Summary of the Transactions

We provide below a summary of the Transactions. See “The Transactions” for a more detailed description.

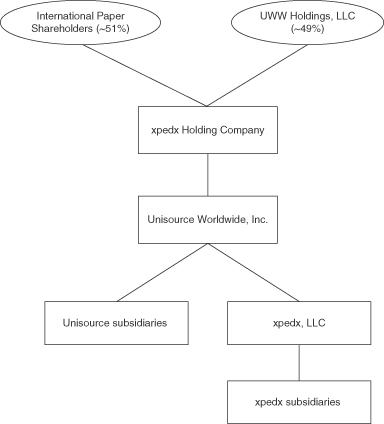

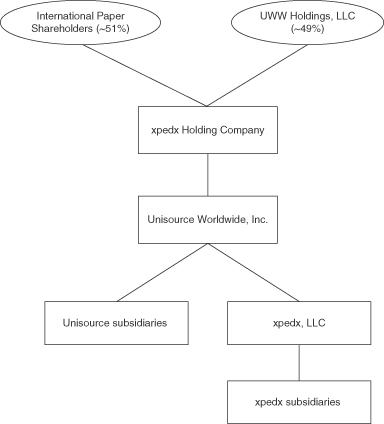

The following chart illustrates our organizational structure following the Transactions.

As filed with the Securities and Exchange Commission on February 14, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

xpedx Holding Company

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 5110 | 46-3234977 | ||

| (State or other jurisdiction of incorporation) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

6400 Poplar Ave.

Memphis, TN 38197

Tel: (901) 419-9000

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Mark W. Hianik, Esq.

Senior Vice President, General Counsel and Corporate Secretary

xpedx Holding Company

6400 Poplar Ave.

Memphis, TN 38197

Tel: (901) 419-9000

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

With a copy to:

| Peter J. Loughran, Esq. Debevoise & Plimpton LLP 919 Third Avenue New York, NY 10022 (212) 909-6000 |

Dennis M. Myers, P.C. Kirkland & Ellis LLP 300 North LaSalle Chicago, IL 60654 (312) 862-2000 |

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable following the effective date of this registration statement and the date on which all other conditions to the merger of UWW Holdings, Inc. with and into xpedx Holding Company (“SpinCo” or the “registrant”) pursuant to the merger agreement described herein have been satisfied or waived.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||

| Common Stock, $0.01 par value per share |

$1,317,400,000 | $169,682 | ||

|

| ||||

|

| ||||

| (1) | This registration statement relates to shares of SpinCo common stock which will be distributed to shareholders of International Paper Company (“International Paper”) pursuant to a spin-off transaction. The number of shares of SpinCo common stock that will be distributed to the shareholders of International Paper upon the consummation of the spin-off transaction will be determined based on a formula described in this registration statement and a distribution ratio to be determined as of the distribution date for the spin-off. |

| (2) | Represents the aggregate book value, as of September 30, 2013, of International Paper’s xpedx business. |

| (3) | The registration fee has been calculated pursuant to Rule 457(f)(2) and Rule 457(o) under the Securities Act. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 14, 2014

PRELIMINARY PROSPECTUS

xpedx Holding Company

Common Stock

This prospectus is being furnished in connection with the planned distribution by International Paper Company (“International Paper”) on a pro rata basis to its shareholders of all the shares of common stock of its wholly-owned subsidiary xpedx Holding Company (“SpinCo”) outstanding prior to the Merger described below. SpinCo will own and operate xpedx, the business-to-business distribution business of International Paper (“xpedx”). We refer to such planned distribution as the “Distribution” or “spin-off.” Immediately following the Distribution, UWW Holdings, Inc. (“UWWH”) will merge with SpinCo, with SpinCo continuing as the surviving corporation (the “Merger”).

Each share of International Paper common stock outstanding as of 5:00 p.m. New York City time on , 2014, the record date for the Distribution (the “record date”), will entitle its holder to receive a number of SpinCo shares of common stock determined by a formula as described in this prospectus. We expect the distribution ratio to be approximately SpinCo shares of common stock for each share of International Paper common stock. The distribution of SpinCo common stock will be made in book-entry form. As a result of the Merger, the sole shareholder of UWWH will receive a number of shares of SpinCo common stock for each share of UWWH common stock that it holds at the time of the Merger in a private placement transaction that will result in International Paper’s shareholders owning approximately 51%, and the sole shareholder of UWWH owning approximately 49%, of the shares of SpinCo common stock on a fully-diluted basis immediately following the Merger. We expect that the Distribution and the Merger will be tax-free to International Paper’s shareholders for U.S. federal income tax purposes, except for gain or loss attributable to cash received in lieu of fractional shares in the Distribution. Immediately after the Transactions (as defined below), SpinCo will be an independent, publicly-traded company that will own and operate the combined businesses of xpedx and Unisource Worldwide, Inc. (“UWW”).

SpinCo intends to apply to list its common stock on the New York Stock Exchange (the “NYSE”) under the symbol “ ”.

No action will be required of you to receive common stock of SpinCo, which means that:

| • | you will not be required to pay for our common stock that you receive in the Distribution; |

| • | you do not need to surrender or exchange any of your International Paper common stock in order to receive SpinCo common stock, or take any other action in connection with the spin-off. |

There is currently no trading market for our common stock. However, we expect that a limited market, commonly known as a “when-issued” trading market, for our common stock will develop on or shortly before the record date for the Distribution, and we expect “regular way” trading of our common stock will begin the first trading day after the completion of the Distribution.

You should carefully consider the matters described under “Risk Factors” beginning on page 37 of this prospectus for a discussion of factors that should be considered by recipients of our common stock.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this prospectus is , 2014.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

This prospectus is being furnished solely to provide information to International Paper shareholders who will receive shares of SpinCo common stock in the Distribution. It is not to be construed as an inducement or encouragement to buy or sell any of our securities or any securities of International Paper. This prospectus describes our business, our relationship with International Paper, Unisource’s business, and the Distribution and the Mergers, and provides other information to assist you in evaluating the benefits and risks of holding or disposing of our common stock that you will receive in the Distribution. You should be aware of certain risks relating to the spin-off, our business, Unisource’s business and ownership of our common stock, which are described under the heading “Risk Factors.”

You should not assume that the information contained in this prospectus is accurate as of any date other than the date set forth on the cover. Changes to the information contained in this prospectus may occur after that date, and we undertake no obligation to update the information, except in the normal course of our public disclosure obligations.

2

In this prospectus:

“ABL Facility” has the meaning specified in “Description of Material Indebtedness.”

“Bain Capital” means Bain Capital Partners, LLC and investment funds advised or managed by it.

“Closing Date” means the date on which the Merger occurs pursuant to the Merger Agreement.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“combined company” means SpinCo and its subsidiaries following and giving effect to the completion of the Transactions.

“Contribution” means the contribution by International Paper of xpedx to SpinCo pursuant to the terms of the Contribution and Distribution Agreement.

“Contribution and Distribution Agreement” means the Contribution and Distribution Agreement, dated January 28, 2014, among International Paper, SpinCo, UWWH and the UWWH Stockholder.

“Consulting and Non-Competition Agreement” means the Consulting and Non-Competition Agreement, dated as of January 28, 2014, between UWWH and Allan R. Dragone.

“Debevoise” means Debevoise & Plimpton LLP.

“DGCL” means the General Corporation Law of the State of Delaware.

