ | 1,443 | | | $ | (2,077) | | | |

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | |

| (In millions) | June 30, 2021 | | December 31, 2020 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 8 | | | $ | 15 | |

| | | |

| Receivables, net | 538 | | | 452 | |

| Current assets - related parties | 614 | | | 677 | |

| Inventories | 126 | | | 118 | |

| Assets held for sale | — | | | 188 | |

| Other current assets | 46 | | | 65 | |

| Total current assets | 1,332 | | | 1,515 | |

| Equity method investments | 4,033 | | | 4,036 | |

| Property, plant and equipment, net | 20,352 | | | 21,218 | |

| Intangibles, net | 896 | | | 959 | |

| Goodwill | 7,657 | | | 7,657 | |

| Right of use assets, net | 297 | | | 309 | |

| Noncurrent assets - related parties | 1,144 | | | 672 | |

| Other noncurrent assets | 62 | | | 48 | |

| Total assets | 35,773 | | | 36,414 | |

| Liabilities | | | |

| Current liabilities: | | | |

| Accounts payable | 158 | | | 152 | |

| Accrued liabilities | 258 | | | 194 | |

| | | |

| | | |

| | | |

| Current liabilities - related parties | 812 | | | 356 | |

| Accrued property, plant and equipment | 54 | | | 84 | |

| | | |

| Long-term debt due within one year | 1 | | | 764 | |

| Accrued interest payable | 203 | | | 222 | |

| Operating lease liabilities | 63 | | | 63 | |

| Liabilities held for sale | — | | | 101 | |

| Other current liabilities | 178 | | | 150 | |

| Total current liabilities | 1,727 | | | 2,086 | |

| Long-term deferred revenue | 349 | | | 314 | |

| Long-term liabilities - related parties | 306 | | | 283 | |

| Long-term debt | 19,234 | | | 19,375 | |

| Deferred income taxes | 11 | | | 12 | |

| Long-term operating lease liabilities | 232 | | | 244 | |

| Deferred credits and other liabilities | 151 | | | 115 | |

| Total liabilities | 22,010 | | | 22,429 | |

| Commitments and contingencies (see Note 21) | | | |

| Series A preferred units | 968 | | | 968 | |

| Equity | | | |

Common unitholders - public (380 million and 391 million units issued and outstanding) | 9,061 | | | 9,384 | |

| | | |

Common unitholders - MPC (647 million and 647 million units issued and outstanding) | 2,897 | | | 2,792 | |

| | | |

| | | |

Series B preferred units (.6 million and .6 million units issued and outstanding) | 611 | | | 611 | |

| | | |

| Accumulated other comprehensive loss | (17) | | | (15) | |

| Total MPLX LP partners’ capital | 12,552 | | | 12,772 | |

| Noncontrolling interests | 243 | | | 245 | |

| Total equity | 12,795 | | | 13,017 | |

| Total liabilities, preferred units and equity | $ | 35,773 | | | $ | 36,414 | |

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Statements of Cash Flows (Unaudited) | | | | | | | | | | | |

| Six Months Ended

June 30, |

| (In millions) | 2021 | | 2020 |

| Increase/(decrease) in cash, cash equivalents and restricted cash | | | |

| Operating activities: | | | |

| Net income/(loss) | $ | 1,463 | | | $ | (2,061) | |

| Adjustments to reconcile net income/(loss) to net cash provided by operating activities: | | | |

| Amortization of deferred financing costs | 35 | | | 29 | |

| Depreciation and amortization | 647 | | | 646 | |

| Impairment expense | 42 | | | 2,165 | |

| Deferred income taxes | (1) | | | (1) | |

| | | |

| Loss on disposal of assets | 1 | | | 1 | |

(Income)/loss from equity method investments(1) | (136) | | | 1,095 | |

| Distributions from unconsolidated affiliates | 239 | | | 226 | |

| Changes in: | | | |

| Current receivables | (83) | | | 31 | |

| Inventories | (8) | | | (7) | |

| Fair value of derivatives | 39 | | | (9) | |

| Current accounts payable and accrued liabilities | 77 | | | (102) | |

| Current assets/current liabilities - related parties | 101 | | | 27 | |

| | | |

| Right of use assets/operating lease liabilities | 1 | | | (1) | |

| Deferred revenue | 43 | | | 49 | |

| All other, net | 29 | | | 26 | |

| Net cash provided by operating activities | 2,489 | | | 2,114 | |

| Investing activities: | | | |

| Additions to property, plant and equipment | (235) | | | (708) | |

| | | |

| Disposal of assets | 74 | | | 43 | |

| | | |

| Investments in unconsolidated affiliates | (84) | | | (222) | |

| | | |

| Distributions from unconsolidated affiliates - return of capital | — | | | 110 | |

