UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

Form 10-Q

(Mark One)

|

| |

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2019

or

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission file number: 001-15787

_____________________________________

MetLife, Inc.

(Exact name of registrant as specified in its charter) |

| | |

Delaware | | 13-4075851 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

200 Park Avenue, New York, N.Y. | | 10166-0188 |

(Address of principal executive offices) | | (Zip Code) |

(212) 578-9500

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| | | |

Large accelerated filer | þ | Accelerated filer | ¨ |

Non-accelerated filer | ¨

| Smaller reporting company | ¨

|

| | Emerging growth company | ¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨No þ

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.01 | MET | New York Stock Exchange |

Floating Rate Non-Cumulative Preferred Stock, Series A, par value $0.01 | METPrA | New York Stock Exchange |

Depositary Shares each representing a 1/1000th interest in a share of 5.625% Non-Cumulative Preferred Stock, Series E

| METPrE | New York Stock Exchange |

At April 30, 2019, 950,369,346 shares of the registrant’s common stock, $0.01 par value per share, were outstanding.

Table of Contents |

| | |

| | Page |

| |

Item 1. | Financial Statements (Unaudited) (at March 31, 2019 and December 31, 2018 and for the Three Months Ended March 31, 2019 and 2018) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

| |

Item 1. | | |

Item 1A. | | |

Item 2. | | |

Item 6. | | |

| | |

| |

| |

| |

| |

As used in this Form 10‑Q, “MetLife,” the “Company,” “we,” “our” and “us” refer to MetLife, Inc., a Delaware corporation incorporated in 1999, its subsidiaries and affiliates.

Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10‑Q, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, may contain or incorporate by reference information that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events. These statements can be identified by the fact that they do not relate strictly to historical or current facts. They use words and terms such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” and other words and terms of similar meaning, or are tied to future periods, in connection with a discussion of future performance. In particular, these include statements relating to future actions, prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, trends in operations and financial results.

Many factors will be important in determining the results of MetLife, Inc., its subsidiaries and affiliates. Forward-looking statements are based on our assumptions and current expectations, which may be inaccurate, and on the current economic environment, which may change. These statements are not guarantees of future performance. They involve a number of risks and uncertainties that are difficult to predict. Results could differ materially from those expressed or implied in the forward-looking statements. Risks, uncertainties, and other factors that might cause such differences include the risks, uncertainties and other factors identified in MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission. These factors include: (1) difficult economic conditions, including risks relating to interest rates, credit spreads, equity, real estate, obligors and counterparties, currency exchange rates, derivatives, and terrorism and security; (2) adverse global capital and credit market conditions, which may affect our ability to meet liquidity needs and access capital, including through our credit facilities; (3) downgrades in our claims paying ability, financial strength or credit ratings; (4) availability and effectiveness of reinsurance, hedging or indemnification arrangements; (5) increasing cost and limited market capacity for statutory life insurance reserve financings; (6) the impact on us of changes to and implementation of the wide variety of laws and regulations to which we are subject; (7) regulatory, legislative or tax changes relating to our operations that may affect the cost of, or demand for, our products or services; (8) adverse results or other consequences from litigation, arbitration or regulatory investigations; (9) legal, regulatory and other restrictions affecting MetLife, Inc.’s ability to pay dividends and repurchase common stock; (10) MetLife, Inc.’s primary reliance, as a holding company, on dividends from subsidiaries to meet free cash flow targets and debt payment obligations and the applicable regulatory restrictions on the ability of the subsidiaries to pay such dividends; (11) investment losses, defaults and volatility; (12) potential liquidity and other risks resulting from our participation in a securities lending program and other transactions; (13) changes to investment valuations, allowances and impairments taken on investments, and methodologies, estimates and assumptions; (14) differences between actual claims experience and underwriting and reserving assumptions; (15) political, legal, operational, economic and other risks relating to our global operations; (16) competitive pressures, including with respect to pricing, entry of new competitors, consolidation of distributors, the development of new products by new and existing competitors, and for personnel; (17) the impact of technological changes on our businesses; (18) catastrophe losses; (19) a deterioration in the experience of the closed block established in connection with the reorganization of Metropolitan Life Insurance Company; (20) impairment of goodwill or other long-lived assets, or the establishment of a valuation allowance against our deferred income tax asset; (21) changes in assumptions related to deferred policy acquisition costs, deferred sales inducements or value of business acquired; (22) exposure to losses related to guarantees in certain products; (23) ineffectiveness of risk management policies and procedures or models; (24) a failure in our cybersecurity systems or other information security systems or our disaster recovery plans; (25) any failure to protect the confidentiality of client information; (26) changes in accounting standards; (27) our associates taking excessive risks; (28) difficulties in marketing and distributing products through our distribution channels; (29) increased expenses relating to pension and other postretirement benefit plans; (30) inability to protect our intellectual property rights or claims of infringement of others’ intellectual property rights; (31) difficulties, unforeseen liabilities, asset impairments, or rating agency actions arising from business acquisitions and dispositions, joint ventures, or other legal entity reorganizations; (32) unanticipated or adverse developments that could adversely affect our expected operational or other benefits from the separation of Brighthouse Financial, Inc. and its subsidiaries; (33) the possibility that MetLife, Inc.’s Board of Directors may influence the outcome of stockholder votes through the voting provisions of the MetLife Policyholder Trust; (34) provisions of laws and our incorporation documents that may delay, deter or prevent takeovers and corporate combinations involving MetLife; and (35) other risks and uncertainties described from time to time in MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission.

MetLife, Inc. does not undertake any obligation to publicly correct or update any forward-looking statement if MetLife, Inc. later becomes aware that such statement is not likely to be achieved. Please consult any further disclosures MetLife, Inc. makes on related subjects in reports to the U.S. Securities and Exchange Commission.

Corporate Information

We announce financial and other information about MetLife to our investors on our website (www.metlife.com) through the MetLife Investor Relations web page (https://investor.metlife.com), as well as U.S. Securities and Exchange Commission filings, news releases, public conference calls and webcasts. MetLife encourages investors to visit the Investor Relations web page from time to time, as information is updated and new information is posted. The information found on our website is not incorporated by reference into this Quarterly Report on Form 10-Q or in any other report or document we file with the U.S. Securities and Exchange Commission, and any references to our website are intended to be inactive textual references only.

Note Regarding Reliance on Statements in Our Contracts

See “Exhibits — Note Regarding Reliance on Statements in Our Contracts” for information regarding agreements included as exhibits to this Quarterly Report on Form 10-Q.

Part I — Financial Information

Item 1. Financial Statements

MetLife, Inc.

Interim Condensed Consolidated Balance Sheets

March 31, 2019 and December 31, 2018 (Unaudited)

(In millions, except share and per share data)

|

| | | | | | | | |

| | March 31, 2019 | | December 31, 2018 |

Assets | | | | |

Investments: | | | | |

Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $288,559 and $286,816, respectively) | | $ | 308,410 |

| | $ | 298,265 |

|

Equity securities, at estimated fair value | | 1,432 |

| | 1,440 |

|

Contractholder-directed equity securities and fair value option securities, at estimated fair value (includes $3 and $4, respectively, relating to variable interest entities) | | 13,245 |

| | 12,616 |

|

Mortgage loans (net of valuation allowances of $350 and $342, respectively; includes $276 and $299, respectively, under the fair value option) | | 78,601 |

| | 75,752 |

|

Policy loans | | 9,670 |

| | 9,699 |

|

Real estate and real estate joint ventures | | 10,022 |

| | 9,698 |

|

Other limited partnership interests | | 6,787 |

| | 6,613 |

|

Short-term investments, principally at estimated fair value | | 4,524 |

| | 3,937 |

|

Other invested assets (includes $2,392 and $2,300, respectively, of leveraged and direct financing leases and $214 and $141, respectively, relating to variable interest entities) | | 18,175 |

| | 18,190 |

|

Total investments | | 450,866 |

| | 436,210 |

|

Cash and cash equivalents, principally at estimated fair value (includes $19 and $52, respectively, relating to variable interest entities) | | 14,506 |

