As filed with the Securities and Exchange Commission on January 10, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CASPER SLEEP INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2510 (Primary Standard Industrial Classification Code Number) |

46-3987647 (I.R.S. Employer Identification No.) |

Three World Trade Center

175 Greenwich Street, Floor 39

New York, New York 10007

Telephone: (347) 941-1871

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Jonathan Truppman

General Counsel

Casper Sleep Inc.

Three World Trade Center

175 Greenwich Street, Floor 39

New York, New York 10007

Telephone: (347) 941-1871

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

| Marc D. Jaffe, Esq. Ian D. Schuman, Esq. Adam J. Gelardi, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022 Telephone: (212) 906-1200 Fax: (212) 751-4864 |

David Goldschmidt, Esq. Ryan Dzierniejko, Esq. Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 Telephone: (212) 735-3000 Fax: (212) 735-2000 |

|

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC:

AS SOON AS PRACTICABLE AFTER THIS REGISTRATION STATEMENT IS DECLARED EFFECTIVE.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý |

Smaller reporting company o Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee |

||

|---|---|---|---|---|

Common Stock, $0.000001 par value per share |

$100,000,000 | $12,980 | ||

|

||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF CONTENTS

Neither we nor any of the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any related free writing prospectuses. Neither we nor any of the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of common stock offered by this prospectus, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date regardless of the time of delivery of this prospectus or any sale of shares of common

i

stock. Our business, financial condition, results of operations and prospectus may have changed since that date.

For investors outside the United States: We have not, and the underwriters have not, done anything that would permit this offering or the possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States. See "Underwriters."

As used in this prospectus, unless the context otherwise requires, references to "we," "us," "our," the "Company," "Casper," and similar references refer to Casper Sleep Inc. together with its subsidiaries. "Net Promoter Score," or "NPS," refers to our net promoter score, which can range from a low of negative 100 to a high of positive 100, that we use to gauge customer satisfaction. NPS benchmarks can vary significantly by industry, but a score greater than zero represents a company having more promoters than detractors. NPS reflects client responses to the following question—"On a scale of zero to ten: How likely are you to recommend Casper to a friend or colleague?" Responses of 9 or 10 are considered "promoters," responses of 7 or 8 are considered neutral or "passives," and responses of 6 or less are considered "detractors." We then subtract the number of respondents who are detractors from the number of respondents who are promoters and divide that number by the total number of respondents. Our methodology of calculating NPS reflects responses from customers who purchase products from us in our direct-to-consumer channel and choose to respond to the survey question. In particular, it reflects responses given between January 1, 2019, and September 30, 2019, and reflects a sample size of 11,537 responses over that period. NPS gives no weight to customers who decline to answer the survey question.

Certain monetary amounts, percentages, and other figures included in this prospectus have been subject to rounding adjustments. Percentage amounts included in this prospectus have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this prospectus may vary from those obtained by performing the same calculations using the figures in our consolidated financial statements included elsewhere in this prospectus. Certain other amounts that appear in this prospectus may not sum due to rounding.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus includes our trademarks, and trade names, including but not limited to Casper®, A New Day in Sleep®, Bedtime is Back®, Great Minds Sleep Alike™, and It's Bedtime Somewhere®, which are protected under applicable intellectual property laws. This prospectus also contains trademarks, trade names, and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names, and service marks referred to in this prospectus may appear without the ®, ™, or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names, and service marks. We do not intend our use or display of other parties' trademarks, trade names, or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

ii

Unless otherwise indicated, information contained in this prospectus concerning the industries in which we operate, competitive position, and the markets in which we operate is based on information from independent industry and research studies and reports, including the Frost & Sullivan Global Total Addressable Market (TAM) Assessment for the Sleep Economy, or the Frost & Sullivan Assessment, which was commissioned by us in 2019, other third-party sources, and management estimates. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates and information. Although we have not independently verified the accuracy or completeness of any third-party information, we believe the information in this prospectus concerning the industries in which we operate, competitive positions, and the markets in which we operate is reliable. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industries and markets, which we believe to be reasonable. In addition, projections, assumptions, and estimates of the future performance of the industries and markets in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements." These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

iii

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our common stock. You should read the entire prospectus carefully, including the sections entitled "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations," and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Some of the statements in this prospectus constitute forward-looking statements. See "Cautionary Note Regarding Forward-Looking Statements."

Overview

People spend more time sleeping than on any other single activity throughout their lives. When we sleep better, we experience better hours awake, making us more productive, creative, happy, and healthy. We believe sleep is rapidly becoming the third pillar of wellness and is poised to undergo the same massive transformation that fitness and nutrition have as they became major consumer categories.

As the wellness equation increasingly evolves to include sleep, the business of sleep is growing and evolving into what we call the Sleep Economy. We are helping to accelerate this transformation. Our mission is to awaken the potential of a well-rested world, and we want Casper to become the top-of-mind brand for best-in-class products and experiences that improve how we sleep.

As a pioneer of the Sleep Economy, we bring the benefits of cutting-edge technology, data, and insights directly to consumers. We focus on building direct relationships with consumers, providing a human experience, and making shopping for sleep joyful. We meet consumers wherever they are, online and in person, providing a fun and engaging experience, while reducing the hassles associated with traditional purchases. We are building a universal, enduring brand that is already embraced by over 1.4 million happy customers.

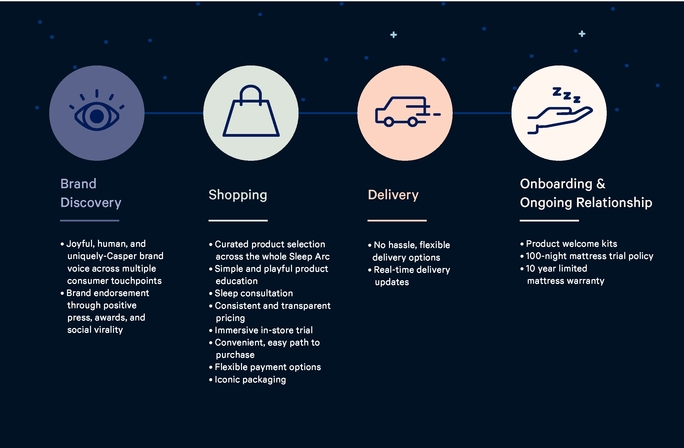

We do all of this because we understand the consumer. Shopping for sleep is a highly considered and personal decision. Today's consumers research their purchases and move freely back and forth from online to offline. At Casper, we put the consumer first in everything we do and invest to ensure long-term valuable relationships where consumers return again and again to shop for more sleep products and services.

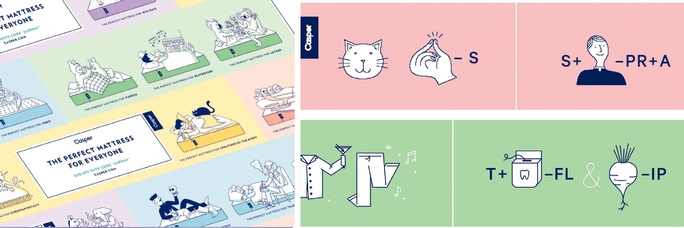

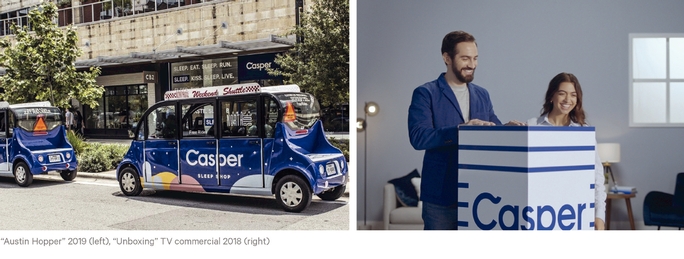

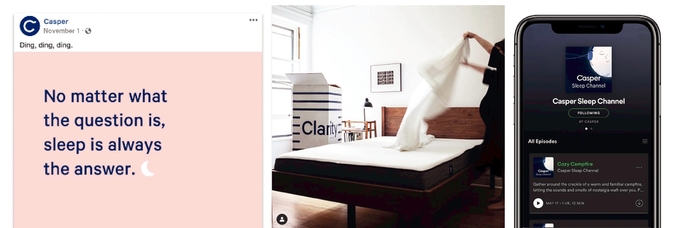

We believe great brands win over the long-term and have the ability to change the culture around them. We have endeavored to build a brand that is genuine, trustworthy, and approachable, as well as fun and playful. Through our investment in a sophisticated and integrated marketing strategy, we engage consumers across the entire consumer journey, from our iconic public transit advertising campaigns, to our "Napmobiles" and experiential retail store concepts, to our category-leading social media presence. We see the Casper brand as an immeasurably valuable asset that we are utilizing to help capture a large share of the Sleep Economy.

