As filed with the Securities and Exchange Commission on May 24, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Focus Financial Partners Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

6282 (Primary Standard Industrial Classification Code Number) |

47-4780811 (IRS Employer Identification No.) |

825 Third Avenue, 27th Floor

New York, NY 10022

(646) 519-2456

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

J. Russell McGranahan

General Counsel

825 Third Avenue, 27th Floor

New York, NY 10022

(646) 519-2456

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Robert Seber Brenda K. Lenahan Vinson & Elkins L.L.P. 666 Fifth Avenue, 26th Floor New York, New York 10103 (212) 237-0000 |

Richard D. Truesdell, Jr. Derek J. Dostal Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 |

|

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided in Section 7(a)(2)(B) of the Securities Act. ý

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||

|---|---|---|---|---|

Class A common stock, par value $0.01 per share |

$100,000,000 | $12,450 | ||

|

||||

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated May 24, 2018

P R O S P E C T U S

Shares

Focus Financial Partners Inc.

Class A Common Stock

This is Focus Financial Partners Inc.'s initial public offering. We are offering shares of our Class A common stock.

We expect the initial public offering price to be between $ and $ per share. Currently, no public market exists for our Class A common stock. We have applied to list our shares of Class A common stock on the NASDAQ Global Select Market under the symbol "FOCS."

Investing in our Class A common stock involves risks that are described in the "Risk Factors" section beginning on page 29 of this prospectus.

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act and will therefore be subject to reduced reporting requirements. Please read "Prospectus Summary—Emerging Growth Company Status."

| |

Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

Initial public offering price |

$ | $ | |||||

Underwriting discount |

$ | $ | |||||

Proceeds, before expenses, to us(1) |

$ | $ | |||||

The underwriters may also exercise their option to purchase up to an additional shares of our Class A common stock from us, at the initial public offering price less the underwriting discount, for 30 days after the date of this prospectus to cover overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares of Class A common stock will be ready for delivery on or about , 2018.

Joint Book-Running Managers

| Goldman Sachs & Co. LLC | BofA Merrill Lynch | KKR |

| BMO Capital Markets | RBC Capital Markets | SunTrust Robinson Humphrey |

Co-Managers

| Keefe, Bruyette & Woods A Stifel Company |

Raymond James | William Blair |

The date of this prospectus is , 2018.

TABLE OF CONTENTS

Neither we nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus and any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell shares of our Class A common stock and seeking offers to buy shares of our Class A common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time

i

of any sale of the Class A common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read "Risk Factors" and "Special Note Regarding Forward-Looking Statements."

Industry and Market Data

Unless otherwise indicated, industry and market data used throughout this prospectus were obtained through company research, surveys and studies conducted by third parties and industry and general publications. Certain information contained in "Prospectus Summary" and "Business" is based on studies, analyses and surveys prepared by Cerulli Associates, Inc., Capgemini/RBC Wealth Management, IBISWorld Inc. and other third-party sources. The industry data presented herein involves uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors," "Special Note Regarding Forward-Looking Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Trademarks and Trade Names

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties' trademarks, service marks or trade names in this prospectus is not intended to, and does not, imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

ii

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully before making an investment decision, including the information under the headings "Risk Factors," "Special Note Regarding Forward-Looking Statements," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business" and the historical and pro forma consolidated financial statements and the related notes thereto appearing elsewhere in this prospectus. The information presented in this prospectus assumes (i) an initial public offering price of $ per share of Class A common stock (the midpoint of the price range set forth on the cover of this prospectus) and (ii) unless otherwise indicated, that the underwriters do not exercise their option to purchase additional shares of Class A common stock to cover overallotments, if any.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to "we," "us," "our," the "Company," "Focus" and similar terms refer (i) for periods prior to giving effect to the reorganization transactions described under "Internal Reorganization," to Focus Financial Partners, LLC and its consolidated subsidiaries and (ii) for periods beginning on the date of and after giving effect to such reorganization transactions, to Focus Financial Partners Inc. and its consolidated subsidiaries. Also, unless otherwise indicated or the context otherwise requires, all information in this prospectus gives effect to the reorganization transactions. "Focus LLC" refers to Focus Financial Partners, LLC, a Delaware limited liability company and a consolidated subsidiary of ours following the reorganization transactions. The term "partner firms" refers to our consolidated subsidiaries engaged in wealth management and related services, the businesses of which are typically managed by the principals. The term "principals" refers to the wealth management professionals who manage the businesses of our partner firms pursuant to the relevant management agreement. The term "our partnership" refers to our business and relationship with our partner firms and is not intended to describe a particular form of legal entity or a legal relationship. For explanations of certain terms used in this prospectus, please read "Glossary" beginning on page A-1.

We are a leading partnership of independent, fiduciary wealth management firms operating in the highly fragmented registered investment advisor ("RIA") industry, with a footprint of over 50 partner firms across the country. We have achieved this market leadership by positioning ourselves as the partner of choice for many firms in an industry where a number of secular trends are driving RIA consolidation. Our partner firms primarily service high net worth individuals and families by providing highly differentiated and comprehensive wealth management services. Our partner firms benefit from our intellectual and financial resources, operating in a scaled business model with aligned interests, while retaining their entrepreneurial culture and independence.

Our partnership is built on the following principles, which enable us to attract and retain high-quality wealth management firms and accelerate their growth:

1

We were founded by entrepreneurs and began revenue-generating and acquisition activities in 2006. Since that time, we have:

We are in the midst of a fundamental shift in the growing wealth management services industry. According to the Capgemini 2017 World Wealth Report (the "2017 World Wealth Report"), the population of high net worth individuals continues to grow globally and has reached record levels in the United States since 2010, which is driving increased demand for wealth management services. In addition, due to the significant increase in retirees in the United States, the industry is witnessing significant growth in the flow of retirement assets from company-sponsored plans into flexible investment accounts. For example, rollovers, primarily from employer-sponsored retirement plans, to traditional IRAs grew significantly from $114.0 billion in 1996 to $423.9 billion in 2014 according to The IRA Investor Profile: Traditional IRA Investors' Activity, 2007-2015 ICI Research Report (June 2017) by Sarah Holden and Steven Bass (the "June 2017 ICI Report"). Additionally, the delivery of wealth management services is moving from traditional brokerage, commission-based platforms to a fiduciary, open architecture and fee-based structure. This shift has resulted in a significant transfer of client assets and wealth management professionals out of traditional brokerage, commission-based platforms to independent wealth management practices. We believe that our leading partnership of independent, fiduciary wealth management firms positions us to benefit from these trends.

The independent wealth management industry, including RIAs, is highly fragmented, which we believe enables us to continue our growth strategy of acquiring high-quality wealth management firms, directly and through acquisitions by our partner firms. We have a track record of enhancing the competitive position of our partner firms by providing them with access to the resources of our large organization. Our scale enables us to help our partner firms achieve operational efficiencies and ensure organizational continuity. Additionally, our scale, resources and value-added services increase our partner firms' ability to achieve growth through a variety of tactical, operational and strategic initiatives, as well as the consummation of their own acquisitions. As our existing partner firms benefit from these growth initiatives, we continue to focus on acquisitions of new partner firms.