| | 15,821 |

|

Accrued investment income | | 3,569 |

| | 3,582 |

|

Premiums, reinsurance and other receivables (includes $2 and $3, respectively, relating to variable interest entities) | | 20,615 |

| | 19,644 |

|

Deferred policy acquisition costs and value of business acquired | | 18,349 |

| | 18,895 |

|

Goodwill | | 9,418 |

| | 9,422 |

|

Other assets (includes $2 and $2, respectively, relating to variable interest entities) | | 10,100 |

| | 8,408 |

|

Separate account assets | | 185,765 |

| | 175,556 |

|

Total assets | | $ | 713,188 |

| | $ | 687,538 |

|

Liabilities and Equity | | | | |

Liabilities | | | | |

Future policy benefits | | $ | 187,508 |

| | $ | 186,780 |

|

Policyholder account balances | | 187,333 |

| | 183,693 |

|

Other policy-related balances | | 16,967 |

| | 16,529 |

|

Policyholder dividends payable | | 671 |

| | 677 |

|

Policyholder dividend obligation | | 1,116 |

| | 428 |

|

Payables for collateral under securities loaned and other transactions | | 25,084 |

| | 24,794 |

|

Short-term debt | | 289 |

| | 268 |

|

Long-term debt (includes $5 and $5, respectively, at estimated fair value, relating to variable interest entities) | | 12,850 |

| | 12,829 |

|

Collateral financing arrangement | | 1,048 |

| | 1,060 |

|

Junior subordinated debt securities | | 3,148 |

| | 3,147 |

|

Current income tax payable | | 505 |

| | 441 |

|

Deferred income tax liability | | 7,075 |

| | 5,414 |

|

Other liabilities (includes $1 and $1, respectively, relating to variable interest entities) | | 25,091 |

| | 22,964 |

|

Separate account liabilities | | 185,765 |

| | 175,556 |

|

Total liabilities | | 654,450 |

| | 634,580 |

|

Contingencies, Commitments and Guarantees (Note 14) | |

| |

|

Equity | | | | |

MetLife, Inc.’s stockholders’ equity: | | | | |

Preferred stock, par value $0.01 per share; $3,405 aggregate liquidation preference | | — |

| | — |

|

Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 1,174,590,790 and 1,171,824,242 shares issued, respectively; 950,181,456 and 958,613,542 shares outstanding, respectively | | 12 |

| | 12 |

|

Additional paid-in capital | | 32,535 |

| | 32,474 |

|

Retained earnings | | 29,944 |

| | 28,926 |

|

Treasury stock, at cost; 224,409,334 and 213,210,700 shares, respectively | | (10,893 | ) | | (10,393 | ) |

Accumulated other comprehensive income (loss) | | 6,911 |

| | 1,722 |

|

Total MetLife, Inc.’s stockholders’ equity | | 58,509 |

| | 52,741 |

|

Noncontrolling interests | | 229 |

| | 217 |

|

Total equity | | 58,738 |

| | 52,958 |

|

Total liabilities and equity | | $ | 713,188 |

| | $ | 687,538 |

|

MetLife, Inc.

Interim Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

For the Three Months Ended March 31, 2019 and 2018 (Unaudited)

(In millions, except per share data)

|

| | | | | | | | |

| | Three Months

Ended

March 31, |

| | 2019 | | 2018 |

Revenues | | | | |

Premiums | | $ | 9,405 |

| | $ | 9,178 |

|

Universal life and investment-type product policy fees | | 1,365 |

| | 1,392 |

|

Net investment income | | 4,908 |

| | 3,745 |

|

Other revenues | | 494 |

| | 474 |

|

Net investment gains (losses) | | 15 |

| | (333 | ) |

Net derivative gains (losses) | | 115 |

| | 349 |

|

Total revenues | | 16,302 |

| | 14,805 |

|

Expenses | | | | |

Policyholder benefits and claims | | 9,072 |

| | 8,718 |

|

Interest credited to policyholder account balances | | 1,961 |

| | 769 |

|

Policyholder dividends | | 300 |

| | 297 |

|

Other expenses | | 3,225 |

| | 3,365 |

|

Total expenses | | 14,558 |

| | 13,149 |

|

Income (loss) before provision for income tax | | 1,744 |

| | 1,656 |

|

Provision for income tax expense (benefit) | | 359 |

| | 399 |

|

Net income (loss) | | 1,385 |

| | 1,257 |

|

Less: Net income (loss) attributable to noncontrolling interests | | 4 |

| | 4 |

|

Net income (loss) attributable to MetLife, Inc. | | 1,381 |

| | 1,253 |

|

Less: Preferred stock dividends | | 32 |

| | 6 |

|

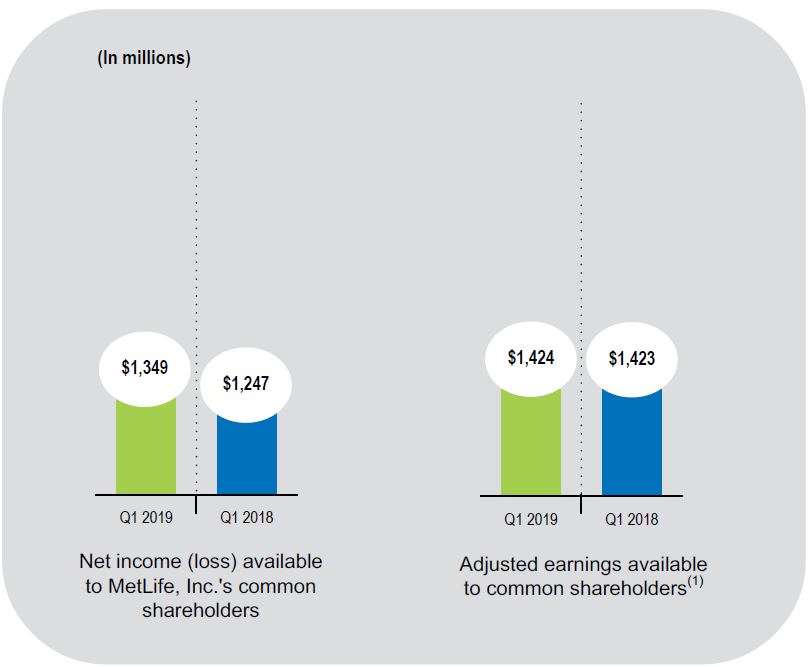

Net income (loss) available to MetLife, Inc.’s common shareholders | | $ | 1,349 |

| | $ | 1,247 |

|

Comprehensive income (loss) | | $ | 6,555 |

| | $ | (1,448 | ) |

Less: Comprehensive income (loss) attributable to noncontrolling interests, net of income tax | | 6 |

| | 4 |

|

Comprehensive income (loss) attributable to MetLife, Inc. | | $ | 6,549 |

| | $ | (1,452 | ) |

|

| | | | | | | | |

Net income (loss) available to MetLife, Inc.’s common shareholders per common share: | | | | |

Basic | | $ | 1.41 |

| | $ | 1.20 |

|

Diluted | | $ | 1.40 |

| | $ | 1.19 |

|

See accompanying notes to the interim condensed consolidated financial statements.

MetLife, Inc.