| | | |

| Net cash used in investing activities | (245) | | | (777) | |

| Financing activities: | | | |

| Long-term debt - borrowings | 2,800 | | | 2,500 | |

| - repayments | (3,746) | | | (1,682) | |

| Related party debt - borrowings | 4,435 | | | 2,708 | |

| - repayments | (3,942) | | | (3,302) | |

| | | |

| | | |

| Unit repurchases | (310) | | | — | |

| | | |

| | | |

| | | |

| | | |

| Distributions to noncontrolling interests | (20) | | | (17) | |

| Distributions to Series A preferred unitholders | (41) | | | (41) | |

| Distributions to Series B preferred unitholders | (21) | | | (21) | |

| Distributions to unitholders and general partner | (1,421) | | | (1,445) | |

| | | |

| Contributions from MPC | 17 | | | 20 | |

| | | |

| All other, net | (2) | | | (5) | |

| Net cash used in financing activities | (2,251) | | | (1,285) | |

| Net (decrease)/increase in cash, cash equivalents and restricted cash | (7) | | | 52 | |

| Cash, cash equivalents and restricted cash at beginning of period | 15 | | | 15 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 8 | | | $ | 67 | |

(1) The 2021 period includes $6 million of impairment expense. The 2020 period includes $1,264 million of impairment expense.

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Statements of Equity (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Partnership | | | | | | | | |

| (In millions) | Common

Unit-holders

Public | | Common

Unit-holder

MPC | | Series B Preferred Unit-holders | | Accumulated Other Comprehensive Loss | | Non-controlling

Interests | | | | Total |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

|

| Balance at December 31, 2019 | $ | 10,800 | | | $ | 4,968 | | | $ | 611 | | | $ | (15) | | | $ | 249 | | | | | $ | 16,613 | |

| Net (loss)/income (excludes amounts attributable to preferred units) | (1,022) | | | (1,733) | | | 11 | | | — | | | 8 | | | | | (2,736) | |

| Distributions to: | | | | | | | | | | | | | |

| Unitholders | (271) | | | (446) | | | (21) | | | — | | | — | | | | | (738) | |

| Noncontrolling interests | — | | | — | | | — | | | — | | | (9) | | | | | (9) | |

| Contributions from: | | | | | | | | | | | | | |

| MPC | — | | | 225 | | | — | | | — | | | — | | | | | 225 | |

| | | | | | | | | | | | | |

| Other | 2 | | | — | | | — | | | (1) | | | — | | | | | 1 | |

| Balance at March 31, 2020 | 9,509 | | | 3,014 | | | 601 | | | (16) | | | 248 | | | | | 13,356 | |

| | | | | | | | | | | | | |

| Net income (excludes amounts attributable to preferred units) | 229 | | | 388 | | | 10 | | | — | | | 7 | | | | | 634 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Distributions to: | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Unitholders | (270) | | | (458) | | | — | | | — | | | — | | | | | (728) | |

| Noncontrolling interests | — | | | — | | | — | | | — | | | (8) | | | | | (8) | |

| Contributions from: | | | | | | | | | | | | | |

| MPC | — | | | 6 | | | — | | | — | | | — | | | | | 6 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Other | 1 | | | 1 | | | — | | | — | | | — | | | | | 2 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance at June 30, 2020 | 9,469 | | | 2,951 | | | 611 | | | (16) | | | 247 | | | | | 13,262 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

|

| Balance at December 31, 2020 | 9,384 | | | 2,792 | | | 611 | | | (15) | | | 245 | | | | | 13,017 | |

| | | | | | | | | | | | | |

| Net income (excludes amounts attributable to preferred units) | 266 | | | 443 | | | 11 | | | — | | | 9 | | | | | 729 | |

| Unit Repurchases | (155) | | | — | | | — | | | — | | | — | | | | | (155) | |

| | | | | | | | | | | | | |

| Distributions to: | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Unitholders | (269) | | | (445) | | | (21) | | | — | | | — | | | | | (735) | |