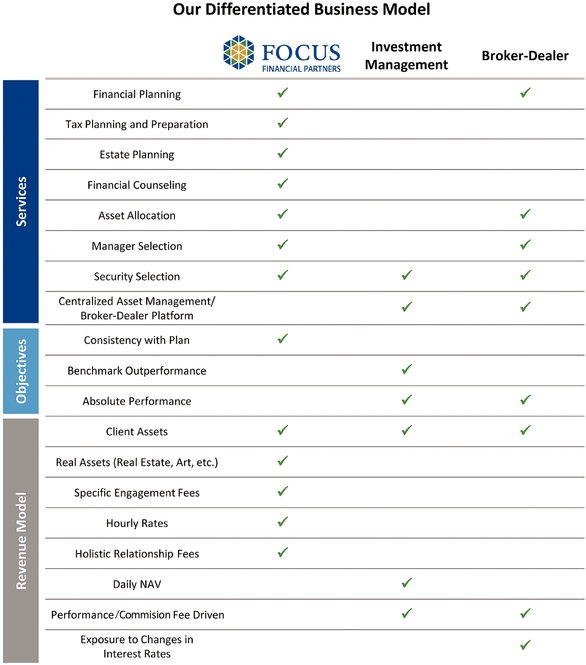

Our partnership is comprised of trusted professionals providing comprehensive wealth management services under a largely recurring, fee-based model, which differentiates our partner firms from the traditional brokerage platforms whose revenues are largely derived from commissions. We derive a substantial majority of our revenues from wealth management fees for investment advice, financial and tax planning, consulting, tax return preparation, family office services and other services. We also generate other revenues from recordkeeping and administration service fees, commissions and distribution fees.

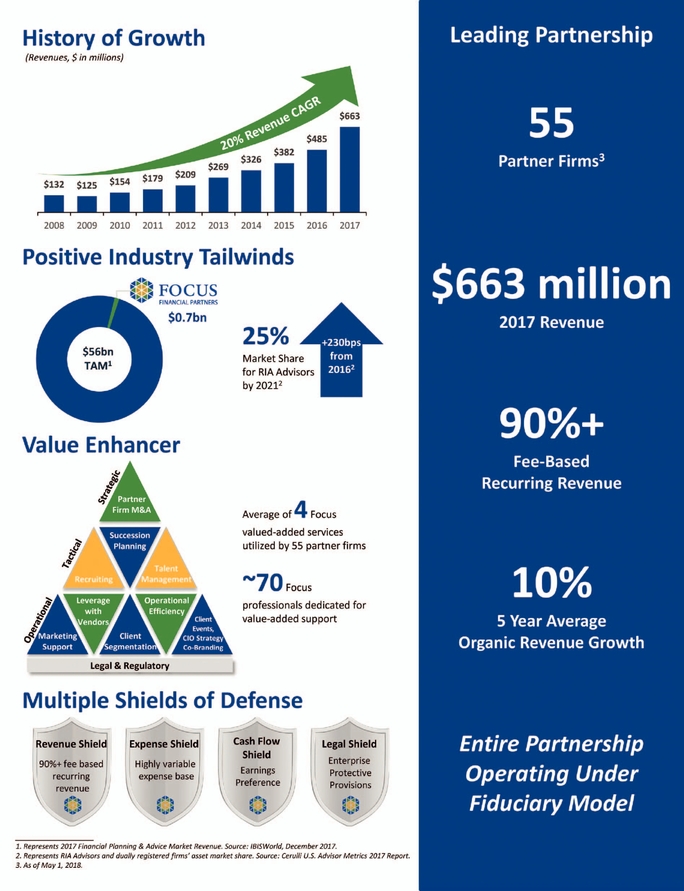

For the year ended December 31, 2017, we generated total revenues of $662.9 million, net loss of $48.4 million, Adjusted EBITDA of $145.2 million and Adjusted Net Income of $96.6 million. For the

2

three months ended March 31, 2018, we generated total revenues of $196.2 million, net loss of $12.1 million, Adjusted EBITDA of $44.2 million and Adjusted Net Income of $28.3 million. Over the last three fiscal years, our total revenues, our net income, our Adjusted EBITDA and our Adjusted Net Income have changed at compounded annual growth rates ("CAGR") of 26.7%, (259.2)%, 28.9% and 20.0%, respectively. We expect our growth to continue as a result of the growth of our partner firms, attractive market and industry tailwinds and ongoing acquisition opportunities within the fragmented wealth management industry. For additional information regarding our non-GAAP financial measures, including a reconciliation of Adjusted EBITDA and Adjusted Net Income to the most directly comparable GAAP financial measure, please read "Management's Discussion and Analysis of Financial Condition and Results of Operations—How We Evaluate Our Business."

The following chart shows key aspects of our differentiated business model versus the typical investment manager and broker dealer.

3

Our differentiated partnership model has allowed us to grow and enhance our leadership position in the wealth management industry. The hallmarks of our model include:

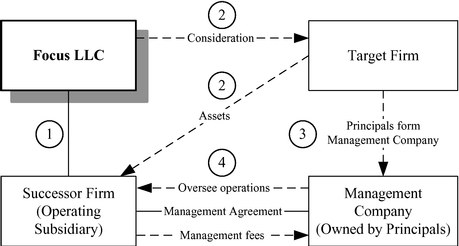

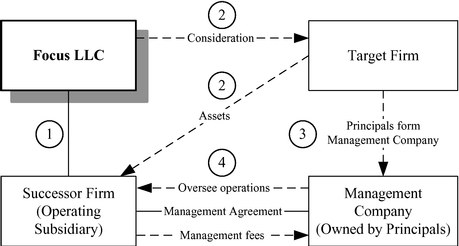

Since 2006 when we began revenue generating and acquisition activities, we have grown to a partnership with over 50 partner firms. Acquisitions of partner firms to date have been structured as illustrated below, with limited exceptions. Subsidiary mergers at the partner firm level have been

4

structured differently, and in the future we may structure acquisitions in foreign jurisdictions differently depending on legal and tax considerations.

Overview of the Wealth Management Industry

The market we serve is significant and expanding. The Financial Planning and Advice market in the United States, as defined by an IBISWorld report dated December 2017, is estimated to have a total revenue pool of $56.0 billion in 2017, up from $37.9 billion in 2012. Furthermore, the total revenue pool for the Financial Planning and Advice market is expected to reach $78.5 billion by 2023. The U.S. wealth management market is generally categorized into six distinct channels, including the RIA channel we focus on and five broker-dealer channels (independent broker-dealer, wirehouse, regional, bank and insurance). We believe that the RIA channel and channels with similar characteristics in other countries provide a superior structure through which to deliver wealth management services, which leads to attractive growth opportunities and a high-quality client base relative to other channels.

5

The high net worth population worldwide grew at a 7.2% annual rate from 2010 to 2016, according to the 2017 World Wealth Report. In addition, globally, the wealth of high net worth individuals is expected to grow at a 5.9% annual rate from 2016 to 2025, according to the same report. We believe this trend is increasing overall demand for wealth management services and provides an attractive underlying growth trajectory for our business. Within the larger wealth management industry, we have focused primarily on the United States to date. Between 2014 and 2016, the U.S. high net worth population increased at an annual rate of approximately 5.0% from 4.4 million to 4.8 million, which represents approximately 29.0% of the global high net worth population, according to the 2017 World Wealth Report.