Interim Condensed Consolidated Statements of Equity

For the Three Months Ended March 31, 2019 and 2018 (Unaudited)

(In millions) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred Stock | | Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Treasury Stock at Cost | | Accumulated Other Comprehensive Income (Loss) | | Total MetLife, Inc.’s Stockholders’ Equity | | Noncontrolling Interests | | Total Equity |

Balance at December 31, 2018 | | $ | — |

| | $ | 12 |

| | $ | 32,474 |

| | $ | 28,926 |

| | $ | (10,393 | ) | | $ | 1,722 |

| | $ | 52,741 |

| | $ | 217 |

| | $ | 52,958 |

|

Cumulative effects of changes in accounting principles, net of income tax (Note 1) | | | | | | | | 74 |

| | | | 21 |

| | 95 |

| | | | 95 |

|

Balance at January 1, 2019 | | — |

| | 12 |

| | 32,474 |

| | 29,000 |

| | (10,393 | ) | | 1,743 |

| | 52,836 |

| | 217 |

| | 53,053 |

|

Treasury stock acquired in connection with share repurchases | | | | | |

|

| | | | (500 | ) | | | | (500 | ) | | | | (500 | ) |

Stock-based compensation | | | | | | 61 |

| | | | | | | | 61 |

| | | | 61 |

|

Dividends on preferred stock | | | | | | | | (32 | ) | | | | | | (32 | ) | | | | (32 | ) |

Dividends on common stock | | | | | | | | (405 | ) | | | | | | (405 | ) | | | | (405 | ) |

Change in equity of noncontrolling interests | | | | | | | | | | | | | | — |

| | 6 |

| | 6 |

|

Net income (loss) | | | | | | | | 1,381 |

| | | | | | 1,381 |

| | 4 |

| | 1,385 |

|

Other comprehensive income (loss), net of income tax | | | | | | | | | | | | 5,168 |

| | 5,168 |

| | 2 |

| | 5,170 |

|

Balance at March 31, 2019 | | $ | — |

| | $ | 12 |

| | $ | 32,535 |

| | $ | 29,944 |

| | $ | (10,893 | ) | | $ | 6,911 |

| | $ | 58,509 |

| | $ | 229 |

| | $ | 58,738 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred Stock | | Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Treasury Stock at Cost | | Accumulated Other Comprehensive Income (Loss) | | Total MetLife, Inc.’s Stockholders’ Equity | | Noncontrolling Interests | | Total Equity |

Balance at December 31, 2017 | | $ | — |

| | $ | 12 |

| | $ | 31,111 |

| | $ | 26,527 |

| | $ | (6,401 | ) | | $ | 7,427 |

| | $ | 58,676 |

| | $ | 194 |

| | $ | 58,870 |

|

Cumulative effects of changes in accounting principles, net of income tax | | | | | | | | (905 | ) | | | | 912 |

| | 7 |

| | | | 7 |

|

Balance at January 1, 2018 | | — |

| | 12 |

| | 31,111 |

| | 25,622 |

| | (6,401 | ) | | 8,339 |

| | 58,683 |

| | 194 |

| | 58,877 |

|

Preferred stock issuance | | | | | | 494 |

| | | | | | | | 494 |

| | | | 494 |

|

Treasury stock acquired in connection with share repurchases | | | | | | | | | | (1,041 | ) | | | | (1,041 | ) | | | | (1,041 | ) |

Stock-based compensation | | | | | | 48 |

| | | | | | | | 48 |

| | | | 48 |

|

Dividends on preferred stock | | | | | | | | (6 | ) | | | | | | (6 | ) | | | | (6 | ) |

Dividends on common stock | | | | | | | | (416 | ) | | | | | | (416 | ) | | | | (416 | ) |

Change in equity of noncontrolling interests | | | | | | | | | | | | | | — |

| | — |

| | — |

|

Net income (loss) | | | | | | | | 1,253 |

| | | | | | 1,253 |

| | 4 |

| | 1,257 |

|

Other comprehensive income (loss), net of income tax | | | | | | | | | | | | (2,705 | ) | | (2,705 | ) | | — |

| | (2,705 | ) |

Balance at March 31, 2018 | | $ | — |

| | $ | 12 |

| | $ | 31,653 |

| | $ | 26,453 |

| | $ | (7,442 | ) | | $ | 5,634 |

| | $ | 56,310 |

| | $ | 198 |

| | $ | 56,508 |

|

See accompanying notes to the interim condensed consolidated financial statements.

MetLife, Inc.

Interim Condensed Consolidated Statements of Cash Flows

For the Three Months Ended March 31, 2019 and 2018 (Unaudited)

(In millions)

|

| | | | | | | |

| Three Months

Ended

March 31, |

| 2019 | | 2018 |

Net cash provided by (used in) operating activities | $ | 2,072 |

| | $ | 1,296 |

|

Cash flows from investing activities | | | |

Sales, maturities and repayments of: | | | |

Fixed maturity securities available-for-sale | 21,606 |

| | 26,053 |

|

Equity securities | 149 |

| | 187 |

|

Mortgage loans | 1,769 |

| | 2,076 |

|

Real estate and real estate joint ventures | 103 |

| | 128 |

|

Other limited partnership interests | 250 |

| | 139 |

|

Purchases and originations of: | | | |

Fixed maturity securities available-for-sale | (23,386 | ) | | (24,220 | ) |

Equity securities | (16 | ) | | (51 | ) |

Mortgage loans | (4,416 | ) | | (4,024 | ) |

Real estate and real estate joint ventures | (483 | ) | | (242 | ) |

Other limited partnership interests | (428 | ) | | (260 | ) |

Cash received in connection with freestanding derivatives | 1,021 |

| | 1,974 |

|

Cash paid in connection with freestanding derivatives | (1,231 | ) | | (2,192 | ) |

Net change in policy loans | 16 |

| | (25 | ) |

Net change in short-term investments | (545 | ) | | (160 | ) |

Net change in other invested assets | (53 | ) | | 46 |

|

Other, net | (55 | ) | | 86 |

|

Net cash provided by (used in) investing activities | (5,699 | ) | | (485 | ) |

Cash flows from financing activities | | | |

Policyholder account balances: | | | |

Deposits | 23,891 |

| | 24,861 |

|

Withdrawals | (20,904 | ) | | (24,447 | ) |

Payables for collateral under securities loaned and other transactions:

| | | |

Net change in payables for collateral under securities loaned and other transactions | 388 |

| | 592 |

|

Cash received for other transactions with tenors greater than three months

| — |

| | 75 |

|

Cash paid for other transactions with tenors greater than three months

| (75 | ) | | — |

|

Long-term debt issued | — |

| | 14 |

|

Long-term debt repaid | (10 | ) | | (32 | ) |

Collateral financing arrangements repaid | (12 | ) | | (13 | ) |

Financing element on certain derivative instruments and other derivative related transactions, net | (29 | ) | | 37 |

|

Treasury stock acquired in connection with share repurchases | (500 | ) | | (1,041 | ) |

Preferred stock issued, net of issuance costs | — |

| | 494 |

|

Dividends on preferred stock | (32 | ) | | (6 | ) |

Dividends on common stock | (405 | ) | | (416 | ) |

Other, net | 4 |

| | 100 |

|

Net cash provided by (used in) financing activities | 2,316 |

| | 218 |

|

Effect of change in foreign currency exchange rates on cash and cash equivalents balances | (4 | ) | | 197 |

|

Change in cash and cash equivalents | (1,315 | ) | | 1,226 |

|

Cash and cash equivalents, beginning of period | 15,821 |

| | 12,701 |

|

Cash and cash equivalents, end of period | $ | 14,506 |

| | $ | 13,927 |

|

|

| | | | | | | |

Supplemental disclosures of cash flow information | | | |

Net cash paid (received) for: | | | |

Interest | $ | 148 |

| | $ | 243 |

|

Income tax | $ | 114 |

| | $ | 146 |

|

Non-cash transactions: | | | |

Reclassification of certain equity securities to other invested assets | $ | — |

| | $ | 791 |

|

See accompanying notes to the interim condensed consolidated financial statements.

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies

Business

“MetLife” and the “Company” refer to MetLife, Inc., a Delaware corporation incorporated in 1999, its subsidiaries and affiliates. MetLife is one of the world’s leading financial services companies, providing insurance, annuities, employee benefits and asset management. MetLife is organized into five segments: U.S.; Asia; Latin America; Europe, the Middle East and Africa (“EMEA”); and MetLife Holdings.