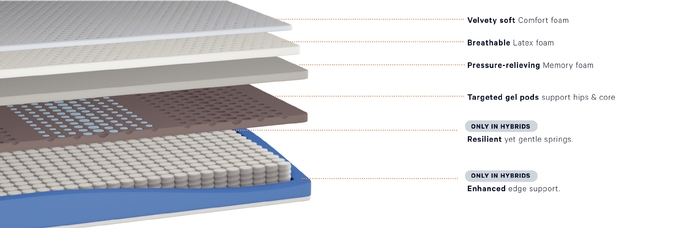

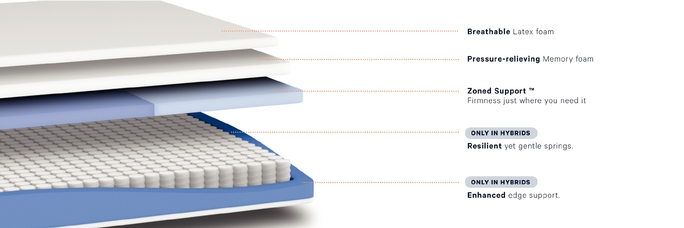

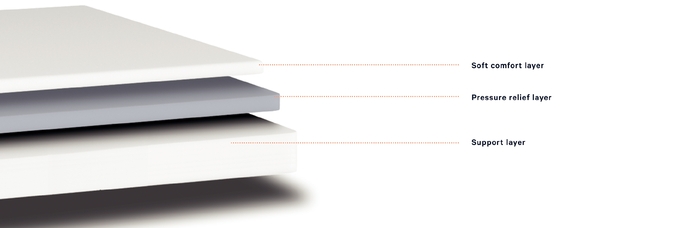

Product innovation and excellence lie at the heart of our business. Since the release of our first product, the award-winning Casper mattress, we have expanded into pillows, sheets, duvets, bedroom furniture, sleep accessories, sleep technology, and sleep services. We design and engineer our products in-house at Casper Labs. We believe this state-of-the-art research and development facility puts Casper on the cutting edge of sleep innovations. We employ a team of data-driven researchers, designers, and engineers focused on building a better night's sleep through innovative new products such as our Wave mattress with hyper-targeted support technology and the revolutionary Glow Light, which is designed to synchronize with the body's circadian rhythm and was named one of Time Magazine's Best Inventions of 2019. We believe that no other company catering to the Sleep Economy has our level of product development talent, resources, data-driven insights, or expertise.

1

We seek to deliver a joyful shopping experience, regardless of sales channel. Our consumer experience includes knowledgeable and consultative sales associates, appealing and thoughtfully curated stores, immersive in-store trials, engaging and convenient online shopping, and fast and flexible delivery. The Casper experience allows consumers to seamlessly navigate between online and offline channels, eliminating boundaries, and reducing the friction associated with traditional purchases. Currently, we distribute our products directly to customers in seven countries through our e-commerce platform, 60 Casper retail stores, and 18 retail partners.

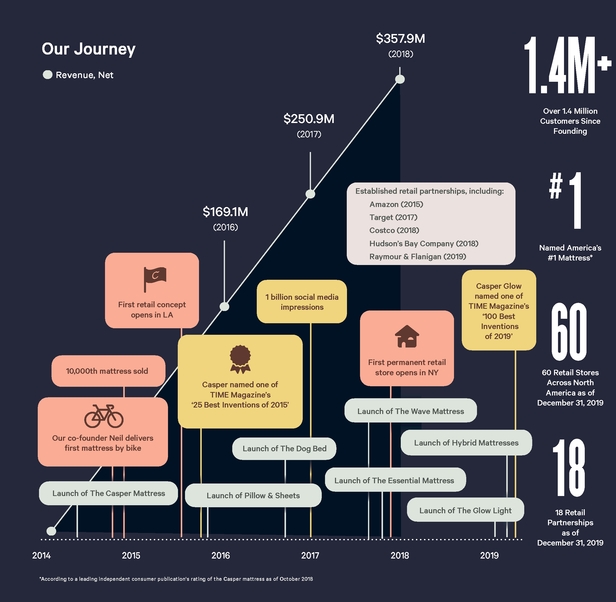

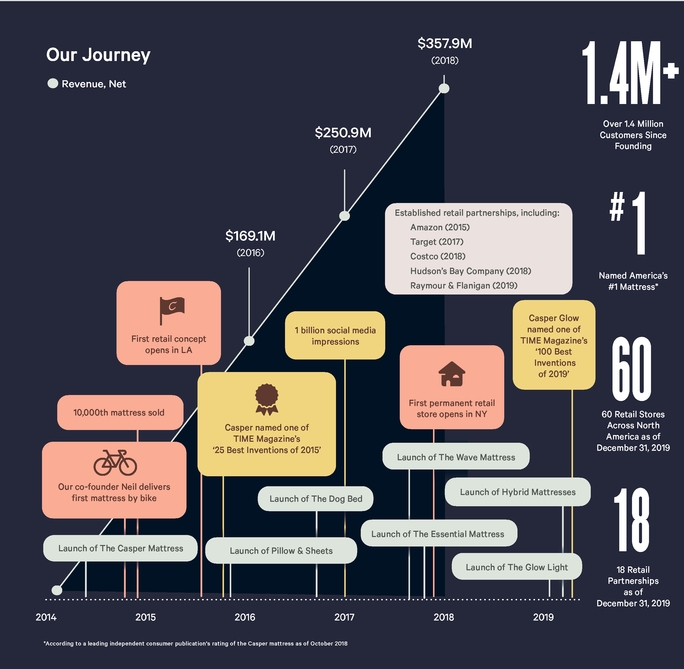

In our first five years, Casper has experienced rapid growth. We believe our consumer focus, innovative products, and multichannel go-to-market strategy differentiate us both from legacy competitors and new entrants. For the years 2018, 2017, and 2016, our net revenue was $357.9 million, $250.9 million, and $169.1 million, respectively, representing a 45.5% compound annual growth rate, or CAGR, and for the nine months ended September 30, 2019 and 2018, our net revenue was $312.3 million and $259.7 million, respectively, representing 20.3% year-over-year growth.

2

The Sleep Economy

We believe that the Sleep Economy represents a rapidly growing and traditionally fragmented market.