Overview of the RIA Channel in the United States

RIAs are generally focused on providing high net worth clients a full suite of wealth management services under a fee-based model. RIAs are registered with the SEC or a state's securities agency and therefore have a legal obligation to adhere to the fiduciary standard, whereas broker-dealers operate under a client suitability standard of conduct, which requires only that investment recommendations be based on a reasonable inquiry into a client's situation. In addition, while RIAs are required by the fiduciary standard to make full and fair disclosure to clients of all material facts, including any potential conflicts of interest, broker-dealers have more limited disclosure obligations. Lastly, whereas broker-dealers generally operate under a commission-based system, RIAs generally operate under a fee-based system, which leads to more recurring and visible revenue streams.

In 2016, RIAs grew 6.5% to 36,959 total advisors, according to the Cerulli U.S. Advisor Metrics 2017 Report (the "Cerulli 2017 Advisor Report"). In addition, from 2007 to 2016, RIAs increased their share of total advisors across all channels from 7.0% to 11.9%. The number of advisors in the RIA channel is expected to reach 42,523 advisors with an advisor headcount share of 14.1% by 2021, based on estimates from the Cerulli 2017 Advisor Report. In addition to a growing number of advisors, the RIA channel is fragmented with 14,693 RIAs as of December 31, 2016, according to the Cerulli 2017 Advisor Report. As a leading partnership of RIAs, we believe this gives us a competitive advantage for further expansion in this growing, yet fragmented, channel.

Key Trends Driving Growth of RIAs and Hybrid RIA Firms

We believe there are several key factors driving the growth of RIAs and hybrid RIA firms:

6

Expanding International Opportunities

We believe that there are similar business and regulatory trends in several key international jurisdictions that are driving wealth management professionals toward independent, fee-based business models consistent with our partner firms' approach. In particular, in addition to targeting the RIA-led wealth management industry in the United States, we believe the heightened regulatory scrutiny and proliferating awareness of the fiduciary standard for wealth management as well as the growing population of high net worth clients in various regions globally will provide us with an increasing number of acquisition targets abroad. We have identified Canada, the United Kingdom, Western Europe and Australia as attractive markets where we expect our philosophy of fiduciary alignment and independence to resonate with potential partner firms. We also believe that Asia in the medium term is an attractive market for wealth management services and presents growth opportunities in the future given the growth of the high net worth population in the region. We believe that we are well-positioned to take advantage of the growth opportunities in these and other international markets.

7

reforms, became mandatory in July 2013 and provides formal guidelines that provide structural tailwinds for the independent wealth management model.

Our future international acquisitions may not be structured like our typical partner firm acquisitions. For example, we have a minority equity investment in Australia. A variety of structures may be used for future international investments and acquisitions.

As a leading partnership of independent, fiduciary wealth management firms led by entrepreneurs, we believe the following strengths provide us with a sustainable competitive advantage:

A Leading Partnership of Fiduciary Wealth Management Firms

We strategically built a leading partnership of independent, fiduciary wealth management firms led by entrepreneurs through a unique, disciplined and proven acquisition strategy. Our partnership delivers key innovative features that clients are increasingly seeking in today's environment, such as adoption of the fiduciary standard and a lack of dependence on cross-selling and commission-based revenues. Our position as a large-scale partnership of wealth management firms provides significant tangible benefits to our partner firms, including acquisition opportunities. Today, we have over 50 partner firms that operate under the fiduciary standard with open-architecture access. Our model allows our partner firms to use each other as business development resources and drives innovation through Centers of Competence, our program through which we share best practices among our partner firms and provide them with value-added services. We believe we have a proven model for transitioning new wealth management firms into the partnership with minimal disruption to the operations of the firm.

Unique Value Proposition for Entrepreneurial Wealth Management Professionals

We are actively involved in providing strategic advice and other value-added services to our partner firms without compromising their autonomy, client service or culture. As early as the acquisition due diligence process, we identify areas where we believe we can add value to a potential partner firm, and upon acquisition, we assign a relationship leader to each partner firm who is responsible for collaborating with that firm to drive business strategy and growth. Each relationship leader is tasked with intimately understanding the partner firm, identifying opportunities for growth and coordinating our value-added services to assist that partner firm in accelerating its growth. In the interest of emphasizing the independence of our partner firms, we do not impose business decisions on them but rather consult and advise.

Our operating model ensures financial alignment between us and our partner firms allowing each of us to benefit from the adoption of new value add services and growth strategies. We have a team of approximately 70 professionals who support our partner firms by providing value-added services including marketing and business development support, advisor coaching and development and structuring compensation and incentive models along with career path planning, succession planning advice, operational and technology expertise, legal and regulatory support and providing negotiating leverage with vendors. Our value-added services also include acquisition opportunities for our partner

8

firms through a proactive outreach program, structuring transactions and providing guidance to partner firms to facilitate their integration into our partnership. Additionally, we offer offsite meetings, seminars and other opportunities for partner firms to learn and adopt best practices. We host semiannual meetings of our partner firms, as well as periodic summits for the chief investment officers, chief compliance officers, chief operating officers and chief marketing officers of our partner firms where our partner firms can gather and share industry expertise and business development practices. Our partner firms are encouraged to share best practices regularly in order to enhance their collective ability to better serve their clients. We believe the strong growth across our partner firms is evidence of the impact of our value-added services.

Proven Acquisition Expertise

Growth through acquisitions of new partner firms by us and acquisitions by our partner firms is integral to and a core competency of our business. Since 2006, we have completed over 140 acquisitions, both directly and through acquisitions by our partner firms. In the past three years, we have averaged approximately 21 transactions per year. Our senior leadership team, along with all of our other headquarters personnel, spend a significant portion of their time on sourcing and executing acquisitions. Our value-added services professionals have acquisition, legal, financial, tax, compliance and operational experience and are devoted to our acquisition strategy. We are disciplined about both the types of wealth management firms we acquire and the terms at which we are willing to transact. Our areas of expertise include:

We believe that our disciplined acquisition strategy allows us to attract and execute acquisitions of high-quality, fiduciary wealth management firms that continue to support our growth. This is demonstrated by our track record to date, with over 50 partner firms and numerous acquisitions executed by our partner firms.

9

Attractive Financial Model

Our attractive, differentiated financial model is evidenced by our proven track record of strong financial performance. Since 2008, we have generated a revenue growth CAGR of approximately 20%, achieved through executing our balanced strategy of acquiring new partner firms and supporting organic growth at our existing partner firms. In our most recent year ended December 31, 2017, our revenue grew by 36.6%, we had a net loss, our Adjusted EBITDA grew by 40.9% and our Adjusted Net Income grew by 24.6%, each as compared to the prior year. Further, our business generated net income (loss) margins of approximately 2.4%, 3.2% and (7.3)% for the years ended December 31, 2015, 2016 and 2017, respectively, and Adjusted EBITDA margins of approximately 20% for each of the years ended December 31, 2015, 2016 and 2017 and is capital light given our limited working and regulatory capital requirements, which together create substantial operating leverage and drive free cash flow generation. We believe our financial profile provides the flexibility to continue to execute our various growth initiatives.

Our attractive financial model is further supported by certain elements that insulate our revenue and earnings streams from operational and market volatility:

Experienced Management Team with Proven Execution Track Record

Our management team, which includes our co-founders, has played a significant role in building the business and has a deep, fundamental understanding of the company. Our executives have strong relationships in the wealth management industry and are actively involved in the day-to-day operations of the business and in sourcing acquisitions. Prior to joining Focus, members of our management team developed financial services and consultative expertise and leadership capabilities at organizations such as McKinsey & Company, The Boston Consulting Group, American Express ("AMEX"), Merrill Lynch, BlackRock and PricewaterhouseCoopers. Our management team is closely aligned with shareholders' interests as a result of its significant equity ownership in us.

