As filed with the Securities and Exchange Commission on July 20, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

First Data Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 7389 | 47-0731996 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

225 Liberty Street, 29th Floor

New York, New York 10281

(800) 735-3362

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Adam L. Rosman, Esq.

Executive Vice President, General Counsel and Secretary

225 Liberty Street, 29th Floor

New York, New York 10281

(800) 735-3362

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Joseph H. Kaufman, Esq. Richard A. Fenyes, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017-3954 (212) 455-2000 |

Richard D. Truesdell, Jr., Esq. Byron B. Rooney, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1)(2) |

Amount of Registration Fee | ||

| Class A common stock, par value $0.01 per share |

$100,000,000 | $11,620 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of shares of Class A common stock that the underwriters have the option to purchase. See “Underwriting.” |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated July 20, 2015.

PRELIMINARY PROSPECTUS

Shares

FIRST DATA CORPORATION

Class A Common Stock

This is an initial public offering of shares of Class A common stock of First Data Corporation. We are offering shares of our Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. We currently expect that the initial public offering price of our Class A common stock will be between $ and $ per share. We intend to apply to list our Class A common stock on under the symbol “ .”

Upon consummation of this offering, we will have two classes of common stock: our Class A common stock and our Class B common stock. The rights of the holders of Class A common stock and Class B common stock will be identical, except with respect to voting, conversion, and transfer restrictions applicable to the Class B common stock. Each share of Class A common stock will be entitled to one vote. Each share of Class B common stock will be entitled to ten votes and will be convertible at any time into one share of Class A common stock.

After the completion of this offering, affiliates of Kohlberg Kravis Roberts & Co. L.P. (KKR) will continue to control a majority of the voting power of our common stock. As a result, we will be a “controlled company” within the meaning of the corporate governance standards of the applicable stock exchange. See “Principal Stockholders.”

Investing in our Class A common stock involves risk. See “Risk Factors” beginning on page 18 to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission (SEC) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to us(1) |

$ | $ | ||||||

| (1) | See “Underwriting.” |

To the extent that the underwriters sell more than shares of our Class A common stock, the underwriters have the option to purchase up to an additional shares from us at the initial public offering price, less the underwriting discounts and commissions, within 30 days of the date of this prospectus.

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2015.

Prospectus dated , 2015.

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize to be delivered to you. We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. We are offering to sell, and seeking offers to buy, these securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the securities. Our business, financial condition, results of operations, and prospects may have changed since that date.

| Page | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| iii | ||||

| iv | ||||

| v | ||||

| 1 | ||||

| 18 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 43 | ||||

| 45 | ||||

| 50 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

52 | |||

| 92 | ||||

| 154 | ||||

| 188 | ||||

| 190 | ||||

| 192 | ||||

| 206 | ||||

| 215 | ||||

| Certain United States Federal Income and Estate Tax Consequences to Non-U.S. Holders |

218 | |||

| 221 | ||||

| 227 | ||||

| 227 | ||||

| 227 | ||||

| F-1 | ||||

Unless otherwise indicated or the context otherwise requires, financial data in this prospectus reflects the consolidated business and operations of First Data Corporation and its consolidated subsidiaries. Unless the context otherwise requires, all references herein to “First Data,” “FDC,” the “Company,” “we,” “our,” or “us” refer to First Data Corporation and its consolidated subsidiaries.

Amounts in this prospectus and the consolidated financial statements included in this prospectus are presented in U.S. Dollars rounded to the nearest million, unless otherwise noted. The accounting policies set out in the audited consolidated financial statements contained elsewhere in this prospectus have been consistently applied to all periods presented.

i

MARKET, RANKING, AND OTHER INDUSTRY DATA

The data included in this prospectus regarding markets, ranking, and other industry information are based on reports of government agencies or published industry sources, and estimates are based on First Data management’s knowledge and experience in the markets in which First Data operates. The Nilson Report, an industry source we cite in this prospectus, is generally published monthly. Data regarding the industries in which we compete and our market position and market share within these industries are inherently imprecise and are subject to significant business, economic, and competitive uncertainties beyond our control, but we believe they generally indicate size, position, and market share within these industries. Our own estimates are based on information obtained from our trade and business organizations and other contacts in the markets in which we operate. We are responsible for all of the disclosure in this prospectus, and we believe these estimates to be accurate as of the date of this prospectus or such other date stated in this prospectus. However, this information may prove to be inaccurate because of the method by which we obtained some of the data for the estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process, and other limitations and uncertainties. As a result, you should be aware that market, ranking, and other similar industry data included in this prospectus, and estimates and beliefs based on that data, may not be reliable. Neither we nor the underwriters can guarantee the accuracy or completeness of any such information contained in this prospectus.

TRADEMARKS, SERVICE MARKS, AND TRADE NAMES

Solely for convenience, the trademarks, service marks, and trade names referred to in this prospectus are presented without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, and trade names. All trademarks, service marks, and trade names appearing in this prospectus are the property of their respective owners.

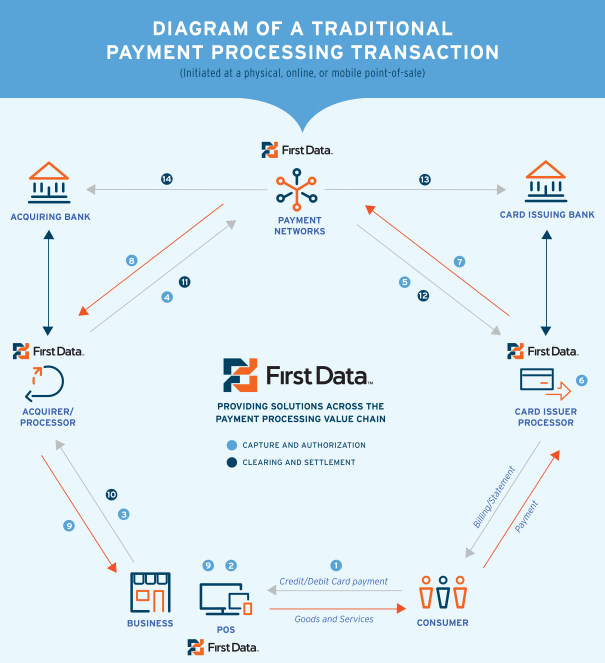

A substantial portion of our business is conducted through “alliances” with banks and other institutions. Where we discuss the operations of our Global Business Solutions segment, such discussions include our alliances because they generally do not have their own operations (other than certain majority owned and equity method alliances) and are part of our core operations. Our alliance structures take on different forms, including consolidated subsidiaries, equity method investments, and revenue sharing arrangements. Under the alliance program, we and a bank or other institution form a venture, either contractually or through a separate legal entity. Merchant contracts may be contributed to the venture by us and/or the bank or institution. The banks or other institutions generally provide card association sponsorship, clearing, and settlement services. These institutions typically act as a merchant referral source when the institution has an existing banking or other relationship. We provide transaction processing and related functions. Both we and our alliance partners may provide management, sales, marketing, and other administrative services. The alliance structure allows us to be the processor for multiple financial institutions, any one of which may be selected by the merchant as their bank partner.

ii

This prospectus contains “non-GAAP financial measures” that are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with generally accepted accounting principles in the United States (GAAP). Specifically, we make use of the non-GAAP financial measures “Adjusted EBITDA,” “Adjusted Net Income,” and “Covenant EBITDA.”