“Distribution” means the pro rata distribution immediately prior to the consummation of the Merger of all the then outstanding shares of SpinCo to the shareholders of International Paper.

“distribution agent” means Computershare Inc., a Delaware corporation and its fully owned subsidiary, Computershare Trust Company, N.A., a national banking association, the distribution agent in connection with the Distribution.

“distribution date” means , 2014, the expected date of the Distribution.

“Employee Matters Agreement” means the Employee Matters Agreement, dated as of January 28, 2014, among International Paper, SpinCo and UWWH.

“Employment Agreement” means the Employment Agreement, dated as of January 28, 2014, between xpedx Holding Company and Mary A. Laschinger.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Georgia-Pacific” means Georgia-Pacific, LLC or its predecessor, Georgia-Pacific Corporation.

“Kirkland” means Kirkland & Ellis LLP.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1977.

“International Paper” means International Paper Company, a New York corporation.

“IRS” means the U.S. Internal Revenue Service.

“IRS ruling” means the private letter ruling from the IRS to the effect that the spin-off and certain related transactions will qualify as tax-free to SpinCo, International Paper and International Paper’s shareholders for U.S. federal income tax purposes.

3

“Merger” means the merger of UWWH with and into SpinCo, with SpinCo continuing as the surviving company.

“Mergers” means the Merger and the Subsidiary Merger.

“Merger Agreement” means the Merger Agreement, dated January 28, 2014, among International Paper, SpinCo, xpedx Intermediate, xpedx LLC, the UWWH Stockholder, UWWH and UWW.

“NYSE” means the New York Stock Exchange.

“record date” means 5:00 p.m., New York City time on , 2014, the record date for the Distribution.

“Sarbanes Oxley Act” means the Sarbanes-Oxley Act of 2002.

“SEC” means the U.S. Securities and Exchange Commission.

“SpinCo” means xpedx Holding Company, a Delaware corporation.

“Subsidiary Merger” means the merger of xpedx Intermediate with and into UWW, with UWW continuing as the surviving company.

“Tax Receivable Agreement” means the Tax Receivable Agreement, to be dated as of the Closing Date, between SpinCo and the UWWH Stockholder.

“Tax Matters Agreement” means the Tax Matters Agreement, dated as of January 28, 2014, among International Paper, SpinCo and UWWH.

“Transaction Agreements” means the Contribution and Distribution Agreement, the Merger Agreement, the Tax Receivable Agreement, the Tax Matters Agreement, the Employee Matters Agreement, the Transition Services Agreement and the other agreements entered into by International Paper, UWWH and their respective affiliates in connection with the Transactions.

“Transactions” means the transactions contemplated by the Merger Agreement and the Contribution and Distribution Agreement which provide, among other things, for the Distribution and the Mergers, as described under the section “The Transactions.”

“Transition Services Agreement” means the Transition Services Agreement, to be dated as of the Closing Date, between International Paper and SpinCo.

“Unisource” means UWWH and its subsidiaries.

“UWW” means Unisource Worldwide, Inc., a Delaware corporation and a wholly-owned subsidiary of UWWH.

“UWWH” means UWW Holdings, Inc., a Delaware corporation and a wholly-owned subsidiary of the UWWH Stockholder.

“UWWH Stockholder” means UWW Holdings, LLC, a Delaware limited liability company, the sole shareholder of UWW Holdings, Inc.

“we,” “us” and “our” refers to SpinCo and its subsidiaries and the xpedx business that will be contributed thereto for periods prior to the completion of the Transactions, and to SpinCo and its subsidiaries, including the combined businesses of xpedx and Unisource, after giving effect to the Transactions, unless the context otherwise requires or indicates.

4

“xpedx” or the “xpedx business” means the business-to-business printing, packaging and facility supplies and equipment distribution business of International Paper, as described in International Paper’s public filings as its distribution segment.

“xpedx Intermediate” means xpedx Intermediate, LLC, a Delaware limited liability company and a wholly-owned subsidiary of International Paper (that will be a wholly-owned subsidiary of SpinCo at the time of the Distribution).

“xpedx LLC” means xpedx, LLC, a New York limited liability company and a wholly-owned subsidiary of International Paper (that will be a wholly-owned, indirect subsidiary of SpinCo at the time of the Distribution).

Throughout this prospectus, with respect to Unisource, references to “December 31, 2012” or “fiscal 2012” refers to the 52 weeks ended December 29, 2012, references to “fiscal 2011” refers to the 52 weeks ended December 31, 2011, references to “December 31, 2010” or “fiscal 2010” refers to the 52 weeks ended January 1, 2011, references to “December 31, 2009” or “fiscal 2009” refers to the 52 weeks ended January 2, 2010 and references to “December 31, 2008” or “fiscal 2008” refers to the 52 weeks ended January 3, 2009. In addition, references to “September 30, 2013” refer to the 39 weeks ended September 28, 2013 and references to “September 30, 2012” refer to the 39 weeks ended September 29, 2012.

5

On April 22, 2013, International Paper announced that it had entered into a letter of intent with UWWH regarding a proposed business combination of xpedx, its business-to-business printing, packaging and facility supplies and equipment distribution business, and Unisource in a transaction structured as a “Reverse Morris Trust,” in which a newly-formed entity holding the xpedx business would be spun off and merged with UWWH, creating an independent, publicly-traded company. International Paper will effect the spin-off through a pro rata distribution to International Paper shareholders of all of the shares of common stock of SpinCo outstanding prior to the Merger. SpinCo will hold, through its subsidiaries, all of the assets and liabilities of xpedx. The Distribution will occur pursuant to a Contribution and Distribution Agreement, which International Paper, SpinCo, UWWH and the UWWH Stockholder entered into on January 28, 2014.

On January 28, 2014, International Paper announced that it, SpinCo, xpedx Intermediate and xpedx LLC had entered into an Agreement and Plan of Merger with UWWH, the UWWH Stockholder and UWW (the “Merger Agreement”), providing that sequentially and immediately following the Distribution and on the terms and subject to the other conditions of the Merger Agreement, UWWH will merge with and into SpinCo, with SpinCo continuing as the surviving corporation. Immediately thereafter, a wholly-owned subsidiary of SpinCo (“xpedx Intermediate”) will merge with and into UWW, a wholly-owned subsidiary of UWWH, with UWW surviving such merger as a wholly-owned subsidiary of SpinCo (the “Subsidiary Merger”). The Merger and the Subsidiary Merger are collectively referred to as the “Mergers.”

