As filed with the U.S. Securities and Exchange Commission on February 8, 2021

Registration No. 333-249513

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Cancer Genetics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 8071 | 04-3462475 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

201 Route 17 North, 2nd Floor

Rutherford, NJ 07070

(201) 528-9200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John A. Roberts

President and Chief Executive Officer

Cancer Genetics, Inc.

201 Route 17 North, 2nd Floor

Rutherford, NJ 07070

(201) 528-9200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Alan Wovsaniker, Esq. Lowenstein Sandler LLP One Lowenstein Drive Roseland, New Jersey 07068 Tel: 973-597-2500

|

Yung-Ping Yeh Chief Executive Officer StemoniX, Inc. 13300 67th Avenue North Maple Grove, Minnesota 55311 Tel: 612-807-9889 |

Steve Kozachok, Esq. Taft Stettinius & Hollister LLP 2200 IDS Center 80 South Eighth Street Minneapolis, MN 55402 Tel: 612-977-8400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement and the satisfaction or waiver of all other conditions under the Merger Agreement described herein.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b–2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | ||

| Emerging growth company | ☐ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Amount to be registered(1)(2) | Proposed maximum offering price per share | Proposed maximum aggregate offering price(3) | Amount of registration fee(4) | ||||||||||||

| Common stock, par value $0.0001 per share | 38,903,566 | N/A | $ | 498.96 | $ | 0.05 | ||||||||||

| (1) | Represents an estimate of the maximum number of shares of common stock of Cancer Genetics, Inc. (“CGI”) that could be issuable upon completion of the transactions contemplated by the Agreement and Plan of Merger and Reorganization, dated as of August 21, 2020, among CGI, StemoniX, Inc. (“StemoniX”) and CGI Acquisition, Inc., as amended by Amendment No. 1 to Agreement and Plan of Merger and Reorganization dated February 8, 2021 (the “Merger Agreement”), as described in this registration statement. |

| (2) | Pursuant to Rule 416 under the Securities Act of 1933, as amended, or Securities Act, there are also being registered such additional shares of CGI common stock that may be issued because of events such as recapitalizations, stock dividends, stock splits and reverse stock splits, and similar transactions. |

| (3) | Calculated in accordance with Rule 457(f) of the Securities Act. StemoniX is a private company and no market exists for its equity securities. StemoniX has accumulated a capital deficit; therefore, pursuant to Rule 457(f)(2) under the Securities Act, the proposed maximum offering price would be one-third of the aggregate par value of StemoniX’s capital stock being acquired in the proposed merger. |

| (4) | Registration fee previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this proxy statement/prospectus/information statement is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This proxy statement/prospectus/information statement is not an offer to sell and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 8, 2021

|

|

PROPOSED MERGER

YOUR VOTE IS VERY IMPORTANT

To the Stockholders of Cancer Genetics, Inc. and the Shareholders of StemoniX, Inc.:

Cancer Genetics, Inc., a Delaware corporation (“CGI”), CGI Acquisition, Inc., a Minnesota corporation and a wholly-owned subsidiary of CGI (“Merger Sub”), and StemoniX, Inc., a Minnesota corporation (“StemoniX”), have entered into an Agreement and Plan of Merger and Reorganization, as amended (the “Merger Agreement”), pursuant to which Merger Sub will merge with and into StemoniX, with StemoniX surviving the merger as a wholly-owned subsidiary of CGI following the merger. These transactions are referred to herein collectively as the “merger.” CGI, with StemoniX as a wholly-owned subsidiary following the merger, is sometimes referred to herein as the “post-merger company.” It is expected that the shareholders of StemoniX will become the majority owners of CGI’s outstanding common stock upon the closing of the merger.

Pursuant to the Merger Agreement, each share of common stock of StemoniX, par value $0.0001 per share (the “StemoniX Common Stock”) (other than Dissenting Shares (as defined in the Merger Agreement)), issued and outstanding immediately prior to the effective time of the merger (the “Effective Time”) will be automatically converted into the right to receive a number of shares of common stock, par value $0.0001 per share, of CGI (the “CGI Common Stock”) equal to the Exchange Ratio (as defined in the Merger Agreement). All options to purchase shares of StemoniX Common Stock (“StemoniX Options”) outstanding immediately prior to the Effective Time, whether vested or unvested, will be converted into a stock option to purchase shares of CGI Common Stock, proportionately adjusted based on the Exchange Ratio. All warrants (“StemoniX Warrants”) to purchase shares of StemoniX capital stock, excluding certain warrants that are anticipated to be issued to investors purchasing at least a minimum amount of additional StemoniX Convertible Notes (the “Convertible Note Warrants”), outstanding immediately prior to the Effective Time will automatically be cancelled and each StemoniX warrantholder will be entitled to receive the same consideration they would have received had they exercised the StemoniX Warrant immediately prior to the merger, based on the Exchange Ratio, net of the exercise price. All Convertible Note Warrants will be exchanged for warrants (the “Convertible Note Exchange Warrants”) to purchase a number of shares of CGI Common Stock equal to 20% of the principal amount of Convertible Notes purchased divided by the weighted average share price of CGI Common Stock over the five trading days prior to the closing of the merger (the “5-Day VWAP”), with an exercise price equal to the 5-Day VWAP. In addition, each share of StemoniX Series C Preferred Stock (the “Series C Preferred Stock”) issued and outstanding immediately prior to the Effective Time will be converted into the right to receive a number of shares of CGI Common Stock equal to the price per share paid for the Series C Preferred Stock divided by a conversion price, subject to a valuation cap described elsewhere in this proxy statement/prospectus/information statement, equal to 85% of the 5-Day VWAP.

Pursuant to the amended Merger Agreement, CGI and StemoniX have agreed that their respective equity holders’ ownership in the post-merger company would be at the 22%/78% ratio described below, but that securities issued by each party in certain private placement transactions after the date of the original Merger Agreement would not be included in determining that ratio and would instead dilute the ownership of all holders proportionately. Those transactions to date are (a) the private offering by StemoniX of Series C Preferred Stock (the “Series C Financing”), in which an aggregate of $2 million has been committed to date and (b) the private offering by CGI of CGI Common Stock and warrants that closed on February 1, 2021 for gross proceeds of $10 million (the “CGI PIPE”, and collectively with the Series C Financing, the “Private Placement”). Under the Merger Agreement, it is a condition to closing that StemoniX shall have sold, no later than the closing of the merger, an aggregate of at least $5 million of Series C Preferred Stock (which may include the $2 million committed to date).

As a result, immediately following the Effective Time, but excluding the proportionate dilution resulting from the Private Placement, (A) the former StemoniX equity holders ((including the effect of the conversion of StemoniX convertible notes and excluding the effect of those purchasing Series C Preferred Stock in the Private Placement (the “Series C Investors”)) will hold approximately 78% of the “Deemed Outstanding Shares” of CGI Common Stock (defined below), and (B) the pre-merger outstanding (i) shares of CGI Common Stock (including underlying CGI options and CGI warrants on a net exercise basis but excluding the CGI securities issued in the CGI PIPE) and (ii) November PA Warrants will represent approximately 22% of the Deemed Outstanding Shares, with such percentages subject to certain closing adjustments based on the Net Cash (as defined in the section titled “The Merger Agreement—Exchange Ratio”, which excludes proceeds from the Private Placement) held by each company before closing (such adjustment, the “Net Cash Adjustment”).

