As filed with the Securities and Exchange Commission on January 19, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WESTERN REFINING, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2911 | 20-3472415 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

123 West Mills Avenue, Suite 200

El Paso, Texas 79901

(915) 534-1400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Lowry Barfield

Senior Vice President – Legal, General Counsel and Secretary

123 West Mills Avenue, Suite 200

El Paso, Texas 79901

(915) 534-1400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||

| Jeffery B. Floyd Alan Beck Vinson & Elkins L.L.P. 1001 Fannin Street, Suite 2500 Houston, Texas 77002-6760 (713) 758-2222 |

Melissa M. Buhrig Executive Vice President, General Northern Tier Energy GP LLC 1250 W. Washington Street, Suite 300 Tempe, Arizona 85281 (602) 302-5450 |

John Goodgame Christopher J. Arntzen Akin Gump Strauss Hauer & Feld LLP 1111 Louisiana Street, 44th Floor Houston, Texas 77002-5200 (713) 220-5800 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective and upon consummation of the merger described in the enclosed proxy statement/prospectus.

If the securities being registered on this Form are to be offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price per Security |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fees(3) | ||||

| Common Stock, par value $0.01 per share |

17,083,200 | Not applicable | $629,320,846 | $63,373 | ||||

|

| ||||||||

| (1) | Represents the estimated maximum number of shares of common stock to be issued in the merger described herein to holders of common units of Northern Tier Energy LP (“NTI”) other than the Registrant and its subsidiaries, which will continue to own NTI common units following the effective time of the merger. |

| (2) | Estimated solely for the purpose of calculating the registration fee required by Section 6(b) of the Securities Act and calculated pursuant to Rule 457(f) and 457(c) under the Securities Act of 1933 (the “Securities Act”). The proposed maximum aggregate offering price of shares of the Registrant’s common stock was calculated based upon the market value of the NTI common units to be converted in the merger in accordance with Rule 457(c) under the Securities Act as follows: the product of (a) $26.00 (the average of the high and low prices per NTI common unit on January 13, 2016, as quoted on the New York Stock Exchange) and (b) 57,210,986, the estimated maximum number of NTI common units that may be exchanged for the merger consideration minus $858,164,790, the estimated aggregate amount of cash consideration to be paid by the registrant to the former holders of NTI common units. |

| (3) | Determined in accordance with Section 6(b) of the Securities Act at a rate equal to $100.70 per $1,000,000 of the proposed maximum aggregate offering price (prorated for amounts less than $1,000,000). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary proxy statement/prospectus is not complete and may be changed. Western Refining, Inc. may not distribute or issue the securities being registered pursuant to this registration statement until the registration statement, as filed with the Securities and Exchange Commission (of which this preliminary proxy statement/prospectus is a part), is effective. This preliminary proxy statement/prospectus is not an offer to sell nor should it be considered a solicitation of an offer to buy the securities described herein in any state where the offer or sale is not permitted.

PRELIMINARY PROXY STATEMENT/PROSPECTUS—SUBJECT TO COMPLETION—

DATED JANUARY 19, 2016

|

|

MERGER PROPOSAL—YOUR VOTE IS VERY IMPORTANT

On December 21, 2015, Western Refining, Inc. (“WNR”), Western Acquisition Co, LLC (“MergerCo”), an indirect wholly-owned subsidiary of WNR, Northern Tier Energy LP (“NTI”) and Northern Tier Energy GP LLC (“NTI GP”), an indirect wholly-owned subsidiary of WNR and the general partner of NTI, entered into an agreement and plan of merger (as such agreement may be amended from time to time, the “Merger Agreement”). Pursuant to the Merger Agreement, MergerCo will merge with and into NTI (the “Merger”), with NTI surviving the Merger as an indirect wholly-owned subsidiary of WNR, and each common unit representing limited partner interests in NTI (“NTI Common Units”) issued and outstanding immediately prior to the effective time of the Merger and not owned by WNR or any of its subsidiaries will be converted into the right to receive $15.00 in cash without interest and 0.2986 of a share of WNR’s common stock, par value $0.01 per share (“WNR Common Stock”) (which we refer to as the “Mixed Election” or the “Standard Mix of Consideration”). Instead of receiving the Standard Mix of Consideration, each NTI common unitholder other than WNR and its subsidiaries will have an opportunity to make an election to receive $26.06 in cash without interest (which we refer to as a “Cash Election”) or to receive 0.7036 of a share of WNR Common Stock (which we refer to as a “Stock Election”), for each NTI Common Unit they own immediately prior to the Merger. The Cash Election and Stock Election, however, will be subject to proration to ensure that the total amount of cash paid and the total number of shares of WNR Common Stock issued in the Merger to NTI common unitholders as a whole are equal to the total amount of cash and number of shares of WNR Common Stock that would have been paid and delivered if all NTI common unitholders other than WNR and its subsidiaries received the Standard Mix of Consideration.

Pursuant to the terms of the Merger Agreement, with respect to the quarter in which the closing date of the Merger (the “Closing Date”) occurs, NTI will, to the extent it generates available cash in such quarter, make a prorated quarterly cash distribution to NTI common unitholders of record as of immediately prior to the effective time of the Merger of such available cash if the record date for the WNR quarterly cash dividend to be paid in that quarter occurs before the Closing Date. Accordingly, in the quarter that the Closing Date occurs, NTI common unitholders who receive WNR Common Stock in the Merger will receive (i) an NTI cash distribution in respect of the previous quarter, to the extent NTI generates available cash in such quarter; and (ii) either an NTI prorated cash distribution in respect of available cash generated by NTI in the quarter in which the Closing Date occurs or (assuming such unitholders continue to hold the shares of WNR Common Stock received in the Merger through the record date for such WNR dividend) the WNR quarterly cash dividend payable in the quarter in which the Closing Date occurs. The amount of any distribution will not have any effect on the merger consideration to be received by NTI common unitholders.

No fractional shares of WNR Common Stock will be issued in the Merger. NTI common unitholders will receive cash (without interest and rounded up to the nearest whole cent) in lieu of receiving any fractional shares of WNR Common Stock to which any NTI common unitholder would otherwise have been entitled. WNR stockholders will continue to own their existing shares of WNR Common Stock.

Based on the estimated number of shares of WNR Common Stock and the estimated number of NTI Common Units that will be outstanding immediately before the closing of the Merger (other than NTI Common Units owned by WNR or any of its subsidiaries), we estimate that, upon the closing, the number of shares of WNR Common Stock issued in exchange for NTI Common Units will represent approximately 15% of WNR Common Stock outstanding immediately after the Merger.

The Merger Agreement requires that, prior to the Closing Date, the Merger Agreement and the transactions contemplated thereby (the “Merger Transactions”) be approved by the affirmative vote of NTI common unitholders, as of the record date for the NTI special meeting, holding a majority of the outstanding NTI Common Units. NTI will hold a special meeting of its common unitholders in connection with the proposed Merger. At the special meeting of NTI common unitholders, NTI common unitholders will be asked to vote on

the proposal to approve the Merger Agreement and the Merger Transactions, including the Merger (the “Merger Proposal”). The Merger Proposal will be approved by the requisite vote of the NTI common unitholders if the holders, as of the record date of the NTI special meeting, of a majority of the outstanding NTI Common Units vote in favor of the Merger Proposal at the NTI special meeting. Pursuant to the Merger Agreement, WNR has agreed to vote the NTI Common Units owned beneficially or of record by it or any of its subsidiaries in favor of the adoption and approval of the Merger Agreement and the Merger Transactions. As of the close of business on [ ], 2016, the record date for the NTI special meeting, WNR held 35,622,500 NTI Common Units, representing approximately 38.4% of the outstanding NTI Common Units.

At the special meeting of NTI common unitholders, NTI common unitholders will also be asked to vote on a proposal to approve, on an advisory, non-binding basis, the compensation payments that may be paid or become payable to NTI’s named executive officers in connection with the Merger (the “NTI Compensation Proposal”). Approval, on an advisory, non-binding basis, of the NTI Compensation Proposal requires the affirmative vote of a majority of the outstanding NTI Common Units present in person or represented by proxy and entitled to vote at the NTI special meeting.