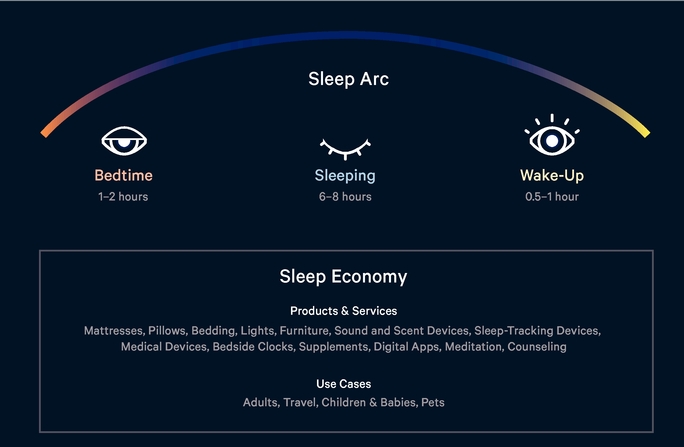

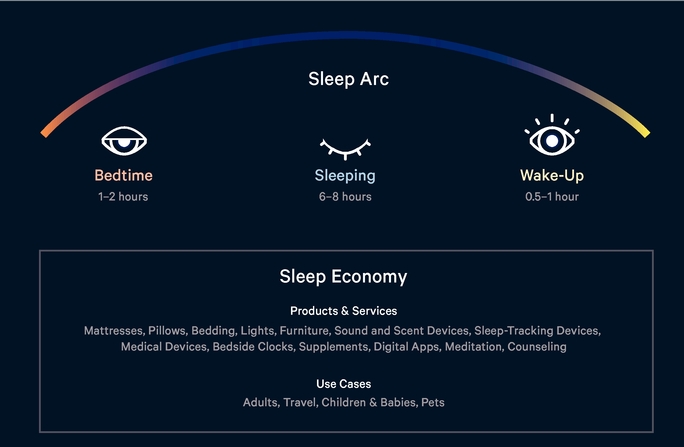

Consumers are increasingly recognizing quality sleep as a key component of a healthy lifestyle. There are many factors affecting sleep quality, including light, sound, temperature and humidity, mattress and bedding selection, as well as bedtime and wake-up rituals. Importantly, we believe that sleep consists of more than just the act of sleeping, and instead, includes the entire set of human behaviors that span from bedtime to wake-up and affect sleep quality—this is what we refer to as the Sleep Arc. With outspoken proponents, from CEOs and business leaders to celebrities and professional athletes, the concept that high-quality sleep is critical to health and wellness is becoming well known. Further, as consumers become educated around the serious potential health consequences of poor sleep, they are poised to spend more on sleep products in the same way that they have increased spending in other areas of health and wellness. However, unlike other categories of health and wellness, historically there were no powerful brands that provided holistic solutions to the Sleep Economy. Instead, the Sleep Economy has traditionally been characterized by a fragmented set of providers across different products, services, and use cases.

Our approach is to offer products and services across the entirety of the Sleep Arc under one brand. Our offerings encompass traditional sleep categories for consumers, such as mattresses, soft goods, and bedroom furniture, and are increasingly focused on non-traditional categories, including products that promote the ideal ambience for sleep, such as lighting, sound, scents, temperature, and humidity; sleep technology, such as tracking devices, medical machines, bedside clocks, and connected devices; sleep supplements, such as sprays, pills, and vitamins; and sleep services, such as digital apps, meditation, sleep programming, and counseling. Beyond the daily sleep needs of adults, we aim to meet a range of use cases with unique product and service needs, such as for travel, children and babies, and

3

pets. We believe we are the first company that understands and serves the Sleep Economy in a holistic way.

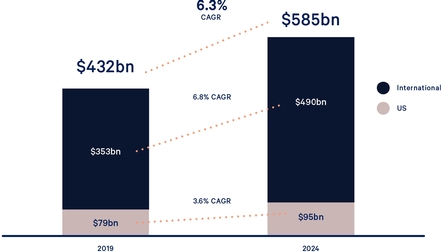

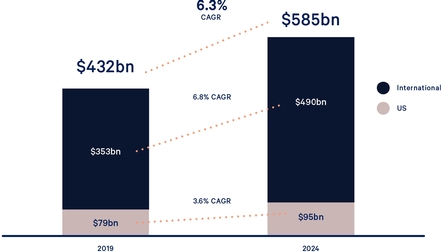

The Sleep Economy is Large and Growing

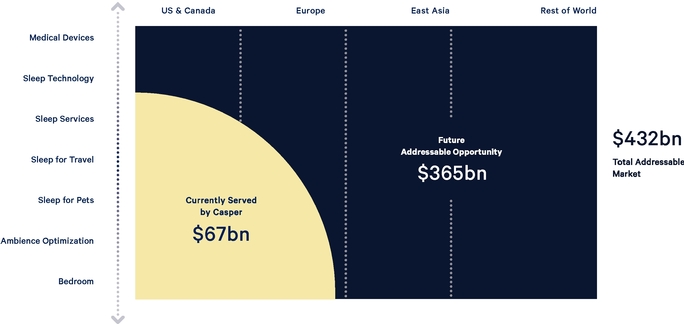

The Frost & Sullivan Assessment forecasts the global Sleep Economy to be $432 billion in 2019, growing at a CAGR of 6.3% to $585 billion by 2024, and forecasts the U.S. Sleep Economy to be $79 billion in 2019, growing at a CAGR of 3.6% to $95 billion by 2024.

Global Sleep Economy, 2019-2024

4

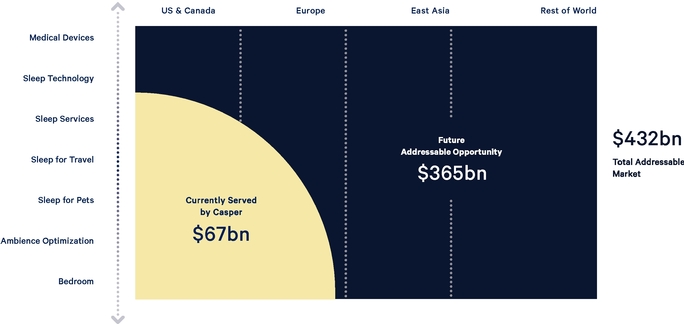

The global Sleep Economy is comprised of a variety of products, services, and applications.

Global Sleep Economy by Product Category, 2019

$432bn

5

The total market size of the categories and geographies we currently address is $67 billion in 2019, leaving significant opportunity for growth.

Casper's Sleep Economy Opportunity in 2019

Growth of the Sleep Economy is Driven by Attractive Trends

6

Our Competitive Strengths

We believe we are changing the way that people shop for sleep by transforming what has historically been an impersonal, highly-pressured, one-time transaction into a rewarding and long-term relationship. Sleep products are highly personal and purchases of sleep products can require substantial consumer time and research. We understand that the path to purchase typically includes multiple touchpoints across both physical and online sales channels and can span weeks or months of education and deliberation.

We have built a company based on this understanding of our consumers' purchasing behavior, with a focus on building long-term relationships where consumers return again and again to shop for more sleep products and services. We believe our trusted brand, continued investment into the consumer experience, innovative products, multi-channel approach, and relentless focus on data have resulted in strong customer relationships with significant lifetime values. We have compelling experiences with customers making repeat purchases despite the fact that the traditional replacement cycle of many of our products is longer than Casper's existence. From Casper's beginning through September 30, 2019, we have seen more than 16% of customers who have purchased at least once through our direct-to-consumer channel return to purchase another product. Importantly, 14% of our customers returned within a year of their original purchase (excluding those customers whose original purchase date was less than one year prior to September 30, 2019 and had not made a repeat purchase as of that date). Further, 20% of customers in our direct-to-consumer channel during the first nine months of 2019 were repeat customers.

The following strengths differentiate us from our competitors and drive our success.

A Transformational, Consumer-Centric Sleep Brand

We see Casper's powerful brand as a market-defining opportunity and an immeasurably valuable asset. Our brand is genuine, trustworthy, and approachable, as well as fun and playful. With $422.8 million invested in marketing from January 1, 2016 through September 30, 2019, we have elevated our brand through a sophisticated, data-driven, and integrated marketing strategy. The success of this strategy has helped us build our brand into a household name and created a large and highly engaged consumer following.

In just five years, our consumer-centric focus has allowed us to achieve the following milestones as of September 30, 2019:

8

Our customers are brand champions and serve as a valuable source of referrals to friends and family, a built-in market as we further develop new products and services, and a source of future growth as they replace previously purchased Casper or competitor products. Based on a recent survey of Casper customers, we are proud that the largest source of new customers for Casper is referrals from happy, satisfied customers to their friends and family. Additionally, our brand attracts new retail partners looking to diversify their consumer profile and increase in-store foot and web traffic. We believe the strength of our brand is integral to the growth of our business, and we will continue to focus on enhancing our brand to maintain and further our competitive advantage.

An Innovative Products and Services Platform Built for Better Sleep

Since our founding in 2014, Casper has delivered innovative products and services that enable our customers to achieve a better night's sleep. Our story started with our first product, the award-winning Casper mattress, which was rated America's number one mattress in October 2018 and named one of "The Most Influential Products of the Past Decade" by Consumer Reports in December 2019. We subsequently developed a range of mattresses and expanded into pillows, sheets and duvets, bedroom furniture and accessories, sleep technology, and related services.

Product innovation and excellence lie at the heart of our business. Based in San Francisco, Casper Labs has over 25,000 square feet of fabrication and test space, featuring state-of-the-art capabilities to test against a wide range of factors affecting sleep quality. We employ over 40 dedicated researchers, designers, engineers, and support staff focused on building a better night's sleep through innovative new products and services development and the continuous improvement of existing offerings. We believe that no other company in the category has our level of product development talent, resources, or expertise.