On , 2014, the expected date of the Distribution (the “distribution date”), each holder of International Paper common stock as of the record date will receive a number of shares of SpinCo common stock determined by a formula based on the number of International Paper shares of common stock outstanding at 5:00 p.m. New York City time on the distribution date. Each such holder will receive a number of SpinCo shares of common stock equal to the percentage of the total number of SpinCo shares of common stock outstanding as of the time of the Distribution as is equal to a fraction, (a) the numerator of which is the total number of issued and outstanding International Paper shares of common stock held by such holder as of the record date and (b) the denominator of which is the total number of International Paper shares of common stock issued and outstanding (excluding treasury shares held by International Paper and any other International Paper shares otherwise held by International Paper or one of its subsidiaries). Based on the number of International Paper shares of common stock outstanding as of , 2014, we expect the distribution ratio to be approximately SpinCo shares of common stock for each International Paper share of common stock. As a result of the Merger, the UWWH Stockholder will receive a number of newly issued shares of SpinCo common stock for each share of UWWH common stock that it holds at the time of the Merger, in a private placement transaction, equal to (i) the aggregate number of SpinCo shares issued and outstanding after the Distribution, but prior to the Merger, divided by (ii) 0.51, multiplied by (iii) 0.49. Although the number of International Paper shares of common stock outstanding may increase or decrease prior to the distribution date and as a result the distribution ratio may change, it will nonetheless result in International Paper shareholders owning approximately 51%, and the UWWH Stockholder owning approximately 49%, of the shares of SpinCo common stock on a fully-diluted basis immediately following the Merger. Immediately following the Distribution, but prior to the Merger, International Paper’s shareholders will own all of the shares of common stock of SpinCo outstanding. You will not be required to make any payment, surrender or exchange your International Paper common stock or take any other action to receive your shares of SpinCo common stock. In lieu of fractional shares of SpinCo, shareholders will receive a cash payment. To that end, the distribution agent will sell whole shares that otherwise would have been distributed as fractional shares of SpinCo in the open market at prevailing market prices and distribute the aggregate cash proceeds of the sales, net of brokerage fees and similar costs, pro rata to each International Paper shareholder who would otherwise have been entitled to receive a fractional share of SpinCo, as applicable, in the Distribution.

We expect that the Distribution and the Merger will be tax-free to International Paper’s shareholders for U.S. federal income tax purposes, except for any gain or loss attributable to cash received in lieu of a fractional share in the Distribution. Immediately after the Transactions, we will be an independent, publicly-traded company that will own and operate the combined businesses of xpedx and Unisource.

6

You may contact International Paper with any questions. International Paper’s contact information is:

International Paper Company

Attn: Investor Relations

6400 Poplar Ave.

Memphis, TN 38197

Tel: (901) 419-4352

7

QUESTIONS AND ANSWERS ABOUT THE TRANSACTIONS

Set forth below are commonly asked questions and answers about the Distribution, the Merger and the transactions contemplated thereby. You should read the sections entitled “The Transactions,” “The Merger Agreement” and “The Contribution and Distribution Agreement and the Ancillary Agreements” of this prospectus for a more detailed description of the matters described below.

Q: What are the Transactions?

A: The Distribution is the final step in the separation of the xpedx business from International Paper, which will be accomplished through a series of transactions that will result in International Paper’s shareholders owning approximately 51% of the shares of common stock of SpinCo, with SpinCo in turn holding the xpedx business, which is currently operated by International Paper. The Distribution will be a pro rata distribution immediately prior to the consummation of the Merger of all the then outstanding shares of common stock of SpinCo by International Paper to holders of International Paper common stock. Under the terms of the Merger Agreement, immediately following the Distribution, UWWH will merge with and into SpinCo, with SpinCo continuing as the surviving corporation, and xpedx Intermediate will merge with and into UWW, with UWW surviving the merger as a wholly-owned subsidiary of SpinCo. As a result of the Merger, the UWWH Stockholder will receive a number of shares of SpinCo common stock for each share of UWWH common stock that it holds at the time of the Merger in a private placement transaction. This will result in International Paper’s shareholders owning approximately 51%, and the UWWH Stockholder owning approximately 49%, of the common stock of SpinCo on a fully-diluted basis immediately following the Merger.

Q: What is SpinCo?

A: SpinCo is a wholly-owned subsidiary of International Paper incorporated under the laws of Delaware. Following the Transactions, SpinCo will be an independent, publicly-traded company operating through its subsidiaries what was formerly International Paper’s xpedx business and Unisource’s business.

Q: What is the reason for the Transactions?

A: International Paper determined that the Transactions would be in the best interests of International Paper and its shareholders because the Transactions would provide a number of key benefits, including primarily: (i) greater strategic focus of resources and management’s efforts for each of International Paper and for the combined company, (ii) the special payment, (iii) direct and differentiated access by each of International Paper and the combined company to capital resources and (iv) increased value to International Paper’s shareholders, in particular the combined company’s anticipated value on a stand-alone basis. In assessing and approving the Transactions, International Paper considered the unavailability of alternative transactions that would produce similar or better results for International Paper and its shareholders, and the spinoff’s facilitating the strategic combination of the xpedx and Unisource businesses. See “The Transactions—International Paper’s Reasons for the Transactions.”

Q: Why did International Paper decide not to separate SpinCo into a stand-alone public company and instead engage in the Transactions with Unisource?

A: International Paper decided to pursue the Transactions with Unisource rather than a stand-alone spin-off or split-off transaction involving the xpedx business because it determined that the expected value to International Paper and its shareholders from pursuing the Transactions was greater than the value to International Paper and its shareholders of a stand-alone spin-off or split-off of the xpedx business. The principal factor considered by International Paper in reaching this decision, in addition to the factors noted above, was Unisource’s business and prospects, after giving effect to the proposed acquisition by SpinCo, including expected synergies to be realized as a result of a combination of xpedx and Unisource.

8

The principal countervailing factors considered by International Paper in its deliberations concerning the Transactions were:

| • | the fact that the Unisource transaction necessarily involved another party and therefore presented execution risks that would not be present in a single party transaction like a spin-off or split-off; |

| • | the possibility that the Unisource business will not perform in the anticipated manner; and |

| • | risks relating to integrating the xpedx business with Unisource’s current operations and the potential effects on the value of SpinCo common stock to be received in the Transactions. |

After consideration of the above factors and based on information furnished by Unisource to International Paper, particularly in respect of synergies SpinCo expected to realize in the Transactions, and the terms of the Transaction Agreements as finally negotiated by International Paper, International Paper concluded that the expected value to International Paper and its shareholders from pursuing the Transactions was greater than the value to International Paper and its shareholders of a stand-alone spin-off or split-off of the xpedx business. See “The Transactions.”

Q: What will I receive in the Transactions?

A: Each share of International Paper common stock outstanding as of the record date will entitle its holder to receive a number of shares of SpinCo common stock, as determined by a formula based on the number of International Paper shares of common stock outstanding at 5:00 p.m. New York City time on the distribution date. Each such holder will receive a number of SpinCo shares of common stock equal to the percentage of the total number of SpinCo shares of common stock outstanding as of the time of the Distribution as is equal to a fraction, (a) the numerator of which is the total number of issued and outstanding International Paper shares of common stock held by such holder as of the record date and (b) the denominator of which is the total number of International Paper shares of common stock issued and outstanding (excluding treasury shares held by International Paper and any other International Paper shares otherwise held by International Paper or one of its subsidiaries). Based on the number of International Paper shares of common stock outstanding as of , 2014, we expect the distribution ratio to be approximately SpinCo shares for each International Paper share of common stock. Although the number of International Paper shares of common stock outstanding may increase or decrease prior to the distribution date and as a result this distribution ratio may change, it will nonetheless result in International Paper shareholders owning approximately 51%, and the UWWH Stockholder owning approximately 49%, of the common stock of SpinCo on a fully-diluted basis immediately following the Merger. International Paper shareholders will not receive any new shares of common stock of SpinCo in the Merger and will continue to hold the SpinCo shares they received in the Distribution.

Q: What International Paper shareholder approvals are required?