Basis of Presentation

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to adopt accounting policies and make estimates and assumptions that affect amounts reported on the interim condensed consolidated financial statements. In applying these policies and estimates, management makes subjective and complex judgments that frequently require assumptions about matters that are inherently uncertain. Many of these policies, estimates and related judgments are common in the insurance and financial services industries; others are specific to the Company’s business and operations. Actual results could differ from these estimates.

The accompanying interim condensed consolidated financial statements are unaudited and reflect all adjustments (including normal recurring adjustments) necessary to present fairly the financial position, results of operations and cash flows for the interim periods presented in conformity with GAAP. Interim results are not necessarily indicative of full year performance. The December 31, 2018 consolidated balance sheet data was derived from audited consolidated financial statements included in MetLife, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2018 (the “2018 Annual Report”), which include all disclosures required by GAAP. Therefore, these interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements of the Company included in the 2018 Annual Report.

Consolidation

The accompanying interim condensed consolidated financial statements include the accounts of MetLife, Inc. and its subsidiaries, as well as partnerships and joint ventures in which the Company has control, and variable interest entities (“VIEs”) for which the Company is the primary beneficiary. Intercompany accounts and transactions have been eliminated.

The Company uses the equity method of accounting for real estate joint ventures and other limited partnership interests (“investee”) when it has more than a minor ownership interest or more than a minor influence over the investee’s operations. The Company generally recognizes its share of the investee’s earnings in net investment income on a three-month lag in instances where the investee’s financial information is not sufficiently timely or when the investee’s reporting period differs from the Company’s reporting period.

Reclassifications

Certain amounts in the prior year periods’ interim condensed consolidated financial statements and related footnotes thereto have been reclassified to conform to the 2019 presentation as discussed throughout the Notes to the Interim Condensed Consolidated Financial Statements.

Recent Accounting Pronouncements

Changes to GAAP are established by the Financial Accounting Standards Board (“FASB”) in the form of accounting standards updates (“ASUs”) to the FASB Accounting Standards Codification. The Company considers the applicability and impact of all ASUs. The following tables provide a description of new ASUs issued by the FASB and the impact of the adoption on the Company’s consolidated financial statements.

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies (continued)

Adoption of New Accounting Pronouncements

Except as noted below, the ASUs adopted by the Company effective January 1, 2019 did not have a material impact on its consolidated financial statements.

|

| | | |

Standard | Description | Effective Date and Method of Adoption | Impact on Financial Statements |

ASU 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities, as clarified and amended by ASU 2019-04, Codification Improvements to Topic 326, Financial Instruments—Credit Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments

| The new guidance simplifies the application of hedge accounting in certain situations and amends the hedge accounting model to enable entities to better portray the economics of their risk management activities in their financial statements. | January 1, 2019. The Company adopted using a modified retrospective approach.

| The adoption of the guidance resulted in a $18 million, net of income tax, increase to accumulated other comprehensive income (loss) (“AOCI”) with a corresponding decrease to retained earnings due to the reclassification of hedge ineffectiveness for cash flow hedging relationships existing as of January 1, 2019. The Company has included the expanded disclosures within Note 6. |

ASU 2016-02, Leases (Topic 842), as clarified and amended by ASU 2018-10, Codification Improvements to Topic 842, Leases, ASU 2018-11, Leases (Topic 842): Targeted Improvements, and ASU 2018-20, Leases (Topic 842): Narrow-Scope Improvements for Lessors

| The new guidance requires a lessee to recognize assets and liabilities for leases with lease terms of more than 12 months. Leases would be classified as finance or operating leases and both types of leases will be recognized on the balance sheet. Lessor accounting will remain largely unchanged from current guidance except for certain targeted changes. The new guidance also requires new qualitative and quantitative disclosures. In July 2018, two amendments to the new guidance were issued. The amendments provide the option to adopt the new guidance prospectively without adjusting comparative periods. Also, the amendments provide lessors with a practical expedient not to separate lease and non-lease components for certain operating leases. In December 2018, an amendment was issued to clarify lessor accounting relating to taxes, certain lessor’s costs and variable payments related to both lease and non-lease components.

| January 1, 2019. The Company adopted using a modified retrospective approach. | The Company elected the package of practical expedients allowed under the transition guidance. This allowed the Company to carry forward its historical lease classification. In addition, the Company elected all other practical expedients that were allowed under the new guidance and were applicable, including the practical expedient to combine lease and non-lease components into one lease component for certain real estate leases.

The adoption of this guidance resulted in the recording of additional net right-of-use (“ROU”) assets and lease liabilities of approximately $1.5 billion and $1.7 billion, respectively, as of January 1, 2019. The reduction of the ROU assets was a result of adjustments for prepaid/deferred rent, unamortized initial direct costs and impairment of certain ROU assets based on the net present value of the remaining minimum lease payments and sublease revenues. In addition, retained earnings increased by $95 million, net of income tax, as a result of the recognition of deferred gains on previous sale leaseback transactions. The guidance did not have a material impact on the Company’s consolidated net income and cash flows. The Company has included expanded disclosures on the consolidated balance sheets and in Notes 5 and 8. |

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies (continued)

Future Adoption of New Accounting Pronouncements

ASUs not listed below were assessed and either determined to be not applicable or are not expected to have a material impact on the Company’s consolidated financial statements. ASUs issued but not yet adopted as of March 31, 2019 that are currently being assessed and may or may not have a material impact on the Company’s consolidated financial statements are summarized in the table below.

|

| | | |

Standard | Description | Effective Date and Method of Adoption | Impact on Financial Statements |

ASU 2018-15, Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract | The new guidance requires a customer in a cloud computing arrangement that is a service contract to follow the internal-use software guidance to determine which implementation costs to capitalize as an asset and which costs to expense as incurred. Implementation costs that are capitalized under the new guidance are required to be amortized over the term of the hosting arrangement, beginning when the module or component of the hosting arrangement is ready for its intended use.

| January 1, 2020. The new guidance can be applied either prospectively to eligible costs incurred on or after the guidance is first applied, or retrospectively to all periods presented. | The Company is currently evaluating the impact of the new guidance on its consolidated financial statements.

|

ASU 2018-14, Compensation—Retirement Benefits—Defined Benefit Plans—General (Subtopic 715-20): Disclosure Framework—Changes to the Disclosure Requirements for Defined Benefit Plans

| The new guidance removes certain disclosures that no longer are considered cost beneficial, clarifies the specific requirements of disclosures, and adds disclosure requirements identified as relevant for employers that sponsor defined benefit pension or other postretirement plans.

| December 31, 2020, to be applied on a retrospective basis to all periods presented (with early adoption permitted). | The Company is currently evaluating the impact of the new guidance on its consolidated financial statements.

|

ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement | The new guidance modifies the disclosure requirements on fair value by removing some requirements, modifying others, adding changes in unrealized gains and losses included in other comprehensive income (loss) (“OCI”) for recurring Level 3 fair value measurements, and under certain circumstances, providing the option to disclose certain other quantitative information with respect to significant unobservable inputs in lieu of a weighted average.

| January 1, 2020. Amendments related to changes in unrealized gains and losses, the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements, and the narrative description of measurement uncertainty should be applied prospectively. All other amendments should be applied retrospectively. | As of December 31, 2018, the Company early adopted the provisions of the guidance that removed the requirements relating to transfers between fair value hierarchy levels and certain disclosures about valuation processes for Level 3 fair value measurements. The Company will adopt the remainder of the new guidance at the effective date, and is currently evaluating the impact of those changes on its consolidated financial statements.

|

ASU 2018-12, Financial Services—Insurance (Topic 944): Targeted Improvements to the Accounting for Long-Duration Contracts | The new guidance (i) prescribes the discount rate to be used in measuring the liability for future policy benefits for traditional and limited payment long-duration contracts, and requires assumptions for those liability valuations to be updated after contract inception, (ii) requires more market-based product guarantees on certain separate account and other account balance long-duration contracts to be accounted for at fair value, (iii) simplifies the amortization of deferred policy acquisition costs (“DAC”) for virtually all long-duration contracts, and (iv) introduces certain financial statement presentation requirements, as well as significant additional quantitative and qualitative disclosures. | January 1, 2021, to be applied retrospectively to January 1, 2019 (with early adoption permitted). | The Company has started its implementation efforts and is currently evaluating the impact of the new guidance. Given the nature and extent of the required changes to a significant portion of the Company’s operations, the adoption of this standard is expected to have a material impact on its consolidated financial statements.