Our products seek to address real life sleep challenges by addressing a variety of factors that impact sleep including: the microclimate under the covers, through the regulation of humidity and temperature; comfort and support, through the use of high-quality materials and ergonomic designs; and lighting in the sleep environment, through smart devices that provide sleep-conducive lighting. We also work to address "the little things" in our products, offering innovative features to make the sleep experience better and less stressful. These features range from simple solutions such as head and foot markings on bed sheets for ease of placement, to our gesture-controlled Glow Light.

We also offer sleep-related services that complement our sleep products. Such services are currently focused on providing a seamless purchase and delivery experience, a range of financing options and extended warranties, online sleep content, and an app that accompanies the Glow Light. For instance, we offer various delivery options, in-home setup services, mattress removal, no-hassle returns, and product warranties that focus on providing fast and quality service options to consumers. With the launch of The Sleep Channel, a social media offering that includes meditations, bedtime stories, and soothing sounds to help you fall asleep, we are broadening our offerings across the Sleep Economy.

9

We believe the high-quality nature of our products and continual iterative improvement have helped drive Casper's strong repeat customer business—from Casper's beginning through September 30, 2019, we have seen over 16% of our customers who have purchased at least once returning to make a repeat purchase, with the repeat customer rate reaching 20% for the first nine months of 2019. These repeat consumers most frequently return to purchase the same product—for example, a mattress customer returning to purchase a second or third mattress, which indicates our customers are looking for sleep solutions for other bedrooms and, in some cases, have shortened traditional replacement cycles for their existing sleep products. We believe that, as existing customers return to Casper for additional bedroom solutions, we have the opportunity to offer these customers more holistic sleep solutions in adjacent categories, particularly as our product portfolio and cross-sell capabilities grow.

A Joyful Consumer Experience

We believe a joyful consumer experience differentiates us from legacy competitors. Our consumers benefit from knowledgeable, consultative sales associates, appealing and thoughtfully curated stores, immersive in-store trials, engaging and convenient online shopping, and fast and flexible delivery.

Our approachable and transparent shopping experience is achieved through:

Our business is dependent on our ability to attract new customers and retain existing customers through a joyful consumer experience.

A Synergistic, Multi-Channel Go-to-Market Approach

Sleep products are personal, often significant investments that can require substantial consumer consideration and research. Our data shows that the path to purchase may include multiple touchpoints across both physical and online sales channels and can involve weeks of education and deliberation.

10

Consumers research online, test products in stores, consult friends, and speak with customer service teams, and they expect the companies with whom they interact to facilitate this journey. We believe our multi-channel expansion creates synergies and that these channels, to date, have proven to be complementary, not cannibalistic. In fact, for the nine months ended September 30, 2019, our direct-to-consumer sales in cities where we have opened retail stores have grown over 100% faster on average than cities without a Casper retail store.

We distribute our products through a flexible, multi-channel approach, combining our direct-to-consumer channel, including our e-commerce platform and retail stores, with our retail partnerships. We strive to ensure a consistent look, feel, and approach across our channels, product and service offerings, pricing, return policies, warranties, inventory availability, and brand presentation. We believe that consumers increasingly expect consistency between digital and physical retail, and Casper is focused on ensuring the best possible experience for consumers throughout their journey, regardless of channel.

Our e-commerce sales are generated through casper.com, which has country-specific functionality, and a best-in-class guided user experience supported by Sleep Specialists available through phone, chat, email, and social channels. We have also invested in large digital product and technology engineering teams who develop and maintain our desktop and mobile platforms. Our digital platforms also allow for constant experimentation and rich data collection that enable us to improve key business variables such as pricing offers and promotions, upsell incentives, responsiveness, conversion efficiency, and advertising effectiveness, all of which help inform our marketing mix and attribution models and further

11

our business. Across our e-commerce channel, our average order value, or AOV, which is defined as net revenue divided by total orders placed, increased from $583 in 2017 to $686 in 2018 and to $710 for the nine months ended September 30, 2019. From 2017 through September 30, 2019, while growing our e-commerce channel, we have maintained 'first purchase profitable' e-commerce economics, defined as gross profit dollars, less marketing dollars, over a specific time period.

We currently operate 60 retail stores in the United States and Canada. As of September 30, 2019, our existing stores that have been operating for one year or longer are all four-wall profitable, calculated as gross profit, less operating expenses (excluding one-time build-out costs and non-allocable marketing and overhead expenses), for each store. In addition, as of September 30, 2019, our stores that have been operating for one year or longer have averaged approximately $1,600 in annual net sales per sellable square foot, which we believe is reflective of our high volumes of consumer traffic, our ability to successfully engage with consumers to drive sales, and an effective pricing strategy. Consistent with our experience to date, we target for our future retail stores a cash-on-cash payback period ranging from 18 to 24 months. Consumers have proven to be highly engaged when they experience our retail stores and spend, on average, more than 25 minutes in store when they visit. Across our retail channel, our AOV increased from $437 in 2017 to $720 in 2018 and to $820 for the nine months ended September 30, 2019. Our presence in physical retail stores has proven complementary to our e-commerce channel, as we believe interaction with multiple channels has created a synergistic "network effect" that increases system-wide sales as a whole. Driving continued success in our retail store expansions will be an important contributor to our future growth and profitability.

Additionally, our retail partnerships allow us to further grow our brand reach as we selectively pursue partnerships with like-minded retailers. Currently, we have 18 retail partners including Amazon, Costco, Hudson's Bay Company, and Target, among others. Casper works with each retail partner to enhance the consumer experience and to best showcase select Casper sleep products. We tailor our approach to each retail partner with a variety of options, including unique floor positioning, visual merchandising, inventory availability, flexible packaging options, training, and marketing support while maintaining consistent brand, pricing, and product offerings across our business.

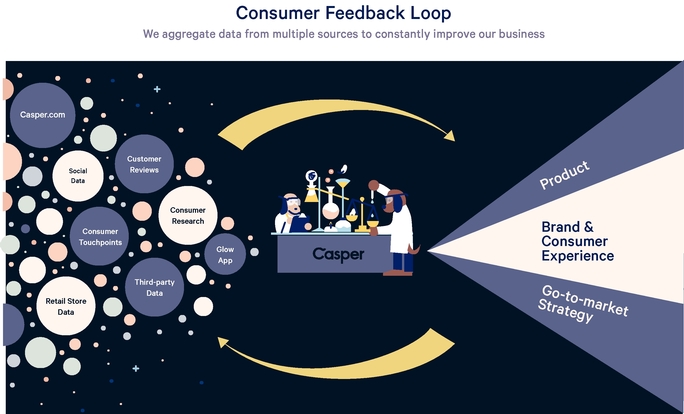

Agile, Data-Driven Business

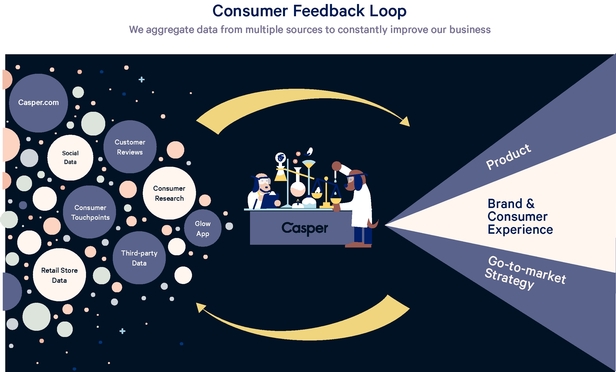

We believe we have more data on consumer sleep behavior than any other competitor, and we use it to enhance all areas of our business. We gather data from a variety of sources including webpage visits, retail store analytics technology, retail points of sale, delivery partners, retail partners, media partners, social media, consumer reviews, inbound consumer interactions, returns, and a variety of third-party data sources. Our in-house teams of data scientists and analysts leverage this data for insights to enhance various areas of our business including new product development, current product improvements, casper.com user experience optimizations, pricing, and delivery improvements.

12

Data and analytics are at the heart of our marketing strategy, and we constantly test and experiment to further grow our business. We leverage sophisticated proprietary marketing decision models to inform both our absolute spend and our relative spend allocation among marketing channels, as well as the pacing of spend by part of day and week. The bulk of our data models have been built in-house by a team of data scientists, statisticians, and engineers. We believe this level of insight has not been brought to bear on the Sleep Economy prior to Casper.