A: None. No International Paper shareholder approvals are required for the Transactions. International Paper, as the sole shareholder of SpinCo and the sole member of xpedx Intermediate, must approve the Merger and the Subsidiary Merger, the UWWH Stockholder must approve the Merger and UWW’s sole shareholder must approve the Subsidiary Merger, which each of them did promptly after the Merger Agreement was signed. International Paper shareholders are not required to take any action to approve the Distribution or the Merger. After the Merger, SpinCo will mail to the holders of International Paper common stock who are entitled to receive shares of SpinCo common stock book-entry statements evidencing their ownership of SpinCo common stock, cash payments in lieu of fractional shares (if any) and related tax information, and other information regarding their receipt of SpinCo common stock.

No International Paper shareholder will be required to pay any cash or other consideration for shares of SpinCo common stock received in the Distribution, or to surrender or exchange International Paper shares in order to receive shares of SpinCo common stock and they should not return their International Paper stock certificates. The Transactions will not result in any changes in International Paper shareholders’ ownership of

9

International Paper common stock. No vote of International Paper shareholders is required or sought in connection with the Distribution or Merger, and International Paper shareholders will have no appraisal rights in connection with the Transactions.

Q: How will International Paper distribute SpinCo shares of common stock?

A: Holders of International Paper common stock as of the record date will receive shares of SpinCo common stock in book-entry form. See “The Transactions.”

Q: What is the record date for the Distribution?

A: Record ownership will be determined as of 5:00 p.m., New York City time, on , 2014, which we refer to as the record date.

Q: When will the Transactions occur?

A: The date of the Distribution is expected to be on or about , 2014, which we refer to as the distribution date. The Merger will occur immediately thereafter, and the Subsidiary Merger will occur immediately after the Merger. We expect that it will take the distribution agent, acting on behalf of International Paper, up to three business days after the distribution date to fully distribute our common stock to International Paper shareholders.

Q: Are there any conditions to the consummation of the Transactions?

A: Yes, the consummation of the Transactions is subject to the satisfaction or waiver (to the extent permitted by applicable law) of a number of conditions, including (i) SpinCo’s receipt of the proceeds from the special payment financing in an amount sufficient to pay the special payment, and International Paper’s receipt of the special payment from SpinCo, (ii) receipt of the IRS ruling by International Paper, (iii) the International Paper board of directors’ receipt of a solvency opinion with respect to International Paper and SpinCo, (iv) this registration statement having been declared effective and the approval for listing on the New York Stock Exchange of SpinCo common stock to be issued in the Merger, (v) subject to certain exceptions, the accuracy of representations and warranties in the Merger Agreement, (vi) receipt of customary tax opinions and (vii) the absence of a material adverse effect on xpedx and Unisource since June 30, 2013. In addition, the consummation of the Merger is subject to the Contribution and Distribution having occurred pursuant to the terms of the Contribution and Distribution Agreement. This prospectus describes these conditions in more detail in “The Merger Agreement—Conditions to Consummation of the Merger” and “The Contribution and Distribution Agreement and the Ancillary Agreements—Contribution and Distribution Agreement—Conditions to the Completion of the Spin-off” and “—Termination.”

Q: What will happen to the listing of my International Paper common stock?

A: Nothing. International Paper common stock will continue to be traded on the NYSE under the symbol “IP”.

Q: Will the spin-off affect the trading of my International Paper common stock?

A: Until the market has fully analyzed the value of International Paper without the xpedx business, the price of International Paper common stock may fluctuate. In addition, it is anticipated that shortly before the record date and through the distribution date, there will be two markets in International Paper common stock: a “regular way” market and an “ex-distribution” market. International Paper common stock that will trade on the regular way market will trade with an entitlement to SpinCo common stock distributed pursuant to the Distribution. Stock that trades on the ex-distribution market will trade without an entitlement to SpinCo common stock distributed pursuant to the Distribution. See “The Transactions—Listing and Trading of Our Common Stock.”

Q: What if I want to sell my International Paper common stock or my SpinCo common stock?

A: You should consult with your financial advisors, such as your stockbroker, bank or tax advisor. Neither International Paper nor SpinCo makes any recommendations on the purchase, retention or sale of International Paper common stock or the SpinCo common stock to be distributed in the Distribution.

10

If you decide to sell any stock before the Distribution, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your International Paper common stock or the SpinCo common stock you will receive in the Distribution or both. If you sell your International Paper common stock in the “regular way” market up to and including the distribution date, you will be selling your right to receive SpinCo common stock in the Distribution. However, if you own International Paper common stock as of 5:00 p.m., New York City time, on the record date and sell those shares in the “ex-distribution” market up to and including the distribution date, you will still receive the SpinCo common stock that you would be entitled to receive in respect of the International Paper common stock you owned as of 5:00 p.m., New York City time on the record date. See “The Transactions—Listing and Trading of our Common Stock.”

Q: How will fractional shares be treated in the spin-off?

A: Holders of International Paper common stock will not receive fractional shares in connection with the spin-off. Instead, the distribution agent will sell whole shares that otherwise would have been distributed as fractional shares of SpinCo in the open market at prevailing market prices and distribute the aggregate cash proceeds of the sales, net of brokerage fees and similar costs, pro rata to each International Paper shareholder who would otherwise have been entitled to receive a fractional share in the Distribution. The receipt of cash in lieu of fractional shares will generally be taxable to the recipient shareholder. See “The Transactions—Manner of Effecting the Distribution.”

Q: Who will serve on the board of directors of the combined company?

A: Pursuant to the terms of the Contribution and Distribution Agreement, immediately prior to the distribution date, International Paper will cause to be elected the following individuals who have been agreed upon by International Paper and the UWWH Stockholder as the initial members of SpinCo’s board of directors: Allan R. Dragone, Jr., Daniel T. Henry, Mary A. Laschinger, Tracy A. Leinbach, Seth A. Meisel, William E. Mitchell, Michael P. Muldowney, Charles G. Ward, III and John J. Zillmer. Pursuant to the terms of the Merger Agreement, these individuals will constitute the board of directors of SpinCo following the Merger, and the majority of SpinCo’s directors will be independent, as determined in accordance with the criteria for independence required by the NYSE. See “Management of SpinCo Following the Transactions—Directors.”

Q: Who will manage the business of the combined company following the Merger?

A: Following the Merger, the business of the combined company will be managed by: Mary A. Laschinger, Chief Executive Officer and Chairman; Stephen J. Smith, Senior Vice President and Chief Financial Officer; Mark W. Hianik, Senior Vice President, General Counsel and Corporate Secretary; Elizabeth Patrick, Senior Vice President and Chief Human Resources Officer; and Neil Russell, Senior Vice President Corporate Affairs. We expect to name additional members of senior management prior to the completion of the Transactions. See “Management of SpinCo Following the Transactions—Executive Officers.”

Q: What will be the indebtedness of the combined company following completion of the Transactions?

A: In connection with the Transactions, assuming the closing of the Transactions as of September 30, 2013, subsidiaries of SpinCo will incur an amount of indebtedness equal to approximately $744.2 million. This indebtedness will consist of borrowings under the ABL Facility, which will be used to fund the special payment to International Paper, described below, to repay certain outstanding indebtedness of Unisource and to pay related fees and expenses. Based upon Unisource’s outstanding indebtedness as of September 28, 2013, assuming the closing of the Transactions as of September 30, 2013, we expect that, immediately following the Merger, the combined company will have approximately $835.5 million in total indebtedness, including the new borrowings of $744.2 million under the ABL Facility, $77.5 million of capital lease obligations (exclusive of the non-monetary portion) and $13.8 million of Unisource Canadian bank overdrafts. See “Capitalization.”

11

Q: What is the current relationship between SpinCo and both International Paper and Unisource?