The conflicts committee (the “NTI GP Conflicts Committee”) of the board of directors of NTI GP (the “NTI GP Board”), acting on behalf of NTI GP, in its capacity as the general partner of NTI, approved the Merger Agreement and the Merger Transactions and determined that the Merger Agreement and the Merger Transactions are fair and reasonable to the holders of NTI Common Units other than WNR and its affiliates (the “NTI Unaffiliated Unitholders”) and NTI, and are not adverse to the interests of the NTI Unaffiliated Unitholders or the interests of NTI. The NTI GP Conflicts Committee’s approval of the Merger Agreement and the Merger Transactions constitutes “Special Approval,” as such term is defined by the NTI partnership agreement. The NTI GP Conflicts Committee, acting on behalf of NTI GP, in its capacity as the general partner of NTI, has called an NTI special meeting and has directed that the Merger Agreement and the Merger Transactions be submitted to the NTI common unitholders at the NTI special meeting for approval. The NTI GP Conflicts Committee recommends that the NTI common unitholders vote in favor of the Merger Proposal and in favor of the NTI Compensation Proposal.

This proxy statement/prospectus provides you with detailed information about the Merger Agreement, the proposed Merger and related matters. We encourage you to read the entire document carefully. In particular, please read “Risk Factors” beginning on page 106 of this proxy statement/prospectus for a discussion of risks related to the Merger, ownership of WNR Common Stock and material U.S. federal income tax consequences of the Merger.

Shares of WNR Common Stock are listed on the New York Stock Exchange (“NYSE”) under the symbol “WNR,” and NTI Common Units are listed on the NYSE under the symbol “NTI.” The last reported sale price of shares of WNR Common Stock on the NYSE on , 2016 was $[●]. The last reported sale price of NTI Common Units on the NYSE on , 2016 was $[●].

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this proxy statement/prospectus or has determined if this proxy statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

All information in this proxy statement/prospectus concerning WNR has been furnished by WNR. All information in this proxy statement/prospectus concerning NTI has been furnished by NTI.

This proxy statement/prospectus is dated , 2016, and is being first mailed to NTI common unitholders on or about , 2016.

| On behalf of the NTI GP Conflicts Committee, |

|

|

| Rocky Duckworth |

| Chairman of the Conflicts Committee of the Board of Directors of Northern Tier Energy GP LLC |

Tempe, Arizona

, 2016

Notice of Special Meeting of Common Unitholders

To the Common Unitholders of Northern Tier Energy LP:

A special meeting of common unitholders of Northern Tier Energy LP (“NTI”) will be held on , 2016 at 9:00 a.m., Tempe, Arizona Time, in , located on the Floor of , , for the following purposes:

| • | To consider and vote on a proposal to approve the Agreement and Plan of Merger dated as of December 21, 2015, by and among NTI, Northern Tier Energy GP LLC (“NTI GP”), an indirect wholly-owned subsidiary of WNR and the general partner of NTI, Western Refining, Inc. (“WNR”), and Western Acquisition Co, LLC (“MergerCo”), an indirect wholly-owned subsidiary of WNR, as it may be amended from time to time (the “Merger Agreement”), and the transactions contemplated thereby (the “Merger Transactions”), including the merger of MergerCo with and into NTI (the “Merger”) (the “Merger Proposal”); |

| • | To consider and vote upon, on an advisory, non-binding basis, the compensation payments that may be paid or become payable to NTI’s named executive officers in connection with the Merger, which is referred to as the “NTI Compensation Proposal.” |

NTI will transact no other business at the special meeting except such business as may properly be brought before the special meeting or any adjournments or postponements thereof. At this time, NTI knows of no other matters that will be presented for the consideration of its common unitholders at the special meeting.

The Merger Proposal will be approved by the requisite vote of the NTI common unitholders if the holders, as of the record date of the NTI special meeting, of a majority of the outstanding NTI common units (“NTI Common Units”) vote in favor of the Merger Proposal. Failure to vote, abstentions and broker non-votes (if any) will have the same effect as a vote against the Merger Proposal. Approval, on an advisory, non-binding basis, of the NTI Compensation Proposal requires the affirmative vote of a majority of the outstanding NTI common units present in person or represented by proxy and entitled to vote at the NTI special meeting. Abstentions will have the same effect as a vote against the NTI Compensation Proposal. Broker non-votes (if any) will have no effect on the NTI Compensation Proposal. Pursuant to the Merger Agreement, WNR has agreed to vote the NTI Common Units owned beneficially or of record by it or any of its subsidiaries in favor of the approval of the Merger Agreement and the Merger Transactions. As of the close of business on , 2016, the record date for the NTI special meeting, WNR held 35,622,500 NTI Common Units, representing approximately 38.4% of the outstanding NTI Common Units. Because the vote on the NTI Compensation Proposal is advisory in nature only, it will not be binding on NTI or WNR.

The conflicts committee (the “NTI GP Conflicts Committee”) of the board of directors of NTI GP (the “NTI GP Board”), acting on behalf of NTI GP, in its capacity as the general partner of NTI, approved the Merger Agreement and the Merger Transactions and determined that the Merger Agreement and the Merger Transactions are fair and reasonable to the holders of NTI Common Units other than WNR and its affiliates (the “NTI Unaffiliated Unitholders”) and NTI, and are not adverse to the interests of the NTI Unaffiliated Unitholders or the interests of NTI. The NTI GP Conflicts Committee’s approval of the Merger Agreement and the Merger Transactions constitutes “Special Approval,” as such term is defined by the NTI partnership agreement. The NTI GP Conflicts Committee, acting on behalf of NTI GP, in its capacity as the general partner of NTI, has called this special meeting and has directed that the Merger

Agreement and the Merger Transactions be submitted to the NTI common unitholders at the NTI special meeting for approval. The NTI GP Conflicts Committee recommends that the NTI common unitholders vote in favor of the Merger Proposal and the NTI Compensation Proposal.

Only NTI common unitholders of record as of the close of business on , 2016, are entitled to notice of and to vote at the special meeting and any adjournments of the special meeting. A list of NTI common unitholders entitled to vote at the NTI special meeting will be available for inspection to the NTI common unitholders of record at NTI’s offices in Tempe, Arizona, for any purpose relevant to the special meeting during normal business hours for a period of ten days before the special meeting and at the special meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE SPECIAL MEETING, PLEASE CAUSE YOUR UNITS TO BE VOTED IN ONE OF THE FOLLOWING WAYS:

| • | If you hold your NTI Common Units in the name of a bank, broker or other nominee, you should follow the instructions provided by your bank, broker or nominee for voting your NTI Common Units. |

| • | If you hold your NTI Common Units in your own name, you may submit a proxy for your NTI Common Units by: |

| • | using the toll-free telephone number shown on the proxy card; |

| • | using the internet website shown on the proxy card; or |

| • | marking, signing, dating and promptly returning the enclosed proxy card in the postage-paid envelope, which requires no postage if mailed in the United States. |

The enclosed proxy statement/prospectus provides a detailed description of the Merger Transactions and the Merger Agreement as well as a description of the WNR Common Stock issuable to NTI common unitholders pursuant to the Merger Agreement. We urge you to read this proxy statement/prospectus, including any documents incorporated by reference and the Annexes, carefully and in its entirety. If you have any questions concerning the Merger or this proxy statement/prospectus, would like additional copies of this proxy statement/prospectus, or have questions about how to vote your NTI Common Units, please contact NTI’s proxy solicitor, , toll-free at [●].

| By order of Northern Tier Energy GP LLC, as the general partner of Northern Tier Energy LP |

|

David L. Lamp |

| President and Chief Executive Officer |

| Northern Tier Energy GP LLC |

IMPORTANT NOTE ABOUT THIS PROXY STATEMENT/PROSPECTUS

This proxy statement/prospectus, which forms part of a registration statement on Form S-4 filed with the Securities and Exchange Commission (the “SEC”), constitutes a proxy statement of NTI under the Securities Exchange Act of 1934 (the “Exchange Act”) with respect to the solicitation of proxies for the special meeting of NTI Common Unitholders to, among other things, approve the Merger Proposal and the NTI Compensation Proposal. This proxy statement/prospectus is also a prospectus of WNR under the Securities Act of 1933 (the “Securities Act”) for shares of WNR Common Stock that will be issued to NTI Common Unitholders in the Merger pursuant to the Merger Agreement.