10

We believe we are well-positioned to take advantage of favorable trends in the wealth management industry, including the migration of wealth management professionals from traditional brokerage, commission-based platforms to a fiduciary, open-architecture and fee-based structure. We plan to grow our business through the growth of our existing partner firms and expansion of our partnership.

Growth of Our Existing Partner Firms

11

Acquisitions of New Partner Firms

Since inception, a fundamental aspect of our growth strategy has been the acquisition of high-quality, entrepreneurial wealth management firms to expand our partnership. We believe that there are over 500 firms in the United States that are high-quality targets for future acquisitions. While most of our acquisitions have taken place in the United States, we see opportunities in multiple international locations where market and regulatory trends toward the fiduciary standard and open-architecture access mirror those occurring in the United States. We have already begun expansion into the United Kingdom, Canada and Australia.

Risks Related to Our Partnership Model and Growth Strategy

We face risks related to our partnership model and growth strategy. You should carefully read the section of this prospectus entitled "Risk Factors" for an explanation of these risks before investing in our Class A common stock. The principal risks we face related to our partnership model and growth strategy include:

Our Structure and Reorganization

Summary of Offering Structure

This offering is conducted through an "Up-C" structure, which is often used by partnerships and limited liability companies when they go public. An Up-C structure allows the equity holders in an

12

entity that is treated as a partnership for U.S. federal income tax purposes to retain and realize tax benefits associated with their continued ownership interest following an initial public offering.

In connection with the closing of this offering, we will enter into the Fourth Amended and Restated Operating Agreement of Focus LLC (the "Fourth Amended and Restated Focus LLC Agreement"). Following this offering and the reorganization transactions described below, Focus will be a holding company and its sole material asset will be a membership interest in Focus LLC. Focus will be the sole managing member of Focus LLC, will be responsible for all operational, management and administrative decisions of Focus LLC and will consolidate the financial results of Focus LLC and its operating subsidiaries. All other membership interests in Focus LLC will be non-voting.

Investors in this offering will purchase shares of our Class A common stock. Focus will use a portion of the proceeds to purchase outstanding Focus LLC units from certain existing owners other than our private equity investors (as defined below). In addition, certain existing owners will exchange all or a portion of their Focus LLC units for shares of our Class A common stock and, in some cases, receive either compensatory stock options or non-compensatory stock options and cash. Certain existing owners will continue to hold Focus LLC units representing economic, non-voting interests in Focus LLC and receive shares of our Class B common stock.

Purchasers of our Class A common stock in this offering will experience immediate and substantial dilution in the net tangible book value per share of Class A common stock for accounting purposes. After giving effect to the sale of shares of Class A common stock in this offering and further assuming the receipt of the estimated net proceeds (assuming the midpoint of the price range set forth on the cover of this prospectus and after deducting the underwriting discount and estimated offering expenses payable by us), our adjusted pro forma net tangible book value as of March 31, 2018 would have been approximately $ million, or $ per share of Class A common stock. This represents an immediate increase in the net tangible book value of $ per share to our existing owners and immediate dilution (i.e., the difference between the offering price and the adjusted pro forma net tangible book value after this offering) to new investors purchasing shares of Class A common stock in this offering of $ per share. Please read "Risk Factors—Risks Relating to the Offering and Our Class A Common Stock—Investors in this offering will experience immediate and substantial dilution of $ per share." and "Dilution."

The Class A and Class B common stock will generally vote together as a single class on all matters submitted to a vote of shareholders. The Class B common stock will not have any economic rights. Upon completion of this offering (assuming no exercise of the underwriters' option to purchase additional shares), existing owners, including our private equity investors and other shareholders, will own approximately % of our Class A common stock (representing % of the economic interest and % of the voting power). The continuing owners will own 100% of our Class B common stock (representing 0% of the economic interest and % of the voting power).

Reorganization Transactions

In connection with this offering, we will effect an internal reorganization, which we refer to as the "reorganization transactions." The existing equity interests in Focus LLC consist of convertible preferred units, common units and incentive units. Each incentive unit has a hurdle amount, which is similar to the exercise price of a stock option. The owners of existing Focus LLC units, whom we refer to as the "existing owners," primarily include (i) affiliates of Stone Point Capital LLC (together with its affiliates, "Stone Point"), Kohlberg Kravis Roberts & Co. L.P. (together with its affiliates, "KKR") and Centerbridge Partners, L.P., whom we refer to as our "private equity investors," (ii) members of management, (iii) current and former principals and (iv) current and former employees of us and our partner firms.

13

We will implement the following steps in connection with this offering:

14

Class A common stock, (ii) vested incentive units will be converted into the appropriate conversion number of vested common units and exchanged for an equal number of shares of vested Class A common stock and (iii) unvested incentive units will be converted into the appropriate conversion number of unvested common units and exchanged for an equal number of shares of unvested Class A common stock, which will vest in three equal installments on December 31, 2018, 2019 and 2020. We refer to existing owners who elect such exchange as "optionally exchanging owners." Optionally exchanging owners may elect to exchange a portion of their common and incentive units only if they exchange at least 25,000 common units and incentive units in the aggregate and, after any elective sale and such exchange, they continue to hold at least 25,000 common units and incentive units in the aggregate in Focus LLC following this offering. These existing owners will continue to hold their common units and incentive units remaining after any such sale or exchange in Focus LLC.

We refer to existing owners who will hold common units or incentive units in Focus LLC after the reorganization transactions, including common units converted from convertible preferred units, as "continuing owners." In connection with this offering, Focus will issue shares of its Class B common stock to the continuing owners who hold vested common units in exchange for their assignment to Focus of their voting rights in Focus LLC. Each such owner will receive one share of Class B common stock for each vested common unit held. Continuing owners holding unvested common units will receive Class B common stock only upon vesting of such units. Continuing owners holding incentive units will not receive any Class B common stock.

Shares of Class B common stock will not entitle their holders to any economic rights. Holders of Class A common stock and Class B common stock will vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law. Each share of Class B common stock will entitle its holder to one vote. We do not intend to list the Class B common stock on any stock exchange. Continuing owners holding unvested common units will not have any voting rights until such units vest. Continuing owners holding incentive units will not have any voting rights.

15

Structure Upon Completion of Offering

From the proceeds received in this offering after deducting the underwriting discount and estimated offering expenses payable by us:

Upon completion of the reorganization transactions and this offering:

16

Each unitholder of Focus LLC (other than Focus) will, subject to certain limitations, have the right to cause Focus LLC to redeem all or a portion of its vested common units and vested incentive units, which we refer to as an "exchange right." Upon an exercise of an exchange right with respect to vested incentive units, such incentive units will first be converted into a number of common units that takes into account the then-current value of the common units and such incentive units' aggregate hurdle amount. Upon an exercise of an exchange right with respect to vested common units, and immediately after the conversion of vested incentive units into common units as described in the preceding sentence, Focus LLC will acquire each tendered common unit for, at its election, (i) one share of Class A common stock, subject to conversion rate adjustments for stock splits, stock dividends, reclassification and other similar transactions, or (ii) an equivalent amount of cash. In addition, in connection with any redemption of vested common units (other than common units received upon a conversion of incentive units as described in this paragraph), the corresponding shares of Class B common stock will be cancelled. Alternatively, upon the exercise of any exchange right, Focus (instead of Focus LLC) will have the right to acquire each tendered common unit (and corresponding share of Class B common stock, as applicable) from the exchanging unitholder for, at its election, (i) one share of Class A common stock, subject to conversion rate adjustments for stock splits, stock dividends, reclassification and other similar transactions, or (ii) an equivalent amount of cash, which we refer to as our "call right." The exchange rights will be subject to certain limitations and restrictions intended to ensure that Focus LLC will continue to be treated as a partnership for U.S. federal income tax purposes. Please read "Certain Relationships and Related Party Transactions—Fourth Amended and Restated Focus LLC Agreement."