A: SpinCo is currently a wholly-owned subsidiary of International Paper and was incorporated as a Delaware corporation in order to effect the separation of the xpedx business from International Paper. Other than in connection with the Transactions, there is currently no relationship between SpinCo and Unisource. After the Transactions, SpinCo or its subsidiaries will be a party to certain commercial agreements with International Paper and Georgia-Pacific. See “The Contribution and Distribution Agreement and the Ancillary Agreements.”

Q: How will the rights of shareholders of SpinCo and International Paper change after the Merger?

A: The rights of shareholders of SpinCo will not change as a result of the Merger. The rights of shareholders of International Paper will also remain the same as prior to the Merger, except that shareholders of International Paper will also receive shares of SpinCo common stock and cash paid in lieu of fractional shares in the Transactions.

Following the Transactions, International Paper shareholders will continue to own all of their shares of International Paper common stock. Their rights as International Paper shareholders will not change, except that their shares of International Paper common stock will represent an interest in International Paper that no longer includes the ownership and operation of the xpedx business (but will include receipt by International Paper of the special payment). International Paper shareholders will also separately own stock of the combined company, which will include the combined business operations of Unisource and xpedx.

Q: Will the Transactions affect employees and former employees of International Paper who hold International Paper stock options and other stock-based awards?

A: International Paper granted stock options in 2004, which have expiration dates of May 10, 2014 and October 11, 2014. These options are currently fully vested. Employees of International Paper who hold International Paper options will retain the options and will not be granted SpinCo options (as replacement for such International Paper options) in connection with the Transactions. No adjustment to International Paper options or exercise prices will be made by reason of the Transactions. Any outstanding options held by employees of International Paper who will be employed by SpinCo following the closing of the Transactions will be treated by International Paper in accordance with the terms of the relevant International Paper equity incentive plan as though each employee incurred a termination of employment without cause from International Paper as of the closing of the Transactions.

Certain International Paper employees hold International Paper Performance Share Plan (“PSP”) awards pursuant to which an employee has been granted units that are paid in International Paper common stock at the end of a three-year period. The amounts earned under the PSP fluctuate based on the performance of International Paper, measured at the end of each year in the three-year period. No adjustment to the performance metrics of the PSP awards by reason of the Transactions is currently contemplated. If an employee received a PSP grant in 2011 and continues to be employed by International Paper through February 2014, that employee will be paid under the PSP in February 2014, regardless of when the Transactions close, because the performance period ended December 31, 2013. International Paper employees who will be employed by SpinCo following the Transactions will continue to hold the 2012, 2013, and 2014 grants through the remainder of the performance period. The amounts to which these individuals will be entitled will be based on International Paper’s actual performance during the performance period but will be prorated based on the period of time from the grant date through the occurrence of the Transactions. Payments in respect of these awards will be paid in February of the year following the end of the relevant three-year period (e.g., the employee’s pro rata portion of the 2012 grant will be paid in February 2015).

Certain employees of International Paper also hold restricted shares of International Paper common stock. No adjustment to International Paper restricted stock will be made for the value of SpinCo. Other than

12

Mary A. Laschinger, Chief Executive Officer of SpinCo, no employee of the xpedx business currently holds International Paper restricted stock awards. The awards of restricted stock currently held by Ms. Laschinger will vest by reason of the Transactions.

Q: Will there be any payments by SpinCo to International Paper in connection with the Distribution?

A: Yes, pursuant to the Contribution and Distribution Agreement, SpinCo is required to make a special payment to International Paper of $400 million, subject to adjustment based on estimates of changes in the net working capital and net indebtedness of the xpedx business and Unisource, and the transaction expenses of Unisource. If the sum of the changes in net working capital and net indebtedness of the xpedx business represents a positive change in the value of the xpedx business, the special payment to International Paper will be increased by such amount. If that amount represents a negative change in the value of the xpedx business, the special payment to International Paper will be reduced by such amount. Pursuant to the Contribution and Distribution Agreement and the Merger Agreement, if the sum of the Unisource transaction expenses in excess of $15 million and changes in the net working capital and net indebtedness of Unisource represents a positive change in the value of Unisource, SpinCo will pay such amount to the UWWH Stockholder. If that amount represents a negative change in the value of Unisource, the special payment to International Paper will be increased by a corresponding amount. See “The Contribution and Distribution Agreement and the Ancillary Agreements—Contribution and Distribution Agreement—Working Capital and Net Indebtedness Adjustments.”

Q: Will there be post-closing adjustments in connection with the Distribution?

A: Yes, pursuant to the Contribution and Distribution Agreement and the Merger Agreement, after the Merger, the parties will determine the actual amount of Unisource transaction expenses, net working capital and net indebtedness and, if such actual amounts differ from the estimated amounts, a corresponding payment will be made to the applicable party. See “The Contribution and Distribution Agreement and the Ancillary Agreements—Contribution and Distribution Agreement—Working Capital and Net Indebtedness Adjustments.”

Q: What are the U.S. federal income tax consequences to me of the Distribution?

A: International Paper expects to receive the IRS ruling to the effect that the Distribution will qualify as tax-free under Sections 355 and 361 of the Code. The IRS ruling is also expected to provide that the Merger, the Subsidiary Merger and certain internal transactions undertaken in anticipation of the Distribution will qualify for tax-free treatment under the Code. In addition to obtaining the IRS ruling, International Paper expects to receive an opinion from Debevoise confirming the tax-free status of the Distribution for U.S. federal income tax purposes, which opinion will rely on the IRS ruling as to matters covered by the IRS ruling. The IRS ruling and such opinion will rely on certain facts and assumptions, and certain representations and undertakings, provided by us, International Paper and Unisource regarding the past and future conduct of our business and other matters.

Assuming that the Distribution qualifies as tax-free under Section 355 of the Code, for U.S. federal income tax purposes no gain or loss will be recognized by an International Paper shareholder upon the receipt of our common stock pursuant to the Distribution, except for any gain or loss attributable to cash received in lieu of a fractional share. International Paper shareholders will not recognize any gain or loss for U.S. federal income tax purposes as a result of the Merger.

See “The Transactions—Material U.S. Federal Income Tax Consequences of the Transactions” and “Risk Factors—Risks Relating to the Transactions—If the spin-off does not qualify as a tax-free spin-off under Section 355 of the Code, including as a result of subsequent acquisitions of stock of International Paper or SpinCo, then International Paper and/or the International Paper shareholders may be required to pay substantial U.S. federal income taxes.”

Each International Paper shareholder is urged to consult his, her or its tax advisor as to the specific tax consequences of the Distribution or the Merger to that shareholder, including the effect of any state, local or non-U.S. tax laws and of changes in applicable tax laws.

13

Q: How will I determine the tax basis I will have in the SpinCo shares of common stock I receive in this distribution?

A: Generally, for U.S. federal income tax purposes, your aggregate basis in the shares of common stock you hold in International Paper and the new shares of SpinCo common stock received in the Distribution (including any fractional shares in SpinCo for which cash is received) will equal the aggregate basis of International Paper common stock held by you immediately before the Distribution. This aggregate basis will be allocated among your International Paper common stock and the SpinCo common stock you receive in the Distribution (including any fractional shares in SpinCo for which cash is received), in proportion to the relative fair market value of each immediately following the Distribution. See “The Transactions—Material U.S. Federal Income Tax Consequences of the Transactions” for more information.

Q: Does SpinCo intend to pay cash dividends?