As permitted under the rules of the SEC, this proxy statement/prospectus incorporates by reference important business and financial information about WNR and NTI from other documents filed with the SEC that are not included in or delivered with this proxy statement/prospectus. Please read “Where You Can Find More Information” beginning on page 181 of this proxy statement/prospectus. You can obtain any of the documents incorporated by reference into this proxy statement/prospectus from the SEC’s website at www.sec.gov. This information is also available to you without charge upon your request in writing or by telephone to WNR or NTI at the following addresses and telephone numbers:

Western Refining, Inc.

123 W. Mills Ave., Suite 200

El Paso, Texas 79901

Attention: Jeffrey S. Beyersdorfer

Telephone: (602) 286-1530

Northern Tier Energy LP

1250 W. Washington Street, Suite 300

Tempe, Arizona 85281

Attention: Investor Relations

Telephone: (602) 302-5450

Please note that copies of the documents provided to you will not include exhibits, unless the exhibits are specifically incorporated by reference into those documents or this proxy statement/prospectus.

You may obtain certain of these documents at WNR’s website, www.wnr.com, under the “Investor Relations” section, and at NTI’s website, www.northerntier.com, under the “Investors” section. Information contained on WNR’s or NTI’s website is not incorporated by reference into this proxy statement/prospectus except as otherwise expressly stated.

You may also obtain additional copies of this proxy statement/prospectus or the documents incorporated by reference into this proxy statement/prospectus by contacting NTI’s proxy solicitor, [ ], at the address and telephone number listed below. You will not be charged for any of these documents that you request.

[[●], address, phone number]

In order to receive timely delivery of requested documents in advance of the NTI special meeting, your request should be received no later than , 2016. If you request any documents, WNR or NTI or [Proxy Solicitor] will mail them to you by first class mail or another equally prompt means within one business day after receipt of your request.

In addition, if you would like to request any documents incorporated by reference in this proxy statement/prospectus prior to deciding what merger consideration to elect, please do so at least five business days prior to the election deadline, which will be identified in the form of election provided to you in a separate mailing following the NTI special meeting.

WNR and NTI have not authorized anyone to give any information or make any representation about the Merger, WNR or NTI that is different from, or in addition to, the information contained in this proxy statement/prospectus or in any of the materials that have been incorporated by reference into this proxy statement/prospectus. Therefore, if anyone distributes any such information, you should not rely on it. If you are in a jurisdiction where offers to exchange or sell or solicitations of offers to exchange or purchase the securities offered by this proxy statement/prospectus or the solicitation of proxies is unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this proxy statement/prospectus does not extend to you. The information contained in this proxy statement/prospectus speaks only as of the date of this proxy statement/prospectus or, in the case of information in a document incorporated by reference, as of the date of such document, unless the information specifically indicates that another date applies. All information in this proxy statement/prospectus concerning WNR has been furnished by WNR. All information in this proxy statement/prospectus concerning NTI has been furnished by NTI.

PROXY STATEMENT/PROSPECTUS

i

| 102 | ||||

| 103 | ||||

| 103 | ||||

| Impact of Selling Units as to which an Election Has Already Been Made |

103 | |||

| 103 | ||||

| 104 | ||||

| 104 | ||||

| 105 | ||||

| 105 | ||||

| 105 | ||||

| 105 | ||||

| Restrictions on Sales of WNR Common Stock Received in the Merger |

105 | |||

| 106 | ||||

| 106 | ||||

| 110 | ||||

| 113 | ||||

| 113 | ||||

| 113 | ||||

| 113 | ||||

| 114 | ||||

| 114 | ||||

| 114 | ||||

| 116 | ||||

| 116 | ||||

| 117 | ||||

| 119 | ||||

| 120 | ||||

| 120 | ||||

| 121 | ||||

| Effect of Merger on Outstanding NTI Common Units and Other Interests |

121 | |||

| 126 | ||||

| 129 | ||||

| 132 | ||||

| 134 | ||||

| 135 | ||||

| 147 | ||||

| 148 | ||||

| 149 | ||||

| 149 | ||||

| 149 | ||||

| 149 | ||||

| 150 | ||||

| 151 | ||||

| 151 | ||||

| COMPARISON OF THE RIGHTS OF WNR STOCKHOLDERS AND NTI COMMON UNITHOLDERS |

152 | |||

ii

| 166 | ||||

| 166 | ||||

| 166 | ||||

| 166 | ||||

| 168 | ||||

| 169 | ||||

| UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

173 | |||

| 180 | ||||

| 180 | ||||

| 180 | ||||

| 180 | ||||

| 182 | ||||

| 182 | ||||

| 183 | ||||

| ANNEX A – Agreement and Plan of Merger dated as of December 21, 2015 |

A-1 | |||

| B-1 | ||||

iii

The following summary, together with the section entitled “Questions and Answers about the Merger and the NTI Special Meeting,” highlights some of the information in this proxy statement/prospectus. It may not contain all of the information that is important to you. To understand the merger fully and for a more complete description of the terms of the merger agreement, you should read carefully this proxy statement/prospectus, the documents incorporated by reference and the Annexes to this proxy statement/prospectus, including the full text of the merger agreement included as Annex A. Please also read “Where You Can Find More Information” on page 181. Where appropriate, we have set forth a section and page reference directing you to a more complete description of the topics described in this summary.

The following terms have the meanings set forth below for purposes of this proxy statement/prospectus, unless the context otherwise indicates:

| • | “Akin Gump” means the law firm of Akin Gump Strauss Hauer & Feld LLP, counsel to the NTI GP Conflicts Committee. |

| • | “Available Cash” means NTI’s cash flow from operations for the applicable quarter, less cash required for maintenance, regulatory and previously approved organic growth capital expenditures, reimbursement of expenses incurred by NTI GP and its affiliates, debt service and other contractual obligations and reserves for future operating or capital needs that the NTI GP Board deems necessary or appropriate, including reserves for turnaround and related expenses. |

| • | “Closing Date” means the date on which the Merger and the other Merger Transactions occur. |

| • | “Effective Time” means the date and time the Merger will become effective, which will occur upon the filing of a properly executed certificate of merger with the Secretary of State of the State of Delaware or at such later date and time as may be agreed by WNR and NTI and set forth in the certificate of merger. |

| • | “Evercore” means Evercore Group L.L.C., financial advisor to the NTI GP Conflicts Committee. |

| • | “Exchange Act” means the Securities Exchange Act of 1934, as amended. |

| • | “Exchange Ratios” means the Mixed Election Exchange Ratio and the Stock Election Exchange Ratio. |

| • | “GAAP” means accounting principles that are generally accepted in the United States of America. |

| • | “Goldman Sachs” means Goldman Sachs & Co., financial advisor to WNR. |

| • | “Merger” means, as contemplated by the Merger Agreement, the proposed Merger of MergerCo with and into NTI, with NTI surviving the Merger as an indirect wholly-owned subsidiary of WNR, and each NTI common unit outstanding at the Effective Time of the Merger and not owned by WNR or any of its subsidiaries being converted into the right to receive, at the election of the holder but subject to proration, either (i) $15.00 in cash without interest and 0.2986 of a share of WNR Common Stock, or (ii) $26.06 in cash without interest, or (iii) 0.7036 of a share of WNR Common Stock. |

| • | “Merger Agreement” means that certain Agreement and Plan of Merger dated as of December 21, 2015, by and among WNR, MergerCo, NTI and NTI GP, as it may be amended from time to time, according to which the parties thereto have agreed to consummate the Merger transactions. |

| • | “MergerCo” means Western Acquisition Co, LLC, an indirect wholly-owned subsidiary of WNR. |

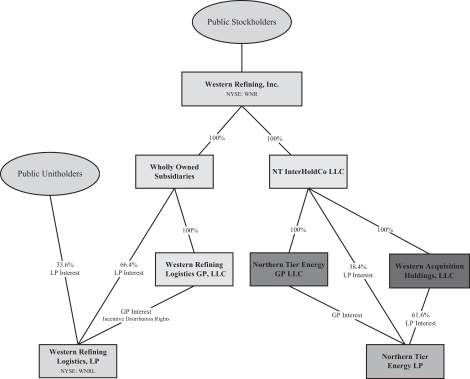

| • | “MergerCo HoldCo” means Western Acquisition Holdings, LLC, a Delaware limited liability company and an indirect wholly-owned subsidiary of WNR. |