Liquidity Rights and Limitations

All existing owners will, subject to certain exceptions, be restricted from selling or transferring any shares of Class A common stock or any other of our equity securities for 180 days after the date of this prospectus. Please read "Certain Relationships and Related Party Transactions—Fourth Amended and Restated Focus LLC Agreement—Transfer of Securities" and "Underwriting (Conflicts of Interest)—No Sales of Similar Securities."

Following the expiration of this 180-day period and except as otherwise permitted by the Fourth Amended and Restated Focus LLC Agreement, continuing owners will be restricted in exchanging Focus LLC units beneficially owned by them at the closing of this offering, such that they may exchange only up to one-third of such beneficially owned units per year, with certain carry-forward rights, and subject to certain exceptions, all as described below. The foregoing volume restrictions will apply to the existing owners affiliated with our private equity investors ("PE Holders") as an aggregate limitation on their ability to sell Focus LLC units or the shares of Class A common stock received in connection with the reorganization transactions.

Except for certain additional liquidity rights provided under the registration rights agreement described below and except as otherwise permitted by the Fourth Amended and Restated Focus LLC Agreement, continuing owners will only be permitted to exercise their exchange rights on quarterly exchange dates and with respect to one-twelfth of the units held by them at the closing of this offering, with an ability to carry forward unused exchange rights to subsequent exchange dates. The foregoing volume restrictions will apply to the PE Holders as an aggregate limitation on their ability to sell Focus LLC units or the shares of Class A common stock received in connection with the reorganization transactions.

Pursuant to a registration rights agreement, we will file a shelf registration statement to permit the resale of shares of Class A common stock held by PE Holders or issuable upon the exercise of exchange rights by continuing owners as soon as practicable following the one year anniversary of this offering.

17

The PE Holders will have the right to demand up to three secondary underwritten offerings per year. We may initiate one additional underwritten offering per year for the benefit of the other continuing owners.

The PE Holders and the other continuing owners may have participation rights with respect to any such underwritten offerings. We may also participate on a primary basis and issue and sell shares of our Class A common stock for our own account. We will use the proceeds from any such offering to purchase outstanding Focus LLC units from continuing owners and pay related fees and expenses. In the event of any underwriter cutbacks, all participating holders will be treated equally and included pro rata based on their ownership of registrable shares at the closing of this offering.

The PE Holders and the other continuing owners may also have piggyback registration rights with respect to other underwritten offerings by us under certain circumstances.

We expect that future unitholders in certain instances may also be granted registration rights in connection with future acquisitions by Focus LLC, but on terms that are not superior to the registration rights of the continuing owners. Please read "Certain Relationships and Related Party Transactions—Registration Rights Agreement."

In addition, continuing owners will be subject to certain transfer restrictions under the Fourth Amended and Restated Focus LLC Agreement, which will be entered into in connection with the closing of this offering, intended to ensure that Focus LLC will continue to be treated as a partnership for U.S. federal income tax purposes.

Tax Receivable Agreements

Focus's acquisition (or deemed acquisition for U.S. federal income tax purposes) of Focus LLC units in connection with this offering or pursuant to an exercise of an exchange right or the call right is expected to result in adjustments to the tax basis of the tangible and intangible assets of Focus LLC and such adjustments will be allocated to Focus. Moreover, following Focus's acquisition or deemed acquisition of Focus LLC units and of the blockers, Focus will be allocated adjustments to the tax basis of the tangible and intangible assets of Focus LLC as a result of the acquisition in July 2017 of convertible preferred units by our private equity investors and certain of the blockers owned by our private equity investors. These adjustments would not have been available to Focus absent its acquisition or deemed acquisition of Focus LLC units or its acquisition of the blockers and are expected to reduce the amount of cash tax that Focus would otherwise be required to pay in the future.

In connection with the closing of this offering, Focus will enter into two tax receivable agreements (the "Tax Receivable Agreements"), the first of which will be entered into with the blocker owners and the PE Holders, and the second of which will be entered into with the continuing owners who are not PE Holders and certain other existing owners (the parties to the two agreements collectively, the "TRA holders"). The term of each Tax Receivable Agreement will commence upon the closing of this offering and will continue until all tax benefits that are subject to such Tax Receivable Agreement have been utilized or expired, unless we experience a change of control (as defined in the Tax Receivable Agreements, which includes certain mergers, asset sales and other forms of business combinations) or the Tax Receivable Agreements terminate early (at our election or as a result of our breach), and we make the termination payments specified in the Tax Receivable Agreements. The Tax Receivable Agreements generally provide for the payment by Focus to each TRA holder of 85% of the net cash savings, if any, in U.S. federal, state and local income and franchise tax that Focus actually realizes (computed using simplifying assumptions to address the impact of state and local taxes) or is deemed to realize in certain circumstances in periods after this offering as a result of, as applicable to the relevant TRA holder, (i) certain increases in tax basis that occur as a result of Focus's acquisition (or deemed acquisition for U.S. federal income tax purposes) of all or a portion of such TRA holder's units in connection with this offering or pursuant to the exercise of an exchange right or the call right,

18

(ii) the increases in tax basis relating to the July 2017 acquisition by our private equity investors that will be available to Focus as a result of its acquisition of the blockers in connection with this offering and (iii) imputed interest deemed to be paid by Focus as a result of, and additional tax basis arising from, any payments Focus makes under the relevant Tax Receivable Agreement. We will retain the benefit of the remaining 15% of these cash savings. For purposes of the Tax Receivable Agreements, cash savings in tax generally are calculated by comparing Focus's actual tax liability (using the actual applicable U.S. federal income tax rate and an assumed combined state and local income and franchise tax rate) to the amount it would have been required to pay had it not been able to utilize any of the tax benefits subject to the Tax Receivable Agreements. In addition, if we elect to terminate the Tax Receivable Agreements early, or upon certain mergers, asset sales, other forms of business combinations or other changes of control, Focus's (or Focus's successor's) tax savings under the Tax Receivable Agreements would be based on certain assumptions, including the assumption that Focus has sufficient taxable income to fully utilize the tax benefits covered by the Tax Receivable Agreements. Please read "Certain Relationships and Related Party Transactions—Tax Receivable Agreements" for a description of the Tax Receivable Agreements generally and for a discussion of circumstances in which Focus will be deemed to acquire units or realize net cash tax savings. We expect that future unitholders may become party to one or more tax receivable agreements entered into in connection with future acquisitions by Focus LLC.

Because Focus is a holding company with no operations of its own, Focus's ability to make payments under the Tax Receivable Agreements is dependent on the ability of Focus LLC to make distributions to Focus in an amount sufficient to cover its obligations under the Tax Receivable Agreements. See "Risk Factors—Risks Related to Our Internal Reorganization and Resulting Structure—Focus is a holding company. Focus's sole material asset after completion of this offering will be its equity interest in Focus LLC and Focus will be accordingly dependent upon distributions from Focus LLC to pay taxes, make payments under the Tax Receivable Agreements and cover its corporate and other overhead expenses." If we experience a change of control (as defined under the Tax Receivable Agreements, which includes certain mergers, asset sales and other forms of business combinations) or the Tax Receivable Agreements terminate early (at our election or as a result of our breach), Focus could be required to make a substantial, immediate lump-sum payment.