| Noncontrolling interests | — | | | — | | | — | | | — | | | (10) | | | | | (10) | |

| Contributions from: | | | | | | | | | | | | | |

| MPC | — | | | 7 | | | — | | | — | | | — | | | | | 7 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Other | — | | | (1) | | | — | | | (2) | | | — | | | | | (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance at March 31, 2021 | 9,226 | | | 2,796 | | | 601 | | | (17) | | | 244 | | | | | 12,850 | |

| | | | | | | | | | | | | |

| Net income (excludes amounts attributable to preferred units) | 251 | | | 423 | | | 10 | | | — | | | 9 | | | | | 693 | |

| Unit Repurchases | (155) | | | — | | | — | | | — | | | — | | | | | (155) | |

| | | | | | | | | | | | | |

| Distributions to: | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Unitholders | (262) | | | (445) | | | — | | | — | | | — | | | | | (707) | |

| Noncontrolling interests | — | | | — | | | — | | | — | | | (10) | | | | | (10) | |

| Contributions from: | | | | | | | | | | | | | |

| MPC | — | | | 122 | | | — | | | — | | | — | | | | | 122 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Other | 1 | | | 1 | | | — | | | — | | | — | | | | | 2 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance at June 30, 2021 | $ | 9,061 | | | $ | 2,897 | | | $ | 611 | | | $ | (17) | | | $ | 243 | | | | | $ | 12,795 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

Notes to Consolidated Financial Statements (Unaudited)

1. Description of the Business and Basis of Presentation

Description of the Business – MPLX LP is a diversified, large-cap master limited partnership formed by Marathon Petroleum Corporation that owns and operates midstream energy infrastructure and logistics assets, and provides fuels distribution services. References in this report to “MPLX LP,” “MPLX,” “the Partnership,” “we,” “ours,” “us,” or like terms refer to MPLX LP and its subsidiaries. References to “MPC” refer collectively to Marathon Petroleum Corporation as our sponsor and its subsidiaries, other than the Partnership. We are engaged in the transportation, storage and distribution of crude oil, asphalt and refined petroleum products; the gathering, processing and transportation of natural gas; and the gathering, transportation, fractionation, storage and marketing of NGLs. MPLX’s principal executive office is located in Findlay, Ohio.

MPLX’s business consists of two segments based on the nature of services it offers: Logistics and Storage (“L&S”), which relates primarily to crude oil, asphalt and refined petroleum products; and Gathering and Processing (“G&P”), which relates primarily to natural gas and NGLs. See Note 9 for additional information regarding the operations and results of these segments.

On July 31, 2020, MPLX completed the exchange of Western Refining Wholesale, LLC (“WRW”) to Western Refining Southwest, Inc. (now known as Western Refining Southwest LLC) (“WRSW”), a wholly owned subsidiary of MPC, in exchange for the redemption of 18,582,088 MPLX common units held by WRSW (the “Wholesale Exchange”). See Note 3 for additional information regarding the Wholesale Exchange. These financial statements include the results of WRSW through July 31, 2020.

Impairments – During the first half of 2021, we continued to see improvements in the environment in which our business operates as COVID-19 impacts continue to subside. The increased availability of vaccinations and easing of COVID-19 restrictions has been followed by an increase in economic activity, however, we are unable to predict the potential effects a resurgence of COVID-19 may have on our financial position and results.

In the second quarter of 2021, we recognized impairment expense of $42 million within our G&P segment related to our continued emphasis on portfolio optimization with the anticipated divestiture of several non-core assets and the closure of other non-core assets.

During the first quarter of 2020, the overall deterioration in the economy and the environment in which MPLX and its customers operate, as well as a sustained decrease in unit price, were considered triggering events at that time resulting in impairments of the carrying value of certain assets. We recognized impairments related to goodwill, certain equity method investments and certain long-lived assets (including intangibles), within our G&P segment. Many of our producer customers refined and updated production forecasts in response to the environment at that time, which impacted their expected future demand for our services, including the future utilization of our assets. Additionally, certain of our contracts have commodity price exposure, including NGL prices, which experienced increased volatility as noted above. The table below provides information related to the impairments recognized during the first quarter of 2020 as well as the corresponding footnote where additional information can be found.