Adjusted EBITDA represents:

| • | Net income or loss attributable to First Data, plus |

| • | Interest expense, net; |

| • | Income tax (benefit) expense; |

| • | Depreciation and amortization; |

| • | Stock-based compensation; and |

| • | Other adjustments as described in Note (8) to “Prospectus Summary—Summary Historical Consolidated Financial and Other Data.” |

Adjusted Net Income represents:

| • | Net income or loss attributable to First Data, plus |

| • | Stock-based compensation; |

| • | Loss on debt extinguishment; |

| • | Amortization of acquisition intangibles; and |

| • | Other adjustments as described in Note (9) to “Prospectus Summary—Summary Historical Consolidated Financial and Other Data.” |

We also make use of the non-GAAP financial measure “Covenant EBITDA” which is used to measure covenant compliance in agreements governing certain of our indebtedness. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Guarantees and covenants.”

Adjusted EBITDA, Adjusted Net Income, and Covenant EBITDA are not recognized terms under GAAP and do not purport to be alternatives to net income (loss) attributable to First Data as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Additionally, these measures are not intended to be a measure of free cash flow available for management’s discretionary use as they do not consider certain cash requirements such as interest payments, tax payments, and debt service requirements. The presentations of these measures have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Management believes that Adjusted EBITDA and Adjusted Net Income are helpful in highlighting trends because they exclude the results of decisions that are outside the control of operating management. Management believes that the presentation of Covenant EBITDA is useful to provide additional information to investors about items that will impact the calculation of EBITDA that is used to determine covenant compliance under the agreements governing certain of our existing indebtedness. Management compensates for the limitations of using non-GAAP financial measures by using them to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, and capital investments.

iii

iv

I joined First Data in the first half of 2013 because I saw a global leader in the rapidly innovating payments industry. First Data’s central position in global electronic payments was undeniable. The company served millions of businesses around the world and processed more than 2,000 transactions per second. It had a financial services processing business with hundreds of millions of card accounts on file, owned a leading independent debit network, and operated an acquiring business that processed more than 40% of U.S. electronic payment volume, or roughly 10% of U.S. GDP. I considered First Data waterfront property.

Yes, the business had its challenges – continuous management change, a restructuring plan largely based on selling assets, $24.5 billion of debt, and flat revenue growth the year before I joined. But I knew that payments was a growth industry, that technology was the great enabler, and that First Data had a fabulous set of assets and clients with whom it could do so much more. Simply put, I saw a unique opportunity – the potential for strong, profitable growth coupled with deleveraging, on an unparalleled scale.

I also saw that achieving this potential would require transforming this company. In the past two years, we’ve laid a strong foundation, and we are continuing to invest in innovation, infrastructure, and leadership. And we are just getting started.

Today, First Data offers investors the opportunity to join what I believe will be one of the most significant transformations in our industry. We will focus on three main areas: growing First Data profitably, continuing to improve our balance sheet through deleveraging and opportunistic debt refinancing, and building a durable enterprise that can withstand the uncertainties of our global economy.

This prospectus describes in detail our business and strategy, our progress, and how we’re positioned well for the future. In this letter, I want to share my personal perspective on the foundation we’ve built, the transformation underway, and our journey ahead.

Laying the Foundation

As the journey began, it became immediately apparent that we weren’t working on change, we were working on transformation. We needed to all row in the same direction, deliver integrated solutions, and truly manage the company as a global business.

With more than 24,000 employees in a company that was unsure of its direction, it was critical to have everyone completely aligned around a clear mission and purpose. When I arrived, fewer than 300 employees owned stock in this company. That wasn’t sufficient. So in July 2013, we fundamentally changed our compensation and benefits structure. We decided that all employees would become owner-associates and have an equity stake in our future. Our managers, in particular, would receive equity as a significant component of their annual compensation.

We also decided that rather than selling assets to manage our balance sheet, we would invest and build. First Data’s broad array of assets represented to us a source of tremendous competitive advantage. They gave us an opportunity to integrate our offerings and provide clients enterprise solutions on a scale our competitors could not rival.

We have global clients and we intend to further globalize our solutions. But our company was not organized to truly support our global aspirations. We recently reorganized First Data into three global lines of business. The individual geographies now report directly to me with the dissolution of our previous International segment.

v

Our Transformation

We have what so many innovators often lack – the ability to distribute to a large client base. We have a unique opportunity to invest in innovation, integrate new innovations into our existing offerings, and leverage the scale of our distribution. Our team’s deep expertise in technology, commerce, security, operations, and control can all be harnessed to vertically extend our relationships with our clients.

We are focused on embedding innovation deeply into First Data. Clover, a Silicon Valley start-up that we acquired just a few months before I joined, was the first of many examples to follow of First Data’s ability to execute from concept to commercialization, at scale. We brought Clover’s integrated point-of-sale operating system to market in 11 months. After Clover, we acquired five additional innovative commerce technology start-ups, and we now have nearly 200 employees in Silicon Valley and Silicon Alley.

But buying start-ups is not the hard part. We are proud of our ability to retain the key founders and employees of each of the start-ups we have acquired, while commercializing their innovations. We know how to manage technology and technologists.

Our vision is to be the industry’s grand collaborator. Our core belief is that through collaboration, we will help our clients grow their business through greater choice. In the past two years, we have partnered on a variety of innovations and agreements with major and emerging networks, prominent global financial institutions, marquee brands, and leading technology companies large and small.

We have also invested significantly in our technology infrastructure, both in management expertise and dollars. We worked equally on our operations and our service models to deliver to our clients’ expectations. And maintaining a robust control environment is a core responsibility that we have to our clients and regulators. We view our technology infrastructure, operations, and control environment as mission-critical to our long-term success.

First Data had been both an underinvested and undermanaged business. Before I arrived, there were five people on our Management Committee. Critical functions such as operations, technology, and operating control were not even at the table. Diversity on the team was limited at best. Today, I’m honored to partner with 15 members of my Management Committee who are diverse in every aspect, and we are proud of our inclusive environment. Below the Management Committee, we have also injected new leadership talent into First Data. Two-thirds of our 150 most senior employees have been hired since I joined.

While making these investments, we’ve also taken significant steps to strengthen our balance sheet. In the summer of 2014, we raised $3.5 billion of equity to pay down debt in one of the largest-ever U.S. private placements. As part of that capital raise, KKR chose to invest another $1.2 billion in First Data, including capital from its own balance sheet, solidifying First Data as KKR’s largest investment ever and the largest on its own balance sheet. The most revealing part of that capital raise was that we attracted significant interest from new investors who understood our transformation.

The Journey Ahead

Almost daily, when I meet prospective and existing clients, their receptiveness to our new solutions gives me incredible confidence in our future. They love the innovations, but they are equally delighted to learn that a trusted name like First Data can be their partner for a broad array of commerce solutions. We are unlocking the power of enterprise solutions at First Data.

Our transformation is just starting. We are only now beginning to see the benefits of offering our clients enterprise solutions. Our pipeline of innovations—webstore-in-a-box solutions, virtual gift card capabilities, solutions for alternative lenders, next-generation network fraud solutions, among others—are just beginning to enter the market. And key members of our Management Committee have been here less than one year.

vi

We love the hand that we have – we have millions of clients, we know how to innovate and collaborate, our leadership bench is deep, and being in business with KKR has been great. We have much work to do, and we know First Data has not yet truly arrived. We know we are on the right path, and we know we will get there.

I would like to extend my gratitude to First Data’s many clients around the world. This company would not be where it is today without your support. We are truly dedicated to helping you grow your business, as we know we cannot win if you do not prosper.

I would also like to thank all of the owner-associates of First Data worldwide. The changes we have undergone in the past few years have been significant to say the least, and I deeply appreciate your tenacity and loyalty to this storied company. I am honored to be in business with each and every one of you, and consider it my personal responsibility to ensure that First Data is a great place for you to work and prosper.

As we embark on this journey as a public company, we intend to be transparent with all of our owners about what’s working well, and what is not. We will work hard to achieve the full potential of this company and make you proud to be a part of First Data.