The “Deemed Outstanding Shares” of CGI Common Stock means:

| (i) | the shares of CGI Common Stock outstanding, plus | |

| (ii) | any shares of CGI Common Stock issuable on a net exercise basis with respect to any in-the-money CGI options or in-the-money CGI warrants (excluding warrants to purchase an aggregate of 94,092 shares of CGI Common Stock (the “November PA Warrants”) issued to CGI’s placement agent in connection with a public offering on November 2, 2020), plus | |

| (iii) | in-the-money StemoniX Options and in-the-money StemoniX Warrants, plus | |

| (iv) | the amount of shares of CGI Common Stock issuable upon cash exercise of the November PA Warrants and Convertible Note Exchange Warrants, reduced by | |

| (v) | the securities issued in the CGI PIPE and the Series C Conversion Shares). |

The exact number of shares of CGI Common Stock that will be issued to StemoniX shareholders other than the Series C Investors will be fixed immediately prior to the Effective Time to reflect the capitalization of CGI as of immediately prior to such time as well as the Net Cash Adjustment, and the exact number of shares of CGI Common Stock that will be issued to the Series C Investors will be fixed immediately prior to the Effective Time based on the 5-Day VWAP. For a more complete description of the Exchange Ratio, the Series C Preferred Stock and the CGI PIPE, see the sections titled “The Merger Agreement—Exchange Ratio” and “The Merger Agreement—Agreements Related to the Merger”, respectively, in this proxy statement/prospectus/information statement.

| 2 |

For illustrative purposes only, if the closing of the merger occurred on February 1, 2021, CGI would have issued (i) an aggregate of approximately 15,065,280 shares of CGI Common Stock to the holders of StemoniX Common Stock (after giving effect to the conversion of StemoniX preferred shares (other than the Series C Preferred Stock) and convertible notes) and StemoniX Warrants (which does not include the Convertible Note Warrants), (ii) options to purchase an aggregate of up to approximately 774,714 shares of CGI Common Stock to the holders of StemoniX Options and (iii) warrants to purchase an aggregate of up to approximately 227,273 shares of CGI Common Stock to the holders of Convertible Note Warrants, in each case at the time of such closing pursuant to the Merger Agreement, such numbers reflecting the relative valuations of CGI and StemoniX in accordance with the initial 22%/78% split specified in the Merger Agreement (but excluding the Private Placement) and the capitalization of CGI and StemoniX as of February 1, 2021. The foregoing illustration assumes, solely for purposes of this calculation, no Net Cash Adjustment, no adjustment for fractional shares, a CGI closing price of $3.74 per share of common stock (the closing price the CGI Common Stock on the Nasdaq Capital Market on February 1, 2021) and an aggregate of $3 million in principal amount of additional Convertible Notes and related Convertible Note Warrants were sold to the investor who has to date agreed to purchase such amount. This equates to an Exchange Ratio of approximately 1.0347 shares of CGI Common Stock per one share of StemoniX Common Stock. In addition, CGI would have issued an aggregate of approximately 1,572,822 shares of CGI Common Stock to the Series C Investors, assuming a total of $5 million of Series C Preferred Stock was sold in the Private Placement.

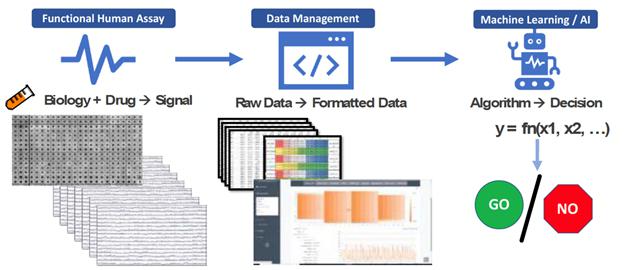

Subject to approval of the Nasdaq Stock Market LLC (“Nasdaq”), the merger will result in a publicly-traded company that will continue to operate CGI’s biotech business and will also focus on advancing StemoniX’s microOrgans® platform and augmented intelligence tools (AnalytiXTM) for drug discovery and development. Upon completion of the merger, the board of directors of the post-merger company is expected to be comprised of eight members comprised of John A. Roberts, President and Chief Executive Officer of CGI, Yung-Ping Yeh, Chief Executive Officer of StemoniX, Geoffrey Harris, current chairman of CGI, Howard McLeod, a current CGI director and four designees (and all current directors) of StemoniX— Paul Hansen, Marcus Boehm, John Fletcher, and Joanna Horobin.

Shares of CGI Common Stock are currently listed on the Nasdaq Capital Market under the symbol “CGIX.” The closing of the merger will be subject to a number of closing conditions, including approval of the continued trading of shares of CGI Common Stock on the Nasdaq Capital Market following the consummation of the merger. On , 2021, the last trading day before the date of this proxy statement/prospectus/information statement, the closing sale price of CGI Common Stock was $ per share.

CGI is holding a special meeting of stockholders in order to obtain the stockholder approvals necessary to complete the merger and other matters. At the CGI special meeting, which will be held on March 24, 2021 at 9:00 a.m., local time, at CGI’s facility located at 1214 Research Boulevard, Hummelstown, PA 17036, unless postponed or adjourned to a later date, CGI will ask its stockholders (i) to approve the issuance of shares of CGI Common Stock, warrants and options as consideration in the merger (the “Stock Issuance Proposal”), (ii) to approve an amendment to CGI’s certificate of incorporation effecting a reverse stock split of both the issued and outstanding and authorized CGI Common Stock at a ratio in the range from 1-for-2 to 1-for-10, with such ratio to be determined in the discretion of CGI’s board of directors and with such reverse stock split to be effected, if at all, at such time and date as determined by CGI’s board of directors in its sole discretion (the “Reverse Stock Split Proposal”), (iii) to approve the Cancer Genetics, Inc. 2021 Equity Incentive Plan and to authorize for issuance 4,500,000 shares of CGI Common Stock thereunder (the “Plan Proposal”), (iv) to approve, on an advisory basis, the compensation that may be paid or become payable to CGI’s named executive officers in connection with the merger (the “Executive Compensation Proposal”) and (v) an adjournment of the CGI special meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the CGI special meeting to approve the proposals submitted at the CGI special meeting (the “Adjournment Proposal”), each as described in this proxy statement/prospectus/information statement.

While as of the date of this proxy statement/prospectus/information statement CGI intends to hold the special meeting in a physical format, as part of its precautions regarding the coronavirus, or COVID-19, CGI is planning for the possibility, if necessary, of a change in the location of the special meeting to hold a hybrid or virtual meeting, which would allow for remote participation by stockholders at the special meeting, as entry to the physical location of the special meeting may be limited due to the requirements of applicable laws or orders restricting the size of public gatherings or other public health measures. If CGI takes this step, CGI will announce the decision to do so as soon as practicable via a press release that will also be filed with the SEC as proxy material, as well as by posting details on its website at https://www.cancergenetics.com/.

No meeting of StemoniX shareholders to adopt the Merger Agreement and approve the merger and related transactions will be held. Instead, all StemoniX shareholders will have the opportunity to vote to adopt the Merger Agreement and approve the merger and related transactions by signing and returning to StemoniX a written consent following the registration statement on Form S-4 (of which this proxy statement/prospectus/information statement is a part) being declared effective by the Securities and Exchange Commission. StemoniX will distribute a separate packet of information, including this proxy statement/prospectus/information statement, to its shareholders in connection with such written consent.

| 3 |

After careful consideration, the respective CGI and StemoniX boards of directors have unanimously approved the Merger Agreement and the transactions contemplated thereby, including the proposals referred to above and discussed elsewhere in this proxy statement/prospectus/information statement. The CGI board of directors unanimously recommends that its stockholders vote “FOR” each of the Stock Issuance Proposal, the Reverse Stock Split Proposal, the Plan Proposal, the Executive Compensation Proposal and the Adjournment Proposal described in this proxy statement/prospectus/information statement, and the StemoniX board of directors unanimously recommends that its shareholders vote to adopt the Merger Agreement and approve the merger and related transactions.

More information about CGI, StemoniX and the proposed transactions are contained in this proxy statement/prospectus/information statement. CGI and StemoniX urge you to read this proxy statement/prospectus/information statement carefully and in its entirety. IN PARTICULAR, YOU SHOULD CAREFULLY CONSIDER THE MATTERS DISCUSSED UNDER “RISK FACTORS” BEGINNING ON PAGE 37.

CGI and StemoniX are excited about the opportunities the merger brings to both CGI stockholders and StemoniX shareholders, and thank you for your consideration and continued support.

| John A. Roberts | Yung-Ping Yeh | |

| President and Chief Executive Officer | Chief Executive Officer | |

| Cancer Genetics, Inc. | StemoniX, Inc. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this proxy statement/prospectus/information statement. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus/information statement is dated , 2021, and is first being mailed to CGI stockholders and StemoniX shareholders on or about , 2021.

| 4 |

CANCER GENETICS, INC.