| | | | | | | | | | | | | | |

| (In millions) | | Impairment | | Footnote Reference |

| Goodwill | | $ | 1,814 | | | 12 |

| Equity method investments | | 1,264 | | | 4 |

| Intangibles, net | | 177 | | | 12 |

| Property, plant and equipment, net | | 174 | | | 11 |

| Total impairments | | $ | 3,429 | | | |

Basis of Presentation – The accompanying interim consolidated financial statements are unaudited; however, in the opinion of MPLX’s management, these statements reflect all adjustments necessary for a fair statement of the results for the periods reported. All such adjustments are of a normal, recurring nature unless otherwise disclosed. These interim consolidated financial statements, including the notes, have been prepared in accordance with the rules and regulations of the SEC applicable to interim period financial statements and do not include all of the information and disclosures required by GAAP for complete financial statements. Certain amounts in prior years have been reclassified to conform to current year presentation.

These interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Annual Report on Form 10-K for the year ended December 31, 2020. The results of operations for the three and six months ended June 30, 2021 are not necessarily indicative of the results to be expected for the full year.

MPLX’s consolidated financial statements include all majority-owned and controlled subsidiaries. For non-wholly owned consolidated subsidiaries, the interests owned by third parties have been recorded as “Noncontrolling interests” on the accompanying Consolidated Balance Sheets. Intercompany investments, accounts and transactions have been eliminated. MPLX’s investments in which MPLX exercises significant influence but does not control and does not have a controlling financial interest are accounted for using the equity method. MPLX’s investments in VIEs in which MPLX exercises significant influence but does not control and is not the primary beneficiary are also accounted for using the equity method.

In preparing the Consolidated Statements of Equity, net income attributable to MPLX LP is allocated to Series A and Series B preferred unitholders based on a fixed distribution schedule. Distributions, although earned, are not accrued until declared. The allocation of net income attributable to MPLX LP for purposes of calculating net income per limited partner unit is described in Note 6.

2. Accounting Standards

Recently Adopted

We did not adopt any ASUs during the first six months of 2021 that are expected to have a material impact to our financial statements or financial statement disclosures.

3. Acquisitions and Dispositions

Sale of Javelina Assets and Liabilities

On February 12, 2021, MarkWest Energy Operating Company, L.L.C., (“MarkWest Energy”) a wholly owned subsidiary of MPLX, completed the sale of all of MarkWest Energy’s equity interests in MarkWest Javelina Company L.L.C., MarkWest Javelina Pipeline Company L.L.C., and MarkWest Gas Services L.L.C. (collectively, “Javelina”) pursuant to the terms of an Equity Purchase Agreement entered into with a third party on December 23, 2020. The agreement included adjustments for working capital as well as an earnout provision based on the performance of the assets. No gain or loss was recorded on the sale. The estimated value of the earnout provision was recorded as a contingent asset shown within “Other noncurrent assets” on the Consolidated Balance Sheets as of June 30, 2021. Javelina’s assets and liabilities sold are shown on the Consolidated Balance Sheets as “Assets held for sale” and “Liabilities held for sale” for the year ended December 31, 2020. Prior to the sale, Javelina was reported within the G&P segment.

Wholesale Exchange

On July 31, 2020, MPLX entered into a Redemption Agreement (the “Redemption Agreement”) with WRSW, a wholly owned subsidiary of MPC, pursuant to which MPLX agreed to transfer to WRSW all of the outstanding membership interests in WRW in exchange for the redemption of MPLX common units held by WRSW. The transaction effected the transfer to MPC of the Western wholesale distribution business that MPLX acquired as a result of its acquisition of ANDX. Per the terms of the Redemption Agreement, MPLX redeemed 18,582,088 common units (the “Redeemed Units”) held by WRSW on July 31, 2020. The number of Redeemed Units was calculated by dividing WRW’s aggregate valuation of $340 million by the simple average of the volume weighted average NYSE prices of an MPLX common unit for the ten trading days ending at market close on July 27, 2020. MPLX canceled the Redeemed Units immediately following the Wholesale Exchange. The carrying value of the net assets of WRW transferred to MPC was approximately $90 million as of July 31, 2020, resulting in $250 million being recorded to “Common Unit-holder MPC” within the Consolidated Statements of Equity, netted against the fair value of the redeemed units. Included within the $90 million carrying value of the WRW net assets was approximately $65 million of goodwill.