1

| • | “Merger Consideration” means, if the proposed Merger is consummated, the right of each NTI Public Unitholder upon surrendering their NTI Common Units to receive, at the election of the holder but subject to proration, for each NTI Common Unit held as of the Effective Time, either (i) $15.00 in cash without interest and 0.2986 of a share of WNR Common Stock, or (ii) $26.06 in cash without interest, or (iii) 0.7036 of a share of WNR Common Stock. |

| • | “Merger Proposal” means the proposal to approve the Merger Agreement and the Merger Transactions, to be considered for a vote of the NTI Common Unitholders at the NTI Special Meeting. |

| • | “Merger Transactions” means the transactions contemplated by the Merger Agreement, including the Merger. |

| • | “Mixed Election Exchange Ratio” means 0.2986 of a share of WNR Common Stock per NTI Common Unit to be converted in the Merger for which a Mixed Election has been made |

| • | “Morris Nichols” means Morris, Nichols, Arsht & Tunnell LLP, the NTI GP Conflicts Committee’s independent Delaware legal counsel. |

| • | “NTI” means Northern Tier Energy LP. |

| • | “NTI Common Unitholders” means the holders of NTI Common Units. |

| • | “NTI Common Units” or “NTI’s Common Units” means the common units of NTI representing limited partner interests in NTI having the rights and obligations specified with respect to “Common Units” as set forth in NTI’s Partnership Agreement. |

| • | “NTI Compensation Proposal” means the proposal to approve, on an advisory, non-binding basis, the compensation payments that may be paid or become payable to NTI’s named executive officers in connection with the Merger. |

| • | “NTI Employee” means each employee of Northern Tier Energy LLC, a wholly-owned subsidiary of NTI, and its subsidiaries (other than the NTI Executives) immediately prior to the Effective Time. |

| • | “NTI Executive” means each of David L. Lamp, Karen B. Davis, Scott L. Stevens or Melissa M. Buhrig. |

| • | “NTI GP” means Northern Tier Energy GP LLC, the general partner of NTI and an indirect wholly-owned subsidiary of WNR. |

| • | “NTI GP Board” means the board of directors of NTI GP. |

| • | “NTI GP Conflicts Committee” means the conflicts committee of the NTI GP Board. |

| • | “NTI Public Unitholders” means the NTI Common Unitholders other than WNR and its subsidiaries. |

| • | “NTI’s Partnership Agreement” or the “NTI Partnership Agreement” means the First Amended and Restated Agreement of Limited Partnership of NTI dated as of July 31, 2012, as amended from time to time. |

| • | “NTI Special Meeting” or “Special Meeting” means the special meeting of NTI Common Unitholders described in this proxy statement/prospectus at which the NTI Common Unitholders will vote on the Merger Proposal. |

| • | “NTI Unaffiliated Unitholders” means the NTI Common Unitholders other than WNR and its affiliates. |

| • | “NTI Unitholder Approval” means approval of the Merger Transactions by the holders, as of the record date of the NTI Special Meeting, of a majority of the outstanding NTI Common Units. |

| • | “NT InterHoldCo” means NT InterHoldCo LLC, a wholly-owned subsidiary of WNR. |

| • | “NYSE” means the New York Stock Exchange. |

2

| • | “PADD II” means Petroleum Administration for Defense District II. |

| • | “SEC” means the United States Securities and Exchange Commission. |

| • | “Securities Act” means the Securities Act of 1933, as amended. |

| • | “Stock Election Exchange Ratio” means 0.7036 of a share of WNR Common Stock per NTI Common Unit to be converted in the Merger for which a Stock Election has been made. |

| • | “U.S.” means the United States of America. |

| • | “Vinson & Elkins” means the law firm of Vinson & Elkins L.L.P., counsel to WNR. |

| • | “VWAP” means the volume-weighted average price. |

| • | “WNR” means Western Refining, Inc. |

| • | “WNRL” means Western Refining Logistics, LP. |

| • | “WNR Board” means the board of directors of WNR. |

| • | “WNR’s Bylaws” or the “WNR Bylaws” means the Bylaws of WNR, dated as of August 4, 2014, as amended from time to time. |

| • | “WNR Common Stock” means the common stock, par value $0.01 per share, of WNR. |

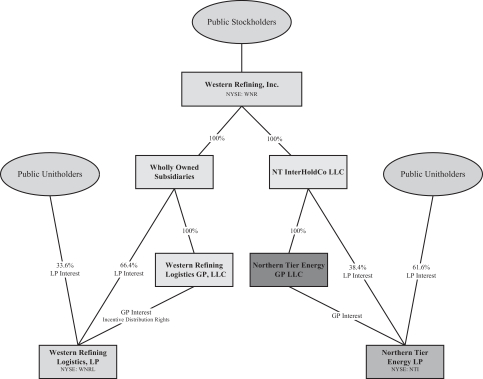

WNR is a Delaware corporation with its common stock traded on the NYSE under the symbol “WNR.” WNR indirectly owns the general partner interest of, and common units representing a 38.4% limited partner interest in, NTI.

NTI is a Delaware limited partnership traded on the NYSE under the symbol “NTI.” NTI GP is a Delaware limited liability company and is the general partner of NTI.

MergerCo is a Delaware limited liability company and an indirect wholly-owned subsidiary of WNR that was formed solely in contemplation of the Merger.

See “The Parties to the Merger” beginning on page 113 of this proxy statement/prospectus.

The Merger Parties’ Businesses

WNR

WNR is an independent crude oil refiner and marketer of refined products incorporated in September 2005 under Delaware law with principal offices located in El Paso, Texas. WNR owns, directly and through its subsidiaries, certain operating assets directly, the general partner interest and approximately 38.4% of the NTI Common Units outstanding and the general partner interest, incentive distribution rights and a 66.4% limited partner interest in WNRL. WNR has four reportable business segments: refining, NTI, WNRL and retail.

WNR produces refined products at its refineries in El Paso, Texas (131,000 barrels per day, or bpd) and near Gallup, New Mexico (25,000 bpd). WNR also sells refined products through its Southwest retail network with a total of 261 company-operated sites in the U.S.

WNRL owns and operates terminal, storage and transportation assets and provides related services primarily to WNR’s refining segment in the Southwest region of the U.S. The WNRL segment also includes wholesale

3

assets consisting of a fleet of crude oil and refined product truck transports and wholesale petroleum product and lubricant distribution operations in the Southwest region of the U.S. WNRL receives its product supply from the refining segment and third-party suppliers. WNRL distributes wholesale petroleum products primarily in Arizona, California, Colorado, Nevada, New Mexico and Texas.

WNR’s retail segment located in the Southwest region of the U.S. sells various grades of gasoline, diesel fuel, convenience store merchandise and beverage and food products to the general public through retail convenience stores and various grades of gasoline and diesel fuel to commercial vehicle fleets through unmanned commercial fleet fueling, or “cardlocks.” WNRL supplies the majority of gasoline and diesel fuel that WNR’s retail segment sells. WNR purchases general merchandise and beverage and food products from various third-party suppliers.

For the year ended December 31, 2014, WNR had net income attributable to WNR of $559.9 million, or $5.61 per diluted share, and revenues of $15.2 billion. For the nine months ended September 30, 2015, WNR had net income attributable to WNR of $393.2 million, or $4.12 per diluted share, and revenues of $7.7 billion.

WNR’s principal executive offices are located at 123 W. Mills Ave., Suite 200, El Paso, Texas 79901. WNR’s telephone number is (915) 534-1400, and its website address is www.wnr.com. Information contained on or available through WNR’s website is not incorporated into or otherwise a part of this proxy statement/prospectus except as otherwise expressly provided.

NTI

NTI is an independent downstream energy limited partnership with refining, retail and logistics operations that serve the PADD II region of the U.S.

NTI’s refining business primarily consists of a refinery located in St. Paul Park, Minnesota with total crude oil throughput capacity of 97,800 bpd. NTI is one of only two refineries in Minnesota and one of four refineries in the Upper Great Plains area within the PADD II region. The PADD II region covers Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Ohio, Oklahoma, Tennessee and Wisconsin. NTI’s strategic location allows NTI direct access, primarily via the Minnesota Pipeline, to sources of crude oil from Western Canada and North Dakota, as well as the ability to distribute NTI refined products throughout the Midwestern U.S. NTI’s refinery produces a broad slate of refined products including gasoline, diesel, jet fuel and asphalt, which are then marketed to resellers and consumers primarily in the PADD II region.