A: No, we do not currently expect to declare or pay dividends on our common stock for the foreseeable future. See “Dividend Policy.” Furthermore, we are restricted under the Contribution and Distribution Agreement from declaring or paying special dividends through the second anniversary of the Closing Date (or, in certain circumstances, January 1, 2016). See “The Contribution and Distribution Agreement and The Ancillary Agreements—Contribution and Distribution Agreement—Additional Post-Closing Covenants.”

Q: How will SpinCo shares trade?

A: Currently, there is no public market for our common stock. We intend to apply to list our common stock on the NYSE under the symbol “ ”.

We anticipate that trading will commence on a “when-issued” basis on or shortly prior to the record date and before the distribution date. When-issued trading in the context of a spin-off refers to a sale or purchase of securities effected on or before the distribution date and made conditionally because the securities of the spun-off entity have not yet been distributed. When-issued trades generally settle within four trading days of the distribution date. On the first trading day following the distribution date, any when-issued trading in respect of SpinCo common stock will end and “regular-way” trading will begin. Regular-way trading refers to trading after the security has been distributed and typically involves a trade that settles on the third full trading day following the date of the sale transactions. See “The Transactions—Listing and Trading of Our Common Stock.”

Q: Do I have appraisal rights?

A: No. Holders of International Paper common stock are not entitled to appraisal rights in connection with the Transactions.

Q: Who will be the transfer agent for SpinCo shares?

A: Computershare Inc. will be the transfer agent for SpinCo shares.

Q: Are there risks associated with owning SpinCo common stock upon consummation of the Transactions?

A: Our business is subject to both general and specific risks and uncertainties relating to the xpedx business and Unisource’s business. Our business is also subject to risks relating to the Transactions. Accordingly, you should read carefully the information set forth in the section entitled “Risk Factors.”

14

Q: Where can I get more information?

A: If you have any questions relating to the mechanics of the Distribution, you should contact the distribution agent at:

Computershare Inc.

250 Royall Street

Canton, MA 02021

Tel: (800) 522-6645

Before the Distribution and the Merger, if you have any questions relating to the Distribution or the Merger, you should contact International Paper at:

International Paper Company

Attn: Investor Relations

6400 Poplar Ave.

Memphis, TN 38197

Tel: (901) 419-4352

www.internationalpaper.com

15

The following summary highlights information contained elsewhere in this prospectus relating to the Transactions. You should read this entire prospectus including the risk factors, our and Unisource’s management’s discussion and analysis of financial condition and results of operations, our and Unisource’s historical financial statements, and our unaudited pro forma condensed combined financial statements and the respective notes to those historical and pro forma financial statements.

Our historical combined financial data have been prepared on a “carve-out” basis to reflect the operations, financial condition and cash flows specifically allocable to the xpedx business of International Paper during all periods shown. Our pro forma combined financial data adjust our historical combined financial data to give effect to the Transactions and our anticipated post-Transactions capital structure.

Except as otherwise indicated or the context otherwise requires, the information included in this prospectus assumes the completion of the Transactions.

The Companies

xpedx

xpedx is a leading business-to-business printing, packaging and facility supplies and equipment distribution business. Through its three operating segments, Print, Packaging and Facility Solutions, xpedx offers an extensive portfolio of nationally recognized, high quality public and private brands of paper, graphics, packaging and facility supplies primarily in the United States and Mexico.

The Print segment includes the sale and distribution of printing and communication papers, publishing papers, digital papers, specialty papers, graphics consumables, wide format papers and substrates, graphics equipment and related equipment installation and service. The Packaging segment includes the design, sourcing, sale and distribution of customized packaging and packing equipment and the sale and distribution of custom and standard corrugated boxes, shrink and stretch films, tape, strapping, cushioning, labels, bags, mailers, molded fiber, bio-polymer and plastics and packaging equipment and related equipment installation and service. The packaging segment also includes fulfillment and contract packaging services. The Facility Solutions segment markets and sells products necessary to maintain large public facilities, including hand towel and bathroom tissue, cleaning chemicals, disinfectants, skin care products, safety and hazard products, trash bags and receptacles, sanitary maintenance supplies, facilities maintenance equipment and related equipment installation and service.

Products and equipment are sourced from approximately 6,000 vendors in the United States and approximately 600 vendors in Mexico as of December 31, 2013, with xpedx serving as an important distribution channel for these vendors. The xpedx network consists of 86 strategically located distribution centers in 39 states and Mexico and a fleet of more than 1,500 trucks and trailers travelling approximately 32 million miles annually in the United States. xpedx markets and distributed these supplies, products and services to more than 58,000 customer locations as of December 31, 2013, including printers, publishers, data centers, manufacturers, higher education institutions, contract packaging/fulfillment providers, healthcare facilities, print design agencies, sporting and performance arenas, retail stores, government agencies, property managers and building service contractors, through more than 1,150 sales professionals, equipment representatives and service technicians.

Unisource

Unisource is a leading distributor of printing and business paper products, packaging supplies and equipment, and facility supplies and equipment, primarily in the United States and Canada, with additional

16

international operations in Europe, Asia and Latin America. Through its six business units, U.S. Distribution, Canada Distribution, Graphic Communications, Rollsource, PaperPlus and Unisource Global Solutions, Unisource operates in four primary product categories: Print, Packaging, Facility Supplies and Other.

The Print product category includes the sale and distribution of high-quality commercial printing, writing, copying and digital printing paper to commercial printers, retailers, publishers, business form manufacturers, direct mail firms and the digital printing industry, as well as corporate and retail copy centers, in-plant print facilities, government institutions and other paper-intensive businesses. The Packaging product category includes the sale and distribution of consumer goods packaging, packaging for industrial or manufacturing components and point-of-sale displays, as well as the sale and distribution of single function or fully automated packaging machines. The Facility Supplies product category includes the sale and distribution of products such as towels, tissues, wipers and dispensers, can liners, commercial cleaning chemicals, soaps and sanitizers, sanitary maintenance supplies and equipment, safety and hazard supplies, and shampoos and amenities from leading manufacturers. In the Other category, Unisource provides third-party logistics services, which includes freight brokerage, material handling, warehousing and kitting.

Products and equipment sourced in North America, Europe and Asia include approximately 2,500 vendors in the United States, approximately 1,000 vendors in Canada and approximately 100 vendors in Europe and Asia, with Unisource serving as an important North American distribution channel for many of these vendors. Unisource sells its products to a diverse customer base of approximately 45,000 customers, based on customer bill-to locations, including building service contractors, catalog and direct mail providers, commercial printers, consumer goods providers, cruise lines, food processors, healthcare providers, higher education institutions, government agencies, fulfillment, hotels and resorts, manufacturers and property managers, through approximately 760 sales representatives. Unisource provides supply chain management through its 93 distribution centers, providing next-day services to most major metropolitan areas in the United States and Canada.