19

Organizational Structure

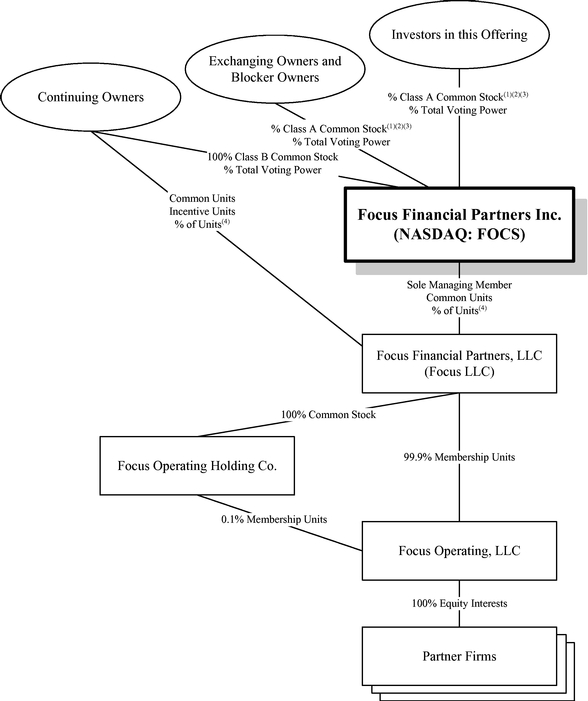

The following diagram indicates our ownership structure immediately following the reorganization transactions and this offering (assuming the underwriters do not exercise their option to purchase additional shares).

20

Investing in our Class A common stock involves risks and uncertainties. You should carefully read the section of this prospectus entitled "Risk Factors" for an explanation of these risks before investing in our Class A common stock. The principal risks we face include fluctuations in wealth management fees, our reliance on our partner firms and the principals who manage their businesses, our ability to make successful acquisitions, unknown liabilities of or poor performance by acquired businesses, harm to our reputation, our inability to facilitate smooth succession planning at our partner firms, our inability to compete, our reliance on key personnel, our inability to attract, develop and retain talented wealth management professionals, our inability to retain clients following an acquisition, write down of goodwill and other intangible assets, our failure to maintain and properly safeguard an adequate technology infrastructure, cyber-attacks, our inability to recover from business continuity problems, inadequate insurance coverage, the termination of management agreements by management companies, our inability to generate sufficient cash to service all of our indebtedness, the failure of our partner firms to comply with applicable U.S. and non-U.S. regulatory requirements, legal proceedings and governmental inquiries.

Emerging Growth Company Status

We are an "emerging growth company" within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with certain requirements that are applicable to other public companies that are not "emerging growth companies," including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act"), the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions until we are no longer an emerging growth company.

In addition, Section 107 of the Jumpstart Our Business Startups Act (the "JOBS Act") also provides that an emerging growth company can use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the "Securities Act") for complying with new or revised accounting standards. This permits an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to "opt out" of such extended transition period and, as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

For a description of the qualifications and other requirements applicable to emerging growth companies, please read "Risk Factors—Risks Related to the Offering and our Class A Common Stock—For as long as we are an emerging growth company, we will not be required to comply with certain reporting requirements, including those relating to accounting standards and disclosure about our executive compensation, that apply to other public companies."

We are a Delaware corporation. Our principal executive offices are located at 825 Third Avenue, 27th Floor, New York, NY 10022 and our telephone number at that address is (646) 519-2456. Our website address is www. . Information contained on our website does not constitute part of this prospectus.

21

Class A common stock outstanding before this offering |

shares. | |

Class A common stock offered by us |

shares ( shares if the underwriters' option to purchase additional shares is exercised in full). |

|

Class A common stock to be outstanding immediately after completion of this offering |

shares ( shares if the underwriters' option to purchase additional shares is exercised in full).(1) |

|

Option to purchase additional shares of Class A common stock |

We have granted the underwriters a 30-day option to purchase up to an aggregate of additional shares of our Class A common stock. |

|

Class B common stock to be outstanding immediately after completion of this offering |

shares, or one share for each vested common unit held by the continuing owners immediately following this offering. Each share of Class B common stock has no economic rights but entitles its holder to one vote. When a vested common unit is acquired pursuant to the exercise of an exchange right or the call right, a corresponding share of Class B common stock will be cancelled. |

|

Voting power of Class A common stock immediately after giving effect to this offering(1) |

% |

|

Voting power of Class B common stock immediately after giving effect to this offering |

% |

22

Voting rights |

Each share of our Class A common stock entitles its holder to one vote. Each share of our Class B common stock entitles its holder to one vote. Holders of our Class A common stock and Class B common stock vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law. Please read "Description of Capital Stock." | |

Use of proceeds |

We expect to receive approximately $ million of net proceeds from the sale of the Class A common stock offered by us, based upon the assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover of this prospectus), after deducting the underwriting discount and estimated offering expenses payable by us (or approximately $ million if the underwriters' option to purchase additional shares is exercised in full). | |

|

We intend to use the net proceeds from this offering as follows: | |

|

• we intend to use the net proceeds from this offering to pay $ million to mandatorily exchanging owners of vested incentive units and pay $ million to exchanging owners who elect to sell their Focus LLC units; and |

|

|

• we intend to contribute $ million of the net proceeds from this offering to Focus LLC (or $ million if the underwriters exercise their option to purchase additional shares in full) in exchange for common units. Focus LLC will use $ million of such contribution amount to reduce indebtedness under our credit facilities. The remaining $ million of such contribution amount (or $ million if the underwriters exercise their option to purchase additional shares in full) will be used by Focus LLC for acquisitions and general corporate business purposes and to pay the expenses of this offering. |

23

|

Each $1.00 increase (decrease) in the public offering price would increase (decrease) our net proceeds by approximately $ million (assuming no exercise of the underwriters' option to purchase additional shares). An increase (decrease) of 1,000,000 shares from the expected number of shares of Class A common stock to be sold by us in this offering, assuming no change in the assumed initial public offering price per share (the midpoint of the price range set forth on the cover of this prospectus), would increase (decrease) our net proceeds by approximately $ million. Any increase or decrease in proceeds due to a change in the initial public offering price or number of shares issued would increase or decrease, respectively, the amount of net proceeds contributed to Focus LLC to be used by it for acquisitions and general corporate business purposes. | |

Exchange rights of continuing owners |

Each unitholder of Focus LLC (other than Focus) will, subject to certain limitations, have the right to cause Focus LLC to redeem all or a portion of its vested common units and vested incentive units, which we refer to as an "exchange right." Upon an exercise of an exchange right with respect to vested incentive units, such incentive units will first be converted into a number of common units that takes into account the then-current value of the common units and such incentive units' aggregate hurdle amount. Upon an exercise of an exchange right with respect to vested common units, and immediately after the conversion of vested incentive units into common units as described in the preceding sentence, Focus LLC will acquire each tendered common unit for, at its election, (i) one share of Class A common stock, subject to conversion rate adjustments for stock splits, stock dividends, reclassification and other similar transactions, or (ii) an equivalent amount of cash. In addition, in connection with any redemption of vested common units (other than common units received upon a conversion of incentive units as described in this paragraph), the corresponding shares of Class B common stock will be cancelled. Alternatively, upon the exercise of any exchange right, Focus (instead of Focus LLC) will have the right to acquire each tendered unit (and corresponding share of Class B common stock, as applicable) from the exchanging unitholder for, at its election, (i) one share of Class A common stock, subject to conversion rate adjustments for stock splits, stock dividends, reclassification and other similar transactions, or (ii) an equivalent amount of cash, which we refer to as our "call right." The exchange rights will be subject to certain limitations and restrictions intended to ensure that Focus LLC will continue to be treated as a partnership for U.S. federal income tax purposes. Please read "Certain Relationships and Related Party Transactions—Fourth Amended and Restated Focus LLC Agreement." |