NTI also owns various storage and transportation assets, including a light products terminal, a heavy products terminal, storage tanks, rail loading/unloading facilities, the Aranco and Cottage Grove pipelines and a Mississippi River loading dock. NTI operates a crude oil transportation business in North Dakota that allows NTI to purchase crude oil at the wellhead in the Bakken Shale area. NTI’s refining business also includes its 17% interest in MPL Investments, Inc. and the Minnesota Pipe Line Company, LLC, which own and operate the Minnesota Pipeline, a 465,000 bpd crude oil pipeline system that transports crude oil (primarily from Western Canada and North Dakota) for approximately 300 miles from the Enbridge pipeline hub at Clearbrook, Minnesota to NTI’s refinery. The Minnesota Pipeline has historically transported the majority of the crude oil used and processed in NTI’s refinery.

As of September 30, 2015, NTI’s retail business operated 165 convenience stores under the SuperAmerica brand and also supported 102 franchised convenience stores, which are also operated under the SuperAmerica brand. These convenience stores are located primarily in Minnesota and Wisconsin and sell various grades of gasoline and diesel, tobacco products and immediately consumable items, such as beverages, prepared food and a

4

large variety of snacks and prepackaged items. NTI’s refinery supplies a majority of the gasoline and diesel sold in NTI’s company-operated stores and franchised convenience stores within NTI’s distribution area.

NTI also owns and operates SuperMom’s bakery, which prepares and distributes baked goods and other prepared food items for sale in NTI company-operated and franchised convenience stores and other third party locations.

For the year ended December 31, 2014, NTI had net income of $241.6 million, or $2.61 per diluted unit, and total revenues of $5.6 billion. For the nine months ended September 30, 2015, NTI had net income of $343.6 million, or $3.69 per diluted unit, and total revenues of $2.6 billion.

NTI’s principal executive offices are located at 1250 W. Washington Street, Suite 300, Tempe, Arizona, 85281. NTI’s telephone number is (602) 302-5450, and its website address is www.northerntier.com. Information contained on or available through NTI’s website is not incorporated into or otherwise a part of this proxy statement/prospectus except as otherwise expressly provided.

Relationship of the Parties to the Merger

WNR owns all of the membership interests in NT InterHoldCo, which owns all of the membership interests in NTI GP and approximately 38.4% of the NTI Common Units outstanding. NT InterHoldCo has the right to appoint and remove all of the members of the NTI GP Board. Thus, through its ownership in NT InterHoldCo, WNR has a controlling interest in NTI GP, which manages the operations and activities of NTI.

The NTI GP Board includes four non-employee directors who are also directors and/or executive officers of WNR (Messrs. Foster, Stevens, Weaver and Barfield). Paul L. Foster is the Chairman of the WNR Board and Executive Chairman of WNR and the Chairman of the NTI GP Board. Jeff A. Stevens is a director of WNR, President and Chief Executive Officer of WNR and a director of NTI GP. Scott D. Weaver is a director and Vice President, Assistant Treasurer, of WNR, and a director of NTI GP. Lowry Barfield is the Senior Vice President – Legal, General Counsel and Secretary of WNR and a director of NTI GP. Persons who are directors or officers of both WNR and NTI GP owe duties to both the stockholders of WNR and to the NTI Common Unitholders and may have interests in the Merger that are different than yours. None of Messrs. Foster, Stevens, Weaver and Barfield are on the NTI GP Conflicts Committee.

For more information regarding these relationships and related party transactions between WNR and NTI, see “Special Factors—Relationship of the Parties to the Merger” beginning on page 47 of this proxy statement/prospectus.

NTI, NTI GP, WNR and MergerCo have entered in to the Merger Agreement. Subject to the terms and conditions of the Merger Agreement and in accordance with Delaware law, at the Effective Time of the Merger, WNR will acquire all of the outstanding NTI Common Units that WNR and its subsidiaries do not already own through the merger of MergerCo, an indirect wholly-owned subsidiary of WNR, with and into NTI, with NTI surviving the Merger as an indirect wholly-owned subsidiary of WNR. Each NTI Common Unit issued and outstanding immediately prior to the Effective Time, other than those NTI Common Units owned by WNR or any of its subsidiaries, will be converted into the right to receive, at the election of the holder but subject to proration, either (i) $15.00 in cash without interest and 0.2986 of a share of WNR Common Stock (the “Mixed Election” or “Standard Mix of Consideration”), or (ii) $26.06 in cash without interest (the “Cash Election”), or (iii) 0.7036 of a share of WNR Common Stock (the “Stock Election”). The Cash Election and the Stock Election will be subject to proration to ensure that the total amount of cash paid and the total number of shares of WNR

5

Common Stock issued in the Merger to NTI Public Unitholders as a whole are equal to the total amount of cash and number of shares of WNR Common Stock that would have been paid and delivered if all NTI Public Unitholders received the Standard Mix of Consideration. For more information about the proration and adjustment procedures, see “Special Factors—Proration and Adjustment Procedures” beginning on page 104 of this proxy statement/prospectus.

Because the Exchange Ratios were fixed at the time the Merger Agreement was executed and because the market values of WNR Common Stock and NTI Common Units will fluctuate during the pendency of the Merger, NTI Common Unitholders cannot be sure of the actual value of the Merger Consideration they elect to receive compared to the value of the NTI Common Units that they are exchanging. See “Risk Factors—Risks Related to the Merger.” NTI Common Unitholders are urged to obtain current market quotations for the WNR Common Stock when they make their elections.

All of the limited liability company interests in MergerCo outstanding immediately prior to the Effective Time, which are currently held by MergerCo HoldCo, will automatically be converted into, in the aggregate, the number of NTI Common Units (excluding any NTI Common Units owned by WNR or any of its subsidiaries) issued and outstanding immediately prior to the Effective Time. All NTI Common Units owned by WNR or any of its subsidiaries immediately prior to the Effective Time will be unchanged and remain issued and outstanding as NTI Common Units of the surviving entity at the Effective Time. Immediately after the Effective Time, the NTI Common Units resulting from the conversion of the limited liability company interests in MergerCo and the NTI Common Units owned by WNR or its subsidiaries immediately prior to the Effective Time will constitute all of the issued and outstanding common units of, and limited partnership interests in, the surviving entity. Consequently, MergerCo HoldCo, a wholly-owned subsidiary of NT InterHoldCo and the sole member of MergerCo, and NT InterHoldCo, a wholly-owned subsidiary of WNR and direct holder of the NTI Common Units owned by WNR or its subsidiaries immediately prior to the Effective Time, will jointly own all of the limited partner interests in the surviving entity. The general partner interest in NTI issued and outstanding immediately prior to the Effective Time will be unchanged and remain issued and outstanding in the surviving entity, and NTI GP, as the holder of such general partner interest, will continue as the sole general partner of the surviving entity as set forth in NTI’s Partnership Agreement (which will continue unchanged as the agreement of limited partnership of the surviving entity as of the Effective Time).

Based on the VWAP of a share of WNR Common Stock for the 20 consecutive NYSE full trading days ending at the close of regular trading hours on the NYSE on October 23, 2015 (the last trading day before the announcement of WNR’s proposal to acquire all of the outstanding NTI Common Units owned by the public), the Merger Consideration represents a premium of approximately 18% above the VWAP of the NTI Common Units for the same period.

If the Exchange Ratios result in an NTI Public Unitholder being entitled to receive a fractional share of WNR Common Stock, that NTI Common Unitholder will receive cash (without interest and rounded up to the nearest whole cent) in lieu of receiving any fractional share of WNR Common Stock to which any NTI Public Unitholder would otherwise have been entitled in an amount equal to such fractional interest multiplied by the VWAP of a share of WNR Common Stock as reported on the NYSE Composite Transactions Reporting System for the 20 consecutive NYSE full trading days ending at the close of the last NYSE full trading day immediately preceding the day the Merger closes.