201 Route 17 North, 2nd Floor

Rutherford, New Jersey

(201) 528-9200

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On March 24, 2021

Dear Stockholders of CGI:

On behalf of the board of directors of Cancer Genetics, Inc., a Delaware corporation (“CGI”), CGI is pleased to deliver this proxy statement/prospectus/information statement for the proposed merger between CGI and StemoniX, Inc., a Minnesota corporation (“StemoniX”), pursuant to which CGI Acquisition, Inc., a wholly-owned subsidiary of CGI (“Merger Sub”), will merge with and into StemoniX, with StemoniX surviving the merger as a wholly-owned subsidiary of the post-merger company. The special meeting of CGI stockholders will be held on March 24, 2021 at 9:00 a.m. local time, at CGI’s facility located at 1214 Research Boulevard, Hummelstown, PA 17036, for the following purposes:

| 1. | To consider and vote upon a proposal to approve the issuance of shares of CGI Common Stock, warrants and options pursuant to the Agreement and Plan of Merger and Reorganization, dated as of August 21, 2020, by and among CGI, Merger Sub, and StemoniX, a copy of which is attached as Annex A-1 to this proxy statement/prospectus/information statement, as amended by the Amendment No. 1 to Agreement and Plan of Merger and Reorganization dated February 8, 2021, a copy of which is attached as Annex A-2 to this proxy statement/prospectus/information statement (the “Stock Issuance Proposal”); |

| 2. | To consider and vote upon an amendment to the certificate of incorporation of CGI to effect a reverse stock split of both the issued and outstanding and authorized CGI Common Stock, at a ratio in the range from 1-for-2 to 1-for-10, with such ratio to be determined in the discretion of CGI’s board of directors and with such reverse stock split to be effected at such time and date as determined by CGI’s board of directors in its sole discretion (the “Reverse Split”), the form of which is attached as Annex B to this proxy statement/prospectus/information statement (the “Reverse Stock Split Proposal”); |

| 3. | To consider and vote upon a proposal to approve the Cancer Genetics, Inc. 2021 Equity Incentive Plan, the form of which is attached as Annex C to this proxy statement/prospectus/information statement, and to authorize for issuance 4,500,000 shares of CGI Common Stock thereunder (the “Plan Proposal”); and |

| 4. | To approve, on an advisory basis, the compensation that may be paid or become payable to CGI’s named executive officers in connection with the merger, as disclosed in this proxy statement/prospectus/information statement (the “Executive Compensation Proposal”); |

| 5. | To consider and vote upon an adjournment of the CGI special meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the CGI special meeting to approve the proposals submitted at the CGI special meeting (the “Adjournment Proposal”). |

The foregoing items of business are more fully described in the proxy statement/prospectus/information statement that accompanies this notice. The CGI board of directors has fixed the close of business on February 8, 2021 as the record date for the determination of stockholders entitled to notice of and to vote at this CGI special meeting and at any adjournment or postponement thereof. At the close of business on the record date, CGI had 7,094,924 shares of common stock outstanding and entitled to vote.

All CGI stockholders are cordially invited to attend the CGI special meeting in person. Whether or not you expect to attend the CGI special meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for that purpose. Even if you have given your proxy, you may still vote in person if you attend the CGI special meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the CGI special meeting, you must obtain from the record holder a proxy issued in your name. You may revoke your proxy in the manner described in the proxy statement at any time before it has been voted at the meeting.

While as of the date of this proxy statement/prospectus/information statement CGI intends to hold the special meeting in a physical format, as part of its precautions regarding the coronavirus, or COVID-19, CGI is planning for the possibility, if necessary, of a change in the location of the special meeting to hold a hybrid or virtual meeting, which would allow for remote participation by stockholders at the special meeting, as entry to the physical location of the special meeting may be limited due to the requirements of applicable laws or orders restricting the size of public gatherings or other public health measures. If CGI takes this step, CGI will announce the decision to do so as soon as practicable via a press release that will also be filed with the SEC as proxy material, as well as by posting details on its website at https://www.cancergenetics.com/.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS OF CANCER GENETICS, INC. TO BE HELD MARCH 24, 2021. THIS PROXY STATEMENT AND THE ACCOMPANYING FORM OF PROXY CARD ARE AVAILABLE AT www.proxyvote.com. Under Securities and Exchange Commission rules, we are providing access to our proxy materials both by sending you this full set of proxy materials, and by notifying you of the availability of our proxy materials on the Internet.

| By Order of the Board of Directors of Cancer Genetics, Inc. | |

| John A. Roberts | |

| President and Chief Executive Officer | |

| Rutherford, New Jersey | |

| , 2021 |

| 5 |

ADDITIONAL INFORMATION

This proxy statement/prospectus/information statement incorporates important business and financial information about CGI that is not included in or delivered with the document. This information is available without charge to security holders upon written or oral request.

The registration statement to which this proxy statement/prospectus/information statement relates and the exhibits thereto, the information incorporated by reference herein and the other information filed by CGI with the SEC are available on or through CGI’s website at www.cancergenetics.com, free of charge. The SEC maintains a website that contains the documents that CGI files electronically with the SEC. The address of the SEC’s website is http://www.sec.gov. In addition, CGI will provide to each person to whom a proxy statement/prospectus/information statement is delivered, without charge upon written or oral request, a copy of any or all of the documents that CGI files with the SEC. Requests should be directed to:

Cancer Genetics, Inc.

201 Route 17 North, 2nd Floor

Rutherford, New Jersey

(201) 528-9200

Attention: John A. Roberts, President and Chief Executive Officer

You may also request additional copies from CGI’s proxy solicitor using the following contact information:

Alliance Advisors

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Toll Free: 800-574-6216

CGI Stockholders Meeting: To obtain timely delivery of such information, you must request the information no later than five business days before the CGI special meeting of stockholders. Accordingly, if you would like to request any information, please do so no later than March 17, 2021.

| 6 |

ABOUT THIS PROXY STATEMENT/PROSPECTUS/INFORMATION STATEMENT

This proxy statement/prospectus/information statement, which forms part of a registration statement on Form S-4 filed with the SEC by CGI (File No. 333-249513), constitutes a prospectus of CGI under Section 5 of the Securities Act of 1933, as amended, or the Securities Act, with respect to the shares of CGI Common Stock, par value $0.0001, of Cancer Genetics, Inc. to be issued pursuant to the Merger Agreement. This document also constitutes a notice of meeting and a proxy statement under Section 14(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, with respect to the CGI special meeting, at which CGI stockholders will be asked to consider and vote on, among other matters, a proposal to approve the issuance of shares of CGI Common Stock, warrants and options pursuant to the Merger Agreement.

No one has been authorized to provide you with information that is different from that contained in, or incorporated by reference into, this proxy statement/prospectus/information statement. This proxy statement/prospectus/information statement is dated , 2021. The information contained in this proxy statement/prospectus/information statement is accurate only as of that date or, in the case of information in a document incorporated by reference, as of the date of such document, unless the information specifically indicates that another date applies.

This proxy statement/prospectus/information statement does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction in which or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

The information concerning CGI contained in this proxy statement/prospectus/information statement or incorporated by reference has been provided by CGI, and the information concerning StemoniX contained in this proxy statement/prospectus/information statement has been provided by StemoniX.

| 7 |

TABLE OF CONTENTS

| 8 |

| 9 |

QUESTIONS AND ANSWERS ABOUT THE MERGER and other proposals

The following are brief answers to some questions that you may have regarding the merger and the CGI special meeting. The questions and answers in this section may not address all questions that might be important to you as a stockholder. For more detailed information, and for a description of the legal terms governing the merger, CGI urges you to read carefully and in its entirety this proxy statement/prospectus/information statement, including the Annexes hereto, as well as the registration statement to which this proxy statement/prospectus/information statement relates, including the exhibits to the registration statement. For more information, please see the section titled “Where You Can Find More Information.”

Except where specifically noted, the following information and all other information contained in this proxy statement/prospectus/information statement does not give effect to the proposed reverse stock split of CGI Common Stock described in the Reverse Stock Split Proposal in this proxy statement/prospectus/information statement.

The following section provides answers to frequently asked questions about the merger. This section, however, provides only summary information. For a more complete response to these questions and for additional information, please refer to the cross-referenced sections.

Q: What is the merger?