|

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies (continued)

|

| | | |

Standard | Description | Effective Date and Method of Adoption | Impact on Financial Statements |

ASU 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment

| The new guidance simplifies the current two-step goodwill impairment test by eliminating Step 2 of the test. The new guidance requires a one-step impairment test in which an entity compares the fair value of a reporting unit with its carrying amount and recognizes an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value, if any.

| January 1, 2020, to be applied on a prospective basis. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. | The new guidance will reduce the complexity involved with the evaluation of goodwill for impairment. The impact of the new guidance will depend on the outcomes of future goodwill impairment tests.

|

ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, as clarified and amended by ASU 2018-19, Codification Improvements to Topic 326, Financial Instruments—Credit Losses and ASU 2019-04, Codification Improvements to Topic 326, Financial Instruments—Credit Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments | This new guidance replaces the incurred loss impairment methodology with one that reflects expected credit losses. The measurement of expected credit losses should be based on historical loss information, current conditions, and reasonable and supportable forecasts. The new guidance requires that an other-than-temporary impairment (“OTTI”) on a debt security will be recognized as an allowance going forward, such that improvements in expected future cash flows after an impairment will no longer be reflected as a prospective yield adjustment through net investment income, but rather a reversal of the previous impairment and recognized through realized investment gains and losses. The guidance also requires enhanced disclosures. In November 2018, the FASB issued ASU 2018-19, clarifying that receivables arising from operating leases should be accounted for in accordance with Topic 842, Leases. The Company has assessed the asset classes impacted by the new guidance and is currently assessing the accounting and reporting system changes that will be required to comply with the new guidance.

| January 1, 2020. For substantially all financial assets, the ASU is to be applied on a modified retrospective basis through a cumulative effect adjustment to retained earnings. For previously impaired debt securities and certain debt securities acquired with evidence of credit quality deterioration since origination, the new guidance is to be applied prospectively. | The Company believes that the most significant impact upon adoption will be to its mortgage loan investments. The Company is currently evaluating the impact of the new guidance on its consolidated financial statements.

|

2. Segment Information

MetLife is organized into five segments: U.S.; Asia; Latin America; EMEA; and MetLife Holdings. In addition, the Company reports certain of its results of operations in Corporate & Other.

U.S.

The U.S. segment offers a broad range of protection products and services aimed at serving the financial needs of customers throughout their lives. These products are sold to corporations and their respective employees, other institutions and their respective members, as well as individuals. The U.S. segment is organized into three businesses: Group Benefits, Retirement and Income Solutions (“RIS”) and Property & Casualty.

| |

• | The Group Benefits business offers life, dental, group short- and long-term disability, individual disability, accidental death and dismemberment, vision and accident & health coverages, as well as prepaid legal plans. This business also sells administrative services-only arrangements to some employers. |

| |

• | The RIS business offers a broad range of life and annuity-based insurance and investment products, including stable value and pension risk transfer products, institutional income annuities, tort settlements, and capital markets investment products, as well as solutions for funding postretirement benefits and company-, bank- or trust-owned life insurance. |

| |

• | The Property & Casualty business offers personal and commercial lines of property and casualty insurance, including private passenger automobile, homeowners’ and personal excess liability insurance. In addition, Property & Casualty offers to small business owners property, liability and business interruption insurance. |

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

2. Segment Information (continued)

Asia

The Asia segment offers a broad range of products to both individuals and corporations, as well as to other institutions, and their respective employees, which include whole and term life, endowments, universal and variable life, accident & health insurance and fixed and variable annuities.

Latin America

The Latin America segment offers a broad range of products to both individuals and corporations, as well as to other institutions, and their respective employees, which include life insurance, retirement and savings products, accident & health insurance and credit insurance.

EMEA

The EMEA segment offers a broad range of products to both individuals and corporations, as well as to other institutions, and their respective employees, which include life insurance, accident & health insurance, retirement and savings products and credit insurance.

MetLife Holdings

The MetLife Holdings segment consists of operations relating to products and businesses, previously included in MetLife’s former retail business, that the Company no longer actively markets in the United States, such as variable, universal, term and whole life insurance, variable, fixed and index-linked annuities, and long-term care insurance, as well as the assumed variable annuity guarantees from the Company’s former operating joint venture in Japan.

Corporate & Other

Corporate & Other contains the excess capital, as well as certain charges and activities, not allocated to the segments, including external integration and disposition costs, internal resource costs for associates committed to acquisitions and dispositions, enterprise-wide strategic initiative restructuring charges and various start-up and developing businesses (including the investment management business through which the Company, as a manager of assets such as global fixed income and real estate, provides differentiated investment solutions to institutional investors worldwide). Additionally, Corporate & Other includes run-off businesses. Corporate & Other also includes interest expense related to the majority of the Company’s outstanding debt, as well as expenses associated with certain legal proceedings and income tax audit issues. In addition, Corporate & Other includes the elimination of intersegment amounts, which generally relate to affiliated reinsurance, investment expenses and intersegment loans, which bear interest rates commensurate with related borrowings.

Financial Measures and Segment Accounting Policies

Adjusted earnings is used by management to evaluate performance and allocate resources. Consistent with GAAP guidance for segment reporting, adjusted earnings is also the Company’s GAAP measure of segment performance and is reported below. Adjusted earnings should not be viewed as a substitute for net income (loss). The Company believes the presentation of adjusted earnings, as the Company measures it for management purposes, enhances the understanding of its performance by highlighting the results of operations and the underlying profitability drivers of the business.

Adjusted earnings is defined as adjusted revenues less adjusted expenses, net of income tax.

The financial measures of adjusted revenues and adjusted expenses focus on the Company’s primary businesses principally by excluding the impact of market volatility, which could distort trends, and revenues and costs related to non-core products and certain entities required to be consolidated under GAAP. Also, these measures exclude results of discontinued operations under GAAP and other businesses that have been or will be sold or exited by MetLife but do not meet the discontinued operations criteria under GAAP and are referred to as divested businesses. Divested businesses also includes the net impact of transactions with exited businesses that have been eliminated in consolidation under GAAP and costs relating to businesses that have been or will be sold or exited by MetLife that do not meet the criteria to be included in results of discontinued operations under GAAP. Adjusted revenues also excludes net investment gains (losses) and net derivative gains (losses). Adjusted expenses also excludes goodwill impairments.

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

2. Segment Information (continued)

The following additional adjustments are made to revenues, in the line items indicated, in calculating adjusted revenues:

| |

• | Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to net investment gains (losses) and net derivative gains (losses) and certain variable annuity guaranteed minimum income benefits (“GMIBs”) fees (“GMIB fees”); |

| |

• | Net investment income: (i) includes earned income on derivatives and amortization of premium on derivatives that are hedges of investments or that are used to replicate certain investments, but do not qualify for hedge accounting treatment, (ii) excludes post-tax adjusted earnings adjustments relating to insurance joint ventures accounted for under the equity method, (iii) excludes certain amounts related to contractholder-directed equity securities, (iv) excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP and (v) includes distributions of profits from certain other limited partnership interests that were previously accounted for under the cost method, but are now accounted for at estimated fair value, where the change in estimated fair value is recognized in net investment gains (losses) under GAAP; and |

| |

• | Other revenues is adjusted for settlements of foreign currency earnings hedges and excludes fees received in association with services provided under transition service agreements (“TSA fees”). |

The following additional adjustments are made to expenses, in the line items indicated, in calculating adjusted expenses:

| |

• | Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder dividend obligation related to net investment gains (losses) and net derivative gains (losses), (ii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of assets and other pass-through adjustments, (iii) benefits and hedging costs related to GMIBs (“GMIB costs”) and (iv) market value adjustments associated with surrenders or terminations of contracts (“Market value adjustments”); |

| |

• | Interest credited to policyholder account balances includes adjustments for earned income on derivatives and amortization of premium on derivatives that are hedges of policyholder account balances but do not qualify for hedge accounting treatment and excludes certain amounts related to net investment income earned on contractholder-directed equity securities; |

| |

• | Amortization of DAC and value of business acquired (“VOBA”) excludes amounts related to: (i) net investment gains (losses) and net derivative gains (losses), (ii) GMIB fees and GMIB costs and (iii) Market value adjustments; |

| |

• | Amortization of negative VOBA excludes amounts related to Market value adjustments; |

| |

• | Interest expense on debt excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP; and |

| |

• | Other expenses excludes costs related to: (i) noncontrolling interests, (ii) implementation of new insurance regulatory requirements and (iii) acquisition, integration and other costs. Other expenses includes TSA fees. |

Adjusted earnings also excludes the recognition of certain contingent assets and liabilities that could not be recognized at acquisition or adjusted for during the measurement period under GAAP business combination accounting guidance.