Based on the 57,210,986 NTI Common Units outstanding on January 8, 2016, and eligible to be converted into shares of WNR Common Stock pursuant to the Merger Agreement (which number does not include the NTI Common Units owned by WNR or any of its subsidiaries), WNR expects to issue approximately 17,083,200 shares of WNR Common Stock in connection with the Merger. This number will represent approximately 15% of WNR’s outstanding common stock immediately after the Merger, based on the 93,687,506 shares of WNR Common Stock outstanding as of January 8, 2016.

6

Pursuant to the terms of the Merger Agreement, with respect to the quarter in which the Closing Date occurs, NTI will, to the extent it generates available cash in such quarter, make a prorated quarterly cash distribution to NTI Common Unitholders of record as of immediately prior to the Effective Time of the Merger of such available cash if the record date for the WNR quarterly cash dividend to be paid in that quarter occurs before the Closing Date. Accordingly, in the quarter that the Closing Date occurs, NTI Common Unitholders who receive WNR Common Stock in the Merger will receive (i) an NTI cash distribution in respect of the previous quarter, to the extent NTI generates available cash in such quarter; and (ii) either an NTI prorated cash distribution in respect of available cash generated by NTI in the quarter in which the Closing Date occurs or (assuming such unitholders continue to hold the shares of WNR Common Stock received in the Merger through the record date for such WNR dividend) the WNR quarterly cash dividend payable in the quarter in which the Closing Date occurs. The amount of any distribution will not have any effect on the Merger Consideration to be received by NTI common unitholders. For more information regarding the Merger Agreement terms governing the payment of NTI cash distributions, please read “The Merger Agreement—Covenants—Distributions.”

Pursuant to the Merger Agreement, prior to the Effective Time, the WNR Board or its compensation committee may adopt the NTI 2012 Long Term Incentive Plan, as amended from time to time (the “NTI LTIP”) as of the Effective Time, authorize the conversion of the outstanding NTI phantom units and NTI restricted units in accordance with the Merger Agreement, and take such other actions as may be necessary to authorize the events contemplated in the Merger Agreement in connection with the conversion of the NTI phantom units and the NTI restricted units. The Merger Agreement also provides that the WNR Board may determine not to adopt the NTI LTIP, in which case the conversion of the NTI phantom units and NTI restricted units would occur under existing WNR equity compensation plans, but otherwise the conversions would occur in the same manner as if the NTI LTIP was adopted by WNR. Pursuant to the Merger Agreement, the equity awards held by non-employee NTI directors, NTI Executives and NTI Employees will be converted as follows.

Equity Awards Held by Non-Employee NTI Directors

Immediately prior to the Effective Time, all awards of time-based NTI phantom units held by a non-employee member of the NTI GP Board that are outstanding immediately prior to the Effective Time will receive immediate and full acceleration of vesting. In exchange for each NTI phantom unit that becomes vested, a non-employee member of the NTI GP Board will receive $15.00 in cash without interest and 0.2986 of a share of WNR Common Stock (which is the Standard Mix of Consideration that NTI Public Unitholders will receive).

Equity Awards Held by NTI Executives and NTI Employees

With respect to the treatment of the outstanding and unvested NTI equity awards held by NTI Executives and NTI Employees, the general intent of the parties to the Merger Agreement is that such persons be in a generally comparable position after the Effective Time as before. At this time, neither NTI nor WNR have plans to grant new equity awards to the NTI Executives or the NTI Employees in connection with the Merger that are unrelated to the conversions described below.

| • | Time-Based NTI Phantom Units Held by NTI Executives. At the Effective Time, any award of time-based NTI phantom units held by an NTI Executive and outstanding and unvested immediately prior to the Effective Time will be converted into an award of phantom stock based on WNR Common Stock (“WNR Phantom Stock”). |

| • | Time-Based NTI Phantom Units Held by an NTI Employee. At the Effective Time, any award of time-based NTI phantom units held by an NTI Employee and outstanding and unvested immediately prior to the Effective Time will be converted into either a new WNR Phantom Stock award or a cash award, as determined by WNR in its discretion prior to the Effective Time. |

7

| • | Performance-Based NTI Phantom Units Held by an NTI Executive or an NTI Employee. At the Effective Time, any award of performance-based NTI phantom units held by an NTI Executive or an NTI Employee and outstanding immediately prior to the Effective Time and still subject to performance-based vesting criteria will be converted into either a new award of performance-based and time-based WNR Phantom Stock or a performance-based and time-based cash award, as determined by WNR in its discretion prior to the Effective Time. |

| • | Time-Based NTI Restricted Units Held by David L. Lamp. At the Effective Time, any award of time-based NTI restricted units held by David L. Lamp and outstanding immediately prior to the Effective Time will be cancelled in exchange for a new award of WNR Phantom Stock. |

| • | NTI Restricted Units Held by an NTI Employee. At the Effective Time, any NTI restricted units held by an NTI Employee (including any NTI restricted units that were originally granted as performance-based NTI restricted units but for which the performance period has lapsed and only time-based vesting restrictions remain) and outstanding immediately prior to the Effective Time will be cancelled and exchanged for either a new WNR Phantom Stock award or a cash award, as determined by WNR in its discretion prior to the Effective Time. |

With respect to the conversions summarized above, NTI phantom units and NTI restricted units will be converted with a formula that utilizes the exchange rates of the Standard Mix of Consideration. For a more complete discussion of the treatment of NTI equity awards, see “The Merger Agreement—Effect of Merger on Outstanding NTI Common Units and Other Interests” beginning on page 121 and “The Merger Agreement—Covenants—Conversion of Equity Awards” beginning on page 145.

Interest of Certain Persons in the Merger

In considering the recommendations of the NTI GP Conflicts Committee with respect to the Merger, NTI Common Unitholders should be aware that certain of the executive officers and directors of NTI GP have interests in the transaction that differ from, or are in addition to, the interests of NTI Common Unitholders generally, including:

| • | All of the directors and executive officers of NTI GP will receive continued indemnification for their actions as directors and executive officers. |

| • | Four of the nine directors of NTI GP are also employees or directors of WNR and own WNR Common Stock. One director of NTI GP, David L. Lamp, is the President and Chief Executive Officer of NTI GP and is expected to become the President and Chief Operating Officer of WNR following the consummation of the Merger. None of these five directors of NTI GP is on the NTI GP Conflicts Committee. |

| • | Some executive officers of NTI GP own WNR Common Stock, common units representing limited partner interests of WNRL (“WNRL Common Units”), and/or phantom units in WNRL and are expected to become employees of WNR following the Merger. |

| • | The directors and executive officers of NTI GP hold unvested and outstanding equity awards in NTI that may be subject to different treatment under the Merger Agreement than NTI Common Units. |

| • | Senior management of NTI GP provided certain input with respect to NTI’s future financial performance that WNR management utilized with respect to the preparation of the Management Projections (as defined in “Special Factors—Projected Financial Information” beginning on page 55 of this proxy statement/prospectus). The Management Projections were provided to the WNR Board and the NTI GP Conflicts Committee for purposes of evaluating the proposed Merger. The Management Projections were also provided to Evercore for use in connection with its financial analyses and opinions and to Goldman Sachs for use in its financial analyses. For a detailed description of the Management Projections, see “Special Factors—Projected Financial Information.” |

8

| • | The Chairman of the NTI GP Conflicts Committee receives $10,000 annually and each member of the NTI GP Conflicts Committee, including the Chairman, receives $1,500 per NTI GP Conflicts Committee meeting attended, in addition to other compensation they receive for service on the NTI GP Board and its other committees. |

For more detail about these interests, see “Special Factors—Interest of Certain Persons in the Merger” beginning on page 93 of this proxy statement/prospectus.

NTI Unit Ownership of WNR and of WNR and NTI GP’s Directors and Executive Officers

As of [●], 2016, the record date, WNR and its subsidiaries held and were entitled to vote, in the aggregate, 35,622,500 NTI Common Units, which represent approximately 38.4% of the outstanding NTI Common Units. The directors and officers of WNR and NTI GP held and were entitled to vote, in the aggregate, NTI Common Units representing less than one percent of the outstanding NTI Common Units. We believe that the directors and officers of WNR and NTI GP intend to vote all of their NTI Common Units FOR the Merger Proposal and FOR the NTI Compensation Proposal. Pursuant to the Merger Agreement, WNR has agreed to vote the NTI Common Units owned beneficially or of record by it or any of its subsidiaries in favor of the Merger Proposal and the NTI Compensation Proposal. Accordingly, we believe approximately 36,121,019 of the outstanding NTI Common Units will be voted in favor of the Merger Proposal and the NTI Compensation Proposal by WNR and its subsidiaries and the directors and officers of WNR and NTI GP. See “Special Factors—Security Ownership of Certain Beneficial Owners and Management of NTI” beginning on page 99 of this proxy statement/prospectus.