Transaction Rationale

Size and Scale

By combining two well-established businesses, we anticipate that the Transactions will create a North American business-to-business distribution company with a broad geographic reach, extensive product offerings and a differentiated and leading service platform. We expect the Transactions to strengthen the combined company’s relationships with suppliers and customers by:

| • | expanding our reach to multi-location customers that value a broader, national footprint; |

| • | enhancing our supply chain capabilities with greater scale; and |

| • | providing greater sourcing strategies. |

Expertise

We anticipate that the combined company will be able to deliver a greater breadth of expertise in the following:

| • | Packaging—a full service platform for designing, sourcing and delivering commodity and specialty packaging, which we believe will enable the combined company to provide solutions to customers at every point in the packaging process, including design, engineering, materials, equipment, workflow and logistics; |

17

| • | Print—a fully integrated national distributor with expertise in paper, graphics, equipment and print management; |

| • | Facility Solutions—a comprehensive facility solution to help customers maintain a safe, clean, healthy and productive environment; and |

| • | Other—a third-party logistics service, including supply chain solutions, freight brokerage, warehousing and kitting. |

Synergies

We expect that the Merger will provide significant opportunities for the combined company to capture cost savings and other synergies. We are targeting annual cost savings and other synergies in the range of approximately $150 million to $225 million, which we anticipate will be fully realized by the end of 2018. We anticipate cost savings and other synergies in the following areas: overhead, strategic sourcing, supply chain efficiencies, optimizing the ability to service customers and reduction of fixed costs. We currently expect the one-time costs associated with achieving these cost savings and other synergies to be approximately $225 million over a five-year period.

Stable Platform with Improved Strategic Prospects

We expect that the combination of xpedx and Unisource will strengthen the combined company’s overall business platform and provide improved opportunities for strategic options as a combined enterprise. Additional advantages to the combination include:

| • | xpedx’s and Unisource’s complementary businesses; |

| • | minimal customer overlap between the businesses; |

| • | strong relationships with each company’s customers and suppliers; |

| • | better positioning the combined company to manage through the secular decline in the print segment; and |

| • | an enterprise better able to take advantage of strategic opportunities, including acquisitions. |

Risk Factors

We face numerous risks related to, among other things, our business operations, our strategies, general economic conditions, competitive dynamics of the industry, our level of indebtedness, the legal and regulatory environment in which we operate, and our status as an independent public company following the Transactions. These risks are set forth in detail under the heading “Risk Factors.” If any of these risks should materialize, they could have a material adverse effect on our business, financial condition, results of operations or cash flows. We encourage you to review these risk factors carefully. Furthermore, this prospectus contains forward-looking statements that involve risks, uncertainties and assumptions. Actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including but not limited to those under the headings “Risk Factors” and “Note Regarding Forward-Looking Statements and Information.”

18

Summary of the Transactions

We provide below a summary of the Transactions. See “The Transactions” for a more detailed description.

The following chart illustrates our organizational structure following the Transactions.

19

The Distribution

| Distributing company |

International Paper Company. After the Distribution, International Paper will not own any shares of SpinCo. |

| Distributed company |

xpedx Holding Company, referred to herein as “SpinCo.” |

| Record date |

Record ownership will be determined as of 5:00 p.m., New York City time, on , 2014. |

| Distribution date |

The distribution date is expected to be on or about , 2014. |

| Distribution ratio |

Each share of International Paper common stock outstanding as of the record date will entitle its holder to receive a number of shares of SpinCo common stock determined by a formula based on the number of International Paper shares of common stock outstanding at 5:00 p.m. New York City time on the distribution date. Each such holder will receive a number of SpinCo shares of common stock equal to the percentage of the total number of SpinCo shares of common stock outstanding as of the time of the Distribution as is equal to a fraction, (a) the numerator of which is the total number of issued and outstanding International Paper shares of common stock held by such holder as of the record date and (b) the denominator of which is the total number of International Paper shares of common stock issued and outstanding (excluding treasury shares held by International Paper and any other International Paper shares otherwise held by International Paper or one of its subsidiaries). Based on the number of fully diluted International Paper shares of common stock outstanding as of , 2014, we expect the distribution ratio to be approximately shares of SpinCo common stock for each share of International Paper common stock. Although the number of International Paper shares of common stock outstanding may increase or decrease prior to the distribution date and as a result the distribution ratio may change, it will nonetheless result in International Paper shareholders as of the record date and their transferees owning approximately 51%, and the UWWH Stockholder owning approximately 49%, of the shares of SpinCo common stock on a fully diluted basis immediately following the Merger. |

| Securities to be distributed |

All of the shares of common stock of SpinCo outstanding immediately prior to the Merger will be distributed pro rata to International Paper shareholders who hold International Paper common stock as of the record date. Assuming a record date of , 2014 and approximately shares of International Paper common stock outstanding as of such date, and applying the assumed distribution ratio of SpinCo shares for every International Paper share of common stock, approximately shares of our common stock would be distributed to International Paper shareholders. The number of SpinCo shares that International Paper will ultimately distribute to its shareholders will (i) fluctuate depending on the number of International Paper shares of common |

20

| stock actually outstanding as of the record date and (ii) be reduced to the extent that cash payments are to be made in lieu of fractional shares, as described below. |

| The Distribution |

On the distribution date, International Paper will cause the distribution agent to distribute the shares of SpinCo common stock to the International Paper shareholders as of the record date. The distribution of shares of SpinCo common stock will be made in book-entry form. It is expected that it will take the distribution agent up to three business days to electronically issue SpinCo shares to you or your bank or brokerage firm on your behalf by way of direct registration in book-entry form. You will not be required to make any payment, surrender or exchange your International Paper common stock or take any other action to receive your SpinCo common stock. |

| No fractional shares |

Holders of International Paper common stock will not receive any fractional shares of SpinCo common stock. In lieu of fractional shares of SpinCo, International Paper shareholders will receive a cash payment. To that end, the distribution agent will aggregate and sell whole shares that otherwise would have been distributed as fractional shares of SpinCo in the open market at prevailing market prices and distribute the aggregate cash proceeds of the sales, net of brokerage fees and similar costs, pro rata to each International Paper shareholder who would otherwise have been entitled to receive a fractional share of SpinCo, as applicable, in the Distribution. Recipients of cash in lieu of fractional shares will not be entitled to any interest on payments made in lieu of fractional shares. See “The Transactions—Manner of Effecting the Distribution.” The receipt of cash in lieu of fractional shares generally will be taxable to the recipient shareholders that are subject to U.S. federal income tax as described in “The Transactions—Material U.S. Federal Income Tax Consequences of the Transactions.” |

| Conditions to the Distribution |

The Distribution is subject to a number of important conditions. Under the terms of the Contribution and Distribution Agreement, the consummation of the Distribution is conditioned upon (i) SpinCo’s receipt of the proceeds from the completion of the special payment financing in an amount sufficient to pay the special payment, and International Paper’s receipt of the special payment from SpinCo, (ii) the satisfaction (or waiver by International Paper) of each of the conditions to International Paper’s obligation to effect the closing of the transactions contemplated by the Merger Agreement (other than the consummation of the Distribution) and (iii) each of International Paper, SpinCo and Unisource having irrevocably confirmed to the other that each of the conditions to its obligations to effect the closing of the Merger has been satisfied or waived and that it is prepared to proceed with the Merger. For a more detailed description of the Merger conditions see “The Merger Agreement—Conditions to Consummation of the Merger.” |

| Special payment adjustment |

Pursuant to the Contribution and Distribution Agreement, SpinCo is required to make a special payment to International Paper of |