A Visionary, Founder-led Team

Our story began in 2014 with five founders who shared a common vision: bring sleep to the forefront of the wellness conversation. That same spirit of innovation and consumer-focused attitude guides Casper to this day and extends to all members of the organization. We are currently led by a team of experienced executives with diverse industry backgrounds and who have worked for companies such as Amazon, Google, H&R Block, IDEO, Kate Spade, Ralph Lauren, Tesla, Tory Burch, and Wayfair. Our management team has proven track records of generating results through developing powerful consumer insights, designing best-in-class products, and building scalable global operations, all while preserving the same entrepreneurial spirit that drove Casper from the start.

Our leadership team is supported by a world-class board of directors with experience successfully investing in, building, and running high-growth, consumer-focused global companies. Further, our leadership team is supported by a Sleep Advisory Board assembled from experts in the fields of sleep research, clinical psychology, and integrated medicine who are all committed to Casper's vision.

Our Growth Strategy

We have achieved rapid growth, generating 45.5% net revenue CAGR from 2016 to 2018, and 20.3% year-over-year net revenue growth for the nine months ended September 30, 2019. We have also expanded our gross margin from 42.8% in 2016 to 44.1% in 2018 and to 50.7% for the three months ended September 30, 2019, while making significant long-term investments in human capital, research and development, brand-building, and distribution. Our continued investment in, and expansion of, the Casper brand, distribution, and product offerings will further increase opportunities to acquire new customers and expand relationships with our existing customer base.

13

We believe we are creating a meaningful future customer asset. As of September 30, 2019, over 16% of customers who have purchased at least once since Casper's inception have made a repeat purchase, despite the fact that the traditional replacement cycle of many of our products is longer than Casper's existence. This demonstrates that customers are returning to Casper to expand the number of products they own, not merely to replace them—we expect this rate to grow further as we expand our product and consumer offerings for our customers. Importantly, we are also able to acquire these returning customers more efficiently than new customers. While we are proud of our accomplishments to date, we believe the most exciting opportunities for Casper's growth story lie ahead, and we intend to pursue the following strategies to help us achieve this growth.

Increase Brand Awareness and Equity to Acquire New Customers

Increasing brand awareness and growing favorable brand equity among consumers in both existing and new markets has been, and remains, central to our growth. We believe brand familiarity and preference will continue to have a significant role in winning customers as the decision to buy sleep products and solutions is thoughtful and personal.

Our investment in marketing initiatives from 2016 to September 30, 2019 totaled $422.8 million. In just five years, as of September 30, 2019, we have achieved 31% aided brand awareness amongst the general U.S. population according to YouGov BrandIndex. Additionally, for the nine months ended September 30, 2019, Casper's brand awareness is approximately 36% higher on average than the nearest direct-to-consumer competitor. We are excited about the opportunities that we believe will follow as awareness continues to grow.

We drive brand awareness through a combination of sophisticated, multi-layered marketing programs, word-of-mouth referrals, experiential brand events, retail expansion, and ongoing product usage. A core tenet of our brand growth strategy is offering consumers increased ways to engage with our products and services, both online and offline through our direct-to-consumer channel and our retail partners.

Expand Direct-to-Consumer Presence and Network of Retail Partnerships

We complement our strong online presence by expanding our physical retail footprint to deliver additional consumer touchpoints and increase sales and margin. A greater physical retail presence helps us to not only increase consumer awareness and education, but also to offer convenient product trial opportunities, multiple purchase options, and flexibility in delivery.

We plan to continue the rollout of new Casper retail stores to strengthen our footprint in existing cities, while selectively entering into new cities in the United States, Canada, and other international markets. Our new store opening process is highly scalable, and we believe there is a significant opportunity for us to further expand our retail store base. We expect that our typical new stores will have between 1,750 and 2,250 square feet of selling space. Over time, we believe there is an opportunity to have more than 200 Casper retail stores in North America alone. We believe our multi-channel expansion creates synergies and that these channels, to date, have proven to be complementary, not cannibalistic. In fact, for the nine months ended September 30, 2019, our direct-to-consumer sales in cities where we have opened retail stores have grown over 100% faster on average than cities without a Casper retail store. From 2017 through September 30, 2019, while growing our e-commerce channel, we have maintained 'first purchase profitable' e-commerce economics.

Casper works with each retail partner to enhance the consumer experience and to best showcase select Casper sleep offerings in their physical environments and their online platforms. We tailor our approach to each retail partner with a variety of options, including unique floor positioning, visual merchandising, inventory availability, flexible packaging options, training, and marketing support while maintaining consistent brand, pricing, and product SKU offerings across our business. We believe we have an opportunity to increase sales by adding new locations, with both existing and new partners, and increase volume in existing locations.

14

We will continue to invest in e-commerce technology, talent, and marketing to complement our physical retail strategy.

Invest in New Products and Services

We plan to continue to offer products and services that span and work together across the entire Sleep Arc. We believe this expansion will attract new customer segments and retail partners, as well as enhance average order value, increase attachment rate opportunities, and deliver higher overall customer lifetime value.

Casper Labs sits at the center of our ability to continue bringing innovative and enhanced performance-driven products to market with both speed and excellence. Casper's powerful products increasingly cover the entire Sleep Arc, profoundly impact sleep performance, introduce us to new markets and distribution partners, and increase the lifetime value of our customer relationships.

We anticipate that growth of our products and services will span entirely new categories of the Sleep Arc, including:

Drive Continued Operational Excellence

We are committed to improving productivity and profitability through a number of operational initiatives designed to grow our revenue and expand our margins. To date, Casper has had significant results improving gross margins, achieving 50.7% in gross margin for the three months ended September 30, 2019, up from 42.8% for the year ended December 31, 2016. Overall business profitability will be driven by continued net revenue growth in conjunction with gross margin improvements, continued marketing efficiencies, and generating operating leverage. We believe there is opportunity for continued improvement in gross margins, marketing efficiencies, and operating leverage through these key initiatives:

15

Expand into New Countries

Our vision of becoming the world's most loved and largest sleep company leads to further global growth opportunities. Casper currently operates in seven countries—the United States, Canada, the United Kingdom, Germany, Austria, Switzerland, and France—with product and service offerings tailored to each market by channel but maintaining a consistent brand and consumer experience. We carefully balance brand, creative consistency and global standardization—including leveraging back and middle office, and technology support—balancing local preferences and market tastes in product, sizing, and distribution in order to both ensure strong consumer relevance and maximize company synergies. We intend to expand into new international markets organically, through acquisitions, and through other partnership opportunities, depending on the best product and channel strategy for each country or region. We envision expanding our total international footprint to more than 20 countries.

Summary Risk Factors

Participating in this offering involves substantial risk. Our ability to execute our strategy is also subject to certain risks. The risks described under the heading "Risk Factors" included elsewhere in this prospectus may cause us not to realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the most significant challenges and risks include the following:

16

Before you invest in our common stock, you should carefully consider all the information in this prospectus, including matters set forth under the heading "Risk Factors."

Our Corporate Information

Casper Sleep Inc., the issuer of our common stock in this offering, was incorporated as a Delaware corporation on October 24, 2013 under the name Providence Mattress Company, and subsequently changed its name to Casper Sleep Inc. on January 10, 2014. Our corporate headquarters are located at Three World Trade Center, 175 Greenwich Street, Floor 39, New York, New York 10007. Our telephone number is (347) 941-1871. Our principal website address is www.casper.com. The information on, or that can be accessed through, any of our websites is deemed not to be incorporated in this prospectus or to be part of this prospectus.

Implications of Being an Emerging Growth Company

We qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of certain reduced reporting and other requirements that are otherwise generally applicable to public companies. As a result:

17

We may take advantage of these reduced reporting and other requirements until the last day of our fiscal year following the fifth anniversary of the completion of this offering, or such earlier time that we are no longer an emerging growth company. If certain events occur prior to the end of such five-year period, including if we have more than $1.07 billion in annual gross revenue, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period, we will cease to be an emerging growth company prior to the end of such five-year period. We may choose to take advantage of some but not all of these reduced requirements. We have elected to adopt the reduced requirements with respect to our financial statements and the related selected financial data and "Management's Discussion and Analysis of Financial Condition and Results of Operations" disclosure. We have also elected to take advantage of the extended transition periods for complying with new or revised accounting standards. As a result, the information that we provide to stockholders may be different than the information you may receive from other public companies in which you hold equity.