Directors and Executive Officers of WNR and NTI GP Following the Merger

The directors of WNR and the executive officers of NTI GP prior to the Merger are expected to continue as the directors of WNR and the executive officers of NTI GP, respectively, following the Merger. David L. Lamp, currently the President and Chief Executive Officer of NTI GP, is expected to become the President and Chief Operating Officer of WNR upon consummation of the Merger. Jeff A. Stevens, currently the President and Chief Executive Officer of WNR, is expected to resign from his position as President but will remain the Chief Executive Officer of WNR upon consummation of the Merger. Otherwise, it is expected that the executive officers of WNR prior to the Merger will continue in their respective positions after the Merger. The independent directors of NTI GP are not expected to continue to serve as directors of NTI GP following the Merger. Under the terms of the Merger Agreement, WNR has no obligation to appoint or nominate the independent directors of NTI GP to serve as directors of WNR or any of its affiliates and no discussions have occurred between such directors and WNR with respect to serving as a director of WNR or any of its affiliates.

Where and When

The NTI Special Meeting will take place in [●], located [●], on [●], at [●]., Tempe, Arizona Time.

What You Are Being Asked to Vote On

At the NTI Special Meeting, NTI Common Unitholders will be asked to consider and vote upon the Merger Proposal. The NTI Common Unitholders will also be asked to vote, on an advisory basis, on the NTI Compensation Proposal.

9

Who May Vote

You may vote at the NTI Special Meeting if you owned NTI Common Units at the close of business on the record date, [●]. On that date, there were [●] NTI Common Units outstanding. You may cast one vote for each outstanding NTI Common Unit that you owned at the close of business on the record date.

What Constitutes a Quorum

The presence in person or by proxy at the NTI Special Meeting of the holders of a majority of NTI Common Units as of the close of business on the record date will constitute a quorum and will permit NTI to conduct the proposed business at the NTI Special Meeting. NTI Common Units held in your name will be counted as present at the NTI Special Meeting if you (i) are present in person at the NTI Special Meeting or (ii) have submitted and not revoked a properly executed proxy card or properly submitted your proxy by telephone or internet. Proxies received but marked as abstentions will be counted as NTI Common Units that are present and entitled to vote for purposes of determining the presence of a quorum. Broker non-votes (if any) will also be considered present at the NTI Special Meeting for purposes of determining the presence of a quorum but will not be included in the vote.

What Vote Is Needed

The Merger Proposal will be approved if the holders, as of the record date of the NTI Special Meeting, of a majority of the outstanding NTI Common Units vote in favor of the Merger Proposal at the NTI Special Meeting. Failure to vote, abstentions and broker non-votes (if any) will have the same effect as a vote against the Merger Proposal. Approval, on an advisory, non-binding basis, of the NTI Compensation Proposal requires the affirmative vote of a majority of the outstanding NTI Common Units present in person or represented by proxy and entitled to vote at the NTI Special Meeting. Abstentions will have the same effect as a vote against the NTI Compensation Proposal. Broker non-votes (if any) will have no effect on the NTI Compensation Proposal. Because the vote on the NTI Compensation Proposal is advisory in nature only, it will not be binding on NTI or WNR.

Recommendation of the NTI GP Conflicts Committee and Its Reasons for Recommending Approval of the Merger Proposal and the NTI Compensation Proposal

On December 21, 2015, the NTI GP Conflicts Committee unanimously determined that the Merger Agreement and the Merger Transactions are fair and reasonable to the NTI Unaffiliated Unitholders and NTI, and are not adverse to the interests of the NTI Unaffiliated Unitholders or the interests of NTI. Based upon such determination, the NTI GP Conflicts Committee approved the Merger Agreement and the Merger Transactions, the execution, delivery and performance of the Merger Agreement by NTI GP and NTI, and the submission of the Merger Agreement and the Merger Transactions to a vote of the NTI Common Unitholders. The NTI GP Conflicts Committee recommends that NTI Common Unitholders vote in favor of the Merger Proposal and the NTI Compensation Proposal.

The NTI GP Conflicts Committee consulted with its financial and legal advisors and considered many factors in making its determination, approvals and recommendation. For a discussion of these factors, see “Special Factors—Recommendation of the NTI GP Conflicts Committee and Its Reasons for Recommending Approval of the Merger Proposal and the NTI Compensation Proposal” beginning on page 49 of this proxy statement/prospectus.

Opinion of Evercore Group L.L.C.

The NTI GP Conflicts Committee retained Evercore to act as its financial advisor in connection with the Merger. At the meeting of the NTI GP Conflicts Committee on December 21, 2015, Evercore rendered its oral

10

opinion (subsequently confirmed in writing) that, as of that date, and based upon and subject to the factors, procedures, assumptions, qualifications and limitations set forth in its opinion, the Merger Consideration to be received in the Merger was fair, from a financial point of view, to the NTI Unaffiliated Unitholders.

Evercore’s opinion is directed to the NTI GP Conflicts Committee. It does not address any aspects of the Merger other than the Merger Consideration and does not constitute a recommendation as to how NTI Common Unitholders should vote on the Merger or any matters related thereto.

The full text of the Evercore written opinion dated December 21, 2015 is attached to this proxy statement/prospectus as Annex B. NTI encourages its unitholders to read the opinion carefully and in its entirety. The summary of Evercore’s opinion set forth in this proxy statement/prospectus is qualified in its entirety by reference to the full text of the opinion.

The Merger Agreement is attached to this proxy statement/prospectus as Annex A and is incorporated by reference into this proxy statement/prospectus. You are encouraged to read the Merger Agreement in its entirety because it is the legal document that governs the Merger.

Conditions to Completion of the Merger

As more fully described in this proxy statement/prospectus and in the Merger Agreement, each party’s obligation to complete the Merger depends on a number of conditions being satisfied or, where legally permissible, waived, including the following:

| • | the Merger Agreement and the Merger Transactions must have been approved by the affirmative vote of NTI Common Unitholders, as of the record date for the NTI Special Meeting, holding a majority of the outstanding NTI Common Units; |

| • | any waiting period applicable to the transactions contemplated by the Merger Agreement under the Hart-Scott Rodino Antitrust Act of 1976, as amended, must have been terminated or expired; |

| • | all filings required to be made prior to the Effective Time with, and all other consents, approvals, permits and authorizations required to be obtained prior to the Effective Time from, any governmental authority in connection with the execution and delivery of the Merger Agreement and the consummation of the Merger Transactions by the parties or their affiliates must have been made or obtained, except where the failure to obtain such consents, approvals, permits and authorizations could not be reasonably likely to result in a material adverse effect with respect to WNR, on the one hand, or NTI and NTI GP on the other hand; |

| • | no order, decree or injunction of any court or agency of competent jurisdiction may be in effect, and no law may have been enacted or adopted, that enjoins, prohibits or makes illegal the consummation of any of the Merger Transactions, and no action, proceeding or investigation by any governmental authority with respect to the Merger or the other Merger Transactions may be pending that seeks to restrain, enjoin, prohibit or delay the consummation of the Merger or such other Merger Transaction or to impose any material restrictions or requirements thereon or on WNR or NTI with respect to the Merger Transactions; |

| • | the registration statement of which this proxy statement/prospectus is a part must have become effective under the Securities Act and no stop order suspending the effectiveness of the registration statement has been issued and no proceedings for that purpose has been initiated or threatened by the SEC; and |

| • | the shares of WNR Common Stock to be issued in the Merger must have been approved for listing on the NYSE, subject to official notice of issuance. |