The tax impact of the adjustments mentioned above are calculated net of the U.S. or foreign statutory tax rate, which could differ from the Company’s effective tax rate. Additionally, the provision for income tax (expense) benefit also includes the impact related to the timing of certain tax credits, as well as certain tax reforms.

Set forth in the tables below is certain financial information with respect to the Company’s segments, as well as Corporate & Other, for the three months ended March 31, 2019 and 2018. The segment accounting policies are the same as those used to prepare the Company’s consolidated financial statements, except for adjusted earnings adjustments as defined above. In addition, segment accounting policies include the method of capital allocation described below.

Economic capital is an internally developed risk capital model, the purpose of which is to measure the risk in the business and to provide a basis upon which capital is deployed. The economic capital model accounts for the unique and specific nature of the risks inherent in the Company’s business.

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

2. Segment Information (continued)

The Company’s economic capital model, coupled with considerations of local capital requirements, aligns segment allocated equity with emerging standards and consistent risk principles. The model applies statistics-based risk evaluation principles to the material risks to which the Company is exposed. These consistent risk principles include calibrating required economic capital shock factors to a specific confidence level and time horizon while applying an industry standard method for the inclusion of diversification benefits among risk types. The Company’s management is responsible for the ongoing production and enhancement of the economic capital model and reviews its approach periodically to ensure that it remains consistent with emerging industry practice standards.

Segment net investment income is credited or charged based on the level of allocated equity; however, changes in allocated equity do not impact the Company’s consolidated net investment income, net income (loss), or adjusted earnings.

Net investment income is based upon the actual results of each segment’s specifically identifiable investment portfolios adjusted for allocated equity. Other costs are allocated to each of the segments based upon: (i) a review of the nature of such costs; (ii) time studies analyzing the amount of employee compensation costs incurred by each segment; and (iii) cost estimates included in the Company’s product pricing.

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

2. Segment Information (continued)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

Three Months Ended March 31, 2019 |

| U.S. | | Asia | | Latin

America | | EMEA | | MetLife Holdings | | Corporate & Other | | Total | | Adjustments | | Total

Consolidated |

|

| (In millions) |

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Premiums |

| $ | 5,567 |

|

| $ | 1,699 |

|

| $ | 646 |

|

| $ | 542 |

|

| $ | 927 |

|

| $ | 24 |

|

| $ | 9,405 |

|

| $ | — |

|

| $ | 9,405 |

|

Universal life and investment-type product policy fees |

| 270 |

|

| 406 |

|

| 284 |

|

| 103 |

|

| 274 |

|

| 1 |

|

| 1,338 |

|

| 27 |

|

| 1,365 |

|

Net investment income |

| 1,719 |

|

| 880 |

|

| 296 |

|

| 74 |

|

| 1,287 |

|

| 25 |

|

| 4,281 |

|

| 627 |

|

| 4,908 |

|

Other revenues |

| 221 |

|

| 16 |

|

| 12 |

|

| 14 |

|

| 67 |

|

| 94 |

|

| 424 |

|

| 70 |

|

| 494 |

|

Net investment gains (losses) |

| — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| 15 |

|

| 15 |

|

Net derivative gains (losses) |

| — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| 115 |

|

| 115 |

|

Total revenues |

| 7,777 |

| | 3,001 |

| | 1,238 |

| | 733 |

| | 2,555 |

| | 144 |

| | 15,448 |

| | 854 |

| | 16,302 |

|

Expenses |

|

|

|

|

|

|

|

|

| |

|

|

| |

|

|

| |

Policyholder benefits and claims and policyholder dividends |

| 5,373 |

|

| 1,319 |

|

| 597 |

|

| 284 |

|

| 1,648 |

|

| 20 |

|

| 9,241 |

|

| 131 |

|

| 9,372 |

|

Interest credited to policyholder account balances |

| 501 |

|

| 403 |

|

| 94 |

|

| 24 |

|

| 226 |

|

| — |

|

| 1,248 |

|

| 713 |

|

| 1,961 |

|

Capitalization of DAC |

| (114 | ) |

| (479 | ) |

| (94 | ) |

| (117 | ) |

| (6 | ) |

| (2 | ) |

| (812 | ) |

| — |

|

| (812 | ) |

Amortization of DAC and VOBA |

| 114 |

|

| 307 |

|

| 78 |

|

| 92 |

|

| 63 |

|

| 1 |

|

| 655 |

|

| (31 | ) |

| 624 |

|

Amortization of negative VOBA |

| — |

|

| (9 | ) |

| — |

|

| (1 | ) |

| — |

|

| — |

|

| (10 | ) |

| — |

|

| (10 | ) |

Interest expense on debt |

| 2 |

|

| — |

|

| 1 |

|

| — |

|

| 2 |

|

| 229 |

|

| 234 |

|

| — |

|

| 234 |

|

Other expenses |

| 993 |

|

| 955 |

|

| 366 |

|

| 338 |

|

| 227 |

|

| 222 |

|

| 3,101 |

|

| 88 |

|

| 3,189 |

|

Total expenses |

| 6,869 |

| | 2,496 |

| | 1,042 |

| | 620 |

| | 2,160 |

| | 470 |

| | 13,657 |

| | 901 |

| | 14,558 |

|

Provision for income tax expense (benefit) |

| 184 |

|

| 149 |

|

| 62 |

|

| 27 |

|

| 78 |

|

| (165 | ) |

| 335 |

|

| 24 |

|

| 359 |

|

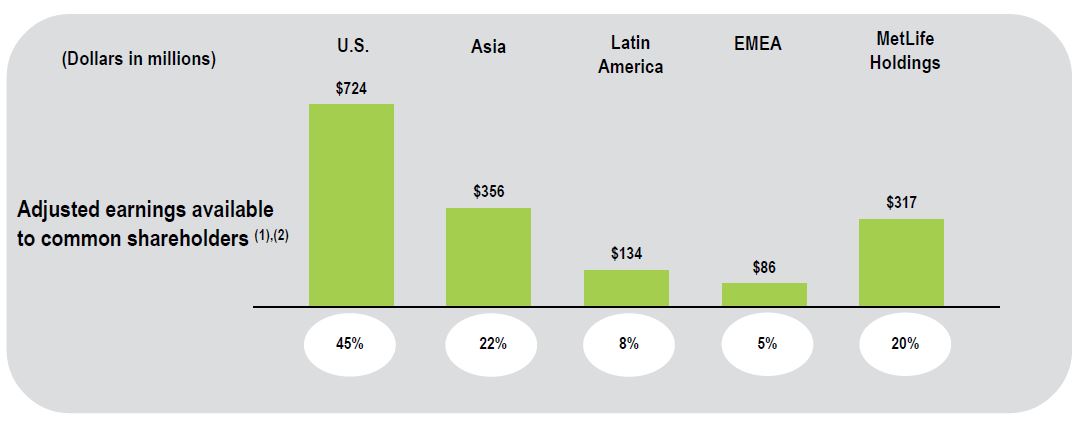

Adjusted earnings |

| $ | 724 |

| | $ | 356 |

| | $ | 134 |

| | $ | 86 |

| | $ | 317 |

| | $ | (161 | ) |

| 1,456 |

|

|

|

|

|

Adjustments to: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

Total revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| 854 |

|

|

|

| |

Total expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| (901 | ) |

|

|

| |

Provision for income tax (expense) benefit | | | | | | | | | | | | |

| (24 | ) |

|

|

| |

Net income (loss) | | | | | | | | | | | | |

| $ | 1,385 |

|

|

|

| $ | 1,385 |

|

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

2. Segment Information (continued)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | |

Three Months Ended March 31, 2018 | | U.S. | | Asia | | Latin America | | EMEA | | MetLife Holdings | | Corporate & Other | | Total | | Adjustments | | Total