18

Shares of common stock offered by us |

shares ( shares if the underwriters exercise their over-allotment option in full). | |

Shares of common stock to be outstanding after this offering |

shares ( shares if the underwriters exercise their over-allotment option in full). |

|

Over-allotment option to purchase additional shares of common stock |

shares. |

|

Use of proceeds |

We estimate, based upon an assumed initial public offering price of $ per share (which is the midpoint of the price range set forth on the cover page of this prospectus), that we will receive net proceeds from this offering of approximately $ million (or $ million if the underwriters exercise their over-allotment option in full), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

|

|

We intend to use the net proceeds from this offering for working capital, to fund growth and for other general corporate purposes, including the repayment of approximately $ million of borrowings outstanding under our Senior Secured Facility. We will have broad discretion in the way that we use the net proceeds of this offering. See "Use of Proceeds." |

|

Dividend policy |

We currently intend to retain all available funds and any future earnings to fund the development and growth of our business and to repay indebtedness, and therefore we do not anticipate declaring or paying any cash dividends on our common stock in the foreseeable future. Any future determination as to the declaration and payment of dividends, if any, will be at the discretion of our board of directors, subject to compliance with contractual restrictions and covenants in the agreements governing our current and future indebtedness. Any such determination will also depend upon our business prospects, results of operations, financial condition, cash requirements and availability, industry trends, and other factors that our board of directors may deem relevant. See "Dividend Policy." |

|

Risk factors |

See the section titled "Risk Factors" and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

|

Trading symbol |

We have applied to list our common stock on the NYSE under the symbol "CSPR." |

The number of shares of our common stock to be outstanding after this offering is based on shares of our common stock outstanding as of , 2019, after giving effect to the conversion of all outstanding shares of (i) our Series Seed preferred stock and Series A preferred

19

stock into shares of our Class A common stock and (ii) our Series B preferred stock, Series C preferred stock, and Series D preferred stock into shares of our Class B common stock, in each case immediately after the pricing of this offering, referred to herein as the Preferred Conversion, and the reclassification of all of our outstanding shares of Class A common stock and our Class B common stock (including shares issued upon the Preferred Conversion) into shares of our common stock, immediately prior to the closing of this offering, referred to herein as the Reclassification, and excludes:

Unless we indicate otherwise or the context otherwise requires, all information in this prospectus assumes or gives effect to:

20

Summary Consolidated Financial and Other Data

The following tables present the summary consolidated financial and other data for Casper Sleep Inc. and its subsidiaries. We have derived the summary consolidated statement of operations data and consolidated statement of cash flows for the nine months ended September 30, 2019 and 2018 and the years ended December 31, 2018 and 2017 and the summary consolidated balance sheet data as of September 30, 2019 from our consolidated financial statements included elsewhere in this prospectus. The unaudited interim consolidated financial statements have been prepared on the same basis as the audited annual consolidated financial statements and reflect, in the opinion of management, all adjustments of a normal, recurring nature that are necessary for a fair statement of the unaudited interim consolidated financial statements. You should read this data together with our consolidated financial statements and related notes included elsewhere in this prospectus and the sections titled "Selected Consolidated Financial and Other Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." Our historical results for any prior period are not necessarily indicative of our future results.

21

| |

Nine Months Ended September 30, |

Year Ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except share and per share data) |

2019 | 2018 | 2018 | 2017 | |||||||||

| |

(unaudited) |

|

|

||||||||||

Consolidated Statement of Operations and Comprehensive Loss: |

|||||||||||||

Revenue, net of $80,085, $57,659, $80,695 and $45,656 in refunds, returns, and discounts for the nine months ended September 30, 2019 and 2018 and the year ended December 31, 2018 and 2017, respectively |

$ | 312,319 | $ | 259,687 | $ | 357,891 | $ | 250,909 | |||||

Cost of goods sold |

157,342 | 143,556 | 200,139 | 134,038 | |||||||||

| | | | | | | | | | | | | | |

Gross profit |

154,977 | 116,131 | 157,752 | 116,871 | |||||||||

Operating expenses |

|||||||||||||

Sales and marketing expenses |

113,994 | 92,705 | 126,189 | 106,809 | |||||||||

General and administrative expense |

106,126 | 88,166 | 123,523 | 81,323 | |||||||||

| | | | | | | | | | | | | | |

Total operating expenses |

220,120 | 180,871 | 249,712 | 188,132 | |||||||||

| | | | | | | | | | | | | | |

Loss from operations |

(65,143 | ) | (64,740 | ) | (91,960 | ) | (71,261 | ) | |||||

| | | | | | | | | | | | | | |

Other (income) expense |

|||||||||||||

Interest (income) expense |

1,355 | (503 | ) | (248 | ) | (307 | ) | ||||||

Other (income) expense, net |

841 | (51 | ) | 341 | 2,415 | ||||||||

| | | | | | | | | | | | | | |

Total other (income) expenses, net |

2,196 | (554 | ) | 93 | 2,108 | ||||||||

| | | | | | | | | | | | | | |

Loss before income taxes |

(67,339 | ) | (64,186 | ) | (92,053 | ) | (73,369 | ) | |||||

Income tax expense |

60 | 44 | 39 | 23 | |||||||||

| | | | | | | | | | | | | | |

Net loss |

(67,399 | ) | (64,230 | ) | (92,092 | ) | (73,392 | ) | |||||

Other comprehensive income (loss) |

|||||||||||||

Currency translation adjustment |

75 | (1,288 | ) | (1,077 | ) | 279 | |||||||

| | | | | | | | | | | | | | |

Total comprehensive loss |

$ | (67,324 | ) | $ | (65,518 | ) | $ | (93,169 | ) | $ | (73,113 | ) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net loss per share attributable to common stockholders, basic and diluted |

$ | (6.40 | ) | $ | (6.22 | ) | $ | (8.91 | ) | $ | (7.22 | ) | |

Weighted-average number of shares used in computing net loss per share attributable to common stockholders, basic and diluted |

10,530,262 | 10,320,666 | 10,335,986 | 10,164,450 | |||||||||

Pro forma net loss per share attributable to common stockholders, basic and diluted |

$ | ||||||||||||

Pro forma weighted average number of shares used in computing net loss per share attributed to common stockholders, basic and diluted |

|||||||||||||

| |

Nine Months Ended September 30, |

Year ended December 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) |

2019 | 2018 | 2018 | 2017 | |||||||||

| |

(unaudited) |

|

|

||||||||||

Consolidated Statement of Cash Flows: |

|||||||||||||

Net cash used in operating activities |

$ | (29,706 | ) | $ | (44,934 | ) | $ | (72,255 | ) | $ | (84,015 | ) | |

Net cash used in investing activities |

(39,631 | ) | (7,249 | ) | (12,035 | ) | (10,085 | ) | |||||

Net cash provided by financing activities |

95,808 | 183 | 14,840 | 169,294 | |||||||||

22

| |

Nine Months Ended September 30, |

Year ended December 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except percentages) |

2019 | 2018 | 2018 | 2017 | |||||||||

| |

(unaudited) |

|

|

||||||||||

Select Other Data(1): |

|||||||||||||

Gross margin |

49.6 | % | 44.7 | % | 44.1 | % | 46.6 | % | |||||

Adjusted EBITDA(2) |

$ | (53,807 | ) | $ | (57,458 | ) | $ | (82,399 | ) | $ | (70,549 | ) | |

| |

As of September 30, 2019 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) |

Actual | Pro Forma(3) | Pro Forma As Adjusted(3)(4) |

|||||||

| |

(unaudited) |

|||||||||

Consolidated Balance Sheet: |

||||||||||

Cash, cash equivalents, and restricted cash(5) |

$ | 54,901 | $ | $ | ||||||

Total assets |

192,509 | |||||||||

Total liabilities(6) |

169,767 | |||||||||

Additional paid-in capital |

15,716 | |||||||||

Accumulated deficit |

(299,619 | ) | ||||||||

Stockholders' deficit |

(284,247 | ) | ||||||||

We define Adjusted EBITDA as net loss before interest (income) expense, income tax expense and depreciation and amortization as further adjusted to exclude the impact of stock-based compensation expense, impairment and restructuring, and costs associated with legal settlements. We caution investors that amounts presented in accordance with our definition of Adjusted EBITDA may not be comparable to similar measures disclosed by our competitors, because not all companies and analysts calculate Adjusted EBITDA in the same manner. We present Adjusted EBITDA because we consider them to be important supplemental measures of our performance and believe it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry. Management believes that investors' understanding of our performance is enhanced by including this non-GAAP financial measure as a reasonable basis for comparing our ongoing results of operations.