Sincerely yours,

Frank J. Bisignano

Chairman and Chief Executive Officer

vii

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in this prospectus, is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information presented under the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” and the consolidated financial statements and the notes thereto, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties.

Our Company

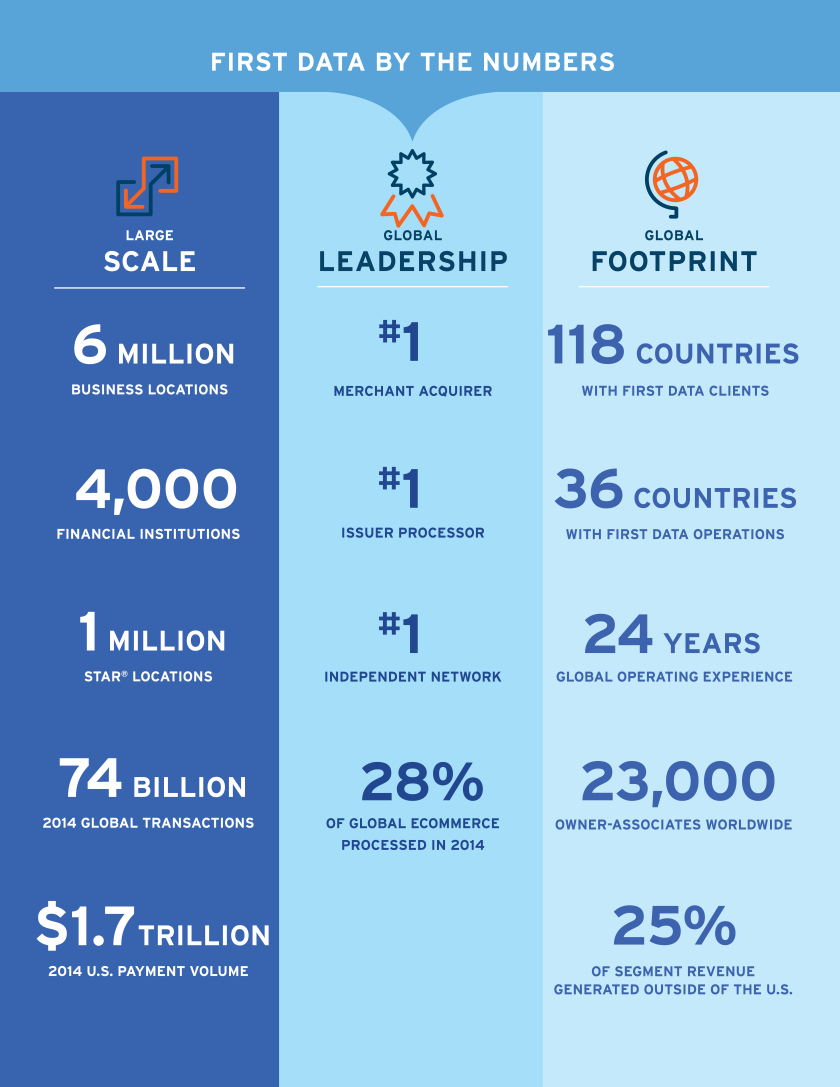

First Data sits at the center of global electronic commerce. We believe we offer our clients the most complete array of integrated solutions in the industry, covering their needs across next-generation commerce technologies, merchant acquiring, issuing, and network solutions. We serve our clients in 118 countries, reaching approximately 6 million business locations and over 4,000 financial institutions. We believe we have the industry’s largest distribution network, driven by our partnerships with many of the world’s leading financial institutions, our direct sales force, and a network of distribution partners. We are the largest merchant acquirer, issuer processor, and independent network services provider in the world, enabling businesses to accept electronic payments, helping financial institutions issue credit, debit and prepaid cards, and routing secure transactions between them. In 2014, we processed 74 billion transactions globally, or over 2,300 per second, and processed 28% of the world’s eCommerce volume. In our largest market, the United States, we acquired $1.7 trillion of payment volume, accounting for nearly 10% of U.S. GDP last year.

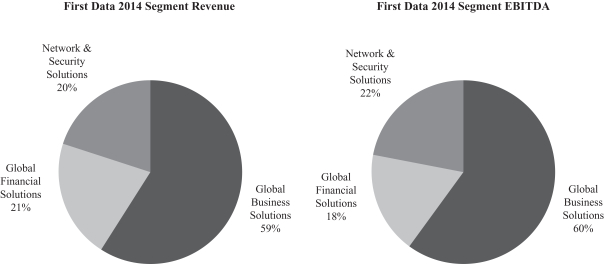

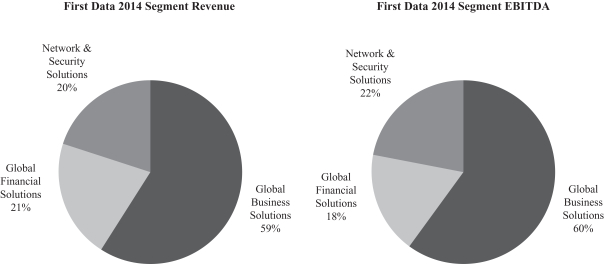

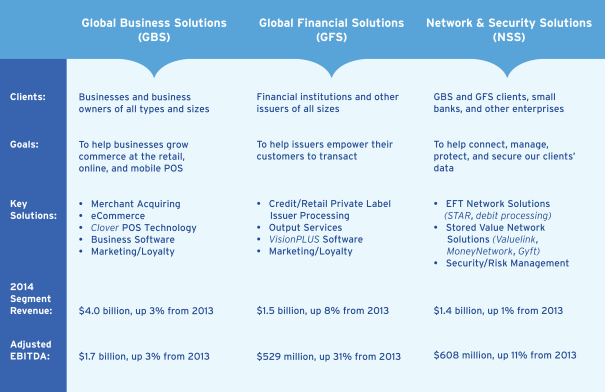

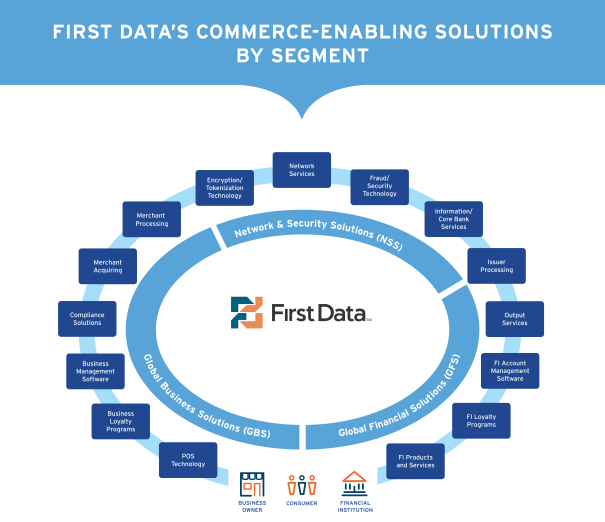

Our company is organized around three primary lines of business:

| • | Global Business Solutions (GBS) – This segment provides retail point-of-sale (POS) merchant acquiring and eCommerce services as well as next-generation offerings such as mobile payment services, webstore-in-a-box solutions, and our cloud-based Clover point-of-sale operating system, which includes a marketplace for proprietary and third-party business apps. |

| • | Global Financial Solutions (GFS) – This segment provides credit solutions for bank and non-bank issuers. These include credit and retail private-label card processing within the United States and international markets, as well as licensed financial software systems, such as our VisionPLUS bank processing application, and lending solutions. GFS also provides financial institutions with a suite of related services including card personalization and embossing, statement printing, client service, and remittance processing. |

| • | Network & Security Solutions (NSS) – This segment provides a wide range of value-added solutions that we sell to clients in our GBS and GFS segments, smaller financial institutions, and other enterprise clients. These solutions include our electronic funds transfer (EFT) network solutions, such as our STAR Network, our debit card processing solutions, our stored value network solutions, such as Money Network, ValueLink, Gyft, and Transaction Wireless, and our security and fraud solutions, such as TransArmor and TeleCheck. This segment also supports our other digital strategies, including online and mobile banking, and our business supporting mobile wallets. |

Our business is characterized by high levels of recurring revenue, such as transaction related fees, a diverse client base, and multi-year client contracts, which enable us to grow alongside our clients. Our business also generally requires minimal incremental capital expenditures and working capital to support additional revenue within our existing business lines.