24

Tax Receivable Agreements |

In connection with the closing of this offering, we will enter into two Tax Receivable Agreements with the TRA holders which generally provide for the payment by Focus to the TRA holders of 85% of the net cash savings, if any, in U.S. federal, state and local income and franchise tax that Focus actually realizes (computed using simplifying assumptions to address the impact of state and local income taxes) or is deemed to realize in certain circumstances in periods after this offering as a result of certain increases in tax basis and certain tax benefits attributable to imputed interest. We will retain the benefit of the remaining 15% of these cash savings. Please read "Certain Relationships and Related Party Transactions—Tax Receivable Agreements" for a description of the Tax Receivable Agreements generally and for a discussion of circumstances in which Focus will be deemed to realize net cash tax savings. | |

Dividend policy |

We do not anticipate paying any cash dividends on our Class A common stock. If we decide to pay cash dividends in the future, the declaration and payment of such dividends will be at the sole discretion of our board of directors and may be discontinued at any time. In determining the amount of any future dividends, our board of directors will take into account any legal or contractual limitations, our actual and anticipated future earnings, cash flow, debt service and capital requirements and the amount of distributions to us from Focus LLC. Because we are a holding company, our cash flow and ability to pay dividends depends upon the financial results and cash flows of our operating subsidiaries and the distribution or other payment of cash to us in the form of dividends or otherwise from Focus LLC. Please read "Dividend Policy." | |

Directed share program |

The underwriters have reserved for sale at the initial public offering price up to % of the Class A common stock being offered by this prospectus for sale to our employees, executive officers, directors, business associates and related persons who have expressed an interest in purchasing Class A common stock in the offering. We do not know if these persons will choose to purchase all or any portion of these reserved shares, but any purchases they do make will reduce the number of shares available to the general public. Please read "Underwriting (Conflicts of Interest)." | |

Listing and trading symbol |

We have applied to list our Class A common stock on the NASDAQ Global Select Market under the symbol "FOCS". | |

Risk factors |

You should carefully read and consider the information beginning on page 29 of this prospectus set forth under the heading "Risk Factors" and all other information set forth in this prospectus before deciding to invest in our Class A common stock. |

25

Conflicts of interest |

Affiliates of KKR Capital Markets LLC own more than 10% of existing Focus LLC units. Because KKR Capital Markets LLC is an underwriter for this offering, it is deemed to have a "conflict of interest" within the meaning of FINRA Rule 5121(f)(5)(B). Accordingly, this offering is being made in compliance with the requirements of FINRA Rule 5121. Since KKR Capital Markets LLC is not primarily responsible for managing this offering, pursuant to FINRA Rule 5121, the appointment of a qualified independent underwriter is not necessary. KKR Capital Markets LLC will not confirm sales to discretionary accounts without the prior written approval of the customer. See "Underwriting (Conflicts of Interest)." |

26

Summary Historical and Pro Forma Consolidated Financial Data

Focus Financial Partners Inc. was formed in July 2015 and does not have historical financial operating results. The following table shows summary historical and pro forma consolidated financial data of our accounting predecessor, Focus Financial Partners, LLC, for the periods and as of the dates presented. Focus Financial Partners, LLC was formed on November 30, 2004.

The summary historical consolidated financial data as of December 31, 2016 and 2017 and for the years ended December 31, 2015, 2016 and 2017 were derived from the audited historical consolidated financial statements of our accounting predecessor included elsewhere in this prospectus. The summary historical consolidated financial data as of December 31, 2015 were derived from the audited historical consolidated financial statements of our accounting predecessor not included in this prospectus. The summary unaudited historical consolidated financial data for the three months ended March 31, 2017 and as of and for the three months ended March 31, 2018 were derived from the unaudited condensed consolidated financial statements of our accounting predecessor included elsewhere in this prospectus. The summary unaudited historical balance sheet data as of March 31, 2017 were derived from unaudited condensed consolidated financial statements of our accounting predecessor not included in this prospectus. The summary unaudited historical consolidated financial data has been prepared on a consistent basis with the audited consolidated financial statements of Focus Financial Partners, LLC. In the opinion of management, such summary unaudited historical consolidated financial data reflects all adjustments, consisting of normal recurring adjustments, considered necessary to present our financial position for the periods presented. The results for the three months ended March 31, 2018 are not necessarily indicative of the results that may be expected for the full year. Our historical results are not necessarily indicative of statements of financial position or results of operations as of any future date or for any future period.

The summary unaudited pro forma consolidated statement of operations data for the year ended December 31, 2017 has been prepared to give pro forma effect to (i) the reorganization transactions described under "Internal Reorganization", (ii) this offering and the application of the net proceeds from this offering and (iii) the acquisition of the business of SCS Financial Services, LLC and subsidiaries on July 3, 2017 (the "SCS Acquisition") as if they had each been completed as of January 1, 2017. The summary unaudited pro forma consolidated statement of operations data for the three months ended March 31, 2018 has been prepared to give pro forma effect to these transactions as if they had been completed as of January 1, 2017, with the exception of the SCS Acquisition, which is included in the unaudited consolidated statement of operations data of our accounting predecessor for the three months ended March 31, 2018. The summary unaudited pro forma consolidated balance sheet data as of March 31, 2018 has been prepared to give pro forma effect to these transactions as if they had been completed as of March 31, 2018, with the exception of the SCS Acquisition, which is included in the unaudited balance sheet of our accounting predecessor as of March 31, 2018. The summary unaudited pro forma consolidated financial data are presented for informational purposes only and should not be considered indicative of actual results of operations that would have been achieved had the reorganization transactions, this offering and the SCS Acquisition been consummated on the dates indicated and do not purport to be indicative of statements of financial position or results of operations as of any future date or for any future period.