A: Cancer Genetics, Inc., a Delaware corporation (“CGI”), CGI Acquisition, Inc., a Minnesota corporation and a wholly-owned subsidiary of CGI (“Merger Sub”), and StemoniX, Inc., a Minnesota corporation (“StemoniX”), have entered into an Agreement and Plan of Merger and Reorganization, dated August 21, 2020 (the “Original Merger Agreement”), as amended by Amendment No. 1 to Agreement and Plan of Merger and Reorganization dated February 8, 2021 (the “Merger Agreement Amendment” and, together with the Original Merger Agreement, the “Merger Agreement”), pursuant to which Merger Sub will merge with and into StemoniX, with StemoniX surviving the merger as a wholly-owned subsidiary of CGI. These transactions are referred to herein collectively as the “merger.” CGI, with StemoniX as a wholly-owned subsidiary following the merger, is sometimes referred to herein as the “post-merger company.” It is expected that the shareholders of StemoniX will become the majority owners of CGI’s outstanding common stock upon the closing of the merger.

Pursuant to the Merger Agreement, each share of common stock of StemoniX, par value $0.0001 per share (the “StemoniX Common Stock”) (other than Dissenting Shares (as defined in the Merger Agreement)), issued and outstanding immediately prior to the effective time of the merger (the “Effective Time”) will be automatically converted into the right to receive a number of shares of common stock, par value $0.0001 per share, of CGI (“CGI Common Stock”) equal to the Exchange Ratio (as defined in the Merger Agreement), as described in the section entitled “The Merger Agreement—Merger Consideration.” All options to purchase shares of StemoniX Common Stock (“StemoniX Options”) outstanding immediately prior to the Effective Time, whether vested or unvested, will be exchanged for options to purchase CGI Common Stock, proportionately adjusted based on the Exchange Ratio. All warrants (“StemoniX Warrants”) to purchase shares of StemoniX capital stock, excluding certain warrants that may be issued to investors purchasing at least a minimum amount of additional StemoniX Convertible Notes (the “Convertible Note Warrants”), outstanding immediately prior to the Effective Time will automatically be cancelled and each StemoniX warrantholder will be entitled to receive the same consideration they would have received had they exercised the StemoniX Warrant immediately prior to the merger, based on the Exchange Ratio, net of the exercise price. All Convertible Note Warrants will be exchanged for warrants (the “Convertible Note Exchange Warrants”) to purchase a number of shares of CGI Common Stock equal to 20% of the principal amount of Convertible Notes purchased divided by the weighted average share price of CGI Common Stock over the five trading days prior to the closing of the merger (the “5-Day VWAP”), with an exercise price equal to the 5-Day VWAP. The exact number of shares of CGI Common Stock that will be issued to StemoniX shareholders (other than with respect to the Series C Preferred Stock (as defined below)) will be fixed immediately prior to the Effective Time to reflect the capitalization of CGI as of immediately prior to such time as well as the Net Cash Adjustment (as defined below). For a more complete description of the Exchange Ratio, see the section titled “The Merger Agreement—Exchange Ratio” in this proxy statement/prospectus/information statement.

In connection with the Merger Agreement, on January 28, 2021, StemoniX entered into a stock purchase agreement (the “Series C Preferred Stock Purchase Agreement”) with an institutional accredited investor (such investor, together with any future purchaser of Series C Preferred Stock, the “Series C Investors”), pursuant to which StemoniX agreed to issue to the Series C Investor shares of its Series C Preferred Stock (the “Series C Preferred Stock”) for an aggregate purchase price of $2 million, at the initial closing in an ongoing private placement of StemoniX Series C Preferred Stock for up to $10 million (subject to increase to up to $20 million with CGI’s consent) that may involve one or more additional closings prior to the closing of the merger (the “Series C Financing”), and that as a condition to closing requires that StemoniX have agreements for the purchase of at least another $6 million of Series C Preferred Stock. No assurance can be given that the conditions to closing the Series C Preferred Stock Purchase Agreement will be satisfied or waived, including that the additional shares be sold. Pursuant to the Merger Agreement, each share of Series C Preferred Stock issued and outstanding immediately prior to the Effective Time will be converted in the merger into the right to receive a number of shares of CGI Common Stock (the “Series C Conversion Shares”) equal to the price per share paid for the Series C Preferred Stock divided by a conversion price (the “Series C Conversion Price”) equal to 85% of the 5-Day VWAP, which conversion price is subject to a valuation cap (the “Series C Valuation Cap”) based on a $85,000,000 valuation of CGI, after giving effect to the issuance of all shares of CGI Common Stock at or prior to the closing of the merger (excluding the Series C Conversion Shares and out-of-the-money options and warrants to purchase shares of CGI Common Stock, but including in-the-money options and warrants to purchase shares of CGI Common Stock on a net exercise basis).

Pursuant to the amended Merger Agreement, CGI and StemoniX have agreed that their respective equity holders’ ownership in the post-merger company would be at the 22%/78% ratio described below, but that securities issued by each party in certain private placement transactions after the date of the original Merger Agreement would not be included in determining that ratio and would instead dilute the ownership of all holders proportionately. Those transactions to date are (a) the Series C Financing and (b) the private placement transaction of CGI that closed on February 1, 2021 for gross proceeds of $10 million in which CGI issued an aggregate of 2,758,624 shares of CGI Common Stock (the “CGI PIPE Shares”), warrants to purchase an aggregate of 2,758,624 shares of CGI Common Stock (the “CGI PIPE Warrants”) and placement agent warrants to purchase an aggregate of 165,517 shares of CGI Common Stock (the “CGI PIPE PA Warrants”) (the “CGI PIPE”, and collectively with the Series C Financing, the “Private Placement”). Under the Merger Agreement, it is a condition to closing that StemoniX shall have sold, no later than the closing of the merger, an aggregate of at least $5 million of Series C Preferred Stock. As described above, a condition to closing the Series C Financing requires that StemoniX have agreements for the purchase of at least $8 million of Series C Preferred Stock ($2 million of which has been committed as described above).

As a result, immediately following the Effective Time, but excluding the proportionate dilution resulting from the Private Placement, the following pre-merger StemoniX securities will represent approximately 78% of the Deemed Outstanding Shares (as defined below):

| (i) | StemoniX Common Stock (after the conversion to StemoniX Common Stock of all (A) shares of StemoniX Series A Convertible Preferred Stock (referred to herein as the “Series A Preferred Stock”) and Series B Convertible Preferred Stock (referred to herein as the “Series B Preferred Stock”) (specifically excluding the Series C Preferred Stock) and (B) StemoniX convertible promissory notes (referred to herein as the “Convertible Notes”)), | |

| (ii) | in-the-money StemoniX Options, | |

| (iii) | in-the-money StemoniX Warrants and | |

| (iv) | Convertible Note Warrants. |

The pre-merger outstanding (i) CGI Common Stock (other than the CGI PIPE Shares), (ii) in-the-money CGI stock options, if any, (iii) in-the-money CGI warrants, if any (other than the CGI PIPE Warrants and CGI PIPE PA Warrants) and (iv) November PA Warrants (as defined below) will represent approximately 22% of the Deemed Outstanding Shares, with such percentages subject to certain closing adjustments based on the Net Cash (as defined in the section titled “The Merger Agreement—Exchange Ratio ”, which excludes proceeds from the Private Placement) held by each company before closing (such adjustment, the “Net Cash Adjustment”) and, proportionately for all equity holders of the post-merger company, the Private Placement. As part of the Private Placement, the Series C Investors will receive shares of CGI Common Stock in the merger based on the 5-Day VWAP. “Deemed Outstanding Shares” means:

| (i) | the shares of CGI Common Stock outstanding, plus | |

| (ii) | any shares of CGI Common Stock issuable on a net exercise basis with respect to any in-the-money CGI options or in-the-money CGI warrants (excluding warrants to purchase an aggregate of 94,092 shares of CGI Common Stock (the “November PA Warrants”) issued to CGI’s placement agent in connection with a public offering on November 2, 2020), plus | |

| (iii) | in-the-money StemoniX Options and in-the-money StemoniX Warrants, plus | |

| (iv) | the amount of shares of CGI Common Stock issuable upon cash exercise of the November PA Warrants and Convertible Note Exchange Warrants, reduced by | |

| (v) | the securities issued in the CGI PIPE and the Series C Conversion Shares. |

| 10 |

On February 1, 2021, CGI had outstanding 7,094,924 (including 2,758,624 issued in the CGI PIPE) shares of CGI Common Stock, CGI warrants to purchase 3,125,503 (including 2,758,624 and 165,517 represented by the CGI PIPE Warrants and CGI PIPE PA Warrants, respectively) shares of CGI Common Stock with a weighted average exercise price of $5.98 per share (of which 210,233 shares were issuable on a net exercise basis) and CGI Options to purchase 55,907 shares of CGI Common Stock with a weighted average exercise price of $45.92 per share (of which 0 shares were issuable on a net exercise basis).