1

In 2014, we generated $11.2 billion of revenue, $1.4 billion of operating profit, and had a net loss attributable to First Data of $458 million, reflecting an increase of 3%, 28% and 47% (decrease of loss), respectively, over 2013. For the same period, we generated segment revenues (which exclude reimbursable fees and other items) of $6.9 billion, Adjusted EBITDA of $2.7 billion, and Adjusted Net Income of $409 million, reflecting an increase of 3%, 9% and 354%, respectively, over 2013. For additional information regarding our segment revenues and non-GAAP financial measures, including a reconciliation of Adjusted EBITDA and Adjusted Net Income to net income attributable to First Data, see “—Summary Historical Consolidated Financial and Other Data.”

Our Distribution Platform

We deliver our solutions around the world through a broad set of distribution channels. We believe these channels, collectively, give us one of the largest sales forces in our industry, enabling us to reach clients of all sizes, types, and industry verticals in a cost-effective manner. Our large distribution platform often makes us an attractive partner for established and emerging commerce solution providers.

For GBS, we believe we have the industry’s largest network of bank partnerships for merchant acquiring, including equity alliances with eight large banks around the world in which we have a controlling or material equity stake, and over 80 revenue sharing partnerships. Our bank partnerships include some of the largest financial institutions in the world, such as Bank of America Corporation, Wells Fargo, The PNC Financial Services Group, Citigroup, SunTrust Banks, Lloyds Banking Group, Allied Irish Banks, ICICI Bank, and ABN AMRO Group.

In addition, we have a large direct sales force, and we partner with over 1,100 third parties who actively re-sell our solutions, including independent sales agents, independent sales organizations (ISOs), payment services providers (PSPs), independent software vendors (ISVs), and value-added resellers (VARs) who often have specialized sales capabilities to reach into local communities, small businesses, eCommerce channels, or specific industry verticals. We also have over 1,600 referral arrangements with bank and non-bank partners.

For GFS, we have a large direct sales force and reach a broad base of smaller financial institutions through group service providers (GSPs).

2

For NSS, we leverage the distribution platforms of GBS and GFS, and also distribute through a direct sales force.

Our Transformation

In 2013, we began transforming our business by investing in next-generation commerce solutions aimed at helping our clients grow their businesses, investing in our client-facing teams to enhance their reach and effectiveness, and recruiting a new group of experienced leaders into critical positions across the Company.

We have moved beyond payment processing. We believe our long-term success will be driven by focusing on helping our clients grow their businesses by providing them with a suite of new commerce-enabling technologies as well as our broad set of existing solutions. Our focus on innovation – combined with the direct relationships we enjoy with many businesses and financial institutions, and the critical nature of the services we already provide many clients – positions us well to quickly develop, commercialize, and deliver new commerce solutions to our clients.

We have many opportunities, in our view, to sell our expanded set of commerce solutions. We intend to sell these products to new clients through all of our major existing distribution channels, often through more enhanced product bundling. In addition, given the large size of our existing client base, we believe we have an outsized opportunity to sell our new solutions to existing clients, many of whom may not be aware of the availability of our next-generation commerce solutions nor that these solutions are designed to easily integrate into their existing First Data solutions.

First Data’s focus on innovation has accelerated. In the last three years, we have acquired six commerce-focused technology start-ups: Clover, Perka, Gyft, SpreeCommerce, EasyWay Ordering, and Transaction Wireless; we now employ nearly 200 employees in Silicon Valley and Silicon Alley; and we have partnered with some of the world’s leading technology companies to deliver commerce-enabling solutions.

Since 2013, we have launched many innovative solutions. For example, we launched Clover, a tablet-based integrated POS system that can harness the creativity of third-party developer solutions, to target the small and medium-sized business (SMB) market; with Clover we aim to create the largest open architecture operating system for commerce-enabling solutions and applications for business owners. Recognizing the growing desire for analytics, we launched Insightics, an innovative cloud-based software solution that unlocks the power of big data behind payment transactions for the SMB market. Seeing the growing need for security solutions, we launched TransArmor, an encryption and tokenization solution for business owners, and we partnered with a leading chip technology company to build a comprehensive EMV (Europay, MasterCard and Visa) solution for card issuers. Seeing the growing interest in the virtualization of payment cards, we acquired Gyft and Transaction Wireless, significantly increasing our capabilities in the issuance and distribution of virtual cards. Finally, we launched a web / mobile-enabled version of our VisionPLUS software application with improved features for multi-currency, multi-wallet, and prepaid cards, and we commercialized functionality for enabling consumer alerts and card controls on our U.S. issuing platform.

We are investing to enhance our client-facing teams. We believe we can grow our business and serve our clients better by investing to improve the effectiveness of our client-facing teams. Given our now-expanded solution suite, we believe we have more opportunities to conduct enterprise selling to new and existing clients, and more opportunities to sell new innovations into our large existing base of clients. For example, we are building out enterprise coverage teams, and we believe initiatives like these should help drive new sales and increase client loyalty and retention.

3

We have also focused heavily on adding new executive talent to First Data. Led by Chairman and CEO Frank Bisignano, our Management Committee has been significantly reconstituted and expanded, bringing to First Data deep expertise from leading global organizations in technology, financial services, payments, cyber-security, operations, and controls. Beyond the Management Committee, 104 of our top 150 executives have joined First Data since May 2013, injecting a significant level of new talent into the Company’s leadership.

Benefitting from Industry Trends

We believe First Data is strongly positioned to take advantage of several global industry trends:

| • | Consumer payments are continuing to shift from cash to electronic, including in the United States, where, according to The Nilson Report, credit and debit card purchase volumes are projected to increase by 65% and 49%, respectively, from 2013 to 2018; |

| • | Consumer shopping continues to shift from brick and mortar locations to online, as global eCommerce spending as a percentage of total global retail spending is projected to increase from 6% in 2013 to 9% in 2018 according to eMarketer; |

| • | SMB owners are increasingly demanding next-generation technology such as tablet-based POS systems and devices that accept mobile payments: for example, 67% of restaurant businesses surveyed by Hospitality Technology are planning to add new functionality, features and/or modules to current POS software in 2015; |

| • | Given recent payment data breaches, clients are increasingly demanding robust security and fraud solutions, resulting in projected spending of $125 billion in 2015, according to IDC; and |

| • | Financial institutions continue to outsource and leverage technology providers given their constrained budgets and growing industry complexity. |

We believe First Data is well positioned to take advantage of all of these trends given the breadth of our solutions and our global operating scale.

Our Competitive Strengths

We believe First Data has many competitive advantages that position us favorably in the global marketplace and will help us drive growth in the future.

Our Industry Leadership and Large Scale Give Us Operating Advantages

Based on our size, scale, and global footprint, we are a leading provider in our industry. Our clients include some of the largest and best known global retail and financial institutions, as well as millions of smaller businesses and banks across the world. We are:

| • | #1 in global merchant acquiring; |

| • | #1 in global issuer processing; |

| • | #1 in independent network services; and |

| • | a world leader in global eCommerce. |

Our scale enables us to cost-effectively leverage our fixed technology and operations infrastructure, helping us to produce high operating margins, incur low marginal capital expenditures, and generate strong

4

operating cash flow. Our scale also allows us to efficiently develop, acquire, and commercialize next-generation technologies globally.