Consolidated |

| | (In millions) |

Revenues | | | | | | | | | | | | | | | | | | |

Premiums | | $ | 5,217 |

| | $ | 1,748 |

| | $ | 699 |

| | $ | 551 |

| | $ | 950 |

| | $ | 13 |

| | $ | 9,178 |

| | $ | — |

| | $ | 9,178 |

|

Universal life and investment-type product policy fees | | 258 |

| | 394 |

| | 282 |

| | 112 |

| | 314 |

| | — |

| | 1,360 |

| | 32 |

| | 1,392 |

|

Net investment income | | 1,662 |

| | 795 |

| | 276 |

| | 75 |

| | 1,352 |

| | 59 |

| | 4,219 |

| | (474 | ) | | 3,745 |

|

Other revenues | | 204 |

| | 15 |

| | 8 |

| | 16 |

| | 67 |

| | 81 |

| | 391 |

| | 83 |

| | 474 |

|

Net investment gains (losses) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (333 | ) | | (333 | ) |

Net derivative gains (losses) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 349 |

| | 349 |

|

Total revenues | | 7,341 |

| | 2,952 |

| | 1,265 |

| | 754 |

| | 2,683 |

| | 153 |

| | 15,148 |

| | (343 | ) | | 14,805 |

|

Expenses | | | | | | | | | | | | | | | | | | |

Policyholder benefits and claims and policyholder dividends | | 5,138 |

| | 1,343 |

| | 646 |

| | 294 |

| | 1,550 |

| | (3 | ) | | 8,968 |

| | 47 |

| | 9,015 |

|

Interest credited to policyholder account balances | | 407 |

| | 351 |

| | 98 |

| | 25 |

| | 236 |

| | — |

| | 1,117 |

| | (348 | ) | | 769 |

|

Capitalization of DAC | | (106 | ) | | (465 | ) | | (94 | ) | | (118 | ) | | (10 | ) | | (2 | ) | | (795 | ) | | (1 | ) | | (796 | ) |

Amortization of DAC and VOBA | | 115 |

| | 314 |

| | 60 |

| | 106 |

| | 100 |

| | 2 |

| | 697 |

| | (4 | ) | | 693 |

|

Amortization of negative VOBA | | — |

| | (15 | ) | | — |

| | (6 | ) | | — |

| | — |

| | (21 | ) | | (1 | ) | | (22 | ) |

Interest expense on debt | | 2 |

| | — |

| | 2 |

| | — |

| | 2 |

| | 280 |

| | 286 |

| | — |

| | 286 |

|

Other expenses | | 961 |

| | 952 |

| | 338 |

| | 351 |

| | 276 |

| | 232 |

| | 3,110 |

| | 94 |

| | 3,204 |

|

Total expenses | | 6,517 |

| | 2,480 |

| | 1,050 |

| | 652 |

| | 2,154 |

| | 509 |

| | 13,362 |

| | (213 | ) | | 13,149 |

|

Provision for income tax expense (benefit) | | 171 |

| | 145 |

| | 75 |

| | 21 |

| | 104 |

| | (159 | ) | | 357 |

| | 42 |

| | 399 |

|

Adjusted earnings | | $ | 653 |

| | $ | 327 |

| | $ | 140 |

| | $ | 81 |

| | $ | 425 |

| | $ | (197 | ) | | 1,429 |

| | | | |

Adjustments to: | | | | | | | | | | | | | | | | | | |

Total revenues | | | | | | | | | | | | | | (343 | ) | | | | |

Total expenses | | | | | | | | | | | | | | 213 |

| | | | |

Provision for income tax (expense) benefit | | | | | | | | | | | | | | (42 | ) | | | | |

Net income (loss) | | | | | | | | | | | | | | $ | 1,257 |

| | | | $ | 1,257 |

|

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

2. Segment Information (continued)

The following table presents total assets with respect to the Company’s segments, as well as Corporate & Other, at:

|

| | | | | | | | |

| | March 31, 2019 | | December 31, 2018 |

| | (In millions) |

U.S. | | $ | 257,461 |

| | $ | 248,174 |

|

Asia | | 152,264 |

| | 146,278 |

|

Latin America | | 74,329 |

| | 70,417 |

|

EMEA | | 27,834 |

| | 27,829 |

|

MetLife Holdings | | 171,267 |

| | 166,872 |

|

Corporate & Other | | 30,033 |

| | 27,968 |

|

Total | | $ | 713,188 |

| | $ | 687,538 |

|

Revenues derived from any customer did not exceed 10% of consolidated premiums, universal life and investment-type product policy fees and other revenues for the three months ended March 31, 2019 and 2018.

3. Insurance

Guarantees

As discussed in Notes 1 and 4 of the Notes to the Consolidated Financial Statements included in the 2018 Annual Report, the Company issues directly and assumes through reinsurance variable annuity products with guaranteed minimum benefits. Guaranteed minimum accumulation benefits (“GMABs”), the non-life contingent portion of guaranteed minimum withdrawal benefits (“GMWBs”) and certain non-life contingent portions of GMIBs are accounted for as embedded derivatives in policyholder account balances and are further discussed in Note 6.

The Company also issues other annuity contracts that apply a lower rate on funds deposited if the contractholder elects to surrender the contract for cash and a higher rate if the contractholder elects to annuitize. These guarantees include benefits that are payable in the event of death, maturity or at annuitization. Certain other annuity contracts contain guaranteed annuitization benefits that may be above what would be provided by the current account value of the contract. Additionally, the Company issues universal and variable life contracts where the Company contractually guarantees to the contractholder a secondary guarantee or a guaranteed paid-up benefit.

Information regarding the Company’s guarantee exposure, which includes direct and assumed business, but excludes offsets from hedging or ceded reinsurance, if any, was as follows at:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2019 | | | December 31, 2018 | |

| | In the

Event of Death | | At

Annuitization | | In the

Event of Death (8) | | At

Annuitization (8) |

| | (Dollars in millions) | |

Annuity Contracts: | | | | | | | | | | | | |

Variable Annuity Guarantees: | | | | | | | | | | | | |

Total account value (1), (2), (3) | | $ | 66,192 |

| | | $ | 24,409 |

| | | $ | 63,381 |

| | | $ | 23,174 |

| |

Separate account value (1) | | $ | 41,540 |

| | | $ | 22,632 |

| | | $ | 38,888 |

| | | $ | 21,385 |

| |

Net amount at risk (2) | | $ | 2,027 |

| (4 | ) | | $ | 424 |

| (5 | ) | | $ | 3,197 |

| (4 | ) | | $ | 511 |

| (5 | ) |

Average attained age of contractholders | | 66 years |

| | | 65 years |

| | | 66 years |

| | | 64 years |

| |

Other Annuity Guarantees: | | | | | | | | | | | | |

Total account value (1), (3) | | N/A |

| | | $ | 5,825 |

| | | N/A |

| | | $ | 5,787 |

| |

Net amount at risk | | N/A |

| | | $ | 530 |

| (6 | ) | | N/A |

| | | $ | 549 |

| (6 | ) |

Average attained age of contractholders | | N/A |

| | | 50 years |

| | | N/A |

| | | 50 years |

| |

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

3. Insurance (continued)

|

| | | | | | | | | | | | | | | | |

| | March 31, 2019 | | December 31, 2018 |

| | Secondary

Guarantees | | Paid-Up

Guarantees | | Secondary

Guarantees (8) | | Paid-Up

Guarantees |

| | (Dollars in millions) |

Universal and Variable Life Contracts: | | | | | | | | |

Total account value (1), (3) | | $ | 11,398 |

| | $ | 3,035 |

| | $ | 11,205 |

| | $ | 3,070 |

|

Net amount at risk (7) | | $ | 91,404 |

| | $ | 15,279 |

| | $ | 93,028 |

| | $ | 15,539 |

|

Average attained age of policyholders | | 53 years |

| | 64 years |

| | 52 years |

| | 64 years |

|

__________________

| |

(1) | The Company’s annuity and life contracts with guarantees may offer more than one type of guarantee in each contract. Therefore, the amounts listed above may not be mutually exclusive. |