On February 1, 2021, StemoniX had outstanding:

(i) 2,593,607 shares of StemoniX Common Stock (40,900 of such shares are non-voting common stock);

(ii) 4,611,587 shares of Series A Preferred Stock and 3,489,470 shares of Series B Preferred Stock, which are convertible into StemoniX Common Stock at a conversion ratio that is subject to broad-based anti-dilution protections, and which will be converted into shares of StemoniX Common Stock immediately prior to the merger;

(iii) $8,212,933 ($11,212,933 if an additional $3 million in principal amount were sold to the investor who has to date agreed to purchase such amount) in principal amount of Convertible Notes (plus $330,775 in accrued interest), which are convertible into StemoniX Common Stock based on a percent of the then-fair market value per share of Common Stock and which will be converted into shares of StemoniX Common Stock immediately prior to the merger;

(iv) StemoniX Options to purchase 748,733 shares of StemoniX Common Stock with a weighted average exercise price of $1.82;

(v) StemoniX Warrants to purchase 58,657 shares of StemoniX Preferred Stock with a weighted average exercise price of $3.47; and

(vi) Convertible Note Warrants that will be exchanged in the merger for warrants to purchase $850,000 of CGI Common Stock (representing 20% of the total principal amount of Convertible Notes held by certain holders after the assumed sale of $3 million of additional Convertible Notes to the investor who has to date agreed to purchase such amount) divided by the 5-Day VWAP, with an exercise price equal to the 5-Day VWAP.

In addition, StemoniX has entered into the Series C Preferred Stock Purchase Agreement with one Series C Investor, pursuant to which StemoniX agreed to issue Series C Preferred Stock for an aggregate purchase price of $2 million, at the initial closing in the ongoing Series C Financing, and that as a condition to closing requires that StemoniX have agreements for the purchase of at least another $6 million of Series C Preferred Stock. No assurance can be given that the conditions to closing the Series C Preferred Stock Purchase Agreement will be satisfied or waived, including that the additional shares be sold.

Accordingly, by way of example only, if the closing of the merger occurred on February 1, 2021, at the Effective Time CGI would have issued

| (i) | an aggregate of approximately 15,065,280 shares of CGI Common Stock to the holders of StemoniX Common Stock (after giving effect to the conversion of StemoniX preferred shares (other than the Series C Preferred Stock) and convertible notes) and StemoniX Warrants (which does not include the Convertible Note Warrants), | |

| (ii) | options to purchase an aggregate of up to approximately 774,714 shares of CGI Common Stock to the holders of StemoniX Options and | |

| (iii) | warrants to purchase an aggregate of up to approximately 227,273 shares of CGI Common Stock to the holders of Convertible Note Warrants. |

The foregoing amounts listed in (i) through (iii) above reflect the relative valuations of CGI and StemoniX in accordance with the initial 22%/78% split specified in the Merger Agreement (but excluding the Private Placement) and the capitalization of CGI and StemoniX as of February 1, 2021. The foregoing illustration assumes, solely for purposes of this calculation, no Net Cash Adjustment, no adjustment for fractional shares, a CGI closing price of $3.74 per share of common stock (the closing price the CGI Common Stock on the Nasdaq Capital Market on February 1, 2021) and an aggregate of $3 million in principal amount of additional Convertible Notes and related Convertible Note Warrants were sold to the investor who has to date agreed to purchase such amount. This equates to an Exchange Ratio of approximately 1.0347 shares of CGI Common Stock per (A) one share of StemoniX Common Stock, (B) share of StemoniX Common Stock issuable on a net exercise basis under in-the-money StemoniX Warrants (which does not include the Convertible Note Warrants) and/or in-the-money StemoniX Options or (C) equivalent share of StemoniX Common Stock (converted to StemoniX Common Stock from CGI Common Stock using the Exchange Ratio) issuable upon cash exercise of the Convertible Note Warrants. In addition, CGI would have issued an aggregate of approximately 1,572,822 shares of CGI Common Stock to the Series C Investors, assuming a total of $5 million of Series C Preferred Stock was sold in the Private Placement (the amount required by the closing condition in the Merger Agreement). As a result, following the closing of the merger, CGI would have had outstanding a total of approximately 23,733,028 shares of CGI Common Stock, CGI warrants to purchase approximately 3,352,776 shares of CGI Common Stock and options to purchase approximately 830,621 shares of CGI Common Stock.

Any changes in the market price of CGI Common Stock before the closing of the merger will not affect the total number of shares of CGI Common Stock that historical StemoniX security holders (meaning those other than the Series C Investors with respect to the Series C Preferred Stock) will be entitled to receive (or will be entitled to receive upon the exercise of options to purchase CGI Common Stock issued in exchange for StemoniX Options) pursuant to the Merger Agreement (collectively, the “Merger Shares”) except to the extent that changes in the market price of CGI Common Stock impact (a) the number of shares that become issuable on a net exercise basis under in-the-money CGI warrants and in-the-money CGI Options, and which therefore become part of the CGI Outstanding Equity (as defined in the section titled “The Merger Agreement—Exchange Ratio”, which does not include securities issued in the CGI PIPE) as of the Effective Time and (b) the number of shares of CGI Common Stock issuable upon the exercise of the Convertible Note Exchange Warrants. However, due to the conversion or exercise provisions of the convertible and exercisable debt and equity securities of StemoniX, including the Series C Preferred Stock, changes in the market price of CGI Common Stock will affect:

| ● | the Exchange Ratio; | |

| ● | the allocation of the Merger Shares among the historical holders of StemoniX securities, including holders of the Convertible Note Warrants; | |

| ● | the number of shares of CGI Common Stock required to be issued in the merger for the conversion of the Series C Preferred Stock; and | |

| ● | the number of shares of CGI Common Stock issuable upon the exercise of the Convertible Note Exchange Warrants. |

| 11 |

The first part of the table below shows the number of shares of StemoniX Common Stock that each class of StemoniX securities (other than the Series C Preferred Stock) will represent in the aggregate immediately prior to the merger on an as-converted, net exercise or equivalent basis, as applicable, as well as the resulting Exchange Ratio at the various CGI stock prices shown below, such numbers reflecting the relative valuations of CGI and StemoniX in accordance with the initial 22%/78% split specified in the Merger Agreement and the capitalization of CGI and StemoniX as of February 1, 2021, assuming, solely for purposes of this calculation, no Net Cash Adjustment, no adjustment for fractional shares and an additional $3 million in principal amount of Convertible Notes and related Convertible Note Warrants were sold to the investor who has to date agreed to purchase such amount (together with an aggregate of $1.25 million previously sold to such holder). Changes in the stock price of CGI Common Stock impact the allocation of equity ownership within the StemoniX capital structure, but will have minimal impact on the initial 22%/78% split between the historical CGI (meaning excluding CGI securities issued in the CGI PIPE) and StemoniX equity holders specified in the Merger Agreement.

The last two rows of the table below show the number of shares of CGI Common Stock that would be issued in the merger for the conversion of the Series C Preferred Stock at the different CGI Common Stock prices, assuming an aggregate of $5 million and $10 million of Series C Preferred Stock, respectively, was sold prior to the merger.