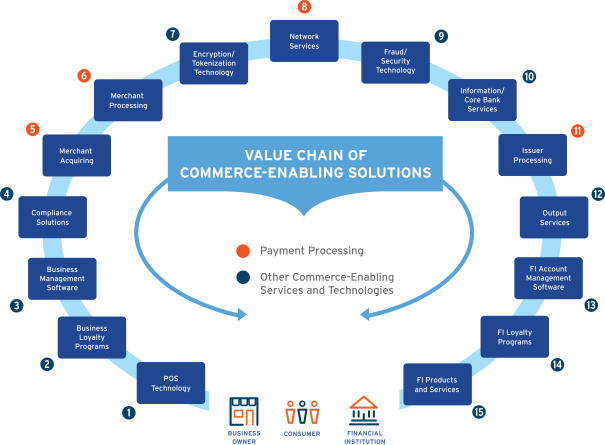

We Deliver Integrated Solutions Across the Commerce Value Chain

We believe we offer our clients the most complete array of integrated solutions in the industry, covering their needs across next-generation commerce technology, merchant acquiring, issuing, and network solutions. We believe this differentiates us from our competition and will continue to drive growth in the future. Our suite of commerce-enabling solutions includes a range of products for businesses and financial institutions of all sizes and types that help our clients grow their business, interact with their customers, and manage their operations. These solutions include, among others, POS, mobile and online payment acceptance and the Clover operating system for business clients, and debit processing, STAR Network and online banking for financial institution clients.

We Have a Large and Diverse Distribution Platform

We sell our commerce-enabling solutions through a combination of channels that provide us with a large, global distribution platform. Our distribution channels allow us to reach clients of all types and sizes. Our distribution platform includes equity and revenue sharing alliances with bank partners, direct sales, referral partnerships with bank and non-bank entities, and indirect sales through third-party re-sellers.

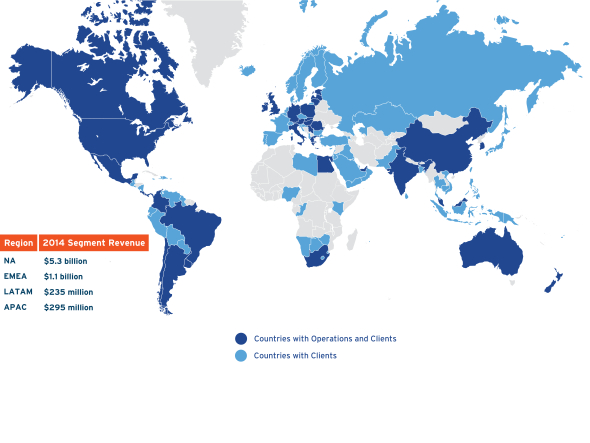

We Have a Global Footprint Enabling Us to Reach Clients Around the World

We have operations in 36 countries and serve clients in 118 countries around the world directly and indirectly. We have well-established businesses and partnerships to serve clients in large developed economies and have also made strategic investments and developed key partnerships in fast-growing emerging markets where the penetration of electronic payments is lower, such as India and Brazil. We believe our global breadth is an increasing competitive advantage as multi-national organizations, such as retailers, restaurant chains, and financial institutions, want to work with a single trusted technology partner across multiple geographies to deploy various solutions.

Our Broad-Based Client Service Capabilities Differentiate Us

Most clients view their payments systems as mission-critical infrastructure for their businesses. In addition, our clients around the world are also facing increasing operating complexity due to new technologies, such as mobile payments, and the implementation of new regulations and standards, such as the EMV liability shift in the United States beginning in October 2015. Our ability to provide our clients with broad-based client service is a major competitive advantage, especially against emerging companies that often lack deep client service capabilities.

We Have Powerful, Proprietary Technology Platforms

We own and operate proprietary technology platforms which give us a wide range of capabilities that distinguish First Data in the global marketplace and provide us with significant competitive advantages. Our powerful technology platforms are strategically positioned around the world to meet the different technical needs of our large, diversified client base and support our global operations. We develop and maintain our platforms in-house, which enables us to ensure they are highly stable, secure and scalable with substantial excess capacity to expand our capabilities without the need for material new investment.

5

We Have a Strong Controls Operation

We have built a strong controls operation that helps us manage our risks and work collaboratively with our clients on control-related issues. This provides us with a stable controls environment around enterprise risk management, underwriting and credit risk, third-party risk, and regulatory compliance, among other areas. It also makes us an attractive third-party provider for all of our clients, but particularly for our financial institution clients and partners, who are under intense regulatory scrutiny. We believe these capabilities help us retain and win clients.

Our Experienced, World-Class Management Team Has a Track Record of Execution

Beginning with the hiring of Frank Bisignano, our Chairman and Chief Executive Officer and the former co-chief operating officer of JPMorgan Chase & Co., in April 2013, we have built a world-class management team as part of our transformation efforts. Beyond the Management Committee, 104 of our top 150 management executives have been hired since May 2013, bringing with them extensive operating experience in the financial services, payments, and technology industries and a track record of execution at leading public companies.

Our Strategies

Our competitive strengths have positioned us favorably to pursue a variety of opportunities around the world. We plan to grow our business and improve our operations by executing on the following strategies.

Help Our Clients Grow Their Businesses Through Our Expanded Set of Solutions

We believe our success will be driven by our focus on helping our clients grow their businesses. We intend to achieve this by providing our clients with innovative, next-generation commerce solutions along with our broad set of existing solutions. Our focus on innovation — combined with the direct relationships we enjoy with many businesses and financial institutions, and the critical nature of the services we already provide to many clients — positions us well, in our view, to quickly develop, commercialize, and deploy new commerce innovation to our clients.

We have many opportunities, in our view, to sell our expanded set of commerce solutions. We intend to sell these products to new clients through all of our major existing distribution channels, often through more enhanced product bundling. In addition, given the large size of our existing client base, we believe we have an outsized opportunity to sell our new solutions to existing clients, many of whom may not be aware of the availability of our next generation commerce solutions nor that these solutions are designed to easily integrate into their existing First Data solutions.

Continue Our Greater Focus on Innovation

We drive innovation through a combination of building organically, partnering with other technology innovators, and selectively pursuing acquisitions — all approaches in which we have significant experience. We believe we are an attractive partner and often the acquirer-of-choice for next-generation commerce technology companies, who seek to leverage our large distribution network and existing client base to deploy their solutions. Within the past three years, we acquired and are commercializing the solutions of six commerce-focused technology start-ups: Clover, Perka, Gyft, SpreeCommerce, EasyWay Ordering, and Transaction Wireless. We also partner with many leading technology companies to deliver commerce-enabling solutions.

6

Our innovation investments are focused on helping our clients attract new customers, interact in more innovative ways with their customers, understand their customers better, and protect their and their customers’ data and other information.

Enhance Our Client-Facing Teams

We believe we can grow our business and serve our clients better by investing in our client-facing personnel. Given our now-expanded solution suite, we believe we have more opportunities to conduct enterprise selling to new and existing clients, and more opportunities to sell new innovations into our large existing base of clients. We believe these initiatives should help drive new sales and increase client loyalty and retention.

We are undertaking key initiatives to enhance the effectiveness of our client-facing teams, including expanding our sales force, building our enterprise coverage teams, deepening our focus on select attractive verticals, and expanding our distribution partnerships.

Grow Our eCommerce Business

Our leading eCommerce presence positions us well to continue to capitalize on this fast-growing segment. We are focused on improving the eCommerce technical capabilities we provide our clients, expanding our relationships with businesses whose presence is primarily online, and increasing sales of eCommerce to brick and mortar businesses.