4. Investments and Noncontrolling Interests

The following table presents MPLX’s equity method investments at the dates indicated:

| | | | | | | | | | | | | | | | | |

| Ownership as of | | Carrying value at |

| June 30, | | June 30, | | December 31, |

| (In millions, except ownership percentages) | 2021 | | 2021 | | 2020 |

| L&S | | | | | |

MarEn Bakken Company LLC(1) | 25% | | $ | 460 | | | $ | 465 | |

| Illinois Extension Pipeline Company, L.L.C. | 35% | | 257 | | | 254 | |

| LOOP LLC | 41% | | 264 | | | 252 | |

Andeavor Logistics Rio Pipeline LLC(2) | 67% | | 191 | | | 194 | |

| Minnesota Pipe Line Company, LLC | 17% | | 185 | | | 188 | |

Whistler Pipeline LLC(2) | 38% | | 181 | | | 185 | |

| Explorer Pipeline Company | 25% | | 65 | | | 72 | |

W2W Holdings LLC(2)(3) | 50% | | 70 | | | 72 | |

| | | | | |

Other(2) | | | 109 | | | 103 | |

| Total L&S | | | 1,782 | | | 1,785 | |

| G&P | | | | | |

MarkWest Utica EMG, L.L.C.(2) | 57% | | 690 | | | 698 | |

Sherwood Midstream LLC(2) | 50% | | 550 | | | 557 | |

MarkWest EMG Jefferson Dry Gas Gathering Company, L.L.C.(2) | 67% | | 327 | | | 307 | |

MarkWest Torñado GP, L.L.C.(2) | 60% | | 213 | | | 188 | |

Rendezvous Gas Services, L.L.C.(2) | 78% | | 153 | | | 159 | |

Sherwood Midstream Holdings LLC(2) | 51% | | 141 | | | 148 | |

| | | | | |

| Centrahoma Processing LLC | 40% | | 131 | | | 145 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Other(2) | | | 46 | | | 49 | |

| Total G&P | | | 2,251 | | | 2,251 | |

| Total | | | $ | 4,033 | | | $ | 4,036 | |

(1) The investment in MarEn Bakken Company LLC includes our 9.19 percent indirect interest in a joint venture (“Dakota Access”) that owns and operates the Dakota Access Pipeline and Energy Transfer Crude Oil Pipeline projects, collectively referred to as the Bakken Pipeline system or DAPL.

(2) Investments deemed to be VIEs. Some investments included within “Other” have also been deemed to be VIEs.

(3) Through our ownership interest in W2W Holdings LLC, we have a 15 percent equity interest Wink to Webster Pipeline LLC.

For those entities that have been deemed to be VIEs, neither MPLX nor any of its subsidiaries have been deemed to be the primary beneficiary due to voting rights on significant matters. While we have the ability to exercise influence through participation in the management committees which make all significant decisions, we have equal influence over each committee as a joint interest partner and all significant decisions require the consent of the other investors without regard to economic interest and as such we have determined that these entities should not be consolidated and apply the equity method of accounting with respect to our investments in each entity.

Sherwood Midstream LLC (“Sherwood Midstream”) has been deemed the primary beneficiary of Sherwood Midstream Holdings LLC (Sherwood Midstream Holdings”) due to its controlling financial interest through its authority to manage the joint venture. As a result, Sherwood Midstream consolidates Sherwood Midstream Holdings. Therefore, MPLX also reports its portion of Sherwood Midstream Holdings’ net assets as a component of its investment in Sherwood Midstream. As of June 30, 2021, MPLX has a 24.55 percent indirect ownership interest in Sherwood Midstream Holdings through Sherwood Midstream.

MPLX’s maximum exposure to loss as a result of its involvement with equity method investments includes its equity investment, any additional capital contribution commitments and any operating expenses incurred by the subsidiary operator in excess of its compensation received for the performance of the operating services. MPLX did not provide any financial support to equity method investments that it was not contractually obligated to provide during the six months ended June 30, 2021.

During the first quarter of 2020, we recorded an other than temporary impairment for three joint ventures in which we have an interest as discussed in Note 1. Impairment of these investments was $1,264 million, of which $1,251 million was related to MarkWest Utica EMG, L.L.C. and its investment in Ohio Gathering Company, L.L.C. The impairment was recorded through “Income from equity method investments.” The impairments were largely due to a reduction in forecasted volumes gathered and processed by the systems operated by the joint ventures.