The table is for illustrative purposes only and the numbers shown will be different upon the closing of the merger.

| EXCHANGE RATIO SENSITIVITY TABLE | ||||

| As of 2/1/21 | ||||

| CGI Common Stock (excluding CGI PIPE Shares, including issuable under the November PA Warrants): | 4,430,392 | |||

| CGI/StemoniX Percentages: | 22%/78% | |||

| Total Merger Shares: | 15,707,753 | |||

| CGI PIPE Shares (not included in the 22%/78%): | 2,758,624 | |||

| CGI Common Stock Price | ||||||||||||||||||||||||||||||||

| StemoniX Equity Class | $2.50 | $3.00 | $3.50 | $3.74 | $4.50 | $5.00 | $5.50 | $6.00 | ||||||||||||||||||||||||

| StemoniX Common Stock | 2,593,607 | 2,593,607 | 2,593,607 | 2,593,607 | 2,593,607 | 2,593,607 | 2,593,607 | 2,593,607 | ||||||||||||||||||||||||

| % of total StemoniX Common Stock | 13.0 | % | 15.2 | % | 16.6 | % | 17.1 | % | 18.2 | % | 18.7 | % | 19.0 | % | 18.9 | % | ||||||||||||||||

| Convertible Notes (as converted to StemoniX Common Stock) | 7,130,012 | 5,097,894 | 4,004,295 | 3,642,134 | 2,852,446 | 2,501,199 | 2,283,726 | 2,270,151 | ||||||||||||||||||||||||

| % of total StemoniX Common Stock | 35.6 | % | 29.8 | % | 25.6 | % | 24.0 | % | 20.0 | % | 18.0 | % | 16.7 | % | 16.6 | % | ||||||||||||||||

| Series A Preferred Stock (as converted to StemoniX Common Stock) | 5,267,390 | 4,801,221 | 4,634,731 | 4,611,587 | 4,611,587 | 4,611,587 | 4,611,587 | 4,611,587 | ||||||||||||||||||||||||

| % of total StemoniX Common Stock | 26.3 | % | 28.1 | % | 29.6 | % | 30.4 | % | 32.3 | % | 33.2 | % | 33.7 | % | 33.7 | % | ||||||||||||||||

| Series B Preferred Stock (as converted to StemoniX Common Stock) | 4,519,473 | 4,043,563 | 3,787,455 | 3,702,642 | 3,543,365 | 3,493,894 | 3,489,886 | 3,489,470 | ||||||||||||||||||||||||

| % of total StemoniX Common Stock | 22.6 | % | 23.6 | % | 24.2 | % | 24.4 | % | 24.8 | % | 25.2 | % | 25.5 | % | 25.5 | % | ||||||||||||||||

| StemoniX Options (net exercise basis) | 69,535 | 262,396 | 366,725 | 401,275 | 476,611 | 510,120 | 531,605 | 573,711 | ||||||||||||||||||||||||

| % of total StemoniX Common Stock | 0.3 | % | 1.5 | % | 2.3 | % | 2.6 | % | 3.3 | % | 3.7 | % | 3.9 | % | 4.2 | % | ||||||||||||||||

| StemoniX Warrants (net exercise basis) | - | - | 6,838 | 10,026 | 20,450 | 25,012 | 28,533 | 30,600 | ||||||||||||||||||||||||

| % of total StemoniX Common Stock | 0.0 | % | 0.0 | % | 0.0 | % | 0.1 | % | 0.1 | % | 0.2 | % | 0.2 | % | 0.2 | % | ||||||||||||||||

| Convertible Note Warrants (in shares of StemoniX Common Stock) | 433,193 | 308,577 | 241,738 | 219,650 | 171,596 | 150,280 | 134,531 | 123,492 | ||||||||||||||||||||||||

| % of total StemoniX Common Stock | 2.2 | % | 1.8 | % | 1.5 | % | 1.4 | % | 1.2 | % | 1.1 | % | 1.0 | % | 0.9 | % | ||||||||||||||||

| Total (in Shares of StemoniX Common Stock) | 20,013,210 | 17,107,259 | 15,635,389 | 15,180,921 | 14,269,661 | 13,885,699 | 13,673,476 | 13,692,619 | ||||||||||||||||||||||||

| Exchange Ratio (Merger Shares/Total StemoniX Common Stock Equivalent): | 0.7849 | 0.9182 | 1.0046 | 1.0347 | 1.1008 | 1.1312 | 1.1488 | 1.1472 | ||||||||||||||||||||||||

| Series C Preferred Stock (assuming $5 million of capital raised) | 2,352,941 | 1,960,784 | 1,680,672 | 1,572,822 | 1,340,483 | 1,340,483 | 1,340,483 | 1,340,483 | ||||||||||||||||||||||||

| Series C Preferred Stock (assuming $10 million of capital raised) | 4,705,882 | 3,921,569 | 3,361,345 | 3,145,643 | 2,680,965 | 2,680,965 | 2,680,965 | 2,680,965 | ||||||||||||||||||||||||

The table below shows the number of shares and percentage ownership of outstanding CGI Common Stock, immediately following the merger and assuming a CGI Common Stock price of $3.74, that each of the following would hold: (i) the historical holders of CGI Common Stock (excluding the CGI PIPE Shares), (ii) the holders of the CGI PIPE Shares, (iii) the former holders of StemoniX Common Stock, Convertible Notes, Series A Preferred Stock, Series B Preferred Stock, StemoniX Options and StemoniX Warrants, collectively, and (iv) the holders of Series C Preferred Stock.

| Aggregate Amount Sold in Series C Offering | ||||||||

| Equity Class | $5 million | $10 million | ||||||

| CGI Common Stock (excluding the CGI PIPE Shares) | 4,336,300 / 18.3% | 4,336,300 / 17.1% | ||||||

| CGI PIPE Shares | 2,758,624 / 11.6% | 2,758,624 / 10.9% | ||||||

| StemoniX Common Stock, Convertible Notes, Series A Preferred Stock, Series B Preferred Stock and Warrants (excluding Convertible Note Warrants) | 15,065,280 / 63.5% | 15,065,280 / 59.5% | ||||||

| Series C Preferred Stock | 1,572,822 / 6.6% | 3,145,643 / 12.4% | ||||||

| Total | 23,733,028 | 25,305,847 | ||||||

| 12 |

Q: Why are the companies proposing to merge?

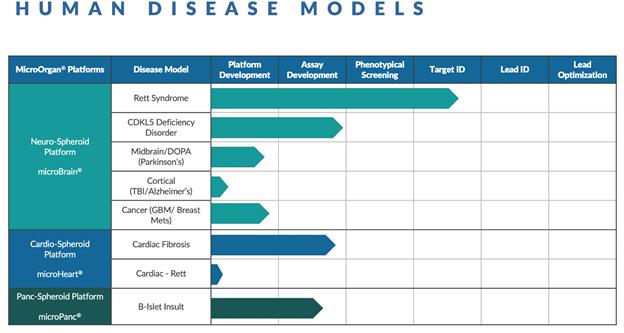

A: CGI is a leader in drug discovery and preclinical oncology and immuno-oncology services, and StemoniX, a private company, is a leader in developing high-throughput disease-specific human organoid platforms integrated with leading-edge data science technologies. CGI and StemoniX believe that the merger will position the post-merger company to harness the synergies between two critical modalities of drug discovery and development - advanced animal models and relevant human high-throughput organoid platforms. CGI and StemoniX further believe that the resulting integration of scientific and technology-based expertise, skilled management teams, and ability to offer customers an end-to-end platform will de-risk and accelerate discovery and development of preclinical and clinical pipelines for biopharma partners as well as for the proprietary pipeline of the post-merger company. For a more complete discussion of CGI and StemoniX reasons for the merger, please see the section titled “The Merger—CGI Reasons for the Merger” and “The Merger—StemoniX Reasons for the Merger.”

Q: Why am I receiving this proxy statement/prospectus/information statement?

A: You are receiving this proxy statement/prospectus/information statement because you have been identified as a stockholder of CGI as of the record date and you are entitled to vote at the CGI stockholder meeting or you are a shareholder of StemoniX eligible to execute the written consent for the adoption of the Merger Agreement and the approval of the merger and related transactions. This document serves as:

| ● | a proxy statement of CGI used to solicit proxies for its special meeting of stockholders; | |

| ● | a prospectus of CGI used to issue shares of CGI Common Stock (i) in exchange for shares of StemoniX Common Stock or StemoniX Warrants, (ii) issuable upon the exercise of options and warrants being issued in exchange for StemoniX Options and Convertible Note Warrants, respectively, and (iii) in exchange for shares of the StemoniX Series C Preferred Stock, in each case pursuant to the merger; and | |

| ● | an information statement of StemoniX used to solicit the written consent of its stockholders for the adoption of the Merger Agreement and the approval of the merger and related transactions. |

Q: What is required to consummate the merger?

A: To consummate the merger, among other things, CGI stockholders must approve the Stock Issuance Proposal, and StemoniX shareholders must adopt the Merger Agreement and approve the merger and the transactions and related corporate changes contemplated by the Merger Agreement.

The approval of the Stock Issuance Proposal by the CGI stockholders requires the affirmative vote of the holders of a majority in voting power of the shares of stock which are present in person or by proxy at the special meeting and entitled to vote thereon, presuming a quorum is present at the meeting. In addition, to the extent a reverse stock split of CGI Common Stock becomes necessary for the continued listing of the CGI Common Stock on the Nasdaq Capital Market post-merger, the approval of the Reverse Stock Split Proposal will become necessary for the merger, which approval requires the affirmative vote of the holders of a majority of the outstanding shares of CGI Common Stock as of the record date for the special meeting.