21

| $400 million, subject to adjustment based on estimates of changes in the net working capital and net indebtedness of the xpedx business and Unisource, and the transaction expenses of Unisource. If the sum of the changes in the net working capital and net indebtedness of the xpedx business represents a positive change in the value of the xpedx business, the special payment to International Paper will be increased by such amount. If that amount represents a negative change in the value of the xpedx business, the special payment to International Paper will be reduced by such amount. Pursuant to the Contribution and Distribution Agreement and the Merger Agreement, if the sum of the Unisource transaction expenses in excess of $15 million and changes in the net working capital and net indebtedness of Unisource represents a positive change in the value of Unisource, SpinCo shall pay such amount to the UWWH Stockholder. If that amount represents a negative change in the value of Unisource, the special payment to International Paper will be increased by a corresponding amount. See “The Contribution and Distribution Agreement and the Ancillary Agreements—Contribution and Distribution Agreement—Working Capital and Net Indebtedness Adjustments.” |

| Earnout Payment |

The Contribution and Distribution Agreement provides that in 2020 the combined company may be required to pay to International Paper an earnout payment of up to $100 million if the combined company’s aggregate EBITDA for its 2017, 2018 and 2019 fiscal years exceeds an agreed-upon target, subject to certain adjustments. The amount of the earnout payment, if owed by the combined company, will be an amount equal to (i) the excess of the combined company’s aggregate EBITDA for its 2017, 2018 and 2019 fiscal years over the agreed-upon target, (ii) multiplied by four divided by three, capped at $100 million in the aggregate. The earnout payment may also be due in certain other circumstances. See “The Contribution and Distribution Agreement and the Ancillary Agreements—Contribution and Distribution Agreement—Earnout Payment.” |

| Trading market and symbol |

We intend to apply to list our common stock on the NYSE under the ticker symbol “ ”. We anticipate that, on or shortly before the record date for the Distribution, trading of SpinCo common stock will begin on a “when-issued” basis and will continue up to and including the distribution date. See “The Transactions—Listing and Trading of Our Common Stock.” |

| Dividend policy |

We do not currently expect to declare or pay dividends on our common stock for the foreseeable future. See “Dividend Policy.” |

| Tax consequences of the Distribution to International Paper shareholders |

International Paper expects to receive a private letter ruling from the IRS to the effect that the Distribution will qualify as tax-free under Sections 355 and 361 of the Code. The IRS ruling is also expected to provide that the Merger, the Subsidiary Merger and certain internal transactions undertaken in anticipation of the Distribution will qualify |

22

| for tax-free treatment under the Code. In addition to obtaining the IRS ruling, International Paper expects to receive an opinion from Debevoise confirming the tax-free status of the Distribution for U.S. federal income tax purposes, which opinion will rely on the IRS ruling as to matters covered by the IRS ruling. The IRS ruling and such opinion will rely on certain facts and assumptions, and certain representations and undertakings, provided by us, International Paper and Unisource regarding the past and future conduct of our respective business and other matters. |

| Assuming that the Distribution qualifies as tax-free under Section 355 of the Code, for U.S. federal income tax purposes no gain or loss will be recognized by an International Paper shareholder upon the receipt of our common stock pursuant to the Distribution, except for any gain or loss attributable to cash received in lieu of a fractional share. |

| See “The Transactions—Material U.S. Federal Income Tax Consequences of the Transactions” and “Risk Factors—Risks Relating to the Transactions—If the spin-off does not qualify as a tax-free spin-off under Section 355 of the Code, including as a result of subsequent acquisitions of stock of International Paper or SpinCo, then International Paper and/or the International Paper shareholders may be required to pay substantial U.S. federal income taxes.” |

| Each International Paper shareholder is urged to consult his, her or its tax advisor as to the specific tax consequences of the Distribution to that shareholder, including the effect of any state, local or non-U.S. tax laws and of changes in applicable tax laws. |

| Relationship with International Paper after the spin-off |

We have entered into the Contribution and Distribution Agreement and shortly before the Distribution, we expect to enter into other agreements with International Paper related to the Transactions. These agreements will govern the relationship between SpinCo and International Paper subsequent to the completion of the Distribution and provide for the allocation between SpinCo and International Paper of various assets, liabilities and obligations (including employee benefits and tax-related assets and liabilities). The Contribution and Distribution Agreement, in particular, provides for the settlement or extinguishment of certain obligations between SpinCo and International Paper. We will enter into a Transition Services Agreement pursuant to which International Paper will provide certain services to SpinCo, and SpinCo will provide certain services to International Paper, on a transitional basis. Further, we have entered into the Tax Matters Agreement with International Paper which governs the rights and obligations of International Paper and SpinCo for certain tax liabilities with respect to periods or portions thereof ending on or before the date of the Distribution. The Tax Matters Agreement also contains certain restrictions with respect to the intended tax-free status of the Transactions and indemnification |

23

| obligations on the part of SpinCo if the Transactions are not tax-free. We will enter into a supply agreement with International Paper pursuant to which International Paper will supply xpedx LLC with certain printing and communications papers and coated paperboard and xpedx LLC will supply International Paper with certain products, in each case, for a period of 18 months. We describe these and related arrangements in greater detail under “The Contribution and Distribution Agreement and the Ancillary Agreements” and describe some of the risks of these arrangements under “Risk Factors—Risks Relating to the Transactions.” |

| Distribution Agent |

Computershare Inc., a Delaware corporation and its fully owned subsidiary, Computershare Trust Company, N.A., a national banking association. |

The Merger

| Structure of the Merger |

UWWH will merge with and into SpinCo, with SpinCo continuing as the surviving corporation, and xpedx Intermediate, which will be SpinCo’s direct, wholly-owned subsidiary, will merge with and into UWW, with UWW surviving the Subsidiary Merger as SpinCo’s direct, wholly-owned subsidiary. We expect the Mergers to be consummated sequentially and immediately following the Distribution and on the terms and subject to the other conditions of the Merger Agreement. The Merger Agreement provides that the Mergers will take place on the date of the Distribution (such date, the “Closing Date”). |

| Primary purposes of the Transactions |

International Paper determined that the Transactions would be in the best interests of International Paper and its shareholders because the Transactions would provide a number of key benefits, including primarily: (i) greater strategic focus of resources and management’s efforts for each of International Paper and for the combined company, (ii) the special payment, (iii) direct and differentiated access by each of International Paper and the combined company to capital resources and (iv) increased value to International Paper’s shareholders, in particular the combined company’s anticipated value on a stand-alone basis. In assessing and approving the Transactions, International Paper considered the unavailability of alternative transactions that would produce similar or better results for International Paper and its shareholders, and the spinoff’s facilitating the strategic combination of the xpedx and Unisource businesses. See “The Transactions—International Paper’s Reasons for the Transactions.” |

| Consideration for the Merger |

SpinCo shareholders will not receive any consideration in the Merger, and SpinCo will remain the parent company for the combined company. Each UWWH share of common stock outstanding as of , 2014 will be converted into the right to receive a number of shares of SpinCo common stock in a private placement transaction, that will result |

24

| in International Paper’s shareholders as of the record date and their transferees owning approximately 51% of the common stock of SpinCo, and the UWWH Stockholder owning approximately 49%, on a fully-diluted basis immediately following the Merger. |

| Approval of the Merger |

No vote by International Paper shareholders is required or is being sought in connection with the Transactions. International Paper, as the sole shareholder of SpinCo, has already approved the Merger. |

| Conditions to the Merger |

The obligations of each party to consummate the Merger are subject to the satisfaction or waiver (to the extent permitted by applicable law) of certain conditions, including: |

| • | the Contribution and Distribution having occurred pursuant to the terms of the Contribution and Distribution Agreement; |

| • | SpinCo’s receipt of the proceeds from the special financing in an amount sufficient to pay the special payment, and International Paper’s receipt of the special payment from SpinCo; |