You should read the following table in conjunction with "Internal Reorganization," "Use of Proceeds," "Selected Historical and Pro Forma Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations," the historical consolidated financial statements of our accounting predecessor included elsewhere in this prospectus and the pro forma consolidated financial statements of Focus Financial Partners Inc. set forth under "Unaudited Pro Forma Consolidated Financial Information." Among other things, the historical and pro forma

27

financial statements include more detailed information regarding the basis of presentation for the following information.

| |

|

|

|

Three Months Ended March 31, | |

|

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

|

Focus Financial Partners Inc. Pro Forma |

||||||||||||||||||

| |

Focus Financial Partners, LLC | |||||||||||||||||||||

| |

Year Ended December 31, | |

|

|

Three Months Ended March 31, 2018 |

|||||||||||||||||

| |

|

|

Year Ended December 31, 2017 |

|||||||||||||||||||

| |

2015 | 2016 | 2017 | 2017 | 2018 | |||||||||||||||||

| |

(dollars in thousands, except per share data) |

|||||||||||||||||||||

Consolidated Statements of Operations Data: |

||||||||||||||||||||||

Revenues |

$ | 382,347 | $ | 485,444 | $ | 662,887 | $ | 135,546 | $ | 196,229 | $ | $ | ||||||||||

Operating expenses |

361,030 | 447,161 | 657,134 | 124,152 | 183,683 | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Income from operations |

21,317 | 38,283 | 5,753 | 11,394 | 12,546 | |||||||||||||||||

Other expense, net |

(11,347 | ) | (21,580 | ) | (55,613 | ) | (6,501 | ) | (23,424 | ) | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income tax |

9,970 | 16,703 | (49,860 | ) | 4,893 | (10,878 | ) | |||||||||||||||

Income tax expense (benefit) |

649 | 981 | (1,501 | ) | 442 | 1,176 | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) |

$ | 9,321 | $ | 15,722 | $ | (48,359 | ) | $ | 4,451 | $ | (12,054 | ) | $ | $ | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) per share of Class A common stock: |

||||||||||||||||||||||

Basic |

$ | $ | ||||||||||||||||||||

Diluted |

$ | $ | ||||||||||||||||||||

Consolidated Balance Sheets Data (at period end): |

||||||||||||||||||||||

Cash and cash equivalents |

$ | 15,499 | $ | 16,508 | $ | 51,455 | $ | 17,815 | $ | 27,949 | $ | $ | ||||||||||

Total assets |

550,670 | 752,941 | 1,234,837 | 814,765 | 1,254,519 | |||||||||||||||||

Total liabilities |

418,871 | 562,339 | 1,148,749 | 605,862 | 1,170,399 | |||||||||||||||||

Total mezzanine equity |

405,347 | 452,485 | 864,749 | 468,416 | 864,749 | |||||||||||||||||

Total members' deficit/shareholders' equity |

(273,548 | ) | (261,883 | ) | (778,661 | ) | (259,513 | ) | (780,629 | ) | ||||||||||||

Other Financial Data: |

||||||||||||||||||||||

Net income (loss) margin(1) |

2.4 | % | 3.2 | % | (7.3 | )% | 3.3 | % | (6.1 | )% | ||||||||||||

Adjusted EBITDA(2) |

$ | 75,442 | $ | 103,038 | $ | 145,226 | $ | 28,198 | $ | 44,221 | $ | $ | ||||||||||

Adjusted EBITDA margin(3) |

19.7 | % | 21.2 | % | 21.9 | % | 20.8 | % | 22.5 | % | ||||||||||||

Adjusted Net Income(4) |

$ | 60,538 | $ | 77,504 | $ | 96,553 | $ | 20,627 | $ | 28,302 | $ | $ | ||||||||||

28

RISK FACTORS

Investing in our Class A common stock involves risks. You should carefully consider the information in this prospectus, including the matters addressed under "Special Note Regarding Forward-Looking Statements," and the following risks before making an investment decision. The trading price of our Class A common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to Capital Markets and Competition

Our financial results largely depend on wealth management fees received by our partner firms, which are impacted by market fluctuations.

The substantial majority of our revenues are derived from the wealth management fees charged by our partner firms for providing clients with investment advice, financial and tax planning, consulting, tax return preparation, family office services and other services. Wealth management fees may be adversely affected by prolonged declines in the capital markets because assets of clients may decline. Global economic conditions, exacerbated by changes in the equity or debt marketplaces, unanticipated changes in currency exchange rates, interest rates, inflation rates, the yield curve, financial crises, war, terrorism, natural disasters or other factors that are difficult to predict affect the capital markets. If unfavorable market conditions, actions taken by clients in response to market conditions (such as clients reducing or eliminating the amount of their assets with respect to which our partner firms provide advice) or volatility in the capital markets cause a decline in client assets overseen by our partner firms, such a decline could result in lower revenues from wealth management fees. If our partner firms' revenues decline without a commensurate reduction in their expenses, their net income will be reduced and their business will be negatively affected, which may have an adverse effect on our results of operations and financial condition.

The historical returns of existing investment strategies of our partner firms may not be indicative of their future results or of the future results of investment strategies they may develop in the future.

The historical returns of our partner firms' existing investment strategies should not be considered indicative of the future results of these strategies or of the results of any other strategies that our partner firms may develop in the future. The investment performance that our partner firms achieve for their clients varies over time, and the variance can be wide. The performance that our partner firms achieve as of a future date and for a future period may be higher or lower, and the difference may be material. During times of negative economic and market conditions, our partner firms may not be able to identify investment opportunities within their current or future strategies.

Our partner firms may not be able to maintain their current wealth management fee structure as a result of poor investment performance or competitive pressures or as a result of changes in their mix of wealth management services, which could have an adverse effect on our partner firms' results of operations.

Our partner firms may not be able to maintain their current wealth management fee structure for any number of reasons, including as a result of poor investment performance, competitive pressures or changes in their mix of wealth management services. In order to maintain their fee structure in a competitive environment, our partner firms must be able to continue to provide clients with investment services that their clients believe justify their fees. Our partner firms may not succeed in providing the investment services that will allow them to maintain their current fee structure. If our partner firms' investment strategies perform poorly, they may be forced to lower their fees in order to retain current, and attract additional, clients. Such decline in a partner firm's revenue could have an adverse effect on our results of operations and financial condition.

29

The wealth management industry is very competitive.

We compete for clients, advisors and other personnel with a broad range of wealth management firms, including public and privately held investment advisors, firms associated with securities broker-dealers, financial institutions and insurance companies, many of whom have greater resources than we do. The wealth management industry is very competitive, with competition based on a variety of factors, including investment performance, wealth management fee rates, the quality of services provided to clients, the ability to attract and retain key wealth management professionals, the depth and continuity of client relationships, adherence to the fiduciary standard and reputation. A number of factors, including the following, serve to increase the competitive risks of our partner firms: (i) many competitors have greater financial, technical, marketing, name recognition and other resources and more personnel than our partner firms do, (ii) potential competitors have a relatively low cost of entering the wealth management industry, (iii) some competitors may invest according to different investment styles or in alternative asset classes that the markets may perceive as more attractive than the investment strategies our partner firms offer, (iv) some competitors charge lower fees for their wealth management services than our partner firms do and (v) some competitors may be able to engage in more widespread marketing activities or may have access to products and services to which our partner firms do not.

If we are unable to compete effectively, our results of operations and financial condition may be adversely affected.

Risks Related to Our Operations

Because clients can terminate their client service contracts at any time, poor wealth management service or performance of the investment strategies that our partner firms recommend may have an adverse effect on our results of operations and financial condition.

Our clients can generally terminate their client service contracts with us at any time. We cannot be certain that we will be able to retain our existing clients or attract new clients, and these client service contracts and client relationships may be terminated or not renewed for any number of reasons. In particular, poor wealth management service or performance of the investment strategies that our partner firms recommend relative to the performance of other wealth management firms could result in the loss of accounts. Moreover, certain clients specify guidelines regarding investment allocation and strategy that our partner firms are required to follow in managing their portfolios, and the failure to comply with any of these guidelines and other limitations could result in losses to clients, which could result in the obligation to make clients whole for such losses. If we believe that the circumstances do not justify a reimbursement, or our client believes that the reimbursement it was offered was insufficient, the client could seek to recover damages from us in addition to terminating its client service contract. Any of these events could adversely affect our results of operations and financial condition and harm our reputation.