The adoption of the Merger Agreement and the approval of the merger and the transactions and related corporate changes contemplated by the Merger Agreement by the shareholders of StemoniX requires the affirmative vote of:

(i) holders of a majority of the voting power of the StemoniX Common Stock;

(ii) holders of at least sixty-five percent (65%) of the outstanding shares of Series A Preferred Stock of StemoniX, Series B Preferred Stock of StemoniX and Series C Preferred Stock (if any), voting together as a single class;

| 13 |

(iii) holders of a majority of the outstanding shares of the Series A Preferred Stock, voting as a separate class; and

(iv) holders of a majority of the outstanding shares of the Series B Preferred Stock, voting as a separate class.

In addition to the requirement of obtaining such shareholder approvals and appropriate regulatory approvals, completion of the merger is subject to the satisfaction of a number of other conditions, including authorization for listing of the shares of CGI Common Stock issued in the merger on The Nasdaq Stock Market LLC (“Nasdaq”), the continued listing of the CGI Common Stock on the Nasdaq Capital Market post-merger and the effectiveness of the Registration Statement of which this proxy statement/prospectus/information statement forms a part. Under the Merger Agreement, it is also a condition to closing that StemoniX shall have sold, no later than the closing of the merger, an aggregate of at least $5 million of Series C Preferred Stock.

For a more complete description of the closing conditions under the Merger Agreement, please see the section titled “The Merger Agreement—Conditions to the Closing of the Merger.”

Q: What will StemoniX securityholders receive in the merger?

A: As a result of the merger and in accordance with the Exchange Ratio, the holders of (i) StemoniX Common Stock (after the conversion to StemoniX Common Stock of all (A) shares of StemoniX Series A Preferred Stock and Series B Preferred Stock and (B) StemoniX Convertible Notes), (ii) in-the-money StemoniX Options, (iii) in-the-money StemoniX Warrants and (iv) Convertible Note Warrants will hold approximately 78% of the Deemed Outstanding Shares, with such percentages subject to the Net Cash Adjustment and, proportionately for all equity holders of the post-merger company, the Private Placement, and the Series C Investors will hold an amount of CGI Common Stock equal to the amount paid for the Series C Preferred Stock divided by a conversion price (the “Series C Conversion Price”) equal to 85% of the 5-Day VWAP, which conversion price is subject to the Series C Valuation Cap.

For a more complete description of what StemoniX securityholders will receive in the merger, please see the sections titled “Market Price and Dividend Information” and “The Merger Agreement—Merger Consideration.”

Q: What will CGI securityholders receive in the merger?

A: CGI securityholders, including holders of securities purchased in the CGI PIPE, will not receive any new securities in the merger and will instead retain ownership of their shares of CGI Common Stock and other securities exercisable or convertible to CGI Common Stock, but their percentage ownership will decrease due to the number of shares being issued in the merger and the Private Placement.

Q: Who will be the directors of the post-merger company?

A: Upon the closing of the merger, the post-merger company’s board of directors is expected to be composed of eight directors. The table below provides the names and principal affiliation of the individuals currently identified to serve as directors of the post-merger company.

| Name | Current Principal Affiliation | |

| John A. Roberts(1) | President and Chief Executive Officer, CGI | |

| Yung-Ping Yeh(2) | Chief Executive Officer, StemoniX | |

| Geoffrey Harris (1) | Managing Partner, c7 Advisors; Chairman of CGI | |

| Howard McLeod (1) | Medical Director, Precision Medicine for the Geriatric Oncology Consortium; Professor, USF Taneja College of Pharmacy; Director of CGI | |

| Paul Hansen(2) | Director, StemoniX; Senior Fellow, University of Minnesota Technological Leadership Institute; Founder and President, Minnepura Technologies, SBC | |

| Marcus Boehm(2) | Founder and Chief Scientific Officers, Escient Pharmaceuticals, Inc. | |

| John Fletcher (2) | Chief Executive Officer, Fletcher Spaght, Inc.; Managing Partner, Fletcher Spaght Ventures | |

| Joanna Horobin(2) | Director, Kynera Therapeutics Inc.; Director, Nordic Nanovector ASA; Director, Liquidia Corporation | |

| (1) CGI designee | ||

| (2) StemoniX designee |

In addition, if the current Series C Investor purchases at least $5,000,000 Series C Preferred Stock in the Series C Financing, the current Series C Investor will be entitled to have one observer on the CGI board after the merger is consummated. Further, the investor that has agreed to purchase an additional $3 million of Convertible Notes and accompanying Convertible Note Warrants will be entitled to have one observer on the CGI board after the merger is consummated, assuming such purchase is consummated.

| 14 |

Q: Who will be the executive officers of post-merger company?

A: Upon the closing of the merger, the executive management team of the post-merger company is expected to be composed of the following persons:

| Name | Post-Merger Company Position(s) | Current Position(s) | ||

| John A. Roberts | President and Chief Executive Officer | President and Chief Executive Officer, CGI | ||

| Yung-Ping Yeh | Chief Innovation Officer | Chief Executive Officer, StemoniX | ||

| Andrew D.C. LaFrence | Chief Financial Officer | Chief Financial Officer and Chief Operating Officer, StemoniX | ||

| Ralf Brandt, Ph.D. | President, Discovery Services | President of Discovery & Early Development Services, CGI |

Q: What are the material U.S. federal income tax consequences of the merger to holders of StemoniX Common Stock?

A: The merger is intended to qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). In connection with the filing of the registration statement of which this proxy statement/prospectus/information statement is a part, Lowenstein Sandler LLP (“Lowenstein Sandler”), CGI’s counsel, has delivered to CGI, and, Taft Stettinius & Hollister LLP (“Taft”) StemoniX’s counsel, has delivered to StemoniX, their respective opinions that, for United States federal income tax purposes, subject to the limitations, assumptions and qualifications described in the opinions and in the section entitled “Material United States Federal Income Tax Consequences of the Reverse Stock Split and the Merger,” the merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Code. The opinions of Lowenstein Sandler and Taft will be based on certain representations, assumptions and covenants regarding the merger, including representations and covenants contained in officer’s certificates furnished to Lowenstein Sandler and Taft by CGI, StemoniX and Merger Sub, which are customary for transactions of this type. If any of the representations, assumptions or covenants upon which the opinions rely is incorrect, incomplete or inaccurate or is violated, the accuracy of the opinions may be affected and the tax consequences of the merger could differ from those described in this proxy statement/prospectus/information statement.

Accordingly, assuming the merger qualifies as a “reorganization” within the meaning of Section 368(a) of the Code, if you are a U.S. holder (as defined in the section entitled “Material United States Federal Income Tax Consequences of the Reverse Stock Split and the Merger”) of StemoniX Common Stock, you will not recognize any gain or loss for U.S. federal income tax purposes upon your exchange of shares of StemoniX Common Stock for shares of CGI Common Stock in the merger, except with respect to cash received in lieu of fractional shares of CGI Common Stock. Notwithstanding the foregoing, your tax treatment will depend on your specific situation and many variables not within CGI’s or StemoniX’s control.

However, there are many requirements that must be satisfied in order for the merger to be treated as a reorganization under Section 368(a) of the Code, some of which are based upon factual determinations, and the reorganization treatment could be affected by actions taken after the merger. If the merger failed to qualify as a reorganization under Section 368(a) of the Code, U.S. holders of StemoniX Common Stock generally would recognize the full amount of gains and losses realized on the exchange of their StemoniX Common Stock for CGI Common Stock in the merger.

The Reverse Stock Split is expected to constitute a “recapitalization” for U.S. federal income tax purposes. As a result, a CGI U.S. holder generally should not recognize gain or loss upon the Reverse Stock Split, except with respect to cash received in lieu of a fractional share of CGI Common Stock (as discussed in the section entitled “Material United States Federal Income Tax Consequences of the Reverse Stok Split and Merger”). A CGI U.S. holder’s aggregate tax basis in the shares of CGI Common Stock received pursuant to the Reverse Stock Split should equal the aggregate tax basis of the shares of CGI Common Stock surrendered (excluding any portion of such basis that is allocated to any fractional share of CGI Common Stock), and such CGI U.S. holder’s holding period in the shares of CGI Common Stock received should include the holding period in the shares of CGI Common Stock surrendered.