Summarized financial information for MPLX’s equity method investments for the six months ended June 30, 2021 and 2020 is as follows:

| | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2021 |

| (In millions) | VIEs | | Non-VIEs | | Total |

| Revenues and other income | $ | 336 | | | $ | 607 | | | $ | 943 | |

| Costs and expenses | 217 | | | 284 | | | 501 | |

| Income from operations | 119 | | | 323 | | | 442 | |

| Net income | 105 | | | 283 | | | 388 | |

Income from equity method investments(1) | $ | 73 | | | $ | 63 | | | $ | 136 | |

(1) Includes the impact of any basis differential amortization or accretion in addition to an impairment of $6 million.

| | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2020 |

| (In millions) | VIEs | | Non-VIEs | | Total |

| Revenues and other income | $ | (43) | | | $ | 640 | | | $ | 597 | |

| Costs and expenses | 202 | | | 274 | | | 476 | |

| (Loss)/income from operations | (245) | | | 366 | | | 121 | |

| Net (loss)/income | (283) | | | 332 | | | 49 | |

(Loss)/income from equity method investments(1) | $ | (1,178) | | | $ | 83 | | | $ | (1,095) | |

(1) Includes the impact of any basis differential amortization or accretion in addition to the impairment of $1,264 million.

Summarized balance sheet information for MPLX’s equity method investments as of June 30, 2021 and December 31, 2020 is as follows:

| | | | | | | | | | | | | | | | | |

| June 30, 2021 |

| (In millions) | VIEs | | Non-VIEs | | Total |

| Current assets | $ | 355 | | | $ | 464 | | | $ | 819 | |

| Noncurrent assets | 7,401 | | | 4,909 | | | 12,310 | |

| Current liabilities | 183 | | | 281 | | | 464 | |

| Noncurrent liabilities | $ | 2,379 | | | $ | 862 | | | $ | 3,241 | |

| | | | | | | | | | | | | | | | | |

| December 31, 2020 |

| (In millions) | VIEs | | Non-VIEs | | Total |

| Current assets | $ | 530 | | | $ | 318 | | | $ | 848 | |

| Noncurrent assets | 6,889 | | | 4,997 | | | 11,886 | |

| Current liabilities | 323 | | | 187 | | | 510 | |

| Noncurrent liabilities | $ | 1,904 | | | $ | 830 | | | $ | 2,734 | |

As of June 30, 2021 and December 31, 2020, the underlying net assets of MPLX’s investees in the G&P segment exceeded the carrying value of its equity method investments by approximately $56 million and $57 million, respectively. As of June 30, 2021 and December 31, 2020, the carrying value of MPLX’s equity method investments in the L&S segment exceeded the underlying net assets of its investees by $332 million and $331 million, respectively.

At June 30, 2021 and December 31, 2020, the G&P basis difference was being amortized into net income over the remaining estimated useful lives of the underlying assets, except for $31 million of excess related to goodwill. At June 30, 2021 and December 31, 2020, the L&S basis difference was being amortized into net income over the remaining estimated useful lives of the underlying assets, except for $167 million of excess related to goodwill.

5. Related Party Agreements and Transactions

MPLX engages in transactions with both MPC and certain of its equity method investments as part of its normal business; however, transactions with MPC make up the majority of MPLX’s related party transactions. Transactions with related parties are further described below.

MPLX has various long-term, fee-based commercial agreements with MPC. Under these agreements, MPLX provides transportation, terminal, fuels distribution, marketing, storage, management, operational and other services to MPC. MPC has committed to provide MPLX with minimum quarterly throughput volumes on crude oil and refined products and other fees for storage capacity; operating and management fees; as well as reimbursements for certain direct and indirect costs. MPC has also committed to provide a fixed fee for 100 percent of available capacity for boats, barges and third-party chartered equipment under the marine transportation service agreement. MPLX also has a keep-whole commodity agreement with MPC under which MPC pays us a processing fee for NGLs related to keep-whole agreements and delivers shrink gas to the producers on our behalf. We pay MPC a marketing fee in exchange for assuming the commodity risk. Additionally, MPLX has obligations to MPC for services provided to MPLX by MPC under omnibus and employee services-type agreements as well as other various agreements.

Related Party Loan