We plan to strengthen our core eCommerce technical capabilities and global reach through significant ongoing investments. We are also focused on expanding our relationships with businesses whose presence is primarily online by, among other things, widening our integration with other eCommerce infrastructure partners. We also plan to increase the penetration of eCommerce sales to existing brick and mortar businesses through solutions such as Payeezy, increased bundling of eCommerce with other First Data solutions, and selling eCommerce solutions to clients who currently lack an online presence.

Expand Our Clover Operating System

We acquired Clover, an open architecture, integrated POS operating system, in December 2012. At the time of acquisition, Clover had less than a dozen employees, none or only partially developed software, hardware options, and distribution strategy. Since then, we have grown Clover to 53 engineers, launched three versions — Clover Station, Clover Mobile and Clover Mini — and built a robust open architecture platform that can service a broad array of business clients. Within Clover, we also offer a cloud-based Clover App Market for business applications.

Our goal with Clover is to create the largest open architecture platform of commerce-enabling solutions and applications for business owners. We believe we can achieve this goal by leveraging the breadth and scale of our distribution channels, and selling into our large existing client base. The recently launched Clover Mini, for example, will compete in the high-volume traditional POS terminal space, and will, over time, likely become First Data’s preferred terminal solution for acquiring clients.

Expanding the STAR Network’s Capabilities

We intend to drive the STAR Network’s growth by expanding its functionality and by cross-selling it more effectively with other First Data solutions. We have already expanded STAR’s available card holder verification methods from PIN to now also include PIN-less. We are also investing in more advanced fraud

7

capabilities for STAR, and we will continue to consider additional enhancements to STAR’s capabilities. We believe financial institutions, businesses, and commerce technology companies are increasingly looking for additional network options. This, coupled with the expanded array of solutions we sell to these business and financial services client bases, creates more opportunities for us to cross-sell STAR issuance and STAR acceptance with our other issuing and acquiring solutions.

Expand Our Global Footprint and Offerings

We have expanded globally over the past 15 years, including recently in India and Brazil, and we intend to continue to expand our global footprint by making strategic investments and developing key partnerships in attractive new markets. This strategy allows us to expand our offerings by selling many of our integrated solutions, including several recently developed next-generation products, to our non-U.S. client base in existing and new markets. We are selective in determining which markets to enter and typically consider a range of factors before entering a new country or region, including local market size, growth, profitability, commerce and technology trends, regulatory and other risks, required investments, management resources, and the potential return on investment.

Continue to Enhance Our Operating Efficiencies

Our focus on cost optimization will remain a persistent part of our culture. We will leverage the deep operating expertise of our management team to identify opportunities to improve our operating efficiencies and continue to leverage our fixed technology and operations infrastructure as our business grows. We plan to execute on this strategy by implementing various initiatives, including productivity improvements, pursuing improved terms with vendors, implementing a location strategy to consolidate our work force in more efficient regional hubs, and strengthening our offshoring and outsourcing programs.

Manage Our Capital Structure to Enhance Free Cash Flow Generation

We intend to proactively manage our capital structure to reduce our interest expense and increase our free cash flow, which could be used to further de-leverage our consolidated balance sheet. For example, giving effect to this offering and our July 2014 recapitalization, in less than two years we will have raised $ in equity capital to reduce debt, which reduces our annual interest expense by approximately $ .

We believe refinancing opportunities can further enhance free cash flow generation. After this offering and the related use of proceeds, we will have $ of debt outstanding with a weighted average cost of approximately %. In the current market environment, we believe there may be material refinancing opportunities of our debt at lower interest rates. Over $11.2 billion of our notes become callable on more favorable terms over the next 12 months, with approximately $2.6 billion in the second half of 2015 and $8.6 billion in the first half of 2016. For example, in July 2015, we will refinance $955 million of our $1.6 billion aggregate principal amount of 7.375% senior secured first lien notes that became callable on more favorable terms in June 2015 with term loans priced at the London Interbank Offered Rate (LIBOR) plus 375 basis points (the “2015 Refinancing”).

Risks Related to Our Business and this Offering

Investing in our Class A common stock involves substantial risk, and our ability to successfully operate our business is subject to numerous risks, including those that are generally associated with operating in the commerce-enabling solutions industry. Any of the factors set forth under “Risk Factors” may limit our ability to

8

successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our Class A common stock.

Corporate History and Information

We were incorporated in Delaware in 1989 and were spun off from American Express in a public offering in 1992. On September 24, 2007, we were acquired by affiliates of KKR that resulted in our equity becoming privately held (the “2007 Merger”). Our principal executive offices are located at 225 Liberty Street, 29th Floor, New York, New York 10281. The telephone number of our principal executive offices is (800) 735-3362. Our Internet address is www.firstdata.com. Information on our web site does not constitute part of this prospectus.

Prior to the consummation of this offering, First Data Holdings Inc. (“FDH” or “Holdings”), our direct parent company, will merge with and into First Data Corporation, with First Data Corporation being the surviving entity (the “HoldCo Merger”), pursuant to which holders of FDH capital stock will become holders of comparable classes of capital stock of First Data Corporation. Upon the consummation of this offering, all outstanding capital stock of First Data Corporation will automatically convert into common stock in accordance with its terms and we will amend and restate our certificate of incorporation to effectuate a dual class common stock structure consisting of our Class A common stock and Class B common stock, with all common stock outstanding prior to this offering being designated as Class B common stock. Prior to the consummation of this offering, we will also effect a -for-one reverse stock split of our capital stock (the “Reverse Stock Split”). We refer to these transactions collectively as the “Reorganization.”

About KKR

Founded in 1976 and led by Henry Kravis and George Roberts, KKR is a leading investment firm with approximately $99.1 billion in assets under management as of March 31, 2015. With offices around the world, KKR manages assets through a variety of investment funds and accounts covering multiple asset classes. KKR seeks to create value by bringing operational expertise to its portfolio companies and through active oversight and monitoring of its investments. KKR complements its investment expertise and strengthens interactions with investors through its client relationships and capital markets platforms. KKR is publicly traded on The New York Stock Exchange (NYSE: KKR).

9

The Offering

| Class A common stock offered |

shares. |

| Underwriters’ option to purchase additional shares of Class A common stock |

shares. |

| Class A common stock to be outstanding immediately after this offering |

shares (or shares if the underwriters exercise in full their option to purchase additional shares). |

| Class B common stock to be outstanding immediately after this offering |

shares. |

| Total common stock to be outstanding immediately after this offering |

shares (or shares if the underwriters exercise in full their option to purchase additional shares). |

| Voting rights |

Upon consummation of this offering, the holders of our Class A common stock will be entitled to one vote per share, and the holders of our Class B common stock will be entitled to ten votes per share. |

| Each share of Class B common stock may be converted into one share of Class A common stock at the option of the holder. |

| If, on the record date for any meeting of the stockholders, the number of shares of Class B common stock then outstanding is less than 10% of the aggregate number of shares of Class A common stock and Class B common stock outstanding, then each share of Class B common stock will automatically convert into one share of Class A common stock. |

| In addition, each share of Class B common stock will convert automatically into one share of Class A common stock upon any transfer, except for certain transfers to other holders of Class B common stock or their affiliates or to certain unrelated third parties as described under “Description of Capital Stock—Common Stock—Conversion and Restrictions on Transfer.” |

| Holders of Class A common stock and Class B common stock will vote together as a single class on all matters unless otherwise required by law. |

| Upon consummation of this offering, assuming no exercise of the underwriters’ option to purchase additional shares, (1) holders of Class A common stock will hold approximately % of the combined voting power of our outstanding common stock and approximately % of our total equity ownership and (2) holders of Class B common stock will hold approximately % of the combined voting power of our outstanding common stock and approximately % of our total equity ownership. |