| |

(2) | Includes amounts, which are not reported on the interim condensed consolidated balance sheets, from assumed variable annuity guarantees from the Company’s former operating joint venture in Japan. |

| |

(3) | Includes the contractholder’s investments in the general account and separate account, if applicable. |

| |

(4) | Defined as the death benefit less the total account value, as of the balance sheet date. It represents the amount of the claim that the Company would incur if death claims were filed on all contracts on the balance sheet date and includes any additional contractual claims associated with riders purchased to assist with covering income taxes payable upon death. |

| |

(5) | Defined as the amount (if any) that would be required to be added to the total account value to purchase a lifetime income stream, based on current annuity rates, equal to the minimum amount provided under the guaranteed benefit. This amount represents the Company’s potential economic exposure to such guarantees in the event all contractholders were to annuitize on the balance sheet date, even though the contracts contain terms that allow annuitization of the guaranteed amount only after the 10th anniversary of the contract, which not all contractholders have achieved. |

| |

(6) | Defined as either the excess of the upper tier, adjusted for a profit margin, less the lower tier, as of the balance sheet date or the amount (if any) that would be required to be added to the total account value to purchase a lifetime income stream, based on current annuity rates, equal to the minimum amount provided under the guaranteed benefit. These amounts represent the Company’s potential economic exposure to such guarantees in the event all contractholders were to annuitize on the balance sheet date. |

| |

(7) | Defined as the guarantee amount less the account value, as of the balance sheet date. It represents the amount of the claim that the Company would incur if death claims were filed on all contracts on the balance sheet date. |

| |

(8) | The Company’s guarantee exposure amounts at December 31, 2018 as reported in the 2018 Annual Report have been revised. They conform to the presentation for the first quarter of 2019, which includes certain contracts with guarantees that were previously excluded. They include the following increases from the amounts reported in the 2018 Annual Report: (i) variable annuity guarantees in the event of death: $7.1 billion from $56.2 billion for total account value, $1.5 billion from $37.3 billion for separate account value and $429 million from $2.8 billion for net amount at risk; (ii) variable annuity guarantees at annuitization: $1.5 billion from $21.6 billion for total account value, $1.5 billion from $19.8 billion for separate account value and $28 million from $483 million for net amount at risk; (iii) other annuity guarantees: $4.5 billion from $1.3 billion for total account value and $60 million from $489 million for net amount at risk; and (iv) universal and variable life contract secondary guarantees: $2.3 billion from $8.9 billion for total account value and $28.9 billion from $64.2 billion for net amount at risk. |

Additionally, the average attained age of contractholders at annuitization for variable annuity guarantees decreased by one year from 65 years and the average attained age of policyholders with universal and variable life contract secondary guarantees decreased by five years from 57 years.

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

3. Insurance (continued)

Liabilities for Unpaid Claims and Claim Expenses

Rollforward of Claims and Claim Adjustment Expenses

Information regarding the liabilities for unpaid claims and claim adjustment expenses was as follows:

|

| | | | | | | | |

| | Three Months

Ended

March 31, |

| | 2019 | | 2018 |

| | (In millions) |

Balance, beginning of period | | $ | 17,788 |

| | $ | 17,094 |

|

Less: Reinsurance recoverables | | 2,332 |

| | 2,198 |

|

Net balance, beginning of period | | 15,456 |

| | 14,896 |

|

Incurred related to: | | | | |

Current period | | 6,338 |

| | 6,504 |

|

Prior periods (1) | | 210 |

| | (148 | ) |

Total incurred | | 6,548 |

| | 6,356 |

|

Paid related to: | | | | |

Current period | | (3,430 | ) | | (3,339 | ) |

Prior periods | | (2,814 | ) | | (2,719 | ) |

Total paid | | (6,244 | ) | | (6,058 | ) |

Net balance, end of period | | 15,760 |

| | 15,194 |

|

Add: Reinsurance recoverables | | 2,354 |

| | 2,237 |

|

Balance, end of period (included in future policy benefits and other policy-related balances) | | $ | 18,114 |

| | $ | 17,431 |

|

__________________

| |

(1) | For the three months ended March 31, 2019, claims and claim adjustment expenses associated with prior periods increased due to events incurred in prior periods but reported in the current period. For the three months ended March 31, 2018, claims and claim adjustment expenses associated with prior periods decreased due to favorable claims experience in the current period. |

4. Closed Block

On April 7, 2000 (the “Demutualization Date”), Metropolitan Life Insurance Company (“MLIC”) converted from a mutual life insurance company to a stock life insurance company and became a wholly-owned subsidiary of MetLife, Inc. The conversion was pursuant to an order by the New York Superintendent of Insurance approving MLIC’s plan of reorganization, as amended (the “Plan of Reorganization”). On the Demutualization Date, MLIC established a closed block for the benefit of holders of certain individual life insurance policies of MLIC.

Experience within the closed block, in particular mortality and investment yields, as well as realized and unrealized gains and losses, directly impact the policyholder dividend obligation. Amortization of the closed block DAC, which resides outside of the closed block, is based upon cumulative actual and expected earnings within the closed block. Accordingly, the Company’s net income continues to be sensitive to the actual performance of the closed block.

Closed block assets, liabilities, revenues and expenses are combined on a line-by-line basis with the assets, liabilities, revenues and expenses outside the closed block based on the nature of the particular item.

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

4. Closed Block (continued)

Information regarding the closed block liabilities and assets designated to the closed block was as follows at:

|

| | | | | | | | |

| | March 31, 2019 | | December 31, 2018 |

| | (In millions) |

Closed Block Liabilities | | | | |

Future policy benefits | | $ | 39,727 |

| | $ | 40,032 |

|

Other policy-related balances | | 422 |

| | 317 |

|

Policyholder dividends payable | | 453 |

| | 431 |

|

Policyholder dividend obligation | | 1,116 |

| | 428 |

|

Deferred income tax liability | | 36 |

| | 28 |

|

Other liabilities | | 200 |

| | 328 |

|

Total closed block liabilities | | 41,954 |

| | 41,564 |

|

Assets Designated to the Closed Block | | | | |

Investments: | | | | |

Fixed maturity securities available-for-sale, at estimated fair value | | 25,616 |

| | 25,354 |

|

Equity securities, at estimated fair value | | 63 |

| | 61 |

|

Contractholder-directed equity securities and fair value option securities, at estimated fair value | | 47 |

| | 43 |

|

Mortgage loans | | 6,994 |

| | 6,778 |

|

Policy loans | | 4,505 |

| | 4,527 |

|

Real estate and real estate joint ventures | | 556 |

| | 544 |

|

Other invested assets | | 592 |

| | 643 |

|

Total investments | | 38,373 |

| | 37,950 |

|

Accrued investment income | | 451 |

| | 443 |

|

Premiums, reinsurance and other receivables | | 70 |

| | 83 |

|

Current income tax recoverable | | 71 |

| | 69 |

|

Total assets designated to the closed block | | 38,965 |