Management uses Adjusted EBITDA:

By providing these non-GAAP financial measures, together with reconciliations, we believe we are enhancing investors' understanding of our business and our results of operations, as well as

23

assisting investors in evaluating how well we are executing our strategic initiatives. Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation, or as an alternative to, or a substitute for net income or other financial statement data presented in our consolidated financial statements as indicators of financial performance. Some of the limitations are:

The following table reconciles Adjusted EBITDA to the most directly comparable GAAP financial performance measure, which is net loss:

| |

Nine Months Ended September 30, |

Year Ended December 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) |

2019 | 2018 | 2018 | 2017 | |||||||||

| |

(unaudited) |

|

|

||||||||||

Net loss |

$ | (67,399 | ) | $ | (64,230 | ) | $ | (92,092 | ) | $ | (73,392 | ) | |

Income tax expense |

60 | 44 | 39 | 23 | |||||||||

Interest (income) expense |

1,355 | (503 | ) | (248 | ) | (307 | ) | ||||||

Depreciation and amortization |

4,804 | 2,394 | 3,426 | 1,675 | |||||||||

Stock-based compensation(a) |

5,648 | 4,573 | 5,716 | 1,423 | |||||||||

Impairment/reorganization(b) |

681 | — | 490 | — | |||||||||

Legal settlements(c) |

138 | 264 | 270 | 29 | |||||||||

Transaction costs(d) |

906 | — | — | — | |||||||||

| | | | | | | | | | | | | | |

Adjusted EBITDA |

$ | (53,807 | ) | $ | (57,458 | ) | $ | (82,399 | ) | $ | (70,549 | ) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

24

25

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this prospectus before purchasing our common stock. If any of the following risks occur, our business, financial condition, and results of operations could be materially and adversely affected. In that case, the trading price of our common stock could decline and you may lose some or all of your investment.

Risks Related to Our Business

We operate in highly competitive industries, and if we are unable to compete successfully it could have a material adverse effect on our business, financial condition, and results of operations.

Our business is rapidly evolving and intensely competitive, and we have many competitors across what we define as the Sleep Economy, including in the mattress, soft goods, and bedroom furniture industries, as well as in non-traditional sleep categories, such as sleep technology, sleep services, and sleep supplements. Our competition with respect to these offerings includes: department and furniture stores, big-box retailers, specialty retailers, and online, direct-to-consumer mattress, and other home goods retailers and online marketplaces. Our core offerings compete with new and established manufacturers, direct-to-consumer companies, and white label in-house brands offered by some large retail chains, online retailers, and department stores. We believe that our ability to compete successfully depends upon many factors both within and beyond our control, including:

In addition, retailers in the United States and internationally have integrated vertically in certain of the industries in which we operate, particularly as it relates to mattresses, and it is possible that such vertical integration may create circumstances that would negatively impact our net revenue and results of operations. Although we are pursuing a strategy to vertically integrate, we may not be successful in pursuing this strategy, which may make our products less desirable than products produced by our competitors who have complete control over the manufacturing process and the quality of their products. The highly competitive nature of the industries in which we operate means we are continually subject to the risk of loss of market share, loss of key retail partners, reductions in margins, and the inability to acquire new customers.

Also, some of our current competitors have, and potential competitors may have, longer operating histories, greater brand recognition, larger fulfillment infrastructures, greater resources and technical

26

capabilities, faster and less costly shipping, significantly greater financial, marketing and other resources and larger customer bases than we do. These factors may allow our competitors to derive greater net revenue and profits from their existing customer base, capture market share from us, acquire customers at lower costs, or respond more quickly than we can to new or emerging technologies and changes in consumer preferences or habits. These competitors may engage in more extensive research and development efforts, undertake more impactful marketing campaigns, and adopt more aggressive pricing strategies, which may allow them to build larger customer bases or generate net revenue from their customer bases more effectively than we do. For example, we compete with large retailers, such as Amazon and Wal-Mart, who have house brands that offer competing sleep products and who also have significantly greater scale and more sophisticated distribution operations than we do, a longer track record of successfully building trusted brands, greater technical capabilities and significantly more financial resources. Failure to successfully compete in the industries in which we operate could have a material adverse effect on our business, financial condition, and results of operations.

Our business depends on the strength of our brand, and if we are not able to maintain and enhance our brand, we may be unable to sell our products, which could have a material adverse effect on our business, financial condition, and results of operations.

Our brand name and image are integral to the growth of our business and to the implementation of our strategies for expanding our business. We believe that our brand image has significantly contributed to the success of our business and is critical to maintaining and expanding our customer base. Maintaining and enhancing our brand may require us to make substantial investments in areas such as research and development, marketing, e-commerce, and customer experience and these investments may not be successful.

We anticipate that, as our business expands into new markets and new product categories, and as the industries in which we operate become increasingly competitive, maintaining and enhancing our brand may become difficult and expensive. For example, consumers in any new international markets into which we expand may not know our brand and/or may not accept our brand, resulting in increased costs to market and attract customers to our brand. Further, as we grow our retail partnerships, it may be difficult for us to maintain control of our brand with our retail partners, which may result in negative perceptions of our brand. Our brand may also be adversely affected if our public image or reputation is tarnished by negative publicity, including negative social media campaigns or poor reviews of our products or customer experiences. In addition, ineffective marketing, product diversion to unauthorized distribution channels, product defects, unfair labor practices, and failure to protect our intellectual property rights are some of the potential threats to the strength of our brand, and those and other factors could rapidly and severely diminish consumer confidence in us. Maintaining and enhancing our brand will depend largely on our ability to continue to be a leader in the industries in which we operate and to continue to offer a range of high-quality products as well as a leading end-to-end experience to our customers, which we may not execute successfully. Failure to maintain the strength of our brand could have a material adverse effect on our business, financial condition, and results of operations.

If we do not successfully implement our future retail store expansion, our growth and profitability could be harmed.

We intend to continue to expand our existing direct-to-consumer channel by opening additional retail stores. Over time, we believe there is an opportunity to have more than 200 Casper stores in North America alone. Our ability to open new retail stores in a timely and efficient manner and

27

operate them profitably depends on a number of factors, many of which are beyond our control, including:

In order to pursue our retail store strategy, we will be required to expend significant cash and human capital resources prior to generating any sales in these stores. Delays in new store openings or an inability to generate sufficient sales from these stores to justify such expenses could harm our business and profitability. The substantial management time and resources which any future retail store

28

expansion strategy may require could also result in disruption to our existing business operations which may decrease our net revenue and profitability.

If we are unable to successfully implement our growth strategies related to launching new products, it could have a material adverse effect on our business, financial condition, and results of operations.

Each year we invest significant time and resources in research and development to improve and expand our product offerings, introduce new technologies to customers, support our sales channels, and generate consumer interest and engagement. In 2019, we launched several new products, including our Casper and Wave Hybrid mattresses, Glow Light, Down Pillow, and Upholstered Bed Frame. In addition, from time to time, we also update existing product lines. Launching new products can involve a significant investment in advertising and public relations campaigns. There are also certain risks involved in launching new products, including increased costs in the near term associated with the introduction of new product lines and training of our employees in new manufacturing processes and sales techniques, development delays, failure of new products to achieve anticipated levels of market acceptance, the possibility of increased competition with our current products, and unrecovered costs associated with failed product or service introductions. Implementation of these plans may also divert management's attention from other aspects of our business and place a strain on management, operational and financial resources, as well as our information systems. Launching new products or updating existing products may also leave us with obsolete inventory that we may not be able to sell or we may sell at significantly discounted prices. Further, as we expand into new markets, we may not accurately predict consumer preferences in that market, which could result in lower than expected sales.