10

| If the underwriters exercise their option to purchase additional shares in full, (1) holders of Class A common stock will hold approximately % of the combined voting power of our outstanding common stock and approximately % of our total equity ownership and (2) holders of Class B common stock will hold approximately % of the combined voting power of our outstanding common stock and approximately % of our total equity ownership. See “Description of Capital Stock—Common Stock—Voting Rights.” |

| The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting, conversion, and transfer restrictions applicable to the Class B common stock. See “Description of Capital Stock—Common Stock” for a description of the material terms of our common stock. |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $ million (or $ million, if the underwriters exercise in full their option to purchase additional shares), based on the assumed initial public offering price of $ per share, which is the mid-point of the range set forth on the cover page of this prospectus. For sensitivity analysis as to the offering price and other information, see “Use of Proceeds.” |

| We intend to use the net proceeds from this offering for the repayment of certain indebtedness. |

| Risk factors |

See “Risk Factors” beginning on page 18 and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Class A common stock. |

| Dividend policy |

We do not currently anticipate paying any dividends on our common stock immediately following this offering. Following this offering and upon repayment of certain outstanding indebtedness, we may reevaluate our dividend policy. Any future determinations relating to our dividend policies will be made at the discretion of our board of directors (the “Board”) and will depend on various factors. See “Dividend Policy.” |

| Proposed ticker symbol |

“ ” |

Unless we indicate otherwise or the context otherwise requires, all information in this prospectus:

| • | gives effect to the Reorganization; |

| • | assumes (1) no exercise of the underwriters’ option to purchase additional shares of our Class A common stock and (2) an initial public offering price of $ per share, the midpoint of the estimated price range set forth on the cover of this prospectus; and |

11

| • | does not reflect (1) shares of Class B common stock issuable upon the exercise of options outstanding as of , at a weighted average exercise price of $ per share, of which were then vested and exercisable, and shares of Class B common stock issuable upon vesting of outstanding restricted stock units and (2) shares of Class A common stock available for issuance under our new 2015 Omnibus Incentive Plan, which we intend to adopt in connection with this offering. See “Management—Compensation Discussion and Analysis—Compensation Arrangements to be Adopted in Connection with this Offering.” |

12

Summary Historical Consolidated Financial and Other Data

Set forth below is summary historical consolidated financial and other data of First Data Corporation as of the dates and for the periods indicated. The summary historical financial data as of December 31, 2013 and 2014 and for the years ended December 31, 2012, 2013 and 2014 have been derived from our historical consolidated financial statements included elsewhere in this prospectus, and the summary historical financial data as of December 31, 2012 have been derived from our historical consolidated financial statements not included in this prospectus, each of which have been audited by Ernst & Young LLP. The summary historical financial data as of March 31, 2015 and for the three month periods ended March 31, 2014 and 2015 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus, which have been prepared on a basis consistent with our annual audited consolidated financial statements. The summary historical financial data as of March 31, 2014 have been derived from our historical consolidated financial statements not included in this prospectus, which have been prepared on a basis consistent with our annual audited consolidated financial statements. In the opinion of management, such unaudited financial data reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for these periods. The results of operations for the interim periods are not necessarily indicative of the results for the full year or any future period.

The summary historical consolidated financial and other data should be read in conjunction with “Unaudited Pro Forma Consolidated Financial Statements,” “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| (in millions, except shares and per share data) | 2012 | 2013 | 2014 | 2014 | 2015 | |||||||||||||||

| (unaudited) | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Revenues(1): |

$ | 10,680 | $ | 10,809 | $ | 11,152 | $ | 2,640 | $ | 2,695 | ||||||||||

| Expenses: |

||||||||||||||||||||

| Cost of services (exclusive of items shown below) |

2,781 | 2,723 | 2,668 | 635 | 714 | |||||||||||||||

| Cost of products sold |

330 | 328 | 330 | 79 | 76 | |||||||||||||||

| Selling, general and administrative |

1,913 | 1,980 | 2,043 | 498 | 520 | |||||||||||||||

| Reimbursable debit network fees, postage and other |

3,362 | 3,507 | 3,604 | 875 | 873 | |||||||||||||||

| Depreciation and amortization |

1,192 | 1,091 | 1,056 | 265 | 251 | |||||||||||||||

| Other operating expenses, net(2) |

28 | 56 | 13 | 3 | 1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating profit |

1,074 | 1,124 | 1,438 | 285 | 260 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Interest income |

9 | 11 | 11 | 3 | 1 | |||||||||||||||

| Interest expense |

(1,898 | ) | (1,881 | ) | (1,753 | ) | (467 | ) | (407 | ) | ||||||||||

| Loss on debt extinguishment(3) |

— | — | (260 | ) | — | — | ||||||||||||||

| Other income (expense)(4) |

(94 | ) | (47 | ) | 161 | 1 | 35 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1,983 | ) | (1,917 | ) | (1,841 | ) | (463 | ) | (371 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before income taxes and equity earnings in affiliates |

(909 | ) | (793 | ) | (403 | ) | (178 | ) | (111 | ) | ||||||||||

| Income tax expense (benefit) |

(224 | ) | 87 | 82 | 37 | 3 | ||||||||||||||

| Equity earnings in affiliates |

158 | 188 | 220 | 50 | 51 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

(527 | ) | (692 | ) | (265 | ) | (165 | ) | (63 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less: Net income attributable to noncontrolling interests and redeemable noncontrolling interest |

174 | 177 | 193 | 36 | 49 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to First Data |

$ | (701 | ) | $ | (869 | ) | $ | (458 | ) | $ | (201 | ) | $ | (112 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

13

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| (in millions, except shares and per share data) | 2012 | 2013 | 2014 | 2014 | 2015 | |||||||||||||||

| (unaudited) | ||||||||||||||||||||

| Pro forma net loss per share:(5) |

||||||||||||||||||||

| Basic |

$ | $ | ||||||||||||||||||

| Diluted |

$ | $ | ||||||||||||||||||

| Pro forma weighted average common shares outstanding:(5) |

||||||||||||||||||||

| Basic |

||||||||||||||||||||

| Diluted |

||||||||||||||||||||

| Cash Flow Data: |

||||||||||||||||||||

| Net cash provided by (used in) operating activities |

$ | 767 | $ | 673 | $ | 1,013 | $ | (44 | ) | $ | (102 | ) | ||||||||

| Net cash (used in) investing activities |

(397 | ) | (353 | ) | (329 | ) | (112 | ) | (167 | ) | ||||||||||

| Net cash provided by (used in) financing activities |

(249 | ) | (490 | ) | (721 | ) | 146 | 253 | ||||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 358 | $ | 340 | ||||||||||||||||

| Total assets (including settlement assets of $7,558 (2014) and $7,690 (March 31, 2015)) |