For further information, see the section entitled “Material U.S. Federal Income Tax Consequences of the Reverse Stock Split and the Merger.”

| 15 |

Q: Do persons involved in the merger have interests that may conflict with mine as a CGI stockholder?

A: Yes. In considering the recommendation of the CGI board of directors with respect to issuing shares of CGI Common Stock pursuant to the Merger Agreement and the other matters to be acted upon by CGI stockholders at the CGI special meeting, CGI stockholders should be aware that certain members of the CGI board of directors and executive officers of CGI have interests in the merger that may be different from, or in addition to, interests they have as CGI stockholders.

As of February 1, 2021, CGI’s directors and executive officers beneficially owned approximately 1.6% of the outstanding shares of CGI Common Stock. John A. Roberts, currently CGI’s President and Chief Executive Officer, will continue as the President and Chief Executive Officer of the post-merger company and be appointed to its board of directors, and Ralf Brandt, Ph.D., currently CGI’s President of Discovery & Early Development Services, will continue as President, Discovery Services, in each case following the consummation of the merger.

For more information, please see the section titled “The Merger—Interests of the CGI Directors and Executive Officers in the Merger.”

Q: Do persons involved in the merger have interests that may conflict with mine as a StemoniX stockholder?

A: Yes. In considering the recommendation of the StemoniX board of directors with respect to adopting the Merger Agreement and approving the merger and related transactions and corporate changes by written consent, StemoniX shareholders should be aware that certain members of the StemoniX board of directors and executive officers of StemoniX have interests in the merger that may be different from, or in addition to, interests they have as StemoniX shareholders.

All of StemoniX’s current executive officers and directors hold shares of StemoniX Common Stock, StemoniX Options, Series A Preferred Stock, Series B Preferred Stock and Convertible Notes, all of which will, at the Effective Time, entitle them to receive an amount of registered shares of CGI Common Stock or options to purchase CGI Common Stock, as applicable, based on the Exchange Ratio. As of February 1, 2021, StemoniX’s directors and executive officers beneficially owned approximately 86.8% of the outstanding shares of StemoniX Common Stock. Beneficial ownership is determined according to the rules of the SEC and generally means that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power of that security, including securities that are exercisable or convertible, as the case may be, within 60 days of February 1, 2021. Shares of StemoniX Common Stock issuable pursuant to such securities are deemed outstanding for computing the percentage of the person holding such securities and the percentage of any group of which the person is a member but are not deemed outstanding for computing the percentage of any other person. Accordingly, if a shareholder of StemoniX owns preferred stock of StemoniX, the beneficial ownership of such shareholder is computed as if such shareholder’s preferred stock was converted to StemoniX Common Stock, but no other preferred stock is converted to StemoniX Common Stock. Accordingly, the percentage above, together with the beneficial ownership of all other StemoniX holders may add to more than 100%.

In addition, Yung-Ping Yeh, currently StemoniX’s Chief Executive Officer, will serve as the Chief Innovation Officer of CGI and be appointed to its board of directors, and Andrew D.C. LaFrence, currently StemoniX’s Chief Financial Officer and Chief Operating Officer, will serve as CGI’s Chief Financial Officer, in each case following the consummation of the merger.

For more information, please see the sections titled “The Merger—Interests of the StemoniX Directors and Executive Officers in the Merger.”

Q: As a CGI stockholder, how does the CGI board of directors recommend that I vote?

A: After careful consideration, the CGI board of directors unanimously recommends that CGI stockholders vote:

| ● | “FOR” the Stock Issuance Proposal; |

| ● | “FOR” the Reverse Stock Split Proposal; |

| ● | “FOR” the Plan Proposal; |

| ● | “FOR” the Executive Compensation Proposal; and |

| ● | “FOR” the Adjournment Proposal. |

| 16 |

If on the date of the CGI special meeting, or a date preceding the date on which the CGI special meeting is scheduled, CGI reasonably believes that (i) it will not receive proxies sufficient to obtain the required vote to approve the proposals listed above (the “CGI Proposals”), whether or not a quorum would be present or (ii) it will not have sufficient shares of CGI Common Stock represented (whether in person or by proxy) to constitute a quorum necessary to conduct the business of the CGI special meeting, CGI may postpone or adjourn, or make one or more successive postponements or adjournments of, the CGI special meeting as long as the date of the CGI special meeting is not postponed or adjourned more than an aggregate of 30 calendar days in connection with any postponements or adjournments.

The merger will not be consummated unless the Stock Issuance Proposal is approved by the CGI stockholders at the CGI special meeting. No CGI Proposal is contingent upon any other CGI Proposal. Therefore, assuming all other closing conditions have been either satisfied or waived, the merger may be consummated even if the Reverse Stock Split Proposal is not approved by CGI’s stockholders, unless doing so would cause CGI to fail to meet the condition of closing that the shares of CGI Common Stock issued in the merger be listed on the Nasdaq Capital Market, and such condition (i) is not able to be met without the Reverse Stock Split Proposal being approved or (ii) is not waived.

Q: As a StemoniX shareholder, how does the StemoniX board of directors recommend that I vote?

A: After careful consideration, the StemoniX board of directors recommends that StemoniX shareholders execute the written consent indicating their vote in favor of the adoption of the Merger Agreement and the approval of the merger and the transactions and related corporate changes contemplated by the Merger Agreement.

Q: Do StemoniX shareholders have dissenters’ rights if they object to the proposed merger?

A: Yes. StemoniX shareholders are entitled to dissenters’ rights in connection with the merger under Minnesota law. For more information about such rights, see the provisions of Section 471 of the Minnesota Business Corporation Act, attached hereto as Annex D, and the section entitled “The Merger—Appraisal Rights and Dissenters’ Rights.”

Q: What risks should I consider in deciding whether to vote in favor of the CGI Proposals or to execute and return the written consent of StemoniX shareholders, as applicable?

A: You should carefully review this proxy statement/prospectus/information statement, including the section titled “Risk Factors,” which sets forth certain risks and uncertainties related to the merger, risks and uncertainties to which the post-merger company’s business will be subject, and risks and uncertainties to which each of CGI and StemoniX, as an independent company, is subject.

Q: What will happen to CGI if, for any reason, the merger does not close?

A: If, for any reason, the merger does not close, the CGI board of directors may elect to, among other things, attempt to complete another strategic transaction like the merger, attempt to sell or otherwise dispose of the various assets of CGI or continue to operate the business of CGI.

If the merger does not close, CGI believes that its cash at September 30, 2020, together with net proceeds of (i) $2.9 million from its underwritten public offering of common stock that closed on November 2, 2020 (the “November Offering”), (ii) $957 thousand from sales to date pursuant to its At The Market Offering Agreement dated December 2, 2020 (the “CGI ATM”) and (iii) $8.9 million from the issuance and sale of CGI securities in the CGI PIPE will be sufficient to fund normal operations for the twelve months from the date of this filing.

Q: When do you expect the merger to be consummated?

A: The merger is anticipated to close as soon as practicable after the consent of the shareholders of StemoniX is obtained and the CGI special meeting is held on March 24, 2021, but CGI cannot predict the exact timing. For more information, please see the section titled “The Merger Agreement—Conditions to the Closing of the Merger.”

Q: What do I need to do now?

A: CGI and StemoniX urge you to read this proxy statement/prospectus/information statement carefully, including its annexes, and to consider how the merger affects you.

If you are a CGI stockholder, you may provide your proxy instructions in one of two different ways. First, you can mail your signed proxy card in the enclosed return envelope. Second, you may also provide your proxy instructions via the Internet by following the instructions on your proxy card or voting instruction form. Please provide your proxy instructions only once, unless you are revoking a previously delivered proxy instruction, and as soon as possible so that your shares can be voted at the special meeting of CGI stockholders.

If you are a shareholder of StemoniX, you may execute and deliver your written consent to StemoniX in accordance with the instructions provided by StemoniX.

| 17 |

Q: What happens if I do not return a proxy card or otherwise provide proxy instructions, as applicable?

A: If you are a stockholder of record of CGI and you return a signed proxy card without marking any selections, your shares will be voted “FOR” each of the Stock Issuance Proposal, the Reverse Stock Split Proposal, the Plan Proposal, the Executive Compensation Proposal and the Adjournment Proposal.