Additionally, launching new products requires substantial investments in research and development. Investments in research and development are inherently speculative and require substantial capital and other expenditures. Unforeseen obstacles and challenges that we encounter in the research and development process could result in delays or the abandonment of plans to launch new products and may substantially increase development costs.

If we are unable to maintain the high product-quality standards expected by our customers when we launch new products, or if our competitors are able to produce higher quality or more accessible products, our sales may be harmed. Should this occur, we may need to increase our investments in research and development and manufacturing processes, lower our prices or take other measures to address any loss of sales, which could increase our expenses, reduce our margins and/or negatively impact our brand and our ability to execute our overall pricing and promotion strategy.

We may not be successful in executing our growth strategy related to launching new products, and even if we achieve such plan, we may not be able to achieve profitability. Failure to successfully launch new products could have a material adverse effect on our business, financial condition, and results of operations.

Our future growth and profitability depend on the effectiveness and efficiency of our marketing programs.

We are highly dependent on the effectiveness of our marketing programs and the efficiency of our related expenditures in generating consumer awareness and sales of our products. We rely on a combination of paid and nonpaid advertising and public relations efforts to market our products.

Our paid advertising efforts consist of online channels, including search engine marketing, display advertising, and paid social media, as well as more traditional forms of advertising, such as direct mail and television advertisements. These efforts are expensive and may not result in the cost-effective acquisition of customers. We cannot assure you that the net profit from new customers we acquire will ultimately exceed the cost of acquiring those customers. We also utilize non-paid advertising. Our non-paid advertising efforts include search engine optimization, non-paid social media and email.

29

Moreover, we rely in part upon third parties, such as search engines, social media influencers, and product reviewers, for both paid and unpaid services, and we are unable to fully control their efforts. We obtain a significant amount of traffic via search engines and, therefore, rely on search engines such as Google. Search engines frequently update and change the logic that determines the placement and display of results of a user's search, such that the purchased or algorithmic placement of links to our site can be negatively affected. Moreover, a search engine could, for competitive or other purposes, alter its algorithms or results in a manner that negatively affects our paid or non-paid search ranking, and competitive dynamics could impact the effectiveness of search engine marketing or search engine optimization. We also obtain a significant amount of traffic via social networking websites or other channels used by our current and prospective customers. As e-commerce and social networking continue to rapidly evolve, we must continue to establish relationships with these channels and may be unable to develop or maintain these relationships on acceptable terms. If we are unable to cost-effectively drive traffic to our sites, our ability to acquire new customers and our financial condition would suffer.

In addition, the number of third-party providers of consumer product reviews, consumer recommendations, and referrals is growing across industries and may influence consumers. Negative or no reviews from such third parties may receive widespread attention from consumers, which could damage our reputation and brand value and result in lower sales. Influencers with whom we maintain relationships could also engage in behavior or use their platforms to communicate directly with our customers in a manner that reflects poorly on our brand and may be attributed to us or otherwise adversely affect us. It is not possible to prevent such behavior, and the precautions we take to detect this activity may not be effective in all cases. If we are unable to effectively manage relationships with such reviewers to promote accurate reviews of our products, reviewers may decline to review our products or may post reviews with misleading information, which could damage our reputation and make it more difficult for us to sustain or improve our brand value. Moreover, if any of the third parties on which we rely were to cease operations, temporarily or permanently, face financial distress or other business disruption, we could suffer increased costs and delays in their ability to provide similar services until an equivalent service provider could be found, or until we could develop replacement technology or operations, any of which could also have an adverse impact on our business and financial performance.

We continue to evolve our marketing strategies, adjusting our messages, the amount we spend on advertising and where we spend it with no assurance that we will be successful in developing future effective messages and in achieving efficiency in our marketing and advertising expenditures. Our marketing activities and the marketing activities of any third parties on which we rely are subject to various types of regulations, including laws relating to the protection of personal information, consumer protection and competition. In addition, the regulatory environment surrounding the use of data is increasingly demanding. In recent years, lawmakers and regulators have expressed concern over the use of third-party cookies and similar technologies for online targeted advertising, and laws in this area in the European Union have been strengthened and are also under reform. Moreover, user data protection and communication-based laws may be interpreted and applied inconsistently from jurisdiction to jurisdiction, and these laws continue to develop in ways we cannot predict and that may adversely affect our business. Complying with these varying requirements could cause us to incur substantial costs or require us to change our business practices in a manner with adverse effects on our business, and violations of privacy-related laws can result in significant penalties. These developments, including in the way these laws are interpreted, could impair our ability, or the ability of third parties on which we rely, to collect user information, including personal data and usage information, that helps us provide more targeted advertising to our current and prospective consumers, which could adversely affect our business, particularly given our use of cookies and similar technologies to target our marketing and personalize the consumer experience. See "—Failure to comply with federal, state and foreign laws and regulations relating to privacy, data protection and consumer protection, or the

30

expansion of current or the enactment of new laws or regulations relating to privacy, data protection and consumer protection, could adversely affect our business and our financial condition."

If our marketing programs and related expenditures are ineffective or are inefficient in creating and increasing awareness of our products and brand, in driving consumer traffic to our websites and stores and in motivating customers to purchase our products, it could have a material adverse effect on our business, financial condition, and results of operations.

We have grown rapidly in recent years. If we are unable to manage our operations at our current size or to manage any future growth effectively, the pace of our growth may slow.

We have expanded our operations rapidly since our founding in 2014. In 2014, we launched our e-commerce platform in the United States and Canada, followed by the European Union, Switzerland, and the United Kingdom, in 2016. We launched our first retail concept in Los Angeles in 2015, followed by permanent retail stores in San Francisco and New York in 2017 and 2018, respectively, and we now have 60 retail stores across the United States and Canada. Our revenue increased from $250.9 million for 2017 to $357.9 million for 2018, an increase of 42.6%.

If our operations are to continue to grow, of which there can be no assurance, we will be required to continue to (i) expand our sales and marketing, digital and technology teams, research and development, customer and commercial strategy, product offerings, supply, and manufacturing and distribution functions, (ii) upgrade our management information systems and other processes, and (iii) obtain more space for our expanding administrative support and other personnel. Our continued growth could increase the strain on our resources, and we could experience operating difficulties, including difficulties in hiring, training, and managing an increasing number of employees, finding manufacturing capacity to produce our products, and delays in production and shipments. These difficulties may result in the erosion of our brand image, divert the attention of management and key employees and impact financial and operational results. In addition, in order to continue to expand our direct-to-consumer presence and retail partnerships, we expect to continue to add selling and general and administrative expenses to our operating profile. If we are unable to drive commensurate growth, these costs, which include lease commitments, headcount and capital assets, could result in decreased margins.

We have a history of losses and expect to have operating losses and negative cash flow as we continue to expand our business.

We have a history of losses. We incurred net losses of $92.1 million and $73.4 million in 2018 and 2017, respectively, and $232.2 million in accumulated deficit through December 31, 2018. Because we have a short operating history at scale, particularly in our own and third-party retail sales channels, it is difficult for us to predict our future operating results. As a result, our losses may be larger than anticipated, and we may not achieve profitability when expected, or at all. Also, we expect our operating expenses to increase over the next several years as we further increase marketing spend, open additional retail stores, hire more employees, continue to develop new products and services, and expand internationally. These efforts may be more costly than we expect and may not result in increased revenue or growth in our business. Any failure to increase our revenue sufficiently to keep pace with our investments and other expenses could prevent us from achieving or maintaining profitability or positive cash flow on a consistent basis. Furthermore, if our future growth and operating performance fail to meet investor or analyst expectations, or if we have future negative cash flow or losses resulting from our investment in acquiring new customers or expanding our business, our business, financial condition, and operating results may be materially adversely affected.

31

We have a limited operating history and, as a result, our past results may not be indicative of future operating performance.

We have a limited operating history with the current scale of our business, which makes it difficult to forecast our future results, particularly with respect to our own and third-party retail channels, which we have only recently developed. You should not rely on our past annual or quarterly results of operations as indicators of future performance. You should consider and evaluate our prospects in light of the risks and uncertainty frequently encountered by companies like ours. See "—We may experience fluctuations in our quarterly results of operations due to seasonality and other factors, which could make sequential quarter to quarter comparison an unreliable indication of our performance."

If we fail to attract new customers, or retain existing customers, or fail to do either in a cost-effective manner, we may not be able to increase sales.