34,269 | 34,138 | ||||||||||||||||||

| Total debt (including current portion of long-term debt) |

20,872 | 21,137 | ||||||||||||||||||

| Total First Data stockholder’s equity (deficit) |

(452 | ) | (723 | ) | ||||||||||||||||

| Other Financial Data (unaudited): |

||||||||||||||||||||

| Pro forma interest expense(6) |

$ | $ | ||||||||||||||||||

| Segment Revenue(7) |

$ | 6,682 | $ | 6,684 | 6,904 | $ | 1,629 | 1,655 | ||||||||||||

| Adjusted EBITDA(8) |

2,436 | 2,449 | 2,663 | 614 | 563 | |||||||||||||||

| Adjusted Net Income(9) |

(15 | ) | 90 | 409 | (9 | ) | 40 | |||||||||||||

| Operating Data (unaudited): |

||||||||||||||||||||

| North America merchant transactions(10) |

38,806 | 40,445 | 41,453 | 9,837 | 10,008 | |||||||||||||||

| International merchant transactions(11) |

4,867 | 5,338 | 6,030 | 1,363 | 1,549 | |||||||||||||||

| North America card accounts on file(12) |

676 | 692 | 714 | 694 | 719 | |||||||||||||||

| International card accounts on file(13) |

98 | 115 | 132 | 122 | 135 | |||||||||||||||

| Network transactions(14) |

16,299 | 16,763 | 17,435 | 4,228 | 4,415 | |||||||||||||||

| (1) | Includes processing fees, administrative service fees, and other fees charged to merchant alliances accounted for under the equity method of $181 million, $164 million, and $160 million for the years ended December 31, 2014, 2013 and 2012, respectively, and $50 million for the three months ended March 31, 2015 and $44 million for the three months ended March 31, 2014. |

| (2) | Other operating expenses, net includes restructuring, net; impairments; and litigation and regulatory settlements, as applicable to the periods presented. |

| (3) | Represents loss incurred due to early extinguishment of debt. |

| (4) | Includes investment gains and (losses), derivative financial instruments gains and (losses), divestitures, net, non-operating foreign currency exchange gains and (losses) and other, as applicable to the periods presented. |

| (5) | Gives effect to the Reorganization, the 2015 Refinancing, this offering and the related use of proceeds, and, for the year ended December 31, 2014 only, the partial redemptions of our 6.75% senior secured first lien notes due 2020, 10.625% senior unsecured notes due 2021, 11.25% senior unsecured notes due 2021, and 11.75% senior subordinated notes due 2021 with the proceeds from the July 2014 issuance of FDH’s Class B common stock in a private placement (collectively, the “Equity Recapitalization”), and the repayment of all outstanding debt of FDH, which occurred during 2014, as if each had occurred on January 1, 2014. See “Unaudited Pro Forma Consolidated Financial Statements.” |

14

| (6) | Gives effect to the 2015 Refinancing, the Equity Recapitalization, and this offering and the related use of proceeds, as if each had occurred on January 1, 2014. See “Unaudited Pro Forma Consolidated Financial Statements.” |

| (7) | A reconciliation of Segment Revenues to our Revenues is as follows: |

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| (in millions) | 2012 | 2013 | 2014 | 2014 | 2015 | |||||||||||||||

| Segment Revenues |

$ | 6,682 | $ | 6,684 | $ | 6,904 | $ | 1,629 | $ | 1,655 | ||||||||||

| Adjustments for non-wholly owned entities |

73 | 39 | 57 | 1 | 20 | |||||||||||||||

| ISO commission expense |

563 | 579 | 587 | 135 | 147 | |||||||||||||||

| Reimbursable debit network fees, postage, and other |

3,362 | 3,507 | 3,604 | 875 | 873 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Revenues |

$ | 10,680 | $ | 10,809 | $ | 11,152 | $ | 2,640 | $ | 2,695 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See the Segment Information notes to our consolidated financial statements included elsewhere in this prospectus.

| (8) | EBITDA, a measure used by management to measure operating performance, is defined as net income (loss) attributable to First Data before interest expense, net, income tax (benefit) expense, and depreciation and amortization. EBITDA is not a recognized term under GAAP and does not purport to be an alternative to net income (loss) attributable to First Data as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Additionally, EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. The presentation of EBITDA has limitations as an analytical tool and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Management believes that EBITDA is helpful in highlighting trends because EBITDA excludes the results of decisions that are outside the control of operating management. Management compensates for the limitations of using non-GAAP financial measures by using them to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Because not all companies use identical calculations, these presentations of EBITDA may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate and capital investments. |

Adjusted EBITDA is defined as EBITDA further adjusted to exclude certain items and other adjustments and is used by management as a measure of operating performance. We believe that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA are appropriate to provide additional information to investors about certain material non-cash items and about non-recurring items that we do not expect to continue at the same level in the future. Because not all companies use identical calculations, this presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies.

Adjusted EBITDA is the profit (loss) measurement we utilize in the Segment Information notes to our consolidated financial statements included elsewhere in this prospectus.

15

EBITDA and Adjusted EBITDA are calculated as follows:

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| (in millions) |

2012 | 2013 | 2014 | 2014 | 2015 | |||||||||||||||

| Net loss attributable to First Data |

$ | (701 | ) | $ | (869 | ) | $ | (458 | ) | $ | (201 | ) | $ | (112 | ) | |||||

| Interest expense, net |

1,889 | 1,870 | 1,742 | 464 | 406 | |||||||||||||||

| Income tax (benefit) expense |

(224 | ) | 87 | 82 | 37 | 3 | ||||||||||||||

| Depreciation and amortization |

1,331 | 1,212 | 1,163 | 292 | 277 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

2,295 | 2,300 | 2,529 | 592 | 574 | |||||||||||||||

| Stock-based compensation(a) |

12 | 38 | 50 | 29 | 7 | |||||||||||||||

| Other items(b) |

150 | 129 | (95 | ) | 6 | 5 | ||||||||||||||

| Cost of alliance conversions and data center, technology and savings initiatives(c) |

77 | 68 | 20 | 7 | 3 | |||||||||||||||

| KKR related items(d) |

34 | 32 | 27 | 6 | 6 | |||||||||||||||

| Debt issuance costs(e) |

14 | 5 | 3 | 3 | 1 | |||||||||||||||

| Loss on debt extinguishment |

— | — | 260 | — | — | |||||||||||||||

| Adjustments for non-wholly owned entities(f) |

(102 | ) | (81 | ) | (86 | ) | (18 | ) | (22 | ) | ||||||||||

| Amortization of initial payments for new contracts(g) |

(44 | ) | (42 | ) | (45 | ) | (11 | ) | (11 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 2,436 | $ | 2,449 | $ | 2,663 | $ | 614 | $ | 563 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Represents stock-based compensation recognized as expense. |

| (b) | Includes adjustments to exclude the official check and money order businesses due to the Company’s wind down of these businesses, restructuring, certain retention bonuses, litigation and regulatory settlements, and “Other income” as presented in the consolidated statements of operations included elsewhere in this prospectus, which includes divestitures, impairments, derivative gains and (losses), and non-operating foreign currency gains and (losses). |

| (c) | Represents costs directly associated with the strategy to have First Data operate Bank of America N.A.’s legacy settlement platform and costs associated with the termination of our former Chase Paymentech alliance in 2008, both of which are considered business optimization projects, and other technology initiatives. |

| (d) | Represents KKR fees for management, consulting, financial and other advisory services. |

| (e) | Represents costs associated with refinancing and modifying our debt structure. |

| (f) | Net adjustment to reflect our proportionate share of alliance EBITDA within the Global Business Solutions segment, equity earnings in affiliates, and amortization related to equity method investments not included in segment EBITDA. See the Segment Information notes to our consolidated financial statements included elsewhere in this prospectus. |

| (g) | Represents adjustment for amortization of initial payments for new contracts which is included in Adjusted EBITDA. |

| (9) | Adjusted Net Income, a measure used by management to measure operating performance, is not a recognized term under GAAP and does not purport to be an alternative to net income (loss) attributable to First Data as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Additionally, Adjusted Net Income is not intended to be a measure of free cash flow available for management’s discretionary use as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. The presentation of Adjusted Net Income has limitations as an analytical tool and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Management believes that Adjusted Net Income is helpful in highlighting trends because Adjusted Net Income excludes the results of decisions that are outside the control of operating management. Management compensates for the limitations of using non-GAAP financial measures by using them to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Because not all companies use identical calculations, these presentations of |

16