11

The respective obligations of WNR and MergerCo, on the one hand, and NTI and NTI GP, on the other hand, to effect the Merger are further subject to the satisfaction or, if applicable, waiver, on or prior to the Closing Date of the Merger, of each of the following conditions:

| • | the representations and warranties of the other parties being true and correct both when made and at and as of the date of the closing, subject to certain standards, including materiality and material adverse effect qualifications, as described under “The Merger Agreement—Conditions to the Merger” beginning on page 132; |

| • | each and all of the agreements and covenants of the other parties to be performed and complied with pursuant to the Merger Agreement on or prior to the Effective Time must have been duly performed and complied with in all material respects; |

| • | the receipt of a certificate signed by the chief executive officer or chief financial officer of the other parties dated as of the Closing Date and to the effect that the conditions described in the first two bullet points immediately above have been satisfied; and |

| • | there must not have occurred a material adverse effect with respect to the other parties between the signing of the Merger Agreement and the Closing Date. |

Unitholder Approval; Acquisition Proposal; Change in Recommendation

Subject to the terms and conditions of the Merger Agreement, and except as described further in “The Merger Agreement—Covenants—Unitholder Approval,” NTI will take, in accordance with applicable law, applicable stock exchange rules and NTI’s Partnership Agreement, all action necessary to establish a record date for, duly call, give notice of, convene and hold the NTI Special Meeting to consider and vote upon the approval of the Merger Proposal, as promptly as practicable after the registration statement of which this proxy statement/prospectus is a part is declared effective. Subject to the terms and conditions of the Merger Agreement, the NTI GP Conflicts Committee will recommend approval of the Merger Proposal to the NTI Common Unitholders (the “NTI Recommendation”), and NTI and NTI GP will take all reasonable lawful action to solicit such approval by the NTI Common Unitholders. Except under certain conditions described in the following paragraph and in “The Merger Agreement—Covenants—Unitholder Approval,” neither the NTI GP Conflicts Committee nor the NTI GP Board will (i) withdraw, modify or qualify, or publicly propose to withdraw, modify or qualify, in any manner adverse to WNR, the NTI Recommendation or (ii) publicly approve, adopt or recommend, or publicly propose to approve, adopt or recommend, any “Acquisition Proposal” (defined and described more fully under “The Merger Agreement—Covenants—Acquisition Proposals”). The actions described in the preceding sentence are referred to in this proxy statement/prospectus as an “NTI Change in Recommendation.” None of NTI GP, NTI or any of their subsidiaries will execute or enter into any letter of intent, memorandum of understanding, agreement in principle, merger agreement, acquisition agreement, option agreement, joint venture agreement, partnership agreement or other similar contract providing for any Acquisition Proposal. NTI’s obligations pursuant to the first sentence of this paragraph will not be affected by (A) the commencement, public proposal, public disclosure or communication to NTI of any Acquisition Proposal or (B) the withdrawal, modification or qualification by the NTI GP Conflicts Committee or the NTI GP Board of the NTI Recommendation or their approval of the Merger Agreement or the Merger Transactions.

Notwithstanding the immediately preceding paragraph, at any time prior to obtaining the NTI Unitholder Approval, the NTI GP Conflicts Committee or the NTI GP Board may, in response to an unsolicited Acquisition Proposal, make an NTI Change in Recommendation if it has determined in good faith, after consultation with its outside legal counsel and financial advisors, that (i) failure to make an NTI Change in Recommendation would be inconsistent with its duties under NTI’s Partnership Agreement or applicable law and (ii) such Acquisition Proposal constitutes a Superior Proposal (defined and described more fully under “The Merger Agreement—Covenants—Acquisition Proposals”); provided, however, that neither the NTI GP Conflicts Committee nor the

12

NTI GP Board will be entitled to exercise its right to make an NTI Change in Recommendation pursuant to this sentence, unless (a) NTI has not breached its obligations described under “The Merger Agreement—Covenants—Acquisition Proposals;” in any material respect, (b) NTI has provided to WNR three business days prior written notice (such notice, a “Notice of Proposed Recommendation Change”), advising WNR that the NTI GP Conflicts Committee or the NTI GP Board intends to take such action, specifying the reasons for taking such action in reasonable detail, including that the NTI GP Conflicts Committee has determined that the Acquisition Proposal is a Superior Proposal, and specifying the material terms and conditions of such Acquisition Proposal and the identity of the person making such Acquisition Proposal (with any amendment to the terms of any such Acquisition Proposal requiring a new notice and an additional three business day period), (c) NTI has provided to WNR all materials and information delivered or made available to the person or persons making such determined Superior Proposal (to the extent not previously provided to WNR), (d) each of NTI and the NTI GP Conflicts Committee has negotiated, and has caused its representatives to negotiate, in good faith with WNR during such notice period to enable WNR to revise the terms of the Merger Agreement such that it would obviate the need for making the NTI Change in Recommendation and (e) following the end of such notice period, the NTI GP Conflicts Committee will have considered in good faith any changes to the Merger Agreement proposed by WNR and will have determined, after consultation with its outside legal counsel and financial advisors, that the failure to make an NTI Change in Recommendation would continue to be inconsistent with its duties under NTI’s Partnership Agreement or applicable law even if such revisions proposed by WNR were to be given effect and that the Acquisition Proposal continues to be a Superior Proposal even if the revisions proposed by WNR were to be given effect. Any NTI Change in Recommendation will not invalidate the approval (including approval by a majority of the members of the NTI GP Conflicts Committee) of the Merger Agreement or any other approval of the NTI GP Conflicts Committee or of NTI GP, including in any respect that would have the effect of causing any state (including Delaware) takeover statute or other similar statute to be applicable to the Merger Transactions.

Notwithstanding the first paragraph in this subsection “Unitholder Approval; Acquisition Proposal; Change in Recommendation,” at any time prior to obtaining NTI Unitholder Approval, the NTI GP Conflicts Committee or the NTI GP Board may make an NTI Change in Recommendation if it has determined in good faith, after consultation with its outside legal counsel and financial advisors, that failure to make an NTI Change in Recommendation would be inconsistent with its duties under NTI’s Partnership Agreement or applicable law; provided, however, that neither the NTI GP Conflicts Committee nor the NTI GP Board will be entitled to exercise its right to make an NTI Change in Recommendation pursuant to this sentence unless (i) NTI has not breached its obligations described under “The Merger Agreement—Covenants—Acquisition Proposals” in any material respect, (ii) NTI has provided to WNR a Notice of Proposed Recommendation Change advising WNR that the NTI GP Conflicts Committee or the NTI GP Board intends to take such action, specifying the reasons therefor in reasonable detail, (iii) each of NTI and the NTI GP Conflicts Committee has negotiated, and has caused its representatives to negotiate, in good faith with WNR during such notice period to enable WNR to revise the terms of the Merger Agreement such that it would obviate the need for making the NTI Change in Recommendation, and (iv) following the end of such notice period, the NTI GP Conflicts Committee will have considered in good faith any changes to the Merger Agreement proposed by WNR and will have determined, after consultation with its outside legal counsel and financial advisors, that the failure to make an NTI Change in Recommendation would continue to be inconsistent with its duties under NTI’s Partnership Agreement or applicable law even if such revisions proposed by WNR were to be given effect. Any NTI Change in Recommendation will not invalidate the approval (including approval by a majority of the members of the NTI GP Conflicts Committee) of the Merger Agreement or any other approval of the NTI GP Conflicts Committee or NTI GP, including in any respect that would have the effect of causing any state (including Delaware) takeover statute or other similar statute to be applicable to the Merger Transactions.

NTI GP and NTI will, and they will cause their respective subsidiaries and will use reasonable best efforts to cause their respective representatives to, immediately cease and terminate any solicitation, encouragement,

13

discussions or negotiations with any person that may be ongoing with respect to or that may reasonably be expected to lead to an Acquisition Proposal, and request such person to promptly return or destroy all confidential information concerning NTI and its subsidiaries.

Neither NTI GP nor NTI will, and they will cause their respective subsidiaries and will use reasonable best efforts to cause their respective representatives not to, directly or indirectly, (i) initiate, solicit, knowingly encourage or facilitate (including by way of furnishing information) any inquiries regarding, or the making or submission of any proposal or offer that constitutes, or may reasonably be expected to lead to, an Acquisition Proposal, (ii) conduct or participate in any discussions or negotiations regarding any Acquisition Proposal, or (iii) furnish to any person any non-public information or data relating to NTI or any of its subsidiaries or afford access to the business, properties, assets, or, except as required by law or the NTI Partnership Agreement, books or records of NTI or any of its subsidiaries.